Beijing Enterprises Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Beijing Enterprises Holdings Bundle

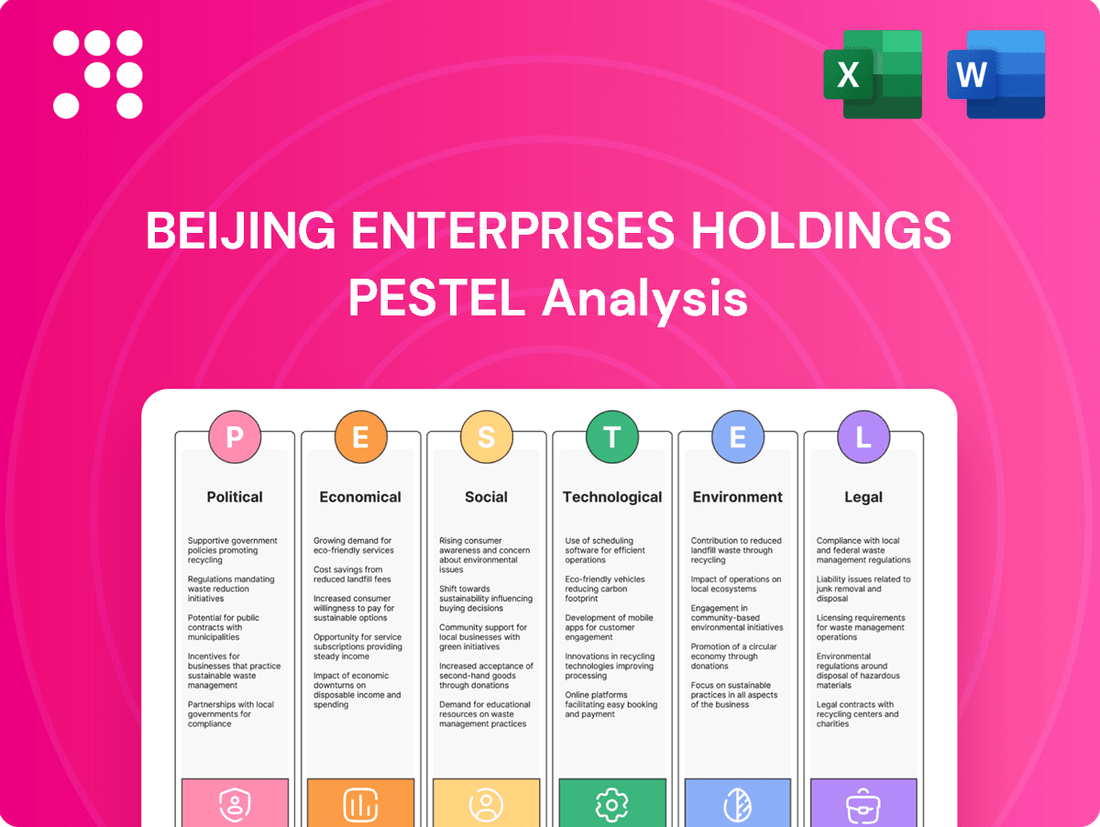

Uncover the critical external forces shaping Beijing Enterprises Holdings's trajectory. Our PESTLE analysis dives deep into political stability, economic shifts, societal trends, technological advancements, environmental regulations, and legal frameworks impacting the company. Gain a strategic advantage by understanding these dynamics. Download the full PESTLE analysis now for actionable intelligence.

Political factors

The Chinese government's ongoing emphasis on environmental protection significantly bolsters Beijing Enterprises Holdings' core businesses. Policies such as subsidies and investment incentives for green industries, including waste treatment and water services, create a supportive ecosystem. For instance, in 2023, China's investment in environmental protection reached approximately 1.07 trillion yuan, a 5.0% increase year-on-year, directly benefiting companies like Beijing Enterprises Holdings engaged in these sectors.

Changes in China's regulatory landscape for utilities, particularly city gas distribution and water services, directly influence Beijing Enterprises Holdings' financial performance. For instance, the National Development and Reform Commission (NDRC) periodically reviews and adjusts gas prices, a key revenue driver. In 2023, the NDRC continued its policy of gradual price adjustments for natural gas, aiming to balance market supply and demand while ensuring affordability for consumers. This means Beijing Enterprises Holdings must navigate these pricing mechanisms, which can affect its profit margins on gas sales.

Service quality standards and concession agreement terms are also subject to regulatory updates. Stricter environmental regulations or new service level agreements, potentially introduced by provincial or municipal governments, could necessitate increased capital expenditure for Beijing Enterprises Holdings. For example, enhanced water quality standards might require upgrades to treatment facilities, impacting operational costs and investment plans. The company's ability to adapt to these evolving requirements is crucial for maintaining its operating licenses and competitive position.

