Bajaj Finserv Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bajaj Finserv Bundle

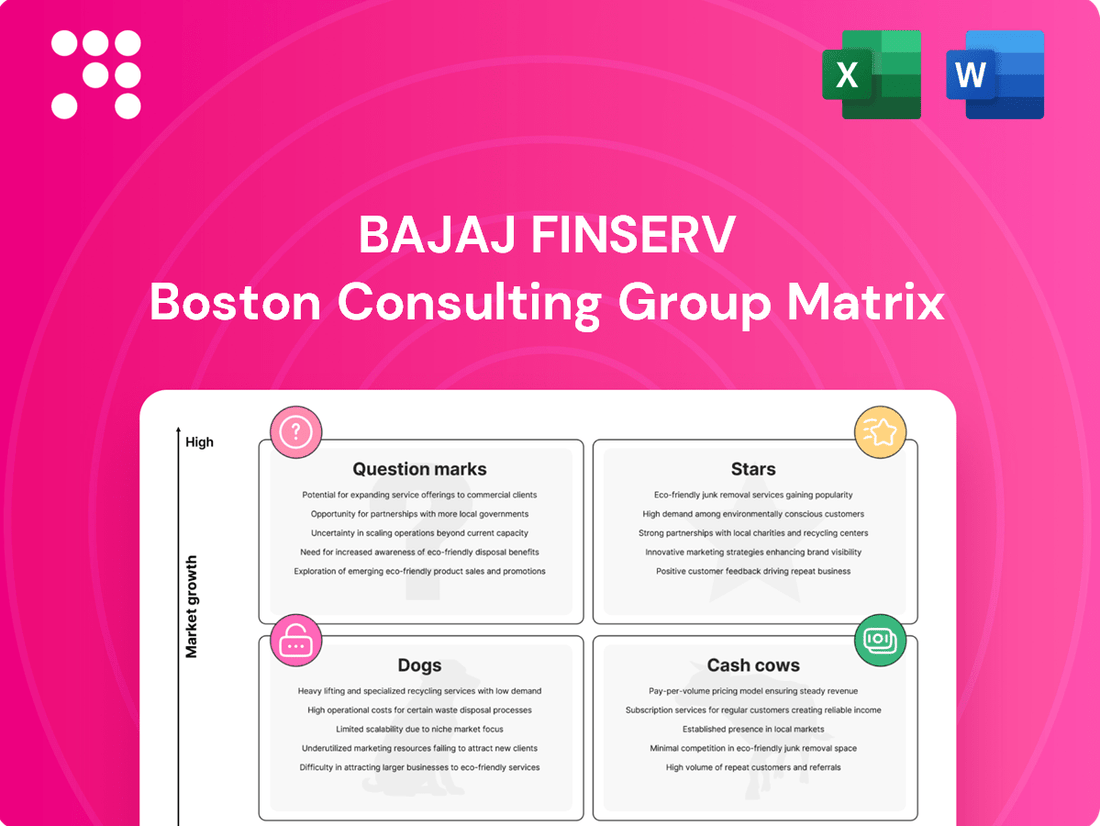

Curious about Bajaj Finserv's strategic positioning? Our BCG Matrix analysis reveals its key product portfolio segments, highlighting potential growth areas and areas needing attention. Understand where Bajaj Finserv's offerings fit as Stars, Cash Cows, Dogs, or Question Marks.

Unlock the full potential of your strategic planning by diving into the complete Bajaj Finserv BCG Matrix. Gain a comprehensive understanding of each quadrant's implications and discover actionable insights to optimize your investment and product development decisions.

Don't miss out on the detailed breakdown and strategic recommendations that the full Bajaj Finserv BCG Matrix provides. Purchase now to gain a competitive edge and confidently navigate the market landscape.

Stars

Bajaj Finance, a flagship entity of Bajaj Finserv, stands as a formidable force in India's Non-Banking Financial Company (NBFC) landscape. Its lending operations are characterized by robust expansion, evident in its rapidly growing Assets Under Management (AUM) and an ever-increasing customer base.

As of June 30, 2025, Bajaj Finance reported a substantial year-on-year AUM growth of 25%, reaching ₹441,450 crore. Complementing this, its customer franchise expanded by a significant 21% to 106.51 million individuals.

