Auto Trader Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Auto Trader Group Bundle

Auto Trader Group leverages its dominant online marketplace position and strong brand recognition as key strengths, while facing potential threats from evolving digital advertising models and increasing competition. Understanding these dynamics is crucial for anyone looking to invest or strategize within the automotive digital sector.

Want the full story behind Auto Trader Group’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

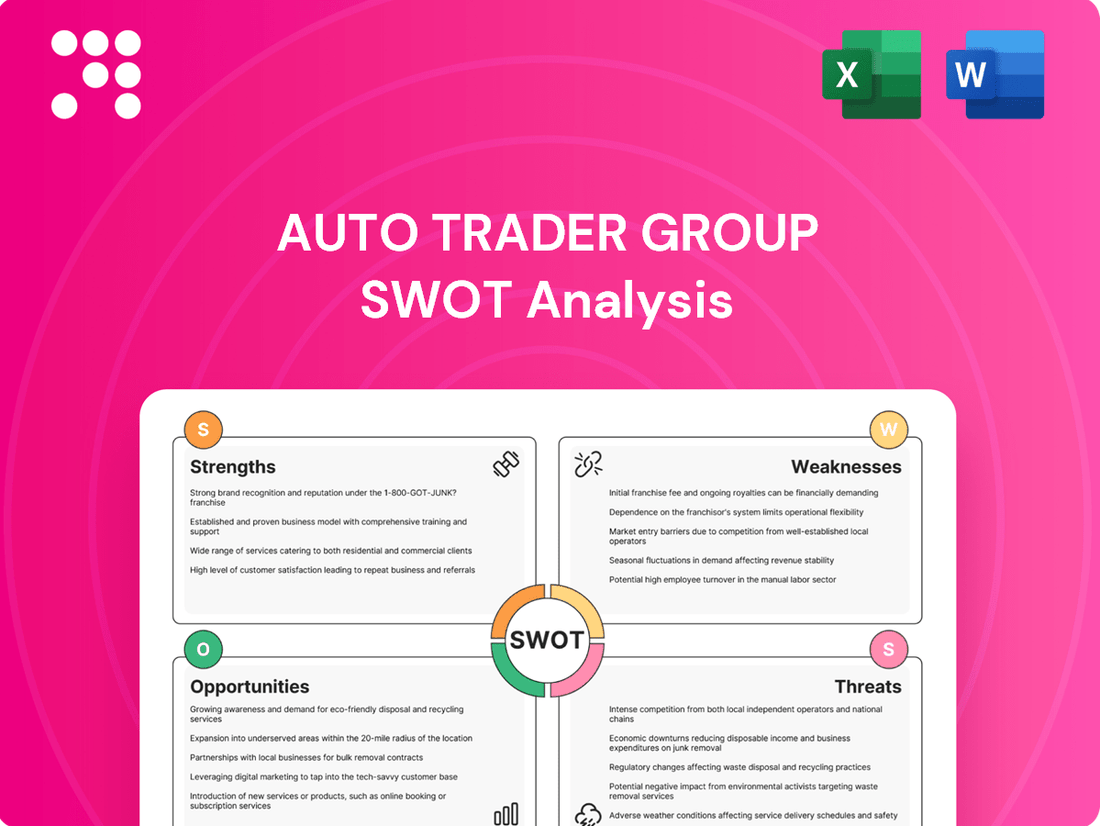

Strengths

Auto Trader Group is the undisputed leader in the UK's digital automotive marketplace, holding a commanding market share. This dominance fosters high brand recognition and trust, a crucial asset in attracting both car buyers and sellers.

In the fiscal year ending June 30, 2024, Auto Trader reported revenue of £511.4 million, underscoring its significant market presence and the value it provides to its users. This strong financial performance is directly linked to its market leadership.

The company benefits from a powerful network effect: more buyers are drawn to the platform due to the extensive inventory, while retailers are attracted by the large, engaged consumer audience. This creates a self-reinforcing cycle that solidifies its competitive advantage.

