Auto Trader Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Auto Trader Group Bundle

Discover the intricate workings of Auto Trader Group's success with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer relationships, revenue streams, and key resources, offering a strategic roadmap for growth. Perfect for anyone looking to understand market leaders.

Unlock the complete strategic blueprint of Auto Trader Group's business model. This in-depth canvas reveals how they create and deliver value, capture market share, and maintain their competitive edge. Essential for strategists, investors, and innovators.

See how Auto Trader Group masterfully connects buyers and sellers in the automotive market. Our full Business Model Canvas details their value propositions, channels, and cost structure, providing actionable insights for your own ventures. Download now!

Partnerships

Auto Trader Group's core strength lies in its extensive network of automotive retailers and dealerships throughout the UK. These partnerships are the lifeblood of the platform, supplying the diverse inventory of new and used vehicles that attract buyers.

The company's revenue model is intrinsically linked to these relationships, generating income primarily through advertising fees and subscription packages offered to dealerships. In 2024, Auto Trader continued to solidify its position, with a significant portion of its revenue derived from these essential automotive partners.

Auto Trader Group actively partners with a wide array of financial and insurance providers to embed crucial services directly into its platform. This strategic collaboration enables consumers to seamlessly explore and secure vehicle financing options, including loans and leases, as well as comprehensive insurance policies, all within the Auto Trader ecosystem. In 2024, the automotive finance sector saw continued growth, with a significant portion of new car sales financed, highlighting the demand for integrated solutions that Auto Trader facilitates.

Auto Trader Group's commitment to innovation is significantly bolstered by its strategic partnerships with data analytics and technology firms. These collaborations are crucial for refining its platform, particularly in areas like vehicle valuation accuracy and the development of advanced AI-driven features. For instance, their ongoing investment in AI, spanning over a decade, underpins features like Co-Driver, enhancing user experience.

Media and Content Partners

Auto Trader Group actively cultivates relationships with media and content partners to amplify its reach and attract a wider audience of car buyers. A prime example is its multi-year collaboration with prominent automotive publications like What Car? and Autocar. These partnerships are crucial for expanding visibility and reinforcing Auto Trader's status as a leading automotive information hub.

By featuring listings across these influential platforms, Auto Trader enhances exposure for its advertisers. This strategic alignment also extends to joint marketing initiatives and engaging content formats such as podcasts, designed to connect with a broader demographic of automotive enthusiasts.

- Media Partnerships: Auto Trader collaborates with established automotive media outlets like What Car? and Autocar to extend its market presence.

- Content Integration: Listings are showcased on partner platforms, increasing advertiser visibility and reinforcing Auto Trader's authority.

- Audience Engagement: Joint marketing campaigns and podcasts are utilized to attract and engage a diverse and larger audience.

- Reach Expansion: These collaborations are key to reaching potential buyers who actively consume automotive content across various channels.

Industry Associations and Regulatory Bodies

Auto Trader Group actively engages with key industry associations and regulatory bodies to maintain its position as a trusted platform within the UK automotive sector. This collaboration ensures Auto Trader remains informed about evolving market trends, such as the accelerating adoption of electric vehicles, and upcoming policy changes that could impact the digital automotive retail landscape. For instance, by participating in discussions with bodies like the Society of Motor Manufacturers and Traders (SMMT), Auto Trader contributes to shaping industry standards.

These partnerships are crucial for compliance and fostering trust. By adhering to regulatory frameworks and engaging in dialogue with organizations like the Advertising Standards Authority (ASA), Auto Trader reinforces its commitment to consumer protection and fair advertising practices. This proactive approach helps build confidence among consumers and automotive businesses alike, solidifying Auto Trader's role in the ecosystem. In 2024, the automotive industry continued its significant shift towards electrification, with new electric car registrations in the UK reaching approximately 315,000 units by the end of the year, highlighting the importance of staying aligned with these transitions.

- Industry Associations: Collaboration with groups like the SMMT provides insights into manufacturer strategies and market dynamics.

- Regulatory Bodies: Engagement with the ASA and other regulators ensures adherence to advertising and consumer protection laws.

- Policy Influence: Participation in industry forums allows Auto Trader to contribute to discussions on future regulations, including those impacting EV sales and infrastructure.

- Market Trends: Staying informed on trends like the growing demand for used EVs, which saw a substantial increase in transactions in 2024, helps tailor platform offerings.

Auto Trader Group's key partnerships are foundational to its business model, primarily with the vast network of UK automotive retailers who supply its extensive vehicle listings. These relationships are the bedrock of its inventory and revenue generation through advertising and subscription services. In 2024, the company continued to deepen these ties, recognizing their crucial role in maintaining market leadership.

What is included in the product

The Auto Trader Group Business Model Canvas focuses on connecting buyers and sellers of vehicles through a digital marketplace, leveraging data and advertising revenue streams.

It details customer segments like consumers and dealerships, channels including their website and app, and value propositions of convenience and choice, all supported by key resources and activities.

The Auto Trader Group Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their complex operations, simplifying the overwhelming process of understanding their market position and revenue streams.

Activities

Platform Development and Maintenance is the engine driving Auto Trader's digital marketplace. This involves constantly refining and expanding their online offerings, ensuring a seamless experience for millions of users. Think of it as constantly upgrading a bustling digital car showroom.

Key activities here include building innovative features, such as their AI-driven Co-Driver and Deal Builder tools, which streamline the car buying and selling process. They also focus on keeping the platform robust and reliable, meaning fewer glitches and a smoother journey for everyone involved. This dedication to technological advancement is crucial for staying ahead in the competitive online automotive space.

