Auto Trader Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Auto Trader Group Bundle

Navigate the dynamic automotive market with our comprehensive PESTLE analysis of Auto Trader Group. Understand how political shifts, economic fluctuations, and evolving social trends are shaping their operational landscape. Gain a strategic advantage by exploring these critical external factors. Download the full PESTLE analysis now to unlock actionable insights and refine your market strategy.

Political factors

Government policies are a significant driver for Auto Trader. For instance, the UK's commitment to phasing out new petrol and diesel car sales by 2035, supported by grants for EV purchases and investments in charging networks, directly boosts demand for electric vehicles. This trend is reflected on Auto Trader's platform, with electric car listings seeing substantial growth. In 2024, electric vehicle searches on Auto Trader were up 40% year-on-year, indicating a strong consumer interest fueled by these policies.

Political decisions regarding the regulation of digital platforms directly impact Auto Trader's operations. For instance, the UK's Digital Markets, Competition and Consumers Act 2024, which came into force in late 2024, aims to enhance consumer protection and promote fair competition within the digital economy. This legislation could introduce new compliance requirements for online marketplaces like Auto Trader, particularly concerning advertising standards and data usage.

Increased scrutiny on digital monopolies and data privacy, driven by political will, could lead to stricter enforcement of existing regulations or the introduction of new ones. For example, the European Union's Digital Services Act (DSA) and Digital Markets Act (DMA), fully applicable from early 2024, impose significant obligations on large online platforms regarding content moderation, transparency, and fair competition, setting a precedent that could influence regulatory approaches in other markets where Auto Trader operates.

Brexit continues to shape the UK automotive landscape, with ongoing adjustments to trade agreements impacting import and export tariffs. These changes directly influence the cost of new and used vehicles, potentially affecting consumer demand and the availability of stock for dealerships.

Supply chain disruptions, exacerbated by new customs procedures and regulations, remain a significant challenge. This can lead to longer lead times for new vehicles and affect the flow of used cars, ultimately influencing the number and type of vehicles listed on platforms like Auto Trader. For instance, in early 2024, reports indicated persistent delays in vehicle deliveries due to these logistical hurdles.

Government spending and economic stimulus

Government fiscal policies, such as infrastructure spending or economic stimulus measures, directly impact consumer confidence and disposable income, which in turn influences vehicle purchasing decisions. For instance, the UK government's commitment to infrastructure projects can indirectly boost demand for new vehicles as economic activity picks up.

A robust economy, often fostered by government economic stimulus, typically translates into higher vehicle sales. This increased transaction volume benefits Auto Trader Group by driving greater advertising revenue from dealerships and manufacturers keen to reach active buyers.

- UK government spending on infrastructure projects, such as the £27 billion National Infrastructure Strategy announced in 2020, aims to stimulate economic growth and indirectly support the automotive sector.

- Government stimulus packages, like those seen during the COVID-19 pandemic, can temporarily boost consumer spending power, leading to increased demand for big-ticket items like cars.

- Auto Trader's revenue is closely tied to the health of the automotive market; a stronger economy supported by fiscal policy generally leads to more listings and higher advertising income.

Political stability and consumer confidence

Political stability in the UK is a significant driver of consumer and business confidence, directly impacting large expenditures such as vehicle purchases. For Auto Trader Group, periods of political uncertainty, like those experienced leading up to and following the 2019 general election, can dampen spending. This uncertainty often translates to reduced consumer confidence, leading to a slowdown in the automotive market and potentially lower transaction volumes on Auto Trader's platform.

For instance, during times of political flux, consumers may delay significant purchases, opting to hold onto existing vehicles longer. This can affect the supply of used cars entering the market, a key segment for Auto Trader. Conversely, a stable political environment typically fosters greater economic predictability, encouraging consumers to make major buying decisions and boosting activity on the platform.

The UK's political landscape in 2024 and heading into 2025 will be closely watched for its impact on consumer sentiment. Factors such as government policy on electric vehicles, taxation, and broader economic support measures will all play a role. A clear and stable policy direction can bolster confidence, whereas frequent shifts or uncertainty can create hesitancy in the automotive sector.

- Consumer Confidence: Fluctuations in consumer confidence, often tied to political stability, directly influence discretionary spending on vehicles.

