Beijing Enterprises Holdings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Beijing Enterprises Holdings Bundle

Beijing Enterprises Holdings operates in a dynamic market shaped by intense competition and evolving consumer demands. Understanding the interplay of buyer power, supplier leverage, and the threat of substitutes is crucial for any strategic decision. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Beijing Enterprises Holdings’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of suppliers for Beijing Enterprises Holdings (BEHL) is significantly shaped by how concentrated the providers of essential inputs are. For BEHL's city gas business, the availability and cost of natural gas are key. While China has a vast natural gas market, major producers and pipeline companies can exert influence, particularly regarding stable and affordable supply. In 2023, China's domestic natural gas production reached approximately 220 billion cubic meters, highlighting the scale but also the potential leverage of large suppliers.

Suppliers offering highly specialized or proprietary technologies for water and waste treatment can wield significant bargaining power over Beijing Enterprises Holdings (BEHL). This leverage stems from the substantial costs and potential operational disruptions BEHL would face if it attempted to switch to alternative solutions. For instance, if a supplier provides a unique, highly efficient filtration system that is critical to BEHL's water purification processes, finding and integrating a replacement could be a complex and expensive undertaking.

In BEHL's brewery segment, the bargaining power of suppliers for agricultural raw materials like malt and hops is generally tempered by the existence of global commodity markets. However, if specific suppliers can offer unique strains or guarantee exceptional quality and consistency from particular origins, they might gain some limited leverage. For example, a supplier of a rare, high-quality hop variety essential for a signature craft beer could command a premium, especially if demand for that specific beer is high.

The threat of suppliers like natural gas or water resource providers moving into Beijing Enterprises Holdings' (BEHL) distribution or treatment services is typically low. This is mainly due to the substantial capital needed for infrastructure and the intricate regulatory landscape governing BEHL's essential utility operations.

However, for less regulated areas or specific components, a supplier might explore entering BEHL's market if the potential profits are enticing. For instance, while large-scale utility infrastructure is a barrier, specialized equipment suppliers might see opportunities if BEHL's procurement costs for certain items are significantly higher than what they could achieve through direct service provision.

Importance of Supplier's Input to BEHL's Cost Structure

The bargaining power of suppliers is a key consideration for Beijing Enterprises Holdings Limited (BEHL), particularly given its significant reliance on key inputs for its core operations. For BEHL's piped gas segment, the cost of natural gas represents a substantial portion of its operational expenses. This makes gas suppliers highly influential in shaping BEHL's cost structure and profitability. In 2024, global energy markets continued to experience volatility, directly impacting the pricing BEHL negotiated with its gas providers.

Similarly, in BEHL's water and waste treatment businesses, the cost of essential materials like chemicals, energy consumption, and the procurement of specialized equipment can significantly affect the company's financial performance. Suppliers of these critical components hold considerable sway. BEHL's strategic approach to managing these input costs, often through the negotiation of long-term supply agreements or by developing a diversified supplier base, is paramount to maintaining its competitive edge and profitability margins.

- Natural Gas Costs: The price of natural gas is a dominant factor in BEHL's piped gas division, directly influencing operating expenses.

- Water Treatment Inputs: Chemicals, energy, and specialized equipment are critical cost drivers in BEHL's water and waste treatment operations.

- Supplier Negotiation: BEHL's ability to secure favorable terms through long-term contracts or by diversifying its supplier network is vital for cost management.

- Market Influence: Fluctuations in global commodity and energy prices in 2024 directly impacted the bargaining power dynamics between BEHL and its key suppliers.

Availability of Substitutes for Supplier Inputs

The availability of substitutes for supplier inputs can significantly influence the bargaining power of suppliers for Beijing Enterprises Holdings (BEHL). While some specialized inputs for BEHL's core businesses, like specific brewing ingredients or water treatment chemicals, might have few direct substitutes, the broader market for general operational inputs frequently presents alternatives. For example, BEHL can source natural gas from various suppliers or adopt different water treatment technologies, thereby reducing reliance on any single provider.

BEHL's diversified operations mean it procures a wide array of goods and services. This diversification inherently creates opportunities to switch suppliers for many of these inputs. For instance, in its property development segment, construction materials and labor can often be sourced from multiple providers, limiting the leverage of any individual supplier. Similarly, in its retail segment, a variety of consumer goods can be procured from different manufacturers and distributors.