Auto Trader Group's strength lies in its diverse and resilient revenue streams, primarily fueled by advertising and subscription services catering to car dealerships. This robust model is further enhanced by ancillary offerings such as vehicle valuations, finance solutions, and insurance products, creating multiple touchpoints for generating income.

This diversification significantly reduces the company's dependence on any single revenue source, fostering stability. Subscription models, in particular, provide a predictable recurring revenue stream, making Auto Trader Group less vulnerable to the volatility often seen in purely transactional businesses. For instance, in the fiscal year ending March 2024, Auto Trader reported revenue growth driven by these varied income sources.

Auto Trader's robust digital platform is the engine of its business, designed for scalability and efficiency. This technological backbone allows them to connect millions of buyers and sellers seamlessly. In the fiscal year ending June 2024, Auto Trader reported that its digital advertising revenue grew by 10%, highlighting the platform's effectiveness in monetizing its user base.

Strong Network Effects and Data Insights

Auto Trader Group benefits immensely from strong network effects, fueled by its vast user base and extensive vehicle listings. This creates a virtuous cycle: more buyers attract more sellers, and more sellers, in turn, draw in more buyers, solidifying its dominant market position. For example, in the fiscal year ending March 2024, Auto Trader reported an average of 13.1 million unique monthly users, underscoring the platform's reach.

The sheer volume of interactions on the platform generates a wealth of data, offering Auto Trader unique insights into market dynamics. This includes granular information on consumer preferences, pricing trends, and emerging vehicle demands. These data insights are crucial for informing product enhancements and guiding strategic business decisions, ensuring the platform remains relevant and competitive.

- Dominant User Base: Over 13 million unique monthly users in FY24.

- Extensive Listings: Millions of vehicle listings available at any given time.

- Data-Driven Insights: Proprietary data on consumer behavior and market trends.

- Reinforced Market Leadership: Network effects create a barrier to entry for competitors.

High Profitability and Cash Generation

Auto Trader Group consistently showcases high profitability, a direct result of its dominant digital marketplace. This strong financial performance translates into robust cash generation, providing a solid foundation for ongoing investment in its platform and services.

For the fiscal year ending June 30, 2024, Auto Trader Group reported an operating profit margin of approximately 70%, underscoring its efficient digital-first operational model. This high margin allows for significant reinvestment into technology and innovation, crucial for maintaining market leadership.

The company’s ability to generate substantial cash flow, evidenced by its free cash flow of over £300 million in FY24, empowers strategic flexibility. This financial muscle supports not only organic growth initiatives but also the potential for value-enhancing acquisitions and consistent shareholder returns, demonstrating a resilient and growth-oriented business.

- Strong Operating Margins: Typically exceeding 70% in recent fiscal years, reflecting the efficiency of its digital platform.

- Significant Cash Generation: Free cash flow consistently above £300 million annually, providing ample resources for investment and shareholder distributions.

- Financial Resilience: The robust cash position enables Auto Trader to navigate economic uncertainties and fund future expansion strategies.

- Investment Capacity: High profitability supports sustained investment in technology, product development, and potential strategic acquisitions.

Auto Trader Group's primary strength lies in its unparalleled market dominance within the UK digital automotive sector. This leadership is quantified by its substantial market share and a highly recognizable brand, fostering significant trust among consumers and businesses alike.

The company benefits from a powerful network effect, where a large buyer base attracts more sellers, and vice versa, creating a self-reinforcing cycle that fortifies its competitive edge. This is evident in its average of 13.1 million unique monthly users reported in FY24, alongside millions of vehicle listings.

Auto Trader Group demonstrates strong financial health, characterized by high profitability and significant cash generation. For the fiscal year ending June 2024, the company reported an operating profit margin of approximately 70% and generated over £300 million in free cash flow, enabling substantial reinvestment and shareholder returns.

| Key Strength | Metric/Data Point | Impact |

| Market Dominance | Largest digital automotive marketplace in the UK | High brand recognition, customer trust |

| Network Effect | 13.1 million unique monthly users (FY24) | Attracts sellers, increases buyer choice, barrier to entry |

| Financial Performance | ~70% operating profit margin (FY24) | Funds innovation, supports growth, shareholder returns |

| Cash Generation | >£300 million free cash flow (FY24) | Financial flexibility, investment capacity |

What is included in the product

Delivers a strategic overview of Auto Trader Group’s internal and external business factors, highlighting its market strengths and potential threats.

