Bajaj Finserv Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bajaj Finserv Bundle

Bajaj Finserv operates in a dynamic financial services landscape, facing moderate buyer power due to product differentiation and a wide array of choices. The threat of substitutes is significant, with fintech innovations constantly offering alternative solutions. Understanding these forces is crucial for strategic positioning.

The full analysis reveals the strength and intensity of each market force affecting Bajaj Finserv, complete with visuals and summaries for fast, clear interpretation.

Suppliers Bargaining Power

Bajaj Finserv, a major player in financial services, secures its capital through diverse channels like customer deposits, bank loans, and capital markets. The leverage these capital providers hold is directly tied to the overall financial system's liquidity and Bajaj Finserv's own financial health and reputation. For instance, as of March 31, 2025, Bajaj Finance had amassed deposits totaling ₹71,403 crore, demonstrating a robust and reliable source of funding.

In today's financial world, technology and software providers are becoming increasingly important suppliers for companies like Bajaj Finserv. These providers offer the essential digital tools that power modern operations, from AI-driven loan approvals to seamless customer service interfaces.

Bajaj Finserv relies heavily on advanced technologies such as artificial intelligence and machine learning for critical functions. For instance, AI is used to streamline the loan disbursal process, making it faster and more efficient for customers. Digital platforms are also key for managing customer interactions and providing support.

The bargaining power of these technology suppliers can be quite substantial. This is particularly true when their software solutions are highly specialized, unique, or provide a significant competitive edge. If a particular AI algorithm or a proprietary digital platform is essential for Bajaj Finserv's operational efficiency and market competitiveness, the supplier holds considerable leverage.

Bajaj Finserv relies heavily on skilled professionals in financial analysis, risk management, and digital technology; these individuals are essentially its human capital suppliers. The ease of access to and the compensation demanded by this talent pool directly impact Bajaj Finserv's operational effectiveness and expansion plans.

The Banking, Financial Services, and Insurance (BFSI) sector in India saw a significant increase in hiring in 2023, with reports indicating a 15-20% rise in job openings compared to the previous year. This growth is particularly driven by demand for tech-savvy individuals, highlighting the critical role of talent as a key input for companies like Bajaj Finserv.

Data and Information Providers

Data and information providers, such as those supplying financial data, credit scores, and market intelligence, wield considerable bargaining power. This is because access to accurate and timely data is absolutely crucial for financial services firms like Bajaj Finserv. This data underpins critical functions like credit assessment, in-depth market analysis, and effective risk management. In 2024, the demand for specialized financial data and analytics platforms continued to grow, driven by the increasing complexity of financial markets and regulatory requirements.

Bajaj Finserv, in its pursuit of enhanced digital services, relies heavily on sophisticated data engineering and advanced analytics. The ability to process and interpret vast datasets allows them to offer personalized financial products and services, improving customer experience and operational efficiency. For instance, the global big data and business analytics market was projected to reach over $300 billion in 2024, highlighting the immense value placed on data-driven insights across industries.

- Critical Reliance on Data: Financial services firms are fundamentally dependent on data providers for core operations like credit scoring and market trend analysis.

- Data Provider Influence: Suppliers of specialized financial data, credit ratings, and market intelligence can exert significant influence due to the essential nature of their offerings.

- Bajaj Finserv's Data Strategy: Bajaj Finserv leverages data engineering and analytics extensively to power its digital offerings and improve decision-making.

- Market Growth for Data Services: The market for big data and business analytics services showed robust growth in 2024, underscoring the strategic importance of data providers.

Regulatory Bodies and Policy Makers

Regulatory bodies and policymakers, like the Reserve Bank of India (RBI) and the Insurance Regulatory and Development Authority of India (IRDAI), act as significant influencers on Bajaj Finserv's operations, even if not traditional suppliers. Their directives on capital requirements, lending practices, and customer safeguards directly shape the company's strategies and financial performance.

These regulatory frameworks, particularly those enacted in recent years, have demonstrably strengthened the Indian financial sector. For instance, the RBI's proactive measures have contributed to improved asset quality in the banking sector, with Gross Non-Performing Assets (GNPAs) for Scheduled Commercial Banks falling to a multi-year low. This enhanced stability benefits companies like Bajaj Finserv by creating a more predictable operating environment.

