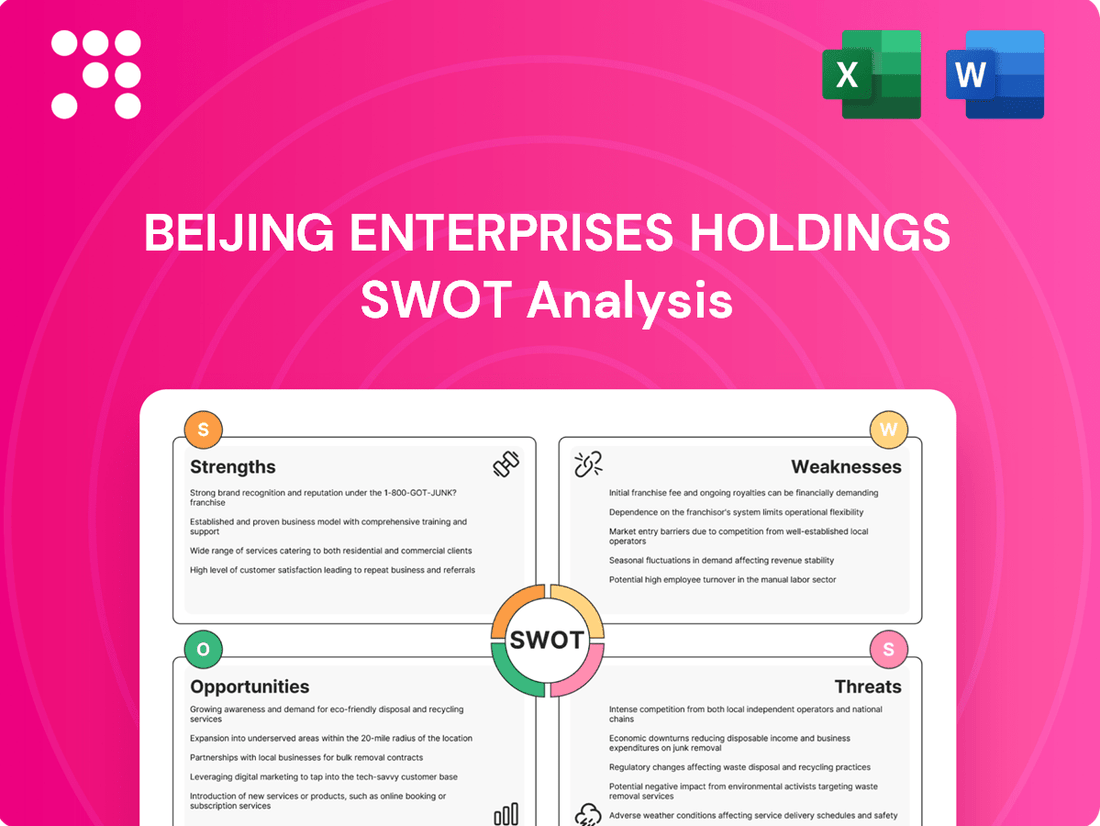

Beijing Enterprises Holdings SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Beijing Enterprises Holdings Bundle

Beijing Enterprises Holdings possesses significant strengths in its diversified portfolio and strong market presence, but faces potential threats from evolving regulations and intense competition. Understanding these dynamics is crucial for any investor or strategist looking to capitalize on opportunities within this dynamic sector.

Want the full story behind Beijing Enterprises Holdings' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Beijing Enterprises Holdings Limited's strength lies in its remarkably diversified business portfolio, spanning city gas distribution, water services, solid waste treatment, and brewery operations. This broad operational base significantly reduces dependence on any single industry, creating a more robust financial structure.

The company's engagement in essential urban infrastructure, such as gas and water, along with consumer-facing segments like breweries, ensures a steady flow of revenue. For instance, in the first half of 2024, the gas segment contributed significantly to revenue, demonstrating the stability of its utility operations.

