Barloworld SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Barloworld Bundle

Barloworld's diversified business model presents significant strengths, but also potential vulnerabilities in a dynamic global market. Understanding these internal capabilities and external challenges is crucial for any strategic decision-maker.

Want the full story behind Barloworld's competitive edge, potential threats, and strategic opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your planning, pitches, and research, offering actionable insights for smarter investing.

Strengths

Barloworld's diversified operational footprint across key sectors like mining, construction, and industrials is a significant strength, fostering a resilient business model. This broad sector exposure helps cushion the impact of downturns in any single industry.

The company's geographic diversification, with notable contributions from operations in regions like Mongolia, provides a crucial buffer against regional economic challenges. For instance, Barloworld Mongolia's strong performance in the fiscal year ended September 30, 2023, helped to mitigate softer results in other markets, demonstrating the value of this spread.

Barloworld's strength lies in its robust aftermarket and rental services, which contribute a substantial portion of its revenue. These segments, including servicing, parts sales, and equipment rentals, are typically more stable and offer higher margins.

This diversified revenue stream provides a consistent income, even when new equipment sales are slow. For instance, in the fiscal year ending September 30, 2023, Barloworld Equipment Southern Africa reported strong performance driven by aftermarket services, with revenue growth of 10% in this segment.

Barloworld's financial management is a significant strength, evident in its strategic debt reduction and robust EBITDA margins, which stood at 13.3% for the six months ended March 31, 2024. This prudent approach ensures financial stability and operational efficiency.

The company boasts a strong liquidity position, providing it with the flexibility to navigate market fluctuations and pursue growth opportunities. This financial resilience is a key enabler for its strategic initiatives.

Consistently achieving a return on invested capital above its threshold underscores Barloworld's effective capital allocation and financial discipline. For example, its return on invested capital was 18.3% in the fiscal year 2023, well above its target, showcasing its ability to generate value.

Strategic Focus and Business System Implementation

Barloworld's strategic focus, particularly its 'Fix, Optimize, and Grow' approach, coupled with the robust implementation of the Barloworld Business System (BBS), has been a significant strength. This integrated strategy has enabled the company to effectively manage through demanding market environments, demonstrating resilience and adaptability. The BBS, a cornerstone of their operational framework, drives continuous improvement and operational efficiencies, which are crucial for maintaining a competitive edge.

The disciplined capital allocation inherent in their strategy further bolsters this strength. For instance, in the fiscal year ending September 30, 2023, Barloworld reported revenue growth of 11% to R120.2 billion, showcasing the tangible results of their strategic execution. This growth was supported by strong performance in their Equipment and Ingrain divisions, reflecting successful optimization and growth initiatives.

Key aspects contributing to this strength include:

- Strategic Clarity: The 'Fix, Optimize, and Grow' strategy provides a clear roadmap for business development and resource deployment.

- Operational Excellence: The Barloworld Business System fosters a culture of continuous improvement and efficiency across all operations.

- Disciplined Capital Allocation: A focused approach to investing capital ensures resources are directed towards high-return opportunities.

- Resilience in Markets: The company's systems and strategy have proven effective in navigating economic volatility and challenging market conditions.

Commitment to Sustainability and Technological Advancement

Barloworld's commitment to sustainability is a significant strength, with the company actively integrating eco-friendly practices across its operations. This focus not only aligns with global objectives such as the UN Sustainable Development Goals but also positions Barloworld favorably in an increasingly environmentally conscious market. For instance, in their 2023 Integrated Report, they highlighted progress in reducing their carbon footprint, a key metric for sustainable operations.

Furthermore, Barloworld is making substantial investments in technological advancement. This includes developing digital capabilities to enhance efficiency and customer service. Their focus on leveraging technology for predictive maintenance, particularly in their equipment divisions, opens up significant aftermarket opportunities. This strategic investment in digital transformation was evident in their capital expenditure plans for 2024, which included a notable allocation towards digital solutions.

- Sustainability Integration: Alignment with UN Sustainable Development Goals and demonstrable efforts in carbon footprint reduction.

- Digital Capabilities: Investment in technology for predictive maintenance and enhanced aftermarket services.

- Operational Efficiency: Leveraging digital tools to improve service delivery and customer engagement.

Barloworld's diversified business model, spanning mining, construction, and industrial sectors across various geographies, provides significant resilience. This broad exposure, exemplified by strong performance in regions like Mongolia in FY2023, helps mitigate risks from localized economic downturns.