- RBI's Capital Adequacy Norms: Bajaj Finserv, like other NBFCs, must adhere to strict capital adequacy ratios, influencing its lending capacity and risk management.

- IRDAI's Solvency Margins: For its insurance businesses, Bajaj Allianz Life and Bajaj Allianz General, compliance with IRDAI's solvency requirements is crucial for financial health.

- Consumer Protection Regulations: Policies aimed at protecting consumers, such as fair lending practices and transparent product disclosures, increase compliance costs but also build trust.

- Digital Innovation Support: Regulatory encouragement of digital financial services has enabled Bajaj Finserv to expand its reach and operational efficiency through platforms like Bajaj Finserv Direct.

The bargaining power of suppliers for Bajaj Finserv is primarily concentrated among technology providers and data aggregators. These entities can command higher prices or dictate terms if their offerings are unique or critical to Bajaj Finserv's competitive edge. For instance, specialized AI algorithms or proprietary data analytics platforms essential for risk assessment and customer segmentation can give these suppliers significant leverage.

In 2024, the demand for advanced data analytics and AI solutions within the BFSI sector remained exceptionally high, increasing the negotiating power of key technology vendors. Companies like Bajaj Finserv, heavily reliant on these digital tools for operational efficiency and product innovation, face potential cost increases or service limitations if suppliers have limited alternatives.

The availability of skilled talent, particularly in areas like data science and cybersecurity, also represents a form of supplier power. High demand for these professionals in 2023 and 2024 means that specialized talent can negotiate for higher compensation, impacting Bajaj Finserv's operational costs.

| Supplier Type | Key Offerings | Bargaining Power Factors | Impact on Bajaj Finserv |

|---|---|---|---|

| Technology Providers | AI/ML platforms, Digital infrastructure, Software solutions | Uniqueness of technology, Switching costs, Availability of alternatives | Potential for increased software licensing fees, dependency on specific vendors |

| Data Aggregators | Financial data, Credit scores, Market intelligence | Data accuracy, Timeliness, Exclusivity of data access | Higher data acquisition costs, reliance on data quality for decision-making |

| Skilled Workforce | Data scientists, AI specialists, Financial analysts | Demand-supply gap for talent, Specialized skill sets | Increased recruitment and retention costs, potential impact on project timelines |

