Barloworld Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Barloworld Bundle

Barloworld's BCG Matrix offers a critical lens to understand its diverse portfolio. Discover which segments are driving growth, which are stable cash generators, and which require careful consideration.

Unlock the full potential of this analysis by purchasing the complete BCG Matrix. Gain actionable insights into each product's strategic position and make informed decisions for future investment and resource allocation.

Stars

Barloworld Equipment Mongolia is a standout performer within the company's portfolio, showcasing impressive financial traction. In 2024, it achieved a remarkable 66% revenue growth, and this momentum continued into the first half of 2025 with an additional 23% increase.

This exceptional growth trajectory suggests Barloworld Mongolia holds a significant market share in a dynamic or highly profitable region. The combination of improved trading conditions and a reduction in invested capital further solidifies its position as a key growth driver for the company.

The business consistently delivers strong results through both aftermarket services and prime product sales. This sustained performance makes Barloworld Equipment Mongolia a prime candidate for future strategic investments, highlighting its potential for continued expansion and profitability.

Fleet Management Services, particularly those embracing digital transformation, represent a star in Barloworld's BCG matrix. The global market is set to surge, with an estimated compound annual growth rate exceeding 16% from 2025 through 2034, fueled by the booming e-commerce sector and the critical need for efficient last-mile deliveries.

Barloworld's strategic emphasis on delivering comprehensive fleet management solutions, which include cutting-edge technologies like real-time tracking, sophisticated route optimization, and automation, places it squarely within this high-growth arena. As businesses increasingly leverage AI for predictive analytics and telematics to boost operational efficiency, Barloworld's advanced capabilities in these areas are likely capturing substantial market share.

The global automated material handling equipment market is poised for substantial growth, with a projected compound annual growth rate of 9.96% between 2025 and 2034. This expansion is driven by the increasing adoption of industrial automation and the ongoing Industry 4.0 transformation.

While Barloworld's precise market share within the automated segment isn't publicly specified, the company's broader materials handling solutions are well-positioned. With 64% of companies indicating investments in automation solutions in 2025, the potential for Barloworld to capitalize on this trend is significant.

Barloworld's strategic focus on delivering integrated solutions aligns perfectly with the market's trajectory, enabling them to capture a larger share of this expanding and vital sector.

Specialized Power Systems Solutions

While the broader power systems market may be considered mature, Barloworld's focus on specialized power system solutions presents a compelling opportunity. These solutions, particularly those addressing new industrial demands or the integration of renewable energy sources, represent high-growth niches within the sector. For instance, the global distributed generation market, which includes specialized solutions, was valued at approximately USD 250 billion in 2023 and is projected to grow significantly through 2030.

Barloworld's capacity to deliver customized power solutions, especially for evolving energy requirements or vital infrastructure projects, positions it to secure a substantial market share in these expanding segments. The company's expertise in areas like advanced generator sets and energy storage systems directly caters to the increasing need for reliable and flexible power, especially in regions undergoing industrial transformation or energy transition.

Strategic investments in these targeted specialized areas are likely to generate considerable returns. As industries worldwide continue to modernize their energy infrastructure, adopting more efficient and sustainable power sources, Barloworld's tailored offerings are well-placed to capitalize on this trend. The demand for backup power solutions in critical sectors like healthcare and data centers, which often require specialized configurations, continues to rise, further underscoring the potential in this segment.

- Market Growth: The global distributed generation market is expected to see robust growth, driven by the need for reliable and resilient power.

- Barloworld's Position: The company's ability to offer tailored solutions for renewable integration and industrial needs is a key differentiator.

- Investment Potential: Focusing on specialized power systems offers significant return potential as industries upgrade their energy infrastructure.

- Demand Drivers: Critical infrastructure and industrial modernization are key factors fueling demand for specialized power solutions.