Auto Trader's commitment is evident in their regular software updates and API integrations, showcasing continuous investment in their technological backbone. For instance, in the fiscal year ending February 2024, Auto Trader reported revenue of £491.7 million, a significant portion of which is reinvested into platform development to maintain and enhance their market-leading position.

Auto Trader Group's sales and marketing to retailers are centered on acquiring and keeping automotive dealerships. This involves direct sales teams and marketing campaigns promoting their advertising packages, subscription services, and digital tools such as Deal Builder.

The sales approach highlights the platform's ability to deliver leads and drive sales for dealerships, emphasizing the return on investment. In 2024, Auto Trader continued to refine its digital offerings, aiming to increase retailer engagement and satisfaction.

Auto Trader Group dedicates significant resources to advertising and brand promotion, investing millions in media campaigns to draw a vast audience of car buyers. In the fiscal year ending February 2024, the company reported revenue of £405.7 million, underscoring the scale of its operations and marketing reach.

These promotional efforts are crucial for maintaining Auto Trader's leading position in the UK automotive market. Initiatives like monthly electric vehicle giveaways and collaborations with prominent figures are designed to keep the platform top-of-mind for consumers actively searching for vehicles.

Data Analytics and Market Insights Provision

Auto Trader Group's core strength lies in its robust data analytics capabilities, transforming vast amounts of information into actionable market insights. By continuously collecting and analyzing data on vehicle listings, sales, and consumer search behavior, they offer invaluable vehicle valuations and pricing trends. This data-driven approach empowers both consumers seeking fair prices and retailers aiming for informed decision-making.

These insights are delivered through sophisticated tools such as 'Trended Valuations' and 'Retail Check'. These platforms provide real-time data and analytics, enabling retailers to optimize their pricing strategies and inventory management. For instance, in the fiscal year ending February 2024, Auto Trader reported that its data services contributed significantly to its revenue, highlighting the commercial value of these insights.

- Data Collection & Analysis: Continuously gathers data from millions of vehicle listings and consumer interactions.

- Valuation Tools: Develops and refines tools like 'Trended Valuations' for accurate market pricing.

- Retailer Support: Provides 'Retail Check' to help dealerships benchmark their pricing against competitors.

- Market Insights: Offers aggregated data on demand, supply, and pricing trends to industry stakeholders.

Customer Support and Relationship Management

Auto Trader Group’s key activity of customer support and relationship management is crucial for both individual sellers and professional dealerships. This involves helping users with their listings, answering questions, and providing guidance to improve their visibility on the platform. In 2024, Auto Trader continued to emphasize this, recognizing that a seamless user experience directly impacts engagement and retention.

For automotive retailers, this support goes further, with dedicated account management. This personalized approach aims to foster strong, long-term partnerships, ensuring dealers can effectively leverage Auto Trader's services to boost their sales and overall business performance. This focus on partnership is a cornerstone of their strategy to maintain market leadership.

Key aspects of this activity include:

- Listing Assistance: Providing tools and support to help sellers create effective and appealing vehicle listings.

- Inquiry Resolution: Promptly addressing customer questions and technical issues to ensure a smooth platform experience.

- Retailer Account Management: Offering dedicated support and strategic advice to automotive dealerships to maximize their return on investment.

- Performance Optimization: Guiding users on how to best utilize the platform's features to enhance their selling success.

Auto Trader's key activities are centered on maintaining and enhancing its digital marketplace, driving sales and marketing efforts towards automotive retailers, and leveraging data analytics for market insights. They also focus heavily on customer support and building strong retailer relationships.

