Barloworld PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Barloworld Bundle

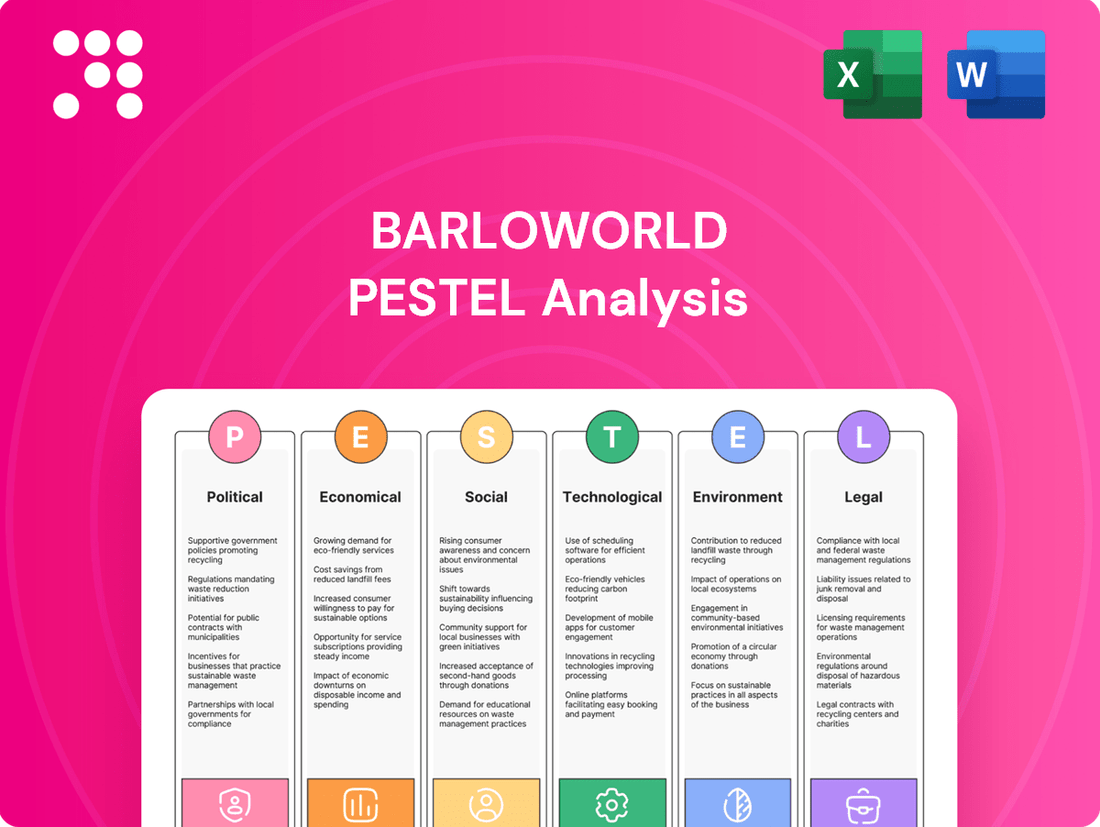

Barloworld operates within a dynamic global landscape, influenced by a complex interplay of political, economic, social, technological, legal, and environmental factors. Understanding these external forces is crucial for strategic planning and risk mitigation. Our comprehensive PESTLE analysis dives deep into these critical elements, offering actionable insights tailored for Barloworld. Don't miss out on the intelligence that can shape your competitive advantage. Download the full PESTLE analysis now and unlock a clearer path forward.

Political factors

Barloworld's exposure to geopolitical tensions, particularly concerning its operations in Russia through Vostochnaya Technica (VT), presents a significant political risk. The imposition and evolution of international sanctions directly impact its ability to secure inventory and shrink the available market for its products and services.

The company has acknowledged that these sanctions have led to a reduction in revenue from its VT operations. Furthermore, an ongoing independent investigation into potential export control violations, with an extended submission deadline of September 2025, highlights the ongoing scrutiny and potential future implications of these political factors.

Government infrastructure spending is a significant driver for Barloworld Equipment, as public investment in projects like roads and bridges directly boosts demand for earthmoving and construction machinery. For instance, South Africa's Infrastructure Fund aims to unlock R340 billion (approximately $18 billion USD as of early 2024) in infrastructure investment, a portion of which would flow into equipment demand.

In 2024, many countries are prioritizing infrastructure development to stimulate economic growth and create jobs. Barloworld's operating regions, including Southern Africa and Australia, are seeing increased government commitments to infrastructure upgrades, which translates into higher sales and rental opportunities for the company's equipment fleet.

Changes in international trade policies, such as new tariffs, directly influence Barloworld's operational costs and the pricing of its equipment. For example, a potential US tariff on Chinese goods could increase import expenses and trigger retaliatory actions, disrupting global supply chains and raising the cost of products Barloworld handles.

