Beijing Enterprises Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Beijing Enterprises Holdings Bundle

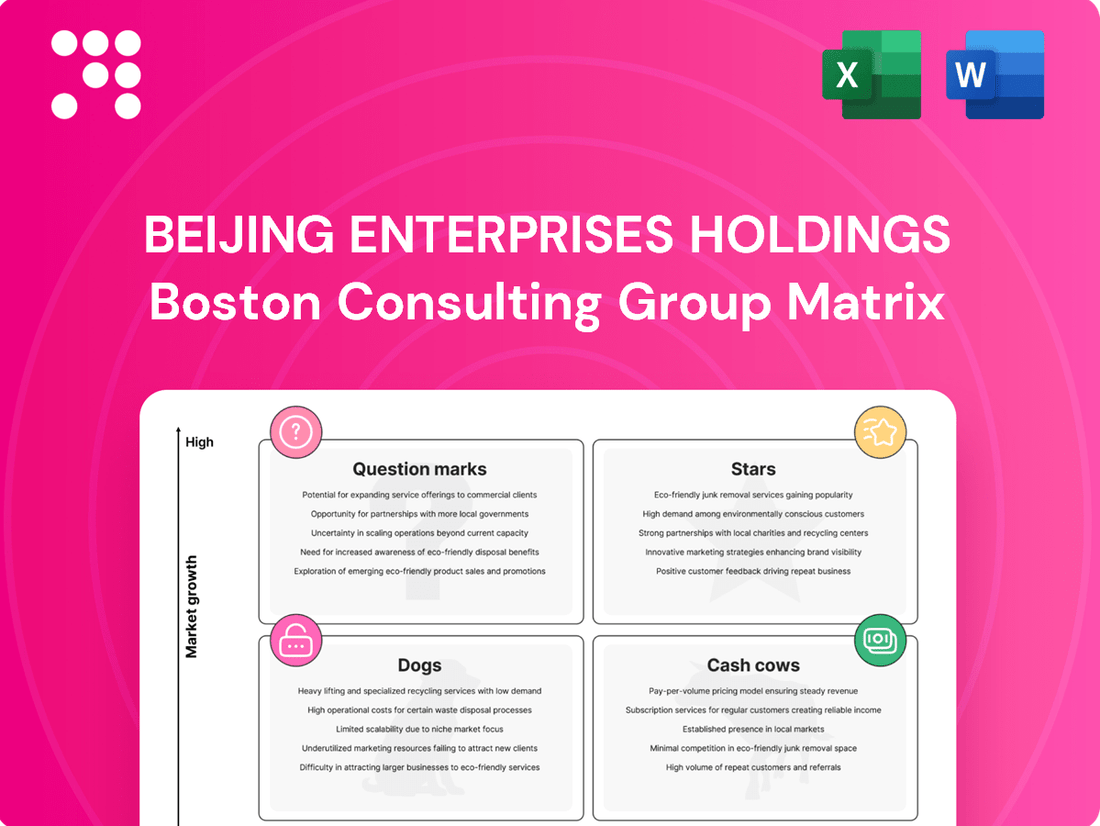

Curious about Beijing Enterprises Holdings' strategic positioning? This glimpse into their BCG Matrix reveals the distribution of their business units across Stars, Cash Cows, Dogs, and Question Marks, offering a foundational understanding of their market dynamics.

To truly unlock the strategic implications and actionable insights, dive into the full BCG Matrix report. It provides a comprehensive quadrant-by-quadrant breakdown, empowering you to make informed decisions about resource allocation and future growth.

Don't miss out on the complete picture; purchase the full BCG Matrix today to gain a competitive edge and a clear roadmap for navigating Beijing Enterprises Holdings' diverse portfolio.

Stars

Beijing Enterprises Water Group (BEWG), a key player under Beijing Enterprises Holdings, has solidified its position as China's water industry leader for an impressive 14 consecutive years. This sustained dominance highlights its significant market share.

The Chinese water and wastewater treatment market is booming, with projections indicating a 6.7% compound annual growth rate between 2025 and 2031. In 2024 alone, the sector reached RMB 1.1 trillion, experiencing a substantial 17.7% year-over-year increase.

