Bajaj Finserv PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bajaj Finserv Bundle

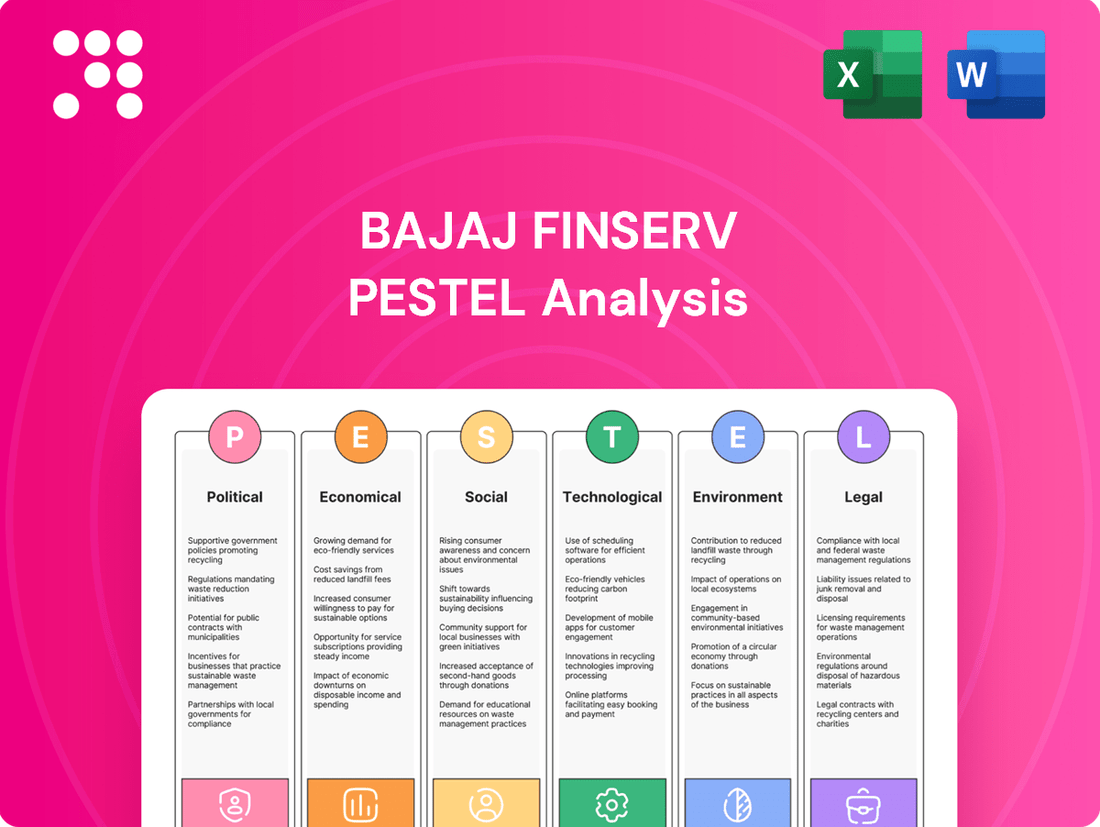

Uncover the critical Political, Economic, Social, Technological, Legal, and Environmental factors shaping Bajaj Finserv's trajectory. Our PESTLE analysis provides a strategic roadmap, highlighting opportunities and threats that could redefine the financial services landscape. Equip yourself with actionable intelligence to navigate this dynamic market. Download the full report now for a comprehensive understanding.

Political factors

The Reserve Bank of India (RBI) is slated to introduce substantial regulatory changes in fiscal year 2024-25. These reforms aim to create a more principle-based and risk-proportionate regulatory environment, specifically targeting systemic risks to enhance the stability of financial intermediaries.

The Department of Financial Services has been a driving force behind ongoing reforms, with a particular emphasis on improving risk assessment frameworks and effectively managing non-performing assets (NPAs) within the banking sector. This focus is crucial for maintaining the health of financial institutions.

A key initiative involves accelerating digital transformation across the banking landscape. For instance, as of early 2024, digital transactions in India have seen exponential growth, with UPI alone processing over 12 billion transactions in a single month, highlighting the government's commitment to modernizing financial services.

The Indian government's 'Digital India' and 'JAM Trinity' (Jan Dhan-Aadhaar-Mobile) initiatives are pivotal in driving digital banking adoption and financial inclusion. These programs are designed to bring more people, especially in rural and remote areas, into the formal financial system.

