Bendigo & Adelaide Bank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bendigo & Adelaide Bank Bundle

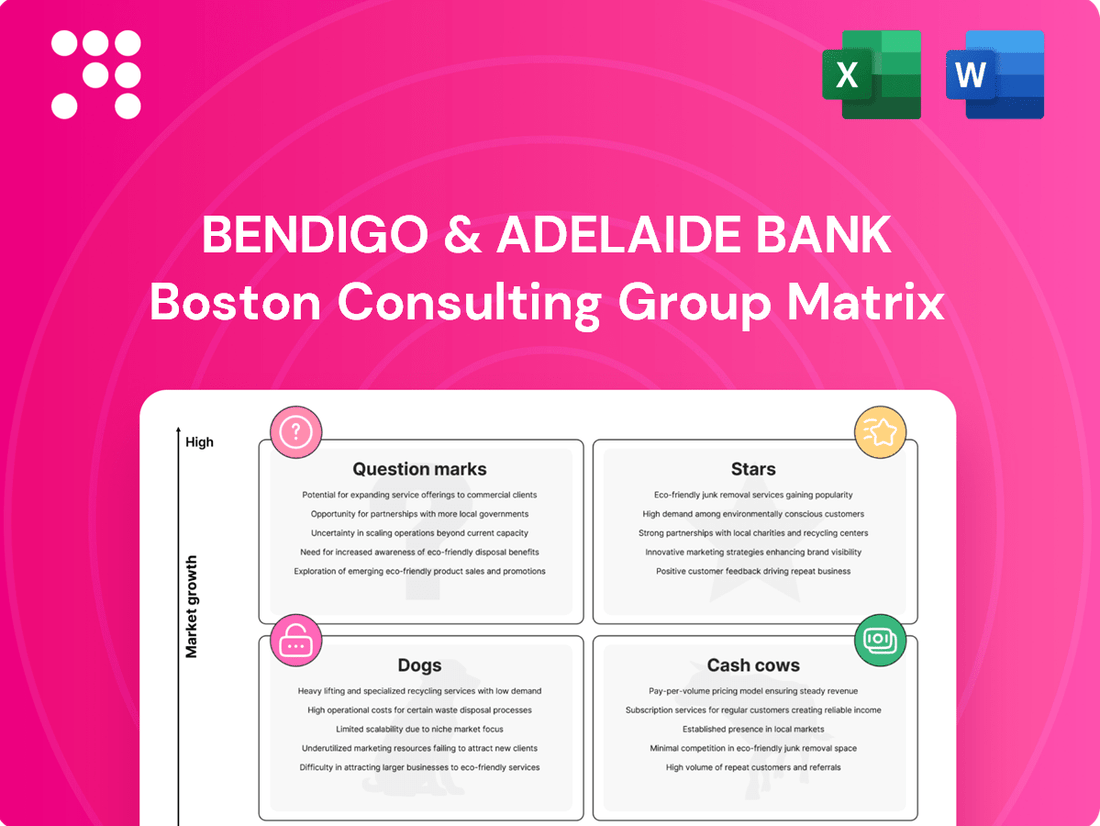

Curious about Bendigo & Adelaide Bank's strategic positioning? Our BCG Matrix analysis reveals which of their products are market leaders (Stars), reliable income generators (Cash Cows), potential future successes (Question Marks), or underperforming assets (Dogs).

This preview offers a glimpse into their portfolio's health, but the full BCG Matrix report provides the detailed quadrant placements, data-backed recommendations, and a clear roadmap to smart investment and product decisions.

Don't miss out on the complete picture; purchase the full BCG Matrix to gain strategic clarity and confidently navigate the evolving financial landscape.

Stars

Up Digital Bank stands as a prime example of a Star within Bendigo and Adelaide Bank's BCG Matrix. Its impressive customer acquisition, exceeding 1 million, and substantial deposit growth to $2.6 billion in the first half of FY25 highlight its significant market share and rapid expansion.

