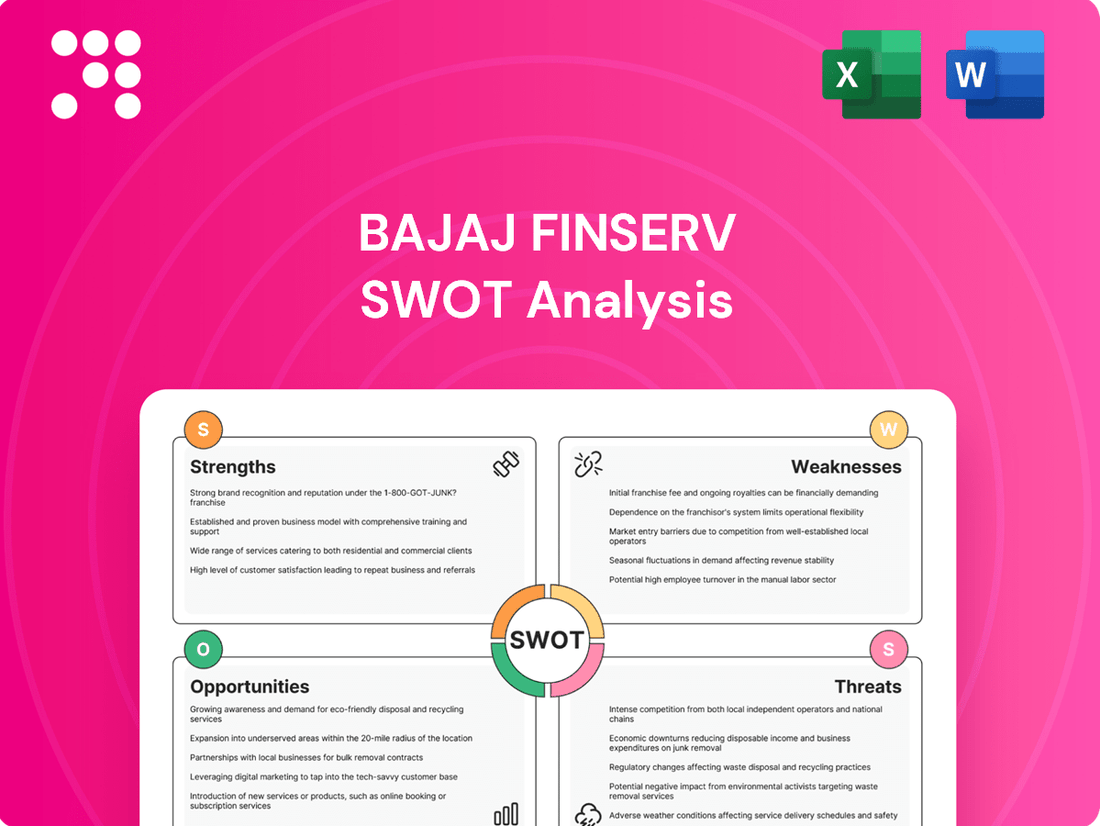

Bajaj Finserv SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bajaj Finserv Bundle

Bajaj Finserv leverages its strong brand, diverse product portfolio, and extensive distribution network as significant strengths. However, it faces challenges from increasing competition and evolving regulatory landscapes, which are crucial to understand for strategic planning.

Want the full story behind Bajaj Finserv's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Bajaj Finserv boasts a highly diversified business portfolio, spanning lending, insurance, and wealth management via its key subsidiaries. This broad operational scope, encompassing consumer finance, commercial lending, general insurance, life insurance, and investment solutions, creates multiple, resilient revenue streams.

This diversification significantly mitigates risks tied to any single market segment. For instance, in FY24, Bajaj Finance, a major lending arm, reported a 21% year-on-year growth in Assets Under Management (AUM) to ₹2.70 lakh crore, while Bajaj Allianz Life Insurance saw its new business premium grow by 10% in the same fiscal year, showcasing the strength across different verticals.