The Pradhan Mantri Jan Dhan Yojana (PMJDY) has been instrumental, with over 51 crore accounts opened by February 2024, providing millions access to banking, insurance, and pension facilities. This broad reach significantly boosts financial inclusion, creating a larger customer base for digital financial services.

The Insurance Regulatory and Development Authority of India (IRDAI) is driving significant changes in 2024 with a comprehensive overhaul of its regulatory framework. This shift leans towards principle-based regulations, aiming to foster greater flexibility and efficiency for insurers. For instance, new guidelines on corporate governance and enhanced policyholder protection measures were introduced early in 2024, directly influencing operational strategies and customer engagement models across the industry.

Government Support for Fintech Innovation

Government policies actively foster fintech growth in India, with initiatives like Startup India providing crucial tax advantages and streamlining regulatory hurdles for new ventures. This supportive framework is designed to accelerate innovation within the financial technology space.

The Union Budget 2025-26 reinforces this dedication by proposing a significant allocation for an Artificial Intelligence (AI) Centre of Excellence specifically for the Banking, Financial Services, and Insurance (BFSI) sector. This move highlights a strategic focus on leveraging advanced technologies to modernize financial services.

- Startup India: Offers tax exemptions and easier compliance for eligible startups, directly benefiting fintech companies.

- Union Budget 2025-26: Proposes dedicated funding for an AI Centre of Excellence in the BFSI sector, fostering cutting-edge technological development.

- Digital India Initiative: Continues to drive digital infrastructure and literacy, creating a fertile ground for fintech adoption and expansion.

Global Trade and Investment Policies

Global trade policies significantly shape India's economic trajectory, impacting sectors where Bajaj Finserv operates. A slowdown in global growth, as projected by the IMF for 2024, could temper demand for Indian exports. This necessitates a strategic pivot towards bolstering domestic consumption and leveraging India's growing digital economy.

Despite a challenging global environment, India's export sector has demonstrated resilience. For instance, India's merchandise exports reached approximately $437 billion in FY23, showcasing an increasing integration into global value chains. This trend is crucial for financial services firms like Bajaj Finserv, as it drives demand for trade finance and related services.

- Tempered Global Growth: Projections from organizations like the World Bank suggest a moderation in global economic expansion for 2024, potentially affecting India's export volumes.

- Export Resilience: India's total exports, including services, have shown robust growth, reaching a record $770 billion in FY23, indicating strong global demand for Indian goods and services.

- Policy Impact: Changes in international trade agreements or tariffs could influence the competitiveness of Indian businesses, indirectly affecting loan growth and investment opportunities for Bajaj Finserv.

Government policies are actively shaping the financial services landscape in India, with a strong emphasis on digital transformation and financial inclusion. Initiatives like the 'Digital India' program and the JAM Trinity are driving the adoption of digital banking, evidenced by the over 12 billion UPI transactions processed in a single month by early 2024. The Pradhan Mantri Jan Dhan Yojana has also been a significant success, with over 51 crore accounts opened by February 2024, expanding access to financial services for millions.

Regulatory bodies like the RBI and IRDAI are implementing principle-based reforms to enhance stability and efficiency, with new guidelines on corporate governance and policyholder protection introduced in early 2024. Furthermore, the Union Budget 2025-26 proposes dedicated funding for an AI Centre of Excellence within the BFSI sector, signaling a strategic focus on leveraging advanced technologies.

The supportive framework for fintech growth, including tax advantages under Startup India, is accelerating innovation. These government-driven changes create a dynamic environment for financial services providers like Bajaj Finserv, influencing operational strategies and market opportunities.

| Initiative | Description | Impact on BFSI | Key Data Point |

|---|---|---|---|

| Digital India | Promotes digital infrastructure and literacy | Increased digital transaction adoption, customer reach | 12+ billion UPI transactions/month (early 2024) |

| JAM Trinity | Links Jan Dhan, Aadhaar, and Mobile for financial inclusion | Expanded customer base for digital financial services | 51+ crore Jan Dhan accounts opened (Feb 2024) |

| RBI Reforms | Principle-based, risk-proportionate regulations | Enhanced financial stability, operational flexibility | Focus on systemic risk mitigation |

| IRDAI Overhaul | Principle-based regulatory framework | Greater efficiency and policyholder protection | New guidelines on corporate governance (early 2024) |

| Union Budget 2025-26 | AI Centre of Excellence for BFSI | Accelerated technological innovation, modernization | Dedicated allocation for AI in BFSI |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Bajaj Finserv, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key opportunities and threats arising from these influential forces.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, transforming complex PESTLE insights into actionable strategies for Bajaj Finserv.