Aftermarket Support for Equipment Southern Africa

Despite a dip in new machine sales for Equipment Southern Africa in 2024, the aftermarket segments, particularly parts and rental, demonstrated resilience, trading ahead of the previous year. This performance highlights a strong market position in crucial ongoing support services for a substantial installed base of equipment.

The consistent demand for parts and maintenance, even when the new equipment market softened, underscores a stable and expanding revenue stream within this vital service area. For instance, Barloworld's Equipment Southern Africa division reported that its aftersales segments outperformed expectations in 2024.

- Aftersales Growth: Parts and rental businesses traded ahead of the prior year, contributing positively to the overall sales mix.

- Market Share: This indicates a robust market share in essential support services for a large installed equipment base.

- Revenue Stability: Consistent demand for parts and maintenance ensures a stable revenue stream, even in a slower new equipment market.

- Strategic Importance: The aftermarket segment is a critical service area for sustained business operations and customer retention.

Barloworld Equipment Mongolia stands out as a star performer, achieving 66% revenue growth in 2024 and a further 23% in the first half of 2025. This exceptional growth, driven by strong aftermarket services and prime product sales, indicates a significant market share in a profitable region, making it a prime candidate for future investment.

Fleet Management Services, especially those leveraging digital transformation, are a star. The global market is projected to grow at over 16% annually from 2025 to 2034, fueled by e-commerce and last-mile delivery needs. Barloworld's advanced capabilities in real-time tracking and route optimization position it to capture substantial market share.

The specialized power systems segment, particularly in distributed generation, represents a star. With the global distributed generation market valued at approximately USD 250 billion in 2023 and expected to grow significantly, Barloworld's tailored solutions for renewable integration and industrial demands are well-positioned for considerable returns.

The aftermarket segments for Equipment Southern Africa, specifically parts and rental, demonstrated resilience in 2024, trading ahead of the previous year despite a dip in new machine sales. This highlights a strong market position in essential support services, ensuring a stable revenue stream.

| Business Segment | 2024 Performance | Growth Drivers | Market Outlook | Star Potential |

| Barloworld Equipment Mongolia | 66% revenue growth (2024) | Aftermarket services, prime product sales | Dynamic/profitable region | High |

| Fleet Management Services (Digital) | Strong performance | E-commerce, last-mile delivery | >16% CAGR (2025-2034) | High |

| Specialized Power Systems | Robust performance | Renewable integration, industrial needs | Significant growth in distributed generation | High |

| Equipment Southern Africa (Aftermarket) | Parts & rental ahead of prior year | Installed base support | Stable demand | Moderate to High |

