Bajaj Finserv Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bajaj Finserv Bundle

Bajaj Finserv masterfully leverages its diverse product portfolio, from insurance to loans, to meet a wide spectrum of customer needs. Their strategic pricing, often competitive and value-driven, makes essential financial services accessible. Discover the intricate details of their distribution channels and promotional campaigns.

Ready to unlock the full picture of Bajaj Finserv's marketing success? Our comprehensive 4Ps analysis goes deep into their product innovation, pricing strategies, expansive reach, and impactful promotions. Get the insights you need for your own business advantage.

Product

Bajaj Finserv's diverse financial services portfolio is a cornerstone of its marketing strategy, encompassing everything from consumer finance and commercial lending to life and general insurance, alongside robust wealth management solutions. This wide array of offerings is designed to meet the multifaceted financial requirements of a broad customer base, spanning individuals and businesses throughout India.

The company's commitment to innovation ensures its product suite remains cutting-edge, adapting to evolving market demands. For instance, as of the fiscal year ending March 31, 2024, Bajaj Finserv reported a consolidated profit after tax of ₹7,960 crore, reflecting the success of its diversified approach in capturing market share across various financial segments.

Bajaj Finserv's Lending and Financing Solutions form a cornerstone of their offerings, encompassing a wide array of credit products. This includes readily accessible personal loans, significant commitments like home loans, and crucial support for businesses through business loans. They also leverage existing assets, providing loans against property, shares, or mutual funds, demonstrating a comprehensive approach to credit accessibility.

Beyond general lending, Bajaj Finserv caters to specific industry needs with specialized financing options. This includes vital medical equipment finance, enabling healthcare providers to acquire necessary technology, and industrial equipment finance, supporting manufacturing and production growth. These specialized solutions highlight a strategic focus on diverse market segments.

Flexibility and speed are key differentiators in their financing solutions. Bajaj Finserv emphasizes adaptable repayment options tailored to customer needs, and often boasts quick disbursal timelines, a critical factor for individuals and businesses needing timely access to funds. For instance, in FY24, Bajaj Finance reported a significant growth in its Assets Under Management (AUM), indicating strong customer uptake of these lending products.

A significant advantage for many customers is the availability of pre-approved loan offers. This feature streamlines the borrowing process, reducing time and effort for eligible applicants by pre-qualifying them based on their financial history and relationship with Bajaj Finserv, further enhancing customer convenience and loyalty.

Bajaj Finserv, via Bajaj Allianz General Insurance and Bajaj Allianz Life Insurance, offers a broad spectrum of insurance products. This encompasses general insurance, such as motor and health coverage, alongside life insurance and retirement solutions, all designed to provide financial security. In 2023-24, Bajaj Allianz General Insurance reported a Gross Written Premium (GWP) of ₹14,033 crore, while Bajaj Allianz Life Insurance’s GWP stood at ₹11,843 crore for the same period, demonstrating significant market presence.

Investment and Wealth Management

Bajaj Finserv offers a comprehensive suite of investment products, catering to diverse financial goals. This includes accessible options like fixed deposits, a wide array of mutual funds spanning equity, debt, and hybrid categories, and streamlined digital stockbroking via Bajaj Financial Securities. Their commitment to expanding offerings is evident with new fund launches by Bajaj Finserv Asset Management in the 2024-2025 period, emphasizing a behavioral finance approach.

Beyond product offerings, Bajaj Finserv's wealth management services provide personalized guidance. Clients receive expert advice on critical areas such as estate planning, tax optimization strategies, and robust retirement planning. The overarching aim is to enhance clients' financial well-being through strategic wealth accumulation and preservation.

- Investment Avenues: Fixed Deposits, Mutual Funds (Equity, Debt, Hybrid), Digital Stockbroking.

- Wealth Management Services: Estate Planning, Tax Optimization, Retirement Planning.

- Asset Management Focus: New fund launches in 2024-2025, behavioral finance-based philosophy.

Digital Platforms and Value-Added Services

Bajaj Finserv extensively utilizes digital platforms to streamline customer engagement and product accessibility. The Bajaj Finserv App acts as a central hub for insurance, investments, and EMI purchases, offering a user-friendly interface for managing financial needs. This digital-first approach by Bajaj Finserv aims to provide a seamless experience, from initial product discovery to post-purchase support, reflecting a significant investment in technology infrastructure.