Economic factors

India's economic outlook is exceptionally strong, positioning it as a leading growth engine globally. The World Bank projects India's GDP to expand by 7% in the fiscal year 2024-2025, underscoring its robust economic trajectory.

Further reinforcing this positive outlook, Deloitte anticipates India's annual GDP growth to hover between 6.5% and 6.8% for FY25, with expectations of even higher growth in the following fiscal year. This sustained economic expansion creates a fertile ground for the financial services sector, including companies like Bajaj Finserv.

The consumer lending market in India is on a strong upward trajectory, with forecasts suggesting it will hit $724.2 billion by 2025, marking a 4.9% growth. This expansion is fueled by a growing middle class with more money to spend and favorable economic conditions. The broader consumer finance sector is also set to reach USD 210.03 Billion by 2031, highlighting a robust demand for various financial solutions.

India's inflation has seen a significant reduction, settling around 5% due to effective fiscal and monetary strategies, with a notable dip to 4.6% in 2024–25. This controlled inflation rate is crucial for economic stability.

The Reserve Bank of India's proactive stance, including two repo rate cuts in 2025, signals an intent to boost consumer spending. Lower interest rates can make borrowing more affordable, potentially stimulating demand for financial products and services offered by companies like Bajaj Finserv.

Foreign Investment and Capital Flows

India's economic landscape is significantly shaped by foreign investment and capital flows, demonstrating strong global investor confidence. Cumulative Foreign Direct Investment (FDI) inflows have surpassed US$ 1.05 trillion, highlighting a substantial long-term commitment to the Indian market. This robust inflow is further evidenced by a notable 27% surge in equity inflows during the first nine months of fiscal year 2025.

The country's foreign exchange reserves have also reached unprecedented levels, providing a strong buffer against external economic shocks and reinforcing financial stability. This healthy accumulation of reserves, coupled with consistent FDI, signals a positive growth trajectory and a stable environment for businesses like Bajaj Finserv to operate and expand.

- Robust FDI Inflows: Cumulative FDI has exceeded US$ 1.05 trillion.

- FY25 Equity Inflow Growth: A 27% increase in equity inflows observed in the first nine months of FY25.

- Record Foreign Exchange Reserves: Indicating enhanced financial stability and investor confidence.

Performance of Financial Services Sector

Bajaj Finserv has shown impressive financial results, with a 30% surge in net profit for the first quarter of fiscal year 2026. This growth is largely thanks to strong earnings from its retail financing and insurance businesses.

The financial services sector as a whole is a significant driver of India's economic expansion. In 2024, the finance and insurance industries contributed substantially to the nation's Gross Domestic Product, underscoring the sector's overall vitality.

- Robust Growth: Bajaj Finserv's Q1 FY26 net profit increased by 30%.

- Segment Strength: Retail financing and insurance were key profit drivers.

- Sector Contribution: Financial services are a major contributor to India's GDP.

- Industry Health: The expansion of finance and insurance reflects sector vitality.

India's economic momentum is a significant tailwind for Bajaj Finserv. With projected GDP growth of 7% for FY25 by the World Bank and Deloitte anticipating 6.5%-6.8% growth, the market is expanding. The consumer lending sector is particularly strong, expected to reach $724.2 billion by 2025, indicating robust demand for financial products.

Controlled inflation, hovering around 5% with a dip to 4.6% in FY25, coupled with the RBI's repo rate cuts in 2025, further supports consumer spending and borrowing. Strong foreign investment, with cumulative FDI exceeding $1.05 trillion and a 27% surge in equity inflows in the first nine months of FY25, signals investor confidence and market stability.

| Economic Indicator | Value/Projection | Source/Period |

| India GDP Growth | 7% | World Bank (FY2024-2025) |

| India GDP Growth | 6.5%-6.8% | Deloitte (FY25) |

| Consumer Lending Market Size | $724.2 billion | By 2025 |

| Inflation Rate | ~5% (4.6% in FY25) | Government/RBI |

| Cumulative FDI Inflows | > US$ 1.05 trillion | |

| Equity Inflows Growth | 27% | First 9 months of FY25 |

Full Version Awaits

Bajaj Finserv PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of Bajaj Finserv.

This is a real screenshot of the product you’re buying—delivered exactly as shown, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Bajaj Finserv, no surprises.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights into the strategic landscape for Bajaj Finserv.