What is included in the product

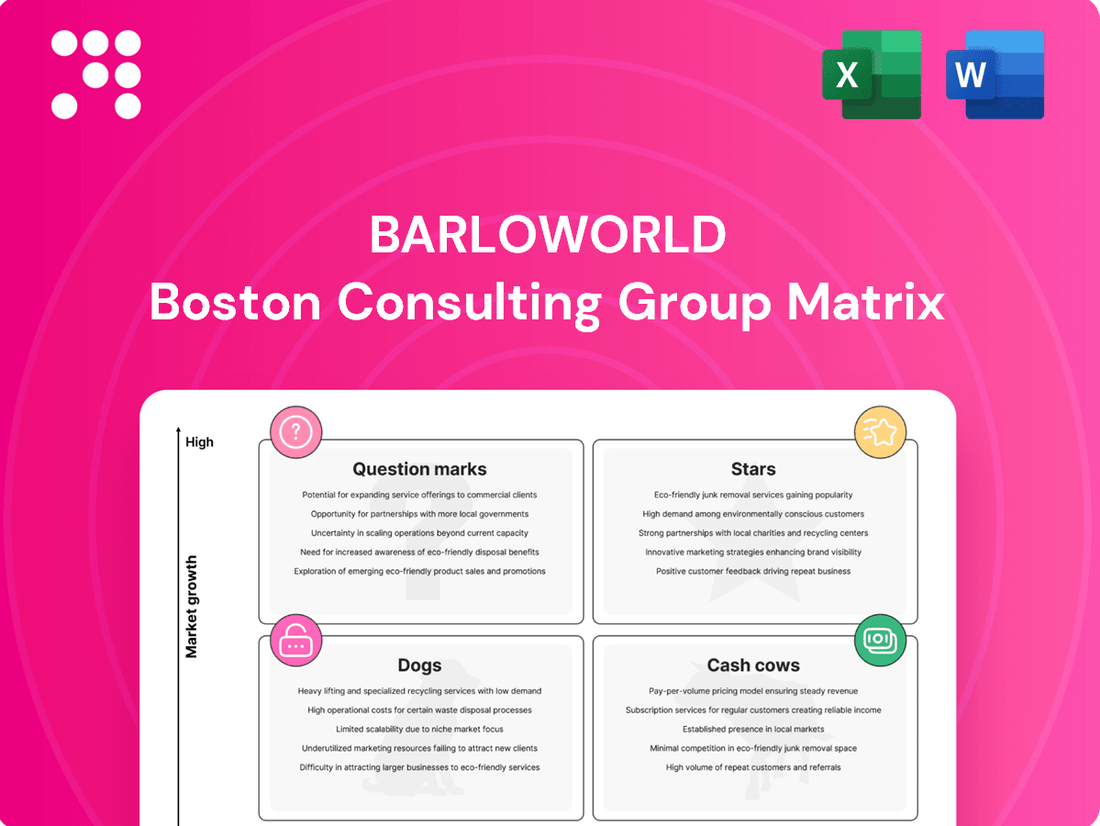

The Barloworld BCG Matrix analyzes business units by market share and growth, guiding investment decisions.

It categorizes units as Stars, Cash Cows, Question Marks, or Dogs to inform strategic resource allocation.

The Barloworld BCG Matrix provides a clear visual of business unit performance, relieving the pain of uncertain strategic allocation.

Cash Cows

Barloworld Equipment Southern Africa, a significant revenue generator at R25.7 billion in 2024, exemplifies a Cash Cow within the BCG matrix. Despite a 12.7% dip in machine sales that year, attributed to market cyclicality, its position as a leading Caterpillar dealer in a mature market underpins its stable performance.

The division benefits from a robust, established customer base and consistent cash inflows from its service and parts operations. This reliability means it requires comparatively modest investment to maintain its market position, freeing up capital for other strategic initiatives.

The broader material handling equipment market is a substantial and steady sector, projected to reach USD 178.2 billion in 2024. This market is expected to grow at a compound annual growth rate of 6% from 2025 to 2034, indicating continued stability.

Barloworld's established distribution networks in traditional materials handling equipment, such as forklifts, likely secure a significant market share. This strong position generates reliable cash flow through ongoing sales and essential maintenance services.

These mature operations typically demand less investment focused on rapid expansion. Consequently, they function as dependable cash cows, consistently contributing to Barloworld's overall financial health with minimal need for aggressive capital deployment.

Barloworld's car rental services in South Africa represent a classic Cash Cow. The market is robust, with projections indicating a compound annual growth rate of 11.3% between 2025 and 2030, expected to reach USD 4,617.7 million by 2030.

Despite competitive pressures, Barloworld's established presence likely secures a substantial market share. This segment is characterized by consistent, reliable cash generation from a mature service, prioritizing operational efficiency and fleet optimization over rapid expansion.

Ingrain (Consumer Industries)

Ingrain, Barloworld's consumer industries segment, demonstrated resilience in 2024. While its EBITDA experienced an 8.4% decrease, this marked an improvement from earlier interim declines, and the segment maintained stability through the first half of 2025.

This business functions as a key supplier of essential ingredients across diverse manufacturing sectors. Its position suggests a strong, established market share within a mature, low-growth industry, characteristic of a cash cow.