Offers a clear understanding of Auto Trader's competitive landscape, helping to identify and mitigate potential threats.

Weaknesses

Auto Trader Group's significant reliance on the UK automotive market presents a key weakness. This concentration means the company is highly vulnerable to any economic slowdowns, changes in government regulations, or shifts in how British consumers buy cars. For instance, a recession impacting disposable income in the UK directly affects car sales, and consequently, Auto Trader's revenue streams.

The lack of substantial international operations further amplifies this risk. While Auto Trader holds a dominant position in the UK, its growth prospects are largely tied to the health of a single market. This limits its ability to offset potential downturns in its primary territory with gains elsewhere, exposing it to greater volatility from localized market shocks.

Auto Trader Group's fortunes are heavily tied to the automotive sector's well-being. When new and used car sales are strong, the company thrives, but downturns directly affect its advertising income and transaction numbers.

Economic slowdowns, like those seen in recent years due to inflation and interest rate hikes, can significantly dampen consumer spending on big-ticket items such as cars. For instance, during periods of economic uncertainty, car dealerships may reduce their advertising budgets, impacting Auto Trader's revenue streams.

Furthermore, disruptions in vehicle manufacturing, such as the semiconductor shortages experienced in 2021-2022, limit the availability of new cars. This scarcity can reduce the overall volume of transactions and, consequently, the advertising opportunities available on the Auto Trader platform.

Auto Trader Group's established position is challenged by emerging business models that bypass its traditional marketplace. Direct-to-consumer sales by car manufacturers, as seen with brands like Tesla, and the rise of online-only retailers such as Cazoo, threaten to disintermediate Auto Trader's core offering.

These new models, along with the growing popularity of vehicle subscription services, could erode Auto Trader's reliance on dealership advertising revenue. For instance, the UK used car market saw significant online growth in 2024, with digital platforms capturing a larger share of transactions, putting pressure on Auto Trader to adapt its platform and services to remain relevant.

Potential for Increased Competition

While Auto Trader Group holds a dominant position, the digital automotive marketplace is ripe for disruption. The potential for well-funded new entrants, including global technology firms or specialized platforms focusing on burgeoning sectors like electric vehicles, poses a significant threat. For instance, in 2024, major tech companies continue to explore adjacent markets, and niche EV marketplaces are gaining traction, indicating a dynamic competitive landscape.

This heightened competition could manifest in several ways. We could see increased pricing pressures as new players vie for market share, forcing Auto Trader to adjust its revenue models. Furthermore, a surge in marketing expenditure might be necessary to maintain brand visibility and customer loyalty. This could impact profitability, especially if market fragmentation occurs, diluting Auto Trader's established dominance.

- New Entrants: Global tech giants and specialized EV platforms are key potential competitors.

- Pricing Pressures: Increased competition could lead to a need for more aggressive pricing strategies.

- Marketing Spend: Maintaining market share may require higher investment in advertising and customer acquisition.

- Market Fragmentation: The emergence of niche players could splinter the customer base, impacting overall market share.

Reliance on Dealer Relationships

Auto Trader Group's reliance on its relationships with car dealerships presents a notable weakness. A substantial part of their income is derived from dealership subscriptions and advertising fees. If these relationships sour, perhaps over pricing issues or if dealers opt for different advertising avenues, Auto Trader's financial results could suffer. For instance, in the fiscal year ending March 2024, Auto Trader reported that approximately 80% of its revenue was generated from its dealer services segment. This highlights the critical need to nurture these partnerships.

The company's revenue model is heavily dependent on the health and willingness of dealerships to continue using its platform. Factors such as economic downturns affecting car sales, increased competition from other digital advertising platforms, or a perceived lack of value from Auto Trader's services could lead dealerships to reduce their spending or switch providers. This concentration risk means that any significant disruption in the dealer network could have a disproportionate impact on Auto Trader's overall performance.