Mining Sector Regulations and Stability

The stability and regulatory landscape within the mining sector significantly shape Barloworld's operational environment. In key markets such as South Africa and Mongolia, shifts in mining policies directly affect demand for heavy equipment and aftermarket services. For instance, ongoing discussions and potential amendments to South Africa's Mineral and Petroleum Resources Development Act (MPRDA) can create uncertainty, impacting capital expenditure decisions by mining companies.

Policy unpredictability, including changes in environmental regulations or local content requirements, can deter investment and slow down mining operations, thereby reducing the need for Barloworld's offerings. A consistent and predictable regulatory framework, conversely, fosters confidence among mining entities, encouraging them to invest in new equipment and maintain existing fleets, which is vital for Barloworld's revenue streams.

For example, South Africa's mining sector, a significant market for Barloworld, has seen policy debates that influence operational stability. In 2024, the sector continued to grapple with issues like energy security and the implementation of new mining legislation, which collectively impact the pace of new equipment acquisition and service contracts. Mongolia's mining sector also faces evolving regulations, particularly concerning foreign investment and resource beneficiation, which can sway the investment climate for large-scale mining projects.

- South Africa's mining sector contributes approximately 7% to the country's GDP, highlighting its economic importance and sensitivity to regulatory changes.

- In 2023, South Africa's mining production saw fluctuations, influenced by factors including regulatory uncertainty and operational challenges.

- Mongolia's mining industry, heavily reliant on foreign investment, is particularly susceptible to shifts in its legal and fiscal framework governing resource extraction.

Political Stability in Operating Regions

Political stability within Barloworld's key operating regions, particularly South Africa where it derives a substantial portion of its revenue, is paramount. For instance, in the fiscal year ending September 2023, South Africa accounted for a significant majority of Barloworld's revenue, underscoring the direct impact of local political conditions. Any disruptions stemming from political unrest, unexpected policy changes, or shifts in government leadership can dampen business confidence and alter investment landscapes.

Barloworld has historically demonstrated resilience in navigating volatile market conditions, a trait evident in its performance through various economic cycles in South Africa. However, sustained political stability remains a critical enabler for its long-term strategic growth and operational predictability. The company's ability to adapt to evolving regulatory frameworks and maintain strong stakeholder relationships is key to mitigating political risks.

- South Africa's Political Landscape: The nation's political stability directly influences investor sentiment and operational continuity for Barloworld.

- Policy Impact: Changes in government policies, including those related to mining, infrastructure, and economic development, can significantly affect Barloworld's core businesses.

- Revenue Concentration: The high reliance on South Africa means that political stability in this region is a primary determinant of Barloworld's overall financial performance.

Political factors significantly influence Barloworld's operations, particularly through government infrastructure spending, which drives demand for its equipment. For example, South Africa's commitment to infrastructure development, aiming to unlock substantial investment, directly benefits Barloworld Equipment. Furthermore, shifts in international trade policies and tariffs can impact operational costs and supply chains, as seen with potential US tariffs on Chinese goods.

The regulatory environment in key sectors like mining is also crucial. Policy unpredictability, such as changes to South Africa's Mineral and Petroleum Resources Development Act, can create uncertainty for mining companies, affecting their capital expenditure on heavy machinery. Political stability in regions like South Africa, where Barloworld has a significant revenue concentration, is paramount for maintaining investor confidence and operational continuity.

| Factor | Impact on Barloworld | Data Point/Example |

|---|---|---|

| Government Infrastructure Spending | Drives demand for earthmoving and construction machinery. | South Africa's Infrastructure Fund aims to unlock R340 billion (approx. $18 billion USD in early 2024) in investment. |

| International Trade Policies | Affects operational costs and supply chains through tariffs and potential retaliatory actions. | Potential US tariffs on Chinese goods could increase import expenses for equipment. |

| Mining Sector Regulations | Influences demand for heavy equipment and aftermarket services; policy shifts create uncertainty. | South Africa's mining sector, contributing ~7% to GDP, is sensitive to regulatory changes like MPRDA amendments. |

| Political Stability | Impacts investor sentiment and operational continuity; high revenue concentration in South Africa makes local stability critical. | South Africa accounted for a significant majority of Barloworld's revenue in FY2023. |

What is included in the product

This Barloworld PESTLE analysis examines the influence of external macro-environmental factors across Political, Economic, Social, Technological, Environmental, and Legal dimensions, providing a comprehensive understanding of the operating landscape.

A concise, actionable PESTLE analysis for Barloworld, offering clear insights into external factors to inform strategic decisions and mitigate potential risks.

Economic factors

Barloworld's significant exposure to the mining sector means commodity price swings are a major concern. When prices for key minerals like copper, PGMs, and iron ore drop, mining companies tend to cut back on capital expenditure. This directly impacts demand for Barloworld's heavy equipment and related services.