The bank's strong advocacy and appeal to younger demographics are key drivers of its success, positioning it favorably in the high-growth digital banking sector. This momentum is further evidenced by its home loan portfolio reaching $1.2 billion in the same period.

Bendigo Bank's residential home loan portfolio, a key component of its lending business, has demonstrated robust expansion. In the first half of FY25, this segment grew to $65.2 billion, outperforming the broader market.

This impressive growth is directly linked to the bank's strategic investment in technology, specifically the new Bendigo Lending Platform. This platform has streamlined the application process, leading to quicker turnaround times and a better customer experience, which in turn fuels loan origination.

The Australian home loan market itself saw substantial growth throughout 2024, with projections indicating continued expansion into 2025. This favorable market environment, bolstered by increased investor participation, provides a strong tailwind for Bendigo Bank's residential lending efforts.

Bendigo & Adelaide Bank's new lending platform, launched in 2024, represents a significant investment in its mortgage business, aiming to standardize and streamline home loan processing. This initiative is crucial for enhancing efficiency and improving the customer experience in a highly competitive market. The platform's rollout across mobile lenders and branches is designed to boost market share and lending volumes by offering faster turnaround times.

Digital Mortgages (e.g., Up Home, BEN Express)

Bendigo and Adelaide Bank's digital mortgage offerings, exemplified by Up Home and BEN Express, are demonstrating robust growth, significantly contributing to the bank's expanding mortgage portfolio. These platforms are capitalizing on the increasing consumer preference for digital interactions, offering streamlined application processes and faster loan approvals.

The success of these digital solutions underscores their position as a high-growth segment within the bank's product suite, reflecting an upward trend in market adoption. For instance, Up Home, a digital-first banking app, has seen substantial customer acquisition, with reports indicating strong engagement and a growing share of new mortgage originations. This digital focus aligns with the broader Australian market trend towards online mortgage applications, which saw a notable increase in volume throughout 2023 and early 2024.

- Up Home's digital-first approach has attracted a younger demographic, contributing to Bendigo and Adelaide Bank's market share gains in the first-home buyer segment.

- BEN Express streamlines the mortgage application process, reducing turnaround times and enhancing customer satisfaction, a key driver for its growth.

- The digital mortgage segment represents a strategic area of investment for the bank, aiming to capture a larger share of the rapidly evolving mortgage market.

Community Bank Model

The Community Bank model is a standout feature for Bendigo and Adelaide Bank, building strong connections within local areas and boosting customer acquisition and retention. This approach allows the bank to capitalize on its trusted brand and regional footprint, channeling profits back into these communities. It's a significant driver of customer growth, with numbers climbing 9.1% in FY24 to surpass 2.5 million customers.

This model’s success is evident in its ability to foster deep community engagement, which translates directly into loyal customer bases. The reinvestment strategy not only benefits local economies but also strengthens the bank’s reputation as a community partner.

- Customer Growth: Achieved a 9.1% increase in customer numbers in FY24, reaching over 2.5 million.

- Brand Differentiation: Leverages a unique community-focused model to stand out in the market.

- Community Reinvestment: Profits generated are reinvested into the local communities served.

- Customer Acquisition & Retention: The model is a key driver for attracting and keeping customers.

Stars in the Bendigo & Adelaide Bank's BCG Matrix represent high-growth, high-market-share businesses. Up Digital Bank and the bank's digital mortgage offerings, like Up Home and BEN Express, fit this description perfectly. These segments are experiencing rapid customer acquisition and significant growth in their respective portfolios, outpacing market averages.

The bank's investment in digital platforms, such as the new Bendigo Lending Platform launched in 2024, is directly fueling the success of these Star segments. This technology enhances efficiency and customer experience, leading to increased lending volumes and market share capture in the competitive Australian mortgage market.