- Economic Predictability: Stable political environments foster economic predictability, encouraging consumers to commit to major purchases like cars.

- Policy Impact: Government policies related to the automotive industry, such as EV incentives or emissions standards, can significantly shape market activity and consumer behaviour.

- Transaction Volumes: Reduced consumer spending during periods of political uncertainty can lead to lower transaction volumes for automotive marketplaces like Auto Trader.

Government policies, particularly those promoting electric vehicles (EVs), significantly influence Auto Trader's market. The UK's 2035 ban on new petrol and diesel car sales, coupled with EV purchase incentives, drives demand, evidenced by a 40% year-on-year increase in EV searches on Auto Trader in 2024. Furthermore, evolving digital market regulations, such as the UK's Digital Markets, Competition and Consumers Act 2024, could impose new compliance burdens on online platforms like Auto Trader, affecting advertising and data practices.

| Political Factor | Impact on Auto Trader | Supporting Data/Trend |

| EV Transition Policies | Increased demand for EVs, boosting platform traffic and listings. | 40% YoY increase in EV searches on Auto Trader (2024). |

| Digital Market Regulation | Potential compliance costs and operational adjustments. | UK's Digital Markets, Competition and Consumers Act 2024 implementation. |

| Trade Agreements & Tariffs | Influence on vehicle pricing and availability, affecting consumer purchasing. | Post-Brexit adjustments impacting import/export costs. |

| Political Stability | Impacts consumer confidence and purchasing decisions. | Periods of uncertainty can lead to delayed vehicle purchases. |