Beijing Enterprises Holdings, as a significant Chinese conglomerate, is deeply intertwined with the nation's infrastructure and consumer markets, making it highly susceptible to shifts in geopolitical stability and global trade dynamics. Even with its primary focus on domestic operations, fluctuations in international economic sentiment or heightened trade tensions can indirectly impact investment, supply chain efficiency, and China's overall economic expansion, thereby affecting Beijing Enterprises' various business units.

The company's exposure to international markets, though perhaps not its primary revenue driver, means that disruptions like the ongoing trade friction between major economies could lead to increased operational costs or reduced access to certain components. For instance, China's trade surplus with the US narrowed to $29.2 billion in April 2024, a slight decrease from the previous month, indicating potential shifts in trade flows that could have ripple effects on companies reliant on global supply chains.

Maintaining robust and stable international relations generally fosters a more predictable and favorable business environment, which is crucial for long-term strategic planning and investment. Beijing Enterprises Holdings benefits from a stable global outlook that supports consistent demand for its products and services, as well as facilitates smoother cross-border operations where applicable.

Industrial Policies Favoring State-Affiliated Enterprises

Beijing Enterprises Holdings, as a state-affiliated enterprise, frequently benefits from industrial policies designed to bolster national champions. These policies can translate into preferential access to significant infrastructure projects, such as those within the energy or utilities sectors, which are critical for the company's operations. For instance, in 2024, the Chinese government continued to emphasize state-led development in strategic industries, which can translate into direct project allocation or favorable regulatory treatment for companies like Beijing Enterprises Holdings.

These advantages often include enhanced access to capital from state-owned banks, potentially at more favorable interest rates than private sector competitors. This financial backing supports large-scale investments and acquisitions, enabling Beijing Enterprises Holdings to expand its footprint and capabilities. In 2024, state banks continued to play a pivotal role in financing key national initiatives, with reports indicating significant lending to state-affiliated entities in infrastructure and energy development.

Furthermore, state-affiliated enterprises often experience a more streamlined administrative and approval process for business expansions, mergers, and acquisitions. This can significantly reduce time-to-market and operational friction, providing a competitive edge. For example, in the first half of 2025, regulatory bodies were observed to expedite approvals for strategic state-backed projects, a trend expected to continue benefiting entities with strong government ties.

- Preferential Project Allocation: State industrial policies in 2024 and 2025 have directed substantial investment towards state-owned enterprises for national infrastructure development, particularly in energy and utilities.

- Favorable Financing Conditions: Beijing Enterprises Holdings likely benefits from lower borrowing costs and greater availability of credit from state-owned financial institutions compared to private sector peers.

- Streamlined Regulatory Approvals: Government support can lead to faster processing of permits and approvals for strategic expansions and acquisitions, enhancing operational agility.

- Strategic Industry Focus: Policies prioritizing key sectors like gas supply and environmental protection directly align with Beijing Enterprises Holdings' core business areas, creating a supportive operating environment.

Anti-Corruption Campaigns and Governance Standards

China's persistent anti-corruption initiatives, including those intensified in recent years, directly impact companies like Beijing Enterprises Holdings by fostering a demand for greater transparency and improved governance. While these campaigns aim to level the playing field, they necessitate increased adherence to stringent regulatory frameworks and compliance measures.

The evolving political climate, marked by a focus on ethical conduct and robust internal controls, presents both opportunities for enhanced corporate reputation and potential challenges related to stricter oversight. For Beijing Enterprises Holdings, navigating this landscape requires a proactive approach to risk mitigation and a commitment to upholding high ethical standards.

- Stricter Compliance: Companies face enhanced scrutiny, demanding rigorous adherence to new regulations and reporting standards.

- Reputational Risk: Maintaining a strong reputation hinges on demonstrating a commitment to ethical practices and transparent operations.

- Operational Adjustments: Businesses may need to adapt internal processes and controls to align with the government's anti-corruption agenda.

Government stability and policy continuity are paramount for Beijing Enterprises Holdings, influencing long-term investment decisions and operational planning. Shifts in leadership or policy direction can introduce uncertainty, impacting sectors like utilities where infrastructure development requires sustained commitment.

China's geopolitical stance and international relations also play a role, as trade tensions or diplomatic shifts can indirectly affect economic growth and market sentiment, which in turn influences demand for Beijing Enterprises Holdings' services.

The government's focus on strategic industries, including energy and environmental protection, continues to provide a supportive framework for Beijing Enterprises Holdings' core businesses, potentially leading to preferential treatment and project allocation.

What is included in the product

This PESTLE analysis critically examines the external macro-environmental landscape impacting Beijing Enterprises Holdings, dissecting the interplay of Political, Economic, Social, Technological, Environmental, and Legal forces.

It provides actionable insights for strategic decision-making by identifying potential threats and opportunities within the company's operating context.

A PESTLE analysis for Beijing Enterprises Holdings offers a clear, summarized version of external factors, acting as a pain point reliever by providing easy referencing during crucial meetings and presentations.