Sociological factors

India's urbanization is accelerating, with projections indicating that by 2030, over 40% of the population will reside in cities, creating a fertile ground for financial services. This demographic shift, coupled with a burgeoning middle class, translates directly into heightened demand for consumer finance products like home loans, auto loans, and financing for durables, as urban lifestyles often necessitate these purchases.

The expanding middle class, characterized by rising disposable incomes and aspirations, is a key demographic for Bajaj Finserv. For instance, the median income for urban Indian households has seen a steady increase, driving greater participation in formal credit markets. This trend is particularly evident in the demand for loans to acquire assets such as vehicles and appliances, directly benefiting companies like Bajaj Finserv.

Financial literacy is on the upswing, especially in India, with a significant boost from the country's vast young demographic. This increased understanding is driving more people to explore and use financial products and services.

Government programs like the Pradhan Mantri Jan Dhan Yojana have been instrumental, bringing financial services to millions who were previously excluded. By the end of 2023, over 51 crore Jan Dhan accounts were opened, demonstrating a massive leap in financial inclusion.

This heightened awareness is empowering individuals, enabling them to make smarter choices about their money, investments, and financial future.

Indian consumers increasingly manage finances digitally, with a strong preference for mobile apps and computers over physical branches. This shift means companies like Bajaj Finserv must invest heavily in their digital infrastructure.

By 2024, over 80% of financial transactions in India are expected to be conducted digitally, highlighting the urgency for Bajaj Finserv to optimize its online services and user experience to cater to this growing demand.

Changing Consumer Preferences for Financial Products

Indian consumers are clearly leaning towards faster and more accessible ways to finance their purchases. This shift is evident in the growing demand for unsecured loans, personal loans, and credit cards, often used for everyday expenses and unexpected emergencies. For instance, the Reserve Bank of India reported that personal loans, a significant portion of which are unsecured, saw a robust year-on-year growth of over 20% in early 2024, highlighting this preference for quick credit.

The rise of 'Buy Now, Pay Later' (BNPL) services has dramatically reshaped how people spend, making it easier to manage larger purchases over time. Companies like Bajaj Finserv itself have seen substantial uptake in their BNPL offerings, with transaction volumes often doubling year-on-year in recent periods, demonstrating a clear consumer appetite for flexible payment solutions. This evolving landscape necessitates that financial institutions like Bajaj Finserv continually adapt their offerings to meet these changing expectations.

- Increased demand for unsecured credit: Personal loans and credit cards are increasingly favored for lifestyle and emergency spending.

- BNPL's growing influence: 'Buy Now, Pay Later' services are altering consumer spending habits, particularly among younger demographics.

- Need for product diversification: Financial institutions must innovate to offer a wider range of flexible and convenient financing options.

- Digital-first approach: Consumers expect seamless, digital onboarding and management of financial products.

Demographic Dividend and Consumption Patterns

India's population, with a significant proportion of young people, is a major driver of consumption. This demographic dividend means a large workforce and a growing consumer base, leading to increased demand for goods and services.

This youthful demographic, aged between 15-59 years, which constitutes over 65% of India's population as of 2024, has evolving aspirations and increasing disposable incomes. This translates directly into higher spending, especially on discretionary items and financial products.

The expanding middle class, estimated to grow significantly in the coming years, fuels this consumption trend. This creates a substantial market for financial services, including loans, insurance, and investment products, offering opportunities for companies like Bajaj Finserv.

- Demographic Dividend: Over 65% of India's population is in the 15-59 age bracket in 2024, representing a large potential workforce and consumer base.

- Rising Income Levels: Increased earning potential among the youth contributes to higher disposable incomes, driving consumption.

- Evolving Aspirations: Younger consumers are increasingly seeking credit for lifestyle upgrades, education, and housing, boosting demand for financial services.

- Growing Middle Class: The expansion of the middle class further amplifies consumption patterns, creating a vast market for financial products and services.

India's rapid urbanization, with over 40% of the population expected to live in cities by 2030, fuels demand for consumer finance. A growing middle class, marked by rising disposable incomes, actively participates in credit markets, particularly for assets like vehicles and appliances, directly benefiting firms like Bajaj Finserv.

Financial literacy is on the rise, especially among India's youth, leading more individuals to engage with financial products. Government initiatives like the Pradhan Mantri Jan Dhan Yojana have significantly boosted financial inclusion, with over 51 crore accounts opened by late 2023, empowering citizens to make informed financial decisions.

