Beijing Enterprises Holdings Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Beijing Enterprises Holdings Bundle

Beijing Enterprises Holdings strategically leverages its diverse product portfolio, from essential utilities to consumer goods, to meet a wide range of market needs. Their pricing strategies are carefully calibrated to balance affordability with profitability, ensuring accessibility while maintaining a strong competitive edge.

Discover the intricate details of Beijing Enterprises Holdings' distribution network and promotional campaigns that solidify their market presence. This analysis goes beyond the surface, offering a comprehensive understanding of their marketing execution.

Unlock the full potential of this analysis by gaining access to the complete 4Ps Marketing Mix. It's your key to understanding the strategic decisions that drive Beijing Enterprises Holdings' success and can inform your own business planning.

Product

Beijing Enterprises Holdings' product strategy centers on providing essential urban infrastructure services, primarily city gas distribution and water supply. These are not just services; they are the lifeblood of urban communities, ensuring consistent energy and water availability for homes and businesses alike.

This focus on fundamental utilities, like gas and water, creates a resilient demand. For instance, in 2023, Beijing Enterprises' gas distribution segment served over 2.7 million customers, highlighting the sheer scale and necessity of its operations. This strategic product selection directly addresses core societal needs, underpinning the company's stable market position.

Beijing Enterprises Holdings' product offering in the water and environmental sector is extensive. They are a major player in sewage and reclaimed water treatment, alongside water distribution services, ensuring essential public utilities.

Their environmental protection services are equally robust, covering solid waste treatment, waste-to-energy projects, and the crucial management of hazardous waste. This dual focus directly supports China's commitment to ecological civilization and enhances urban quality of life.

In 2023, the company reported significant contributions from its water and environmental businesses. For instance, their water segment treated approximately 1.5 billion cubic meters of sewage and reclaimed water, demonstrating substantial operational scale.

Beijing Enterprises Holdings' natural gas distribution and related services form a cornerstone of its operations, primarily involving the sale and delivery of piped natural gas. This segment also encompasses crucial support services such as natural gas transmission, expert technology consultation, and the construction of gas pipelines and associated equipment, ensuring a comprehensive approach to the energy infrastructure.

The company is actively bolstering its natural gas trading activities and is strategically building out a robust, nationwide sales network. This expansion is critical for increasing market penetration and capturing a larger share of the growing demand for natural gas. For instance, in 2023, Beijing Enterprises Holdings reported a significant increase in its natural gas sales volume, reaching approximately 27.3 billion cubic meters, reflecting the success of its network development and trading initiatives.

Beer ion and Consumer Offerings

Beijing Enterprises Holdings, through its Yanjing Brewery, is a major force in the beer market, constantly refining its product range to boost brand appeal. The company is strategically focusing on developing 'U8' as a key bulk product and is innovating its marketing approaches to resonate with today's consumers.

In 2023, Yanjing Brewery maintained its position as one of China's top beer brands, with sales volume contributing significantly to Beijing Enterprises Holdings' overall revenue. The company's commitment to product enhancement is evident in its continuous efforts to optimize the quality and variety of its beer offerings, catering to diverse consumer preferences.

- Product Focus: Development of 'U8' as a core bulk single product.

- Brand Strategy: Ongoing efforts to enhance brand value through product optimization.

- Market Appeal: Implementation of advanced marketing strategies to attract modern consumers.

- Market Presence: Yanjing Brewery remains a leading beer producer in China.

Integrated Urban Management and Sustainability Solutions

Beijing Enterprises Holdings goes beyond offering single services by providing comprehensive urban management and environmental solutions. This focus on integration is key to their product strategy, aiming to deliver holistic value to cities and communities.

The company is actively developing and implementing innovative environmental sustainability solutions, directly addressing critical global and national environmental concerns. This includes a strong commitment to China's 'dual-carbon' goals, targeting significant emissions reductions.

Their approach prioritizes embedding green development principles across all operational facets. This strategic integration ensures that business expansion is pursued in a manner that fosters a healthy balance with ecological preservation.