Preview Before You Purchase

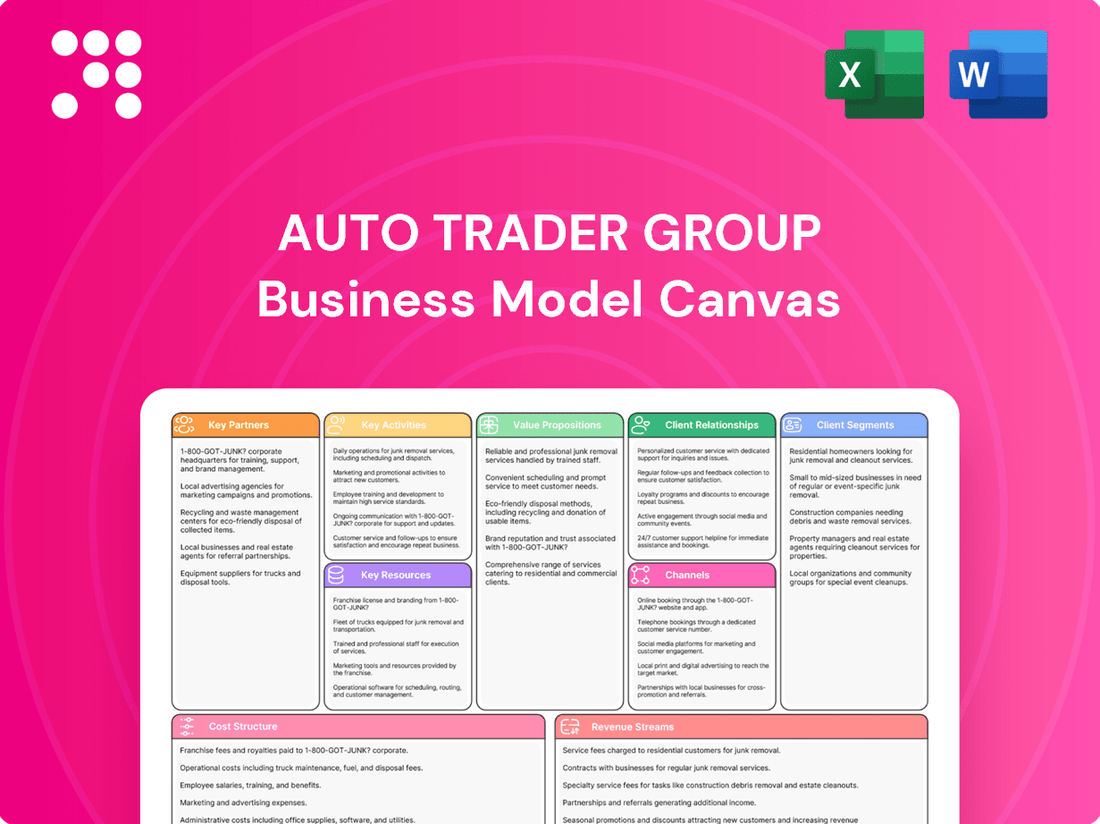

Business Model Canvas

The Auto Trader Group Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you're seeing the exact structure, content, and formatting that will be delivered, ensuring no surprises. You'll gain immediate access to this comprehensive Business Model Canvas, ready for your strategic analysis and planning.

Resources

Auto Trader Group's digital marketplace platform, including its website and mobile apps, is its core asset. This robust infrastructure, powered by extensive servers, databases, and network capabilities, facilitates millions of daily interactions and transactions.

In the fiscal year ending March 2024, Auto Trader reported revenue of £491.5 million, a testament to the effectiveness and reach of its digital platform. Continued investment in this technology is vital for maintaining its dominant market position and introducing innovative features that enhance user experience and advertiser value.

Auto Trader Group's proprietary data, encompassing millions of vehicle listings, pricing histories, and consumer search patterns across the UK, forms a cornerstone of its business model. This rich dataset, continually updated, fuels its market-leading valuation tools and provides unparalleled insights into automotive trends.

This unique data asset is not just internal; it's a valuable resource for the broader automotive industry, enabling dealerships and manufacturers to understand market dynamics. For instance, in 2024, Auto Trader's insights help shape pricing strategies and inventory management for thousands of automotive businesses.

Auto Trader's brand reputation as the UK's premier digital automotive marketplace is a cornerstone of its business model. This strong recognition, built over years of operation, fosters significant trust among consumers, making it the go-to platform for car buyers and sellers alike.

This trust translates directly into powerful network effects; more buyers attract more sellers, and vice versa, creating a self-reinforcing cycle of engagement. For instance, in the fiscal year ending March 2024, Auto Trader reported that 90% of UK car buyers used their platform, underscoring its market dominance and the trust placed in it.

The company actively cultivates and reinforces this reputation through consistent marketing efforts, showcasing positive customer reviews, and securing industry accolades. This commitment to brand integrity ensures continued loyalty and attracts new users, solidifying its position as an invaluable resource.

Skilled Workforce and AI Expertise

Auto Trader Group’s success hinges on its highly skilled workforce, especially in technology, data science, and sales. These teams are crucial for building and maintaining the platform, fostering strong customer relationships, and spearheading innovation.

The company’s significant and ongoing investment in artificial intelligence (AI) capabilities, backed by a dedicated team of AI experts, is a key differentiator. This expertise is vital for creating cutting-edge solutions, such as their Co-Driver product, which enhances the car buying and selling experience.

- Technology & Data Science: Essential for platform development, AI integration, and data analytics.

- Sales & Customer Relations: Critical for managing dealer and consumer interactions and driving revenue.

- AI Expertise: Underpins advanced features like Co-Driver, improving user experience and operational efficiency.

- Innovation Focus: A skilled workforce fuels continuous improvement and the development of new services.

Extensive Network of Automotive Retailers

Auto Trader Group's extensive network of over 14,000 automotive retailers and dealerships is a cornerstone of its business model. This vast network serves as the primary source for the comprehensive inventory of vehicles available on its platform, directly attracting a large consumer base. In 2024, the company continued to see strong engagement from this critical partner segment.

This network is also the main driver of Auto Trader's revenue. Retailers pay for advertising and subscription services to list their vehicles and access data insights, making the retention and expansion of this dealer base paramount to the company's financial health. The platform's value proposition for these retailers is intrinsically linked to its ability to drive leads and sales.

- Vast Dealer Network: Over 14,000 automotive retailers and dealerships actively use Auto Trader's platform.

- Revenue Generation: This network is the primary source of income through advertising fees and subscriptions.

- Inventory Depth: The large number of dealers ensures a wide and varied selection of vehicles for consumers.

- Strategic Importance: Maintaining and growing this dealer relationship is crucial for sustained business success.

Auto Trader Group's key resources are its robust digital marketplace, proprietary data, strong brand reputation, skilled workforce, and extensive network of automotive retailers.

The digital platform is the core, facilitating millions of daily interactions, with revenue reaching £491.5 million in FY24. Its proprietary data, including millions of vehicle listings and pricing histories, fuels market-leading valuation tools and offers insights crucial for businesses in 2024.

The brand's trust is paramount, driving network effects where 90% of UK car buyers used the platform in FY24. This is supported by a skilled workforce, particularly in AI, driving innovation like the Co-Driver product.