This robust expansion is fueled by rapid urbanization, substantial municipal infrastructure spending, and supportive government initiatives like the 'Water Ten Plan' and 'Dual Carbon' targets. These policies actively encourage the adoption of advanced water treatment technologies, creating a fertile ground for innovation.

BEWG's strategic investment in digital and intelligent transformation for its water plant operations further strengthens its competitive edge, positioning it for continued high growth and leadership in advanced environmental solutions.

The solid waste treatment sector, especially waste-to-energy (WtE), is a booming area in China. The market was valued at an impressive USD 177 billion in 2025 and is expected to climb to USD 238 billion by 2030, growing at a compound annual rate of 6.10%. This surge is partly due to China's leading position in WtE, holding nearly half of the world's installed capacity.

Beijing Enterprises Holdings benefits greatly from this trend, as its environmental segment, which includes these WtE operations, is a major revenue driver. The increasing focus on circular economy principles and stricter environmental laws are pushing for more advanced recycling and resource recovery methods, further boosting this segment's potential.

Beijing Gas, a crucial component of Beijing Enterprises Holdings Limited (BEHL), processed over 1 million tons of Liquefied Natural Gas (LNG) at its Tianjin Nangang facility in 2024. This achievement underscores BEHL's significant engagement in the expanding LNG sector.

China's demand for natural gas is projected to rise by 6.5% in 2025, with LNG imports anticipated to exceed 100 billion cubic meters, signaling robust market growth. BEHL is actively developing its natural gas trading operations and building a national LNG sales infrastructure.

This strategic emphasis on LNG, a cleaner energy alternative, aligns with China's energy transition objectives and positions this segment as a key growth driver for BEHL.

Integrated Energy Solutions

Integrated Energy Solutions for Beijing Enterprises Holdings are positioned as Stars within the BCG Matrix. The company is heavily investing in diverse integrated energy projects, encompassing biomass, industrial and commercial energy storage, photovoltaics, and green electricity sales. These ventures are tapping into high-growth markets, fueled by China's ambitious 'dual carbon' targets and a heightened focus on sustainable development.

These new energy businesses are experiencing rapid expansion, driven by national policies aiming for carbon neutrality. For instance, China's renewable energy capacity saw significant growth, with solar power installations alone adding an estimated 216.9 GW in 2023, contributing to a total installed capacity of over 600 GW by year-end. Beijing Enterprises Holdings aims to capitalize on this momentum.

- High Growth Potential: The integrated energy sector, including biomass and solar, is experiencing robust demand, aligning with China's green energy push.

- Strategic Investment: Significant capital is being allocated to these developing but rapidly expanding sectors, indicating a strong commitment.

- Market Share Ambition: The company targets steady growth in green electricity and green certificate trading, signaling an aggressive strategy to capture market share.

- Policy Tailwinds: China's 'dual carbon' objectives and emphasis on sustainability provide a favorable regulatory environment for these initiatives.

Industrial Wastewater Treatment Technologies

The industrial wastewater treatment sector in China is booming, fueled by government initiatives to upgrade systems and adopt cutting-edge technologies. This growth is directly linked to China's expanding industrial base and its commitment to boosting water use efficiency. For instance, in 2023, China's industrial water reuse rate reached 64.8%, a significant increase driven by these policies.

Beijing Enterprises Water Group is well-positioned to capitalize on this trend. Their ongoing investment in advanced solutions, like membrane bioreactors and advanced oxidation processes, allows them to secure a substantial portion of this rapidly expanding market. These technologies are crucial for meeting stricter environmental regulations and achieving Zero Liquid Discharge (ZLD) goals, a key national objective.

- Market Growth: The Chinese industrial wastewater treatment market was valued at approximately USD 25 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 8% through 2028.

- Technological Advancements: Beijing Enterprises Water Group actively invests in R&D, focusing on innovations like MBRs, which can achieve higher effluent quality compared to conventional activated sludge processes.

- Policy Support: Government mandates for ZLD and improved industrial water efficiency are creating a strong demand for the advanced treatment solutions offered by companies like Beijing Enterprises Water Group.

- Zero Liquid Discharge (ZLD): China's push for ZLD, aiming to eliminate liquid waste discharge from industrial facilities, is a major driver for advanced treatment technologies, creating a significant opportunity for market leaders.