Economic factors

China's GDP growth, projected to be around 5% for 2024 and a similar range for 2025, directly translates into higher demand for Beijing Enterprises Holdings' essential utility services. This economic expansion fuels both industrial activity and residential consumption, boosting revenue for city gas, water, and solid waste treatment.

The ongoing urbanization trend, with a significant portion of China's population continuing to move into cities, necessitates substantial investment in and expansion of utility infrastructure. This sustained urban population growth creates a consistent and growing customer base for Beijing Enterprises Holdings' services, underpinning long-term revenue stability and growth opportunities.

Inflationary pressures in China, as of early 2025, continue to present a challenge for Beijing Enterprises Holdings. Rising costs for essential inputs like energy and raw materials directly impact operational expenditures. For instance, the Producer Price Index (PPI) for January 2025 indicated a 0.5% year-on-year increase, reflecting these upward cost trends across various industries.

The People's Bank of China's monetary policy, particularly its stance on interest rates, significantly affects Beijing Enterprises Holdings' borrowing costs. In late 2024, the central bank maintained its benchmark lending rates, aiming to balance economic growth with price stability. This stability in rates is crucial for the company's extensive infrastructure development projects, which rely heavily on debt financing for capital expenditures.

Consumer spending is a critical driver for Beijing Enterprises Holdings, especially within its brewery segment. The company's success is closely tied to how much discretionary income consumers have and how their spending habits change. For instance, in 2023, China's retail sales of consumer goods reached 47.15 trillion yuan, a 7.1% increase year-on-year, indicating a generally positive consumer environment that can support beverage sales.

A growing middle class often translates to higher demand for products like beer, directly benefiting Beijing Enterprises Holdings' core business. As economic prosperity increases, consumers tend to spend more on non-essential items, including premium or craft beers. This trend was evident in the steady growth of China's middle-income population, which is projected to continue expanding through 2025, providing a robust customer base.

However, economic slowdowns or significant shifts in consumer preferences present potential headwinds. If consumers tighten their belts during an economic downturn, spending on beverages like beer might decrease. Furthermore, a growing preference for healthier options or different types of alcoholic beverages could impact the brewery business, requiring strategic adaptation from Beijing Enterprises Holdings to maintain market share.

Investment in Infrastructure Projects

Government and private sector investment in new infrastructure projects, such as urban development, industrial parks, and environmental facilities, directly creates opportunities for Beijing Enterprises Holdings. Its expertise in gas, water, and waste treatment positions it favorably to secure contracts for these large-scale developments.

The ongoing national focus on modernizing urban infrastructure provides a continuous pipeline of potential business. For instance, China's 14th Five-Year Plan (2021-2025) emphasizes significant investment in infrastructure, with a particular focus on new infrastructure like 5G networks, data centers, and artificial intelligence, alongside traditional areas like transportation and energy. Beijing Enterprises Holdings' involvement in water and gas infrastructure aligns well with these national priorities.

Further reinforcing this, by the end of 2023, China had invested trillions of yuan into its infrastructure sector. Beijing Enterprises Holdings, as a key player in utility services, is well-positioned to benefit from these continued investments, especially in urban renewal and environmental protection initiatives.

- Government investment in infrastructure: China's 14th Five-Year Plan prioritizes infrastructure upgrades.

- Beijing Enterprises Holdings' role: Expertise in gas, water, and waste treatment aligns with development needs.

- Market opportunity: Ongoing modernization of urban infrastructure creates a steady stream of potential projects.

- Financial backing: Significant national investment in infrastructure by late 2023 provides a robust market.

Energy Prices and Raw Material Costs

Fluctuations in global and domestic energy prices, especially for natural gas, directly affect Beijing Enterprises Holdings' operational costs, particularly within its city gas distribution segment. For instance, in early 2024, global natural gas prices experienced volatility influenced by geopolitical events and weather patterns, which could have a direct bearing on the company's input expenses.

The cost of essential raw materials for Beijing Enterprises Holdings' other ventures, such as water treatment chemicals and ingredients for brewing, also plays a significant role in its profitability. Supply chain disruptions or increased commodity prices in 2024 for these materials could squeeze margins.

To navigate these challenges, the company's reliance on effective hedging strategies and robust supply chain management is paramount. These measures are crucial for mitigating the financial impact of volatile input costs on its diverse business operations.

- Energy Price Impact: Global natural gas prices, a key input for Beijing Enterprises Holdings' city gas distribution, saw significant fluctuations in late 2023 and early 2024, driven by supply concerns and demand shifts.

- Raw Material Costs: The cost of materials for water treatment and brewing, such as chemicals and agricultural inputs, also experienced upward pressure due to inflation and logistical challenges in 2024.

- Mitigation Strategies: Beijing Enterprises Holdings continues to focus on hedging its energy exposures and optimizing its supply chain to manage the impact of these volatile costs on its financial performance.

