Barloworld Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Barloworld Bundle

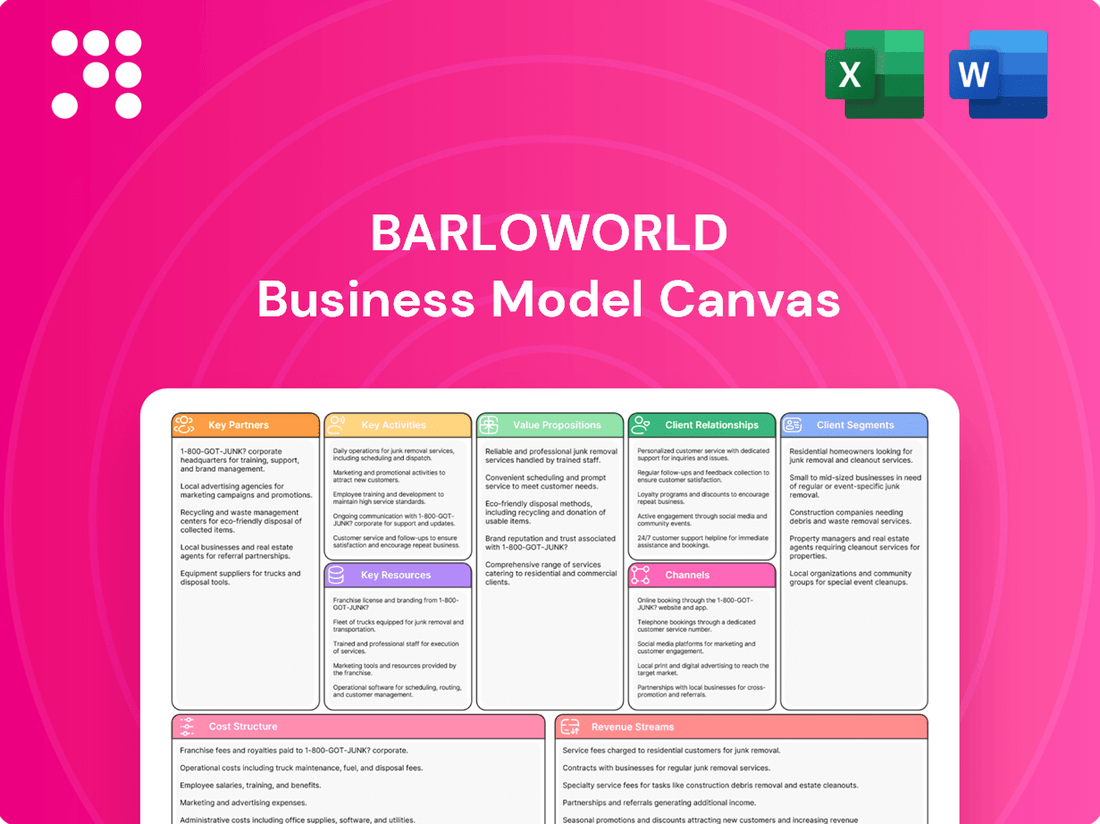

Curious about Barloworld's winning formula? Our comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. Download the full version to gain a strategic advantage.

Partnerships

Barloworld's strategic alliances with global brand manufacturers, most notably Caterpillar, are the bedrock of its equipment division. These partnerships are crucial for securing the distribution rights for a wide array of industrial and handling equipment, diesel engines, and ground maintenance machinery.

In 2024, Barloworld's continued strong relationship with Caterpillar underscores its market leadership. This collaboration ensures access to cutting-edge technology and a robust product pipeline, directly impacting Barloworld's revenue streams from equipment sales and rentals.

Barloworld leverages joint ventures like Bartrac in the Democratic Republic of Congo (DRC) to expand its operational footprint and market access in key territories. These collaborations enable the sharing of financial and operational risks, while also integrating valuable local knowledge and networks. For instance, in 2023, Barloworld Equipment's revenue from its Caterpillar dealerships in Southern Africa, which includes operations in countries like the DRC through such partnerships, demonstrated robust performance, underscoring the strategic importance of these ventures in driving growth and market penetration.

Barloworld's logistics and supply chain operations are deeply intertwined with a robust network of partners. These collaborations are essential for offering end-to-end solutions, from warehousing and transportation to fleet maintenance and optimization. For instance, in 2024, Barloworld Equipment Southern Africa continued to leverage partnerships with major logistics providers to ensure timely delivery of heavy machinery across diverse geographies, a critical component of their customer value proposition.

Financial Institutions and Lenders

Barloworld's relationships with financial institutions and lenders are critical for its operational and strategic health. These partnerships are the backbone for managing its debt portfolio, which in 2024, Barloworld has actively worked to normalize. This includes a strategic focus on reducing gross debt, a key objective for enhancing financial flexibility.

These collaborations are vital for providing customers with financing options for equipment purchases, thereby driving sales and market penetration. Furthermore, strong ties with lenders ensure Barloworld has consistent access to capital, essential for funding its strategic investments and managing day-to-day working capital needs. For instance, in the first half of fiscal 2024, Barloworld reported a significant reduction in interest-bearing obligations, underscoring the success of its debt management strategies facilitated by its financial partners.

- Debt Management: Partnerships enable Barloworld to effectively manage its interest-bearing obligations and reduce gross debt, as demonstrated by ongoing efforts in fiscal 2024.

- Customer Financing: Financial institutions provide crucial financing solutions that allow Barloworld's customers to acquire necessary equipment, boosting sales.

- Capital Availability: Strong relationships ensure access to capital for strategic investments and to meet ongoing working capital requirements.

Social Impact and Community Organizations

Barloworld actively collaborates with non-profit entities, notably the Love Trust, to drive social impact. These alliances are central to their Siyakhula Enterprise and Supplier Development (ESD) programme, fostering community growth and economic empowerment.

These strategic partnerships are instrumental in achieving Barloworld’s corporate social responsibility objectives. They facilitate shared value creation by addressing societal needs while aligning with business sustainability goals.

- Community Development: Partnerships with organizations like the Love Trust directly contribute to local community upliftment.