- Diversified Input Sourcing: BEHL's ability to source natural gas from multiple providers or utilize various water treatment technologies reduces supplier power.

- Construction Material Alternatives: The property segment benefits from numerous options for construction materials and labor, mitigating supplier leverage.

- Retail Procurement Options: In retail, a wide range of consumer goods can be sourced from diverse manufacturers and distributors.

- Financial Market Access: BEHL accesses capital by issuing bonds, a market where it can choose from various financial institutions and investors, further diversifying its funding sources and reducing reliance on any single capital provider.

The bargaining power of suppliers for Beijing Enterprises Holdings (BEHL) is notably high for natural gas, a critical input for its piped gas business. In 2024, global energy market volatility continued to affect pricing, giving major gas producers significant leverage over BEHL's cost structure. While BEHL diversifies its sourcing, the concentrated nature of large-scale gas supply means these providers can exert considerable influence on contract terms and pricing.

For specialized inputs in water and waste treatment, such as proprietary chemicals or advanced equipment, BEHL faces suppliers with strong bargaining power due to high switching costs and potential operational disruptions. This is compounded by the limited availability of direct substitutes for certain advanced technologies crucial to efficient treatment processes.

In contrast, the bargaining power of suppliers in BEHL's brewery segment for agricultural inputs like malt and hops is generally more moderate, influenced by global commodity markets. However, suppliers offering unique, high-quality inputs for premium products can still command some leverage, particularly when demand for those specific offerings is robust.

| Input Category | Supplier Bargaining Power | Key Factors Influencing Power | 2024 Relevance |

| Natural Gas | High | Concentration of major producers, global energy price volatility | Direct impact on operating costs and profitability |

| Water Treatment Chemicals/Equipment | High | Specialized nature, high switching costs, limited substitutes for advanced tech | Critical for operational efficiency and regulatory compliance |

| Brewing Ingredients (Malt, Hops) | Moderate | Global commodity markets, potential for unique/premium offerings | Influenced by demand for specific beer products |

