Auto Trader Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Auto Trader Group Bundle

Auto Trader Group navigates a competitive landscape shaped by moderate buyer power and significant threat of substitutes from online marketplaces. Understanding the intensity of rivalry and supplier bargaining power is crucial for its sustained success.

The complete report reveals the real forces shaping Auto Trader Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Auto Trader Group's reliance on technology and data providers, including those offering specialized analytics and cloud computing services, shapes supplier power. While general IT infrastructure providers might have moderate influence, the power of suppliers offering unique data insights or niche software solutions can be more significant, potentially impacting Auto Trader's operational efficiency and market intelligence capabilities.

The bargaining power of suppliers for Auto Trader Group is influenced by the availability of alternative technology providers. For standard IT services, Auto Trader likely has many options, limiting supplier leverage. However, for specialized needs like proprietary data feeds or advanced AI capabilities, switching can be more complex and costly, granting those suppliers greater influence.

The bargaining power of content suppliers for Auto Trader Group is generally low. These suppliers, including automotive news outlets and review sites, rely on Auto Trader's extensive platform for significant reach. In 2024, Auto Trader continued to solidify its position as the UK's largest digital automotive marketplace, reaching an average of 12.5 million unique monthly visitors.

This dominant market presence means Auto Trader is an indispensable distribution channel for their content. Consequently, suppliers have limited leverage to dictate terms or demand higher payments for their contributions, as their access to a vast audience is paramount.

Supplier Power 4

Auto Trader Group's bargaining power of suppliers is relatively low. This is primarily due to the company's significant internal development capabilities for its platform and tools. For instance, their AI-driven Co-Driver suite and Deal Builder showcase a strong reliance on in-house expertise, diminishing the need for external software development suppliers.

This internal technological prowess strengthens Auto Trader's negotiating position against potential technology vendors. By controlling key aspects of their platform's development, they reduce dependence on outside entities, thereby limiting the suppliers' ability to dictate terms or raise prices.

Key factors contributing to this reduced supplier power include:

- Internal Development Expertise: Auto Trader invests heavily in its own technology teams, allowing for custom solutions.

- Proprietary Technology: Development of unique tools like Co-Driver and Deal Builder reduces reliance on off-the-shelf solutions.

- Diversified Supplier Base (where applicable): While internal capabilities are strong, Auto Trader likely maintains relationships with multiple vendors for non-core services, preventing any single supplier from gaining excessive leverage.

Supplier Power 5

Human capital, especially skilled tech professionals and data scientists, acts as a crucial supplier for Auto Trader Group. The intense competition for this talent within the booming digital sector significantly bolsters their bargaining power. This translates directly into higher operational costs for Auto Trader, driven by the need to offer competitive salaries and attractive benefits packages to secure and retain these essential experts.

The demand for specialized digital skills is a key driver of supplier power in the automotive digital marketplace. For instance, in 2024, the UK tech sector continued to experience a significant skills gap, with demand for data scientists and AI specialists outstripping supply. This dynamic allows skilled individuals to command higher compensation, directly impacting Auto Trader's recruitment and retention expenses.

- High demand for specialized tech talent in the UK digital sector.

- Data scientists and AI specialists are particularly sought after.

- Competitive salaries and benefits are necessary to attract and retain skilled professionals.

- This increases operational costs for companies like Auto Trader Group.

The bargaining power of suppliers for Auto Trader Group is generally low, particularly for content providers who depend on Auto Trader's vast audience. In 2024, Auto Trader's average of 12.5 million monthly unique visitors makes it an essential platform for these content creators, limiting their ability to dictate terms.

For technology and data providers, Auto Trader's strong internal development capabilities, showcased by tools like Co-Driver and Deal Builder, reduce reliance on external solutions. This internal expertise significantly strengthens their negotiating position against technology vendors.

However, the bargaining power of human capital suppliers, specifically skilled tech professionals and data scientists, is high. The UK tech sector's persistent skills gap in 2024 means Auto Trader faces increased operational costs to attract and retain this vital talent.