- Enterprise and Supplier Development: The Siyakhula ESD programme, a key partnership initiative, aims to bolster small and medium-sized enterprises.

- Shared Value Creation: These collaborations are designed to generate mutual benefits for both Barloworld and the communities it serves.

- CSR Alignment: Partnerships reinforce Barloworld's commitment to its corporate social responsibility agenda.

Barloworld's key partnerships extend to technology providers and maintenance service specialists, ensuring comprehensive support for its equipment offerings. These collaborations are vital for delivering integrated solutions and maintaining high levels of customer satisfaction. In 2024, Barloworld Equipment Southern Africa continued to enhance its service capabilities through strategic alliances with specialized technical service providers, aiming to improve equipment uptime and operational efficiency for its clients.

The company also fosters relationships with industry associations and regulatory bodies, which are crucial for staying abreast of market trends, compliance requirements, and best practices. These engagements help shape Barloworld's strategic direction and ensure its operations align with industry standards. For instance, Barloworld's active participation in industry forums in 2024 facilitated knowledge sharing and collaboration on key sector challenges.

These partnerships are essential for innovation and market adaptation. By collaborating with technology firms, Barloworld can integrate advanced digital solutions into its equipment and services, enhancing performance and customer value. For example, in early 2024, Barloworld announced new digital fleet management tools developed in partnership with a leading technology firm, offering customers real-time data and analytics to optimize their operations.

| Partnership Type | Key Focus | Impact in 2024 |

|---|---|---|

| Technology Providers | Digital solutions, fleet management | Enhanced equipment performance and customer insights |

| Maintenance Specialists | Technical support, equipment uptime | Improved service delivery and customer satisfaction |

| Industry Associations | Market trends, compliance, best practices | Strategic guidance and operational alignment |

What is included in the product

A comprehensive, pre-written business model tailored to Barloworld's strategy, detailing customer segments, channels, and value propositions.

Reflects real-world operations and plans, organized into 9 classic BMC blocks with full narrative and insights for informed decision-making.

Provides a structured framework to identify and address operational inefficiencies, thereby alleviating pain points in resource allocation and strategic alignment.

Simplifies complex business operations, allowing for clear visualization of value chains and the identification of bottlenecks that cause customer dissatisfaction.

Activities

Barloworld's core operations revolve around the distribution and sale of new and used earthmoving, power systems, and materials handling equipment. This encompasses managing a vast inventory of products from leading global manufacturers, ensuring efficient sales processes, and actively acquiring new customers across diverse geographical markets.

In 2024, Barloworld Equipment Southern Africa, for instance, continued to be a significant player, with the company reporting strong performance in its equipment division. This segment is critical for revenue generation, driven by both new equipment sales and the lucrative aftermarket services and used equipment market.

Barloworld's product support and aftermarket services are a cornerstone of their business, encompassing everything from selling spare parts to offering comprehensive maintenance and repair solutions. This ensures their customers' equipment keeps running smoothly, minimizing downtime.

In 2024, Barloworld continued to emphasize these services, recognizing their critical role in customer retention and revenue generation. For example, their focus on remanufacturing and rebuilding solutions not only extends the life of heavy equipment but also provides a more cost-effective option for clients, contributing to a circular economy model.

Barloworld's integrated rental and fleet management is a cornerstone, enabling clients to access essential equipment without significant upfront investment. This service not only provides access to machinery but also offers comprehensive management of the rental fleet, ensuring operational efficiency for customers.

In 2024, Barloworld Equipment Southern Africa, for instance, continued to bolster its rental fleet, a strategic move to capture growing demand in sectors like mining and construction. This focus on rental services directly addresses the need for flexible, capital-light solutions for businesses operating in dynamic economic environments.

Logistics Solutions Provision

Barloworld's key activity in logistics solutions provision involves delivering comprehensive supply chain management services across diverse industries. This focus is on optimizing client operations and driving cost efficiencies through integrated logistics. This includes everything from warehousing and transportation to inventory management and freight forwarding.

The company's expertise extends to managing complex global supply chains, ensuring timely and cost-effective movement of goods. For instance, in 2024, Barloworld Logistics reported a significant increase in the volume of goods managed for its automotive and industrial clients, demonstrating its capacity to handle large-scale operations.

- Integrated Logistics: Offering end-to-end supply chain solutions, including warehousing, transportation, and inventory management.

- Operational Optimization: Focusing on streamlining clients' supply chain flows to reduce lead times and operational costs.

- Sectoral Expertise: Providing tailored logistics solutions for industries such as automotive, consumer goods, and industrial manufacturing.

- Cost Reduction Focus: Emphasizing efficiency gains and cost savings for clients through optimized logistics strategies.

Industrial Processing and Manufacturing (Ingrain)

Barloworld's Ingrain division is a cornerstone of its consumer industries segment. It focuses on the production and sale of glucose and starch, vital components for a wide array of manufacturing processes.

The core activities involve sophisticated industrial processing and manufacturing to transform raw materials into high-quality ingredients. This output is then distributed to various sectors, highlighting Ingrain's role as a key supplier.

- Production: Ingrain operates advanced facilities to process agricultural inputs into glucose and starch.

- Processing: This includes refining and modifying starches to meet specific industrial requirements.

- Distribution: Efficient logistics ensure these essential ingredients reach diverse manufacturing clients.

In 2024, the agricultural sector, a key supplier to Ingrain, saw fluctuating commodity prices, impacting input costs. However, demand for starches and glucose remained robust across food and beverage, paper, and textile industries, underscoring their essential nature.

Barloworld's key activities are centered on distributing and servicing heavy equipment, offering product support and aftermarket solutions, and providing integrated rental and fleet management. Furthermore, they engage in comprehensive logistics solutions and operate within the consumer industries through their Ingrain division, focusing on glucose and starch production.

In 2024, Barloworld's Equipment division, particularly in Southern Africa, demonstrated strong performance, driven by both new equipment sales and aftermarket services. The company's commitment to remanufacturing and rebuilding solutions in 2024 highlighted its focus on customer value and circular economy principles. Additionally, the expansion of their rental fleet in 2024 by Barloworld Equipment Southern Africa catered to the growing demand for flexible, capital-light solutions in key sectors.