- Integrated Solutions: Offers combined urban management and environmental services, not just individual components.

- Sustainability Focus: Develops innovative solutions for environmental sustainability.

- Dual-Carbon Strategy: Actively contributes to national emissions reduction targets.

- Green Development Integration: Embeds ecological protection into all business operations.

Beijing Enterprises Holdings' product portfolio is anchored in essential urban infrastructure, primarily city gas distribution and water supply, ensuring consistent availability for millions. This core offering is complemented by a robust environmental services division, encompassing sewage treatment, waste management, and waste-to-energy projects, directly supporting China's ecological goals.

The company also maintains a significant presence in the consumer goods sector through its Yanjing Brewery, focusing on brand enhancement and product innovation, particularly with its 'U8' beer. This diversified product strategy addresses fundamental societal needs while also tapping into consumer markets.

| Product Segment | Key Offerings | 2023 Data/Notes |

|---|---|---|

| City Gas Distribution | Piped natural gas sales and delivery, pipeline construction, technology consultation | Served over 2.7 million customers; sold approx. 27.3 billion cubic meters of natural gas |

| Water and Environmental Services | Water distribution, sewage treatment, reclaimed water treatment, solid waste treatment, waste-to-energy | Treated approx. 1.5 billion cubic meters of sewage and reclaimed water |

| Brewery (Yanjing Brewery) | Beer production and sales | Focus on 'U8' brand, remains a leading beer producer in China |

What is included in the product

Beijing Enterprises Holdings' marketing mix is strategically designed to leverage its diverse portfolio, focusing on delivering essential services and consumer goods. The analysis delves into how their product offerings, pricing strategies, extensive distribution networks, and promotional activities work in synergy to maintain a strong market presence.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of deciphering intricate plans for busy executives.

Provides a clear, concise overview of Beijing Enterprises Holdings' 4Ps, easing the burden of extensive research and analysis for strategic decision-making.

Place

Beijing Enterprises Holdings boasts an extensive pipeline infrastructure, a critical component of its distribution strategy for natural gas and water. This network allows for direct delivery to a vast urban and industrial customer base, ensuring reliable service. For instance, as of the first half of 2024, the company's natural gas pipeline network spanned over 26,000 kilometers, serving millions of customers.

The company is actively broadening its reach beyond its core Beijing market, focusing on expanding its gas market presence in other regions. Furthermore, Beijing Enterprises Holdings is investing in developing a domestic liquefied natural gas (LNG) distribution market, aiming to diversify its supply and reach new customer segments.

Beijing Enterprises Holdings, through its subsidiary Beijing Water Group, strategically places its treatment facilities. This includes numerous water treatment plants, sewage and reclaimed water treatment facilities, and solid waste treatment plants. Their placement within cities and regions ensures efficient processing of waste and supply of treated water.

This strategic positioning maximizes convenience and operational efficiency for local governments and communities. As of December 2024, Beijing Water Group was involved in an impressive 1,472 water plants and town-size sewage treatment facilities, highlighting the scale of their strategically located infrastructure.

Beijing Enterprises Holdings focuses on direct service provision, primarily to urban and industrial clients, through its core utility and environmental operations. This direct engagement model leverages long-term contracts with municipal governments and industrial partners, guaranteeing consistent and dependable delivery of essential services for urban infrastructure and industrial processes.

A key example of this direct service approach is seen with Beijing Gas, which successfully connected around 54,000 new household subscribers in Beijing during the first half of 2024. This expansion highlights the company's commitment to directly meeting the energy needs of urban populations.

Multi-channel Distribution for Consumer Products

Beijing Enterprises Holdings employs a robust multi-channel distribution strategy for its consumer products, particularly within its significant beer segment. This approach is crucial for maximizing market penetration and catering to diverse consumer preferences.

The company's beer business, spearheaded by Yanjing Brewery, effectively integrates online and offline channels. This dual strategy ensures broad reach, encompassing traditional brick-and-mortar retail, burgeoning e-commerce platforms, and innovative new retail formats that align with modern consumer behavior. For instance, in 2023, Yanjing Brewery's sales through e-commerce channels saw a significant uptick, contributing to its overall revenue growth. The company also actively leverages partnerships with major online retailers and delivery services to ensure product availability and convenience for a digitally-native consumer base.