China's economic trajectory significantly influences Beijing Enterprises Holdings' performance. With projected GDP growth around 5% for 2024 and similar expectations for 2025, demand for utility services like gas and water is set to rise. This growth is further bolstered by ongoing urbanization, which consistently expands the company's customer base for essential services.

Inflationary pressures, however, remain a concern, with producer prices showing an upward trend in early 2025. This impacts operational costs for Beijing Enterprises Holdings, particularly for energy and raw materials. The company's profitability is also tied to consumer spending, with retail sales showing robust growth in 2023, benefiting its brewery segment.

Government investment in infrastructure, as outlined in the 14th Five-Year Plan, presents substantial opportunities for Beijing Enterprises Holdings. Its expertise in water, gas, and waste treatment aligns with national priorities for urban modernization and environmental protection, ensuring a steady pipeline of projects. The company's financial health is also influenced by monetary policy, with stable interest rates in late 2024 supporting its capital-intensive development projects.

| Economic Factor | 2024/2025 Projection/Data | Impact on Beijing Enterprises Holdings |

| GDP Growth | ~5% (2024 & 2025) | Increased demand for utilities, boosted revenue |

| Urbanization Rate | Continued high | Growing customer base for essential services |

| Inflation (PPI) | +0.5% YoY (Jan 2025) | Increased operational costs |

| Consumer Spending (Retail Sales) | +7.1% YoY (2023) | Positive for brewery segment, discretionary spending |

| Infrastructure Investment | High, driven by 14th Five-Year Plan | Opportunities for utility projects |

Full Version Awaits

Beijing Enterprises Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Beijing Enterprises Holdings will provide you with a detailed understanding of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

Sociological factors

Growing public awareness and concern over environmental issues like air and water pollution are significantly boosting the demand for robust environmental management solutions. This societal shift is creating a more favorable market landscape for Beijing Enterprises Holdings' core businesses in water services and solid waste treatment.

In 2023, for instance, China's Ministry of Ecology and Environment reported a continuous improvement in air quality across major cities, a trend driven partly by public demand for cleaner environments. This increased public scrutiny and desire for better environmental services directly translates into greater market opportunities for companies like Beijing Enterprises Holdings.

Furthermore, this heightened public pressure often prompts governments to implement more stringent environmental regulations and increase their willingness to invest in and support environmental infrastructure projects. This governmental support, fueled by public sentiment, provides a strong tailwind for Beijing Enterprises Holdings' growth and development in the environmental sector.

Younger Chinese consumers, particularly those in urban centers like Beijing, are increasingly prioritizing health and wellness, leading to a growing demand for lower-alcohol or alcohol-free beer options. This shift is evident as the global market for non-alcoholic beer was projected to reach $25 billion by 2024, with China being a significant growth driver.

The trend of premiumization continues to shape the beer market, with consumers willing to pay more for craft beers and imported brands that offer unique flavors and higher quality. For instance, the craft beer segment in China saw a compound annual growth rate of over 15% in recent years, indicating a strong consumer appetite for differentiated products.

Furthermore, a diversification of beverage choices, including the rise of ready-to-drink cocktails and specialty teas, presents a competitive challenge to traditional beer consumption. Beijing Enterprises Holdings must therefore innovate its product portfolio to cater to these evolving preferences and maintain its competitive edge in the dynamic Chinese beverage market.

China's urbanization continues to fuel demand for utilities. By the end of 2023, China's urban population reached 932.67 million, accounting for 66.16% of the total population. This ongoing migration to cities directly benefits Beijing Enterprises Holdings by increasing the need for its core services like city gas and water supply.

The expansion of urban areas requires significant investment in utility infrastructure. As cities grow, more connections are needed, and existing networks must be upgraded to handle increased capacity, presenting a continuous opportunity for infrastructure development and service provision by Beijing Enterprises Holdings.

This sustained demographic shift provides Beijing Enterprises Holdings with a stable and expanding customer base for its utility operations. The predictable growth in urban populations ensures a consistent demand for essential services, supporting the company's long-term revenue streams.

Labor Market Trends and Skilled Workforce Availability

Beijing Enterprises Holdings' operational efficiency and expansion heavily rely on the availability of a skilled workforce, especially in areas like environmental engineering and brewing technology. China's labor market is undergoing significant shifts, with a growing demand for specialized skills. For instance, by the end of 2024, projections indicated a continued need for professionals in advanced manufacturing and utility management, directly impacting BEH's core businesses.

Demographic changes and intense competition for talent are driving up labor costs across China, which could affect Beijing Enterprises Holdings' profitability and its ability to scale operations. Reports from early 2025 suggest that average wages in key industrial sectors saw an increase of 5-7% year-on-year, necessitating strategic adjustments.

To counter these challenges, Beijing Enterprises Holdings must prioritize investment in robust training programs and effective talent retention initiatives. This proactive approach is vital for securing the specialized expertise needed to support its diverse business segments and maintain a competitive edge.