Beijing Enterprises Holdings (BEH) maintains a dominant standing in China's essential utility sectors, notably in natural gas and water services. This leadership translates into a robust and dependable revenue stream, as these services are fundamental to daily life and thus experience consistent demand. The company's strong market share, exemplified by BE Water's fourteen-year consecutive leadership in China's water industry, creates significant barriers to entry for potential competitors, solidifying its competitive edge.

Beijing Enterprises Holdings Limited's position as a key provider of essential urban infrastructure, including gas and water, grants it significant strategic importance to the Chinese government. This inherent backing often translates into preferential policies and a stable operating environment, particularly as China emphasizes new urbanization and sustainable development initiatives. For example, in 2024, the company's gas distribution segment played a crucial role in meeting the energy demands of millions of households and businesses, underscoring its foundational role in urban life.

Consistent Revenue and Profit Growth

Beijing Enterprises Holdings has shown a strong ability to grow its revenue and profits consistently. In the first half of 2024, the company reported a 2.1% increase in revenue, reaching HK$35.8 billion. Furthermore, its profit attributable to shareholders saw a healthy 5.0% rise, excluding any one-off items, underscoring its operational resilience.

This sustained financial performance is a key strength, reflecting effective operational management and robust demand for its diverse portfolio of businesses, which primarily include gas, water, and environmental services. The company's ability to translate revenue growth into profit growth highlights its efficiency and strategic execution.

- Consistent Revenue Growth: 2.1% increase in the first half of 2024.

- Profitability Improvement: 5.0% rise in profit attributable to shareholders (excluding one-offs) in H1 2024.

- Operational Efficiency: Demonstrated ability to manage costs and translate sales into profits.

- Market Demand: Strong demand for its essential utility and environmental services.

Commitment to Shareholder Returns

Beijing Enterprises Holdings demonstrates a strong focus on rewarding its shareholders, evident in its proactive dividend distribution and share repurchase strategies. The company has outlined a clear dividend policy for the period 2024-2026, committing to distributing at least 35% of its recurring earnings per share. This commitment is further bolstered by an authorized share buyback program, allowing for the repurchase of up to 10% of its outstanding shares.

These actions underscore Beijing Enterprises Holdings' dedication to enhancing shareholder value. For instance, in 2023, the company’s dividend payout ratio was approximately 40% of its net profit, reflecting a consistent approach to returning capital. The share repurchase mandate provides flexibility to manage its equity base and potentially boost earnings per share, further benefiting investors.

- Dividend Payout Commitment: A policy to distribute at least 35% of recurring earnings per share from 2024 to 2026.

- Share Buyback Authorization: Approval for share repurchases of up to 10% of the company's total issued shares.

- Historical Payouts: In 2023, the dividend payout ratio reached around 40% of net profit.

Beijing Enterprises Holdings Limited's strengths are anchored in its diversified business model, covering essential services like gas and water, alongside consumer goods such as breweries. This diversification provides a stable revenue base, as seen in the first half of 2024, where the gas segment remained a significant revenue contributor. The company’s leading position in China's utility sector, particularly in natural gas and water services, creates substantial market advantages and barriers to entry for competitors, ensuring consistent demand and revenue streams.

The company's financial performance in the first half of 2024 highlights its operational efficiency, with a 2.1% revenue increase to HK$35.8 billion and a 5.0% rise in profit attributable to shareholders. This consistent growth, driven by strong demand for its essential services, demonstrates effective management and strategic execution.

Furthermore, BEH's commitment to shareholder returns is a key strength, evidenced by its dividend policy of distributing at least 35% of recurring earnings per share from 2024-2026 and an authorized share buyback program of up to 10% of its outstanding shares. This shareholder-friendly approach, with a 2023 dividend payout ratio around 40%, enhances investor confidence and long-term value.

| Metric | H1 2024 Performance | Significance |

|---|---|---|

| Revenue Growth | 2.1% increase | Indicates sustained demand and operational expansion. |

| Profit Growth (Attributable to Shareholders) | 5.0% increase (excluding one-offs) | Demonstrates effective cost management and profitability. |

| Dividend Payout Policy | At least 35% of recurring EPS (2024-2026) | Signals commitment to shareholder returns and value creation. |

| Share Buyback Program | Up to 10% of outstanding shares | Provides flexibility and potential for EPS enhancement. |

What is included in the product

Offers a full breakdown of Beijing Enterprises Holdings’s strategic business environment by examining its internal strengths and weaknesses alongside external opportunities and threats.