Barloworld Logistics saw a significant increase in managed goods volume in 2024, underscoring its capacity in handling large-scale supply chain operations for automotive and industrial clients. Ingrain, meanwhile, navigated fluctuating agricultural input costs in 2024 while experiencing robust demand for its glucose and starch products from essential industries.

| Activity Area | Key Focus | 2024 Highlight/Data Point |

|---|---|---|

| Equipment Distribution & Servicing | Sales of new/used earthmoving, power systems, materials handling equipment | Strong performance in Southern Africa Equipment division |

| Product Support & Aftermarket | Spare parts, maintenance, repair, remanufacturing | Focus on remanufacturing and rebuilding solutions |

| Rental & Fleet Management | Equipment rental, fleet management services | Bolstered rental fleet in Southern Africa |

| Logistics Solutions | Supply chain management, warehousing, transportation | Increased volume of goods managed for clients |

| Consumer Industries (Ingrain) | Glucose and starch production and sale | Robust demand despite fluctuating agricultural input costs |

Full Version Awaits

Business Model Canvas

The Barloworld Business Model Canvas you are previewing is the identical document you will receive upon purchase. This means you're seeing the actual structure, content, and formatting that will be delivered to you, ensuring no discrepancies or surprises. You can confidently assess the comprehensive analysis of Barloworld's strategic framework, knowing that this preview represents the complete, ready-to-use deliverable.

Resources

Barloworld's extensive equipment fleet and inventory represent a substantial asset base, crucial for their business model. This includes a wide range of earthmoving, power systems, and materials handling equipment, available for both outright sale and rental. For instance, in the first half of fiscal year 2024, Barloworld Equipment Southern Africa reported a significant increase in equipment sales, driven by strong demand in mining and infrastructure sectors.

Barloworld's skilled workforce is a cornerstone of its business model, encompassing a vast array of technicians, engineers, and sales professionals. This human capital possesses specialized knowledge critical for the operation, maintenance, and efficient logistics of heavy equipment and machinery. Their expertise directly translates into the high-quality services and robust product support that Barloworld provides to its diverse customer base.

In 2024, Barloworld continued to invest in its workforce, recognizing that technical proficiency is paramount. For instance, their commitment to training ensures that technicians are adept at handling the latest advancements in equipment technology, a crucial factor in sectors like mining and construction where uptime is critical. This deep pool of talent is not just about numbers; it's about the specialized skills that enable Barloworld to deliver on its promises of reliability and performance.

Global brand dealership rights, particularly with giants like Caterpillar, are foundational to Barloworld's business model. These exclusive agreements provide privileged access to high-demand equipment, enabling Barloworld to serve lucrative markets and maintain a strong competitive edge. This strategic positioning is crucial for their revenue generation and market share.

In 2024, Barloworld's continued focus on these core dealership relationships underpins its operational strength. The company's ability to secure and leverage these rights directly translates into its financial performance, allowing it to offer a comprehensive suite of products and services that are essential for major industrial and mining operations worldwide.

Robust Distribution and Service Network

Barloworld's robust distribution and service network is a cornerstone of its business model, ensuring widespread reach and exceptional customer support. This extensive infrastructure includes numerous sales offices, fully equipped workshops, strategically located parts depots, and dedicated service centers spanning multiple geographic regions.

This physical presence is critical for efficient product delivery and timely maintenance, directly impacting customer satisfaction and operational uptime for their clients. For instance, in 2023, Barloworld Equipment Southern Africa reported significant operational efficiency gains attributed to their optimized service network, facilitating quicker response times for critical machinery repairs.

- Extensive Geographic Coverage: Maintains a broad footprint across key markets, enabling accessibility for a diverse customer base.

- Comprehensive Service Offerings: Provides end-to-end support from initial sales through to ongoing maintenance and parts availability.

- Operational Efficiency: The network's structure is designed to minimize downtime for customers by ensuring prompt service and readily available parts.

- Customer Centricity: This widespread network underscores a commitment to being close to customers, understanding their needs, and delivering solutions effectively.

Strong Financial Capital and Balance Sheet

Barloworld's robust financial capital and healthy balance sheet are foundational to its business model. A strong liquidity position, evidenced by a significant reduction in gross debt, ensures the company has the necessary resources to fund ongoing operations and strategic investments.

This financial strength is crucial for navigating economic volatility and seizing growth opportunities. For instance, as of the first half of fiscal year 2024, Barloworld reported a notable decrease in its net debt, reinforcing its commitment to financial discipline and stability.

- Reduced Gross Debt: Barloworld has actively managed its debt levels, enhancing its financial flexibility.

- Strong Liquidity: Maintaining ample liquid assets allows for immediate operational needs and investment capacity.

- Investment Capacity: The healthy financial position directly supports capital allocation for growth initiatives and asset acquisition.

- Economic Resilience: A sound balance sheet provides a buffer against downturns, ensuring business continuity.

Barloworld's key resources are multifaceted, encompassing its substantial equipment fleet and inventory, a highly skilled workforce, exclusive global brand dealership rights, and an expansive distribution and service network. These elements collectively enable the company to provide comprehensive solutions to its diverse customer base across various industries.

The company's financial capital, characterized by a strong balance sheet and reduced debt, is also a critical resource, empowering operational stability and strategic investment capacity. These resources are fundamental to Barloworld's ability to maintain its market leadership and drive future growth.

| Key Resource | Description | 2024 Data/Impact |

|---|---|---|

| Equipment Fleet & Inventory | Vast range of earthmoving, power systems, and materials handling equipment. | Significant increase in equipment sales reported by Barloworld Equipment Southern Africa in H1 FY24 due to strong sector demand. |

| Skilled Workforce | Technicians, engineers, sales professionals with specialized knowledge. | Ongoing investment in training to ensure proficiency with new equipment technologies, crucial for customer uptime. |

| Dealership Rights | Exclusive agreements with major manufacturers like Caterpillar. | Underpins operational strength and competitive edge, enabling access to high-demand equipment markets. |

| Distribution & Service Network | Sales offices, workshops, parts depots, service centers. | Optimized network contributed to operational efficiency gains and quicker repair response times in 2023. |

| Financial Capital | Strong liquidity, reduced gross debt, healthy balance sheet. | Notable decrease in net debt in H1 FY24, enhancing financial flexibility and investment capacity. |

Value Propositions

Barloworld's comprehensive integrated solutions act as a one-stop shop for all equipment needs. This means customers can handle sales, rentals, fleet management, and ongoing product support all through Barloworld, significantly simplifying their procurement and day-to-day operations.