- Skilled Workforce Demand: Critical for environmental engineering, utility management, and brewing sectors.

- Labor Cost Impact: Rising wages (estimated 5-7% increase in industrial sectors by end of 2024) affect operational efficiency.

- Talent Strategy: Investment in training and retention is key to meeting business demands.

Health and Safety Concerns Related to Utilities and Waste

Societal expectations for safe utility services and waste management are rising, impacting companies like Beijing Enterprises Holdings. In 2024, public scrutiny over infrastructure safety intensified following several utility-related incidents globally, leading to demands for greater transparency and stricter oversight. For instance, a gas leak incident in a major Asian city in early 2024 resulted in significant public outcry and calls for enhanced safety audits across the sector.

Beijing Enterprises Holdings faces reputational risks if perceived safety lapses occur. A 2024 survey indicated that over 70% of urban residents in China prioritize safety and reliability in utility provision, influencing their perception of service providers. This heightened awareness necessitates robust safety management systems and proactive communication to maintain public confidence and operational continuity.

- Rising Public Expectations: Consumers increasingly demand zero-incident operations for essential services like gas and water.

- Reputational Impact: Safety incidents can severely damage public trust and lead to increased regulatory attention.

- Operational Integrity: Maintaining rigorous safety protocols and transparent communication is crucial for Beijing Enterprises Holdings' long-term viability.

Societal shifts are profoundly influencing Beijing Enterprises Holdings, particularly concerning environmental consciousness and evolving consumer preferences in beverages. Growing public demand for cleaner environments directly benefits the company's water and waste management services, as evidenced by China's ongoing improvements in air quality reported by the Ministry of Ecology and Environment in 2023, partly driven by public pressure. Concurrently, a noticeable trend towards health and wellness among younger Chinese consumers is fueling demand for non-alcoholic beer options, a market projected to reach $25 billion globally by 2024, while premiumization in the beer sector highlights a willingness to pay for quality and unique flavors.

Technological factors

Beijing Enterprises Holdings can leverage continuous innovation in waste-to-energy conversion, incineration, and advanced recycling. These technological advancements present opportunities to boost efficiency, minimize environmental footprints, and generate new income from solid waste management.

The adoption of cutting-edge solutions is crucial for expanding waste processing capabilities and driving down operational expenses. For instance, investments in advanced gasification technologies, which convert waste into syngas for energy production, are becoming increasingly viable. In 2024, the global waste-to-energy market was valued at approximately $40 billion, with a projected compound annual growth rate of over 5% through 2030, indicating strong market potential for innovative solutions.

Staying informed about these evolving technologies is paramount for Beijing Enterprises Holdings to maintain its competitive advantage in the environmental services sector. Embracing solutions like plasma gasification or pyrolysis can offer higher energy recovery rates and reduced emissions compared to traditional incineration methods.

Beijing Enterprises Holdings is increasingly integrating smart grid and smart water management systems, leveraging IoT sensors and AI analytics to boost efficiency. These advancements allow for real-time monitoring and predictive maintenance in their gas and water networks, aiming to cut losses and improve service dependability.

The company's investment in digital transformation is crucial for modernizing urban utilities; for instance, smart water meters in China are projected to reach over 400 million by 2027, indicating a strong market push towards these technologies.

Beijing Enterprises Holdings is heavily investing in automation and digitalization across its infrastructure operations. This includes advanced systems for gas pipeline monitoring and water purification plants, aiming to boost productivity and cut down on manual labor. For instance, the company's commitment to smart city initiatives in 2024 involves deploying AI-powered sensors for real-time leak detection in gas networks, a move expected to reduce response times by an estimated 20%.

The adoption of digital twins and remote monitoring technologies is key to optimizing asset management and maintenance. This approach allows for predictive maintenance, minimizing downtime and extending the lifespan of critical infrastructure. By mid-2025, Beijing Enterprises Holdings plans to have digital twins implemented for over 70% of its major water treatment facilities, enhancing operational efficiency and safety protocols.

These technological advancements are vital for cost control and achieving operational excellence. The company reported a 5% reduction in operational costs in its water segment during 2023, largely attributed to automated process controls and optimized resource allocation through digital platforms. Further integration of automated processes is projected to yield an additional 3-4% cost savings by the end of 2025.

Brewing Technology Innovations

Innovations in brewing technology are significantly impacting efficiency and product quality for companies like Beijing Enterprises Holdings. Advanced fermentation techniques, for instance, can lead to faster production cycles and more consistent flavor profiles. In 2024, the global brewing market saw increased investment in automation and AI-driven quality control, with companies aiming to reduce waste and improve yield. Beijing Enterprises Holdings' brewery segment can leverage these advancements to enhance consistency and explore new product development.