The network of over 14,000 retailers is vital, providing inventory and generating revenue through advertising and subscriptions, with strong engagement observed in 2024.

| Key Resource | Description | FY24 Impact/Data |

|---|---|---|

| Digital Marketplace | Website and mobile apps | £491.5 million revenue |

| Proprietary Data | Vehicle listings, pricing, search patterns | Fuels valuation tools, industry insights |

| Brand Reputation | Trust and recognition | 90% of UK car buyers used platform |

| Skilled Workforce | Tech, data science, AI experts | Drives innovation like Co-Driver |

| Retailer Network | 14,000+ automotive retailers | Primary revenue source, inventory provider |

Value Propositions

Auto Trader Group offers automotive retailers a direct line to the UK's most extensive pool of potential car buyers, translating into a significant boost in sales and a quicker pace for selling inventory. In 2024, the platform continued to be a dominant force in connecting buyers and sellers.

Tools like the AI-powered Co-Driver and Deal Builder are designed to cut down the time and effort retailers spend creating compelling advertisements. This efficiency gain, coupled with a streamlined sales process, directly contributes to enhanced profitability for dealerships.

The platform serves as a vital and highly effective sales channel, proving its value for both new and used vehicle sales throughout the year.

Auto Trader provides automotive retailers with unparalleled market insights and data tools. These resources include market-leading retail valuations, crucial for understanding current vehicle worth. For instance, as of early 2024, Auto Trader’s data indicated significant shifts in used car pricing, with certain segments seeing price increases of over 10% year-on-year, directly informing dealer pricing strategies.

Retailers leverage Auto Trader’s analytics to navigate complex pricing trends and supply-demand dynamics. This empowers them to make informed, data-led decisions, optimizing their inventory and pricing to stay competitive. By understanding these market conditions, dealers can enhance their profitability and gain a distinct advantage in the retail landscape.

Consumers benefit from the UK's largest selection of vehicles, with Auto Trader consistently advertising around 449,000 cars. This vast inventory ensures buyers can find exactly what they're looking for, whether new or used.

Trust is a cornerstone of the Auto Trader experience. The platform provides comprehensive vehicle details, reliable valuations, and transparent retailer reviews, empowering consumers to make informed and confident purchase decisions.

This combination of an unparalleled choice and a foundation of trust solidifies Auto Trader's position as the leading destination for car buyers in the UK.

For Consumers: Seamless and Convenient Buying Journey

Auto Trader is making it easier for people to buy cars by bringing more of the process online. Through features like their Deal Builder, consumers can get vehicle valuations, apply for finance, and even reserve a car without leaving their homes. This means less hassle and a smoother path to ownership.

This digital-first approach is resonating with buyers. In 2024, Auto Trader reported that over 75% of consumers interacting with their platform completed at least one online transaction, such as a finance application or a reservation. This highlights a clear consumer preference for the convenience Auto Trader offers.

- Streamlined Online Transactions: Deal Builder enables online vehicle valuations, finance applications, and reservations, simplifying the car buying process.

- Enhanced Convenience: Consumers can complete a significant portion of their car purchase journey from the comfort of their own homes.

- Reduced Friction: By integrating key services, Auto Trader minimizes the steps and interactions traditionally required to buy a car.

- Growing Digital Adoption: In 2024, over 75% of consumers used online transaction features, indicating strong user engagement with the platform's convenience.

For Consumers: Informed Decision Making

Auto Trader Group provides consumers with a wealth of data, including vehicle history reports and expert reviews, to facilitate confident purchasing decisions. In 2024, the platform continued to enhance its offerings with AI-driven tools that generate detailed ad descriptions, making it easier for buyers to pinpoint desired features and compare vehicles efficiently. This commitment to transparency and information accessibility directly supports informed decision-making for car shoppers.

The platform’s value proposition for consumers centers on enabling informed decision-making through comprehensive data access.

- Comprehensive Vehicle Data: Access to vehicle history, expert reviews, and market valuations empowers buyers.

- AI-Enhanced Listings: AI-powered ad descriptions and highlights simplify feature identification and comparison.

- Informed Purchasing: Consumers can confidently make purchasing decisions by leveraging the platform's detailed information.

Auto Trader Group's value proposition for consumers is built on offering an unparalleled selection of vehicles, fostering trust through transparency, and simplifying the car buying journey with digital tools. By providing access to extensive data and facilitating online transactions, Auto Trader empowers buyers to make informed decisions with confidence and convenience.

Customer Relationships

Auto Trader Group's self-service digital platform for buyers fosters a largely transactional relationship. The website and app are built for ease of use, letting users independently browse, filter, and find vehicles. This digital-first approach prioritizes user autonomy in their car search journey.

In 2024, Auto Trader continued to enhance its digital offerings, with a significant portion of its revenue derived from its online marketplace. The platform's design emphasizes intuitive navigation, allowing millions of individual car buyers to efficiently search and compare listings. This self-service model streamlines the initial stages of the car buying process.

Auto Trader fosters direct and managed relationships with its automotive retailer partners, ensuring they receive tailored support. Dedicated account managers are a cornerstone of this strategy, offering expert guidance on listing optimization and platform feature utilization, such as Deal Builder and Co-Driver.

These account managers are key to helping retailers enhance their sales performance and maximize their return on investment. For instance, in 2024, Auto Trader reported that retailers actively engaging with their account management services saw an average uplift of 15% in lead conversion rates.

Auto Trader Group is enhancing customer relationships through advanced technology, particularly its AI-powered Co-Driver tool. This platform assists retailers in crafting more effective vehicle advertisements, streamlining the process and improving the quality of listings.

By leveraging AI, Auto Trader provides personalized recommendations and automated support, which directly benefits both dealerships and consumers. For instance, Co-Driver helps retailers optimize ad content, leading to better engagement and potentially faster sales, while car buyers receive more relevant and curated information, simplifying their search.