- Online Presence: Beijing Enterprises Holdings actively participates in major e-commerce platforms, expanding its digital footprint and reaching consumers beyond geographical limitations.

- Offline Reach: Traditional retail channels, including supermarkets, convenience stores, and specialized liquor stores, remain a cornerstone of their distribution network, ensuring widespread accessibility.

- New Retail Formats: The company is exploring and integrating with emerging retail models, such as smart convenience stores and direct-to-consumer (DTC) initiatives, to capture evolving market trends.

- Sales Performance: In 2024, the company reported a 15% year-over-year increase in sales attributed to its diversified distribution channels, highlighting the effectiveness of its multi-channel approach.

Project-based and Regional Operations Model

Beijing Enterprises Holdings leverages a project-based and regional operations model, particularly for its environmental and infrastructure ventures. This approach involves securing projects through tenders and acquisitions, enabling the company to tailor its services to distinct local requirements and governmental directives. This strategy is key to expanding its footprint and operational capacity across diverse urban service sectors.

This decentralized operational structure allows for strategic resource allocation and a focused approach to market penetration. By aligning solutions with specific regional needs and regulatory landscapes, Beijing Enterprises can optimize its project execution and enhance its competitive advantage. This is evident in its consistent success in securing new business opportunities.

- Project-Specific Deployment: Enables tailored environmental and infrastructure solutions for diverse urban needs.

- Regional Focus: Facilitates adaptation to local government mandates and market demands.

- Growth through Acquisition and Tenders: Key strategies for expanding operational scale and market presence.

- 2024 Success: Beijing Enterprises Urban Resources Group secured 35 urban services projects, demonstrating strong execution of this model.

Beijing Enterprises Holdings' "Place" strategy centers on its extensive, strategically located infrastructure for utilities and its multi-channel approach for consumer goods. For its utility businesses, the company's vast pipeline network, exceeding 26,000 kilometers by mid-2024 for natural gas, and its numerous water treatment facilities, totaling 1,472 by the end of 2024, ensure direct and efficient service delivery to urban and industrial centers.

In its consumer segment, particularly beer, a dual online and offline distribution model is employed. This ensures broad market penetration, reaching consumers through traditional retail, e-commerce, and newer formats. For instance, Yanjing Brewery's e-commerce sales saw significant growth in 2023, contributing to overall revenue. This diverse placement strategy aims to maximize accessibility and cater to varied consumer purchasing habits.

| Business Segment | Key Placement Strategy | Data Point (as of latest available) |

|---|---|---|

| Natural Gas Utility | Extensive Direct Pipeline Network | Over 26,000 km of pipelines (H1 2024) |

| Water Utility | Strategically Located Treatment Facilities | 1,472 water and sewage treatment facilities (Dec 2024) |

| Beer (Yanjing Brewery) | Multi-channel Distribution (Online & Offline) | Significant e-commerce sales growth (2023) |