The Community Bank model, while not a traditional high-growth product in the same vein as digital banking, functions as a Star for Bendigo & Adelaide Bank due to its exceptional customer growth and strong market differentiation. Achieving a 9.1% increase in customer numbers in FY24, reaching over 2.5 million, highlights its significant market penetration and appeal.

| Business Segment | Market Growth | Market Share | BCG Category |

|---|---|---|---|

| Up Digital Bank | High | High | Star |

| Digital Mortgages (Up Home, BEN Express) | High | High | Star |

| Community Bank Model | Moderate to High (Customer Growth) | High (Brand Loyalty/Reach) | Star |

What is included in the product

This BCG Matrix overview details Bendigo & Adelaide Bank's product portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs.

It offers strategic recommendations for investment, holding, or divestment based on market growth and share.

Bendigo & Adelaide Bank's BCG Matrix offers a clear visual of business unit performance, easing the pain of resource allocation uncertainty.

This matrix provides a concise, actionable snapshot, simplifying complex strategic decisions for leadership.

Cash Cows

Bendigo and Adelaide Bank's core customer deposit base is a true cash cow. In the first half of FY25, customer deposits reached $72.0 billion, showing a healthy 3.4% growth from FY24. This stable and reliable funding source significantly fuels the bank's lending operations.

The consistent growth in customer deposits provides a low-cost funding advantage, directly contributing to predictable net interest income within the mature retail banking sector. This established segment is a bedrock for the bank's financial stability, ensuring a steady generation of cash flow.

Bendigo Bank's established personal banking products, such as everyday accounts and term deposits, form a core component of its stable revenue streams. These offerings are crucial for maintaining a consistent income, even in a mature market.

In FY24, Bendigo Bank was recognized as Australia's most trusted bank, a testament to its strong customer relationships. This trust directly translates into customer loyalty for its foundational personal banking products, ensuring a steady demand for these essential services.

The established market presence of these products means they require less aggressive marketing or promotional investment compared to newer or growth-oriented offerings. This efficiency contributes to their status as reliable cash cows for the bank.

Bendigo & Adelaide Bank's existing residential lending portfolio, valued at $65.2 billion as of the first half of 2025, functions as a significant cash cow. This substantial book of home loans reliably generates consistent interest income, forming a stable foundation for the bank's earnings.

The strategic approach for this segment centers on maintaining its scale and maximizing profitability through efficient management. There is no emphasis on aggressive expansion, but rather on optimizing returns from the existing, large asset base.

Rural Bank (Post-Migration to Bendigo Bank Agribusiness)

The agribusiness lending segment, now operating under Bendigo Bank Agribusiness after the migration of Rural Bank customers, is positioned as a strong Cash Cow. This niche market is characterized by its stability and the bank's significant market share within it.

Agribusiness lending demonstrated robust growth, expanding by 7.4% in FY24. This performance underscores the segment's established strength and its capacity to generate consistent returns.

The strategic integration is designed to optimize operations and boost efficiency, which in turn enhances the segment's cash-generating capabilities. This focus on streamlining supports its role as a reliable source of funds for the broader Bendigo Bank group.

- Market Position: Stable, high-market-share within the agribusiness lending niche.

- FY24 Performance: Agribusiness lending grew by 7.4%.

- Strategic Goal: Streamline operations and enhance efficiency for improved cash generation.

General Business Lending

Bendigo and Adelaide Bank’s general business lending segment functions as a Cash Cow within its BCG Matrix. This division consistently contributes to the bank's earnings, primarily serving small to medium-sized enterprises and larger corporations throughout Australia.

The business lending portfolio operates in a mature market, meaning it generates reliable income without demanding substantial new investments for expansion. In the 2024 financial year, Bendigo and Adelaide Bank reported a net interest margin of 1.78%, indicating the profitability of its lending activities, including business loans.

- Steady Revenue Generation: The business lending segment provides a stable and predictable income stream for the bank.

- Mature Market Position: Operating in an established market allows for consistent cash flow with lower investment needs.

- Broad Customer Base: Services extend to a wide range of businesses, from SMEs to large corporations, diversifying revenue sources.

- Contribution to Earnings: This segment plays a vital role in supporting the bank’s overall cash earnings.