What is included in the product

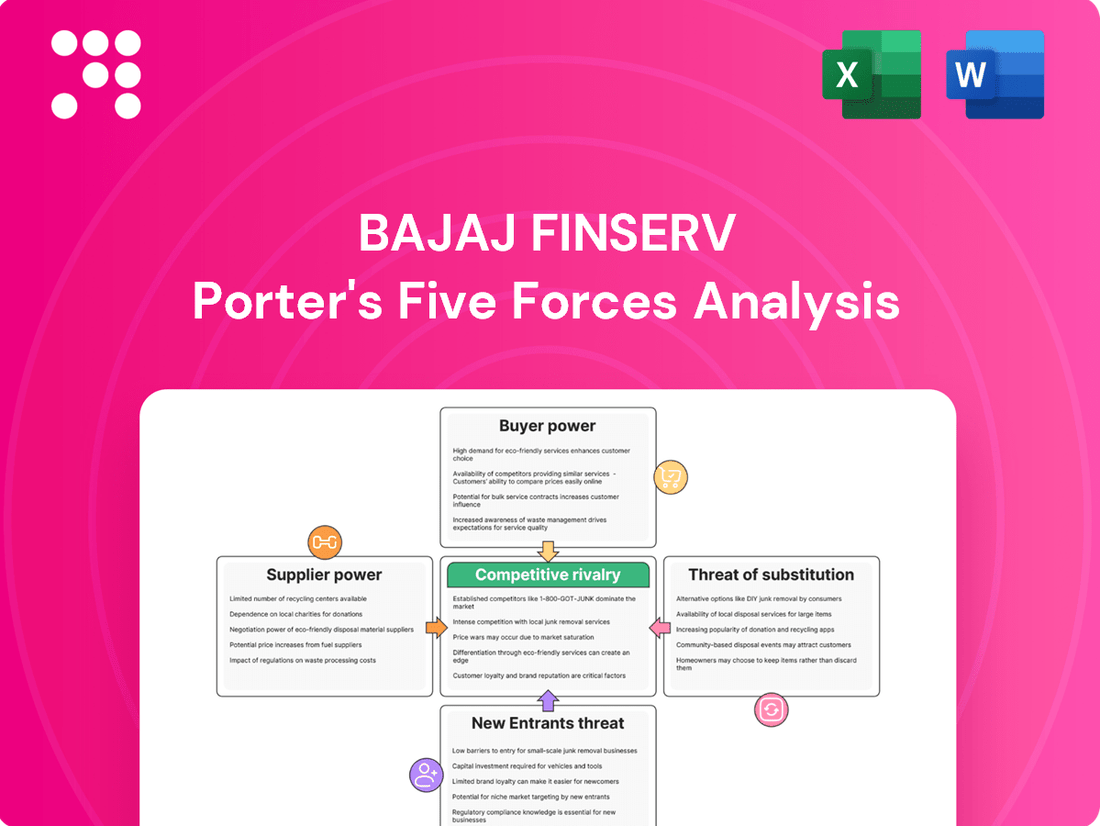

This analysis of Bajaj Finserv's competitive landscape reveals the intensity of rivalry, buyer and supplier power, threat of substitutes, and barriers to entry within the financial services sector.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each Porter's Five Forces, empowering Bajaj Finserv Porter to proactively address market pressures.

Customers Bargaining Power

Bajaj Finserv's broad customer base, spanning individuals and corporations across lending, insurance, and wealth management, naturally dilutes the bargaining power of any single customer group. By serving a diverse market, the company reduces its reliance on any one segment, thereby strengthening its position.

The company's strategic focus on becoming a financial lifecycle partner for India's mass-affluent and middle-income demographics further solidifies this. This approach allows Bajaj Finserv to offer a wide range of integrated financial solutions, making it harder for individual customers to exert significant leverage. For instance, as of March 2024, Bajaj Finserv's customer base for its lending business alone exceeded 50 million individuals, demonstrating the sheer scale and diversification.

Customers today have an unprecedented amount of financial information at their fingertips, thanks to the internet and digital channels. This easy access allows them to meticulously compare loan rates, insurance policies, and investment options from various companies, significantly increasing their bargaining power. For instance, in 2024, the widespread use of financial comparison websites and apps means a customer can get multiple quotes for a home loan in minutes, putting pressure on lenders like Bajaj Finserv to offer competitive pricing.

Bajaj Finserv itself contributes to this trend with its robust digital presence, including the Bajaj Finserv app and website. While these platforms offer convenience and a wide array of financial products, they also highlight the ease with which customers can switch providers if better deals are available elsewhere. This digital accessibility means that customer loyalty is increasingly tied to competitive offerings and superior digital experiences, rather than traditional brand recognition alone.

For Bajaj Finserv, switching costs for customers vary significantly by product. For instance, exiting a long-term home loan or a complex insurance policy can involve substantial paperwork, potential penalties, and the need to re-underwrite, creating moderate to high switching costs. This limits their ability to easily switch to a competitor, thus reducing their bargaining power.

Conversely, for more commoditized offerings like short-term personal loans or digital wallet services, the ease of opening new accounts and transferring funds means switching costs are considerably lower. In 2024, the increasing prevalence of fintech solutions offering seamless onboarding further drives down these costs. This low-switching-cost environment empowers customers to readily compare and switch providers, thereby increasing their bargaining power.

Price Sensitivity of Customers

Customers, particularly in the mass-market and consumer finance sectors, often exhibit considerable price sensitivity. This is especially true for financial products that are largely standardized, where minor differences in interest rates or fees can sway decisions. For instance, in the personal loan segment, a 0.5% difference in interest rate can significantly impact a borrower's choice.

Bajaj Finserv operates within a highly competitive financial landscape. In this environment, pricing frequently emerges as a critical factor for differentiation. Companies must constantly evaluate their pricing strategies to remain attractive to a broad customer base.

- Price Sensitivity: Customers in mass-market segments like personal loans and consumer durables financing are highly sensitive to interest rates and fees.

- Competitive Pricing: Bajaj Finserv faces intense competition from banks and other NBFCs, necessitating competitive pricing to attract and retain customers.

- Product Standardization: For many of its offerings, particularly in consumer finance, products are relatively standardized, amplifying the importance of price as a decision factor.

- Value Proposition: While price is important, Bajaj Finserv also leverages its extensive distribution network and digital offerings as part of its value proposition to mitigate pure price competition.