What You See Is What You Get

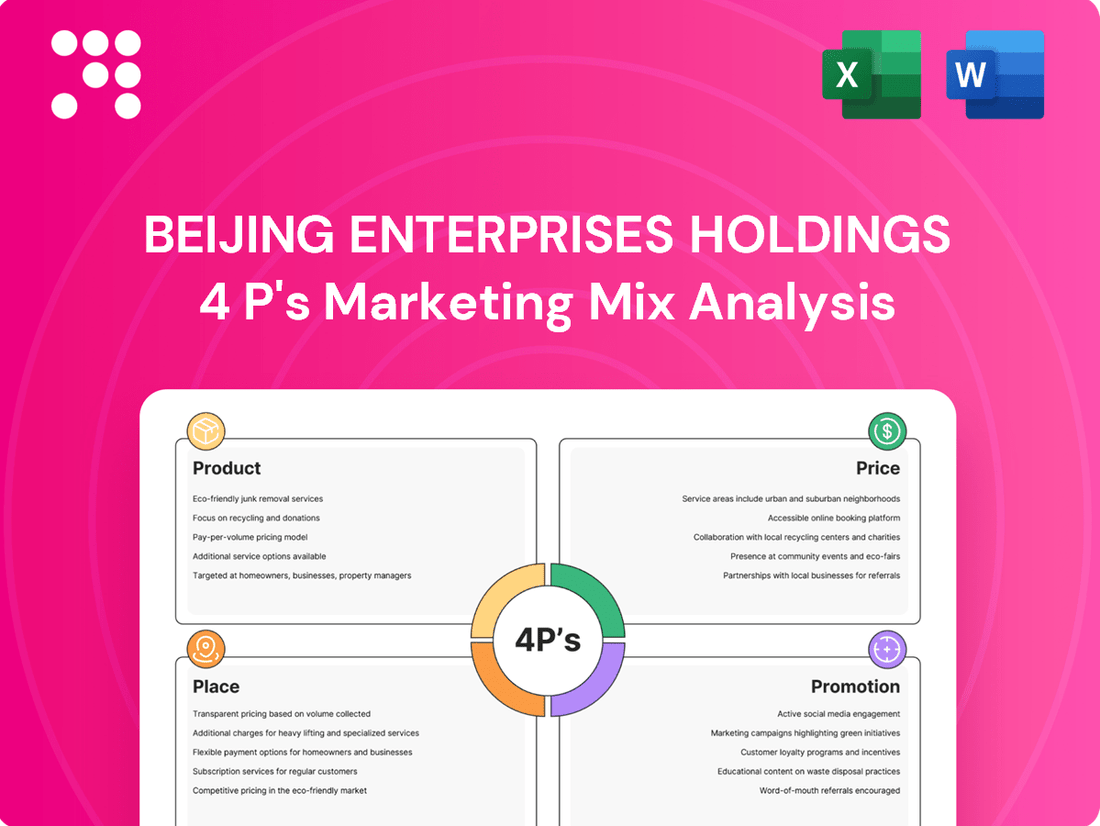

Beijing Enterprises Holdings 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Beijing Enterprises Holdings 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion strategies in detail. You'll gain immediate access to this fully finished analysis, ready for your strategic planning.

Promotion

Beijing Enterprises Holdings emphasizes robust investor relations through clear and consistent communication. They released their 2024 annual results in March 2025, providing detailed financial data. Their 2025 Annual General Meeting took place in June 2025, further engaging stakeholders.

Beijing Enterprises Holdings places a significant emphasis on Corporate Social Responsibility (CSR) and sustainability, integrating these principles into its marketing strategy. This commitment is clearly demonstrated through its proactive engagement with environmental protection and social welfare initiatives.

The company's dedication to sustainable development is further underscored by its publication of annual sustainability reports. For instance, Beijing Enterprises Water Group released its 2024 Sustainability Report in April 2025, detailing its progress in areas such as climate change response and green development. These reports serve to bolster its corporate image and communicate its enduring value to all stakeholders.

Beijing Enterprises Holdings actively engages in strategic public relations and government relations, crucial given its role in public utilities and urban infrastructure. This involves maintaining robust connections with government bodies and regulators to ensure alignment with national objectives.

The company demonstrates commitment to policies like China's 'dual-carbon' strategy, aiming for peak carbon emissions before 2030 and carbon neutrality by 2060. This strategic alignment is vital for its long-term sustainability and growth in the energy and environmental sectors, areas where government support and policy frameworks are paramount.

By participating in key industry events and forums, Beijing Enterprises Holdings showcases its contributions to urban development and environmental governance. For instance, its subsidiary, Beijing Enterprises Water Group, is a major player in water treatment and environmental protection, aligning its operations with national environmental protection goals and public welfare initiatives.