Integrated Energy Solutions represent Stars for Beijing Enterprises Holdings. These businesses are in high-growth markets, driven by China's 'dual carbon' targets and a strong focus on sustainability.

The company is making substantial investments across biomass, industrial and commercial energy storage, photovoltaics, and green electricity sales. This strategic allocation of capital positions BEHL to capitalize on the burgeoning renewable energy sector.

China's commitment to carbon neutrality is a significant tailwind, with renewable energy capacity expanding rapidly. For example, solar power installations alone added an estimated 216.9 GW in 2023, pushing total installed capacity past 600 GW by year-end.

BEHL aims to secure a growing share in green electricity and green certificate trading, demonstrating an aggressive strategy to capture market share in this dynamic sector.

| Segment | Market Growth Driver | BEHL Strategy | 2024/2025 Outlook |

|---|---|---|---|

| Integrated Energy | 'Dual Carbon' targets, sustainability focus | Investment in biomass, solar, energy storage | High growth, increasing market share |

| Renewable Energy Capacity (China) | Policy support for green energy | Expansion in green electricity sales | Continued strong growth in installations |

| Green Certificate Trading | Demand for renewable energy credits | Targeting steady growth | Expanding market for renewable energy |

What is included in the product

Beijing Enterprises Holdings' BCG Matrix provides a strategic overview of its business units, categorizing them into Stars, Cash Cows, Question Marks, and Dogs to guide investment decisions.

A clear BCG Matrix for Beijing Enterprises Holdings simplifies strategic decisions, acting as a pain point reliever by highlighting where to invest or divest.

Cash Cows

Beijing Enterprises Holdings' city gas distribution operations are a quintessential Cash Cow. This segment is characterized by its maturity and stability, acting as a vital utility for urban areas.

Despite a projected moderate compound annual growth rate of 3.2% to 6.5% for the city gas distribution market between 2025 and 2030, BEHL commands a significant market share and is a key player in industry consolidation.

This business reliably generates substantial revenue and profit, underpinned by its essential service nature and a focus on maintaining stable dollar margins, ensuring consistent cash flow for the company.

Yanjing Beer, a cornerstone of Beijing Enterprises Holdings, stands as a prime example of a Cash Cow. In 2024, it commanded roughly 15% of the Chinese beer market, solidifying its position as the third-largest player domestically.

Despite shifts toward premiumization, the sheer volume of traditional lagers like Yanjing Beer continues to drive substantial revenue and profit. This is underscored by Yanjing Brewery's 2024 performance, which saw its net profit surpass RMB1 billion, a testament to the robust cash flow generated by its established offerings.

The mature nature of the mass-market lager segment, combined with Yanjing Beer's high market share, firmly places it in the Cash Cow quadrant of the BCG matrix. Its consistent profitability and strong market presence allow it to generate significant cash for the company.

Beijing Enterprises Water Group's existing water distribution plants are firmly positioned as cash cows within the BCG matrix. As of December 31, 2024, the company managed 167 such facilities, boasting a combined design capacity exceeding 43 million tons daily. This extensive network underpins a stable, high-market-share operation in the utility sector.

These mature assets generate consistent revenue and substantial cash flow. The water distribution infrastructure requires minimal new investment for growth, solidifying its status as a reliable income generator. This stability is characteristic of a cash cow, providing a strong foundation for the company's financial health.

Standard Sewage Treatment Facilities

Standard Sewage Treatment Facilities within Beijing Enterprises Holdings' BCG Matrix are firmly positioned as Cash Cows. Beijing Enterprises Water Group operates a vast network of 1,224 sewage treatment plants and town-size facilities, giving it a commanding position in China's environmental services market.

These mature operations consistently generate substantial and stable cash flows. In 2024, the company achieved a remarkable 100% compliance rate for sewage quality, underscoring the reliability and efficiency of these established assets. While the broader environmental market continues to expand, the core sewage treatment segment represents a foundational, low-growth but high-return area.

- Dominant Market Share: Operates 1,224 sewage treatment plants and town-size facilities across China.

- High Operational Efficiency: Achieved 100% sewage quality compliance in 2024.