Customer Loyalty and Relationship Management

Bajaj Finserv's focus on building robust customer loyalty and relationships is a key strategy to mitigate the bargaining power of customers. By offering personalized services and efficient grievance redressal, the company aims to foster a sense of trust and commitment, making customers less likely to switch providers based on price alone.

Customer centricity is at the core of Bajaj Finserv's operations, driving efforts to enhance the overall customer experience. This includes proactive communication, tailored product offerings, and seamless digital interactions, all designed to deepen engagement and reduce the perceived value of alternative options.

- Customer Retention: Bajaj Finserv's strategies aim to increase customer lifetime value by minimizing churn.

- Personalized Offers: Tailoring financial products and services based on individual customer needs and behaviors.

- Service Excellence: Investing in digital platforms and customer support to ensure a superior and responsive experience.

- Loyalty Programs: Developing initiatives that reward long-term customer relationships and encourage repeat business.

Bajaj Finserv's vast customer base, exceeding 50 million individuals in its lending business alone as of March 2024, significantly dilutes the bargaining power of any single customer. This scale, combined with a diverse product portfolio across lending, insurance, and wealth management, reduces dependence on any one customer segment.

While digital channels and comparison platforms in 2024 empower customers with easy access to competitive pricing, Bajaj Finserv mitigates this by offering integrated financial solutions and focusing on customer loyalty. The company's digital presence, while enabling comparison, also serves to deepen engagement and provide a superior customer experience, making switching less attractive for many.

Switching costs for customers vary; complex products like long-term loans or insurance have moderate to high switching costs, limiting customer leverage. Conversely, low-switching-cost products, increasingly prevalent with fintech solutions, empower customers to switch easily, increasing their bargaining power in those segments.

| Factor | Impact on Bajaj Finserv | Mitigation Strategy |

| Customer Scale & Diversification | Lowers individual customer bargaining power. | Serving a broad market reduces reliance on any single customer group. |

| Digital Information Access | Increases customer ability to compare and switch. | Focus on customer centricity, personalized offers, and superior digital experience. |

| Switching Costs | Varies by product; low for commoditized, high for complex. | Leveraging high switching costs for certain products; enhancing value for low-cost products. |

| Price Sensitivity | High for standardized products, driving price competition. | Balancing competitive pricing with value-added services and loyalty programs. |

What You See Is What You Get

Bajaj Finserv Porter's Five Forces Analysis

This preview showcases the complete Bajaj Finserv Porter's Five Forces Analysis, detailing the competitive landscape of the financial services sector. You're viewing the exact, professionally formatted document you'll receive instantly upon purchase, providing a comprehensive understanding of industry rivalry, buyer bargaining power, supplier power, threat of new entrants, and the threat of substitutes. This allows for immediate strategic planning and decision-making without any discrepancies.

Rivalry Among Competitors

Bajaj Finserv operates within a fiercely competitive Indian financial services landscape. This includes a vast array of public and private sector banks, established non-banking financial companies (NBFCs), and a rapidly expanding fintech sector.

The sheer volume of players is significant, with Bajaj Finserv contending against over 1215 active competitors. This intense rivalry comes from both traditional financial institutions and innovative digital platforms.

Key competitors such as Angel One, Upstox, and Groww, among others, are actively vying for market share. These entities offer a range of financial products and services, directly challenging Bajaj Finserv's customer base and growth strategies.

Competitors in India's financial services sector are notably aggressive, especially in digital lending and customer acquisition. For instance, many fintech companies are rapidly expanding their reach, leveraging technology to offer quicker loan approvals and personalized services.

The broader Banking, Financial Services, and Insurance (BFSI) industry is in a state of flux, heavily influenced by technological advancements and evolving customer expectations. This dynamic environment fuels intense competition as firms vie for market share.

In 2023, the Indian digital lending market saw substantial growth, with transaction volumes increasing significantly. This surge is a testament to the aggressive strategies employed by various players to capture a larger piece of the expanding market.

While Bajaj Finserv boasts a broad range of financial services, a significant portion of these products, like basic loans and insurance, can become commoditized. This means competitors can easily offer similar items, intensifying the battle for customers. The real fight lies in how well companies can stand out.