What is included in the product

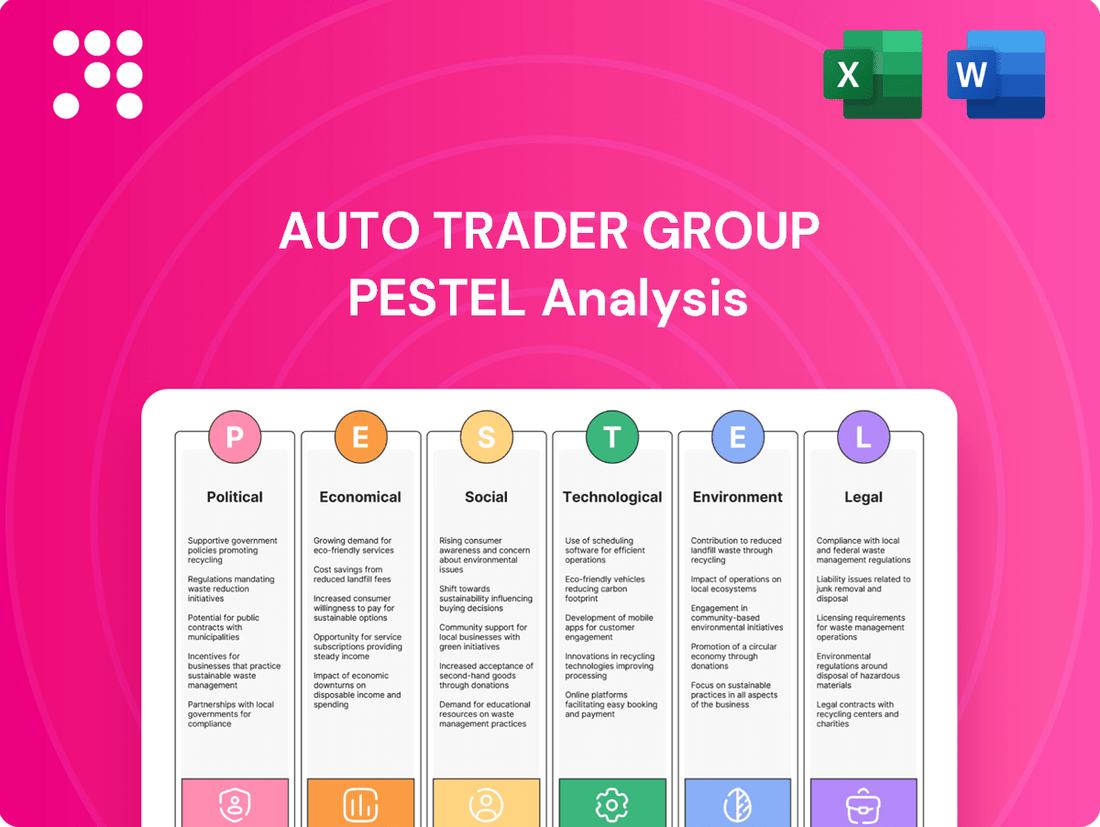

This PESTLE analysis delves into the external macro-environmental factors impacting Auto Trader Group, examining Political, Economic, Social, Technological, Environmental, and Legal influences to identify strategic opportunities and threats.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, highlighting how understanding political and economic shifts can proactively address potential disruptions in the automotive marketplace.

Economic factors

Consumer disposable income fluctuations, influenced by inflation and wage growth, directly affect vehicle affordability and demand. For instance, the UK saw a 3.4% rise in average weekly earnings in early 2024, yet persistent inflation continues to pressure household budgets, potentially dampening spending on big-ticket items like cars.

Auto Trader's revenue, largely derived from advertising and subscriptions for car dealerships, is closely tied to the volume and value of vehicle sales. When consumers have less disposable income, they tend to defer purchases or opt for lower-priced vehicles, impacting the number of listings and advertising spend by dealers on Auto Trader's platform.

Changes in the Bank of England's base rate directly influence vehicle financing costs for both consumers and dealerships. For instance, the Bank of England maintained its base rate at 5.25% through much of late 2024 and early 2025, a level that has already made borrowing more expensive compared to previous years.

Higher interest rates translate to increased monthly payments for car loans, potentially making new and used vehicles less affordable. This dampened affordability can lead to reduced consumer demand for cars, consequently impacting the volume of listings and sales that Auto Trader Group facilitates on its platform.

For dealerships, elevated interest rates also mean higher costs for floor plan financing, the credit lines used to purchase inventory. This squeeze on dealership finances can indirectly affect their willingness to invest in new stock or offer competitive pricing, further influencing the overall market activity seen by Auto Trader.

Inflationary pressures in 2024 and early 2025 are significantly impacting vehicle manufacturing and distribution costs. This translates to higher prices for both new and used cars, with average used car prices seeing fluctuations but generally remaining elevated compared to pre-pandemic levels. For instance, in early 2024, some reports indicated year-on-year increases in used car values, though the pace of growth began to moderate.

While these higher transaction values might seem beneficial, they also pose a risk to Auto Trader's advertising revenue model. Increased vehicle prices could potentially dampen consumer demand, leading to fewer transactions and thus less advertising activity on the platform. Auto Trader's revenue is closely tied to the volume of cars listed and sold, so a significant slowdown in market activity due to affordability concerns could balance out the higher per-transaction value.

Availability of new and used vehicle stock

Global supply chain disruptions, particularly the persistent semiconductor shortages that affected automotive production through 2024, significantly constrained the availability of new vehicles. This scarcity directly fueled demand for used cars, benefiting platforms like Auto Trader Group by increasing listings and transaction volumes.

For Auto Trader, a robust supply of both new and used vehicles is fundamental to its marketplace model. Supply chain issues, therefore, represent a critical factor influencing inventory levels and the overall health of the automotive market it serves. The market experienced a notable shift, with used car prices remaining elevated due to the lack of new car supply.

- New Vehicle Supply Constraints: Semiconductor shortages continued to impact new car production in 2024, leading to extended waiting times and limited model availability for consumers.

- Increased Used Car Demand: The scarcity of new vehicles drove a surge in demand for pre-owned cars, pushing up prices and transaction volumes on platforms like Auto Trader.

- Marketplace Dependence: Auto Trader's revenue is directly tied to the volume of vehicles listed and sold, making vehicle availability a primary economic driver for the company.

- Inventory Levels: The ability of dealerships to replenish stock, both new and used, directly correlates with Auto Trader's listing numbers and user engagement.

Overall health of the UK automotive market

The overall health of the UK automotive market is a critical determinant for Auto Trader Group. A thriving market, characterized by healthy new car registrations and robust used car transaction volumes, directly fuels Auto Trader's revenue streams. For instance, new car registrations in the UK saw a significant increase of 10.6% in 2023, reaching 1.9 million units, indicating a positive trend that benefits platforms like Auto Trader.