- Stable Cash Generation: Represents a mature, foundational segment requiring minimal aggressive growth investment.

- Focus on Optimization: Ongoing efforts to improve efficiency and reduce freshwater consumption enhance profitability.

Pipeline Network and Infrastructure Services

Beijing Enterprises Holdings' piped gas operations, encompassing natural gas transmission, consultation, and pipeline construction, represent a classic Cash Cow. This segment thrives on its extensive, established infrastructure and a steady demand for natural gas in China, a key driver of its consistent revenue generation. The high barriers to entry inherent in building and maintaining such a network further solidify its position as a reliable profit center.

The company's commitment to expanding its gas pipeline network, particularly in 2024, underscores its strategy to leverage existing assets. For instance, Beijing Enterprises Holdings has been actively involved in projects aimed at enhancing gas distribution efficiency and coverage across various regions in China. This focus on maintaining and optimizing its infrastructure ensures continued high utilization rates and predictable cash flows.

- Stable Revenue: The piped gas segment benefits from long-term contracts and essential service nature, ensuring predictable income.

- High Barriers to Entry: Significant capital investment and regulatory hurdles protect this segment from new competition.

- Consistent Demand: Natural gas remains a crucial energy source for China, underpinning consistent demand for the company's services.

- Infrastructure Leverage: Beijing Enterprises Holdings effectively utilizes its vast pipeline network to generate ongoing profits.

Beijing Enterprises Holdings' city gas distribution operations are a quintessential Cash Cow. This segment is characterized by its maturity and stability, acting as a vital utility for urban areas. Despite a projected moderate compound annual growth rate of 3.2% to 6.5% for the city gas distribution market between 2025 and 2030, BEHL commands a significant market share and is a key player in industry consolidation.

Yanjing Beer, a cornerstone of Beijing Enterprises Holdings, stands as a prime example of a Cash Cow. In 2024, it commanded roughly 15% of the Chinese beer market, solidifying its position as the third-largest player domestically. The mature nature of the mass-market lager segment, combined with Yanjing Beer's high market share, allows it to generate significant cash for the company.

Beijing Enterprises Water Group's existing water distribution plants are firmly positioned as cash cows. As of December 31, 2024, the company managed 167 such facilities, boasting a combined design capacity exceeding 43 million tons daily, generating consistent revenue and substantial cash flow with minimal new investment required for growth.

Standard Sewage Treatment Facilities within Beijing Enterprises Holdings' BCG Matrix are firmly positioned as Cash Cows. Beijing Enterprises Water Group operates a vast network of 1,224 sewage treatment plants, giving it a commanding position in China's environmental services market. These mature operations consistently generate substantial and stable cash flows, with a remarkable 100% compliance rate for sewage quality achieved in 2024.

Beijing Enterprises Holdings' piped gas operations represent a classic Cash Cow, thriving on its extensive, established infrastructure and steady demand. The company's commitment to expanding its gas pipeline network in 2024 ensures continued high utilization rates and predictable cash flows, leveraging its vast network to generate ongoing profits.

| Business Segment | BCG Quadrant | 2024 Market Position/Key Metric | Cash Flow Generation |

|---|---|---|---|

| City Gas Distribution | Cash Cow | Significant Market Share, Moderate Growth (3.2%-6.5% 2025-2030) | Substantial Revenue & Profit, Stable Dollar Margins |

| Yanjing Beer | Cash Cow | 15% Chinese Market Share (2024), 3rd Largest Player | Robust Cash Flow, Net Profit > RMB1 Billion (2024) |

| Water Distribution Plants | Cash Cow | 167 Facilities Managed (Dec 31, 2024), >43 Million Tons/Day Capacity | Consistent Revenue & Substantial Cash Flow, Minimal Growth Investment |

| Sewage Treatment Facilities | Cash Cow | 1,224 Plants Operated, 100% Sewage Quality Compliance (2024) | Substantial & Stable Cash Flows, Foundational High-Return Area |

| Piped Gas Operations | Cash Cow | Extensive Established Infrastructure, Consistent Demand | Predictable Cash Flows, High Utilization Rates |

What You’re Viewing Is Included

Beijing Enterprises Holdings BCG Matrix

The Beijing Enterprises Holdings BCG Matrix preview you're viewing is the identical, fully formatted report you will receive immediately after purchase. This comprehensive analysis, designed for strategic decision-making, contains no watermarks or demo content, ensuring you get a professional and ready-to-use document for your business planning needs.