What is included in the product

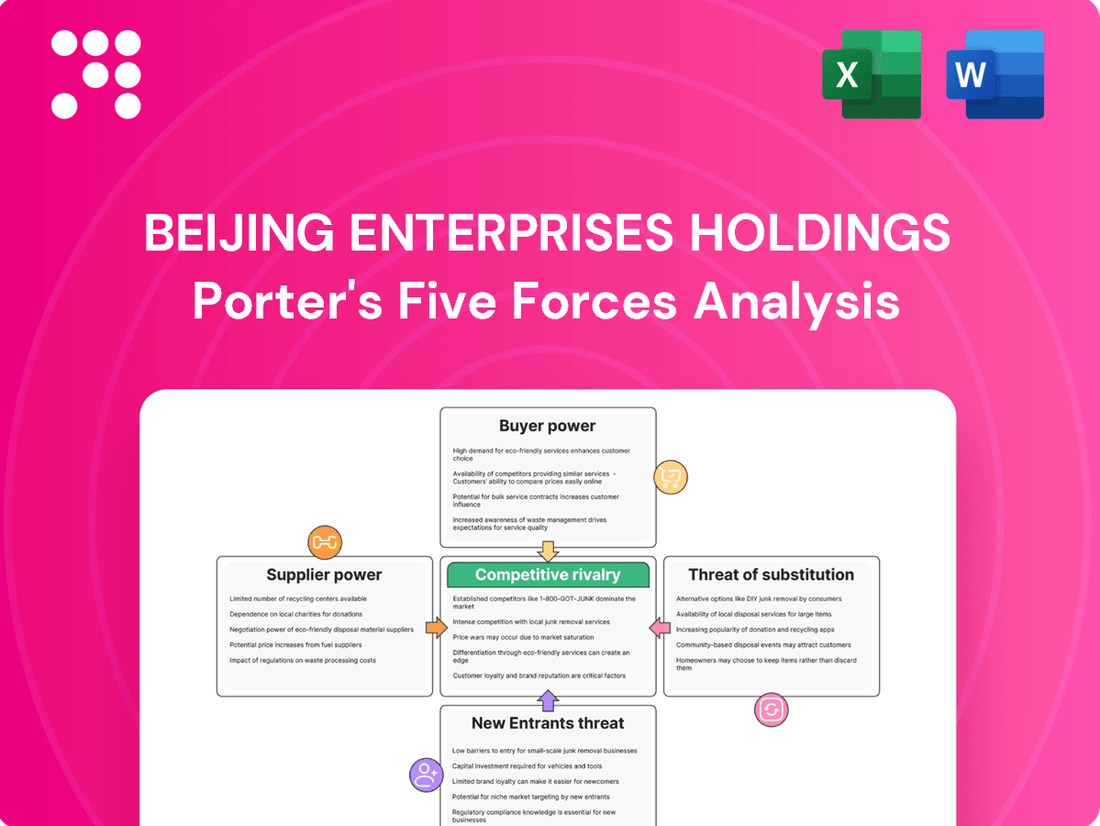

This analysis dissects the competitive landscape for Beijing Enterprises Holdings, examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes.

Instantly understand strategic pressure with a powerful spider/radar chart, simplifying complex competitive dynamics for Beijing Enterprises Holdings.

Customers Bargaining Power

Beijing Enterprises Holdings' customer base is quite broad, spanning residential, commercial, and industrial sectors, particularly in its utility operations like gas, water, and waste management. For the majority of these customers, especially individual households, their sheer number means no single customer holds significant sway over pricing or terms, thus limiting their individual bargaining power.

However, the landscape shifts for larger entities. Major industrial clients or key government bodies, due to the substantial volume of services they consume, can exert considerable influence. For instance, a large industrial park requiring a consistent and high-volume supply of natural gas or water can negotiate more favorable rates, impacting Beijing Enterprises Holdings' pricing strategies for these specific segments.

For Beijing Enterprises Holdings Limited (BEHL), the bargaining power of customers is significantly influenced by switching costs. In its core utilities business, such as piped natural gas and water supply, customers face high switching costs. This is due to the substantial investment in and integration of existing infrastructure, alongside established regulatory frameworks that make it difficult and expensive for consumers to change providers. This high barrier to switching provides BEHL with a stable and predictable revenue stream, as customers are largely locked into their current service. For instance, in 2023, BEHL's piped gas supply segment served over 20 million customers, highlighting the scale of this customer base and the embedded nature of the service.

Conversely, in the beer segment, BEHL's customers exhibit much lower switching costs. Consumers can readily opt for alternative beer brands available in the market with minimal effort or expense. This low switching cost environment means that customer loyalty is more dependent on product quality, pricing, and marketing efforts rather than infrastructural dependencies. In 2023, the competitive landscape for beer in China saw numerous domestic and international players, intensifying the need for BEHL to differentiate its offerings to retain market share in this segment.

Customer price sensitivity for Beijing Enterprises Holdings (BEHL) is a mixed bag. For their core utility businesses, like water and gas, prices are often set by regulators. This means BEHL has limited room to adjust prices based on what customers are willing to pay, but it also offers a predictable revenue stream. In 2024, the regulated nature of these essential services continues to anchor pricing, providing stability.

However, in the consumer-facing segments, such as their beer operations, the picture is more dynamic. While basic utility customers might be highly sensitive to price changes, the Chinese beer market is seeing a trend towards premiumization. This indicates that a growing number of consumers are willing to pay more for higher quality, unique flavors, or brand experiences, making them less sensitive to price alone.

Threat of Backward Integration by Customers

The threat of customers integrating backward into Beijing Enterprises Holdings Limited's (BEHL) utility operations, such as city gas or water supply, is extremely low. This is primarily due to the immense capital outlay, specialized technical knowledge, and stringent regulatory hurdles involved in setting up and running these essential services. For instance, the cost of building a new gas distribution network can run into billions of dollars, a barrier most individual or even corporate customers cannot overcome.

In BEHL's beer segment, the risk of backward integration by customers is also minimal. While major distributors might explore developing their own private label brands, direct backward integration by consumers into the brewing process itself is not a feasible threat. The complexity of brewing, quality control, and distribution channels effectively prevents this.

- Capital Intensity: Utility infrastructure projects require billions in investment, making backward integration prohibitive for most customers.

- Technical Expertise: Operating gas, water, or waste treatment facilities demands highly specialized engineering and operational skills.

- Regulatory Barriers: Obtaining licenses and approvals for utility services is a complex and lengthy process, deterring potential customer integration.