The company's momentum is further underscored by a strong performance in new loan bookings, which saw a 23% increase in the first quarter of fiscal year 2026. This impressive growth trajectory, coupled with a substantial market share in a burgeoning sector, firmly places Bajaj Finance in the 'Star' category within the BCG Matrix.

Bajaj Finance's consumer finance segment, encompassing popular offerings like consumer durable loans and personal loans, stands out with its substantial market share and robust growth trajectory. This segment is a key driver for the company, reflecting a strong demand for accessible credit solutions among Indian consumers.

The digital prowess of Bajaj Finance is clearly evident in this segment, with the company disbursing over ₹20,000 crore in personal loans digitally during FY2025. This impressive figure underscores the successful integration and widespread adoption of their digital lending platforms, catering to a growing digitally-savvy customer base.

Several macro-economic factors are fueling the expansion of this segment. The rising tide of consumerism across India, coupled with increasingly simplified access to credit, creates a fertile ground for growth. These trends are particularly pronounced in India's dynamic and rapidly evolving financial landscape, positioning Bajaj Finance favorably.

Bajaj Finserv's digital lending, primarily through Bajaj Finance, is a significant growth driver, demonstrating strong market acceptance and expansion. The company is actively integrating AI chatbots into its loan disbursement and customer service processes, which is crucial for operational efficiency and broader customer engagement.

The 'Loan Utsav' campaign, prominently featured on the Bajaj Finserv App, underscores a strategic emphasis on digital platforms for business loan distribution. This initiative signals a determined effort to capture a larger share of the rapidly expanding digital finance sector.

Bajaj Housing Finance

Bajaj Housing Finance (BHFL), a key subsidiary of Bajaj Finance, stands out as one of India's largest and most rapidly expanding home finance entities. Its robust financial performance underscores its position as a Star in the Bajaj Finserv group's business portfolio.

BHFL demonstrated significant growth, reporting a 21% increase in profit after tax for the first quarter of FY26. Furthermore, its Assets Under Management (AUM) saw a substantial 26% expansion throughout FY2025, reflecting strong market traction.

- Strong Profit Growth: BHFL's profit after tax grew by 21% in Q1 FY26.

- Expanding AUM: Assets Under Management increased by 26% in FY2025.

- Market Position: BHFL is a leading player in the growing Indian mortgage sector.

- Strategic Importance: Its performance solidifies its Star status within Bajaj Finserv's BCG matrix.

Strategic Acquisitions and Partnerships

Bajaj Finserv actively pursues strategic acquisitions and partnerships to bolster its market standing. A prime example is its acquisition of Allianz SE's 26% stake in both Bajaj Allianz General Insurance and Bajaj Allianz Life Insurance, a move designed to solidify its dominance in the Indian insurance landscape.

These strategic maneuvers underscore Bajaj Finserv's commitment to proactive growth, particularly within the burgeoning Indian insurance sector. The company also emphasizes expanding its reach into Tier 2 and Tier 3 cities, a clear indicator of its growth-oriented strategy.

- Market Consolidation: Bajaj Finserv’s acquisition of Allianz SE's stakes in its insurance joint ventures signifies a strong intent to consolidate its market leadership.

- Sector Growth Focus: The company is strategically positioning itself to capitalize on the significant growth potential observed in India's insurance markets.

- Geographic Expansion: Expanding its presence in Tier 2 and Tier 3 cities is a key component of Bajaj Finserv's broader growth strategy, aiming for wider market penetration.

Bajaj Finance and Bajaj Housing Finance are prime examples of Stars within the Bajaj Finserv portfolio. Their significant market share and high growth rates in their respective segments, consumer finance and home loans, place them firmly in this category. This is supported by their robust financial performance and strategic initiatives aimed at further market penetration.

| Business Unit | BCG Category | Key Growth Drivers | Recent Performance (Illustrative) |

| Bajaj Finance (Consumer Finance) | Star | Digital lending, personal loans, consumer durable loans, rising consumerism | AUM growth of 25% (YoY June 30, 2025), 106.51 million customers (+21% YoY) |

| Bajaj Housing Finance | Star | Growing Indian mortgage sector, expansion into Tier 2/3 cities | AUM growth of 26% (FY2025), Profit after tax growth of 21% (Q1 FY26) |

What is included in the product

This BCG Matrix overview analyzes Bajaj Finserv's business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

The Bajaj Finserv BCG Matrix provides a clear, one-page overview of business unit potential, alleviating the pain of strategic uncertainty.