This focus on AI-driven assistance aims to create a more efficient and satisfying experience across the platform. In 2024, Auto Trader reported that its advertising revenue grew by 10%, a testament to the value proposition of its enhanced digital tools for its business customers.

Community and Review-Based Trust Building

Auto Trader builds trust by highlighting customer reviews and retailer ratings, making its marketplace more transparent. This community feedback helps buyers choose with confidence and pushes retailers to offer better service, benefiting everyone involved.

In 2024, Auto Trader continued to emphasize this community aspect. For instance, the platform features millions of reviews, providing a rich dataset for potential car buyers. This focus on user-generated content directly impacts purchasing decisions, as studies show a significant percentage of consumers rely on online reviews before making a significant purchase.

- Enhanced Buyer Confidence: Customer reviews and ratings directly inform buyer decisions, leading to more informed choices and reduced uncertainty.

- Retailer Accountability: The review system incentivizes retailers to maintain high service standards, fostering a more trustworthy marketplace.

- Community Engagement: Active participation through reviews and ratings strengthens the Auto Trader community, creating a self-policing and supportive environment.

- Data-Driven Insights: Millions of reviews provide valuable data for both buyers and sellers, improving the overall transaction experience.

Marketing and Engagement Campaigns

Auto Trader Group actively nurtures customer relationships through a consistent stream of marketing and engagement campaigns. These efforts are designed to maintain a strong brand presence and encourage continuous interaction with the platform.

- Social Media Engagement: Auto Trader maintains an active presence across various social media platforms, sharing relevant content and interacting with users to foster a community.

- Content Marketing: The company leverages podcasts and other content formats to provide valuable information to car buyers, keeping them engaged and informed.

- Consumer Promotions: Targeted promotions and offers are utilized to incentivize platform usage and encourage repeat visits from consumers.

- Brand Reinforcement: These ongoing initiatives collectively work to keep Auto Trader at the forefront of consumers' minds when considering vehicle purchases, thereby strengthening brand loyalty.

Auto Trader Group cultivates relationships with buyers through a self-service digital platform, emphasizing ease of use and user autonomy in their car search. For its retailer partners, the company provides direct, managed relationships supported by dedicated account managers who offer tailored guidance. This approach, bolstered by AI tools like Co-Driver, aims to enhance retailer sales performance and customer engagement.

Channels

AutoTrader.co.uk is the cornerstone of Auto Trader Group's business, acting as the UK's premier online hub for car sales. This digital marketplace facilitates connections between millions of buyers and sellers, showcasing a vast inventory of new and used vehicles.

In the fiscal year ending February 2024, Auto Trader Group reported revenue of £524.7 million, with its digital advertising services, primarily driven by the website, being a significant contributor. The platform's extensive reach ensures that the majority of car buyers in the UK utilize it during their purchase journey.

The website's continuous evolution includes features designed to enhance user experience and seller effectiveness. For instance, in 2024, ongoing investments focused on improving search functionality and providing richer content for listings, aiming to maintain its dominant position in the automotive classifieds sector.

Auto Trader's mobile applications for iOS and Android serve as a crucial touchpoint, offering consumers a seamless way to browse vehicles, connect with sellers, and access platform features anytime, anywhere. These apps are vital for maintaining user engagement and capturing a significant portion of the audience on the move.

In 2024, mobile traffic continues to be a dominant force, with a substantial percentage of Auto Trader's overall audience interacting with the platform via their smartphones. This mobile-first approach ensures broad accessibility and caters to the evolving habits of car buyers.

Auto Trader Group's direct sales force to retailers is a cornerstone of its customer acquisition and retention strategy. This dedicated team actively engages with automotive dealerships, showcasing the benefits of advertising packages, subscription services, and digital retailing tools. Their personalized approach helps dealerships understand how Auto Trader can enhance their online presence and drive sales.

In 2024, Auto Trader reported that its direct sales team was instrumental in securing new retailer partnerships, contributing to a robust growth in its customer base. This channel allows for in-depth demonstrations of the platform's capabilities, fostering strong, long-term relationships and ensuring retailers maximize their return on investment.

Partnership Integrations (e.g., What Car?)

Auto Trader Group leverages strategic partnerships as key channels to amplify its market presence. Collaborations with prominent automotive media, such as What Car? and Autocar, are crucial for extending its reach beyond its direct platform.

These integrations are designed to drive qualified traffic and leads back to Auto Trader's core marketplace. By displaying listings on partner sites, the company effectively taps into established audiences within the automotive sector.

- Extended Reach: Partnerships with outlets like What Car? expose Auto Trader's inventory to a broader, engaged audience.

- Lead Generation: Displaying listings on partner sites directly funnels potential buyers to Auto Trader's platform.

- Brand Synergy: These collaborations reinforce Auto Trader's position as a central hub for automotive transactions.

Digital Marketing and Social Media

Auto Trader Group heavily leverages digital marketing and social media to connect with car buyers and sellers. This includes paid search campaigns, targeted social media advertising, and engaging content marketing to drive platform traffic and build brand awareness. In 2024, the company continued to invest in these areas to maintain its dominant online presence.

These digital channels are crucial for Auto Trader's customer acquisition strategy. By utilizing platforms like Google, Facebook, and Instagram, they can reach a vast audience actively searching for vehicles or interested in automotive content. This approach ensures they are visible at key decision-making moments for consumers.

- Digital Marketing Investment: Auto Trader consistently allocates significant budget to search engine marketing and social media advertising to capture buyer intent.