Bendigo and Adelaide Bank's established customer deposit base is a core Cash Cow. In the first half of FY25, customer deposits reached $72.0 billion, a 3.4% increase from FY24, providing a low-cost and stable funding source that fuels lending operations and generates predictable net interest income.

The bank's residential lending portfolio, valued at $65.2 billion as of H1 2025, also functions as a significant Cash Cow. This substantial asset base reliably generates consistent interest income, with the strategy focused on optimizing returns from its existing scale rather than aggressive expansion.

The agribusiness lending segment, which grew by 7.4% in FY24, is another strong Cash Cow. Its stability and the bank's significant market share in this niche, coupled with operational streamlining, enhance its cash-generating capabilities.

General business lending contributes steadily to earnings, operating in a mature market that allows for consistent cash flow with lower investment needs. The bank's net interest margin of 1.78% in FY24 reflects the profitability of these lending activities.

| Segment | FY24 Growth/Metric | Role | Key Characteristic |

| Customer Deposits | +3.4% (H1 FY25) | Cash Cow | Low-cost, stable funding |

| Residential Lending | $65.2B (H1 FY25) | Cash Cow | Reliable interest income |

| Agribusiness Lending | +7.4% (FY24) | Cash Cow | Stable niche, efficient operations |

| General Business Lending | 1.78% Net Interest Margin (FY24) | Cash Cow | Mature market, steady revenue |

Delivered as Shown

Bendigo & Adelaide Bank BCG Matrix

The Bendigo & Adelaide Bank BCG Matrix you are previewing is the complete, unwatermarked document you will receive immediately after purchase. This comprehensive analysis, designed for strategic clarity, will be fully editable and ready for your immediate use in business planning and competitive analysis.

Dogs

The Adelaide Bank brand is being retired, with a planned transition of its products and services to the Bendigo Bank brand by the end of 2025. This strategic move, which saw no new business written on the Adelaide Bank platform from June 2024, suggests the brand was likely a question mark or a dog in the BCG matrix, indicating low market share and growth potential.

Bendigo & Adelaide Bank's legacy IT systems and applications are categorized as 'dogs' in the BCG matrix. The bank is undertaking a significant, multi-year transformation to consolidate eight core banking systems into a single platform by FY26, alongside a 50% reduction in IT applications.

These legacy systems are characterized by high maintenance costs, operational inefficiencies, and limited growth potential. By actively decommissioning these outdated platforms, the bank aims to streamline its IT infrastructure, reduce operational expenses, and improve overall agility.

Bendigo and Adelaide Bank has streamlined its brand portfolio significantly, moving from 13 brands in FY19 down to seven, with ongoing integration efforts. This strategic consolidation is designed to simplify operations and boost efficiency across the group.

Brands like Delphi Bank and Alliance Bank, which had minimal standalone market share or limited growth prospects, are being fully absorbed into the core Bendigo Bank offering. This move reflects a focus on consolidating resources and enhancing the strength of the primary brand.

Outdated Product Offerings

Bendigo and Adelaide Bank's "Outdated Product Offerings" likely reside in the Dogs quadrant of the BCG Matrix. These are products or services that have experienced a significant drop in customer interest, often because newer, more innovative digital options have emerged. The bank's ongoing commitment to modernization suggests a strategic pruning of these less profitable offerings.

These products typically operate at a break-even point or even incur losses without generating substantial growth. For instance, while specific figures for individual outdated products aren't publicly disclosed, the bank's 2024 financial reports highlight a strategic shift towards digital transformation, indicating a move away from legacy systems and products that don't align with future growth strategies.

- Declining Customer Uptake: Products like traditional passbook savings accounts or certain types of term deposits may see reduced engagement as customers opt for more convenient digital banking solutions.

- Emergence of Digital Alternatives: The rise of fintech companies and the bank's own investment in digital platforms mean that older, less feature-rich products are becoming less competitive.