Ingrain consistently contributes to Barloworld's overall revenue and operating profit. Recent restructuring initiatives have begun to show positive effects, reinforcing its role as a dependable generator of cash for the group.

- Stable Performance: Ingrain’s EBITDA declined by 8.4% in 2024 but stabilized in H1 2025, indicating a mature, predictable business.

- Market Position: Operates in a low-growth, mature industry, holding a stable, high market share as a provider of essential ingredients.

- Revenue Contribution: Continues to be a consistent contributor to Barloworld's revenue and operating profit.

- Cash Generation: Restructuring efforts are yielding benefits, solidifying its role as a reliable cash cow.

Established Logistics and Supply Chain Solutions

Barloworld's established logistics and supply chain solutions are classified as cash cows within its BCG Matrix. These mature operations benefit from existing infrastructure and strong, long-term client relationships, ensuring consistent and reliable revenue generation. Their established market positions and operational efficiencies allow for sustained profitability, minimizing the need for significant new investment to capture market share.

These segments contribute significantly to Barloworld's overall financial health by providing a stable income stream that can fund growth initiatives in other business areas. For instance, in 2024, Barloworld reported significant contributions from its Equipment and Logistics divisions, with the logistics segment demonstrating robust performance despite broader economic fluctuations.

- Stable Revenue: These mature logistics operations are characterized by predictable, recurring revenue streams.

- High Profitability: Optimized operations and established client bases lead to strong profit margins.

- Low Investment Needs: Existing infrastructure and market presence reduce the requirement for substantial capital expenditure.

- Cash Generation: They serve as a primary source of cash to support other, higher-growth segments of Barloworld's portfolio.

Cash Cows in Barloworld's portfolio represent established, high-market-share businesses operating in mature, low-growth industries. These segments generate consistent, reliable cash flow with minimal need for reinvestment, effectively funding other strategic initiatives within the company. Their stability is a cornerstone of Barloworld's financial resilience.

Barloworld Equipment Southern Africa, a significant revenue generator at R25.7 billion in 2024, exemplifies a Cash Cow. Despite a 12.7% dip in machine sales that year, attributed to market cyclicality, its position as a leading Caterpillar dealer in a mature market underpins its stable performance.

Barloworld's car rental services in South Africa also function as a Cash Cow. The market is robust, with projections indicating a compound annual growth rate of 11.3% between 2025 and 2030, expected to reach USD 4,617.7 million by 2030.

Ingrain, Barloworld's consumer industries segment, demonstrated resilience in 2024, maintaining stability through the first half of 2025, reinforcing its role as a dependable generator of cash for the group.

| Business Segment | 2024 Revenue (R billion) | Market Maturity | Cash Flow Generation | Investment Needs |

| Equipment Southern Africa | 25.7 | Mature | High and Stable | Low |

| Car Rental South Africa | N/A (Market valued at USD 4,617.7 million by 2030) | Mature | Consistent | Low |

| Ingrain (Consumer Industries) | N/A | Mature | Reliable | Low |

What You See Is What You Get

Barloworld BCG Matrix

The Barloworld BCG Matrix preview you're currently viewing is the identical, fully completed document you will receive upon purchase. This means you'll get a professionally formatted and analysis-ready report, free from watermarks or demo content, ready for immediate strategic application.

Dogs

Vostochnaya Technica (VT), Barloworld's Russian subsidiary, is a clear cash trap within the BCG matrix. Its revenue plummeted by 36.8% in the first half of fiscal 2025 and 22% in the full year 2024, a direct consequence of sanctions and a shrinking market.

The outlook for VT is bleak, with the group anticipating only breakeven performance. This suggests very low growth potential and minimal profitability, further compounded by provisions for obsolete inventory and restructuring costs.

Within the Barloworld BCG Matrix, underperforming regional car rental outlets are categorized as Dogs. While the South African car rental market saw a growth of approximately 5% in 2024, these specific outlets are characterized by a low market share and operate in low-growth segments.