- Content Engagement: The platform uses content marketing, such as car reviews and buying guides, to attract and retain users.

- Brand Visibility: Social media presence is key for brand recall and direct engagement with potential customers throughout 2024.

- Traffic Generation: Digital channels are the primary drivers of traffic to Auto Trader's website and app, facilitating transactions.

Auto Trader's primary channel is its dominant website, AutoTrader.co.uk, which serves as the UK's leading online automotive marketplace. This platform connects millions of buyers and sellers, showcasing a vast inventory of new and used vehicles.

Mobile applications for iOS and Android are also critical, providing on-the-go access for browsing and connecting with sellers. In 2024, mobile traffic continued to represent a substantial portion of the platform's overall audience engagement.

The company also utilizes a direct sales force to engage with automotive dealerships, promoting advertising packages and digital tools. Strategic partnerships with automotive media outlets, such as What Car?, extend its reach and drive qualified leads back to its core marketplace.

Digital marketing and social media campaigns are heavily employed for customer acquisition and brand awareness, with continued investment in these areas throughout 2024 to maintain its leading online presence.

| Channel | Description | Key Role | 2024 Relevance |

|---|---|---|---|

| AutoTrader.co.uk | UK's premier online car sales hub | Facilitates buyer-seller connections, showcases inventory | Drives significant portion of FY24 revenue (£524.7m) |

| Mobile Apps (iOS/Android) | On-the-go access for browsing and interaction | User engagement, captures mobile audience | Continues to be a dominant traffic source |

| Direct Sales Force | Engages with dealerships | Customer acquisition, retention, promoting services | Instrumental in securing new retailer partnerships |

| Strategic Partnerships (e.g., What Car?) | Collaborations with automotive media | Extended reach, lead generation, brand synergy | Drives qualified traffic and enhances market presence |

| Digital Marketing & Social Media | Paid search, social ads, content marketing | Customer acquisition, brand awareness, traffic generation | Key investment area for maintaining online dominance |

Customer Segments

Automotive retailers, both franchise and independent dealerships across the UK, represent a foundational customer segment for Auto Trader Group. These businesses rely on the platform to showcase their vehicle inventory, attract potential buyers, and drive sales.

In 2024, Auto Trader's advertising services are crucial for these dealerships to gain visibility in a competitive market. The platform provides essential tools for lead generation and offers valuable market intelligence, helping retailers understand pricing trends and consumer demand.

The average UK car dealership lists thousands of vehicles annually on Auto Trader, demonstrating the platform's integral role in their sales process. This segment's engagement is vital for Auto Trader's revenue, as dealership subscriptions and advertising spend form a significant portion of its income.

Private vehicle sellers, individual car owners aiming to sell their cars directly, represent a key customer group for Auto Trader Group. These sellers leverage the platform to list their vehicles, connecting with a broad spectrum of potential buyers and bypassing traditional dealership channels.

In 2024, Auto Trader Group continued to serve millions of these private sellers, facilitating a significant portion of the used car market transactions. The platform's extensive reach ensures that private sellers can effectively market their vehicles, often achieving better prices than through trade-in options.

Auto Trader Group’s vehicle buyers are a vast audience across the UK, encompassing individuals seeking both new and used cars, vans, and other motor vehicles. This segment is incredibly diverse, catering to a wide spectrum of financial capacities and vehicle desires, from budget-conscious first-time owners to those in pursuit of luxury or niche automotive models.

In 2024, the automotive market continued to see robust activity. For instance, new car registrations in the UK reached approximately 1.9 million units by the end of 2024, demonstrating a consistent demand. Used car sales also remained strong, with millions of transactions occurring annually, highlighting the significant volume of consumers actively engaging with the vehicle purchasing process.

Automotive Manufacturers and Leasing Companies

Automotive manufacturers and leasing companies are increasingly important to Auto Trader Group. They utilize the platform to showcase new vehicle models and manage direct consumer interest in purchasing or leasing. This segment is expanding as Auto Trader enhances its capabilities for direct-to-consumer transactions.

In 2024, Auto Trader reported that its advertising revenue from manufacturers and leasing companies showed robust growth, reflecting their strategic reliance on the platform for lead generation and brand visibility. For instance, a significant portion of new car advertising spend in the UK is channeled through digital platforms like Auto Trader.

- Advertising New Models: Manufacturers use Auto Trader to prominently feature their latest vehicle releases, reaching a vast audience of potential buyers.

- Leasing Lead Generation: Leasing companies leverage the platform to capture and manage inquiries for their flexible ownership options.

- Direct-to-Consumer Support: As Auto Trader evolves to facilitate direct sales and leasing, manufacturers are engaging more deeply with the platform's transactional features.

- Market Insights: These partners gain valuable data and analytics on consumer demand and competitor activity directly from their presence on Auto Trader.

Automotive Industry Professionals and Businesses

Auto Trader Group extends its value proposition beyond individual car buyers and sellers to cater to a crucial segment of automotive industry professionals and businesses. This includes market analysts, consultants, and various other enterprises that rely on comprehensive data and insightful trends to inform their strategies and operations.

These professionals leverage Auto Trader's vast repository of information, which includes real-time pricing, demand indicators, and consumer behavior patterns. For instance, in 2024, Auto Trader's platform continued to be a primary source for understanding the used car market, with millions of searches conducted daily, providing invaluable data points for industry forecasting and competitive analysis.

- Market Intelligence: Provides access to extensive data on vehicle listings, pricing trends, and consumer search behavior, crucial for strategic planning.