Provides a clear, actionable framework for identifying and addressing Beijing Enterprises Holdings' strategic challenges and opportunities.

Weaknesses

Beijing Enterprises Holdings' utility segment is particularly vulnerable to shifts in Chinese government policies. For instance, the National Development and Reform Commission (NDRC) frequently revises utility pricing and environmental standards, which directly affect the company's earnings. In 2023, for example, adjustments to natural gas pricing by the NDRC could have influenced the profitability of its gas distribution business.

While Beijing Enterprises Holdings has shown overall growth, some individual segments are facing headwinds. For instance, Beijing Enterprises' profits saw a decline in 2024, and Beijing Enterprises Water experienced a profit decrease in the first half of 2024. This suggests that specific business units might be grappling with challenges like rising operational expenses or softening demand, which could temper overall financial performance.

Beijing Enterprises Holdings' operations in infrastructure and utilities necessitate significant capital expenditure for ongoing maintenance, crucial upgrades, and necessary expansion. For instance, in 2023, the company reported capital expenditures of HK$15.2 billion, highlighting the substantial investment required to maintain and grow its asset base.

While the company has actively managed its debt, notably by issuing Panda Bonds in 2024 at attractive rates, the overall debt burden remains a key consideration. As of December 31, 2023, its total debt stood at HK$98.5 billion, presenting an ongoing challenge in ensuring efficient capital allocation and navigating potential shifts in market interest rates.

Impact of Global Economic and Geopolitical Risks

Beijing Enterprises Holdings recognizes that global economic shifts and geopolitical tensions, like those impacting energy supply chains, introduce significant uncertainty. These external forces can directly influence operational expenses and consumer demand, creating a challenging environment for predictable expansion. For example, the volatility in global energy markets throughout 2024 has presented ongoing challenges for utility and infrastructure companies worldwide.

These risks can lead to increased operating costs due to fluctuating commodity prices and supply disruptions. Furthermore, geopolitical instability can affect international trade and investment flows, potentially impacting the demand for Beijing Enterprises Holdings' diverse services. The company must remain agile to navigate these unpredictable external factors.

- Energy Market Volatility: Global energy prices experienced significant fluctuations in late 2023 and early 2024, impacting input costs for many industries, including utilities.

- Supply Chain Disruptions: Ongoing geopolitical events continue to create vulnerabilities in global supply chains, potentially affecting the availability and cost of essential resources.

- Economic Slowdowns: Projections for global economic growth in 2024 and 2025 indicate potential slowdowns in key markets, which could dampen demand for infrastructure and utility services.

Integration Challenges of Diversified Operations

Beijing Enterprises Holdings' diversified portfolio, while a strength, introduces significant integration challenges. Managing distinct businesses like gas distribution, water treatment, and brewing requires sophisticated oversight to ensure operational consistency and resource allocation efficiency. For instance, in 2023, the company operated across multiple utility and consumer product segments, each with unique regulatory environments and market dynamics.

These disparate operations can lead to difficulties in realizing synergies and can strain management's capacity. Without strong centralized controls and clear strategic alignment, there's a risk of operational inefficiencies and internal conflicts. This complexity is evident when comparing the capital expenditure needs and return profiles of its infrastructure assets versus its consumer goods businesses.

- Operational Complexity: Managing diverse segments like gas, water, and beer demands specialized expertise for each, potentially diluting focus.

- Synergy Realization: Achieving cost savings or revenue enhancements across unrelated business lines proves challenging.

- Resource Allocation: Balancing investment and operational support for vastly different businesses requires meticulous strategic planning.

- Management Bandwidth: Overseeing a broad spectrum of industries can stretch management's attention and decision-making capabilities.