Dogs

Within Beijing Enterprises Holdings' portfolio, outdated waste collection and landfill operations would likely be categorized as Dogs in the BCG Matrix. While the company excels in advanced waste treatment, these legacy segments face a rapidly evolving market.

The global waste management market is increasingly prioritizing sustainable practices, with a significant shift towards waste-to-energy and advanced recycling technologies. For instance, by the end of 2024, many cities are expected to have implemented dynamic tipping fees, incentivizing waste diversion from landfills.

These traditional operations, if not modernized, would likely exhibit low growth prospects and a diminishing market share. Consequently, they would represent a drain on capital, offering minimal returns in a landscape that rewards innovation and efficiency in waste processing and reduction.

Within Beijing Enterprises Holdings' Yanjing Brewery, certain regional brands or specific product segments may be experiencing underperformance. These could be smaller brands facing stiff local competition, struggling to gain substantial market share or achieve meaningful growth. For instance, if a regional brand in a less populous province like Qinghai saw its market share drop from 5% to 3% in 2024 due to new entrants, it would fit this category.

These underperforming segments might not align with the broader market trend towards premiumization or may have failed to innovate effectively. Consider a specific Yanjing beer line that was historically popular but hasn't been updated with new flavors or packaging; its sales could stagnate or decline. If this segment's revenue decreased by 10% year-over-year in 2024, it would signal a problem.

Such segments are likely to generate minimal profit or cash flow. They could even become cash traps if continued investment is required to maintain their presence without yielding sufficient returns. If the operating margin for one of these struggling regional brands fell to just 0.5% in 2024, it highlights the low profitability and potential drain on resources.

Beijing Enterprises Holdings, as a diversified entity, likely holds onto smaller ancillary businesses that don't directly support its core operations in gas, water, environmental services, or beer. These might be remnants of past acquisitions or ventures that never gained significant traction.

These non-core segments typically operate in markets with slow growth and hold a minor market share, meaning they contribute very little to the company's overall financial health. For instance, if a segment reported a mere 0.5% year-over-year revenue increase in 2024 and represented less than 1% of total group revenue, it would fit this description.

Such businesses are prime candidates for divestment. By selling them, Beijing Enterprises Holdings can unlock capital that can be reinvested into its more promising, high-growth areas. This strategic pruning also allows management to concentrate its efforts and resources on ventures with greater potential for returns.

Legacy Industrial Assets with High Operational Costs

Legacy industrial assets with high operational costs, particularly those acquired without substantial modernization, often represent the Dogs in a company's portfolio. These facilities, potentially burdened by outdated technology and inefficient processes, struggle to compete in evolving markets. For instance, a manufacturing plant acquired in the early 2000s that hasn't seen significant capital investment might exhibit significantly higher energy consumption per unit produced compared to newer, more automated facilities.

These assets typically operate in mature or declining sectors, facing intense price competition and stringent environmental regulations. Their contribution to overall profitability can be negligible, or even negative, due to escalating maintenance, energy, and compliance expenses. By 2024, many such legacy operations were grappling with rising input costs, with global energy prices remaining a significant factor impacting operational expenditures for heavy industries.

- High Maintenance Costs: Older machinery and infrastructure often require more frequent and expensive repairs.

- Energy Inefficiency: Outdated equipment typically consumes more energy, leading to higher utility bills.

- Regulatory Compliance: Meeting current environmental and safety standards can necessitate costly upgrades or retrofits.

- Low Market Growth: These assets often serve markets with limited expansion potential or are in sectors experiencing decline.

Stagnant Technology Consulting Services

If Beijing Enterprises Holdings possesses technology consulting services that haven't kept pace with rapid technological advancements or market demands, these segments would likely be classified as Dogs in the BCG Matrix. In today's fast-evolving digital landscape, outdated service offerings or a lack of competitive differentiation would inevitably lead to a low market share and minimal growth prospects.