Cash Cows

Bajaj Allianz General Insurance (BAGIC) stands as a strong Cash Cow within the Bajaj Finserv portfolio, evidenced by its position as the second-largest private general insurer in India. With a notable market share of 7.5% as of 10M FY2025, BAGIC consistently generates substantial cash flow from its mature operations.

Despite facing some accounting shifts and reliance on tender-driven business, BAGIC’s fundamental business segments are outperforming the broader industry’s growth trajectory. This resilience is underpinned by robust financial health, including a solvency ratio of 3.00 times as of December 31, 2024, and healthy internal accruals, ensuring its capacity to produce significant cash for the group.

Bajaj Allianz Life Insurance stands as a prime example of a cash cow within Bajaj Finserv's portfolio. Its robust market position and consistent financial performance, evidenced by a 23% growth in gross written premium for the quarter ending September 30, 2024, highlight its status as a reliable revenue generator. This strong growth, coupled with a significant 34% increase in Individual Rated New Business during the same period, underscores its ability to consistently attract and retain customers, thereby fueling cash flow for the parent company.

The company's financial health is further bolstered by a high solvency ratio of 4.32, indicating a strong capital base and operational stability. This financial prudence, combined with a strategic emphasis on broadening its distribution network, allows Bajaj Allianz Life Insurance to efficiently convert its market share into substantial cash inflows, solidifying its role as a key cash cow for Bajaj Finserv.

Bajaj Finserv boasts a robust portfolio of established financial products, notably fixed deposits and a diverse range of lending solutions offered by Bajaj Finance. These offerings are firmly entrenched in mature markets and command a significant market share, reflecting their long-standing presence and customer trust.

These mature products are the company's cash cows, consistently generating substantial and predictable cash flows. This stability is a direct result of Bajaj Finserv's extensive customer base and highly efficient operational framework, honed over years of service.

Despite facing increased provisioning requirements in certain lending segments, Bajaj Finserv has demonstrated an impressive ability to maintain stable profit margins. This resilience further solidifies the cash-generating power of these core financial products.

Investment Solutions (Established Offerings)

Bajaj Finserv's established investment solutions, often referred to as Cash Cows in the BCG matrix, represent its mature and reliable offerings. These products, with their long operational history and loyal customer base, are significant contributors to the company's overall cash flow. While they may not be in rapidly expanding market segments, their consistent performance, driven by customer retention and a steady income from fees and commissions, solidifies their position as profit generators.

The strategy for these Cash Cows centers on maximizing profitability through operational efficiency and infrastructure support. By focusing on cost management and streamlining processes, Bajaj Finserv ensures that these established offerings continue to yield strong returns. This approach allows the company to leverage its existing market presence and customer relationships effectively.

- Stable Revenue Streams: Established investment products consistently generate revenue through management fees and commissions, contributing significantly to Bajaj Finserv's financial stability. For instance, in FY24, Bajaj Finserv reported a consolidated profit after tax of ₹7,950 crore, with a substantial portion likely attributable to its mature offerings.

- Customer Loyalty: A long operational history fosters deep customer trust and loyalty, reducing customer acquisition costs and ensuring a predictable income base for these offerings.

- Profitability Focus: Investments in infrastructure and efficiency improvements for these mature products are key to maximizing their profit margins, ensuring they remain strong cash generators for the company.

Large Customer Franchise

Bajaj Finserv's extensive customer franchise, numbering 92 million active customers as of early 2024, is a significant asset, with ambitious plans to expand this to 250 million by 2029. This vast customer base acts as a bedrock for its cash cow segments, ensuring consistent demand for its established financial products and services.

The sheer size of this customer base translates into predictable and substantial revenue streams, a hallmark of a cash cow. This stability allows Bajaj Finserv to generate consistent profits with relatively low investment needs for these core offerings.

Furthermore, the company leverages this large franchise for cross-selling and upselling opportunities. By offering a wider array of financial products to its existing, loyal customers, Bajaj Finserv enhances revenue per customer and strengthens the cash cow status of its core businesses.

- Customer Base Growth: 92 million active customers (early 2024) with a target of 250 million by 2029.

- Revenue Stability: Consistent demand for core financial products ensures sustained revenue generation.

- Cross-selling Potential: Ability to offer additional products to existing customers boosts revenue per customer.