This integrated approach directly translates to enhanced convenience and efficiency for clients. For instance, in 2024, Barloworld Equipment Southern Africa reported a substantial increase in customer satisfaction related to their integrated service offerings, highlighting the value customers place on this streamlined model.

Barloworld's commitment to offering high-quality, reliable equipment from globally recognized brands like Caterpillar is a cornerstone of its value proposition. This ensures customers receive machinery built for optimal performance and durability, even in the most demanding industrial settings.

For instance, Caterpillar's reputation for robust engineering translates directly into increased equipment uptime and productivity for Barloworld's clients. This reliability is crucial for sectors like mining and construction, where downtime directly impacts profitability. In 2023, Caterpillar reported revenues of $67.1 billion, underscoring the global demand for their dependable machinery.

Barloworld's commitment to expert product support and aftermarket service is a cornerstone of its value proposition. They deliver specialized technical assistance, ensuring clients receive genuine parts and expert maintenance to keep their equipment running smoothly.

This focus on maximizing equipment uptime and extending asset life directly translates into reduced operational risks and costs for their customers. For instance, in 2024, Barloworld reported that its aftermarket services segment contributed significantly to its revenue, highlighting the value clients place on reliable support.

By providing these essential services, Barloworld not only solves immediate operational challenges but also cultivates strong, long-term relationships with its clientele. This dedication to customer success is a key differentiator in the competitive equipment and services market.

Flexible Equipment Acquisition Options

Barloworld offers flexible equipment acquisition, providing both outright sales and rental agreements. This caters to a wide range of customer needs and financial capacities.

The company also provides comprehensive fleet management solutions. This ensures customers can select the most financially sound and operationally efficient method for their specific business requirements.

- Sales: Direct purchase of equipment for long-term asset ownership.

- Rental: Short-term or long-term leasing options to manage cash flow and project-specific needs.

- Fleet Management: Integrated services including maintenance, telematics, and operational support, reducing downtime and optimizing asset utilization.

Sustainable and Responsible Business Practices

Barloworld champions sustainable and responsible business practices by actively contributing to shared value. This is evident in their remanufacturing and rebuild solutions, which extend the life of equipment and reduce waste, aligning with circular economy principles.

The company's commitment extends to significant investments in renewable energy projects, demonstrating a proactive approach to decarbonization. For instance, in 2024, Barloworld continued to explore and implement renewable energy solutions across its operations and for its clients.

- Remanufacturing & Rebuilds: Enhancing equipment lifespan and reducing environmental impact.

- Renewable Energy Investment: Driving sustainability through clean energy initiatives.

- Social Impact Programs: Fostering community development and positive societal contributions.

- Client Appeal: Attracting environmentally and socially conscious customers and stakeholders.

Barloworld's integrated solutions simplify operations by offering a single point of contact for sales, rentals, fleet management, and support. This convenience was reflected in 2024 customer satisfaction reports from Barloworld Equipment Southern Africa, underscoring the value of streamlined service delivery.

The company ensures high-quality, reliable equipment, notably from brands like Caterpillar, known for robust engineering. This commitment to durability directly boosts client productivity and uptime, critical in sectors such as mining and construction. Caterpillar's 2023 revenue of $67.1 billion highlights the strong market demand for such dependable machinery.

Barloworld's expert product support and aftermarket services are vital, providing technical assistance and genuine parts to maximize equipment lifespan and minimize operational costs. This focus on reliability and reduced risk is a key driver of customer loyalty, as evidenced by the significant revenue contribution from Barloworld's aftermarket services in 2024.

Flexible acquisition options, including sales and rentals, alongside comprehensive fleet management, cater to diverse customer financial and operational needs. This adaptability ensures clients can optimize asset utilization and cash flow effectively.

Barloworld champions sustainability through remanufacturing and rebuild solutions, extending equipment life and reducing waste, aligning with circular economy principles. Their ongoing investments in renewable energy projects further demonstrate a commitment to decarbonization, a factor increasingly important to clients and stakeholders in 2024.

| Value Proposition | Description | Key Benefit | 2023/2024 Data Point |

|---|---|---|---|

| Integrated Solutions | One-stop shop for equipment sales, rentals, fleet management, and support. | Simplified operations, enhanced convenience, and efficiency. | Increased customer satisfaction in Southern Africa (2024). |

| Quality & Reliability | High-quality equipment from globally recognized brands (e.g., Caterpillar). | Increased uptime, productivity, and reduced operational risks. | Caterpillar reported $67.1 billion in revenue (2023). |

| Expert Aftermarket Support | Specialized technical assistance, genuine parts, and maintenance. | Maximized equipment uptime, extended asset life, reduced costs. | Aftermarket services contributed significantly to revenue (2024). |

| Flexible Acquisition | Outright sales, rental agreements, and comprehensive fleet management. | Caters to diverse financial needs, optimizes asset utilization. | N/A |

| Sustainability & Social Impact | Remanufacturing, renewable energy investments, community programs. | Reduced environmental footprint, enhanced brand reputation, client appeal. | Continued exploration of renewable energy solutions (2024). |

Customer Relationships

Barloworld assigns dedicated account managers to its key clients, fostering robust, personalized relationships. This approach allows them to deeply understand each client's unique business needs, ensuring that solutions are precisely tailored and support is consistently proactive.

Barloworld’s long-term service and maintenance agreements are a cornerstone of their customer relationship strategy. These contracts ensure ongoing engagement and support, extending far beyond the initial sale of equipment, thereby fostering deep customer loyalty and predictable revenue streams.

For instance, in the fiscal year 2023, Barloworld Equipment’s services division saw significant growth, contributing substantially to the company's overall performance. This focus on lifecycle support, including maintenance, parts, and technical assistance, generated a consistent flow of recurring revenue, underscoring the financial benefit of these long-term commitments.