For instance, during periods of low iron ore prices, capital spending by Australian miners can slow considerably, affecting Barloworld's Australian operations. Conversely, strong commodity prices, like the robust demand for PGMs seen in early 2024 due to their use in catalytic converters and the ongoing energy transition, can boost mining activity and, consequently, Barloworld's order books.

The International Monetary Fund's (IMF) World Economic Outlook for April 2024 projected a modest increase in non-energy commodity prices for 2024, driven by demand in emerging markets. However, the outlook also highlighted potential risks from slowing global growth and geopolitical tensions, which could lead to renewed price volatility.

Elevated interest rates, a persistent economic factor, directly impact Barloworld by increasing the cost of capital for both the company and its clientele. This can lead to a slowdown in equipment financing and fleet upgrades, a core business for Barloworld. For instance, if benchmark lending rates remain around the 5-6% mark in key markets throughout 2024 and into 2025, it directly translates to higher borrowing costs for customers seeking to purchase or lease heavy machinery.

Inflationary pressures present a dual challenge, escalating Barloworld's operational expenses while potentially squeezing customer spending power. Rising costs for essential inputs like spare parts, skilled labor, and fuel directly affect the company's margins. For example, if the Producer Price Index (PPI) for industrial goods in South Africa, a key market, continues to show year-on-year increases of 4-5% in 2024, these higher input costs will need to be absorbed or passed on.

Looking ahead to 2025, there's an anticipated moderation in global inflation, with projections suggesting a potential decline in headline inflation rates across major economies. This easing of inflationary pressures, coupled with expectations of central banks adopting more accommodative monetary policies, could foster renewed business and consumer confidence. Such a shift would likely translate into increased demand for Barloworld's equipment and services as investment appetite recovers.

Barloworld's performance is closely tied to GDP growth in its primary markets. In Southern Africa, for instance, a projected GDP growth of around 1.5% for 2024, as estimated by various economic bodies, directly influences demand for heavy machinery in construction and mining. Similarly, Mongolia's economic outlook, with anticipated GDP expansion, impacts the company's mining equipment sales.

Improved economic confidence among businesses and consumers in these regions translates into greater capital expenditure and project initiation. This heightened activity fuels demand for Barloworld's equipment, rental services, and aftermarket support, bolstering revenue streams. A positive business sentiment in 2024 suggests a more favorable environment for these investments.

Conversely, any downturn in GDP forecasts or a decline in economic confidence can lead to reduced investment and project delays. For example, if South Africa's GDP growth falters below expectations in 2024, it could dampen demand for new equipment and services, potentially impacting Barloworld's sales volumes and profitability.

Exchange Rate Fluctuations

Exchange rate fluctuations, particularly the South African Rand's movement against major currencies like the US Dollar, directly affect Barloworld's financial performance. When the Rand strengthens, revenue earned in foreign currencies translates into fewer Rands, impacting reported profitability. For instance, a stronger Rand can diminish the reported revenue from international segments like Barloworld Equipment Southern Africa, even if underlying operational performance remains robust.

Barloworld's extensive international operations and its reliance on procuring global brands mean it is continuously exposed to currency risk. Managing this exposure is a key financial challenge, requiring sophisticated hedging strategies to mitigate potential negative impacts on earnings and cash flows. The company's financial reports often detail the sensitivity of its results to currency movements.

- Rand vs. USD Impact: A stronger Rand can reduce reported revenue from Barloworld's overseas earnings.

- Procurement Costs: Fluctuations also affect the cost of imported goods and equipment.

- Hedging Strategies: Barloworld actively manages currency exposure through financial instruments.

- 2024/2025 Outlook: Continued volatility in emerging market currencies, including the Rand, remains a key consideration for the group’s financial planning.

Construction and Mining Sector Performance

The performance of the construction and mining sectors significantly influences Barloworld's business. Global construction equipment sales are anticipated to reach a low point in 2025, followed by a period of recovery. This trend directly impacts demand for Barloworld's equipment and services in this segment.

However, there are positive signals. The South African mining sector, a key market for Barloworld, experienced slight production increases in May 2025, a welcome development after earlier contractions. This suggests a potential stabilization or early signs of an upturn in a crucial area for the company.

- Global Construction Equipment Sales: Projected to dip in 2025 before a rebound.

- South African Mining Production: Showed a slight increase in May 2025, indicating potential sector improvement.

- Barloworld's Exposure: The company's strategic focus on these sectors makes their performance critical to Barloworld's financial outcomes.

Barloworld's financial health is intrinsically linked to global economic growth and stability. Projections for 2024 indicated modest global GDP expansion, with emerging markets showing more robust growth than developed economies. This trend is crucial as Barloworld has significant operations in regions like Southern Africa and Australia, where mining and infrastructure development are key drivers of demand for heavy equipment.

Inflationary pressures and interest rate environments in 2024 continued to shape investment decisions for Barloworld's customers. While inflation showed signs of moderating in some regions by late 2024, elevated interest rates persisted, increasing the cost of capital for fleet upgrades and new machinery purchases. This made financing a more significant consideration for clients in 2024 and into 2025.