The company's revenue streams are bolstered by robust aftermarket and rental services, which typically offer higher margins and greater stability than new equipment sales. For the six months ended March 31, 2024, Barloworld reported EBITDA margins of 13.3%, reflecting strong operational performance and the contribution of these services.

Barloworld demonstrates financial strength through disciplined capital allocation and a focus on operational efficiency, driven by its 'Fix, Optimize, and Grow' strategy and the Barloworld Business System (BBS). This approach yielded an 11% revenue growth to R120.2 billion in FY2023, with a return on invested capital of 18.3%.

A commitment to sustainability and investment in digital capabilities are key strengths, enhancing operational efficiency and customer service. Barloworld's focus on reducing its carbon footprint and leveraging technology for predictive maintenance positions it well for future growth.

| Metric | FY2023 (ended Sep 30) | H1 FY2024 (ended Mar 31) |

|---|---|---|

| Revenue | R120.2 billion | N/A |

| EBITDA Margin | N/A | 13.3% |

| Return on Invested Capital | 18.3% | N/A |

What is included in the product

Delivers a strategic overview of Barloworld’s internal and external business factors, highlighting its strengths in diverse markets and opportunities for growth, while also acknowledging weaknesses and threats that require careful management.

The Barloworld SWOT Analysis offers a clear, actionable roadmap, pinpointing key opportunities and mitigating potential threats to relieve strategic uncertainty.

Weaknesses

Barloworld's reliance on sectors like mining and construction means its financial health is closely linked to the ups and downs of these industries. When commodity prices dip or the economy slows, the company feels the impact directly.

For instance, the Equipment Southern Africa segment, a key revenue generator, saw its performance affected by a sluggish global economic rebound and ongoing geopolitical tensions throughout 2024.

Vostochnaya Technica (VT), Barloworld's Russian subsidiary, faces substantial headwinds. Revenue has seen a significant downturn, exacerbated by extended sanctions and a shrinking market. This challenging environment has led to expectations that VT will operate at breakeven.

Adding to the operational difficulties, an ongoing independent investigation into potential export control violations introduces considerable uncertainty. The outcome of this investigation could have further implications for VT's future operations and financial performance.

Barloworld's significant reliance on the Southern African region, particularly South Africa, presents a notable weakness. With 81% of its revenue generated from this area, the company is highly susceptible to the region's prevailing economic challenges. These include sluggish growth, elevated unemployment rates, and the persistent issue of deteriorating infrastructure, such as the unreliable power supply, which directly impacts operational efficiency.

Impact of Stronger Rand and Reduced Parts Sales in Southern Africa

The appreciation of the South African Rand against the US Dollar, particularly in 2024, has presented a headwind for Barloworld Equipment Southern Africa. This currency movement directly impacts the reported revenue when earnings in foreign currencies are translated back into a stronger local currency, effectively diminishing the Rand value of those earnings. For instance, if a significant portion of equipment sales or service revenue is denominated in US Dollars, a stronger Rand means that each Dollar earned translates into fewer Rand.

Compounding this challenge is a notable decline in parts sales within the Southern African region. While aftermarket services, including parts sales, are generally a significant revenue stream and a core strength for Barloworld, this downturn signals operational or market-related issues. This reduction in parts sales, a critical component of the equipment lifecycle and a driver of recurring revenue, directly affects the overall financial performance of the division.

The combined effect of a stronger Rand and reduced parts sales creates a dual pressure on Barloworld's Southern African operations. This situation requires a strategic response to mitigate the negative financial impact. Key considerations include:

- Currency Hedging Strategies: Implementing or enhancing currency hedging instruments to protect against adverse Rand fluctuations and lock in more predictable revenue streams.

- Parts Sales Growth Initiatives: Developing targeted campaigns and service offerings to stimulate demand for replacement parts and aftermarket support, potentially through competitive pricing or enhanced service packages.

- Operational Efficiency: Reviewing cost structures within the Southern African division to offset revenue pressures and maintain profitability margins.

- Market Diversification: Exploring opportunities to increase sales or revenue streams in markets less susceptible to the specific pressures impacting Southern Africa.

Decline in New Machine Sales

Barloworld has faced a significant downturn in new machine sales, a direct consequence of the natural ebb following a robust fleet replacement cycle. This slowdown, particularly evident in its Equipment Southern Africa division, directly impacted the company's top line, underscoring a vulnerability in its core revenue-generating area.