Consumers increasingly prefer digital transactions, with over 80% expected by 2024, making a robust digital infrastructure essential for Bajaj Finserv. The preference for quick credit is evident in the over 20% year-on-year growth in personal loans reported by the RBI in early 2024, alongside the substantial uptake in BNPL services.

India's youthful demographic, over 65% aged 15-59 in 2024, drives consumption with evolving aspirations and increasing disposable incomes. This demographic dividend, coupled with a growing middle class, creates a vast market for financial services, from loans to insurance.

| Sociological Factor | Description | Impact on Bajaj Finserv | Supporting Data (2023-2025) |

|---|---|---|---|

| Urbanization | Increasing city populations | Higher demand for housing, auto, and durable goods financing | Over 40% urban population projected by 2030 |

| Middle Class Growth | Expanding segment with higher disposable income | Increased uptake of consumer credit and investment products | Steady rise in urban household median income |

| Financial Literacy | Growing awareness and understanding of financial products | Greater engagement with loans, insurance, and digital financial services | Boosted by young demographic and government initiatives |

| Digital Adoption | Shift towards online and mobile financial transactions | Necessity for strong digital platforms and seamless user experience | Over 80% of financial transactions expected to be digital by 2024 |

| Consumer Preferences | Demand for flexible and accessible credit solutions | Growth opportunities in personal loans, BNPL, and credit cards | Personal loans grew over 20% YoY (early 2024); BNPL volumes doubling |

| Demographic Dividend | Large young population driving consumption | Increased demand for lifestyle upgrades, education, and housing finance | Over 65% of population aged 15-59 (2024) |

Technological factors

Digital transformation is reshaping India's consumer finance landscape, with fintech innovations significantly improving credit access through faster applications and quicker approvals. This evolution is a key technological driver for companies like Bajaj Finserv.

India's fintech sector is booming, reflecting rapid digital advancements. For instance, the value of digital payments in India was projected to reach $3 trillion by 2026, highlighting the widespread adoption of digital financial services.

To stay competitive, financial institutions must constantly evolve and integrate advanced technologies. Bajaj Finserv's focus on digital platforms and seamless customer experiences is a direct response to this imperative, ensuring they meet the demands of an increasingly digital-savvy consumer base.

Bajaj Finserv is heavily investing in AI and ML, aiming to become a 'FINAI' company. This strategic shift involves integrating these technologies across key operational areas like sales, risk management, and compliance, enhancing efficiency and decision-making.

The company is leveraging AI and ML for advanced credit modeling and to better predict customer needs, streamlining processes and improving service delivery. For instance, by 2024-2025, Bajaj Finance plans to significantly increase its AI-driven customer interactions, aiming for a 30% uplift in personalized product recommendations.

Generative AI is also playing a crucial role, transforming customer engagement through AI-powered chatbots and virtual assistants, and automating complex tasks in risk assessment and operational workflows. This is expected to reduce operational costs by an estimated 15% in the next fiscal year.

India's Unified Payments Interface (UPI) is a powerhouse, handling over 14 billion transactions monthly and dominating retail digital payments. This sophisticated digital public infrastructure is a key enabler for advancements in digital banking and payment solutions.

Bajaj Finserv is strategically positioned to leverage this, actively pursuing innovations like the Digital Rupee (CBDC) and Credit on UPI. These initiatives demonstrate a forward-thinking approach to integrating with and shaping the future of India's payment landscape.

Cybersecurity and Data Protection Technologies

The increasing digitalization of financial services makes strong cybersecurity and data protection absolutely critical. Bajaj Finserv has a clear strategy for 2025–2029 focused on bolstering its cybersecurity defenses and adopting Zero Trust models. This approach aims to significantly improve overall security by ensuring that every access request is rigorously verified.

Financial institutions like Bajaj Finserv are under strict mandates to protect customer data. This involves implementing secure identity verification processes and multi-factor authentication, which adds extra layers of security beyond just a password. Furthermore, encrypting sensitive information and continuously monitoring for potential threats are key components in safeguarding customer privacy and trust.

- Data Breaches Costly: In 2024, the average cost of a data breach globally reached $4.73 million, highlighting the financial imperative for robust security.

- Regulatory Focus: Regulations like India's Digital Personal Data Protection Act (2023) impose significant penalties for non-compliance, reinforcing the need for advanced data protection.

- Zero Trust Adoption: By 2025, it's projected that 70% of organizations will have adopted a Zero Trust strategy, a trend Bajaj Finserv is aligning with.

- Customer Trust: A strong cybersecurity posture directly impacts customer confidence, a vital asset in the competitive financial services landscape.