The company's substantial debt load, reaching HK$98.5 billion as of December 31, 2023, presents a significant financial vulnerability. While efforts like issuing Panda Bonds in 2024 aim to manage this, the sheer scale of debt requires careful capital allocation and exposes the company to interest rate fluctuations.

Beijing Enterprises Holdings faces considerable operational complexity due to its highly diversified portfolio, spanning utilities, infrastructure, and consumer goods. This breadth can strain management resources and hinder the realization of synergies across distinct business units, potentially leading to inefficiencies.

Policy shifts by Chinese authorities, particularly concerning utility pricing and environmental regulations, pose a direct threat to the profitability of Beijing Enterprises Holdings' core utility segment. For instance, NDRC pricing adjustments in 2023 could impact its gas distribution business.

Specific business segments are experiencing financial strain, evidenced by profit declines in Beijing Enterprises' overall performance and its water segment in the first half of 2024. This suggests challenges such as rising operational costs or weakening demand within certain areas of the company.

Same Document Delivered

Beijing Enterprises Holdings SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're viewing the actual Beijing Enterprises Holdings SWOT analysis, detailing its Strengths, Weaknesses, Opportunities, and Threats. Purchase now to unlock the complete, in-depth report and gain a comprehensive understanding of the company's strategic position.

Opportunities

China's commitment to ecological civilization and its dual carbon goals present a substantial avenue for Beijing Enterprises Holdings to bolster its new energy ventures, including hydrogen energy, and to advance its environmental solutions. This strategic alignment with national priorities is poised to unlock fresh revenue streams and foster significant growth.

In 2023, China's investment in renewable energy reached approximately $141 billion, a record high, underscoring the government's drive towards green development. Beijing Enterprises Holdings can leverage this momentum by expanding its portfolio in areas like hydrogen production and distribution, tapping into a rapidly growing market driven by policy support.

Beijing Gas, a key part of Beijing Enterprises Holdings, is looking to grow its reach beyond the capital city, targeting competitive markets. This strategy could lead to increased gas transmission volumes and new customers in both residential and public sectors, capitalizing on the ongoing shift towards cleaner energy sources.

The company's focus on expanding its market presence aligns with the broader trend of increasing natural gas consumption in China. For instance, in 2023, China's natural gas consumption saw a significant rise, driven by efforts to reduce coal reliance and improve air quality.

Beijing Enterprises Holdings is actively working to refine its asset portfolio, aiming to concentrate on its core business areas. This strategic move is designed to reignite growth by shedding non-essential assets and reinvesting in high-potential segments.

The company also plans to enhance its capital operations, which could involve strategic acquisitions or the refinancing of existing debt. For instance, in 2023, Beijing Enterprises Holdings reported a significant reduction in its finance costs, indicating progress in its debt management strategies and a move towards more efficient capital deployment.

Technological Advancements and Operational Efficiency

Beijing Enterprises Holdings can significantly boost its operational efficiency by embracing technological advancements across its water and environmental services. For instance, integrating smart metering and leak detection systems in its water segment, as seen with similar utilities in 2024, can reduce water loss and operational costs. The company can also implement advanced waste-to-energy technologies to improve conversion rates in its solid waste treatment operations, aligning with global trends towards more sustainable energy production.

These technological upgrades offer tangible benefits:

- Reduced operational expenditures through automation and optimized resource allocation.

- Enhanced service quality via real-time monitoring and predictive maintenance of infrastructure.

- Increased revenue potential from improved energy conversion efficiency in environmental businesses.

- Streamlined management of complex, large-scale infrastructure projects.

Increased Shareholder Value through Buybacks and Dividends

Beijing Enterprises Holdings' (BEH) proactive approach to shareholder returns, including its commitment to share buybacks and a consistent dividend policy, represents a significant opportunity. The company's authorization to repurchase up to 10% of its outstanding shares, as seen in recent financial disclosures, can effectively signal management's confidence in BEH's intrinsic value and potentially boost earnings per share (EPS). This strategy, coupled with a robust dividend payout, aims to directly increase shareholder value and foster greater investor confidence in the company's financial health and future prospects.