What is included in the product

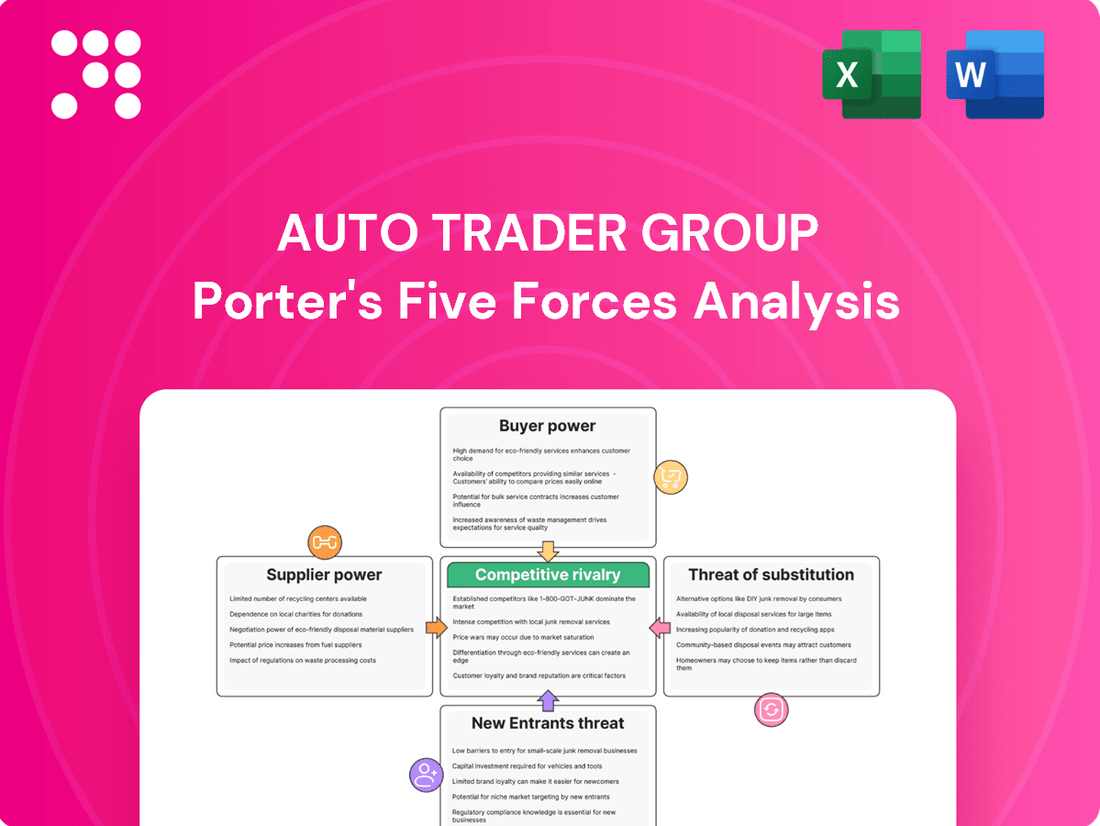

This Porter's Five Forces analysis for Auto Trader Group examines the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the online automotive marketplace.

Instantly assess competitive threats and opportunities with a dynamic Porter's Five Forces model tailored for Auto Trader Group's unique market position.

Customers Bargaining Power

Auto Trader Group's customer base primarily consists of automotive retailers, including dealerships and private sellers who list vehicles, and individual consumers who search for them. Dealerships, particularly larger groups, wield considerable influence due to the sheer volume of vehicles they list, making them crucial to Auto Trader's revenue stream. In 2023, Auto Trader reported that its revenue from retailer advertising was a significant portion of its overall income, highlighting the dependence on these key customers.

Buyer power for Auto Trader Group is relatively low, primarily due to its commanding market share in the UK automotive marketplace. With over 75% of all time spent on automotive marketplaces occurring on Auto Trader, dealers and private sellers have limited viable alternatives to reach a comparable audience. This dominance significantly curtails their ability to negotiate terms or switch to competing platforms without substantial loss of reach.