The Equipment Southern Africa segment, crucial to Barloworld's performance, saw its revenue dip in the first half of fiscal year 2024, partly due to this reduced demand for new equipment. This trend suggests a market correction after a period of heightened activity, posing a challenge for sustained growth in this key business unit.

- Reduced new machine sales: A key weakness for Barloworld, especially in its Equipment Southern Africa division.

- Impact on revenue: The decline in sales directly contributed to a reduction in overall company revenue for the first half of fiscal year 2024.

- Post-replacement cycle slowdown: The weakness is attributed to the natural cyclical nature of fleet replacement programs.

Barloworld's significant concentration in Southern Africa, accounting for 81% of its revenue, makes it highly vulnerable to regional economic instability, including slow growth and infrastructure issues like power supply disruptions.

The company's Russian subsidiary, Vostochnaya Technica, is facing substantial challenges due to prolonged sanctions and a shrinking market, leading to expectations of breakeven performance.

Furthermore, an ongoing investigation into potential export control violations adds a layer of significant uncertainty regarding future operations and financial outcomes.

Preview the Actual Deliverable

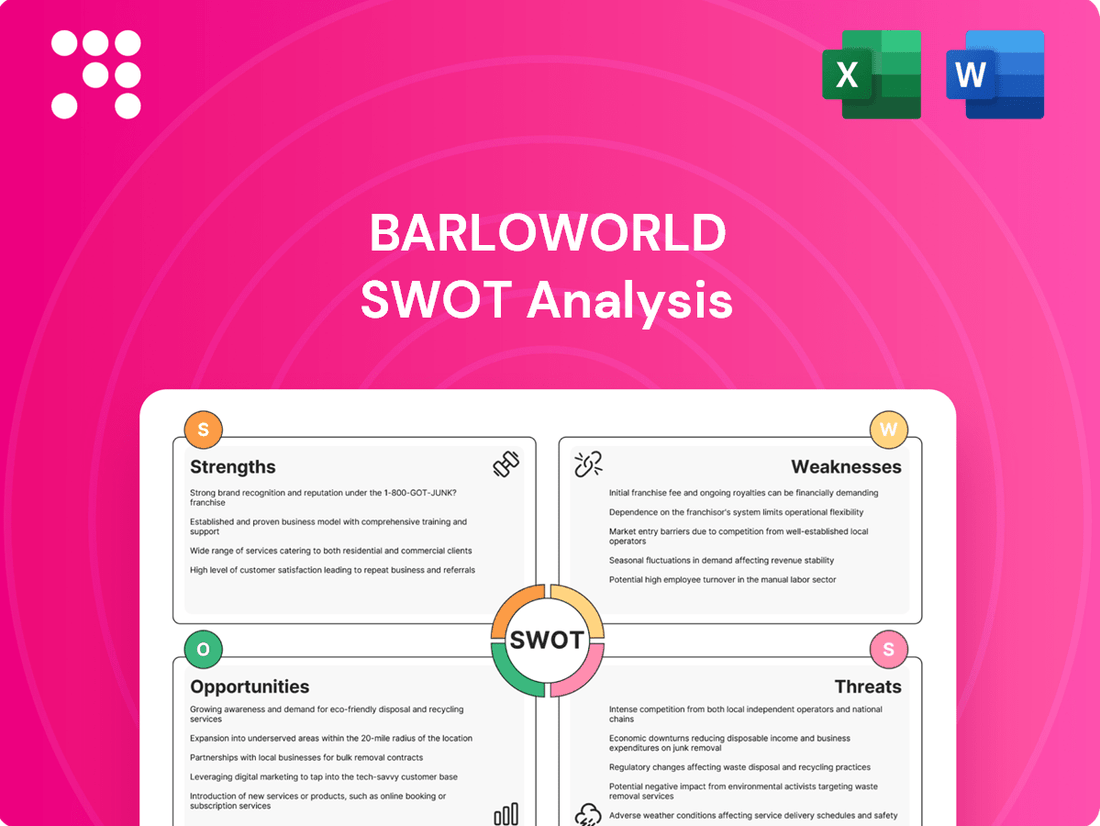

Barloworld SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. It provides a concise overview of Barloworld's Strengths, Weaknesses, Opportunities, and Threats, enabling informed strategic decisions. You're viewing a live preview of the actual SWOT analysis file; the complete version becomes available after checkout.

Opportunities

The global mining equipment market is poised for robust expansion, with projections indicating a compound annual growth rate (CAGR) of around 5.8% through 2028, reaching an estimated value of $21.8 billion. This surge is fueled by escalating demand for critical minerals essential for electric vehicles and renewable energy infrastructure, alongside sustained global investments in large-scale construction and infrastructure projects. Barloworld's Equipment division is well-positioned to capitalize on these trends.