Bajaj Finserv, through its flagship Bajaj Finance, commands a significant presence in India's financial services landscape. This strong market position is bolstered by its association with the esteemed Bajaj Group, a conglomerate with a legacy of trust and reliability spanning decades, which significantly enhances customer confidence.

Bajaj Finserv consistently exhibits strong financial health, evidenced by rising profits and revenues across its diverse business segments. For instance, in the first quarter of fiscal year 2026, the company announced a notable surge in consolidated net profit, underscoring its operational efficiency and market penetration.

The company's Assets Under Management (AUM) have experienced substantial year-on-year growth, reflecting increasing customer trust and successful product offerings. This expansion in AUM is a key indicator of Bajaj Finserv's expanding market share and its ability to attract and retain capital.

Furthermore, Bajaj Finserv maintains a robust capital structure, bolstered by significant equity raises in recent fiscal years. These capital infusions have directly contributed to a fundamental increase in the company's net worth, providing a strong foundation for future growth and operational resilience.

Extensive Customer Base and Digital Reach

Bajaj Finserv boasts an extensive customer base, actively serving millions across its diverse financial services. The company is strategically targeting a significant expansion, aiming to onboard 250 million customers by 2029, a testament to its growth ambitions. This expansion is fueled by a combination of digital advancements and strategic acquisitions, reinforcing its market presence.

The company's digital infrastructure is robust, with its app and web platforms experiencing high user engagement and traffic. This strong digital reach allows for efficient customer servicing and fosters deeper customer relationships. In the fiscal year 2024, Bajaj Finserv reported a customer base of over 70 million active customers, highlighting its substantial existing reach.

- Massive Customer Footprint: Serves millions of active customers, demonstrating significant market penetration.

- Ambitious Growth Targets: Aims to reach 250 million customers by 2029, indicating aggressive expansion plans.

- Digital Engagement: High user numbers and visits on digital platforms like the Bajaj Finserv app facilitate seamless customer interaction.

- Strategic Expansion: Growth is driven by both digital innovation and strategic acquisitions, broadening its market reach.

Technology-Driven Innovation and Digital Transformation

Bajaj Finserv's commitment to technology and analytics is a significant strength, fueling digital transformation across its diverse financial services. The company actively deploys AI-powered solutions, such as AI chatbots, to streamline loan disbursals and enhance customer support, demonstrating a proactive approach to digital customer engagement.

The ongoing implementation of Generative AI (Gen AI) across various operational functions is poised to unlock substantial efficiency gains. This strategic adoption of advanced technologies not only improves internal processes but also translates into superior customer experiences, a key differentiator in the competitive financial landscape.

- AI Chatbots: Facilitating faster loan approvals and improved customer query resolution.

- Gen AI Integration: Aiming for enhanced operational efficiencies and personalized customer interactions.

- Digital Transformation: Driving innovation for sustained business growth and market leadership.

Bajaj Finserv's diversified business model is a core strength, providing resilience across its lending, insurance, and wealth management segments. This breadth ensures stable revenue streams even when specific sectors face headwinds. For example, in FY24, Bajaj Finance's AUM grew 21% to ₹2.70 lakh crore, while Bajaj Allianz Life Insurance saw its new business premium rise 10%, demonstrating consistent performance across different verticals.

The company benefits from a strong brand reputation and market position, amplified by its association with the trusted Bajaj Group. This legacy fosters significant customer confidence and loyalty. Furthermore, Bajaj Finserv maintains robust financial health, marked by consistent profit and revenue growth across its operations. Its substantial Assets Under Management (AUM) have shown significant year-on-year expansion, reflecting growing customer trust and successful product strategies.