- Low Growth, Low Market Share: These offerings are characterized by minimal market share and little to no prospect of future growth, making them candidates for rationalization.

- Strategic Focus on Modernization: Bendigo and Adelaide Bank's emphasis on enhancing its digital capabilities and customer experience implicitly signals a divestment or phasing out of products that hinder this progress.

Underperforming Physical Branch Locations (non-Community Bank)

While Bendigo and Adelaide Bank's Community Bank model is a notable success, individual physical branch locations operating outside this framework might be classified as 'dogs' in a BCG matrix analysis. These traditional branches, if experiencing a consistent decline in customer foot traffic and transaction volumes, may struggle to justify their operational expenses in the current digital banking environment.

The shift towards digital channels means these underperforming branches might not be generating sufficient returns to offset their costs. This situation often leads to a strategic re-evaluation, potentially resulting in consolidation or closure to reallocate resources more effectively.

- Declining Foot Traffic: Many traditional bank branches have seen a significant drop in customer visits, with some reporting decreases of over 30% in the past five years as customers opt for online and mobile banking solutions.

- Low Transaction Volumes: Branches with a high proportion of basic transactions migrating to digital platforms will exhibit lower transaction volumes, impacting their revenue generation potential.

- Operational Costs: The fixed costs associated with maintaining a physical branch, including staffing, rent, and utilities, can become a substantial burden if the branch is not generating adequate income.

- Strategic Reallocation: Banks are increasingly looking to divest or re-purpose underperforming physical assets to invest in digital capabilities and customer experience enhancements.

Bendigo & Adelaide Bank's legacy IT systems and certain outdated product offerings are categorized as 'dogs' in the BCG matrix. These are characterized by low market share and low growth potential, often due to high maintenance costs and declining customer interest in favor of digital alternatives.

The bank is actively addressing these 'dogs' through a significant IT transformation, aiming to consolidate eight core banking systems into one by FY26 and reduce its IT application count by 50%. This strategic divestment of legacy assets and less competitive products is designed to streamline operations and improve overall efficiency.

For instance, the retirement of the Adelaide Bank brand by the end of 2025, with no new business written since June 2024, signifies a clear move to eliminate a low-growth, low-share entity. Similarly, individual physical branches experiencing declining foot traffic and transaction volumes are also candidates for rationalization to focus resources on more profitable areas.

This strategic pruning of 'dog' assets and products is crucial for freeing up capital and management attention to invest in higher-growth areas, ultimately enhancing the bank's competitive position and profitability.

| Category | Description | BCG Matrix Position | Strategic Action | Example |

| IT Systems | Legacy core banking platforms | Dogs | Consolidation and decommissioning | Eight core banking systems being reduced to one by FY26 |

| Product Offerings | Traditional, less competitive products | Dogs | Phasing out or modernization | Outdated term deposit structures, legacy savings accounts |

| Brand Portfolio | Brands with minimal market share or growth | Dogs | Absorption into core brand | Adelaide Bank brand retirement by end of 2025 |

| Physical Branches | Underperforming branches with declining foot traffic | Dogs | Re-evaluation, consolidation, or closure | Branches with low transaction volumes and high operational costs |

Question Marks

Bendigo & Adelaide Bank's advanced AI and data modernization initiatives are positioned as question marks in their BCG matrix. The bank is channeling significant investment into AI to overhaul legacy systems and bolster its cloud infrastructure, striving for an AI-native operational environment.

These ambitious projects reside in a rapidly evolving technological landscape, holding substantial promise for future competitive differentiation, though their immediate market influence and direct revenue contributions are still in their nascent stages. For instance, in the fiscal year 2023, the bank reported a capital expenditure of $186 million, with a significant portion allocated to technology upgrades, reflecting the substantial investment required for these AI and data modernization efforts.

Successfully scaling these initiatives necessitates considerable capital outlay to mature into future Stars. The ultimate goal is to achieve enhanced operational efficiencies and a superior customer experience, thereby unlocking significant long-term value and competitive advantage.