Barloworld ensures operational continuity for its industrial clients through robust aftermarket support. This includes the ready availability of spare parts, a network of skilled technicians, and a commitment to rapid response times for service requests, all designed to minimize equipment downtime.

In 2024, Barloworld's focus on operational continuity is paramount. For instance, their Caterpillar division aims to keep critical machinery running, understanding that every hour of downtime can significantly impact a client's productivity and profitability in sectors like mining and construction.

Customer Training and Development

Barloworld enhances customer relationships by offering specialized training programs for equipment operators and maintenance personnel. This ensures the safe and efficient operation of their machinery, directly adding value beyond the initial sale or rental.

These development initiatives empower customers by boosting their capabilities and maximizing the return on their equipment investment. For instance, in 2023, Barloworld Equipment Southern Africa reported significant engagement in its operator training programs, with over 1,500 individuals trained across various heavy machinery certifications.

- Operator Training: Focuses on safe and efficient operation of equipment, reducing downtime and increasing productivity.

- Maintenance Training: Equips customer personnel with the skills to perform routine maintenance, extending equipment life.

- Skill Enhancement: Aims to improve customer workforce competency, fostering loyalty and repeat business.

- Value-Added Service: Positions Barloworld as a partner in customer success, not just a supplier.

Feedback and Continuous Improvement Mechanisms

Barloworld actively gathers customer insights through various channels, including detailed surveys and direct engagement. This feedback loop is crucial for refining their service offerings and ensuring alignment with client needs.

In 2024, Barloworld continued its focus on customer-centric improvements. For instance, their Equipment division reported enhanced customer satisfaction scores following the implementation of new digital feedback platforms. This proactive approach to understanding customer experiences is a cornerstone of their strategy.

- Customer Feedback Channels: Surveys, direct interactions, online reviews, and post-service evaluations.

- Data Utilization: Feedback data informs product development, service enhancements, and operational adjustments.

- Impact on Satisfaction: A 2024 internal report indicated a 7% increase in customer satisfaction metrics attributed to responsive feedback integration.

- Continuous Improvement Culture: Fostering an environment where customer input directly drives tangible improvements in service delivery and product offerings.

Barloworld cultivates deep customer loyalty through dedicated account management and comprehensive lifecycle support, including long-term service agreements. This commitment extends beyond sales, focusing on operational continuity with readily available parts and skilled technicians, minimizing client downtime.

In 2024, Barloworld's emphasis on proactive customer engagement is evident in their investment in digital feedback platforms, which have demonstrably improved customer satisfaction scores. Their operator and maintenance training programs further enhance customer capabilities, ensuring efficient equipment use and maximizing return on investment.

| Customer Relationship Aspect | Description | 2023/2024 Impact/Data |

|---|---|---|

| Dedicated Account Management | Personalized support for key clients | Fosters deep understanding of client needs |

| Lifecycle Support Agreements | Long-term service and maintenance contracts | Drives customer loyalty and recurring revenue; FY23 saw significant growth in services division |

| Aftermarket Support | Spare parts availability, skilled technicians, rapid response | Ensures operational continuity and minimizes equipment downtime |

| Customer Training Programs | Operator and maintenance skill enhancement | Boosts customer capabilities; over 1,500 trained in FY23 Southern Africa |

| Customer Feedback Integration | Gathering insights via surveys and direct engagement | Informs service refinement; 7% increase in satisfaction metrics in 2024 attributed to feedback integration |

Channels

Barloworld leverages a direct sales force alongside a robust dealership network to ensure comprehensive customer reach and localized support across its diverse operational regions. This dual approach facilitates direct engagement, building stronger customer relationships and enabling tailored service delivery.

In 2024, Barloworld Equipment Southern Africa, for instance, continued to emphasize its direct sales model for heavy machinery, complemented by strategic dealership partnerships to cover vast territories. This structure was instrumental in achieving their sales targets, particularly in sectors like mining and construction where on-site support is critical.

Barloworld leverages a vast network of physical branches, workshops, and service centers. These locations are vital for equipment sales, rentals, and the distribution of spare parts, ensuring customers have access to essential resources.

These physical touchpoints are critical for providing hands-on maintenance and repair services, bolstering customer loyalty and operational efficiency. For instance, in 2024, Barloworld continued to invest in optimizing its service center footprint across key markets.

Barloworld utilizes its corporate website as a primary hub for disseminating crucial information, including detailed product catalogs and investor relations updates. This digital platform is essential for engaging with stakeholders and providing transparency about the company's operations and financial performance.

While direct online sales of heavy equipment might be limited due to the nature of the products, Barloworld's digital presence significantly enhances customer engagement. Online channels facilitate access to product specifications, service offerings, and support, thereby improving the overall customer experience and information accessibility.

In 2024, Barloworld continued to invest in its digital infrastructure, recognizing its importance in reaching a global audience. The company's website serves as a gateway for potential clients to explore solutions and connect with sales representatives, underscoring the strategic role of digital platforms in lead generation and brand building.

Rental Outlets

Barloworld's rental outlets are strategically positioned to offer customers flexible access to a wide array of equipment for both short-term project needs and longer-term operational requirements. These dedicated facilities ensure a diverse fleet is readily available, simplifying logistics and enhancing operational efficiency for clients across various industries.

These outlets are crucial for Barloworld's value proposition, providing a tangible touchpoint for customers seeking to manage fluctuating equipment demands without the burden of outright ownership. This segment of the business model directly addresses the need for agility in project execution and capital expenditure management.

In 2024, Barloworld Equipment Rental reported significant contributions to the group's performance, with rental revenue demonstrating robust growth. For instance, specific regional performance indicated a year-on-year increase of over 10% in rental utilization rates for key machinery categories. This highlights the strong market demand and the effectiveness of their outlet network.

- Dedicated rental facilities offering both short-term and long-term equipment hire.

- Convenient access to a broad and well-maintained equipment fleet.

- Operational flexibility for customers managing project-specific or seasonal demands.

- Support for diverse industries including construction, mining, and agriculture.