Bajaj Finserv actively combats this by focusing on differentiation through technology and superior customer service. For instance, their investment in artificial intelligence (AI) aims to personalize customer experiences and streamline processes, making their offerings more attractive than generic alternatives. This strategic push for innovation is crucial in a market where many products are functionally similar.

Market Growth and Opportunities

India's financial services sector is expanding rapidly, fueled by digital adoption, rising incomes, and efforts to include more people in the formal financial system. This expansion, while presenting significant opportunities, also means more companies are competing fiercely for customers.

The projected growth of India's GDP in FY2025 is expected to further boost the demand for a wide array of financial products and services, intensifying this competitive landscape.

- Digitalization Drive: Increased internet penetration and smartphone usage are enabling new fintech players and traditional institutions to reach a wider audience, creating a more crowded market.

- Rising Disposable Income: As more Indians earn more, their need for savings, investments, insurance, and credit grows, attracting a multitude of providers eager to capture this demand.

- Financial Inclusion Focus: Government initiatives aimed at bringing unbanked populations into the formal financial system open up new customer segments, which all players are targeting.

- Intensified Competition: The confluence of these factors means that established players like Bajaj Finserv face robust competition from both traditional banks and agile fintech startups, all vying for market share in a dynamic environment.

Regulatory Landscape and Consolidation

The financial services sector, including companies like Bajaj Finserv, operates within an increasingly complex and dynamic regulatory environment. While regulations aim to foster stability and consumer protection, they can significantly alter competitive dynamics. For instance, new capital adequacy norms or data privacy mandates can increase operational costs and compliance burdens, potentially favoring larger, more established players who can absorb these expenses more readily. This can lead to a natural consolidation trend as smaller entities struggle to keep pace.

In 2024, regulatory bodies globally continued to emphasize robust oversight. For example, the Reserve Bank of India (RBI) has been proactive in strengthening governance and risk management frameworks for non-banking financial companies (NBFCs), a category Bajaj Finserv falls into. Such actions, while intended to ensure market integrity, can also act as a barrier to entry and encourage mergers and acquisitions as companies seek scale to manage compliance efficiently. The commitment to strong supervision was further evidenced by specific directives on digital lending practices and cybersecurity, impacting how all players, including Bajaj Finserv, conduct their business and manage their competitive positioning.

- Evolving Regulations: New compliance requirements can increase operational costs and favor larger, established players, potentially driving consolidation within the financial services industry.

- RBI's Stance: In 2024, the Reserve Bank of India continued its focus on strengthening governance and risk management for NBFCs, influencing competitive strategies.

- Impact on Competition: Regulatory actions, such as those concerning digital lending and cybersecurity, can reshape market dynamics by imposing stricter operational standards.

- Consolidation Drivers: The need to manage increased compliance burdens and achieve economies of scale can encourage mergers and acquisitions among financial service providers.

Competitive rivalry within India's financial services sector is exceptionally intense, driven by a vast number of players including banks, NBFCs, and fintechs. Bajaj Finserv faces significant competition from established entities and agile startups alike. For instance, in 2023, the digital lending market saw substantial growth, indicating aggressive strategies from competitors vying for market share.

Key competitors like Angel One, Upstox, and Groww are actively challenging Bajaj Finserv by offering a diverse range of financial products and services. This rivalry is amplified by rapid technological advancements and evolving customer expectations, pushing all firms to innovate and differentiate. The projected GDP growth for FY2025 in India is expected to further fuel this competition as demand for financial services rises.

| Competitor Type | Number of Players (Approx.) | Key Competitive Actions |

|---|---|---|

| Public Sector Banks | 12+ | Aggressive deposit rates, wide branch networks |

| Private Sector Banks | 20+ | Digital-first offerings, personalized customer service, competitive loan products |

| NBFCs | 9,000+ | Niche lending, faster approvals, flexible terms |

| Fintech Companies | 1,000+ | Disruptive technology, low-cost services, gamified investing platforms |

SSubstitutes Threaten

The rapid expansion of digital payment platforms like UPI, mobile wallets, and Buy Now Pay Later (BNPL) services presents a strong threat of substitutes for Bajaj Finserv's traditional lending and payment offerings. These digital solutions provide consumers with convenient and often cheaper alternatives for transactions and credit access.

Unified Payments Interface (UPI) has been a game-changer in India, facilitating over 10 billion transactions in the first half of 2024 alone, demonstrating its widespread adoption and a clear substitute for many of Bajaj Finserv's payment-related services.