- Beer Segment: While private labeling is a possibility for distributors, consumers integrating backward into brewing is not a realistic threat.

Information Availability and Product Differentiation

In utility services, customers generally have high access to information, and the services themselves are often quite similar, with the main focus being on dependability and quality. For instance, Beijing Enterprises Holdings (BEHL) reported a 100% qualified and compliance rate for its water supply and sewage treatment services in 2024, underscoring its commitment to service excellence.

However, the bargaining power of customers can increase when products are differentiated. In the beer sector, BEHL faces this dynamic. While the market offers opportunities for differentiation through strong branding and superior quality, the increasing consumer preference for premium and craft beers in China means customers have more choices, potentially increasing their leverage.

- Information Symmetry: High in utility services, low in differentiated consumer goods.

- BEHL Water Services (2024): Maintained 100% qualified and compliance rates, focusing on reliability.

- Beer Market Differentiation: Opportunities exist through branding and quality, but premiumization shifts power.

- Customer Leverage: Increased by the availability of differentiated products and premium options.

In BEHL's utility operations, individual customers possess very low bargaining power due to the essential nature of services and high switching costs. However, large industrial clients or government entities can negotiate better terms due to their significant consumption volumes. This dichotomy means BEHL must manage pricing and service agreements carefully across its diverse customer base.

The bargaining power of customers for Beijing Enterprises Holdings is largely mitigated in its utility segments by high switching costs and regulatory oversight, which limits price sensitivity. Conversely, in the beer segment, lower switching costs and increasing product differentiation, particularly the trend towards premiumization observed in 2023 and 2024, grant consumers more leverage and choice.

Customer price sensitivity varies significantly; essential utilities are regulated, offering stability, while the beer market's premiumization trend means consumers are increasingly willing to pay for quality, reducing price-based bargaining power in that segment.

The threat of backward integration by customers is negligible across BEHL's businesses, given the immense capital, technical expertise, and regulatory hurdles involved in utility operations and the impracticality for consumers to enter brewing.

Same Document Delivered

Beijing Enterprises Holdings Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Beijing Enterprises Holdings, detailing its competitive landscape and strategic positioning. The document you see here is the exact, fully formatted report you will receive immediately after purchase, ensuring no surprises. This analysis delves into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within Beijing Enterprises Holdings' operating environment, providing actionable insights for strategic decision-making.

Rivalry Among Competitors

Beijing Enterprises Holdings (BEHL) faces a competitive landscape that shifts significantly across its operating segments. In China's city gas distribution sector, the market is quite fragmented with over 2,100 businesses, though BEHL is positioned as a major player expected to benefit from ongoing consolidation.

Conversely, the water supply industry presents a more concentrated environment with fewer competing enterprises. BEHL's involvement in solid waste treatment places it in a moderately concentrated market, where competition comes from both large state-linked conglomerates and specialized private firms.

The city gas distribution sector is poised for growth, fueled by a rising urban population and a push for cleaner energy sources. This expansion presents opportunities, but also means the market is attractive to new entrants.

Similarly, the water and wastewater treatment market is experiencing robust expansion, underpinned by significant infrastructure investments and strong government backing. This growth attracts attention from various players.

However, in contrast, China's overall beer market is anticipated to contract by 2025, a trend that will undoubtedly heighten competitive rivalry among established breweries as they fight for a shrinking market share.

In Beijing Enterprises Holdings' utility segment, product differentiation is minimal, with competition focused on service reliability and efficiency rather than unique features. For instance, in 2023, Beijing Gas Group, a subsidiary, reported stable natural gas sales, highlighting the importance of consistent delivery over product innovation. Switching costs for gas and water customers are substantial due to the entrenched infrastructure, creating a natural barrier to entry and reducing competitive intensity in this area.

Conversely, within its beer operations, differentiation is a key strategy. Beijing Enterprises leverages branding, taste profiles, and premium offerings to stand out in a crowded market. While specific 2024 market share data for its beer brands is still emerging, the sector generally sees low switching costs for consumers, meaning brand loyalty and perceived value are paramount in retaining customers against rivals.

Exit Barriers

Beijing Enterprises Holdings (BEHL) faces considerable exit barriers across its diverse operations, particularly within its core utility segments. The substantial capital investments required for infrastructure development, such as gas pipelines, water treatment plants, and waste management facilities, along with the specialized nature of these assets, make it extremely difficult and costly for companies to leave these markets. For instance, in 2023, BEHL's capital expenditures were approximately HKD 12.1 billion, largely directed towards expanding and maintaining these essential utility networks.