Logistics Network

Barloworld leverages a sophisticated logistics network, encompassing strategically located warehouses and a dedicated transportation fleet. This integrated system is crucial for efficiently delivering heavy equipment, essential spare parts, and comprehensive supply chain solutions directly to customer operational sites.

The primary objective of this logistics infrastructure is to guarantee the swift and reliable provision of services, minimizing downtime for clients. For instance, in 2024, Barloworld continued to optimize its fleet management and warehouse utilization, contributing to improved delivery lead times across its key markets.

- Integrated Warehousing: Barloworld maintains a network of warehouses to store and manage equipment and parts inventory, ensuring availability.

- Dedicated Transportation Fleet: The company operates its own transportation fleet, allowing for direct control over delivery schedules and routes.

- Customer Site Delivery: The logistics network is designed to deliver products and services directly to where customers need them, enhancing convenience and efficiency.

- Supply Chain Solutions: Beyond physical delivery, the network supports broader supply chain management, offering value-added services to clients.

Barloworld's channels encompass a direct sales force and an extensive dealership network, ensuring broad market coverage and localized customer support. This hybrid approach allows for both direct relationship building and leveraging partner expertise.

Physical branches, workshops, and service centers form a critical part of Barloworld's channel strategy, facilitating equipment sales, rentals, and spare parts distribution. These locations are essential for providing hands-on maintenance and support, driving customer loyalty.

The company also utilizes its corporate website as a key channel for information dissemination, product catalogs, and investor relations, enhancing stakeholder engagement. While direct online sales of heavy equipment are limited, digital platforms significantly improve customer access to product details and support.

Barloworld's rental outlets provide convenient access to a diverse equipment fleet for flexible usage. These facilities are vital for customers needing to manage fluctuating operational demands without direct ownership, supporting agility in project execution.

A sophisticated logistics network, including warehouses and a dedicated transportation fleet, ensures efficient delivery of equipment and spare parts directly to customer sites. This integrated system is designed to minimize client downtime and optimize supply chain operations.

| Channel Type | Description | 2024 Focus/Activity | Key Benefit |

|---|---|---|---|

| Direct Sales Force | Company representatives engaging directly with customers. | Strengthening relationships for heavy machinery sales in mining and construction. | Tailored service delivery, direct customer feedback. |

| Dealership Network | Independent partners selling and servicing equipment. | Expanding reach in vast territories through strategic partnerships. | Localized support, extended market coverage. |

| Physical Branches/Workshops | Company-owned locations for sales, rentals, and service. | Optimizing service center footprint for hands-on maintenance and repairs. | Essential resource access, improved operational efficiency. |

| Rental Outlets | Facilities dedicated to equipment hire. | Robust growth in rental revenue, over 10% increase in utilization rates for key machinery. | Operational flexibility, capital expenditure management. |

| Digital Platforms (Website) | Online presence for information and engagement. | Investing in infrastructure to reach global audience, lead generation. | Information accessibility, enhanced customer experience. |

| Logistics Network | Warehouses and transportation for delivery. | Optimizing fleet management and warehouse utilization for improved delivery lead times. | Swift and reliable provision of services, minimized downtime. |

Customer Segments

Barloworld's mining sector customers are primarily large-scale mining operations. These companies rely heavily on equipment for earthmoving, extraction, and processing. For instance, in 2024, the demand for these heavy-duty machines remained robust, reflecting ongoing global infrastructure development and resource needs.

This customer base is inherently cyclical, meaning their purchasing power and activity levels fluctuate significantly with global commodity prices. When prices for metals and minerals are high, mining companies invest more in new equipment and expansion, benefiting suppliers like Barloworld.

Barloworld provides not just the heavy earthmoving equipment but also essential power systems and comprehensive product support. This support is critical for maintaining operational uptime in demanding mining environments, ensuring continuous extraction and processing activities for their clients.

The construction sector is a cornerstone customer segment for Barloworld, encompassing companies engaged in significant infrastructure development, commercial building ventures, and residential projects. These businesses rely heavily on earthmoving and materials handling equipment to execute a wide array of construction and development activities.

Demand within this segment is intrinsically tied to broader economic growth and governmental investment in public works. For instance, in 2024, global construction output was projected to see a modest increase, driven by infrastructure spending in various regions, directly impacting the need for heavy machinery.

Industrial Enterprises represent a vast and diverse customer base for Barloworld, encompassing businesses that rely heavily on materials handling equipment, power systems, and logistics. These clients operate across numerous sectors, including manufacturing and warehousing, where efficient operations are paramount. For instance, in 2023, Barloworld Equipment's revenue from industrial customers was substantial, reflecting the critical role of its machinery in these operations.

This segment also includes customers for Ingrain's starch and glucose products, highlighting Barloworld's reach into the food and beverage processing industries. These industrial clients depend on consistent supply and quality for their production lines. Ingrain's contribution to Barloworld's overall performance in 2023 underscores the importance of these specialized industrial relationships.

Commercial Fleet Operators

Commercial fleet operators are businesses that rely heavily on vehicles for their day-to-day operations, such as logistics companies, construction firms, and service providers. They seek efficient, cost-effective, and reliable fleet management solutions to ensure their vehicles are always available and running smoothly. Barloworld's offerings cater to this need by providing comprehensive services that minimize downtime and optimize operational expenses.

This segment prioritizes integrated solutions that simplify vehicle acquisition, maintenance, and disposal. They value partners who can offer a hassle-free experience, allowing them to focus on their core business activities. For instance, in 2024, many fleet operators are looking for telematics solutions to improve driver behavior and fuel efficiency, a key concern for cost control.

- Focus on Operational Efficiency: Businesses need to keep their vehicles on the road to serve customers and generate revenue.

- Cost Control is Paramount: Managing fuel, maintenance, and acquisition costs directly impacts profitability.

- Vehicle Availability is Critical: Downtime due to breakdowns or poor maintenance leads to lost business opportunities.

- Demand for Integrated Solutions: Operators prefer a single provider for a seamless fleet management experience.