Maintaining strong, mutually beneficial relationships with its dealer network is therefore paramount for Auto Trader's continued success. This involves not only competitive pricing but also delivering demonstrable value through leads, market insights, and effective advertising tools. The company's ability to adapt to the evolving needs of dealerships and the broader automotive market will be key to mitigating this weakness.

Auto Trader's heavy dependence on the UK market makes it susceptible to localized economic downturns and regulatory changes. Its limited international presence means it cannot easily offset potential UK market shocks with revenue from other regions. For example, a significant drop in UK car sales, as seen during economic slowdowns, directly impacts Auto Trader's advertising revenue.

The company's reliance on dealership advertising revenue is a key vulnerability. A substantial portion of its income, around 80% as of the fiscal year ending March 2024, comes from dealer services. If dealerships reduce their ad spend due to economic pressures or opt for alternative platforms, Auto Trader's financial performance could be significantly affected. The increasing popularity of direct-to-consumer sales models and online-only retailers also poses a threat by potentially disintermediating Auto Trader's core marketplace function.

Emerging digital models and potential new entrants, including global tech firms and specialized EV platforms, present a competitive threat. This could lead to pricing pressures and necessitate increased marketing expenditure to maintain market share. For instance, the growth of niche EV marketplaces in 2024 highlights the evolving competitive landscape.

Preview Before You Purchase

Auto Trader Group SWOT Analysis

This is the same Auto Trader Group SWOT analysis document included in your download. The full content is unlocked after payment, providing a comprehensive overview of the company's strategic positioning.

Opportunities

The accelerating global shift towards electric vehicles presents a significant opportunity for Auto Trader to deepen its offerings. As of early 2024, EV sales continued their upward trajectory, with projections indicating further substantial growth through 2025. This trend allows Auto Trader to develop specialized EV-centric features, valuation tools, and charging infrastructure information.

By providing dedicated advertising solutions and comprehensive data for the growing demand for electric cars, Auto Trader can position itself as the essential platform for consumers navigating the EV transition. This strategic expansion into the EV ecosystem is key to capturing a larger share of the evolving automotive market.

Auto Trader Group has a significant opportunity to boost revenue by expanding its ancillary services. Think automotive finance, insurance, and even vehicle maintenance bookings. These areas represent untapped potential for growth beyond their core advertising business.

The company's extensive data trove is a goldmine for new revenue streams. By developing data-driven products and insights for retailers, manufacturers, and financial institutions, Auto Trader can monetize its vast datasets, creating valuable offerings that go beyond traditional advertising models.

Auto Trader's established digital marketplace, a proven success in the UK, presents a significant opportunity for international expansion. Its model could be adapted for promising overseas markets, potentially tapping into new customer bases and revenue streams.

Strategic acquisitions or partnerships in key international territories could accelerate this expansion. For example, entering markets with high automotive sales and a developing digital infrastructure, such as parts of Southeast Asia or select European countries, could offer substantial growth potential. This diversification would also mitigate risks associated with over-reliance on the UK market.

Leveraging AI and Advanced Analytics for Enhanced User Experience

Auto Trader Group can significantly boost its user experience by investing more in AI and sophisticated data analysis. This means offering more tailored suggestions to car buyers and generating better leads for sellers. For instance, by analyzing vast datasets, the platform can predict buyer preferences, leading to more relevant vehicle listings. This proactive approach to matching buyers with vehicles is crucial in a competitive online marketplace.

AI's role extends to refining how vehicles are priced, improving customer service interactions through intelligent chatbots, and automating routine tasks. These advancements not only make the platform more efficient for sellers but also create a smoother, more engaging journey for buyers. In 2024, companies leveraging AI in customer service have reported up to a 30% increase in customer satisfaction.

The strategic implementation of AI and advanced analytics presents several key opportunities:

- Personalized Buyer Journeys: AI can curate vehicle recommendations based on individual search history, browsing behavior, and expressed preferences, increasing the likelihood of a successful purchase.