These high exit barriers can intensify competitive rivalry. When companies are locked into long-term contracts and have significant sunk costs in specialized infrastructure, they are often compelled to remain in the market and compete even when profitability is low or during economic downturns. This can lead to prolonged periods of intense price competition or operational adjustments as firms seek to recover their investments rather than exit.

While BEHL's brewery business also involves substantial fixed assets, the exit barriers in this sector are generally considered lower compared to the utility segments. However, the presence of significant investments in production facilities and distribution networks still creates a degree of stickiness.

- High Capital Investment: BEHL's utility businesses require massive upfront capital for infrastructure, making divestment challenging.

- Specialized Assets: Assets like gas pipelines and water treatment plants are highly specific and have limited alternative uses.

- Long-Term Contracts: Many utility operations are governed by long-term concessions and service agreements, binding companies to their commitments.

- Brewery Sector Assets: While significant, brewery assets may offer more flexibility for resale or repurposing compared to utility infrastructure.

Market Concentration and Strategic Stakes

While Beijing Enterprises Holdings Limited (BEHL) operates in markets like city gas that are seeing consolidation, the competitive landscape remains intense. The presence of well-connected State-Owned Enterprises (SOEs) means that securing new projects and expanding market share involves facing formidable rivals with significant advantages.

BEHL's role in providing essential urban infrastructure in China grants it substantial government backing. This support is a double-edged sword; it can bolster BEHL's position but also means its strategies and operations are closely aligned with, and influenced by, national policies and government objectives, shaping the competitive dynamics it faces.

- Market Consolidation: BEHL's city gas distribution business, for instance, is experiencing consolidation, potentially leading to fewer, larger players.

- SOE Competition: Well-established SOEs, often with preferential access to resources and regulatory approvals, present significant competitive challenges in bidding for new infrastructure projects.

- Governmental Influence: BEHL's strategic importance means its competitive actions are often viewed through the lens of national development goals, impacting its strategic flexibility.

- 2024 Context: By 2024, China's energy infrastructure development continues to be a priority, intensifying competition among SOEs and other key players for market dominance and project approvals.

Competitive rivalry for Beijing Enterprises Holdings (BEHL) varies by sector. While its utility segments benefit from high switching costs and infrastructure barriers, the beer market is more dynamic with lower switching costs, demanding strong brand differentiation. By 2024, the city gas sector is seeing consolidation, with BEHL aiming to leverage this trend, though competition from established State-Owned Enterprises (SOEs) remains intense for new projects.

SSubstitutes Threaten

For city gas, potential substitutes like electricity, LPG, and coal present a dynamic threat. While natural gas generally offers a better price-performance ratio and environmental benefits, shifts in energy pricing or policy favoring alternatives could impact demand. For instance, the increasing cost of LPG has already driven some households towards city gas, demonstrating the sensitivity of consumers to these trade-offs, a trend that benefits Beijing Enterprises Holdings (BEHL).

While municipal water supply is essential for urban centers like Beijing, bottled water presents a viable substitute for drinking water, especially for consumers prioritizing perceived quality. In 2024, the global bottled water market was valued at approximately $360 billion, indicating a significant consumer preference for this alternative.

Furthermore, reclaimed water is increasingly becoming a competitive alternative to traditional tap water for a range of non-potable applications. This trend could potentially reduce the demand for conventionally supplied water, impacting entities like Beijing Enterprises Holdings that rely on traditional water distribution.

The threat of substitutes in waste management is evolving, with traditional landfilling facing increasing pressure. China's commitment to a circular economy and stricter environmental regulations are boosting advanced solutions. For instance, waste-to-energy plants, a key area for Beijing Enterprises Holdings (BEHL), offer a more sustainable alternative to simple landfilling.

BEHL's investment in waste-to-energy facilities, which generated approximately RMB 6.3 billion in revenue for the company in 2023, directly addresses this evolving landscape. These facilities not only treat waste but also produce energy, making them a more attractive and environmentally sound option compared to traditional methods. This strategic focus positions BEHL favorably against less advanced, environmentally impactful substitutes.