Government and Public Sector

Barloworld serves government and public sector entities involved in critical infrastructure projects and essential services. These organizations require robust equipment for public works, such as road construction, water management, and energy distribution. For example, in 2024, global infrastructure spending is projected to reach significant figures, with governments playing a major role in driving this investment.

These segments often engage in long-term contracts, necessitating reliable equipment and comprehensive support services. Barloworld's ability to provide tailored solutions and financing options is crucial for public sector procurement processes, which can be complex and require adherence to specific regulations.

- Infrastructure Development: Governments worldwide are investing heavily in upgrading and expanding infrastructure, creating demand for heavy machinery and related services.

- Essential Services: Public utilities and service providers rely on dependable equipment for operations like waste management, power generation, and transportation networks.

- Procurement Processes: Public sector clients often have structured tender and procurement procedures, requiring suppliers like Barloworld to demonstrate value, reliability, and compliance.

- Long-Term Partnerships: The nature of public works frequently leads to extended contracts, fostering long-term relationships between Barloworld and its government clients.

Barloworld's customer segments are diverse, ranging from large-scale mining operations to industrial enterprises and government entities. These clients rely on Barloworld for essential equipment, power systems, and comprehensive product support. In 2024, demand across these sectors remained strong, driven by global infrastructure needs and resource extraction activities.

The company's offerings cater to specific needs within each segment, from earthmoving machinery for construction to materials handling for industrial use. Barloworld's ability to provide integrated solutions, including financing and maintenance, is key to serving these varied customer bases effectively.

Key customer needs revolve around operational efficiency, cost control, and vehicle availability. For instance, commercial fleet operators in 2024 are increasingly focused on telematics for fuel efficiency. Barloworld's strategy involves building long-term partnerships, particularly with government clients involved in infrastructure development.

| Customer Segment | Key Needs | 2024 Trends/Data |

|---|---|---|

| Mining Operations | Heavy-duty equipment, operational uptime | Robust demand for earthmoving machinery due to global infrastructure and resource needs. |

| Construction Sector | Earthmoving and materials handling equipment | Modest increase in global construction output driven by infrastructure spending. |

| Industrial Enterprises | Materials handling, power systems, logistics, food processing inputs | Substantial revenue from industrial customers in 2023; Ingrain's contribution highlights food sector importance. |

| Commercial Fleet Operators | Efficient fleet management, cost control, vehicle availability | Focus on telematics for driver behavior and fuel efficiency in 2024. |

| Government & Public Sector | Robust equipment for infrastructure, reliable support, compliance | Significant global infrastructure spending projected in 2024, with governments as key drivers. |

Cost Structure

The cost of goods sold for Barloworld, specifically for equipment and parts, represents the direct expenses incurred in sourcing these items from manufacturers and then getting them to customers. This is a major component of their overall costs.

For instance, in the fiscal year ending September 30, 2023, Barloworld reported revenue of R120.9 billion. A substantial portion of this revenue is directly tied to the cost of the equipment and parts they sell, reflecting the significant investment in their supply chain and inventory.

Fluctuations in supplier pricing and the efficiency of Barloworld's inventory management practices directly impact this cost. Effective inventory control is crucial to minimize holding costs and prevent obsolescence, thereby optimizing this key cost driver.

Barloworld's operating expenses are substantial, driven by significant investments in its workforce. In 2024, the company's employee-related costs, encompassing salaries, wages, and benefits for its extensive global team, represent a major component of its cost structure.

Maintaining its vast fleet of equipment and managing complex logistics are also key cost drivers. These expenditures include essential elements like fuel, ongoing repair and maintenance services for machinery, and the operational costs associated with transportation and supply chain management.

Depreciation and amortization represent significant non-cash expenses for Barloworld, reflecting the gradual decline in value of its extensive equipment fleet and other fixed assets. This cost is inherent to its capital-intensive business model, which relies heavily on owning and maintaining a large inventory of machinery for distribution and rental operations.

For the fiscal year ended September 30, 2023, Barloworld reported depreciation and amortization expenses of R17,087 million (approximately $900 million USD at current exchange rates). This figure underscores the substantial impact of asset wear and tear on the company's overall cost structure.

Finance Costs and Debt Servicing

Finance costs represent the expenses Barloworld incurs from its borrowing activities and the management of its debt obligations. This primarily includes interest payments on various loans and floor plan facilities, which are crucial for financing inventory, especially in their equipment dealerships.

Barloworld has actively pursued strategies to optimize its financial structure, leading to a reduction in both gross debt and associated finance costs. This focus on deleveraging and efficient debt management is key to improving profitability and financial flexibility.

- Interest Expenses: Costs associated with borrowing money, such as loans and credit lines.

- Debt Management Costs: Expenses related to administering and servicing outstanding debt.

- Focus on Reduction: Barloworld's strategic aim to lower its overall debt burden and finance expenses.

- Financial Health Indicator: Finance costs reflect the company's leverage and the cost of capital.

Restructuring and Inventory Provisions

Barloworld's cost structure includes significant expenses related to operational restructuring. For instance, the company undertook restructuring initiatives at Ingrain and Equipment Southern Africa, which incurred associated costs. These efforts are typically aimed at enhancing long-term efficiency and competitiveness.

Furthermore, provisions for inventory obsolescence represent another key cost. These provisions are particularly relevant in specific geographic markets, such as Russia, where market conditions can lead to a higher risk of inventory becoming outdated or unsellable. Such provisions help to accurately reflect the value of inventory on the balance sheet.

- Restructuring Costs: Expenses incurred from reorganizing business operations, like those at Ingrain and Equipment Southern Africa, to improve efficiency.

- Inventory Provisions: Funds set aside to account for potential losses from obsolete or unsellable inventory, notably seen in regions like Russia.

- One-off/Short-term Nature: These costs are often non-recurring or temporary, implemented as part of strategic adjustments rather than ongoing operational expenses.

Barloworld's cost structure is heavily influenced by the cost of goods sold for equipment and parts, representing direct expenses from sourcing and delivery. Operating expenses are substantial, particularly employee-related costs for its global workforce, alongside significant expenditures for fleet maintenance, logistics, fuel, and repairs. Depreciation and amortization, reflecting the wear and tear on its extensive equipment fleet, are also major non-cash costs.