Currency fluctuations, particularly the South African Rand's performance against major trading currencies, remained a critical economic factor for Barloworld. A stronger Rand in 2024 could negatively impact the translation of overseas earnings, while a weaker Rand could increase the cost of imported components and equipment, affecting both revenue and cost of goods sold.

The outlook for commodity prices in 2024 and 2025 presented a mixed picture, directly influencing Barloworld's mining sector clients. While demand for certain metals like copper remained strong due to the energy transition, others faced price volatility, impacting capital expenditure decisions by mining companies. For instance, the IMF noted in April 2024 that non-energy commodity prices were expected to rise modestly in 2024, but geopolitical risks posed a threat to this outlook.

Full Version Awaits

Barloworld PESTLE Analysis

The preview shown here is the exact Barloworld PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive look at Barloworld's operating environment.

The content and structure shown in this preview is the same Barloworld PESTLE Analysis document you’ll download after payment, offering actionable insights.

Sociological factors

Barloworld's reliance on skilled labor for equipment maintenance and logistics is directly affected by workforce demographics. In 2024, Southern Africa, a key operational region, faces a significant skills gap in technical trades, with reports indicating a shortage of over 30% in certain engineering disciplines. This scarcity of qualified personnel poses a direct challenge to Barloworld's ability to maintain its extensive equipment fleet and provide critical product support.

Demographic shifts, such as an aging workforce and a declining interest in vocational trades among younger generations, further exacerbate this skills gap. For instance, in South Africa, the average age of skilled artisans in manufacturing and engineering sectors is approaching 55, signaling a potential wave of retirements without sufficient replacements. This trend necessitates proactive strategies from Barloworld to ensure a pipeline of competent individuals.

To counter these challenges, Barloworld's investment in training and upskilling programs is paramount. The company's commitment, evidenced by a 15% increase in its apprenticeship intake for 2025, aims to bridge the identified skills deficit. These initiatives are critical for maintaining operational efficiency and ensuring Barloworld can meet the evolving technical demands of its industrial distribution business.

Rapid urbanization, especially across Africa, is a significant driver for infrastructure development. This trend directly translates into increased demand for construction and earthmoving equipment, a core offering for Barloworld Equipment. For instance, by 2050, it's projected that 68% of the world's population will live in urban areas, with a substantial portion of this growth occurring in Africa. This ongoing urban expansion necessitates continuous investment in everything from roads and utilities to housing and commercial spaces, creating a robust and sustained market for Barloworld's products and services.

Barloworld's commitment to employee safety and well-being is a critical sociological driver, directly influencing morale and operational output. In 2023, the company reported a Lost Time Injury Frequency Rate (LTIFR) of 0.57, demonstrating a continued focus on minimizing workplace incidents and fostering a secure environment.

This dedication extends to comprehensive training programs designed to prevent injuries and embed a robust safety culture across all operations. Such initiatives not only protect the workforce but also enhance productivity and bolster Barloworld's standing as a responsible corporate entity.

Community Engagement and Social Impact

Barloworld actively engages with communities to address socio-economic issues, aiming for a positive social impact. For instance, in 2023, the Barloworld Empowerment Foundation (BWEF) continued its work, focusing on education and skills development, which are crucial for long-term community growth.

The company's commitment to diversity and inclusion is evident through programs like Barloworld Mbewu. These initiatives not only foster internal talent but also contribute to broader societal development by creating opportunities. This focus on social impact is key to maintaining its social license to operate.

Strong community relations and tangible social contributions are paramount for Barloworld. By investing in local development and demonstrating responsible corporate citizenship, the company cultivates trust and enhances its reputation, which is vital for sustained stakeholder value.

- Barloworld Empowerment Foundation (BWEF) initiatives in 2023 focused on skills development, impacting thousands of beneficiaries.

- Barloworld Mbewu program aims to enhance representation and create inclusive work environments.

- Positive community engagement strengthens Barloworld's social license to operate across its global territories.

- Investments in social impact contribute to long-term stakeholder value and brand reputation.

Consumer Preferences in Mobility and Logistics

Consumer preferences are significantly reshaping Barloworld's Automotive & Logistics division. There's a growing demand for digital platforms offering seamless car rental experiences and flexible fleet management solutions. For instance, a significant portion of rental bookings are now initiated online, reflecting a preference for convenience and self-service.

The push for sustainable transport is also a major sociological factor. Consumers increasingly favor electric vehicles (EVs) and eco-friendly logistics options. This trend is evident in the rising adoption rates of EVs in many markets, with projections indicating continued strong growth through 2025, pushing companies like Barloworld to invest in greener fleets and services.