Value-added services are integrated into these digital channels, enhancing the overall customer proposition. For instance, free CIBIL score checks and the Bajaj Pay payment solution offer tangible benefits to users. Furthermore, the company frequently rolls out festive and seasonal offers on products available through its EMI store, incentivizing digital transactions and fostering customer loyalty. As of early 2024, Bajaj Finserv reported a substantial increase in digital transactions, with over 70% of customer interactions occurring through its digital platforms, underscoring the success of this strategy.

- Bajaj Finserv App: A comprehensive digital platform for insurance, investments, and EMI purchases.

- Value-Added Services: Includes free CIBIL score checks and the Bajaj Pay payment solution.

- Digital Transaction Growth: Over 70% of customer interactions were digital in early 2024.

- Promotional Offers: Festive and seasonal deals on EMI purchases drive digital engagement.

Bajaj Finserv offers a comprehensive product portfolio designed to meet diverse financial needs, from lending and insurance to investments and wealth management. Their lending solutions include personal, home, and business loans, alongside specialized financing for equipment, demonstrating a commitment to accessibility and speed. The insurance arm, through Bajaj Allianz, provides robust general and life insurance coverage, with substantial Gross Written Premiums in FY24. Investment products range from fixed deposits and mutual funds to digital stockbroking, supported by evolving asset management strategies.

| Product Category | Key Offerings | FY24 Performance/Data |

| Lending & Financing | Personal Loans, Home Loans, Business Loans, Loans Against Property/Shares | Significant growth in Assets Under Management (AUM) reported by Bajaj Finance in FY24. |

| Insurance | Motor Insurance, Health Insurance, Life Insurance, Retirement Solutions | Bajaj Allianz General Insurance GWP: ₹14,033 crore (FY24). Bajaj Allianz Life Insurance GWP: ₹11,843 crore (FY24). |

| Investments | Fixed Deposits, Mutual Funds (Equity, Debt, Hybrid), Digital Stockbroking | New fund launches by Bajaj Finserv Asset Management planned for 2024-2025. |

What is included in the product

This analysis provides a comprehensive breakdown of Bajaj Finserv's marketing mix, examining their product offerings, pricing strategies, distribution channels (place), and promotional activities.

It offers insights into how Bajaj Finserv effectively positions itself in the competitive financial services market, making it a valuable resource for understanding their strategic approach.

Provides a clear, actionable framework to address common marketing challenges, turning complex strategies into easily understood solutions.

Simplifies the evaluation of Bajaj Finserv's marketing efforts, offering a direct path to identifying and resolving customer pain points.

Place

Bajaj Finserv boasts an extensive physical presence, a cornerstone of its marketing strategy. As of December 31, 2023, Bajaj Finance alone operated from 4,092 locations, complemented by over 190,000 active distribution points nationwide. This robust on-ground network is crucial for reaching a diverse customer base across India, including those in semi-urban and rural areas.

Bajaj Finserv leverages a robust digital distribution strategy, making its financial products and services easily accessible. The company's official website and the highly popular Bajaj Finserv App serve as primary touchpoints for customers. In 2023, the Bajaj Finserv App was recognized as one of the most downloaded financial applications in India, highlighting its significant reach and user adoption.

These digital channels facilitate a comprehensive, end-to-end customer journey, allowing for seamless applications for loans, efficient management of investments, and straightforward purchase of insurance policies. Furthermore, dedicated online marketplaces cater to specific needs, including insurance, investments, and an EMI store, simplifying the acquisition of goods and services through flexible payment options.

Bajaj Finserv is dedicated to an omnipresent strategy, blending its physical and digital platforms to ensure a smooth customer journey. This integration allows customers to move effortlessly between online and offline interactions, enhancing both convenience and accessibility across all touchpoints.

The company aims to be present wherever its customers are, whether that's through its physical branches, its user-friendly mobile application, or its comprehensive internet presence. This approach ensures maximum reach and engagement, catering to diverse customer preferences and needs.

By 2024, Bajaj Finserv's digital platforms, including its app and website, were consistently handling millions of transactions monthly, reflecting the significant shift towards digital engagement and the success of its omnichannel efforts.