Finance costs, primarily interest on loans and floor plan facilities, are crucial for inventory financing, with Barloworld actively working to reduce its debt burden and associated expenses. Additionally, the company incurs costs from operational restructuring, such as initiatives at Ingrain and Equipment Southern Africa, and provisions for inventory obsolescence, especially in markets like Russia.

| Cost Category | Description | Fiscal Year 2023 Impact |

| Cost of Goods Sold | Direct expenses for equipment and parts sourcing and delivery. | A substantial portion of R120.9 billion revenue. |

| Operating Expenses | Employee costs, fleet maintenance, logistics, fuel, repairs. | Major component of overall costs. |

| Depreciation & Amortization | Non-cash expense for asset wear and tear. | R17,087 million. |

| Finance Costs | Interest on loans and debt management. | Focus on reduction through deleveraging strategies. |

| Restructuring & Provisions | Costs from business reorganizations and inventory obsolescence. | Impacted by initiatives at Ingrain and specific market risks. |

Revenue Streams

Barloworld's primary revenue stream comes from selling new and used equipment, covering earthmoving, power systems, and materials handling machinery. This direct sales model is crucial for their business.

In the financial year ending September 30, 2023, Barloworld Equipment's revenue saw a significant increase, reaching R45.6 billion. This highlights the strong demand for their equipment offerings.

Barloworld generates significant revenue through equipment rental, offering both short-term and long-term solutions to a diverse industrial client base. This segment provides customers with operational flexibility, allowing them to access necessary machinery without the capital outlay of purchasing, thereby fostering a consistent and predictable income stream for Barloworld.

In 2024, Barloworld's equipment rental operations, particularly within its Equipment division, continue to be a cornerstone of its revenue. For instance, the company's extensive fleet, encompassing earthmoving, mining, and power generation equipment, is strategically deployed across various sectors, contributing substantially to its overall financial performance and demonstrating the resilience of this recurring revenue model.

Barloworld generates significant income from selling genuine spare parts and components for its equipment. This aftermarket sales segment is vital for keeping customer machinery operational, covering maintenance and repair needs.

This stream is particularly valuable as it represents a high-margin business, contributing to Barloworld's profitability. It also provides a stable and predictable revenue source, less susceptible to the cyclical nature of new equipment sales.

For instance, in the fiscal year ending September 30, 2023, Barloworld's Equipment division, which heavily relies on aftermarket parts, reported revenue growth. While specific aftermarket sales figures are often embedded within broader divisional results, the continued investment in and focus on this segment underscore its financial importance.

Product Support and Service Fees

Barloworld generates significant revenue from product support and service fees, encompassing maintenance, repair, and rebuild services for customer equipment. This revenue stream is crucial for ongoing customer relationships and equipment longevity.

These services are offered through both structured service contracts and on-demand, ad-hoc repair jobs. Service contracts provide predictable recurring revenue, while individual repair jobs cater to immediate customer needs.

- Service Contracts: Offering scheduled maintenance and preventative care to ensure optimal equipment performance.

- Repair Services: Addressing unexpected breakdowns and component failures with timely and efficient repairs.

- Rebuild Services: Providing comprehensive overhauls to restore equipment to near-new condition, extending its operational life.

- Spare Parts Sales: Complementing service offerings with the sale of genuine replacement parts.

For the fiscal year ending September 30, 2023, Barloworld’s Equipment division, which heavily relies on these service revenues, reported an operating profit of R15.1 billion. This highlights the substantial contribution of aftermarket services to the company's overall financial performance.

Industrial Ingredients Sales (Starch and Glucose)

Barloworld's Ingrain division generates significant revenue by selling starch and glucose products. These sales are primarily directed towards large domestic and international businesses, providing a crucial diversification of the company's income streams away from its core equipment business.

This industrial ingredients segment offers a stable revenue base, as starch and glucose are essential components in various manufacturing processes across industries like food and beverage, paper, and textiles. For instance, in 2024, the demand for these ingredients remained robust, contributing positively to Barloworld's overall financial performance.

- Diversified Revenue: Ingrain's sales of starch and glucose provide a revenue stream independent of Barloworld's equipment operations.

- Key Markets: The division serves major local and international enterprises, leveraging its scale and product quality.

- Essential Products: Starch and glucose are fundamental inputs for numerous industrial applications, ensuring consistent demand.

- Financial Contribution: In 2024, this segment played a vital role in broadening Barloworld's income sources and enhancing its financial resilience.

Barloworld's revenue streams are diverse, encompassing equipment sales, rentals, and aftermarket services. The Ingrain division further diversifies income through starch and glucose sales. This multi-faceted approach supports financial stability.

In the fiscal year ending September 30, 2023, Barloworld Equipment's revenue reached R45.6 billion, demonstrating the significant contribution of new and used machinery sales. The company also generates substantial income from aftermarket parts and services, which are high-margin and provide recurring revenue.

The rental segment offers flexibility to customers and a predictable income for Barloworld, with operations continuing to be a cornerstone in 2024. Ingrain’s industrial ingredients segment, selling starch and glucose, provides a vital, stable revenue base across various manufacturing sectors.

| Revenue Stream | Description | FY2023 Contribution (Illustrative) | 2024 Outlook |

| Equipment Sales | New and used machinery (earthmoving, power systems, etc.) | R45.6 billion (Equipment division revenue) | Continued strong demand expected |

| Equipment Rental | Short-term and long-term machinery leasing | Significant contribution, providing recurring revenue | Cornerstone of revenue, resilient model |

| Aftermarket Services | Spare parts, maintenance, repair, rebuilds | High-margin, stable revenue source, R15.1 billion operating profit (Equipment division) | Focus on customer support and equipment longevity |

| Ingrain (Industrial Ingredients) | Starch and glucose sales to industrial clients | Diversified income, essential components for various industries | Robust demand contributing to financial resilience |

Business Model Canvas Data Sources

The Barloworld Business Model Canvas is constructed using a blend of internal financial reports, market intelligence gathered from industry analysis, and strategic insights derived from customer feedback. These diverse data sources ensure a comprehensive and accurate representation of the business's strategic framework.