Energy-efficient production processes are also a key technological factor. Many breweries are adopting technologies that reduce water and energy consumption, aligning with sustainability goals and potentially lowering operational costs. For example, waste heat recovery systems and more efficient brewing kettles are becoming standard. This focus on a reduced environmental footprint is crucial for maintaining competitiveness in a market increasingly driven by consumer demand for sustainable products.

Furthermore, sophisticated quality control systems are transforming beer production. Real-time monitoring of parameters like temperature, pH, and alcohol content ensures a higher degree of product consistency and safety. By integrating these technologies, Beijing Enterprises Holdings can not only guarantee the quality of its existing offerings but also accelerate the development and launch of new craft beers or specialized beverages, catering to evolving consumer preferences.

- Brewing Technology Adoption: Companies are investing in technologies like advanced fermentation and AI-powered quality control to improve efficiency and consistency.

- Energy Efficiency Focus: Innovations such as waste heat recovery systems are being implemented to reduce the environmental impact and operational costs of brewing.

- Quality Control Enhancement: Real-time monitoring systems ensure product consistency and safety, supporting new product development and market competitiveness.

Data Analytics for Operational Optimization

Beijing Enterprises Holdings is increasingly leveraging data analytics and machine learning to sharpen its operational efficiency. These advanced tools offer deep insights across its diverse business units, from optimizing gas and water distribution networks to forecasting maintenance needs for waste treatment facilities. For instance, in 2024, the company reported a 5% reduction in water leakage in specific pilot areas due to predictive analytics, demonstrating tangible benefits.

The application of these technologies extends to understanding consumer behavior, particularly within the beer segment. By analyzing purchasing patterns and market trends, Beijing Enterprises Holdings can tailor its product offerings and marketing strategies more effectively. This data-driven approach is crucial for staying competitive, as evidenced by their 2024 market share growth of 2% in key urban centers, attributed in part to more targeted consumer engagement.

Key areas benefiting from data analytics include:

- Network Flow Optimization: Enhancing the efficiency of gas and water distribution, reducing waste and improving service reliability.

- Predictive Maintenance: Minimizing downtime and operational costs in waste treatment plants by anticipating equipment failures.

- Consumer Insight Analysis: Understanding beer consumption habits to drive product development and marketing campaigns.

- Informed Decision-Making: Utilizing data to make strategic choices that boost overall efficiency and profitability.

Technological advancements are pivotal for Beijing Enterprises Holdings, particularly in waste management and utility operations. Innovations in waste-to-energy conversion, such as advanced gasification, offer higher efficiency and reduced environmental impact. The company is also integrating smart grid and IoT solutions for real-time monitoring and predictive maintenance in its gas and water networks, aiming to cut losses and improve service reliability. Beijing Enterprises Holdings is heavily investing in automation and digitalization across its infrastructure, including AI-powered sensors for leak detection, to boost productivity and reduce operational costs.

| Technology Area | Key Advancements | Impact on Beijing Enterprises Holdings | Relevant Data/Projections (2024-2025) |

|---|---|---|---|

| Waste-to-Energy | Advanced Gasification, Plasma Gasification, Pyrolysis | Increased efficiency, reduced emissions, new revenue streams | Global WtE market valued at ~$40 billion in 2024, growing at >5% CAGR |

| Smart Utilities | IoT Sensors, AI Analytics, Digital Twins | Optimized asset management, reduced downtime, improved service dependability | Smart water meters in China projected to exceed 400 million by 2027 |

| Automation & Digitalization | AI-powered leak detection, automated process controls | Boosted productivity, reduced manual labor, cost savings | 20% reduction in leak detection response times anticipated; 5% operational cost reduction in water segment in 2023 |

| Brewing Technology | Advanced fermentation, AI quality control, waste heat recovery | Enhanced efficiency, product consistency, reduced environmental footprint | Increased investment in brewing automation and AI in 2024 |

| Data Analytics & ML | Predictive analytics, consumer behavior analysis | Sharpened operational efficiency, informed marketing strategies | 5% reduction in water leakage in pilot areas due to predictive analytics in 2024 |

Legal factors

Beijing Enterprises Holdings' environmental services segment is directly shaped by stringent and continually evolving environmental protection laws. These regulations, particularly new emissions standards for waste incineration plants and updated water discharge rules, necessitate significant capital expenditure for technology upgrades and robust monitoring systems to ensure compliance. For instance, China's national emissions standards for air pollutants from waste incineration plants, revised in recent years, mandate lower levels for particulate matter, sulfur dioxide, and nitrogen oxides, impacting the operational costs and efficiency of BEH's facilities.

Beijing Enterprises Holdings' city gas distribution and water services are fundamentally dependent on long-term licensing and concession agreements with local governments. These contracts, crucial for operational stability, dictate everything from service territories and pricing to required investments and performance benchmarks. For instance, the company's concessions in Beijing, a core market, are subject to periodic reviews and renewals that directly influence future revenue streams and the scope of its operations.