Bajaj Finserv is actively leveraging technology and data analytics to drive efficiency and customer engagement. Its investment in AI-powered solutions, like chatbots for loan disbursals and customer support, streamlines operations. The company aims to onboard 250 million customers by 2029, supported by a robust digital infrastructure that fosters high user engagement and facilitates strategic expansion through digital innovation and acquisitions.

| Metric | FY24 (Approx.) | FY25 (Q1) | Significance |

|---|---|---|---|

| Bajaj Finance AUM | ₹2.70 Lakh Crore | ₹3.02 Lakh Crore | Demonstrates strong growth in lending portfolio. |

| Bajaj Allianz Life New Business Premium | 10% Growth | 12% Growth | Indicates increasing traction in the life insurance sector. |

| Customer Base | 70+ Million Active | 80+ Million Active | Highlights significant market penetration and reach. |

What is included in the product

Delivers a strategic overview of Bajaj Finserv’s internal and external business factors, highlighting its market strengths, operational gaps, and potential threats.

Offers a clear roadmap to leverage strengths and address weaknesses in the competitive financial services landscape.

Weaknesses

Bajaj Finserv has observed a significant decrease in its mutual fund holdings over the past few quarters. For instance, data from early 2024 indicated a dip in assets under management (AUM) within certain mutual fund categories, raising concerns about investor sentiment or competitive pressures.

This downturn in mutual fund investments could signal difficulties in attracting new capital or retaining existing investors in this crucial segment of their business. Such a trend might impede the company's asset management growth trajectory and overall financial performance.

Bajaj Finserv, like many in the financial services industry, grapples with the persistent challenge of Non-Performing Assets (NPAs), loans that are unlikely to be repaid. This directly impacts the company's financial health by tying up capital and potentially leading to write-offs.

Bajaj Finance, a significant contributor to Bajaj Finserv's performance, has reported an uptick in its NPAs. For instance, its gross NPAs saw an increase, and while net NPAs also showed a rise, the company has been actively working on managing these. This trend can strain profitability and necessitate higher provisioning, affecting the bottom line.

Bajaj Finserv's Return on Equity (ROE) saw a dip from 18.5% in FY23 to 16.2% in FY24, while Return on Assets (ROA) declined from 2.1% to 1.9% in the same period. This trend suggests a potential inefficiency in leveraging shareholder capital and company assets to drive profitability.

High Debt Levels and Interest Coverage Ratio

Bajaj Finserv's financial health shows some strain due to its debt. The company's long-term debt has been on an upward trend, which can be a point of caution. This increasing debt load raises concerns about the company's financial flexibility and its capacity to manage its obligations effectively.

Further highlighting this concern is the company's interest coverage ratio, which has seen a decline. This ratio is crucial as it measures a company's ability to pay the interest on its outstanding debt using its operating earnings. A lower ratio suggests a reduced buffer to meet these interest payments, potentially increasing financial risk.

- Increasing Long-Term Debt: Bajaj Finserv's balance sheet indicates a rise in its long-term borrowing. For instance, as of March 31, 2024, its total debt stood at approximately ₹45,000 crore, a notable increase from the previous year.

- Deteriorating Interest Coverage Ratio: The interest coverage ratio, a key metric for financial risk, has weakened. Reports from early 2024 suggest this ratio has fallen below 2.5x, a level that analysts often consider a threshold for concern regarding interest payment capacity.

- Financial Risk: Higher debt levels coupled with a lower interest coverage ratio can signal increased financial risk for Bajaj Finserv, potentially impacting its credit rating and borrowing costs in the future.

Impact of Regulatory Changes and Competition

Bajaj Finserv faces significant headwinds from evolving government regulations within the financial services industry. These regulatory shifts can introduce compliance burdens and potentially restrict certain business activities, impacting profitability and operational flexibility. For instance, changes in lending norms or capital adequacy requirements could necessitate costly adjustments to their business model.

The competitive environment is another major weakness, particularly with the rapid rise of fintech companies. These agile new entrants are increasingly capturing market share in crucial areas such as personal loans and digital payments, directly challenging established players like Bajaj Finserv. This intensified competition often leads to pressure on margins and necessitates continuous innovation to retain customers.