Strategic Partnerships and Agent Networks

Bajaj Finserv heavily relies on strategic partnerships and a vast agent network to ensure broad product distribution. These collaborations with banks, brokers, and dealers, alongside a substantial insurance agent base, are fundamental to reaching a wider customer segment across its financial offerings, particularly in insurance and lending.

The company's expansive distribution infrastructure is a key competitive advantage. By the end of FY24, Bajaj Finserv boasted a network of over 5.25 lakh agents, further augmented by alliances with numerous banks, brokers, and dealers.

- Strategic Tie-ups: Collaborations with financial institutions and dealerships enhance product accessibility.

- Agent Network: A large, active agent force drives sales and customer engagement.

- Distribution Reach: Over 5.25 lakh agents are part of the network as of FY24, significantly widening market penetration.

- Product Expansion: These channels are vital for distributing a diverse range of financial products, especially insurance and loans.

Targeted Geographic Expansion

Bajaj Finserv is strategically broadening its footprint, with a keen focus on expanding into new territories and reaching previously underserved populations. This includes tapping into India's expanding middle class and individuals seeking credit for the first time, thereby fostering greater financial inclusion.

The company has set an ambitious goal to onboard 250 million customers within the next four years, underscoring its commitment to aggressive geographical and demographic expansion.

- Geographic Focus: Targeting new and emerging markets within India.

- Customer Segments: Prioritizing the growing middle class and first-time borrowers.

- Inclusion Drive: Aiming to enhance financial access across the nation.

- Growth Target: Onboarding 250 million customers by 2028.

Bajaj Finserv's place strategy is characterized by a dual approach, combining an extensive physical network with a powerful digital presence. As of December 31, 2023, Bajaj Finance alone had 4,092 branches, supported by over 190,000 distribution points, ensuring deep market penetration. This physical infrastructure is complemented by a robust digital ecosystem, including the widely adopted Bajaj Finserv App, which was a top financial app download in 2023, facilitating millions of monthly transactions by 2024.

The company further extends its reach through a vast network of over 5.25 lakh agents as of FY24, alongside strategic partnerships with banks, brokers, and dealers. This multi-pronged distribution model allows Bajaj Finserv to cater to diverse customer segments and preferences, from urban centers to remote areas, and across various financial product categories like insurance and lending.

Bajaj Finserv's expansion efforts are focused on new geographies and underserved populations, with a clear objective to onboard 250 million customers by 2028. This ambition highlights a commitment to financial inclusion and capturing growth opportunities within India's expanding middle class and first-time credit users.

| Distribution Channel | Key Metric/Fact | Timeframe |

|---|---|---|

| Physical Branches (Bajaj Finance) | 4,092 locations | As of December 31, 2023 |