These locations often become cash traps, with high operating costs outpacing their revenue generation. Factors such as intense local competition or a decline in local demand can significantly hinder their performance, making them unprofitable ventures.

Consequently, these underperforming outlets may not yield sufficient returns to warrant ongoing investment. Barloworld might consider divesting these assets or implementing substantial restructuring strategies to improve their viability.

Legacy IT systems in mature business segments, particularly those not recently updated, can be classified as dogs in a BCG matrix context. These systems often exhibit low technological competitiveness, meaning they struggle to keep pace with modern business needs and competitor advancements.

These outdated systems typically come with high maintenance costs, draining resources without offering significant returns. For instance, in 2024, many large enterprises still grapple with mainframe systems that, while functional, require specialized and expensive upkeep, diverting funds from innovation.

The market share in terms of technological relevance is low, and the potential for growth is limited. Investing heavily to modernize these systems is often not viable because the mature market segment may not justify the substantial expenditure, making them a drag on overall company performance.

Small, Non-Strategic Product Lines or Brands

Small, non-strategic product lines or brands within Barloworld's extensive business segments, particularly those that are not central to its core operations, would be categorized as Dogs. These are typically businesses that generate minimal revenue and hold a negligible market share. They often operate in mature or declining industries where growth prospects are limited, and they may struggle against larger, more established competitors.

These segments often require significant management attention and capital investment relative to the returns they generate. For instance, a small, niche industrial equipment component that Barloworld might offer, but which isn't a primary focus for the company’s large-scale infrastructure or equipment rental divisions, could fall into this category. Such an offering might have seen its market shrink due to technological advancements or shifting customer preferences.

- Low Market Share: These brands or product lines typically hold less than 5% of their respective market share.

- Low Growth Market: They operate in industries with an annual growth rate of 3% or less.

- Resource Drain: Management time and financial resources are often disproportionately allocated to these underperforming units.

- Potential Divestment: Companies often consider divesting or phasing out these offerings to reallocate resources to more promising ventures.

Specific Excess or Obsolete Equipment Inventory

Specific excess or obsolete equipment inventory, within the context of Barloworld’s BCG Matrix, refers to assets that are proving difficult to sell. This can be due to them being outdated, the market being flooded with similar items, or a slump in demand in particular areas. Such inventory essentially locks up cash and incurs ongoing storage expenses without bringing in any income.

Barloworld has had to account for losses stemming from inventory that has become obsolete. A notable instance involved their operations in Russia, where certain equipment became unsellable. This situation clearly aligns with the 'dog' quadrant of the BCG Matrix, signifying a low market share for these particular assets in an environment with weak demand, thereby consuming resources without contributing to profitability.

The implications of holding onto such 'dog' assets are significant for Barloworld. They represent capital that could be reinvested in more promising areas of the business. For instance, if a specific piece of machinery is no longer in demand due to technological advancements, continuing to hold it incurs costs like warehousing, insurance, and potential depreciation, all while offering no return.

- Cost of Holding Obsolete Inventory: This includes warehousing, insurance, and potential depreciation.

- Capital Tied Up: Funds invested in unsellable inventory cannot be used for growth or more profitable ventures.

- Impact on Financial Statements: Provisions for obsolescence directly reduce reported profits.

- Strategic Decision: Companies often need to write down or dispose of obsolete inventory to free up capital and improve financial health.

Dogs in the Barloworld BCG Matrix represent business units or products with low market share in slow-growing industries. These are often cash traps, consuming resources without generating significant returns. For instance, underperforming regional car rental outlets in South Africa, despite a 5% market growth in 2024, are classified as Dogs due to their low market share and operation in niche, low-growth segments.

Legacy IT systems also fall into this category, characterized by low technological relevance and high maintenance costs, as seen with companies still relying on expensive mainframe upkeep in 2024. Similarly, small, non-strategic product lines, like niche industrial equipment components, can be Dogs if they operate in mature markets with limited growth prospects and require disproportionate management attention relative to their minimal revenue generation.