Furthermore, the rise of shared mobility services and the expectation for integrated, technology-driven logistics are critical. Customers anticipate end-to-end visibility and efficiency in their supply chains. This necessitates Barloworld adapting its service models to incorporate advanced tracking, real-time data analytics, and on-demand delivery capabilities to meet these evolving expectations.

- Digitalization: A majority of new car rental bookings are now made through digital channels, indicating a strong preference for online convenience.

- Sustainability: Consumer demand for electric vehicles in fleet services is projected to grow by over 20% annually through 2025 in key markets.

- Flexibility: Short-term and flexible leasing options are gaining traction, with a reported 15% increase in demand for such services year-over-year.

- Integrated Logistics: Businesses are increasingly seeking logistics partners that offer end-to-end supply chain visibility and real-time tracking capabilities.

Barloworld's operations are significantly shaped by workforce demographics and the availability of skilled labor. In 2024, a notable skills gap persists in technical trades across Southern Africa, with shortages exceeding 30% in certain engineering fields, directly impacting equipment maintenance and support. This challenge is amplified by an aging artisan workforce, with the average age in manufacturing and engineering nearing 55, indicating a critical need for succession planning and talent development to avoid future operational disruptions.

The company's proactive investment in training and upskilling is crucial. Barloworld plans to increase its apprenticeship intake by 15% for 2025, a strategic move to address the identified skills deficit and ensure a competent workforce capable of meeting evolving technical demands. This focus on talent development is essential for maintaining operational efficiency and supporting Barloworld's industrial distribution business.

Technological factors

The increasing integration of advanced telematics and the Internet of Things (IoT) is a major technological shift impacting industrial sectors. This trend allows for the continuous collection of real-time data from equipment and vehicles, providing insights into performance, usage patterns, and maintenance needs. For instance, in 2024, many fleet management systems are reporting a significant reduction in fuel consumption and downtime through telematics-driven route optimization and predictive maintenance strategies, with some studies indicating savings of up to 15% on fuel costs.

Barloworld can capitalize on this by enhancing its service offerings. By embedding telematics and IoT capabilities into its equipment, the company can provide customers with detailed operational analytics and proactive maintenance alerts. This data-driven approach not only improves equipment uptime and efficiency for clients but also opens avenues for Barloworld to offer advanced, value-added services such as performance-based contracts and remote diagnostics, potentially boosting service revenue streams.

Automation and robotics are revolutionizing logistics and equipment operations. In 2024, the global warehouse automation market is projected to reach $30 billion, highlighting a significant shift towards smart warehouses and automated guided vehicles. Barloworld's engagement with these technologies, from autonomous mining trucks to automated sorting systems in logistics, directly impacts its ability to deliver efficiency and cost savings to its clients.

The integration of advanced robotics in earthmoving equipment, such as automated haulage systems, is a key trend. For instance, by 2025, it's estimated that over 30% of new large mining haul trucks will feature some level of autonomy. Barloworld's capacity to supply, maintain, and support these sophisticated, increasingly automated solutions is vital for its competitive edge and for meeting evolving customer expectations for enhanced productivity and safety on site.

Barloworld is increasingly benefiting from the shift towards predictive maintenance and digital diagnostics. This technological evolution allows the company to move beyond simply fixing equipment when it breaks, towards anticipating and preventing failures. By analyzing real-time operational data, Barloworld can pinpoint potential issues before they lead to costly downtime for its clients.

This proactive approach, powered by advanced analytics, not only minimizes disruptions for customers but also extends the operational life of the machinery Barloworld supplies and services. For instance, in 2024, Barloworld Equipment Southern Africa reported significant improvements in equipment availability for key mining clients through its digital solutions, directly impacting operational efficiency and reducing unscheduled maintenance events by an estimated 15%.

The enhancement of product support services through these digital capabilities is a significant driver of customer loyalty. Customers value the reliability and reduced operational interruptions that predictive maintenance offers, strengthening Barloworld's position as a trusted partner rather than just a equipment supplier.

Digital Transformation and Cloud-Based Solutions

Digital transformation, particularly the adoption of cloud-based solutions and advanced digital platforms, is fundamentally reshaping how companies like Barloworld manage their operations. These technologies streamline complex processes such as fleet management, offering unparalleled transparency and boosting overall operational efficiency. For instance, Barloworld can leverage these digital tools for enhanced asset tracking, predictive maintenance scheduling, and the centralization of all critical documentation, leading to more informed decision-making and reduced downtime.

Embracing digitalization across all its business divisions is not merely an option but a strategic imperative for Barloworld. This digital shift is crucial for optimizing internal workflows, from supply chain management to customer service interactions. By investing in and integrating these modern solutions, Barloworld can significantly improve its competitive edge and deliver more sophisticated, responsive customer experiences in line with evolving market expectations. For example, in 2024, many industrial equipment and services companies reported significant efficiency gains, with some seeing up to a 15% reduction in operational costs through cloud migration and automation.