| Distribution Points | Over 190,000 active | As of December 31, 2023 |

| Digital App (Bajaj Finserv) | Most downloaded financial app | 2023 |

| Digital Transactions | Millions monthly | By 2024 |

| Agent Network | Over 5.25 lakh agents | As of FY24 |

| Customer Acquisition Goal | 250 million customers | By 2028 |

Preview the Actual Deliverable

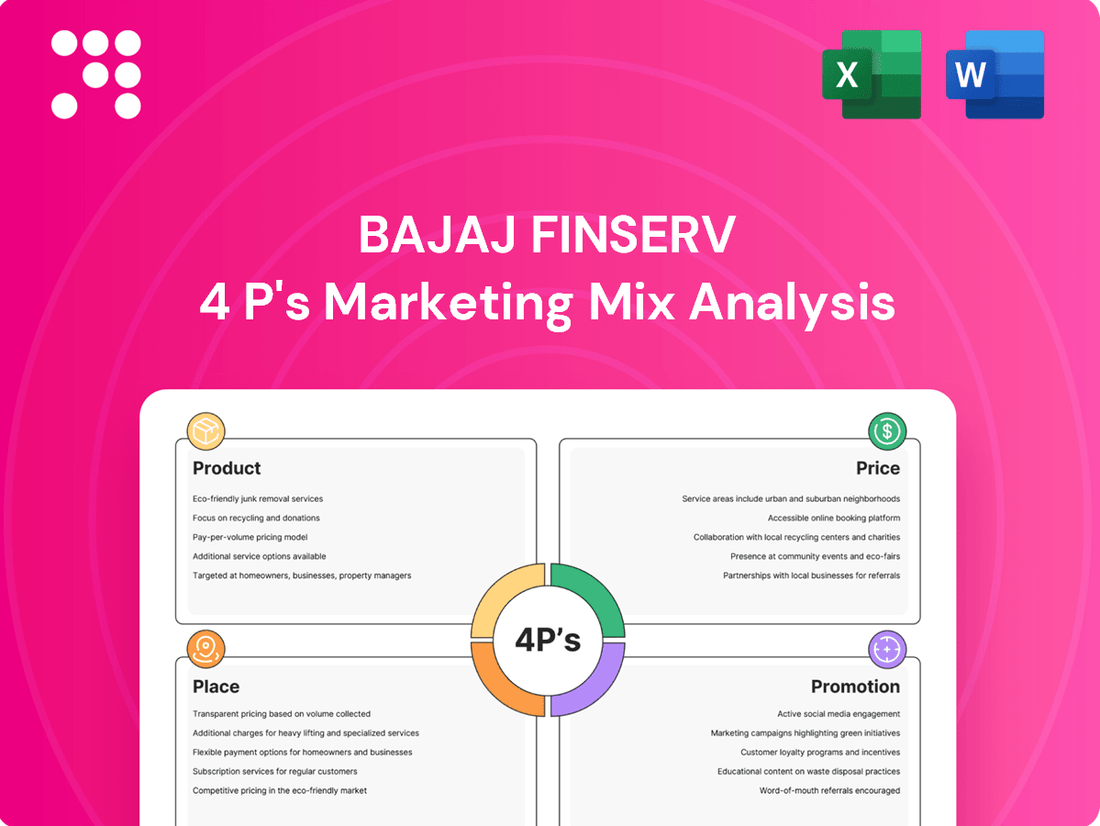

Bajaj Finserv 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Bajaj Finserv's marketing mix, covering Product, Price, Place, and Promotion, is fully complete and ready for your immediate use. You're viewing the exact version of the analysis you'll receive, ensuring you know precisely what you're getting.

Promotion

Bajaj Finserv prioritizes digital marketing, channeling significant investment into areas like Search Engine Optimization (SEO) and informative blogs. This strategy is designed to boost their online presence and educate prospective clients about their diverse financial offerings. In 2023, digital ad spending in India was projected to reach approximately $2.7 billion, highlighting the importance of this channel.

Their content strategy acts as a customer journey facilitator, moving individuals from initial awareness to decisive action. By providing tailored information about their products and services across various online platforms, Bajaj Finserv aims to demystify financial solutions and guide potential customers effectively.

This digitally-focused approach is crucial for building credibility and attracting new clientele through organic search. Bajaj Finserv's commitment to digital engagement reflects a broader trend in the financial services sector, where online visibility and customer education are key drivers of growth.

Bajaj Finserv leverages mass media extensively, employing television, print, and radio to connect with a vast Indian consumer base. These channels are crucial for building brand recognition and communicating the advantages of their diverse financial products.

Recent campaigns, such as those promoting their consumer durable loans which saw a significant uptake in FY24, illustrate their strategy. For example, during the festive season of 2024, Bajaj Finserv ran targeted TV ads showcasing flexible EMI options for electronics, aiming to capture a larger market share in that segment.

Their advertising efforts consistently reinforce Bajaj Finserv's image as a reliable and accessible financial services leader. Print advertisements in leading national dailies and popular magazines, alongside radio spots during prime listening hours, further amplify their message, ensuring broad reach and consistent brand recall.

Bajaj Finserv actively cultivates customer loyalty through personalized communication and tailored loyalty programs. This approach aims to deepen relationships and foster repeat business, recognizing that satisfied customers are the most potent form of promotion. In 2024, the company continued to emphasize customer retention, with initiatives designed to enhance overall satisfaction and encourage ongoing engagement.

Public Relations and Financial Literacy Initiatives

Bajaj Finserv actively cultivates a positive brand image and builds community trust through strategic public relations. This commitment extends to vital financial literacy programs designed to empower individuals and promote economic resilience across India. By educating the public on financial planning and available products, these initiatives indirectly support Bajaj Finserv's growth by fostering a more informed customer base.