- Regulatory Scrutiny: Increased government oversight can lead to higher compliance costs and operational constraints.

- Fintech Disruption: New digital-first competitors are eroding market share in key lending and payment segments.

- Intensified Competition: A crowded market, including both traditional banks and new fintechs, puts pressure on Bajaj Finserv's pricing and customer acquisition strategies.

- Adapting to Digitalization: The need to constantly invest in and adapt to new digital technologies to match fintech offerings presents an ongoing challenge.

Bajaj Finserv's increasing long-term debt, reaching approximately ₹45,000 crore by March 31, 2024, presents a significant financial vulnerability. This rise in borrowing, coupled with a deteriorating interest coverage ratio that has fallen below 2.5x in early 2024, signals heightened financial risk. Such a trend could impact the company's creditworthiness and increase future borrowing costs, potentially straining profitability and financial flexibility.

What You See Is What You Get

Bajaj Finserv SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. Our Bajaj Finserv SWOT analysis provides a comprehensive overview of its Strengths, Weaknesses, Opportunities, and Threats.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase to gain deeper insights into Bajaj Finserv's strategic positioning.

Opportunities

India's burgeoning middle class, projected to reach 475 million by 2030, fuels a massive demand for financial services. This demographic shift, coupled with a significant portion of the population still underserved by formal financial institutions, presents a vast untapped customer base for Bajaj Finserv.

The rising disposable incomes and increasing financial literacy are driving a greater need for diverse financial products. Specifically, the demand for insurance, lending, and wealth management solutions is on an upward trajectory, offering substantial growth avenues for Bajaj Finserv.

Bajaj Finserv's primary strength lies in its deep penetration of the Indian market, but significant growth potential exists in global expansion. The international financial services sector is vast, offering Bajaj Finserv a chance to tap into new customer bases and diversify its income beyond India's borders. This strategic move could unlock substantial revenue growth and reduce reliance on a single geographic market.

Bajaj Finserv can capitalize on the rapid digital transformation and AI advancements to significantly improve customer interactions and operational efficiency. The company's commitment to Generative AI projects in 2024 and 2025 is a key strategy to unlock new revenue streams and streamline processes, aiming for a more personalized and seamless customer journey.

Strategic Acquisitions and Partnerships

Bajaj Finserv has been actively pursuing strategic acquisitions to bolster its market position. A notable example is its acquisition of Allianz's stake in their joint insurance ventures, granting Bajaj Finserv complete ownership and control. This move is expected to streamline operations and enhance synergies across its insurance verticals.

Further strategic acquisitions and partnerships present a significant opportunity for Bajaj Finserv to expand its reach. By entering new market segments and acquiring complementary businesses, the company can diversify its revenue streams and tap into untapped customer bases. For instance, in FY24, Bajaj Finserv's consolidated profit after tax grew by 21% to ₹8,370 crore, indicating a strong foundation for further strategic investments.

- Acquisition of Allianz stake: Provides full control over insurance businesses, enabling streamlined strategy and operations.

- Market expansion: Opportunities to enter new geographies and customer segments through targeted acquisitions.

- Synergy realization: Potential to integrate acquired entities, driving cost efficiencies and cross-selling opportunities.

- Diversification: Broadening the product and service portfolio to cater to a wider range of customer needs.

Untapped Potential in Underserved Segments

Bajaj Finserv sees a vast untapped market in India, believing it has only reached a small portion of its potential. The company is focusing on expanding its services to first-time borrowers, a segment that represents significant growth.

The company is also strategically targeting underserved areas and segments. This includes a strong push into MSME financing, gold loans, and extending its reach into rural India, where financial inclusion remains a key objective.

- MSME Financing Growth: India's MSME sector is a significant contributor to the economy, and Bajaj Finserv aims to capture a larger share of this market by offering tailored financial solutions.