- Low Investment Needs: Mature products require minimal reinvestment, maximizing cash flow.

Bajaj Finance's consumer durable loans and personal loans are quintessential cash cows. These segments, characterized by high demand and established market penetration, consistently generate significant cash flow for Bajaj Finserv. The company's strong brand recall and extensive distribution network further solidify their position as reliable profit centers.

These mature lending products benefit from economies of scale and operational efficiencies, allowing them to maintain healthy profit margins even with competitive interest rates. The predictable cash generation from these segments supports investment in other growth areas within Bajaj Finserv's diverse portfolio.

Bajaj Finance's focus on customer convenience and digital lending platforms enhances its ability to capture market share and drive repeat business, further strengthening the cash cow status of its core lending products. This strategic approach ensures sustained cash inflows, contributing to the overall financial strength of Bajaj Finserv.

| Product Segment | Market Position | Cash Flow Generation | Key Strengths |

| Consumer Durable Loans | Leading market share in a mature segment | High and consistent | Strong brand, wide distribution, repeat business |

| Personal Loans | Significant market presence | Substantial and predictable | Customer trust, operational efficiency, digital capabilities |

Preview = Final Product

Bajaj Finserv BCG Matrix

The Bajaj Finserv BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after purchase. Rest assured, this is not a sample or a demo; it's the complete, analysis-ready report, free from watermarks and ready for your strategic planning needs.

Dogs

While Bajaj Finance's overall loan book is robust, certain newer, smaller segments like microfinance loans might currently show a low market share and lower profitability. These microfinance loans, which started at ₹1,556 crore in bookings, require close observation to prevent them from becoming a drain on resources.

If these microfinance operations consistently struggle to capture market share or achieve profitability, they could be categorized as dogs within the BCG matrix. This classification would highlight the need for a strategic review to either revitalize these operations or consider divestment.

Within Bajaj Finserv's diverse lending offerings, certain niche products, like specialized equipment financing for emerging industries or bespoke loans for niche professional services, might fall into the Dogs category. These segments, while potentially serving specific client needs, often face intense competition from established players or alternative financing methods, limiting their ability to gain significant market traction.

These products may require substantial investment in marketing and tailored operational support to attract and retain a small customer base. For instance, a specialized loan for artisanal craft businesses, while valuable to that segment, might struggle to achieve the scale necessary for profitability, potentially consuming cash without generating substantial returns. In 2024, such products might represent a very small percentage of Bajaj Finserv's overall loan book, perhaps less than 0.5% of total assets under management, with limited growth projections.

Digital platforms or services within Bajaj Finserv that haven't achieved significant user adoption or have been surpassed by newer competitor offerings would fall into the "Dogs" category of the BCG matrix. These underperforming digital assets often represent a considerable investment but yield minimal returns, acting as a drag on financial resources. For instance, if a proprietary mobile app launched in 2022 for a niche financial product saw only a 0.5% adoption rate among the target demographic by the end of 2023, it might be considered a Dog.

These "Dogs" are characterized by low user engagement and struggle to generate substantial revenue or capture meaningful market share. Their continued existence consumes valuable resources – development, maintenance, and marketing – without contributing positively to Bajaj Finserv's overall growth trajectory. For example, a digital lending portal that facilitated less than 1% of the company's total loan disbursals in the first half of 2024, despite significant marketing spend, would fit this description.

The critical imperative for Bajaj Finserv is to continuously innovate its digital ecosystem. Failing to do so risks allowing even current offerings to become obsolete and fall into the "Dogs" category. By Q4 2024, if a digital investment advisory service, initially promising, shows a decline in active users by 15% compared to the previous year and fails to attract new clients, it signals a need for strategic reassessment or discontinuation to avoid becoming a persistent drain.

Legacy Products with Declining Demand

Bajaj Finserv's legacy products, such as certain traditional insurance policies or older loan structures, might fall into the Dog category. These offerings face steadily declining demand as consumers shift towards more modern, digital-first financial solutions. For instance, while specific figures for declining demand in legacy products aren't publicly detailed by Bajaj Finserv, the broader trend in the financial services industry shows a significant drop in interest for products that lack digital integration and flexibility.

These products typically exhibit low market growth and a shrinking share, necessitating minimal investment from the company. Their future potential is also quite limited. Bajaj Finserv’s strategy would likely involve reducing its exposure to these segments, potentially through phasing them out or offering them only to a niche customer base that still prefers them, thereby optimizing resource allocation towards growth areas.