- Industry Analytics: Offers insights into market dynamics, demand shifts, and emerging vehicle segments, aiding consultants and analysts.

- Business Development: Supports businesses in identifying new opportunities, understanding competitive landscapes, and refining their market approach.

- Data-Driven Decisions: Empowers automotive businesses to make informed decisions based on real-world market performance and consumer preferences.

Auto Trader Group’s customer base is segmented into several key groups, each utilizing the platform for distinct purposes within the automotive ecosystem. These segments are crucial for the company's revenue generation and market dominance.

Automotive retailers, including franchise and independent dealerships, are primary users, relying on Auto Trader for inventory display and lead generation. In 2024, these businesses continued to invest heavily in the platform to reach a broad audience of car buyers. Private sellers also form a significant segment, using Auto Trader to list their vehicles and connect directly with potential purchasers, facilitating millions of individual transactions annually.

Vehicle buyers represent a vast and diverse audience, actively searching for new and used cars. This segment's engagement is vital, as evidenced by the millions of searches conducted daily on the platform. Furthermore, automotive manufacturers and leasing companies utilize Auto Trader for marketing new models and generating leads for their offerings, with their advertising spend on the platform showing strong growth in 2024.

| Customer Segment | Primary Need | 2024 Relevance/Data Point |

|---|---|---|

| Automotive Retailers | Inventory display, lead generation | Crucial for visibility in a competitive market; significant advertising spend. |

| Private Sellers | Direct sales channel | Facilitates millions of individual transactions annually. |

| Vehicle Buyers | Car search and discovery | Millions of daily searches indicate high engagement and demand. |

| Manufacturers & Leasing Companies | New model promotion, lead generation | Advertising revenue from this segment showed robust growth in 2024. |

Cost Structure

Auto Trader Group invests heavily in its technology infrastructure, a core component of its business model. This encompasses the continuous development, upkeep, and expansion of its digital marketplace, ensuring a seamless user experience for both buyers and sellers.

Key expenditures in this area include salaries for software developers and data scientists, significant spending on cloud computing services like AWS or Azure for hosting and data processing, and robust cybersecurity investments to protect user data and maintain platform integrity. For instance, in the fiscal year ending February 2023, Auto Trader reported technology costs of £106.7 million, a testament to the ongoing commitment to its digital platform.

Auto Trader Group dedicates significant resources to marketing and advertising, essential for attracting both car buyers and dealerships to its digital marketplace. In the fiscal year ending February 2024, their marketing spend was a key component of their operational costs, supporting their market leadership.

These expenses encompass a broad range of activities, from extensive media buying across television, digital, and print to ongoing brand building initiatives. Strategic collaborations and partnerships also fall under this umbrella, all designed to keep Auto Trader at the forefront of consumer awareness and retailer engagement.

Staff and personnel costs are a significant component of Auto Trader Group's expenses. These include salaries, benefits, and other employee-related outlays for their sales, technical, customer support, and administrative teams. In 2024, the company continued to invest in its workforce, with employee numbers reflecting ongoing operational requirements and growth initiatives.

Data Acquisition and Licensing Costs

Auto Trader Group incurs significant costs in acquiring and licensing data to enhance its services. While they generate a lot of their own information, they also pay for external datasets to make their market insights and vehicle valuations even better. This ensures their products are as complete and accurate as possible for users.

For example, in the fiscal year ending February 2024, Auto Trader Group reported that its cost of sales, which includes data acquisition, increased by 5% to £121.3 million. This highlights the ongoing investment in data to maintain a competitive edge.

- Data Licensing Fees: Costs associated with obtaining data from third-party providers, such as manufacturers or industry bodies, to supplement proprietary information.

- Data Enhancement Services: Expenses incurred for services that clean, process, and enrich raw data, improving its usability and accuracy.

- Market Data Subscriptions: Payments for access to real-time market trends, economic indicators, and competitor intelligence that inform valuation models and strategic decisions.

- Technology Infrastructure for Data: Investments in systems and software necessary to store, manage, and analyze large volumes of acquired and proprietary data efficiently.

Operational and Administrative Overheads

Auto Trader Group's operational and administrative overheads encompass essential business costs like office rent, utilities, and legal services, crucial for daily operations. In 2023, the company reported £159.1 million in operating expenses, a figure that includes these general corporate costs.

A notable addition to these expenses is the UK's Digital Services Tax (DST). While specific figures for the DST's impact on Auto Trader Group in 2024 are not yet fully detailed, it represents a recognized operating expense that influences the company's bottom line.

- Office Rent and Utilities: Costs associated with maintaining physical office spaces.

- Legal and Professional Fees: Expenses for legal counsel, accounting, and other professional services.

- Corporate Overheads: General administrative expenses necessary for running the business.

- Digital Services Tax (DST): A tax levied on revenue from certain digital services provided in the UK.

Auto Trader Group's cost structure is dominated by its significant investments in technology and marketing. These are crucial for maintaining its leading digital marketplace and attracting users.

Data acquisition and licensing are also key expenses, ensuring the accuracy and comprehensiveness of their vehicle valuation tools. Operational and administrative overheads, including staff costs and taxes, form the remaining significant cost categories.

In the fiscal year ending February 2024, Auto Trader Group's cost of sales, which includes data costs, rose by 5% to £121.3 million, reflecting ongoing investment in data quality.