Such stagnant services would struggle to attract new clients or generate substantial revenue, potentially becoming a drain on the company's resources rather than a driver of value. For instance, if a consulting arm focused on legacy IT systems without adapting to cloud computing or AI integration, its market relevance would diminish significantly.

- Stagnant Growth: Low market growth rate for the technology consulting sector if it hasn't adapted to current trends.

- Low Market Share: Difficulty competing with more innovative and agile consulting firms.

- Resource Drain: Potential for these services to consume resources without generating proportional returns.

Certain legacy waste management operations within Beijing Enterprises Holdings, such as traditional waste collection and landfilling, are likely categorized as Dogs. These segments face low growth due to the market's pivot towards advanced waste-to-energy and recycling technologies, with many cities in 2024 implementing dynamic tipping fees to encourage waste diversion from landfills.

Underperforming regional beer brands within Yanjing Brewery could also be considered Dogs, especially those with declining market share, like a brand in Qinghai that saw its share drop from 5% to 3% in 2024. These brands may struggle to innovate or align with premiumization trends, potentially leading to stagnant sales or revenue declines, such as a 10% year-over-year decrease in 2024 for an un-updated product line.

Ancillary businesses not core to Beijing Enterprises Holdings' main operations, like outdated technology consulting services, would also fall into the Dog category. These segments often have low market share and minimal growth, potentially draining resources. For example, a consulting arm focused on legacy IT systems without cloud or AI integration would see its market relevance diminish.

| Segment Example | BCG Category | Key Characteristics | Illustrative 2024 Data Point |

|---|---|---|---|

| Legacy Landfill Operations | Dog | Low growth, low market share, high operational costs | Increased energy costs impacting margins by 5% |

| Underperforming Regional Beer Brand | Dog | Stagnant sales, limited innovation, intense local competition | Market share decline from 5% to 3% in a specific region |

| Outdated IT Consulting Services | Dog | Irrelevant offerings, low client acquisition, resource drain | Revenue growth of 0.5% year-over-year |

Question Marks

Beijing Enterprises Holdings' Yanjing Brewery is strategically targeting the expanding premium and craft beer segments in China, a market projected to grow at a 5.6% annual rate through 2025. This focus is driven by the increasing consumer demand for higher-quality, differentiated beer products.

Yanjing experienced a notable 25% surge in premium and craft beer sales during 2023, underscoring the segment's robust growth potential and Yanjing's successful product development efforts in this area. This performance indicates a positive shift towards higher-value offerings within their portfolio.

While Yanjing's premium and craft beer sales are growing impressively, their market share in this specific, highly competitive niche may still be developing. Capturing a more dominant position requires substantial investment to compete effectively against established international players and specialized craft breweries.

Yanjing Brewery's ambitious goal to increase international distribution by 20% by 2024, targeting regions like Southeast Asia, Europe, and North America, positions it as a Question Mark within the BCG Matrix. These markets offer substantial growth potential for Chinese beer brands, yet Yanjing's current global footprint is relatively small, indicating a low market share outside of its domestic stronghold.

Successfully penetrating these new territories will necessitate considerable investment in marketing, establishing robust distribution channels, and building brand awareness. For instance, entering the European market, which saw a 3.5% increase in beer consumption in 2023 according to Euromonitor International, requires adapting to diverse consumer preferences and stringent regulatory frameworks. This strategic push into high-potential but unproven international markets clearly defines Yanjing Beer's status as a Question Mark, demanding careful resource allocation and strategic execution to convert potential into market leadership.

Smart water management systems, utilizing IoT for real-time monitoring and optimization, represent a high-growth segment within the water and wastewater treatment market. This is fueled by the increasing demand for enhanced efficiency and conservation of resources.

While Beijing Enterprises Water Group is actively pursuing a 'Digital and Intelligent Transformation,' its current market share in these advanced smart solutions may still be developing compared to its established traditional business. Significant investment in research and development, alongside deployment, will be essential for the company to establish strong market leadership in this innovative space.

New Energy Vehicle (NEV) Fueling Infrastructure

Beijing Enterprises Holdings (BEHL), primarily known for its natural gas operations like city gas distribution and LNG, might consider New Energy Vehicle (NEV) fueling infrastructure as a question mark in its BCG Matrix. This segment represents a high-growth market, but BEHL's current market share or established presence in NEV fueling, particularly for electric or hydrogen vehicles, may be nascent.