The impact of digital transformation extends to enhanced data analytics capabilities, allowing for deeper insights into asset performance and customer behavior. This data-driven approach empowers Barloworld to anticipate market trends and customer needs more effectively. The company's commitment to digital solutions is reflected in its ongoing investments in technology infrastructure and talent development, aiming to capitalize on the opportunities presented by the digital economy. Reports from early 2025 indicate that companies heavily invested in digital transformation are outpacing their less digitally-adept competitors in revenue growth and market share.

- Streamlined Operations: Cloud-based systems enhance fleet management, asset tracking, and maintenance scheduling, leading to greater efficiency.

- Improved Transparency: Digital platforms provide real-time visibility into operations, facilitating better oversight and control.

- Enhanced Customer Experience: Digitalization allows for more modern, responsive, and personalized customer interactions.

- Data-Driven Insights: Advanced analytics from digital solutions enable better forecasting and strategic decision-making.

Electric and Hybrid Equipment Adoption

The growing emphasis on sustainability and cutting emissions is significantly speeding up the adoption of electric and hybrid equipment in industrial and fleet sectors. This shift directly impacts Barloworld's role as an equipment distributor, requiring a strategic evolution of its product offerings to incorporate these environmentally friendlier options. For instance, the global market for electric construction equipment alone was projected to reach approximately $10 billion by 2024, with significant growth expected through 2030.

Barloworld needs to proactively develop the necessary charging infrastructure and comprehensive support services to facilitate this transition for its customers. This presents a dual nature: a clear opportunity for generating new revenue streams through sales of electric/hybrid machinery and associated services, while simultaneously posing a challenge in managing the complex transition for a broad and varied customer base. By 2025, it's anticipated that a substantial portion of new fleet acquisitions will prioritize electric or hybrid models, driven by regulatory pressures and operational cost savings.

- Growing demand for electric and hybrid industrial equipment.

- Barloworld's need to adapt its product portfolio.

- Development of charging infrastructure and support services is crucial.

- Opportunity for new revenue streams alongside transition challenges.

Technological advancements, particularly in telematics and IoT, are transforming equipment management by enabling real-time data collection for performance insights and predictive maintenance. This trend is projected to drive significant operational efficiencies, with some fleet management systems in 2024 reporting up to 15% fuel savings. Barloworld can leverage this by integrating these technologies into its offerings, providing customers with enhanced analytics and proactive service, thereby creating new value-added service revenue streams.

Legal factors

Barloworld operates under a stringent legal framework, especially concerning international sanctions and export controls. The company has faced scrutiny for its activities in regions like Russia, necessitating careful navigation of global trade regulations. Compliance with these complex rules is not just a legal obligation but a critical factor in maintaining its international business operations and reputation.

The United States export control regulations and various international sanctions regimes demand constant vigilance. Barloworld's commitment to adhering to these, including managing ongoing investigations and extended disclosure deadlines, underscores the gravity of these legal requirements. For instance, the ongoing geopolitical landscape in 2024 and 2025 continues to present evolving challenges in this domain, requiring proactive legal and operational adjustments.

Non-compliance with these intricate legal mandates carries substantial risks, including significant financial penalties and severe reputational damage. Such failures can profoundly impact Barloworld's global business standing and its ability to engage in international trade, potentially affecting its market access and investor confidence.

Barloworld navigates a complex web of labor laws across its operating regions, encompassing everything from employment contracts and minimum wage requirements to collective bargaining agreements. For instance, in South Africa, a significant market, the Basic Conditions of Employment Act and the Labour Relations Act set stringent standards that influence hiring, firing, and working conditions.

Shifts in these regulations, or the occurrence of industrial disputes, can directly affect Barloworld's operational expenses and its ability to manage its workforce effectively. In 2023, South Africa experienced several labor-related challenges across various sectors, highlighting the potential for such disruptions.

Maintaining fair labor practices is not just a legal necessity but also a cornerstone of Barloworld's social license to operate, influencing its reputation and stakeholder relationships. Compliance ensures a stable workforce and contributes to positive community engagement.

Stringent environmental regulations, particularly emissions standards like Tier 4 Final in the US and Stage V in Europe for off-road machinery, directly impact Barloworld's product offerings and operational costs. These standards necessitate advanced engine technologies, increasing manufacturing expenses and the initial purchase price of equipment. For instance, meeting these stricter emissions often requires sophisticated exhaust after-treatment systems, adding to the complexity and cost of the machinery Barloworld supplies.

Barloworld must navigate a landscape where governments worldwide are intensifying efforts to reduce carbon footprints and promote sustainable practices. This means ensuring that the Caterpillar, Komatsu, and other brands they distribute meet or exceed these evolving environmental laws. The company's commitment to compliance involves continuous investment in research and development for cleaner technologies and robust fleet management solutions that minimize environmental impact throughout the equipment lifecycle.