The ongoing technological advancements in fleet management and logistics present a significant opportunity for Barloworld. Embracing trends like data analytics, AI, and IoT sensors for predictive maintenance, as seen in the broader industry where companies are reporting up to 15% reduction in downtime through such technologies, can boost efficiency and safety across Barloworld's operations.

Leveraging automation in warehousing and transportation, a sector projected to see a 20% increase in automated systems adoption by 2025, can streamline Barloworld's logistics division, leading to cost savings and improved delivery times. This technological integration directly supports enhanced customer satisfaction by ensuring reliability and responsiveness.

Barloworld Mongolia's impressive revenue growth, exceeding expectations, highlights a significant opportunity. This success underscores the potential for Barloworld to replicate this performance in other emerging markets, driving further profitability.

The company's existing geographic diversification strategy is a key asset that can be strategically expanded. By focusing on high-growth regions similar to Mongolia, Barloworld can capitalize on untapped market potential and enhance its global footprint.

Increasing Demand for Supply Chain Solutions and E-commerce Logistics

The increasing recognition of supply chain management as a critical business differentiator, fueled by intense competition and the rapid growth of e-commerce, presents a significant opportunity. Barloworld's logistics division is well-positioned to capitalize on this trend by offering streamlined warehousing and efficient last-mile delivery solutions. The global e-commerce market was projected to reach over $6.3 trillion in 2024, underscoring the immense demand for sophisticated logistics infrastructure and services.

Barloworld's expertise in managing complex operational needs directly addresses the growing demand for robust supply chain solutions.

- Growing E-commerce Penetration: Online retail sales are expected to continue their upward trajectory, driving the need for efficient fulfillment and delivery networks.

- Supply Chain as a Competitive Edge: Businesses are increasingly investing in supply chain optimization to reduce costs and improve customer satisfaction.

- Demand for Specialized Logistics: There's a rising need for specialized services like temperature-controlled warehousing and expedited shipping, areas where Barloworld can leverage its capabilities.

Infrastructure Development in Africa

Africa is experiencing a significant surge in infrastructure development, with major projects underway across the continent. This expansion, coupled with regional trade pacts like the African Continental Free Trade Area (AfCFTA), is creating a robust demand for industrial spaces, advanced logistics solutions, and essential equipment. For instance, the African Development Bank projected that the continent's infrastructure financing needs could reach $130-170 billion annually. Barloworld, already a strong player in Southern Africa, is well-positioned to leverage this growth. Their established network and expertise in supplying and servicing heavy machinery make them a key partner for these burgeoning projects.

Barloworld's opportunity lies in its ability to:

- Capitalize on increased demand for construction and mining equipment driven by infrastructure projects.

- Expand its logistics and industrial equipment offerings to support growing trade volumes under AfCFTA.

- Leverage its existing footprint in Southern Africa to secure contracts for new developments.

- Potentially explore new markets within Africa as infrastructure investment spreads.

Barloworld can leverage the expanding global mining equipment market, projected to reach $21.8 billion by 2028 with a 5.8% CAGR, driven by demand for critical minerals. The company is also positioned to benefit from the increasing adoption of automation in logistics, with a projected 20% increase in automated systems by 2025, and the growing e-commerce sector, estimated to exceed $6.3 trillion in 2024, which necessitates robust supply chain solutions. Furthermore, significant infrastructure development across Africa, supported by initiatives like the AfCFTA and an estimated annual financing need of $130-170 billion, presents a substantial opportunity for Barloworld's equipment and logistics divisions.

Threats

Geopolitical tensions, particularly in regions where Barloworld operates, present a substantial threat. For instance, ongoing sanctions and the potential for new ones, especially concerning any lingering impact from its previous Russian operations, could severely disrupt international business and market access.

These geopolitical flashpoints can lead to significant market contraction, making it harder to sell equipment and services. Furthermore, they can cause considerable supply chain disruptions, impacting the availability of parts and machinery, which in turn increases operational complexities and costs for Barloworld.

Barloworld's deep ties to the mining industry expose it to the inherent ups and downs of commodity prices. When prices for metals like iron ore or coal swing wildly, it directly impacts the demand for Barloworld's heavy equipment and services, creating a challenging operating environment.