Their dedication to financial literacy is a cornerstone of their social responsibility, aiming to make India more financially resilient. This focus on education not only benefits society but also creates a more receptive market for financial services. For instance, in 2023-24, Bajaj Finserv continued to expand its reach through various educational outreach programs, contributing to a growing awareness of financial management among diverse demographics.

- Brand Image Enhancement: Through consistent PR efforts, Bajaj Finserv aims to solidify its reputation as a reliable financial partner.

- Financial Literacy Drive: Initiatives focus on educating citizens about savings, investments, and insurance, fostering financial inclusion.

- Community Engagement: Programs are designed to build trust and a strong connection with the communities they serve.

- Social Impact: Contributing to India's financial resilience is a key objective, aligning business goals with societal well-being.

Leveraging AI and Technology for Personalized Engagement

Bajaj Finserv is significantly enhancing customer engagement by integrating advanced technologies like Artificial Intelligence (AI) and Generative AI into its marketing strategies. This allows for highly personalized interactions and promotions tailored to individual customer needs.

AI-powered chatbots are now actively involved in streamlining loan disbursement processes and providing customer support, thereby elevating the overall customer experience. This technological adoption is a cornerstone of their expansion initiatives.

- AI-driven personalization: Bajaj Finserv utilizes AI to analyze customer data, enabling the delivery of customized product recommendations and targeted marketing campaigns.

- Chatbot efficiency: AI chatbots handle routine queries and assist with loan applications, reducing response times and improving customer satisfaction. For instance, in FY23, Bajaj Finserv reported a significant increase in digital customer interactions, with AI playing a crucial role.

- Data-driven insights: The company leverages AI to gain deeper insights into customer behavior, which informs product development and marketing strategies, aiming for a higher conversion rate on promotions.

Bajaj Finserv's promotional strategy is a multi-faceted approach, blending digital reach with traditional mass media. They heavily invest in SEO and content marketing to educate consumers, recognizing the significant growth in India's digital ad spend, which was projected to hit around $2.7 billion in 2023. This digital focus is complemented by extensive use of television, print, and radio to build brand recognition across India's vast population.

Targeted campaigns, like those promoting consumer durable loans during the 2024 festive season, demonstrate their effectiveness in driving sales through flexible EMI options. Furthermore, Bajaj Finserv actively nurtures customer loyalty through personalized communication and loyalty programs, with a continued emphasis on customer retention in 2024 to foster repeat business.

Public relations and financial literacy initiatives are also key components, aiming to build trust and empower individuals, thereby creating a more informed customer base. Their adoption of AI and Generative AI in marketing allows for hyper-personalized customer interactions and efficient service delivery, as seen in their increased digital customer interactions in FY23.

| Promotional Channel | Key Strategy | 2023-2024 Impact/Focus |

|---|---|---|

| Digital Marketing | SEO, Content Marketing, Social Media | Boosting online presence, customer education, personalized campaigns via AI |

| Mass Media | Television, Print, Radio | Brand awareness, broad reach, reinforcing brand image |

| Public Relations | Financial Literacy Programs, Community Engagement | Building trust, social impact, fostering financial resilience |

| Customer Loyalty | Personalized Communication, Loyalty Programs | Enhancing satisfaction, encouraging repeat business |

Price

Bajaj Finserv stands out by offering competitive interest rates across its extensive range of lending products. For instance, personal loans can begin at an attractive 13% per annum, while home loans start from a compelling 6.75% per annum, making homeownership more attainable.

Beyond just rates, Bajaj Finserv prioritizes flexibility. They provide adaptable loan tenures and repayment schedules, exemplified by options like the Flexi Personal Loan. This approach ensures their financial solutions are not only competitive but also align with the diverse financial situations and preferences of their customer base, enhancing product appeal and accessibility.

Bajaj Finserv utilizes dynamic pricing, adjusting rates based on customer profiles and market dynamics. This includes offering pre-approved loans with potentially lower interest rates to customers with strong credit histories and existing relationships, reflecting a personalized approach to pricing.