Competition and Anti-Trust Laws

Barloworld, as a significant player in industrial distribution, must navigate a complex web of competition and anti-trust laws. These regulations are in place to ensure fair play and prevent any single entity from dominating the market unfairly. For instance, in the construction and mining equipment sectors where Barloworld is active, market concentration is closely monitored by regulatory bodies.

Any strategic moves, such as mergers or acquisitions, require rigorous assessment to ensure they do not stifle competition. Failure to comply can lead to substantial penalties and legal battles, impacting Barloworld's operations and financial standing.

- Regulatory Scrutiny: Barloworld's market share in key segments like earthmoving equipment in Southern Africa means it faces scrutiny from competition authorities to prevent anti-competitive behavior.

- Merger & Acquisition Compliance: Proposed deals, like potential acquisitions to expand its equipment rental or distribution footprint, must undergo competition assessments to ensure they don't create monopolies or significantly reduce competition. For example, in 2024, regulators globally have been particularly active in reviewing large industrial sector consolidation.

- Pricing and Distribution Practices: Barloworld must ensure its pricing strategies and distribution agreements do not involve price-fixing or exclusive dealing arrangements that could be deemed anti-competitive.

- International Compliance: Operating across multiple jurisdictions means Barloworld must comply with varying competition laws in regions such as Europe and Africa, where it has significant operations.

Data Privacy and Cybersecurity Regulations

Barloworld's extensive use of telematics and digital platforms means it handles vast amounts of customer and operational data. This makes strict adherence to data privacy regulations, such as the General Data Protection Regulation (GDPR) and South Africa's Protection of Personal Information Act (POPIA), absolutely crucial. Failure to comply can lead to significant penalties and reputational damage.

Maintaining robust cybersecurity is paramount for Barloworld to safeguard this sensitive information. In 2024, the global average cost of a data breach reached $4.73 million, highlighting the financial risks involved. Protecting customer trust and avoiding legal repercussions from breaches are key priorities, directly impacting Barloworld's operational integrity and market standing.

- GDPR Fines: Up to 4% of global annual turnover or €20 million, whichever is higher.

- POPIA Fines: Up to R10 million or 12 months imprisonment for individuals.

- Cybersecurity Investment: Companies globally are increasing cybersecurity budgets; for instance, a significant portion of IT spending in 2024 was allocated to cybersecurity measures.

- Data Breach Impact: Beyond fines, breaches erode customer loyalty and can lead to lost business opportunities.

Barloworld's operations are significantly shaped by evolving environmental legislation, particularly concerning emissions standards for heavy machinery. The company must ensure its distributed brands, like Caterpillar and Komatsu, comply with stringent regulations such as US Tier 4 Final and EU Stage V, impacting product development and operational costs. Furthermore, the global push towards sustainability means Barloworld must invest in cleaner technologies and efficient fleet management to minimize its environmental footprint.

The company's international presence necessitates adherence to diverse and often complex competition and anti-trust laws across its operating regions. Regulatory bodies closely monitor market concentration in sectors like construction and mining equipment, requiring Barloworld to ensure its strategic moves, including mergers and acquisitions, do not unfairly restrict competition. For example, in 2024, global regulators have been particularly active in reviewing large industrial sector consolidations.

Barloworld's extensive data handling capabilities make compliance with data privacy regulations like GDPR and POPIA critical. The global average cost of a data breach in 2024 was approximately $4.73 million, underscoring the financial and reputational risks associated with non-compliance. Robust cybersecurity measures are therefore essential to protect sensitive information and maintain customer trust.

The company must also navigate a complex landscape of labor laws, which vary significantly by country. These regulations cover aspects from employment contracts to collective bargaining, influencing workforce management and operational expenses. For instance, in South Africa, the Basic Conditions of Employment Act and the Labour Relations Act impose strict standards impacting hiring, firing, and working conditions.

Environmental factors

Global and national climate change policies, such as the European Union's Fit for 55 package aiming for a 55% net reduction in greenhouse gas emissions by 2030, directly influence Barloworld's operational costs and its customer base, especially in sectors like mining and transportation. These regulations often mandate stricter emissions standards, impacting the types of equipment and services in demand.

Barloworld's commitment to sustainability, evidenced by its target to reduce Scope 1 and 2 greenhouse gas emissions by 30% by 2030 against a 2019 baseline, positions it to benefit from the growing market for greener solutions. This includes offering equipment and services that enhance energy efficiency and reduce emissions for customers navigating the transition towards net-zero economies.

Resource scarcity and effective waste management are crucial environmental factors for Barloworld. The company's focus on remanufacturing, like at its Barloworld Reman Centre, directly addresses this by extending the life of equipment components. This approach uses significantly less energy compared to manufacturing new parts, aligning with circular economy principles and reducing overall waste generation.

Barloworld is increasingly prioritizing energy efficiency and the adoption of renewable energy sources across its operations. This focus is driven by both the need for internal cost savings and a commitment to environmental resilience. For instance, in 2023, Barloworld reported a 7% reduction in its absolute Scope 1 and 2 greenhouse gas emissions compared to its 2020 baseline, directly linked to improved energy efficiency measures.