Bendigo and Adelaide Bank's Business Direct initiative targets micro-businesses, a segment experiencing robust growth as these smaller enterprises increasingly demand specialized financial services. This strategic move aims to enhance customer satisfaction within this high-potential market.

While the overall small business lending market is substantial, Bendigo and Adelaide Bank's specific market share in this newly focused micro-business segment is currently modest. For instance, in 2024, the bank's focus on this niche is still developing, necessitating substantial investment to gain traction against established competitors.

The Australian wealth management sector is booming, especially with digital investment tools. Bendigo and Adelaide Bank's newer digital platforms or robo-advisory solutions in this area are currently not prominent. This places them in a high-growth market but with a likely low share, necessitating strategic investment to challenge established firms and FinTech competitors.

Strategic Partnerships (e.g., Qantas Money Home Loans, NRMA Home Loans)

Bendigo and Adelaide Bank's strategic partnerships, exemplified by ventures like Qantas Money Home Loans and NRMA Home Loans, aim to tap into new customer bases and leverage existing brand loyalty for growth.

These collaborations are positioned in the 'Question Marks' quadrant of the BCG matrix, as they operate in expanding markets, such as the Australian home loan sector which saw a 7.7% increase in new housing loan commitments in the 12 months to April 2024, but currently represent a small market share for the bank. Significant investment is needed to nurture these ventures and transition them into 'Stars'.

- Market Reach: Partnerships like Qantas Money Home Loans allow Bendigo and Adelaide Bank to access a broader customer demographic through the partner's established network.

- Customer Acquisition: These alliances are designed to acquire new customers by offering integrated financial products, thereby reducing customer acquisition costs.

- Investment Needs: As 'Question Marks,' these ventures require substantial capital and strategic focus to gain traction and increase market share in competitive segments.

- Growth Potential: The home loan market's ongoing expansion provides a fertile ground for these partnerships to potentially evolve into significant revenue drivers for the bank.

Future-Proofing Initiatives (e.g., single core banking system, API strategy)

Bendigo and Adelaide Bank is heavily investing in future-proofing its operations, notably by aiming for a single core banking system by the close of 2025. This significant undertaking, alongside a robust API strategy, represents a foundational shift. These initiatives, while not directly generating revenue, are crucial for long-term agility and cost efficiency.

The bank's commitment to these infrastructure upgrades is substantial, requiring significant capital allocation and resource deployment. Successfully migrating to a unified core system and expanding its API ecosystem are seen as critical enablers for future innovation and market responsiveness. For instance, the bank has highlighted technology modernization as a key strategic priority, with significant investments planned.

- Core Banking Modernization: Aiming for a single core banking system by the end of 2025 to streamline operations and reduce complexity.

- API Strategy: Developing reusable APIs to foster faster product development and integration with third-party services.

- Resource Allocation: These initiatives are consuming considerable capital and resources, reflecting their strategic importance.

- Future Competitiveness: Success is expected to enhance operational efficiency and product delivery, underpinning future market share growth.

Bendigo and Adelaide Bank's strategic partnerships, such as those with Qantas Money Home Loans and NRMA Home Loans, are categorized as question marks. These ventures operate in expanding markets, like the Australian home loan sector which saw a 7.7% increase in new housing loan commitments in the 12 months to April 2024, but currently represent a small market share for the bank. Significant investment is required to nurture these collaborations and elevate them to star status, leveraging the partner's customer base for growth.

| Partnership Initiative | Market Segment | Current Market Share (Estimated) | Growth Potential | Investment Need |

|---|---|---|---|---|

| Qantas Money Home Loans | Home Loans | Low | High (leveraging Qantas loyalty) | Substantial |

| NRMA Home Loans | Home Loans | Low | High (leveraging NRMA brand) | Substantial |

BCG Matrix Data Sources

Our Bendigo & Adelaide Bank BCG Matrix is built on a foundation of comprehensive financial disclosures, detailed market growth metrics, and internal product performance data to ensure strategic accuracy.