BNPL services, in particular, directly compete with Bajaj Finserv's consumer finance products by offering instant credit at the point of sale, potentially diverting customers seeking short-term financing for purchases.

Direct Peer-to-Peer (P2P) lending platforms represent a significant threat of substitutes for Bajaj Finserv's traditional lending products. These platforms connect individual borrowers directly with individual lenders, often bypassing traditional financial institutions and offering potentially more competitive interest rates. For instance, the P2P lending market in India has seen substantial growth, with platforms facilitating billions of dollars in loans, providing an alternative for consumers seeking personal loans or business financing outside of conventional banking channels.

Informal lending channels, particularly prevalent in rural and semi-urban regions, continue to pose a threat of substitution. These sources, often community-based or individual lenders, offer accessible credit to segments underserved by traditional banking, providing a readily available alternative for immediate financial needs.

Non-Banking Financial Companies (NBFCs) like Bajaj Finserv are strategically positioned to capture these market segments. For instance, in 2023, the Reserve Bank of India reported that NBFCs disbursed loans to over 20 million new customers, many of whom might have previously relied on informal sources, highlighting the competitive landscape.

Self-Financing and Internal Accruals

For entities with strong cash flow, like Bajaj Finserv's corporate clients or affluent individual customers, utilizing retained earnings or internal cash reserves directly bypasses the need for traditional lending. This significantly dampens the demand for external financing options, presenting a direct substitution threat.

In 2024, many Indian corporations demonstrated robust internal accruals. For instance, the aggregate net profit of Nifty 50 companies in FY24 was projected to grow by over 20%, indicating substantial internal funds available for business expansion or debt repayment, thus reducing reliance on external finance.

- Reduced Demand for Lending: Self-financing directly substitutes the need for loans and credit facilities.

- Impact on Financial Institutions: Lower demand for borrowing can affect the revenue streams of lenders like Bajaj Finserv.

- Corporate Financial Health: Strong internal accruals in 2024 suggest a growing capacity for self-funding among businesses.

- Individual Wealth Accumulation: High net worth individuals can also opt for self-financing, impacting the retail lending market.

Alternative Investment Avenues

Investors can choose direct equity investments, offering potential for higher returns but also greater risk, as a substitute for Bajaj Finserv's mutual funds. In 2023, India's equity market saw significant inflows, with retail investors actively participating in direct stock purchases, demonstrating a clear alternative. Real estate also remains a popular substitute, especially for those seeking tangible assets and rental income, with property registrations across major Indian cities showing a steady upward trend in 2024.

Other asset classes, such as gold, bonds, and even alternative investments like peer-to-peer lending platforms, present further substitutes. These options cater to different risk appetites and investment goals, diverting potential capital away from Bajaj Finserv's structured products. For instance, the global gold market experienced price volatility in early 2024, attracting investors seeking safe-haven assets.

- Direct equity investments offer higher potential returns but come with increased risk compared to mutual funds.

- Real estate provides tangible assets and potential rental income, serving as a popular alternative to financial products.

- Gold and bonds are considered safe-haven assets, attracting investors during times of economic uncertainty.

- Alternative investment platforms, like P2P lending, offer diversified options outside traditional financial instruments.

Digital payment platforms like UPI and mobile wallets offer convenient alternatives to Bajaj Finserv's payment services, with UPI transactions exceeding 10 billion in the first half of 2024. Buy Now Pay Later (BNPL) services directly challenge consumer finance products by providing instant point-of-sale credit. P2P lending platforms also serve as a growing substitute for traditional loans, with significant market growth facilitating billions in loans.

| Substitute Type | Example | 2024 Impact/Trend | Bajaj Finserv Offering |

| Digital Payments | UPI, Mobile Wallets | Over 10 billion UPI transactions (H1 2024) | Payment processing, EMI services |

| Point-of-Sale Credit | BNPL Services | Direct competition for consumer purchases | Consumer loans, financing |

| Alternative Lending | P2P Lending Platforms | Facilitating billions in loans, growing market | Personal loans, business loans |

| Self-Financing | Internal Corporate Accruals | Nifty 50 profit growth >20% (FY24) | Corporate lending |

Entrants Threaten

The financial services landscape has seen a dramatic shift with the advent of FinTech, significantly lowering the hurdles for new companies to enter the market. Digital-first models, in particular, can leverage scalable technology and leaner operational costs, allowing them to compete effectively against established institutions. For instance, digital challenger banks have demonstrated robust growth, with some reporting compound annual growth rates (CAGR) exceeding 30% in recent years, showcasing the disruptive potential of these new entrants.