Innovation in Financial Products and Services

Fintech innovation is significantly broadening credit access, especially for those previously underserved, by leveraging technologies like AI and machine learning for streamlined debt approval and conversion processes. For instance, by early 2024, fintech lenders in India were estimated to have disbursed over ₹50,000 crore in small-ticket personal loans, a substantial portion going to new-to-credit customers.

Bajaj Finserv is actively embracing technological advancements to drive innovation across its product and service offerings. The company is deeply involved in developing key initiatives such as the Account Aggregator framework, which facilitates seamless data sharing, and exploring the potential of Social as a Platform and Rewards as a Platform to enhance customer engagement and loyalty. Furthermore, their exploration of blockchain technology aims to bring greater transparency and efficiency to financial transactions.

These strategic technological pursuits are designed to achieve several critical objectives for Bajaj Finserv:

- Process Optimization: Implementing advanced technologies to streamline internal operations, reducing turnaround times for services like loan disbursals and policy issuance.

- Enhanced Customer Experience: Creating more personalized and convenient interactions for customers through digital platforms and data-driven insights.

- Operational Distinction: Differentiating Bajaj Finserv in the market by offering unique, technology-enabled solutions that set new industry benchmarks.

Technological advancements are fundamentally altering India's financial services sector, with fintech innovations significantly expanding credit access through faster application and approval processes, a key driver for Bajaj Finserv.

The company is strategically investing in AI and machine learning, aiming for a significant increase in AI-driven customer interactions, projected to boost personalized product recommendations by 30% by 2024-2025.

Bajaj Finserv is also embracing India's robust digital infrastructure, like UPI, and exploring innovations such as the Digital Rupee and Credit on UPI to enhance its payment solutions and customer engagement.

Given the increasing digitalization, robust cybersecurity is paramount, with Bajaj Finserv focusing on Zero Trust models to bolster defenses against data breaches, which globally cost an average of $4.73 million in 2024.

| Technology Focus | Bajaj Finserv Strategy | Impact/Projection |

|---|---|---|

| AI & Machine Learning | Enhance credit modeling, customer needs prediction, personalized recommendations | 30% uplift in personalized recommendations (2024-2025) |

| Digital Payments (UPI) | Leverage for payment solutions, explore Digital Rupee & Credit on UPI | UPI handles over 14 billion transactions monthly |

| Cybersecurity | Implement Zero Trust models, bolster data protection | Reduce operational costs by ~15% via automation (Generative AI) |

| Account Aggregator Framework | Facilitate seamless data sharing | Streamline internal operations, reduce turnaround times |

Legal factors

The Digital Personal Data Protection Act (DPDPA) 2023, with its anticipated 2025 rules, significantly reshapes data handling for financial entities like Bajaj Finserv. This legislation mandates robust consent frameworks and data localization, impacting how customer information is collected and stored within India.

Compliance with the DPDPA is paramount. Failure to adhere to its stringent data privacy and protection mandates can lead to substantial penalties, potentially affecting consumer trust and financial stability. For Bajaj Finserv, this means a critical review of all data processing activities to align with the Act's requirements by 2025.

The Reserve Bank of India (RBI) is actively shaping the financial landscape, with a significant focus on loan rate reviews and the implementation of the Expected Credit Loss (ECL) model anticipated for the 2024-25 fiscal year. This proactive approach aims to enhance financial sector stability and safeguard consumer interests.

New Digital Lending Directions from the RBI, set to take effect in April 2025, will introduce stringent requirements for digital lending platforms. These include mandates for clear pricing structures, obtaining detailed borrower consent, and adhering to strict disclosure standards, all designed to foster transparency and fairness in digital lending operations.

The Insurance Regulatory and Development Authority of India (IRDAI) has significantly updated its regulatory landscape in 2024. New Corporate Governance Regulations mandate diverse boards and the integration of Environmental, Social, and Governance (ESG) frameworks for insurers, reflecting a push towards more responsible business practices.

Furthermore, the IRDAI (Protection of Policyholders' Interest, Operations and Allied Matters of Insurers) Regulations, 2024, consolidate and strengthen existing rules. This aims to bolster policyholder protection and ensure equitable treatment, impacting how companies like Bajaj Finserv operate and interact with their customers.

Consumer Protection Frameworks

Regulatory bodies are increasingly focused on strengthening consumer protection within financial services. This involves establishing clear guidelines for handling customer complaints and promoting governance that prioritizes policyholder interests. For instance, in India, the Reserve Bank of India (RBI) has been proactive in issuing directives to ensure fair treatment of customers, including those availing services from entities like Bajaj Finserv.