- Declining Market Share: Traditional savings plans or endowment policies, for example, have seen a marked decrease in new policy issuances compared to unit-linked or market-linked products.

- Low Growth Outlook: The overall market for these older financial instruments is stagnant or contracting, offering little opportunity for expansion.

- Minimal Investment Focus: Bajaj Finserv would likely allocate minimal capital to marketing or developing these products, focusing instead on their core, high-growth offerings.

- Strategic Divestment/Phasing Out: Companies often look to either sell off such underperforming business lines or gradually discontinue them to streamline operations and improve profitability.

Segments with Deteriorating Asset Quality

Bajaj Finance, while generally strong, faces challenges in specific segments where asset quality is declining. These areas, marked by rising Gross and Net NPAs, signal a need for careful review. For instance, as of June 30, 2025, a noticeable uptick in these non-performing assets was observed compared to the previous year's June 30, 2024 figures, indicating a potential drag on performance.

The increase in loan losses and provisions within these troubled segments directly impacts profitability by reducing the return on capital. This situation suggests that these particular business lines might be candidates for divestment or a significant strategic overhaul to mitigate further financial strain.

- Deteriorating Asset Quality: Certain segments within Bajaj Finance are experiencing a persistent rise in Gross and Net NPAs.

- Financial Impact: This trend leads to increased loan losses and provisions, negatively affecting return on capital and overall profitability.

- Comparative Data: Bajaj Finance reported an increase in Gross and Net NPAs as of June 30, 2025, compared to June 30, 2024.

- Strategic Consideration: Segments with clear deterioration and no immediate recovery prospects may warrant divestiture or strategic re-evaluation.

Within Bajaj Finserv's portfolio, "Dogs" represent business segments or products with low market share and low growth potential. These are often legacy offerings or niche products that struggle to gain traction against more competitive or modern alternatives. For example, certain older insurance policies or specialized loan products for very small, emerging industries might fit this description.

These segments typically require ongoing investment for maintenance or minimal marketing support but generate little in return. By the end of 2024, such offerings might constitute a small fraction of Bajaj Finserv's total revenue, perhaps less than 1%, with limited prospects for significant improvement. The strategic approach for these "Dogs" usually involves minimizing further investment and potentially phasing them out.

For instance, a digital platform launched in 2023 for a niche financial advisory service that saw only a 0.8% adoption rate by Q3 2024, despite a marketing budget of ₹5 crore, would be a prime example of a Dog. Its continued operation consumes resources without contributing meaningfully to overall growth.

Bajaj Finserv's strategy would focus on reallocating capital from these underperforming areas to more promising "Stars" or "Question Marks" to optimize its overall business performance and ensure sustained growth in the evolving financial landscape.

Question Marks

Bajaj Finserv Asset Management is actively expanding its product suite in the burgeoning Indian mutual fund market. Notably, the launch of the Savings+ product on July 11, 2024, and the upcoming Equity Savings Fund (NFO opening July 28, 2025) signals a strategic push into new segments.

While these new offerings are positioned within a high-growth sector, their current market share is minimal due to their recent introduction. This presents a classic BCG Matrix scenario where these products are likely categorized as 'Question Marks,' requiring substantial investment to capture market share.

The Indian mutual fund industry saw substantial inflows in 2024, with retail investor participation reaching new highs. For instance, equity-oriented schemes alone attracted over ₹2.5 lakh crore in net inflows during the first half of 2024. Bajaj Finserv's new products will need to compete aggressively for a share of this expanding investor base.

Bajaj Finserv Health, as part of Bajaj Finserv's strategic portfolio, is positioned as a potential 'Question Mark' due to its focus on the high-growth Indian healthcare technology and services sector. While the sector offers significant expansion opportunities, Bajaj Finserv Health is likely in its nascent stages of market penetration, suggesting a relatively low current market share.

This classification is further supported by the fact that emerging businesses within Bajaj Finserv, which would encompass Bajaj Finserv Health, collectively reported a loss in Q1 FY26. This financial performance highlights the capital-intensive nature of these ventures as they invest heavily to capture market share and establish leadership in their respective domains.