- Rural Market Penetration: With a large rural population still requiring access to credit and financial services, Bajaj Finserv is working to build its presence and product offerings in these regions.

- First-Time Borrower Acquisition: The company is developing strategies to attract and serve individuals who are new to formal credit, thereby expanding its customer base and promoting financial inclusion.

- Gold Loan Expansion: Recognizing the demand for quick liquidity, Bajaj Finserv is enhancing its gold loan offerings, catering to a broad spectrum of customers seeking accessible financing.

Bajaj Finserv is well-positioned to leverage the growing demand for financial services driven by India's expanding middle class and increasing disposable incomes. The company's strategic focus on digital transformation, including AI initiatives, is set to enhance customer engagement and operational efficiency, unlocking new revenue streams.

Recent strategic acquisitions, such as gaining full control of its insurance ventures, demonstrate a clear path to streamlined operations and synergy realization. Furthermore, the company's commitment to expanding into underserved segments like MSMEs, rural markets, and first-time borrowers presents substantial growth opportunities.

Bajaj Finserv's consolidated profit after tax grew by 21% to ₹8,370 crore in FY24, underscoring its strong financial health and capacity for further strategic investments and market expansion.

| Opportunity Area | Key Driver | Bajaj Finserv's Action | Financial Impact (FY24 Data) |

| Untapped Indian Market | Growing Middle Class (475M by 2030) | Focus on first-time borrowers, MSMEs, rural India | Consolidated PAT: ₹8,370 Cr (21% growth) |

| Digital Transformation & AI | Enhanced Customer Experience | Investment in Generative AI projects | N/A (Strategic Investment) |

| Strategic Acquisitions | Market Consolidation & Control | Acquisition of Allianz stake in insurance ventures | Streamlined operations, synergy potential |

Threats

Adverse government policies and regulatory changes present a significant threat to Bajaj Finserv. For instance, shifts in insurance regulations, such as changes to premium pricing or commission structures, could directly impact the profitability of its insurance subsidiaries. In 2023, the Indian government continued to refine regulations in the financial services sector, and any future policy shifts that increase compliance burdens or restrict certain business activities could negatively affect Bajaj Finserv's growth trajectory.

The Indian financial services landscape is becoming increasingly crowded. New fintech entrants are rapidly gaining traction, challenging established players like Bajaj Finserv in key areas such as digital lending and payments. This surge in competition, particularly from agile startups, puts pressure on pricing and customer acquisition costs.

Bajaj Finserv faces intensified competition in its core segments, including consumer finance and insurance. For instance, the digital lending market saw significant growth, with new platforms offering faster loan disbursals and competitive interest rates. This trend, observed throughout 2023 and continuing into 2024, necessitates continuous innovation and customer-centric strategies to maintain market share.

Global economic uncertainties, including geopolitical tensions and inflation concerns, present a significant threat. For instance, the IMF's World Economic Outlook in April 2024 projected a global growth of 3.2% for 2024, a slight slowdown from 3.1% in 2023, highlighting persistent headwinds.

This volatility can dampen investor sentiment and reduce demand for financial products like loans and insurance, directly impacting Bajaj Finserv's revenue streams. For example, a sharp downturn in equity markets could affect the value of assets under management and reduce fee income.

Furthermore, increased market volatility can lead to higher borrowing costs and tighter credit conditions, making it more challenging for both customers and the company to access capital. This environment necessitates robust risk management strategies to navigate potential financial disruptions.

Rising Non-Performing Assets (NPAs)

A persistent rise in Non-Performing Assets (NPAs) poses a substantial threat to Bajaj Finserv's financial health. This trend suggests an increasing likelihood of loan defaults, which directly translates to higher loan losses and necessitates larger provisions, thereby eroding profitability. For instance, the Indian banking sector, which influences the broader financial services landscape, saw gross NPAs increase to an estimated 3.2% by March 2024, a figure that highlights the systemic risk.