Consumer Preference Shifts in Beverages

The threat of substitutes for Beijing Enterprises Holdings' beer products is moderate to high. Beyond traditional beer, consumers have a wide array of alcoholic alternatives like wine, spirits, and particularly baijiu, a potent Chinese spirit, which holds significant cultural importance and market share in China.

Furthermore, the beverage market is experiencing a notable shift towards health and wellness. This trend directly impacts the beer industry, as evidenced by the expanding market for low-alcohol and alcohol-free beers. For instance, global sales of non-alcoholic beer were projected to reach $25 billion by 2024, indicating a substantial and growing segment that directly competes with traditional beer offerings.

This evolving consumer preference for healthier options presents a direct challenge to established beer brands. Beijing Enterprises Holdings must acknowledge and adapt to this changing landscape where consumers are actively seeking beverages with reduced alcohol content or none at all, potentially diverting sales from their core beer portfolio.

- Alternative Alcoholic Beverages: Wine, spirits, and baijiu offer diverse taste profiles and consumption occasions, competing for consumer spending and loyalty.

- Non-Alcoholic Options: The burgeoning market for zero-alcohol beers and other non-alcoholic drinks caters to health-conscious consumers, directly substituting traditional beer consumption.

- Health-Conscious Trends: Growing consumer awareness about health and wellness is driving demand for lower-alcohol or alcohol-free alternatives across all beverage categories.

- Market Data: The global non-alcoholic beer market's projected growth to $25 billion by 2024 highlights the significant impact of this substitute category.

Impact of Regulatory and Technological Advancements

Government policies actively influence the appeal of substitutes for Beijing Enterprises Holdings (BEHL). For instance, initiatives promoting piped natural gas directly diminish the threat posed by Liquefied Petroleum Gas (LPG) as an alternative energy source for consumers. This regulatory push makes natural gas a more attractive and accessible option, thereby weakening the competitive pressure from LPG.

Technological progress also plays a crucial role in shaping the threat of substitutes. Innovations in areas like advanced water treatment or more efficient waste processing technologies can introduce superior or more cost-effective alternatives to BEHL's core offerings. This necessitates continuous investment in technological upgrades by BEHL to maintain its competitive edge and mitigate the impact of these emerging substitutes.

- Government Support for Natural Gas: Policies encouraging the expansion of piped natural gas networks directly reduce the threat from LPG by making natural gas a more convenient and often cheaper substitute.

- Water Treatment Innovations: Advancements in membrane filtration or desalination technologies could offer more efficient and cost-effective water supply solutions, potentially substituting for BEHL's traditional water services.

- Waste Recycling Technology: New methods for waste-to-energy conversion or advanced material recovery could present alternatives to conventional waste disposal and recycling services, impacting BEHL's waste management segment.

For Beijing Enterprises Holdings' (BEHL) city gas segment, the threat of substitutes like electricity, LPG, and coal is influenced by pricing and policy. While natural gas often holds a price-performance advantage, shifts in energy markets can alter this dynamic. For example, rising LPG costs in 2024 have already nudged some consumers toward city gas, illustrating this sensitivity.

In the water sector, bottled water remains a substitute for drinking water, with the global market valued around $360 billion in 2024. Reclaimed water also presents a growing alternative for non-potable uses, potentially impacting demand for BEHL's traditional water supply services.

The waste management sector sees waste-to-energy plants, a focus for BEHL, emerging as a strong substitute for traditional landfilling, driven by environmental regulations. BEHL's waste-to-energy operations generated approximately RMB 6.3 billion in 2023, highlighting their strategic response to this evolving substitute landscape.

BEHL's beer products face a moderate to high threat from substitutes. Beyond traditional beer, alternatives like wine, spirits, and baijiu are significant competitors. The growing demand for low-alcohol and alcohol-free beverages, with global non-alcoholic beer sales projected to reach $25 billion by 2024, further intensifies this threat.

Entrants Threaten

Entering Beijing Enterprises Holdings Limited's (BEHL) core utility sectors like city gas, water services, and solid waste treatment demands substantial upfront capital for building essential infrastructure. This includes extensive pipeline networks, advanced treatment plants, and sophisticated waste processing facilities, creating a formidable financial hurdle for newcomers.

For instance, the development of a new city gas distribution network alone can cost billions of dollars. In 2024, China's ongoing investments in upgrading and expanding its urban gas infrastructure underscore this point, with significant funding allocated to projects ensuring reliable supply and safety, making it difficult for smaller entities to compete.