The bargaining power of customers for Auto Trader Group is relatively low, primarily due to the strong network effect inherent in its platform. This means that a large number of buyers attract a large number of sellers, and this mutual attraction makes Auto Trader the go-to marketplace in the UK for vehicle sales.

This creates significant switching costs for both buyers and sellers. If a seller moves to a less popular platform, their vehicle's visibility and potential to sell diminishes considerably. Similarly, buyers might find fewer options on smaller sites, impacting their ability to find the right vehicle. For instance, Auto Trader reported that in the year ending August 2024, its platform hosted an average of over 400,000 vehicles, a testament to its seller network.

Buyer Power 4

For private sellers, while free listing sites like Facebook Marketplace and Gumtree exist, Auto Trader offers a more professional and trusted environment. This often leads to quicker and more secure sales, reducing their incentive to switch despite potential fees. In 2023, Auto Trader reported that private sellers contributed a significant portion of their revenue, demonstrating their continued reliance on the platform.

Auto Trader's established brand and extensive reach provide a distinct advantage. Buyers are accustomed to using Auto Trader to find vehicles, creating a network effect that benefits sellers. This established trust means sellers are less likely to opt for unproven or less reputable free alternatives when aiming for a successful transaction.

- Seller Trust: Auto Trader's brand recognition fosters trust, making private sellers more comfortable listing their vehicles.

- Buyer Volume: The platform's large buyer base increases the likelihood of a quick sale for private sellers.

- Platform Features: Enhanced listing options and seller tools, often at a cost, further differentiate Auto Trader from free alternatives.

- Market Dominance: Auto Trader commands a significant share of the online automotive classifieds market, making it the go-to platform for many.

Buyer Power 5

Auto Trader Group's buyer power from retailers is somewhat mitigated by its ongoing innovation. Features like the 'Deal Builder' and AI-driven tools increase the platform's utility for dealerships, making them more dependent on Auto Trader's services. This enhanced value proposition can reduce retailers' leverage when negotiating subscription or advertising costs.

For instance, in the fiscal year ending August 31, 2023, Auto Trader reported revenue growth of 14% to £404.2 million, partly driven by increased digital services adoption by retailers. This indicates that retailers are willing to invest more in Auto Trader's evolving offerings, thereby lessening their bargaining power.

- Innovation as a Counterbalance: Auto Trader's commitment to developing new features, such as advanced analytics and customer engagement tools, directly addresses retailer needs and strengthens their ties to the platform.

- Increased Retailer Dependence: As retailers rely more on Auto Trader for lead generation and sales process efficiency, their ability to dictate terms or switch to competitors diminishes.

- Value Proposition Enhancement: The continuous improvement of the platform's functionalities provides tangible benefits to retailers, justifying current pricing structures and reducing their incentive to exert downward pressure on fees.

Auto Trader Group's customer bargaining power is largely constrained by its dominant market position and the strong network effects it cultivates. The sheer volume of buyers attracted to the platform makes it an indispensable tool for automotive retailers seeking to reach a broad audience, thereby limiting their ability to negotiate terms or switch to less effective alternatives.

Retailers, especially larger dealerships, represent a significant customer segment. While they possess some leverage due to their listing volume, Auto Trader's continuous innovation, such as its Deal Builder and AI tools, increases retailer dependence and reduces their power to dictate terms. For example, Auto Trader's fiscal year ending August 31, 2023, saw revenue growth of 14% to £404.2 million, partly fueled by increased retailer adoption of digital services.