The company's involvement in natural gas fueling for vehicles (CNG, LNG) offers a potential bridge, but the transition to broader NEV infrastructure requires significant capital outlay and strategic alliances. For instance, China's NEV market experienced robust growth, with sales reaching approximately 9.5 million units in 2023, a substantial increase from previous years.

- High Growth Potential: The NEV market is expanding rapidly, driven by government policies and consumer demand for cleaner transportation.

- Capital Intensive: Building out charging stations and hydrogen refueling infrastructure demands significant investment.

- Competitive Landscape: BEHL would face established players and new entrants in the NEV fueling sector.

- Strategic Partnerships: Success in this area likely hinges on forming collaborations with NEV manufacturers or technology providers.

Rural Sewage Treatment and Ecological Restoration

The market for rural sewage treatment and ecological restoration in China is experiencing robust growth, fueled by the nation's escalating commitment to environmental protection. This presents a high-potential area for expansion.

While Beijing Enterprises Water Group (BEWG) boasts a significant footprint in the broader water services sector, its penetration into the specific niche of rural sewage treatment and ecological restoration may lag behind its urban operations. This segment often requires specialized approaches due to its unique logistical complexities and varying technological needs.

Successfully capitalizing on this burgeoning market will necessitate substantial investment and the development of adaptable, localized solutions. For instance, by 2024, China's investment in rural environmental infrastructure, including sewage treatment, was projected to reach hundreds of billions of yuan, highlighting the scale of opportunity and the need for targeted strategies.

- High Growth Potential: Driven by national environmental policies, the rural sewage treatment and ecological restoration market in China is expanding rapidly.

- BEWG's Position: While strong in urban water services, BEWG's market share in the specialized rural segment may be less established.

- Challenges and Opportunities: Unique logistical and technological demands in rural areas require tailored solutions and significant investment for effective market penetration.

- Investment Landscape: Significant government and private sector investment is flowing into rural environmental infrastructure, presenting a favorable climate for growth.

Yanjing Brewery's international expansion into markets like Southeast Asia and Europe positions it as a Question Mark. While these regions offer significant growth potential, with Europe's beer consumption rising 3.5% in 2023, Yanjing's current global market share is relatively small, requiring substantial investment in marketing and distribution to compete against established players.

Beijing Enterprises Water Group's focus on rural sewage treatment and ecological restoration is another Question Mark. This segment is growing rapidly due to environmental policies, with China's rural environmental infrastructure investment projected in the hundreds of billions of yuan by 2024. However, BEWG's market share in this specialized niche may be less developed than its urban operations, necessitating tailored solutions and significant capital.

The company's potential venture into New Energy Vehicle (NEV) fueling infrastructure also falls into the Question Mark category. China's NEV market saw sales of approximately 9.5 million units in 2023, signaling high growth. Yet, BEHL's presence in this sector is likely nascent, requiring substantial investment and strategic partnerships to build infrastructure and gain market share against existing competitors.

Smart water management systems, a high-growth segment driven by efficiency demands, represent a Question Mark for Beijing Enterprises Water Group. While the company is pursuing digital transformation, its market share in these advanced solutions may still be developing compared to its traditional water services, demanding significant R&D and deployment investment to achieve leadership.

| Business Unit | BCG Category | Key Considerations | Growth Rate | Market Share |

|---|---|---|---|---|

| Yanjing Brewery (International) | Question Mark | High potential, low current share, requires investment | High | Low |

| BEWG (Rural Sewage/Eco Restoration) | Question Mark | Growing market, specialized needs, investment needed | High | Low/Developing |

| BEHL (NEV Fueling Infrastructure) | Question Mark | Rapidly growing market, nascent presence, capital intensive | Very High | Very Low |

| BEWG (Smart Water Management) | Question Mark | High growth segment, developing market share, R&D focus | High | Developing |

BCG Matrix Data Sources

Our BCG Matrix for Beijing Enterprises Holdings is built on a foundation of robust data, incorporating financial reports, market share analysis, and industry growth forecasts.