The Indian financial services sector, while embracing digital transformation, remains a heavily regulated industry. New entrants face significant hurdles due to stringent licensing requirements and compliance norms, particularly for businesses involved in deposit-taking or insurance operations. For instance, the Reserve Bank of India (RBI) mandates specific capital requirements and operational standards for banks and non-banking financial companies (NBFCs), making it challenging for newcomers to establish a foothold.

Establishing a financial services entity, especially one aiming for Bajaj Finserv's broad product range, demands significant upfront capital. For instance, a new Non-Banking Financial Company (NBFC) might need to meet Reserve Bank of India's (RBI) minimum net owned fund requirement, which is currently INR 20 crore for a housing finance company and can be higher for diversified NBFCs, making entry costly.

New entrants often face hurdles in accessing low-cost funding compared to established players. Banks, with their deposit-taking capabilities, generally have a cheaper cost of capital. In 2023-24, the average cost of funds for many NBFCs hovered around 8-10%, whereas banks could access funds at potentially lower rates, creating a competitive disadvantage for newcomers.

Brand Reputation and Customer Trust

Established players like Bajaj Finserv leverage a significant advantage through their strong brand reputation and deeply ingrained customer trust, cultivated over many years of operation. Newcomers face the considerable challenge of matching this established credibility, requiring substantial investment in marketing and brand-building initiatives to even begin attracting a customer base. Bajaj Finserv’s vast customer franchise, exceeding 101 million as of March 31, 2025, underscores this loyalty and the high barrier to entry for new competitors seeking to gain market share.

The threat of new entrants is therefore mitigated by the sheer difficulty and cost associated with replicating Bajaj Finserv's brand equity.

- Brand Recognition: Bajaj Finserv benefits from decades of consistent service and visible presence.

- Customer Trust: Long-standing relationships translate into a loyal customer base.

- Marketing Investment: New entrants must allocate significant resources to build awareness and trust.

- Customer Franchise: Bajaj Finserv's 101+ million customers (as of March 31, 2025) represent a formidable advantage.

Technological Advancements and Innovation

Technological advancements, while lowering barriers for new entrants in financial services, also demand constant innovation to maintain a competitive edge. Bajaj Finserv recognizes this, actively pursuing a transformation into a FINAI company, embedding artificial intelligence throughout its operations to boost customer experience and drive expansion.

For instance, in 2024, the company continued its focus on leveraging AI and machine learning for personalized customer offerings and efficient risk management. This strategic shift is crucial as competitors can rapidly adopt new technologies, potentially disrupting the market.

- Bajaj Finserv's FINAI transformation aims to integrate AI across its business verticals.

- Investment in innovation is critical to counter the threat of technologically adept new entrants.

- AI adoption in 2024 focused on enhancing customer satisfaction and operational efficiency.

- Digital capabilities are a key factor in determining the ease with which new players can enter the market.

The threat of new entrants for Bajaj Finserv is moderate, primarily due to high capital requirements and regulatory hurdles in the Indian financial services sector. While FinTech has lowered some barriers, stringent licensing and compliance, such as RBI's minimum net owned fund requirements for NBFCs (e.g., INR 20 crore for housing finance), make it challenging for newcomers to establish a significant presence and replicate Bajaj Finserv's extensive product offerings.

Despite technological advancements enabling digital-first models, established players like Bajaj Finserv benefit from substantial brand equity and customer trust, evidenced by their customer base exceeding 101 million as of March 31, 2025. New entrants must invest heavily in marketing to build comparable credibility, a significant cost that deters many potential competitors.

Furthermore, access to low-cost funding remains a key differentiator; banks typically have a cheaper cost of capital than NBFCs, whose funding costs in 2023-24 averaged 8-10%. Bajaj Finserv's ongoing FINAI transformation, focusing on AI integration for customer experience and efficiency, also raises the technological bar for new entrants.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Bajaj Finserv leverages data from annual reports, investor presentations, and financial news outlets to understand industry dynamics and competitive pressures.