Private sellers, while sometimes attracted to free listing options, often find Auto Trader's trusted environment and higher likelihood of a quick sale more valuable, especially given the platform's average of over 400,000 vehicles listed in the year ending August 2024.

| Customer Segment | Bargaining Power Level | Key Factors Influencing Power |

|---|---|---|

| Automotive Retailers (Dealerships) | Relatively Low | Dominant market share, network effects, platform innovation (e.g., Deal Builder), increased retailer dependence on digital services. |

| Private Sellers | Low | Trust and brand recognition, higher likelihood of quick sales, professional platform features outweighing free alternatives. |

Preview the Actual Deliverable

Auto Trader Group Porter's Five Forces Analysis

This preview showcases the comprehensive Auto Trader Group Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the automotive classifieds market. The document you see here is precisely the same professionally formatted analysis you will receive immediately after purchase, ensuring full transparency and immediate usability. You are looking at the actual, complete document, meaning there are no hidden sections or altered content; what you preview is your deliverable.

Rivalry Among Competitors

Competitive rivalry in the UK digital automotive marketplace exists, but it's heavily influenced by Auto Trader Group's overwhelming dominance. Auto Trader is significantly larger than its closest classified competitors, being more than ten times their size. This substantial gap means the direct threat from smaller, similar platforms is relatively low, as they struggle to match Auto Trader's scale and reach.

Auto Trader Group faces significant competition from platforms like Motors.co.uk, CarGurus, and eBay Motors, all of which provide online vehicle listings. These competitors offer similar services, creating a crowded marketplace for car buyers and sellers.

Despite the presence of these rivals, Auto Trader maintains a dominant position. In 2024, Auto Trader reported a 9% increase in revenue for the first half of the year, reaching £235.5 million, underscoring its strong market performance compared to competitors whose market share remains considerably smaller.

Online car-buying platforms like Motorway and We Buy Any Car present a significant indirect competitive threat to Auto Trader. These services offer consumers a quick and straightforward way to sell their vehicles, bypassing the need to list them on classified sites and engage with multiple potential buyers. This direct-to-consumer sales model can appeal to sellers prioritizing speed and convenience over potentially higher prices achievable through Auto Trader's marketplace.

The competitive landscape intensified in March 2024 when Cazoo, a prominent online car retailer, announced its strategic shift to a marketplace model. This pivot directly positions Cazoo as a rival to Auto Trader, aiming to connect buyers and sellers more directly. This move signifies a growing trend where online automotive businesses are evolving their strategies to capture a larger share of the digital car transaction market, increasing the intensity of rivalry.

Competitive Rivalry 4

The competitive landscape for Auto Trader Group is becoming increasingly dynamic. New technologies and evolving business models, such as manufacturers adopting direct-to-consumer sales through an agency model and the rise of online-only dealerships, are poised to intensify rivalry, especially within the new car segment. This shift challenges traditional dealership and online listing models.

For instance, in 2024, several major automotive manufacturers have been actively exploring or implementing agency sales models in various markets, aiming to streamline the customer experience and potentially capture more margin. This directly impacts how vehicles are listed and sold, creating new competitive pressures for platforms like Auto Trader Group. The increasing prevalence of online-only used car retailers, which often operate with lower overheads, also contributes to a more competitive environment, forcing established players to innovate and adapt their service offerings.

- Emerging Business Models: The adoption of manufacturer agency models and the growth of online-only dealerships are reshaping the market.

- New Car Segment Impact: These changes are expected to particularly intensify competition in the new car sales arena.

- Technological Disruption: Advancements in technology are enabling new ways for consumers to buy cars, directly affecting traditional listing platforms.

- Competitive Pressure: The evolving market necessitates continuous adaptation and innovation from Auto Trader Group to maintain its competitive edge.

Competitive Rivalry 5

Auto Trader Group's competitive rivalry is intensified by its ongoing commitment to technological advancement and data utilization. By investing in areas like AI-powered features and sophisticated valuation tools, the company creates a higher barrier to entry for competitors. This focus on value-added services makes it challenging for rivals to offer a truly differentiated product.

For instance, Auto Trader's digital advertising revenue reached £375.1 million in the fiscal year ending September 30, 2023, underscoring the strength of its online platform. This financial performance highlights how its technological investments translate into market dominance, making it difficult for less advanced platforms to compete effectively.

- Technological Investment: Auto Trader consistently invests in its platform, enhancing user experience and data analytics capabilities.