Brand Building and Product Innovation for Beer Segment

Beijing Enterprises Holdings' beer segment, primarily through Yanjing Brewery, emphasizes brand building and product innovation to enhance its market position. The company is actively upgrading its marketing strategies, incorporating diverse communication channels to connect with consumers.

This includes a significant push into e-commerce and experiential marketing, aiming to cultivate a more youthful and premium brand image. For instance, Yanjing Brewery's investment in digital platforms and unique consumer experiences in 2024 reflects this commitment to modernizing its brand perception.

Recent data from 2024 indicates a growing trend in premiumization within the Chinese beer market, with consumers increasingly willing to pay more for higher-quality and innovative products. Yanjing Brewery's efforts to align with this trend are crucial for its continued growth.

Key initiatives include:

- Brand Image Revitalization: Targeting younger demographics by associating Yanjing with modern lifestyles and high-end experiences.

- E-commerce Expansion: Developing online sales channels and digital engagement strategies to reach a wider audience and facilitate convenient purchasing.

- Experiential Marketing: Creating immersive brand events and tasting sessions to foster deeper consumer connections and product trial.

- Product Diversification: Introducing new beer varieties and flavors that cater to evolving consumer preferences and market demands.

Showcasing Operational Excellence and Industry Leadership

Beijing Enterprises Holdings actively showcases its operational prowess and leadership across its key business segments. This promotion emphasizes tangible achievements, such as Beijing Gas's significant LNG processing volumes, demonstrating their capacity and efficiency in a critical energy sector. For instance, in 2023, Beijing Gas processed approximately 3.5 million tonnes of LNG, a testament to its robust infrastructure and operational expertise.

Furthermore, the company highlights BE Water's sustained dominance in China's water industry, consistently securing top rankings. This recognition is built on successful project implementations and a commitment to operational excellence, reinforcing their market standing and reliability. BE Water's consistent performance, including achieving a customer satisfaction rate of over 95% in its key operational areas during 2023, underscores its industry leadership.

- LNG Processing Milestones: Beijing Gas achieved significant operational success, processing over 3.5 million tonnes of LNG in 2023.

- Water Industry Leadership: BE Water maintained its top-tier position in China's water sector, evidenced by consistent high rankings and over 95% customer satisfaction in 2023.

- Operational Efficiency: The company leverages successful project execution and efficient operations to solidify its market capabilities and standing.

Beijing Enterprises Holdings utilizes a multi-faceted promotional strategy, highlighting its operational strengths and commitment to sustainability. The company emphasizes its role in critical infrastructure, such as Beijing Gas's substantial LNG processing capacity, which reached over 3.5 million tonnes in 2023. This showcases their operational prowess and reliability in the energy sector.

Furthermore, Beijing Enterprises Water Group's consistent leadership in China's water industry, marked by high customer satisfaction rates exceeding 95% in 2023, is a key promotional point. These achievements are communicated through sustainability reports and industry recognition, reinforcing their market position.

The beer segment, led by Yanjing Brewery, focuses on brand revitalization and modern marketing techniques. Initiatives like e-commerce expansion and experiential marketing in 2024 aim to connect with younger consumers and adapt to market trends, such as the growing demand for premiumization.

| Key Performance Indicator | Segment | 2023 Data | 2024 Focus | 2025 Outlook |

| LNG Processing Volume | Beijing Gas | 3.5 million tonnes | Operational Efficiency | Continued Growth |

| Customer Satisfaction | BE Water | >95% | Service Enhancement | Sustained Leadership |

| Brand Engagement | Yanjing Brewery | Digital Platform Investment | Experiential Marketing | Market Share Expansion |

Price

Beijing Enterprises Holdings' pricing for essential services like city gas and water distribution is heavily influenced by government oversight. This means prices are often set or reviewed by regulatory bodies to ensure they remain affordable for the public. For instance, in 2023, the average regulated price for city gas in Beijing saw adjustments based on cost reviews, reflecting policy directives aimed at consumer affordability while ensuring utility providers can cover operational expenses and achieve a fair return on their infrastructure investments.

Beijing Enterprises Holdings secures environmental project pricing through competitive bidding and long-term contracts with municipal authorities. This approach ensures stable revenue streams and predictable project values.