Broader economic headwinds, such as rising inflation and increased interest rates, pose a significant threat. These factors can dampen both consumer and business confidence, leading to a slowdown in spending and a consequent drop in demand for Barloworld's offerings. For instance, a global economic slowdown in 2024 could directly reduce capital expenditure by mining and construction firms.

Barloworld faces significant challenges from intense competition across its diverse operating segments, particularly in equipment and industrial sectors. For instance, in the Australian mining equipment market, competitors like WesTrac and Hastings Deering are strong players.

Furthermore, the company must navigate a dynamic regulatory environment. Stricter emissions standards for machinery, like those being implemented in various regions for diesel engines, could require substantial capital expenditure for fleet upgrades or new technology adoption. Potential shifts in government procurement policies or mining regulations also pose a threat, potentially impacting demand for Barloworld's services and equipment.

Labour Shortages and Rising Costs

Barloworld, like many in the logistics and industrial equipment sectors, is contending with significant labor challenges. Driver shortages and a scarcity of skilled technicians, particularly diesel mechanics, are becoming more pronounced. This talent gap directly affects operational efficiency, potentially leading to delays and increased service times for customers.

The rising cost of labor is another critical threat. As demand for skilled workers outstrips supply, wages are being pushed upwards, impacting Barloworld's operational expenses. For instance, in 2024, the average hourly wage for diesel mechanics in many developed markets saw an increase of 5-7% year-on-year, reflecting this tight labor market. Attracting and retaining qualified personnel in these specialized roles is becoming increasingly difficult and expensive.

- Driver Shortages: Affecting timely delivery and service in logistics operations.

- Skill Gaps: Particularly in specialized technical roles like diesel technicians, hindering maintenance and repair efficiency.

- Rising Labor Costs: Increasing operational expenses and impacting profitability.

- Talent Retention: Difficulty in keeping skilled employees due to competitive market pressures.

Supply Chain Disruptions and Inventory Obsolescence

Ongoing global supply chain issues continue to pose a significant threat to Barloworld, potentially limiting the availability of essential vehicles and spare parts. This scarcity directly impacts their capacity to meet customer demands and maintain efficient service operations. For instance, in the first half of fiscal year 2024, Barloworld noted that while improvements were seen, persistent logistical challenges still affected certain product lines.

Furthermore, the risk of inventory obsolescence is a constant concern. Barloworld's financial statements often include provisions for obsolete stock, highlighting the challenges in accurately forecasting demand and managing inventory levels effectively in a dynamic market. In their 2023 annual report, the company detailed specific inventory write-downs, underscoring the financial implications of holding aging or unsellable stock.

- Limited Vehicle and Parts Availability: Persistent supply chain disruptions in 2024 have led to extended lead times for new equipment and critical components, affecting customer uptime.

- Inventory Obsolescence Risk: Provisions for obsolete inventory in fiscal year 2023 amounted to R1.2 billion, reflecting the difficulty in aligning stock levels with fluctuating market demand.

- Operational Efficiency Impact: Inability to secure timely parts can hinder maintenance schedules, potentially increasing operational costs and reducing customer satisfaction.

Intensifying competition across its key markets, particularly in equipment sales and services, presents a significant threat to Barloworld's market share and profitability. For example, in the Australian mining sector, established players like WesTrac and Hastings Deering continue to exert strong competitive pressure, necessitating continuous innovation and aggressive pricing strategies.

Navigating a complex and evolving regulatory landscape poses another substantial challenge. Stricter environmental regulations, such as upcoming emissions standards for heavy machinery in Europe and South Africa, could necessitate significant capital investment in fleet upgrades or the adoption of new technologies, impacting operational costs and potentially limiting the usability of existing assets.

Barloworld faces considerable risks from volatile commodity prices, as its business is heavily tied to the mining and construction sectors. Fluctuations in the prices of iron ore, coal, and other key commodities directly influence capital expenditure by these industries, impacting demand for Barloworld's equipment and services. For instance, a downturn in global commodity markets in 2024 could lead to reduced equipment sales.

Broader economic instability, including persistent inflation and rising interest rates, poses a threat by potentially dampening consumer and business confidence. This economic slowdown can reduce capital investment in infrastructure and mining, directly impacting Barloworld's revenue streams. A projected global economic slowdown in 2024 could see a significant contraction in demand for heavy machinery.

SWOT Analysis Data Sources

This Barloworld SWOT analysis is built upon a foundation of robust data, including the company's official financial statements, comprehensive market research reports, and expert industry analyses to ensure a well-rounded and accurate assessment.