- Data-Driven Services: The company leverages data to offer valuable services like vehicle valuations and finance solutions, differentiating itself from basic listing sites.

- AI Integration: Implementation of AI features aims to personalize user journeys and provide deeper insights for both consumers and retailers, further solidifying its market position.

- Rival Differentiation Challenge: These advancements make it harder for competitors to carve out a distinct niche or offer comparable value, thus intensifying the rivalry for market share.

While Auto Trader Group holds a commanding position, the competitive rivalry in the UK digital automotive marketplace is intensifying. Emerging business models, such as manufacturers adopting agency sales and the rise of online-only dealerships, are specifically impacting the new car segment. This dynamic environment necessitates continuous innovation from Auto Trader to maintain its market leadership.

The competitive landscape is further shaped by platforms like Motors.co.uk and CarGurus, alongside indirect threats from online car-buying services like Motorway. Cazoo's shift to a marketplace model in March 2024 directly positions it as a rival, increasing market contention. Auto Trader's significant investment in technology, including AI, creates a high barrier for competitors, as evidenced by its £375.1 million digital advertising revenue in fiscal year 2023.

| Competitor Type | Key Players | Competitive Impact |

| Direct Classifieds | Motors.co.uk, CarGurus | Moderate; struggle with Auto Trader's scale |

| Online Car Buying | Motorway, We Buy Any Car | Significant indirect threat; prioritize speed/convenience |

| Evolving Marketplaces | Cazoo (marketplace model) | Increasing rivalry; direct competition |

| Manufacturer Direct Sales | Various OEMs (agency model) | Growing threat, especially in new cars |

SSubstitutes Threaten

The primary substitute for Auto Trader's digital marketplace remains traditional, physical car dealerships. Here, buyers can still inspect vehicles firsthand and complete transactions without relying on an online platform. However, the sheer convenience and extensive selection available through digital channels like Auto Trader are increasingly pulling consumers away from solely offline purchasing methods.

Other online classifieds and social media platforms like Facebook Marketplace, Gumtree, and Shpock present a significant threat. These platforms often allow private sellers to list vehicles for free or at a very low cost, directly competing with Auto Trader's core business for individual sellers.

While these substitutes lack the extensive reach and specialized automotive tools that Auto Trader provides, they are attractive to budget-conscious individuals. For instance, in 2024, the continued growth of peer-to-peer selling on social media indicates a persistent challenge to traditional classifieds.

Instant online car-buying services, such as We Buy Any Car and Motorway, present a significant threat of substitution for Auto Trader Group. These platforms offer sellers a quick and convenient way to offload their vehicles, bypassing the traditional advertising and negotiation stages inherent in using Auto Trader's marketplace.

These substitute services cater to a segment of the market prioritizing speed and ease over achieving the absolute highest sale price. For instance, We Buy Any Car famously emphasizes its rapid valuation and payment process, directly competing for sellers who want a hassle-free transaction, even if it means a slightly lower return.

While Auto Trader facilitates a direct sale between private individuals or dealerships, these online buyers act as intermediaries, purchasing cars directly from consumers. This direct acquisition model removes the need for sellers to engage with potential buyers on Auto Trader's platform, thereby diminishing the value proposition for those seeking immediate liquidity.

Threat of Substitution 4

The threat of substitutes for Auto Trader Group is intensifying, particularly from direct-to-consumer (DTC) sales models. Car manufacturers and large retail groups are increasingly enabling customers to buy new and used vehicles directly through their own websites, bypassing traditional online marketplaces. This shift, accelerated by the growing popularity of electric vehicles (EVs), presents a significant challenge.

For instance, by mid-2024, several major automotive manufacturers have expanded their online sales capabilities, allowing customers to configure, finance, and purchase vehicles entirely online. This DTC approach offers a streamlined experience that can be perceived as a direct substitute for the services provided by Auto Trader, which acts as an intermediary.

Key substitutes include:

- Manufacturer-led online sales platforms: Brands like Tesla have long pioneered this model, but others are rapidly catching up, offering a seamless purchase journey.