- Optimized Lead Generation: For sellers, AI can identify and prioritize high-intent leads, improving conversion rates and sales efficiency.

- Enhanced Pricing Tools: Advanced analytics can provide sellers with real-time, data-driven pricing insights to ensure competitive and profitable listings.

- Streamlined Operations: Automating tasks like data entry and customer inquiries frees up resources and improves overall platform performance.

Partnerships with Automotive Manufacturers and Fintech

Auto Trader Group can significantly boost its market position by deepening collaborations with automotive manufacturers. Imagine exclusive early access to new model launches, allowing Auto Trader to offer customers previews and pre-order opportunities. This strengthens the platform's appeal to buyers eager for the latest vehicles.

Partnering with fintech companies presents a prime opportunity to streamline the car financing process. By integrating seamless finance solutions directly into the Auto Trader platform, the customer journey becomes far more convenient. This could lead to increased conversion rates for both vehicle sales and finance products, capturing more of the value chain.

- Enhanced Customer Experience: Direct manufacturer partnerships can offer exclusive content and early access to new models, improving user engagement.

- Streamlined Transactions: Fintech integrations can simplify the car buying and financing process, potentially increasing sales conversion rates.

- Expanded Revenue Streams: Collaborations can unlock new revenue opportunities through integrated financial services and manufacturer advertising.

- Deeper Market Integration: By embedding itself into the entire vehicle lifecycle, Auto Trader solidifies its role beyond just a listing service.

The growing demand for electric vehicles (EVs) presents a significant opportunity, with EV sales projected to continue their strong growth through 2025, allowing Auto Trader to enhance its EV-specific features and data offerings.

Expanding ancillary services like automotive finance and insurance, alongside monetizing its extensive data through new products, can unlock substantial revenue growth beyond traditional advertising.

International expansion, potentially through strategic acquisitions in high-growth markets, offers a pathway to diversify revenue and mitigate reliance on the UK market, with some European countries showing strong digital automotive adoption.

Leveraging AI and advanced data analytics can personalize buyer journeys and optimize lead generation for sellers, with AI-driven customer service initiatives reporting up to a 30% increase in customer satisfaction in 2024.

Threats

A significant economic downturn, marked by high inflation and potential recession, poses a direct threat to Auto Trader Group. This scenario typically erodes consumer confidence, leading to a sharp decline in discretionary spending, particularly on big-ticket items such as vehicles.

Consequently, a slowdown in the automotive market would translate into fewer car sales, impacting dealerships' need for advertising. This reduced demand from its core customer base directly threatens Auto Trader's primary revenue streams from advertising and lead generation services.

For instance, during periods of economic uncertainty, consumers often postpone large purchases. If this trend persists through late 2024 and into 2025, it could significantly dampen the volume of transactions on Auto Trader's platform.

The digital automotive classifieds market faces a growing threat from nimble online disruptors and potentially even major tech players entering the space. This intensified competition could challenge Auto Trader's established position, potentially impacting its market share and requiring greater investment in marketing to maintain its edge.

Furthermore, a significant concern is the possibility of Original Equipment Manufacturers (OEMs) shifting towards direct-to-consumer sales models. If OEMs bypass traditional classified platforms to sell directly, it could significantly erode Auto Trader's revenue streams and necessitate strategic adjustments to its business model to counter this direct channel competition.

Auto Trader faces evolving regulatory landscapes, particularly concerning online advertising and data privacy. For instance, the ongoing scrutiny of digital platforms by competition authorities, as seen in various global markets throughout 2024, could lead to stricter rules on how Auto Trader utilizes consumer data or engages in advertising practices. These changes might necessitate significant adjustments to their business model, potentially increasing compliance costs and impacting revenue streams derived from data monetization.

Disruption from Alternative Mobility Solutions

The increasing popularity of alternative mobility solutions like ride-sharing and subscription services poses a long-term threat to traditional car ownership models. This gradual shift could eventually lead to a smaller market for private vehicle sales, directly impacting Auto Trader's core business. For instance, by the end of 2024, ride-sharing services are projected to see continued growth, with users potentially foregoing personal vehicle purchases.