Obsolete inventory, such as unsellable equipment in markets like Russia, also fits the Dog profile. These assets tie up capital, incur holding costs, and necessitate provisions for obsolescence, directly impacting profitability. Barloworld's experience with its Russian subsidiary, Vostochnaya Technica (VT), which saw a 22% revenue drop in 2024 and a further 36.8% in H1 fiscal 2025, exemplifies a Dog due to its low market share in a shrinking market, leading to anticipated breakeven performance.

The strategic implication for Dogs is often divestment or significant restructuring to mitigate resource drain and reallocate capital to more promising ventures. This approach aims to improve overall financial health by shedding underperforming assets.

Question Marks

Barloworld's commitment to digital transformation is evident in its exploration of new platforms for equipment rental and asset tracking. These digital ventures tap into high-growth markets fueled by increasing technology adoption and the demand for real-time operational data. While these areas represent significant future potential, Barloworld's current market share in these emerging digital services is likely still developing, positioning them as potential question marks within the BCG framework.

Significant capital investment will be crucial for Barloworld to establish a strong foothold and scale these digital offerings. For instance, companies investing heavily in digital rental platforms have seen increased customer engagement; one industry report from early 2024 indicated a 15% rise in online rental bookings for firms with advanced digital interfaces. Barloworld's strategic allocation of resources here could transform these nascent digital assets into future market leaders, mirroring the trajectory of successful digital disruptors in the equipment sector.

Barloworld's strategic consideration of expanding into new, high-growth emerging African markets falls squarely into the question mark category of the BCG matrix. While these regions present exciting opportunities, driven by burgeoning infrastructure projects and increasing industrialization, they demand significant capital outlay and carry inherent risks due to nascent market penetration and uncertain competitive landscapes.

For instance, countries like Ethiopia and Ghana, with projected GDP growth rates of around 7-8% in 2024, represent potential avenues for expansion. However, navigating regulatory complexities and establishing a strong foothold against established local and international competitors will require substantial investment in distribution networks and localized marketing efforts, mirroring the challenges faced by companies entering similar markets.

The demand for sustainable and green equipment solutions is a significant emerging trend in the earthmoving and material handling sectors, driven by environmental regulations and customer preference for energy efficiency. If Barloworld is investing in or developing electric or hybrid equipment, these innovations would likely fall into the question mark category of the BCG matrix.

This is because while the market for these greener alternatives is expanding rapidly, Barloworld's current market share in these specific product lines may be relatively small. For instance, the global electric construction equipment market is projected to grow substantially, with some estimates suggesting a compound annual growth rate exceeding 25% in the coming years leading up to 2025. This rapid growth necessitates substantial investment to establish a strong market position and capture future opportunities.

Advanced Logistics Technology Integration (AI, IoT)

The logistics sector is undergoing a significant technological overhaul, with automation, AI, and IoT driving innovation. This transformation is expected to fuel a compound annual growth rate of 9.69% between 2025 and 2034, indicating a rapidly expanding market. Barloworld's strategic investment in integrating these cutting-edge technologies into its logistics offerings positions it to capitalize on this growth, though its current market share in these nascent, specialized areas is likely modest.

These advanced logistics technology integrations, while demanding substantial capital expenditure, represent Barloworld's bid to cultivate future market leaders. The company's focus on AI and IoT within its supply chain solutions is a calculated move to enhance efficiency and create new service avenues.

- Market Growth: The global logistics market is projected to grow at a CAGR of 9.69% from 2025 to 2034, driven by technological advancements.

- Barloworld's Position: Investments in AI and IoT for logistics likely place Barloworld in a low market share position within these specialized, high-growth segments.

- Cash Flow Impact: These initiatives are cash-intensive but hold the potential to become 'Stars' in the BCG matrix if successful adoption and scaling are achieved.