- Large dealership groups with robust online presences: Major automotive retail conglomerates are investing heavily in their digital infrastructure, enabling direct online transactions.

- Online-only used car retailers: While not strictly DTC from manufacturers, these platforms offer an alternative purchasing channel that competes for consumer attention.

Threat of Substitution 5

The growing popularity of car leasing and subscription services poses a significant threat to Auto Trader Group. Consumers may choose these flexible options over outright vehicle ownership, directly impacting the demand for both new and used car advertisements on Auto Trader's platform. This shift away from traditional purchasing models means fewer individuals will be actively searching for classified listings.

Auto Trader's own Autorama leasing business is not immune to this competitive pressure. The increasing availability and appeal of leasing and subscription alternatives, often promoted by manufacturers and dedicated service providers, challenge Auto Trader's traditional classifieds revenue streams. For instance, by mid-2024, the UK car leasing market continued to see robust growth, with subscription services gaining traction as a lifestyle choice for many consumers.

- Growing Leasing Market: The UK car leasing market has shown consistent expansion, with a notable increase in new car registrations via leasing agreements, indicating a consumer preference shift.

- Subscription Model Appeal: Car subscription services, offering all-inclusive packages, are becoming a viable alternative to ownership or traditional leasing, potentially diverting users from classified platforms.

- Impact on Demand: A rise in leasing and subscription uptake directly reduces the pool of consumers actively seeking to purchase vehicles through classified advertisements.

The threat of substitutes for Auto Trader Group is multifaceted, encompassing direct online car buyers, manufacturer-led sales, and alternative ownership models like leasing. Platforms such as We Buy Any Car offer a swift exit for sellers, bypassing Auto Trader's marketplace. Furthermore, manufacturers increasingly facilitating direct online purchases, a trend bolstered by the EV market's expansion, directly competes for consumer attention. By mid-2024, major manufacturers were enhancing their online sales capabilities, allowing for end-to-end digital transactions.

The shift towards leasing and subscription services also presents a significant substitute threat. These models reduce the need for outright vehicle purchase, thereby diminishing demand for traditional classified advertisements. The UK car leasing market, for example, continued its strong growth in 2024, with subscription services gaining popularity as a lifestyle choice, impacting Auto Trader's core business.

| Substitute Type | Key Players/Examples | Impact on Auto Trader | 2024 Trend/Data Point |

|---|---|---|---|

| Instant Online Car Buyers | We Buy Any Car, Motorway | Attracts sellers seeking speed and convenience, bypassing the marketplace. | Continued strong demand for quick sales, especially for used vehicles. |

| Manufacturer Direct Sales (DTC) | Tesla, other major manufacturers | Offers a streamlined purchase journey, potentially reducing reliance on intermediaries. | Expansion of online sales capabilities by several major automotive manufacturers. |

| Leasing & Subscription Services | Various leasing companies, car manufacturers | Reduces demand for vehicle purchases, impacting advertising volume. | Robust growth in the UK car leasing market, with subscription services gaining traction. |

Entrants Threaten

The threat of new entrants for Auto Trader Group is considerably low. Establishing a digital automotive marketplace with nationwide reach and strong brand recognition demands substantial capital investment, particularly in marketing and technology infrastructure. For instance, developing and maintaining a robust platform comparable to Auto Trader's requires significant upfront and ongoing expenditure, acting as a strong barrier.

The threat of new entrants for Auto Trader Group is significantly mitigated by the immense challenge of achieving critical mass in its two-sided market. Building a robust network effect, where more buyers attract more sellers and vice versa, requires substantial upfront investment and time. For instance, in 2024, Auto Trader continued to benefit from its vast inventory, listing millions of vehicles, which is a formidable hurdle for any new platform to overcome.

The threat of new entrants for Auto Trader Group is moderately low, largely due to significant regulatory hurdles and compliance requirements within both the automotive sales and online marketplace sectors. Navigating stringent data protection laws, advertising standards, and consumer rights legislation demands substantial investment and expertise, creating a barrier for potential newcomers. For instance, the General Data Protection Regulation (GDPR) in Europe, and similar privacy laws globally, require robust systems for handling user data, which can be costly to implement and maintain.