Consumers now possess defined rights, such as the right to suitability, guaranteeing that financial products are appropriate for their specific circumstances, and the right to privacy, which safeguards the confidentiality of their personal data. These protections are crucial in building trust and ensuring a fair marketplace. The Insurance Regulatory and Development Authority of India (IRDAI) also plays a vital role in overseeing consumer protection measures for insurance products offered by companies like Bajaj Allianz Life Insurance.

- Enhanced Grievance Redressal: Mandated timelines for resolving customer complaints, with escalation mechanisms in place.

- Right to Suitability: Financial products must be recommended based on a thorough assessment of the customer's needs and risk profile.

- Data Privacy and Confidentiality: Strict regulations govern the collection, storage, and use of customer personal information.

- Transparency in Product Disclosure: Clear and understandable information about product features, terms, and conditions is required.

Anti-Money Laundering (AML) and KYC Norms

Bajaj Finserv, like all financial institutions in India, must adhere to rigorous Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These are primarily governed by the Prevention of Money Laundering Act (PMLA), which mandates robust procedures for identifying customers and monitoring transactions to prevent financial crimes.

Compliance with these norms places significant responsibility on Bajaj Finserv to protect sensitive customer data. This includes collecting and verifying identity documents, as well as ongoing monitoring of customer activities to detect suspicious patterns. For instance, the Reserve Bank of India (RBI) has emphasized the need for digital KYC solutions to streamline the process.

The regulatory landscape is dynamic, with authorities like the RBI and Securities and Exchange Board of India (SEBI) actively promoting efficiency in compliance. Initiatives such as RegTech sandboxes and guidelines for KYC automation are being introduced to help financial firms adopt advanced technologies for better adherence.

- PMLA Mandates: Bajaj Finserv is bound by the Prevention of Money Laundering Act (PMLA) to implement strict customer due diligence measures.

- Data Protection: The company must ensure the secure handling and protection of sensitive personal and financial information collected during KYC processes.

- Regulatory Support: RBI and SEBI are fostering innovation in compliance through RegTech sandboxes and promoting automated KYC solutions.

- Compliance Costs: Maintaining robust AML/KYC frameworks involves ongoing investment in technology, training, and operational processes.

The Digital Personal Data Protection Act (DPDPA) 2023, with its anticipated 2025 rules, significantly reshapes data handling for financial entities like Bajaj Finserv, mandating robust consent frameworks and data localization. Compliance with the DPDPA is paramount, with potential substantial penalties for non-adherence, necessitating a critical review of all data processing activities by 2025.

Environmental factors

Bajaj Finserv operates within an Indian financial sector that's rapidly embedding Environmental, Social, and Governance (ESG) principles. This shift is driven by regulatory mandates, such as the IRDAI's Corporate Governance Regulations, 2024, which require insurers to establish board-approved stewardship and ESG policies, including climate risk management.

These regulations underscore a significant push for sustainable and responsible operations, directly impacting how financial institutions like Bajaj Finserv approach risk, investment, and corporate strategy. The focus on ESG is becoming a core component of business planning and operational execution in the financial services industry.

Financial regulators are increasingly recognizing how environmental factors, like extreme weather events, can shake economic stability. The Reserve Bank of India's (RBI) 2023-24 annual report specifically pointed out that climate-related occurrences can create unpredictability in inflation forecasts.

This heightened awareness means financial institutions, including Bajaj Finserv, are now expected to more rigorously assess and disclose their exposure to climate-related risks. This applies to both their day-to-day operations and the investment choices they make.

For instance, the increasing frequency of unseasonal rains or prolonged droughts in India can directly impact agricultural output, a key sector for many financial services. This can lead to higher loan defaults and affect the performance of financial products tied to agricultural cycles.

The Indian financial sector is increasingly prioritizing green finance, with companies like Bajaj Finserv integrating it into their long-term strategies. Bajaj Finserv has specifically identified Green Finance as a key focus for its 2025-2029 strategic plan, signaling a strong commitment to funding eco-friendly projects.

Further bolstering this trend, SEBI introduced a framework in 2024 for ESG debt securities. This initiative is designed to expand the market for green, yellow, and blue bonds, thereby channeling more investment into sustainable ventures.