The company also factors in external market conditions, such as competitor pricing and overall economic demand, to ensure its offerings remain competitive and profitable. For example, in the current market, digital fixed deposits are offering attractive interest rates, with some Bajaj Finserv digital FD rates reaching up to 7.85% per annum for specific tenures as of early 2024, demonstrating this dynamic adjustment.

Bajaj Finserv prioritizes a transparent fee structure for all its financial products, detailing processing fees, late payment charges, and other associated costs upfront. This commitment to clarity is crucial for fostering customer trust and enabling informed decision-making, ensuring no hidden surprises emerge. For instance, as of early 2024, their personal loan processing fees typically range from 0% to 3% of the loan amount, a figure readily accessible on their official website.

Value-Added Services and Bundled Offerings

Bajaj Finserv's pricing strategy frequently reflects the enhanced value proposition of bundled offerings and ancillary services. For instance, loan products may incorporate features like a top-up option during balance transfers, while insurance plans often include supplementary benefits that support their pricing structure. This approach aims to justify the cost by delivering a more comprehensive and advantageous customer experience.

These value-added services, such as Wallet Care, are integrated to differentiate Bajaj Finserv's offerings in a competitive market. By providing these extras, the company aims to increase customer loyalty and perceived value, thereby supporting its pricing tiers. This strategy allows them to command competitive pricing while offering tangible benefits beyond the core product.

- Bundled Benefits: Loans with top-up options during balance transfers add significant value.

- Enhanced Insurance: Insurance plans with added features justify their premium pricing.

- Ancillary Services: Offerings like Wallet Care contribute to a superior customer experience.

- Value Perception: These extras aim to boost customer loyalty and justify pricing tiers.

Strategic Pricing for Diverse Customer Segments

Bajaj Finserv employs a strategic pricing approach, recognizing that a one-size-fits-all model doesn't work for its diverse customer base. They adjust interest rates and loan terms based on the specific segment, acknowledging varying financial capacities and risk appetites.

This segmentation is evident in their offerings for salaried individuals, self-employed professionals, and particularly senior citizens. For instance, senior citizens can benefit from attractive rates, with potential returns of up to 8.85% per annum on digital Fixed Deposits as of mid-2024, reflecting a commitment to this demographic.

- Segmented Interest Rates: Tailored rates for salaried, self-employed, and senior citizens.

- Risk-Based Pricing: Adjustments reflecting the financial capabilities and risk profiles of different customer groups.

- Senior Citizen Benefits: Special rates, such as up to 8.85% p.a. on digital FDs, to attract and retain older customers.

- Affordability Focus: Pricing strategies designed to be accessible to middle-class and low-income families.

Bajaj Finserv's pricing strategy is deeply rooted in offering competitive rates and flexible terms, ensuring accessibility across various customer segments. For example, personal loans start at an attractive 13% per annum, and home loans at a compelling 6.75% per annum as of early 2024, making financial products attainable.

The company employs dynamic pricing, adjusting rates based on customer profiles and market conditions, with pre-approved loans often featuring lower rates for those with strong credit histories. This personalized approach extends to offerings like digital Fixed Deposits, which, as of mid-2024, can yield up to 8.85% per annum for senior citizens, highlighting a commitment to specific demographics.

Transparency in fees, such as personal loan processing fees typically ranging from 0% to 3% as of early 2024, builds trust. Furthermore, bundled benefits, like top-up options on balance transfers and ancillary services such as Wallet Care, enhance the value proposition, justifying tiered pricing and fostering customer loyalty.

| Product | Starting Interest Rate (p.a.) | Example Value-Added Service | Typical Processing Fee | Target Demographic Benefit |

|---|---|---|---|---|

| Personal Loan | 13.00% | Flexi Personal Loan Option | 0% - 3% | Salaried & Self-Employed |

| Home Loan | 6.75% | Balance Transfer Top-up | Varies | Homeowners |

| Digital Fixed Deposit | Up to 8.85% (Senior Citizens) | N/A | N/A | Senior Citizens |

4P's Marketing Mix Analysis Data Sources

Our Bajaj Finserv 4P's analysis is grounded in a comprehensive review of company reports, financial disclosures, and official product information. We also incorporate insights from industry publications and competitive market data to ensure accuracy.