Bajaj Finserv Direct, a digital-first financial services venture, is positioned as a Question Mark in the BCG Matrix. While the direct-to-consumer digital distribution channel in India's financial services sector is experiencing rapid growth, Bajaj Finserv Direct faces established competitors, necessitating substantial investment to build market share.

The company's focus on digital financial services taps into a high-potential market segment. However, achieving significant traction against incumbents will require sustained capital infusion for scaling operations and customer acquisition. This strategic investment is key to transforming Bajaj Finserv Direct from a Question Mark into a potential Star in the future.

Ventures in Emerging Technologies (e.g., AI in finance)

Bajaj Finserv is actively integrating emerging technologies, particularly Artificial Intelligence, into its operations. For instance, AI-powered chatbots are streamlining loan disbursals and enhancing customer service, aiming for greater efficiency and customer satisfaction.

These ventures into AI and machine learning represent significant growth potential within the fintech sector. However, specific new initiatives or advanced AI integrations might still be in their early stages, potentially showing limited immediate market penetration.

The company's exploration of AI in finance, including areas like fraud detection and personalized financial advice, requires substantial capital investment. Successful implementation and adoption are crucial for these initiatives to achieve their projected returns, with the broader AI in finance market projected to reach hundreds of billions of dollars by 2030.

- AI-driven customer service: Bajaj Finserv utilizes AI chatbots for efficient customer interactions.

- Loan disbursement automation: Technology is being employed to speed up and simplify the loan process.

- Exploratory AI applications: Broader uses of AI and machine learning in financial services are under investigation.

- High investment, high potential: These initiatives demand significant funding but offer substantial future rewards.

Expansion into Untapped Rural and Semi-Urban Markets

Bajaj Finserv's strategic push into rural and semi-urban markets, often categorized as Tier 2 and Tier 3 cities, is a key component of its growth strategy. These regions present a significant opportunity due to lower financial product penetration compared to metropolitan areas. For instance, by the end of fiscal year 2023, while urban areas saw higher insurance and lending product adoption, rural and semi-urban segments still offered substantial untapped potential, with many households yet to be fully integrated into formal financial services.

This expansion, however, is not without its challenges. Building a robust presence in these areas necessitates substantial initial investment. Companies like Bajaj Finserv must allocate capital towards establishing physical touchpoints, developing localized marketing campaigns that resonate with the specific needs and cultural nuances of these communities, and training a workforce capable of serving these diverse customer bases. The return on these investments is crucial for these ventures to transition from potential "Question Marks" to "Stars" in the BCG matrix.

- Targeted Expansion: Bajaj Finserv is actively increasing its reach in Tier 2 and Tier 3 cities, aiming to capture a larger share of the underpenetrated financial services market.

- Investment Requirements: Significant upfront capital is needed for infrastructure development, distribution network expansion, and tailored marketing strategies in these new territories.

- Growth Potential: The success of these initiatives hinges on Bajaj Finserv's ability to convert these investments into market share and profitability, thereby elevating these markets to "Star" status.

- Market Penetration Data: In FY23, while urban financial inclusion was higher, rural and semi-urban markets showed considerable room for growth, indicating a strong strategic imperative for expansion.

Bajaj Finserv's new product launches, like the Savings+ and upcoming Equity Savings Fund, are positioned as Question Marks. These require significant investment to capture market share in India's rapidly growing mutual fund industry, which saw over ₹2.5 lakh crore in equity inflows in the first half of 2024.

Bajaj Finserv Health and Bajaj Finserv Direct are also classified as Question Marks. They operate in high-growth sectors but are in early stages with low market share, facing established competitors and requiring substantial capital for expansion and customer acquisition. For example, emerging ventures within Bajaj Finserv reported a collective loss in Q1 FY26, indicating heavy investment.

The company's AI initiatives, while holding significant growth potential in fintech, may also be considered Question Marks if specific new integrations are in early stages with limited market penetration. The AI in finance market is projected to reach hundreds of billions by 2030, underscoring the investment needed for these ventures.

Expansion into Tier 2 and Tier 3 cities represents another area where Bajaj Finserv is investing heavily, aiming to tap into underpenetrated markets. Success here depends on converting these investments into market share, with rural and semi-urban segments showing considerable room for growth as of FY23.

BCG Matrix Data Sources

The Bajaj Finserv BCG Matrix is constructed using a blend of internal financial disclosures, comprehensive market research reports, and publicly available industry data to provide a robust strategic overview.