The widespread adoption of autonomous vehicle fleets, while still in development, represents a significant future disruption. If these services become cost-effective and convenient, they could further diminish the need for individuals to own and maintain their own cars. This trend, if it accelerates into the 2025 timeframe, would directly shrink Auto Trader's addressable market for new and used private car transactions.

The evolving landscape of mobility could necessitate Auto Trader's adaptation to new revenue streams beyond just facilitating private car sales. As of early 2025, the market for car subscription services is expanding, indicating a consumer preference shift that Auto Trader may need to address. This evolving consumer behavior presents a strategic challenge.

- Ride-sharing growth: Projections indicate continued user expansion in ride-sharing services through 2024, potentially reducing demand for personal vehicle ownership.

- Autonomous vehicle impact: The eventual widespread adoption of autonomous vehicle fleets could significantly decrease the necessity of individual car ownership.

- Subscription service rise: The increasing availability and adoption of car subscription models signal a potential shift away from traditional purchase-based transactions.

Cybersecurity Risks and Platform Reliability

Auto Trader Group, as a leading online automotive marketplace, is inherently exposed to significant cybersecurity risks. The platform's reliance on digital infrastructure to manage sensitive customer and dealer data, alongside facilitating substantial financial transactions, makes it a prime target for various cyber threats. These include sophisticated data breaches, malicious hacking attempts, and disruptive denial-of-service (DoS) attacks, all of which could compromise user information and disrupt services.

A major cybersecurity incident or extended platform downtime poses a severe threat to Auto Trader's reputation and financial stability. Such events can erode the crucial trust built with both consumers and its extensive network of automotive dealers. For instance, a successful data breach could lead to significant financial penalties and a loss of confidence, impacting future revenue streams and market position. In 2023, the automotive sector saw a notable increase in cyberattacks targeting customer databases, highlighting the persistent nature of these threats.

- Cybersecurity Threats: Auto Trader is vulnerable to data breaches, hacking, and DoS attacks due to its handling of sensitive user and financial data.

- Reputational Damage: Significant security incidents can severely damage consumer and dealer trust, leading to a negative impact on brand perception.

- Financial Losses: Security breaches or platform outages can result in direct financial losses from remediation efforts, regulatory fines, and lost business opportunities.

The competitive landscape is intensifying with new digital entrants and potential expansion by major technology firms into automotive classifieds. This could fragment market share and necessitate increased marketing spend. Furthermore, OEMs exploring direct-to-consumer sales models present a significant threat, potentially bypassing Auto Trader's platform and impacting its core revenue streams.

Regulatory changes, particularly around data privacy and online advertising, could impose compliance costs and restrict revenue generation methods. The shift towards alternative mobility solutions like ride-sharing and subscription services, projected to continue growing through 2024, may gradually reduce the demand for traditional vehicle ownership and sales facilitated by Auto Trader.

| Threat Category | Specific Threat | Potential Impact | Example/Data Point (2024/2025 Focus) |

|---|---|---|---|

| Competition | New digital disruptors/Tech giants entering market | Market share erosion, increased marketing costs | Increased venture capital funding for automotive tech startups in early 2024. |

| Competition | OEM direct-to-consumer sales | Reduced lead generation revenue | Several major OEMs announced plans to expand online sales capabilities in late 2023/early 2024. |

| Regulatory | Data privacy and advertising regulations | Compliance costs, restricted data monetization | Ongoing antitrust reviews of digital platforms in the UK and EU throughout 2024. |

| Mobility Shifts | Growth of ride-sharing/subscriptions | Decreased demand for private vehicle ownership | Ride-sharing market expected to grow by 10-15% globally in 2024, impacting car purchasing decisions. |

SWOT Analysis Data Sources

This analysis is built upon a foundation of verified financial statements, comprehensive market research reports, and expert industry commentary to ensure a robust and accurate SWOT assessment for Auto Trader Group.