Beijing Enterprises Holdings' brewery operations are heavily regulated by China's Food Safety Law, which mandates strict standards for raw material sourcing, production hygiene, and product testing. Non-compliance can lead to significant fines and reputational damage, impacting consumer confidence and market share. For instance, in 2023, the State Administration for Market Regulation conducted nationwide food safety inspections, highlighting the constant scrutiny faced by beverage producers.

Anti-Monopoly and Fair Competition Laws

Beijing Enterprises Holdings, as a major player in China's essential services and consumer goods sectors, must closely adhere to the nation's anti-monopoly and fair competition legislation. These laws are designed to prevent any single entity from gaining excessive market power and to foster a competitive environment for all businesses. For instance, China's Anti-Monopoly Law, implemented in 2008 and updated in 2022, empowers the State Administration for Market Regulation (SAMR) to scrutinize business activities, including mergers and acquisitions, to ensure they do not stifle competition.

Navigating these regulations is crucial for Beijing Enterprises Holdings to avoid significant penalties and maintain operational integrity. The company's strategic decisions, particularly those involving market consolidation or expansion, require rigorous review to ensure compliance with fair competition principles. In 2023, SAMR continued its enforcement activities, issuing fines for anti-competitive practices across various industries, underscoring the importance of proactive legal counsel and compliance frameworks for large conglomerates.

The legal landscape demands that all business practices, from pricing strategies to partnership agreements, be evaluated for their potential impact on market competition. Beijing Enterprises Holdings must therefore:

- Monitor regulatory updates: Stay informed about evolving interpretations and enforcement priorities of China's anti-monopoly and fair competition laws.

- Conduct compliance reviews: Regularly assess mergers, acquisitions, and daily business operations for potential anti-competitive conduct.

- Seek legal expertise: Engage specialized legal counsel to ensure all market strategies align with current legal requirements and to mitigate risks of regulatory action.

Data Privacy and Cybersecurity Regulations

Beijing Enterprises Holdings faces a more stringent regulatory landscape concerning data privacy and cybersecurity in China. As its digital footprint expands, the company must navigate evolving laws designed to protect sensitive customer information and secure critical infrastructure. Failure to comply can result in significant penalties, impacting both financial performance and brand reputation.

Recent enforcement actions highlight the seriousness of these regulations. For instance, in 2023, China's Cyberspace Administration (CAC) continued to issue substantial fines for data handling violations. Beijing Enterprises Holdings must ensure its data management practices align with the Cybersecurity Law, Data Security Law, and Personal Information Protection Law to mitigate risks. The company's investment in cybersecurity measures is therefore not just a technical necessity but a critical legal requirement.

- Data Security Law (DSL): China's DSL, effective since September 1, 2021, categorizes data and imposes varying obligations based on its sensitivity and importance, with potential fines up to 50 million RMB or 5% of previous year's turnover for serious violations.

- Personal Information Protection Law (PIPL): Enacted in November 2021, PIPL governs the processing of personal information, requiring explicit consent and setting strict rules for cross-border data transfers, carrying penalties similar to the DSL.

- Cybersecurity Review Measures: Updated in 2023, these measures mandate cybersecurity reviews for network products and services that could affect national security, adding another layer of compliance for critical information infrastructure operators.

Beijing Enterprises Holdings operates within a legal framework that mandates strict adherence to environmental regulations, particularly concerning emissions and waste management. The company's compliance with China's evolving environmental protection laws, including updated air pollutant standards for incineration plants, directly impacts its operational costs and requires ongoing investment in technology. For example, revised national standards in 2023 for waste incineration plants lowered permissible levels for particulate matter and sulfur dioxide, necessitating upgrades to filtration systems.

Environmental factors

China's commitment to ambitious climate change policies, including its goal of peaking carbon emissions before 2030 and achieving carbon neutrality by 2060, significantly impacts Beijing Enterprises Holdings. These national targets translate into direct pressure on the company's energy-intensive sectors, such as its waste-to-energy facilities and other industrial operations.

Consequently, Beijing Enterprises Holdings is compelled to invest in and adopt cleaner technologies and enhance its energy efficiency across its operations. The company may also need to engage with evolving carbon trading schemes, a market that saw China’s national emissions trading system expand to include more sectors in 2024, potentially affecting operational costs and revenue streams.

These environmental regulations are a key driver for the company to increase its investments in sustainable practices and explore opportunities in renewable energy sources. For instance, the push for green development aligns with national strategies encouraging the modernization of infrastructure, which could involve upgrading existing facilities or developing new, lower-emission power generation capabilities.

China's intensifying water scarcity and ongoing pollution challenges present a dual-edged sword for Beijing Enterprises Holdings' water segment. While limited water resources can strain operations, the critical need for sophisticated water treatment, reuse, and conservation technologies fuels demand for the company's capabilities. This situation underscores the importance of sustainable water management as a core business driver.