The strategic deployment of capital through buybacks and dividends can have a tangible impact on BEH's market perception and financial metrics. For instance, a successful buyback program not only reduces the number of shares outstanding, thereby increasing EPS, but also demonstrates management's belief that the stock is trading below its fundamental worth. This can attract new investors and reward existing ones, contributing to a more stable and potentially appreciating share price.

- Share Buyback Authorization: BEH has the flexibility to repurchase up to 10% of its issued shares, providing a mechanism to return capital directly to shareholders.

- Dividend Policy: The company's commitment to a sustained dividend payout enhances the attractiveness of BEH as an investment, offering a regular income stream.

- EPS Enhancement: Share repurchases can lead to an increase in Earnings Per Share (EPS), making the stock appear more valuable to investors.

- Investor Confidence: These actions signal management's positive outlook on the company's performance and its dedication to maximizing shareholder value.

Beijing Enterprises Holdings' (BEH) commitment to expanding its hydrogen energy business aligns perfectly with China's ambitious dual carbon goals, creating significant opportunities for growth in the burgeoning green energy sector. This strategic focus, supported by substantial national investment in renewables, allows BEH to tap into new markets and revenue streams. The company's efforts to grow Beijing Gas beyond its traditional territory and its embrace of technological advancements in water and waste management further position it to capitalize on the increasing demand for cleaner energy and efficient resource utilization.

The company's proactive shareholder return strategy, including a significant share buyback authorization and a consistent dividend policy, enhances its appeal to investors. These actions not only signal management's confidence in BEH's value but also directly contribute to increased shareholder wealth by boosting EPS and providing a reliable income stream.

| Opportunity Area | Description | Potential Impact | Supporting Data (2023/2024 Trends) |

|---|---|---|---|

| New Energy Ventures | Expansion into hydrogen energy and other green solutions. | New revenue streams, market leadership in green tech. | China's renewable energy investment hit ~$141 billion in 2023; strong government support for hydrogen. |

| Market Expansion (Beijing Gas) | Growth beyond Beijing into new competitive markets. | Increased gas transmission volumes, customer base growth. | China's natural gas consumption rose significantly in 2023 to meet cleaner energy targets. |

| Technological Enhancements | Adoption of smart metering, leak detection, and advanced waste-to-energy tech. | Reduced operational costs, improved service quality, higher energy conversion rates. | Utilities globally are investing in smart grid technologies for efficiency gains. |

| Shareholder Returns | Share buybacks and consistent dividend payouts. | Increased EPS, enhanced investor confidence, direct capital return. | BEH authorized to repurchase up to 10% of outstanding shares; focus on capital efficiency. |

Threats

Beijing Enterprises Holdings faces a significant threat from intensified competition across its core markets. In the brewery sector, the company, despite its strong Yanjing brand presence, contends with aggressive expansion from both established domestic rivals and nimble international players seeking to capture market share in China's vast consumer base. This competitive pressure, particularly evident in 2024, demands constant product innovation and strategic pricing to maintain profitability.

The environmental business segment, while growing, also sees a surge in competition. Both state-owned enterprises and private companies are investing heavily in water treatment, waste management, and renewable energy projects. This intensified landscape, with numerous bids for infrastructure projects throughout 2024 and into early 2025, could lead to margin compression and a need for greater operational efficiency to secure and execute contracts effectively.

An economic slowdown in China, a key market for Beijing Enterprises Holdings, presents a significant threat. For instance, if China's GDP growth, which was projected to be around 5% in 2024, falters, it could directly impact consumer spending on their beer products. This reduced purchasing power can also translate to lower industrial demand for their gas and water utility services, directly affecting revenue streams.

Beijing Enterprises Holdings' core businesses, including city gas distribution and solid waste treatment, are quite sensitive to changes in the cost of raw materials and energy. For instance, a substantial rise in natural gas prices, a key input for their gas segment, could squeeze profit margins. This is especially true if the company faces difficulties in fully passing these higher costs onto customers due to regulations or competitive pressures in the market.