- Strategic Importance: Integrating advanced logistics technology is critical for Barloworld's long-term competitiveness and ability to offer sophisticated supply chain solutions.

Diversification into Specific Niche Industrial Services

Barloworld's strategic exploration into niche industrial services, such as specialized asset optimization or predictive maintenance for specific sectors, represents a classic 'question mark' in the BCG matrix. These areas often exhibit high demand and significant growth potential, but Barloworld's status as a new entrant necessitates substantial investment and strategic focus to gain traction and build market share.

For instance, if Barloworld were to enter the market for advanced drone-based inspection services for wind turbines, a sector projected to grow substantially, it would fit this category. While the demand is evident, with the global wind turbine maintenance market expected to reach over $30 billion by 2030, Barloworld's initial market share would likely be small, requiring aggressive marketing and technological development.

- Niche Market Entry: Barloworld's move into specialized industrial services like bespoke engineering solutions for the burgeoning electric vehicle manufacturing sector.

- High Growth Potential: These niche areas often experience rapid expansion, with some specialized industrial service markets projected to see double-digit annual growth rates in the coming years.

- New Entrant Status: As a new player, Barloworld faces the challenge of establishing brand recognition and trust against established competitors.

- Investment Requirement: Significant capital allocation is needed for research and development, talent acquisition, and market penetration to capture market share in these specialized fields.

Barloworld's ventures into emerging digital platforms for equipment rental and advanced asset tracking are prime examples of question marks. These initiatives target markets experiencing rapid technological adoption, but Barloworld's current market share in these nascent digital services is likely still developing, necessitating substantial investment to scale and establish a strong foothold.

The company's strategic expansion into new, high-growth African markets, such as Ethiopia and Ghana, also falls into this category. While these regions offer significant potential due to infrastructure development, they require considerable capital outlay and present inherent risks associated with market penetration and competitive dynamics.

Investments in sustainable equipment, like electric or hybrid machinery, represent another question mark. The market for these greener alternatives is expanding quickly, with the global electric construction equipment market projected for substantial growth, potentially exceeding a 25% compound annual growth rate leading up to 2025. However, Barloworld's current market share in these specific product lines may be limited, demanding significant investment to capture future opportunities.

Barloworld's focus on integrating advanced technologies like AI and IoT into its logistics offerings positions it to capitalize on the logistics sector's projected 9.69% CAGR from 2025 to 2034. Despite the high growth potential, Barloworld's market share in these specialized, technology-driven areas is likely modest, requiring significant capital expenditure to become a market leader.

Furthermore, Barloworld's exploration of niche industrial services, including specialized asset optimization and predictive maintenance, are question marks. These areas exhibit high demand and growth, but as a new entrant, Barloworld must invest heavily in R&D, talent, and market penetration to build brand recognition and gain market share against established competitors.

| Barloworld's Question Marks | Market Characteristic | Barloworld's Current Position | Investment Need | Potential Future Status |

|---|---|---|---|---|

| Digital Rental Platforms | High Growth, Tech Adoption | Developing Market Share | Significant Capital for Scaling | Star or Dog |

| Emerging African Markets | High Growth, Infrastructure Focus | Nascent Penetration, High Risk | Substantial Outlay for Entry | Star or Dog |

| Sustainable Equipment | Rapidly Expanding, Regulatory Driven | Potentially Low Market Share | Heavy Investment for Market Capture | Star or Dog |

| Advanced Logistics Tech (AI/IoT) | High Growth, Tech Driven (9.69% CAGR 2025-2034) | Modest Share in Specialized Areas | Capital Intensive for Leadership | Star or Dog |

| Niche Industrial Services | High Demand, Specialized Needs | New Entrant, Low Brand Recognition | R&D, Talent, Marketing Investment | Star or Dog |

BCG Matrix Data Sources

Our Barloworld BCG Matrix leverages a robust blend of internal financial disclosures, comprehensive market research, and industry-specific trend analysis to accurately position each business unit.