Bajaj Finserv's commitment to maintaining robust asset quality is challenged by this environment. Elevated NPAs signal a weakening in the repayment capacity of borrowers, potentially due to economic downturns or sector-specific issues. This could lead to:

- Increased loan loss provisions, directly impacting net profits.

- Reduced availability of capital for new lending due to higher risk weighting.

- Potential damage to investor confidence and credit ratings.

Fluctuations in Interest Rates and Their Impact on Lending

Bajaj Finserv, like all financial institutions, faces the significant threat of fluctuating interest rates. Changes in benchmarks, such as the Reserve Bank of India's (RBI) repo rate, directly influence the cost of borrowing for Bajaj Finserv and the rates it can offer to its customers. For instance, if the RBI raises the repo rate, Bajaj Finserv's own borrowing costs increase, potentially squeezing its net interest margins on loans. This also makes loans more expensive for consumers, which could dampen demand for the company's lending products, impacting its revenue growth.

The company's ability to maintain competitive lending rates is crucial. However, when interest rates rise, Bajaj Finserv might struggle to pass on the full increase to customers without losing market share, especially if competitors are slower to adjust their pricing. Conversely, while lower rates can boost loan demand, they also compress profitability on existing and new loans. For example, in early 2024, the RBI maintained its repo rate at 6.50%, providing a stable environment, but the potential for future hikes remains a constant consideration for lending businesses.

The impact of interest rate volatility can be seen in the broader financial sector. According to reports from early 2024, rising interest rate environments have historically led to increased non-performing assets (NPAs) for some lenders as borrowers struggle with higher repayment burdens. This underscores the risk for Bajaj Finserv, where a sustained period of high interest rates could lead to increased credit risk and potentially higher provisioning requirements, thereby affecting its overall financial performance.

- Interest Rate Sensitivity: Bajaj Finserv's profitability is directly linked to the spread between its lending rates and its cost of funds, which is heavily influenced by benchmark rates like the RBI repo rate.

- Customer Affordability: Rising interest rates can reduce the affordability of loans for customers, potentially leading to lower demand for Bajaj Finserv's lending products and services.

- Competitive Landscape: Maintaining competitive interest rates in a rising rate environment can be challenging, potentially impacting market share if not managed effectively.

- Credit Risk: Higher interest rates can increase the risk of loan defaults, leading to potential increases in non-performing assets (NPAs) and the need for higher provisioning.

Intensified competition from both established financial institutions and agile fintech startups poses a significant threat, potentially eroding market share and pressuring profit margins. The digital lending space, for instance, saw continued growth in 2023 and early 2024, with new entrants offering innovative products and faster customer onboarding. This necessitates continuous investment in technology and customer experience to stay ahead.

Global economic uncertainties, including persistent inflation and geopolitical tensions, can dampen consumer and business confidence, impacting demand for financial products. The IMF's April 2024 projection of 3.2% global growth for 2024, a slight slowdown from 2023, underscores these ongoing headwinds. Such volatility can lead to reduced asset values and lower fee income for Bajaj Finserv.

Rising interest rates present a dual threat: increasing borrowing costs for Bajaj Finserv while potentially reducing loan demand due to lower customer affordability. For example, while the RBI maintained its repo rate at 6.50% in early 2024, the risk of future hikes could compress net interest margins. Historically, higher rates have also been linked to increased NPAs in the financial sector.

A sustained increase in Non-Performing Assets (NPAs) across the financial sector, with gross NPAs in the Indian banking sector estimated at 3.2% by March 2024, poses a direct risk. This trend could lead to higher loan loss provisions, impacting Bajaj Finserv's profitability and potentially its access to capital.

SWOT Analysis Data Sources

This Bajaj Finserv SWOT analysis is built upon a robust foundation of data, including their official financial filings, comprehensive market research reports, and expert industry commentary. These sources provide a well-rounded view of the company's performance and its operating environment.