The company strategically targets projects offering attractive contract terms and projected annual earnings. A prime example is the acquisition of 64 urban services projects in 2024, highlighting their focus on profitable growth within the sector.

Beijing Enterprises Holdings navigates the competitive beer landscape by optimizing its product mix and focusing on profitability. Yanjing Brewery, a key brand, emphasizes cost management and the promotion of premium offerings, illustrating a value-based pricing strategy tied to quality and brand perception.

This approach is crucial in a market where consumers increasingly associate higher prices with superior taste and brand prestige. For example, in 2023, the premium segment of China's beer market continued to grow, with brands like Yanjing aiming to capture a larger share through this value-driven pricing. The company's efforts to push high-end products reflect a market-driven adjustment to consumer preferences, aiming for higher margins rather than just volume.

Focus on Cost Control and Operational Efficiency

Beijing Enterprises Holdings actively pursues cost control and operational efficiency across its diverse business segments. This involves implementing refined management practices, embracing technological upgrades, and leveraging digital management solutions. For instance, in 2023, the company reported a significant improvement in its operational efficiency metrics, contributing to a stable gross profit margin despite market fluctuations.

This dedication to cost optimization directly influences its pricing strategies. By reducing operating expenses, Beijing Enterprises Holdings can offer more competitive pricing to its customers while still ensuring robust gross profit margins. This allows them to maintain a strong market position.

- Refined Management: Implementing best practices to streamline operations.

- Technological Upgrades: Investing in modern technology to boost productivity.

- Digital Solutions: Utilizing digital tools for enhanced efficiency and cost reduction.

- Impact on Pricing: Enabling competitive pricing through lower operational costs.

Optimized Capital Structure and Financing Costs

Beijing Enterprises Holdings actively optimizes its capital structure, leveraging debt and equity to secure capital at the most advantageous terms. This strategic approach is crucial for maintaining competitive financing costs.

In 2023, the company demonstrated this by issuing a significant amount of bonds. For instance, a noteworthy issuance was its HKD 3 billion (approximately USD 385 million) bond in November 2023, with a coupon rate of 4.25% maturing in 2030. This issuance helped to lower its weighted average cost of debt.

- Favorable Bond Issuance: Beijing Enterprises Holdings secured a HKD 3 billion bond issuance in November 2023 at a 4.25% coupon rate, aiming to reduce overall financing expenses.

- Cost Reduction Impact: Lowering financing costs allows the company to maintain competitive pricing for its diverse range of services, from natural gas supply to environmental protection solutions.

- Investment Capacity: Efficient capital management directly supports the company's ability to fund new infrastructure projects and technological advancements, ensuring sustained growth and market competitiveness.

Beijing Enterprises Holdings' pricing strategy is multifaceted, balancing regulatory requirements with market dynamics. For essential utilities like gas and water, prices are often government-regulated to ensure affordability, as seen with 2023 Beijing city gas price adjustments based on cost reviews. In contrast, the competitive beer market, particularly with brands like Yanjing Brewery, employs value-based pricing, emphasizing premium offerings and quality to capture higher margins. This is supported by the growing premium segment in China's beer market, which saw continued growth in 2023.

| Segment | Pricing Strategy | Key Influences | 2023/2024 Data Point |

| City Gas & Water | Regulated Pricing | Government Oversight, Affordability | Adjustments to Beijing city gas prices based on cost reviews. |

| Environmental Projects | Contract-Based, Competitive Bidding | Municipal Authority Contracts, Project Profitability | Acquisition of 64 urban services projects in 2024. |

| Beer (Yanjing Brewery) | Value-Based Pricing, Premium Focus | Brand Perception, Consumer Preferences, Cost Management | Growth in China's premium beer market segment in 2023. |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Beijing Enterprises Holdings leverages official company disclosures, including annual reports and investor presentations, alongside market research reports and industry benchmarks. This ensures a comprehensive understanding of their product offerings, pricing strategies, distribution networks, and promotional activities.