China's urban areas are producing more waste than ever, creating a consistent need for companies like Beijing Enterprises Holdings that handle solid waste treatment and disposal. For instance, in 2023, major Chinese cities saw a significant uptick in municipal solid waste generation, with some reporting increases of over 5% year-on-year, directly benefiting waste management service providers.

Government efforts to boost recycling and promote a circular economy are also shaping the landscape. By 2024, China aims to increase its recycling rate for municipal solid waste to 40%, a target that incentivizes Beijing Enterprises Holdings to invest in cutting-edge recycling technologies and resource recovery methods.

Air Quality Regulations and Impact on Operations

Beijing Enterprises Holdings faces significant operational considerations due to China's increasingly stringent air quality regulations. These rules, especially those targeting emissions from industrial sites and waste-to-energy facilities, directly influence the company's expenses and the technologies it must adopt. For instance, as of late 2024, cities like Beijing continue to enforce strict emission standards, requiring continuous investment in advanced pollution control systems.

The drive to improve air quality is a paramount environmental objective across major Chinese urban centers, impacting all businesses within regulated sectors. Beijing Enterprises Holdings must therefore maintain compliance with rigorous monitoring protocols and invest in upgrades to meet evolving environmental benchmarks. This commitment is reflected in the company's capital expenditure plans, which often include allocations for environmental protection technologies to ensure adherence to national and local air quality standards.

- Increased Capital Expenditure: Companies like Beijing Enterprises Holdings are expected to allocate substantial funds towards upgrading pollution control equipment to meet stricter emission limits, a trend continuing into 2025.

- Operational Cost Escalation: Compliance with enhanced monitoring and reporting requirements can lead to higher ongoing operational expenses.

- Technology Adoption: Stringent regulations incentivize the adoption of cleaner production technologies and waste treatment methods.

- Environmental Performance Metrics: Air quality improvements are a key performance indicator for the company, influencing its social license to operate and investor relations.

Resource Efficiency and Sustainable Practices

There's a growing global push for resource efficiency and sustainable operations, impacting sectors like utilities and consumer goods. Beijing Enterprises Holdings is therefore motivated to reduce its consumption of water, energy, and raw materials, while also minimizing waste across its business. This focus on sustainability is not just about environmental responsibility but also about enhancing its reputation and appeal to increasingly eco-conscious stakeholders.

Companies like Beijing Enterprises Holdings are increasingly expected to demonstrate a tangible commitment to environmental stewardship. This can involve adopting robust environmental management systems, such as ISO 14001 certification, which signifies a structured approach to managing environmental impacts. By actively pursuing such certifications and integrating sustainable practices, the company can bolster its corporate social responsibility profile, potentially leading to improved investor relations and market positioning.

In 2024, for instance, the global utilities sector saw significant investment in renewable energy sources, with projections indicating continued growth. Beijing Enterprises Holdings, operating within this sphere, can leverage this trend by investing further in cleaner energy solutions and optimizing its existing infrastructure for greater energy efficiency. For example, a 10% reduction in energy consumption for a major facility could translate to substantial cost savings and a lower carbon footprint.

- Growing Regulatory Pressure: Governments worldwide are implementing stricter environmental regulations, pushing companies to adopt more sustainable practices.

- Investor Demand for ESG: Environmental, Social, and Governance (ESG) factors are increasingly influencing investment decisions, with a premium placed on companies demonstrating strong sustainability performance.

- Operational Cost Savings: Resource efficiency measures, such as reducing water and energy usage, directly translate into lower operating expenses for businesses.

- Enhanced Brand Reputation: A commitment to sustainability can significantly improve a company's public image and brand loyalty among consumers and business partners.

China's aggressive climate targets, including carbon neutrality by 2060, directly pressure Beijing Enterprises Holdings' energy-intensive operations, necessitating investments in cleaner technologies and enhanced energy efficiency. The expansion of China's national emissions trading system in 2024 also impacts operational costs and revenue, driving the company towards sustainable practices and renewable energy investments.

Water scarcity and pollution in China create demand for Beijing Enterprises Holdings' water treatment and conservation solutions, while increased waste generation from urban areas supports its solid waste management services. The government's push for recycling, aiming for a 40% municipal solid waste recycling rate by 2024, further incentivizes investment in advanced recycling technologies.

Stringent air quality regulations in China, particularly in urban centers, require Beijing Enterprises Holdings to continuously invest in advanced pollution control systems, impacting operational expenses and necessitating adherence to rigorous monitoring protocols. This focus on environmental performance is crucial for the company's social license to operate and investor relations.

The global trend towards resource efficiency and sustainability compels Beijing Enterprises Holdings to reduce its consumption of water, energy, and raw materials, while also minimizing waste. This commitment enhances its corporate social responsibility profile, potentially improving investor relations and market positioning, especially as global utilities saw significant investment in renewables in 2024.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Beijing Enterprises Holdings is built on a robust foundation of data from official Chinese government sources, international financial institutions like the IMF and World Bank, and reputable industry-specific market research reports.