Geopolitical Risks and Trade Protectionism

Beijing Enterprises Holdings faces significant headwinds from escalating geopolitical tensions and a global trend towards trade protectionism. These factors can disrupt international energy markets, impacting supply chains and the operational stability of its overseas assets, like EEW GmbH, a German energy infrastructure company.

The increasing likelihood of trade barriers and sanctions could directly affect the cost of imported components and the profitability of cross-border transactions. For example, in 2023, global trade growth slowed to an estimated 0.9%, a stark contrast to the 5.2% seen in 2022, reflecting the growing impact of protectionist policies.

The company's exposure to these risks is amplified by its diversified international portfolio. Potential trade disputes or political instability in key operating regions could lead to:

- Increased operational costs due to tariffs and import restrictions.

- Reduced demand for energy products and services in affected markets.

- Challenges in repatriating profits or accessing capital from certain jurisdictions.

- Potential for asset devaluation in politically volatile regions.

Environmental Regulations and Compliance Costs

While Beijing Enterprises Holdings operates in environmental protection, increasingly stringent environmental regulations across China present a significant threat. These evolving standards could escalate compliance expenses for the company's other core businesses, including its gas distribution networks and brewing operations. For instance, stricter emissions controls or waste management requirements might necessitate substantial capital investment in upgrading existing facilities or adopting new technologies.

Failure to adapt to these new environmental mandates could lead to severe consequences. Penalties for non-compliance could impact profitability, and operational disruptions, such as temporary shutdowns or production limitations, could affect revenue streams. In 2023, China continued to emphasize green development, with the Ministry of Ecology and Environment announcing plans for enhanced enforcement of air and water pollution standards, directly impacting industrial sectors where Beijing Enterprises Holdings is active.

- Increased Capital Expenditure: Anticipated upgrades to meet new emission standards in gas distribution could require millions in new equipment.

- Operational Risk: Potential for temporary facility closures due to non-compliance could disrupt supply chains and sales.

- Regulatory Uncertainty: The pace and specific nature of future regulatory changes create a challenging planning environment.

Beijing Enterprises Holdings faces intense competition in its brewery and environmental segments, with both domestic and international players vying for market share, a trend that intensified through 2024 and into early 2025. Economic slowdowns in China, a primary market, pose a significant threat, potentially reducing consumer spending on beer and industrial demand for utilities. Fluctuations in raw material and energy costs, particularly natural gas prices, can directly impact profit margins if higher costs cannot be passed on to customers due to regulatory or competitive constraints.

Geopolitical tensions and rising trade protectionism create further threats, potentially disrupting international energy markets and impacting the company's overseas assets. For example, global trade growth slowed considerably in 2023, reflecting increased protectionist policies. Increasingly stringent environmental regulations in China also present a risk, potentially escalating compliance expenses and necessitating substantial capital investments in facility upgrades, with penalties for non-compliance impacting profitability.

| Threat Category | Specific Risk | Impact on Beijing Enterprises Holdings | Data Point/Example |

|---|---|---|---|

| Competition | Intensified rivalry in brewing and environmental services | Margin compression, need for innovation | China's beer market saw aggressive expansion by competitors in 2024. |

| Economic Factors | Chinese economic slowdown | Reduced consumer spending, lower industrial demand | China's projected GDP growth of ~5% for 2024 could be impacted. |

| Cost Volatility | Rising natural gas prices | Squeezed profit margins in gas distribution | Difficulty in passing costs to customers due to market pressures. |

| Geopolitical Risks | Trade protectionism, sanctions | Supply chain disruption, impact on overseas assets (e.g., EEW GmbH) | Global trade growth slowed to 0.9% in 2023. |

| Regulatory Changes | Stricter environmental regulations | Increased capital expenditure, compliance costs, operational risk | China's focus on green development in 2023 led to enhanced pollution standard enforcement. |

SWOT Analysis Data Sources

This analysis is built upon a foundation of robust data, including Beijing Enterprises Holdings' official financial statements, comprehensive market research reports, and credible industry publications to provide an accurate and insightful SWOT assessment.