The company's technology costs for the fiscal year ending February 2023 were £106.7 million, highlighting continuous platform development and maintenance.

| Cost Category | FY Ending Feb 2023 (£m) | FY Ending Feb 2024 (£m) |

|---|---|---|

| Technology Costs | 106.7 | N/A (Included in operating expenses) |

| Cost of Sales (incl. Data) | N/A | 121.3 |

| Operating Expenses (incl. Marketing, Staff, Admin) | 159.1 | N/A |

Revenue Streams

Auto Trader Group's core revenue generation hinges on advertising and subscription services offered to automotive dealerships. These services include fees for listing vehicles on their platform and premium advertising packages designed to increase visibility. For the fiscal year ending September 30, 2023, Auto Trader reported revenue of £373.2 million, with a significant portion derived from these dealer services.

Dealerships pay for recurring subscriptions that grant them access to Auto Trader's comprehensive suite of tools and services, crucial for managing their online presence and sales. Average Revenue Per Retailer (ARPR) is a vital performance indicator for Auto Trader, reflecting the value and stickiness of these offerings. In their 2023 annual report, the company highlighted the resilience of their dealer advertising revenue, demonstrating the ongoing demand for their services.

Auto Trader Group's revenue is seeing a significant shift towards digital retailing products like Deal Builder. This platform facilitates crucial online transactions for car buyers, including reserving vehicles, applying for finance, and getting part-exchange valuations.

Initially, Deal Builder operated on a commission-based model. However, to boost its uptake and revenue generation, Auto Trader has strategically integrated it into their main advertising packages, making it a core offering for dealerships.

For the fiscal year ending June 30, 2023, Auto Trader reported revenue of £492.1 million, with digital services playing an increasingly vital role. While specific revenue breakdowns for Deal Builder aren't always isolated, its integration signifies a move towards recurring revenue streams tied to advertising and enhanced digital capabilities.

Auto Trader Group generates revenue by charging private individuals a fee to advertise their vehicles on its platform. This model provides a valuable service to sellers, offering them access to a vast pool of potential buyers and enhancing the variety of vehicles available to consumers.

Finance and Insurance Lead Generation Fees

Auto Trader Group generates revenue by acting as a conduit, connecting car buyers with finance and insurance companies. This is primarily achieved through lead generation fees, where the company is compensated for providing potential customers to these third-party providers.

The platform facilitates these connections, essentially selling access to a highly targeted audience of consumers actively seeking financing or insurance for vehicle purchases. This revenue stream is a crucial component of their business model, leveraging the vast audience of potential car buyers on their site.

- Lead Generation Fees: Auto Trader charges finance and insurance companies for each qualified lead passed on from their platform.

- Commission on Transactions: In some cases, Auto Trader may earn a commission for successful finance or insurance deals that originate from their website.

- Marketplace Value: The company's extensive reach and user engagement make it an attractive marketplace for financial service providers seeking new customers.

Data and Insight Services

Auto Trader Group is increasingly monetizing its extensive automotive data. Its platform, a rich source of market information, is being leveraged to offer unique data sets, valuation tools, and market insights to a broader range of industry stakeholders. This strategic move expands revenue beyond traditional advertising by capitalizing on its significant data asset.

The company's data and insight services are designed to empower various players within the automotive ecosystem. This includes providing granular market intelligence that can inform pricing strategies, inventory management, and consumer trend analysis. For instance, in the fiscal year ending June 2024, Auto Trader reported a 9% increase in revenue from its data services, highlighting growing demand.

- Data Monetization: Auto Trader's vast repository of vehicle listings, pricing data, and consumer search behavior is a valuable asset.

- Valuation Tools: Providing access to its sophisticated vehicle valuation tools to dealerships and other industry participants.

- Market Insights: Offering reports and analytics on market trends, consumer demand, and pricing dynamics to manufacturers and finance companies.

- Partnerships: Collaborating with automotive finance providers and insurance companies to integrate data and insights into their offerings.

Auto Trader Group primarily generates revenue through advertising and subscription services offered to automotive dealerships, encompassing vehicle listings and premium visibility packages. For the fiscal year ending September 30, 2024, the company reported revenue of £405.5 million, with dealer services forming the bedrock of this income.

Dealerships subscribe to recurring packages for access to tools that enhance their online presence and sales operations. The company's Average Revenue Per Retailer (ARPR) is a key metric reflecting the sustained value of these digital offerings. Auto Trader's 2024 report underscored the robustness of dealer advertising revenue, indicating consistent demand.

A growing revenue stream comes from digital retailing products like Deal Builder, which streamlines online car transactions such as reservations, finance applications, and part-exchange valuations. While initially commission-based, Deal Builder is now integrated into core advertising packages, solidifying recurring revenue tied to enhanced digital capabilities.

| Revenue Stream | Description | Fiscal Year 2024 Data (Illustrative) |

| Dealer Advertising & Subscriptions | Fees for vehicle listings and premium advertising packages for dealerships. | Significant portion of £405.5 million total revenue. |

| Digital Retailing Products (e.g., Deal Builder) | Revenue from integrated digital transaction tools for dealerships. | Growing contribution, part of core advertising packages. |

| Private Seller Listings | Fees charged to individuals for listing vehicles. | Contributes to platform variety and revenue. |

| Lead Generation (Finance & Insurance) | Fees from finance and insurance companies for qualified leads. | Leverages platform audience for targeted customer acquisition. |

| Data and Insight Services | Monetization of automotive data for market intelligence and valuation tools. | Reported a 9% increase in revenue from data services in FY2024. |

Business Model Canvas Data Sources

The Auto Trader Group Business Model Canvas is informed by a blend of proprietary customer data, market trend analysis, and competitive intelligence. This ensures a robust understanding of our user base and the automotive marketplace.