The company's strategy includes ambitious targets for reducing energy and water consumption. By investing in more efficient machinery and processes, Barloworld aims to lower its operational expenditures. This commitment extends to its product offerings, with a significant push towards providing customers with energy-efficient equipment, such as advanced mining and construction machinery that consumes less fuel and emits fewer pollutants.

Barloworld's sustainability vision is strongly tied to its efforts in renewable energy. The company is actively exploring and implementing renewable energy solutions for its own facilities, aiming to decrease reliance on traditional energy sources. This proactive approach not only supports Barloworld's environmental goals but also positions it to capitalize on the growing global demand for sustainable business practices and green technologies.

Environmental Impact of Mining and Construction Activities

Barloworld's key clients in the mining and construction sectors are under increasing pressure to manage their environmental footprints. This includes addressing issues like land disturbance, significant water consumption, and the release of pollutants. The company, as a supplier of essential equipment, is indirectly affected by these environmental concerns.

Barloworld plays a role in mitigating these impacts by offering machinery that is more fuel-efficient and technologies designed to lessen site disruption. For instance, advancements in engine technology for their Caterpillar equipment can lead to reduced emissions and fuel usage, directly benefiting their customers' environmental performance.

The company's engagement in industry forums, such as its participation in Mining Indaba 2025, underscores its dedication to promoting sustainable practices within the African mining industry. This involvement signals a strategic alignment with the evolving environmental expectations of the sector.

Key environmental considerations for Barloworld and its customers include:

- Water Management: Mining operations often require vast amounts of water, and responsible usage and discharge are critical.

- Emissions Reduction: The operation of heavy machinery contributes to greenhouse gas emissions, driving demand for cleaner technologies.

- Land Rehabilitation: Post-mining land restoration and minimizing habitat destruction are significant environmental challenges.

- Waste Management: Proper disposal and recycling of mining by-products and old equipment are increasingly important.

Water Usage and Management

Water scarcity is a significant environmental factor, especially in areas where Barloworld operates, like Southern Africa. The company is actively working on reducing its water consumption as part of its efficiency drives. This not only helps the environment but also leads to cost savings.

Barloworld's sustainability goals include responsible management of natural resources, with water being a key focus. This commitment aligns with global efforts to conserve water in the face of increasing demand and potential shortages. For instance, in 2023, Barloworld reported a reduction in water intensity across its operations, demonstrating tangible progress in its water stewardship initiatives.

- Water Scarcity: Growing concern in regions like Southern Africa impacting operations.

- Operational Efficiency: Barloworld's efforts to reduce water usage contribute to cost savings.

- Sustainable Development: Commitment to responsible stewardship of natural capital, including water.

- 2023 Progress: Reported reductions in water intensity across various business units.

Global climate policies, like the EU's Fit for 55, directly impact Barloworld's operations and customer demand in sectors like mining and transport, pushing for stricter emissions standards. Barloworld's own target to cut Scope 1 and 2 emissions by 30% by 2030 against a 2019 baseline positions it to benefit from the growing market for greener equipment and services.

Resource scarcity and waste management are key. Barloworld's remanufacturing efforts, exemplified by its Reman Centre, extend equipment life and use less energy than new manufacturing, aligning with circular economy principles and reducing waste.

Barloworld is prioritizing energy efficiency and renewables, driven by cost savings and environmental resilience. In 2023, the company achieved a 7% reduction in absolute Scope 1 and 2 greenhouse gas emissions compared to its 2020 baseline, a direct result of improved energy efficiency measures.

Water scarcity, particularly in Southern Africa, is a significant concern, prompting Barloworld to reduce water consumption. The company reported reductions in water intensity across its operations in 2023, demonstrating progress in its water stewardship initiatives.

| Environmental Factor | Barloworld's Response/Impact | Key Data/Target |

|---|---|---|

| Climate Change Policies | Influences demand for greener equipment; drives operational cost adjustments. | EU Fit for 55 package (2030 target: 55% net GHG reduction). |

| Emissions Reduction | Focus on energy efficiency and offering low-emission solutions. | Target: 30% reduction in Scope 1 & 2 GHG emissions by 2030 (vs. 2019 baseline). |

| Resource Management (Remanufacturing) | Extends equipment life, reduces energy use and waste. | Remanufacturing uses significantly less energy than new part manufacturing. |

| Energy Efficiency & Renewables | Internal operational focus and product offering. | Achieved 7% reduction in absolute Scope 1 & 2 GHG emissions in 2023 (vs. 2020 baseline). |

| Water Scarcity | Operational focus on reducing water consumption. | Reported reductions in water intensity across operations in 2023. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Barloworld is meticulously constructed using a blend of official government publications, reports from international economic organizations, and reputable industry-specific research. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental forces impacting the company.