Threat of New Entrants 4

Auto Trader Group benefits from significant barriers to entry, primarily due to its vast repository of proprietary data and deep market insights cultivated over decades. This accumulated knowledge allows Auto Trader to offer highly accurate valuations and targeted advertising solutions, a capability that new entrants would find exceptionally difficult and costly to replicate.

Newcomers would face substantial challenges in building a comparable data advantage, which is crucial for competing effectively in the online automotive marketplace. Without this, their ability to attract both buyers and sellers with relevant listings and pricing information would be severely hampered.

- Proprietary Data Advantage: Auto Trader's extensive historical data on vehicle listings, pricing trends, and consumer behavior provides a significant competitive moat.

- Market Insight Depth: Decades of operation have allowed Auto Trader to develop unparalleled understanding of the UK automotive market dynamics.

- High Initial Investment: Replicating Auto Trader's data infrastructure and market penetration would require immense capital and time investment for any new entrant.

- Brand Recognition and Trust: Auto Trader enjoys strong brand recognition and a high level of trust among consumers and dealerships, built over many years.

Threat of New Entrants 5

The threat of new entrants for Auto Trader Group is generally considered low, primarily due to the significant brand equity and established trust it commands within the automotive marketplace. Years of consistent service have cultivated strong loyalty among both consumers searching for vehicles and dealerships listing them, making it difficult for newcomers to gain traction. For instance, in 2024, Auto Trader continued to be the go-to platform for a vast majority of car buyers and sellers in the UK, a testament to its ingrained presence.

New entrants would face substantial hurdles in replicating Auto Trader's extensive network and the ingrained habits of its user base. Building comparable brand recognition and trust takes considerable time and investment, resources that emerging platforms may struggle to deploy effectively against an incumbent with such a strong market position. The sheer volume of listings and buyer traffic on Auto Trader creates a powerful network effect, further deterring new competition.

- Brand Loyalty: Auto Trader's long-standing reputation fosters deep trust, making it the preferred choice for many.

- High Switching Costs: For dealerships, the effort and potential disruption involved in shifting to a new platform are significant deterrents.

- Network Effects: The large number of buyers attracts sellers, and the abundance of sellers attracts buyers, creating a virtuous cycle for Auto Trader.

- Economies of Scale: Auto Trader's operational scale allows for efficient marketing and platform development, which new entrants would find hard to match.

The threat of new entrants for Auto Trader Group remains low due to significant capital requirements and the challenge of building a comparable network effect. In 2024, Auto Trader's established brand, extensive data, and user base present formidable barriers. New platforms would need massive investment to achieve critical mass and replicate the trust Auto Trader has cultivated over decades.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024 Context) |

|---|---|---|---|

| Capital Investment | High costs for platform development, marketing, and acquiring inventory data. | Substantial financial hurdle. | Millions required for a national launch; Auto Trader's marketing spend is in the tens of millions annually. |

| Network Effects | The dual-sided market requires attracting both buyers and sellers simultaneously. | Difficult to gain traction without critical mass. | Auto Trader listed over 400,000 cars on average per month in the UK during 2024. |

| Brand Recognition & Trust | Decades of operation have built strong consumer and dealer loyalty. | New entrants struggle to gain immediate credibility. | Auto Trader consistently ranks as the most visited automotive website in the UK. |

| Proprietary Data & Insights | Accumulated historical data on pricing, trends, and consumer behavior. | Replication of this data advantage is time-consuming and costly. | Auto Trader's valuation tools and market insights are highly sophisticated and data-driven. |

Porter's Five Forces Analysis Data Sources

Our Auto Trader Group Porter's Five Forces analysis is built upon a foundation of diverse and reliable data sources, including Auto Trader's official annual reports, industry-specific market research reports from firms like Statista and IBISWorld, and publicly available financial filings.