The utility and environmental sectors in China are characterized by stringent regulatory frameworks and licensing requirements. New entrants must navigate a complex web of permits, licenses, and adherence to demanding environmental standards, creating significant barriers to entry. For instance, in 2024, the Ministry of Ecology and Environment continued to emphasize strict enforcement of pollution control measures, requiring substantial upfront investment in compliance technology for any new player in the water treatment or waste management industries.

Beijing Enterprises Holdings (BEHL) benefits significantly from its deeply entrenched distribution networks for essential services like gas and water. The sheer scale of its operations, particularly in waste treatment, creates substantial economies of scale that are difficult for newcomers to replicate. For instance, in 2023, BEHL's gas distribution segment served over 30 million customers across China, a testament to its vast reach.

New entrants would face immense hurdles in establishing comparable infrastructure and achieving similar operational efficiencies. The capital investment required to build out a nationwide gas pipeline network or a widespread water distribution system from the ground up is astronomical, estimated to be in the billions of dollars. This high barrier to entry, coupled with the time needed to gain regulatory approvals and build customer bases, effectively deters most potential competitors.

Access to Essential Resources and Government Relationships

New entrants face significant hurdles in securing essential resources, particularly natural gas, water, and waste treatment services, which are heavily regulated and often controlled by state-backed entities. Beijing Enterprises Holdings Limited (BEHL), as a major player, benefits from established government relationships and long-term contracts that are difficult for newcomers to replicate. For instance, BEHL’s extensive pipeline network and supply agreements are critical assets that new entrants would struggle to match in the short to medium term.

These entrenched relationships translate into preferential access and approvals, creating a substantial barrier to entry. New companies would need to navigate complex bureaucratic processes and build trust with government bodies, a task that is time-consuming and capital-intensive. This reliance on government backing and existing infrastructure effectively deters potential competitors from entering the market.

- Government Approvals: New entrants require extensive permits and licenses, often tied to demonstrating reliable resource access and compliance with national infrastructure plans.

- Existing Infrastructure: BEHL's vast network of gas pipelines and water treatment facilities represents a sunk cost and a significant competitive advantage that new entrants lack.

- Contractual Advantages: Long-term supply and service contracts secured by BEHL provide stability and predictable revenue streams, making it challenging for new entrants to compete on price or availability.

Brand Loyalty and Market Saturation in Brewery Sector

While utility sectors typically present high barriers to entry, the brewery industry faces distinct challenges. The Chinese beer market, despite its considerable size, is characterized by a strong presence of well-established domestic and international brands.

Newcomers would require substantial marketing expenditures to cultivate brand loyalty and secure market share in an environment where overall beer volume is projected to contract.

- Brand Loyalty: Established breweries have cultivated deep customer loyalty over decades, making it difficult for new entrants to gain traction.

- Market Saturation: The Chinese beer market is highly saturated, with numerous players vying for consumer attention and spending.

- Marketing Investment: Significant capital is needed for advertising, promotions, and distribution to overcome existing brand recognition and build a new one.

- Declining Volume: Projections indicate a potential decline in overall beer consumption in China, adding another layer of difficulty for new entrants seeking growth.

The threat of new entrants for Beijing Enterprises Holdings Limited (BEHL) is low, primarily due to the capital-intensive nature of its core utility businesses and stringent regulatory requirements. Building out new gas pipelines, water treatment facilities, or waste processing plants demands billions in upfront investment. For example, China's 2024 infrastructure spending highlights the scale of these capital needs, making it nearly impossible for smaller firms to compete.

Furthermore, securing necessary licenses and adhering to strict environmental standards, as emphasized by the Ministry of Ecology and Environment in 2024, creates significant hurdles. BEHL's established infrastructure and extensive customer base, serving over 30 million gas customers in 2023, provide substantial economies of scale that are difficult to replicate.

Entrenched government relationships and long-term contracts also grant BEHL preferential access and approvals, acting as a strong deterrent to potential new players. These factors combined create a formidable barrier to entry, effectively limiting the threat from new competitors in BEHL's primary markets.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Beijing Enterprises Holdings leverages data from annual reports, investor presentations, and industry-specific research from firms like IBISWorld. We also incorporate information from financial databases and regulatory filings to provide a comprehensive view of the competitive landscape.