Sustainability Reporting Requirements

As environmental, social, and governance (ESG) considerations become more critical, financial institutions like Bajaj Finserv are increasingly expected to provide clear and detailed reports on their environmental footprint and sustainable business operations. While specific regulations targeting Bajaj Finserv directly were not detailed, the broader financial industry is moving towards greater transparency and accountability for environmental performance.

This evolving landscape necessitates the development of strong systems for collecting and reporting environmental data. For instance, by the end of 2024, many global financial regulators are expected to have finalized or implemented enhanced ESG disclosure frameworks, impacting reporting standards for companies operating within their jurisdictions.

Bajaj Finserv, like its peers, will need to adapt to these trends by:

- Implementing robust data management systems to track environmental metrics.

- Ensuring compliance with emerging sustainability reporting standards.

- Communicating its environmental initiatives and performance to stakeholders.

Broader Environmental Consciousness

Broader environmental consciousness is on the rise in India, with a significant push from both public awareness and government programs. This growing sentiment is likely to steer consumer and investor choices towards companies demonstrating strong environmental responsibility. For instance, a 2024 survey indicated that over 60% of Indian investors consider ESG (Environmental, Social, and Governance) factors in their investment decisions.

While Bajaj Finserv’s core financial services model may not face immediate, direct impacts from this trend, it could subtly influence the landscape. There might be emerging investment avenues in green sectors, such as renewable energy financing, which could become more attractive. Additionally, the company might need to consider adopting more sustainable operational practices to align with evolving market expectations and potentially improve its own ESG ratings.

The Indian government's commitment to climate goals, including achieving net-zero emissions by 2070, further underscores this environmental shift. This policy direction can create opportunities for financial institutions to support green infrastructure projects and sustainable businesses. A report from 2024 highlighted a 15% year-on-year growth in green bonds issued in India, signaling increasing investor appetite for environmentally focused financial products.

- Growing ESG Investment: Indian ESG funds saw inflows of over INR 20,000 crore in 2024, demonstrating a clear investor preference for sustainable companies.

- Government Push for Sustainability: Initiatives like the National Green Hydrogen Mission aim to foster environmentally friendly industries, creating new financing opportunities.

- Consumer Preference Shift: Surveys in early 2025 suggest that over 70% of urban Indian consumers are willing to pay a premium for products from eco-conscious brands.

- Financial Sector Adaptation: Banks and financial institutions are increasingly developing green loan products and sustainable investment portfolios to cater to this evolving market.

Environmental factors are increasingly shaping the financial landscape in India, with regulators like IRDAI and RBI emphasizing climate risk management and sustainability. Bajaj Finserv is aligning with this trend, as evidenced by its strategic focus on Green Finance for 2025-2029 and SEBI's 2024 framework for ESG debt securities.

This growing environmental consciousness is influencing investor and consumer behavior, with a significant portion of Indian investors considering ESG factors and consumers showing a willingness to support eco-conscious brands. For instance, ESG funds saw inflows exceeding INR 20,000 crore in 2024.

The government's commitment to net-zero emissions by 2070, coupled with initiatives like the National Green Hydrogen Mission, creates new avenues for financial institutions to support sustainable businesses and green infrastructure, with a notable 15% year-on-year growth in green bonds issued in India as of 2024.

Bajaj Finserv, therefore, must enhance its data management for environmental metrics and align with evolving sustainability reporting standards to meet stakeholder expectations and capitalize on emerging green finance opportunities.

| Factor | Impact on Bajaj Finserv | Supporting Data (2024/2025) |

| Regulatory Push for ESG | Increased compliance requirements and reporting standards. | IRDAI's 2024 Corporate Governance Regulations mandate ESG policies; SEBI's 2024 ESG debt securities framework. |

| Climate Risk Awareness | Need for robust climate risk assessment and disclosure. | RBI's 2023-24 report highlights climate events' impact on inflation forecasts. |

| Green Finance Focus | Opportunities in funding eco-friendly projects and sustainable ventures. | Bajaj Finserv's 2025-2029 strategic plan includes Green Finance; 15% YoY growth in Indian green bond issuance (2024). |

| Investor & Consumer Sentiment | Growing preference for ESG-compliant companies and products. | Over INR 20,000 crore inflows into Indian ESG funds (2024); >70% urban consumers willing to pay premium for eco-conscious brands (early 2025 survey). |

PESTLE Analysis Data Sources

Our Bajaj Finserv PESTLE Analysis is meticulously constructed using data from reputable financial institutions, government economic reports, and leading industry publications. We draw insights from regulatory updates, market performance indicators, and technological advancements to ensure a comprehensive overview.