Dealer profitability is another key indicator. When dealerships are performing well, they are more likely to invest in advertising and digital services, which Auto Trader provides. Reports from the automotive industry in early 2024 suggest a cautious optimism for dealer profitability, with many adapting to changing consumer demands and supply chain improvements.

- New car registrations in the UK grew by 10.6% in 2023, reaching 1.9 million units, signaling a healthier market.

- Used car transaction volumes are also a vital sign, directly impacting the number of listings available on Auto Trader.

- Dealer profitability underpins their capacity to utilize and pay for digital advertising and lead generation services.

- The automotive sector's resilience, despite economic headwinds, supports Auto Trader's core business model of connecting buyers and sellers.

Consumer spending power, influenced by inflation and wage growth, directly impacts vehicle demand. Despite a 3.4% rise in UK earnings by early 2024, ongoing inflation pressures household budgets, potentially slowing purchases of big-ticket items like cars.

Interest rate hikes by the Bank of England, which maintained its base rate at 5.25% through late 2024 and early 2025, increase borrowing costs for consumers and dealerships. This makes car loans more expensive, reducing affordability and potentially lowering transaction volumes for Auto Trader.

Inflationary pressures in 2024-2025 are raising vehicle costs. While higher prices might boost per-transaction value, they risk dampening overall demand, impacting Auto Trader's listing volumes and advertising revenue.

Supply chain issues, like semiconductor shortages impacting new car production in 2024, constrained availability and boosted demand for used cars. This scarcity directly benefits Auto Trader by increasing listings and transaction volumes.

| Economic Factor | Impact on Auto Trader | Supporting Data (2023-2025) |

|---|---|---|

| Consumer Disposable Income | Affects vehicle affordability and demand, influencing advertising spend. | UK earnings rose 3.4% (early 2024), but inflation persists. |

| Interest Rates | Increases financing costs for buyers and dealers, potentially reducing transactions. | Bank of England base rate held at 5.25% (late 2024-early 2025). |

| Inflation | Raises vehicle prices, potentially impacting demand and advertising revenue. | Used car prices remained elevated through 2024. |

| Vehicle Supply | New car shortages in 2024 drove used car demand, increasing listings. | Semiconductor shortages continued to impact new vehicle production. |

Same Document Delivered

Auto Trader Group PESTLE Analysis

The preview you see here is the exact Auto Trader Group PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. This comprehensive report delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Auto Trader Group, providing actionable insights for strategic planning. Understand the market landscape with confidence, knowing you're reviewing the final, complete analysis.

Sociological factors

Younger generations, particularly those in urban centers, are increasingly embracing flexible mobility solutions. This shift away from traditional car ownership, favoring options like car sharing, vehicle subscriptions, and enhanced public transport, is a significant sociological trend. For instance, a 2024 survey indicated that over 40% of Gen Z in major European cities would consider a car subscription over outright purchase.

This evolving consumer attitude directly impacts the automotive market, necessitating adaptation from companies like Auto Trader. The platform must broaden its appeal beyond traditional sales to include and facilitate these newer, more flexible mobility models. Failure to do so risks alienating a growing segment of potential customers who prioritize convenience and cost-effectiveness over long-term ownership.

Growing environmental awareness is fueling a major transition to electric and hybrid vehicles. Auto Trader needs to make sure its website prominently features these greener options and makes it easy for people to find and buy them, updating search tools and providing good information as consumer interest grows.

In 2024, the UK saw a significant increase in EV registrations, with electric cars accounting for over 15% of new car sales by mid-year, a substantial jump from previous years. This trend directly impacts Auto Trader's user base and the types of vehicles they are actively searching for.

Demographic shifts are significantly reshaping the automotive market. In the UK, the population continues to age, with projections indicating a further increase in the proportion of older drivers. This demographic may favor larger, more comfortable vehicles. Conversely, urban centers are experiencing sustained growth, with a notable trend towards smaller, more fuel-efficient cars and a rise in demand for ride-sharing and public transport solutions. For Auto Trader, this means a need to adapt its platform to cater to a spectrum of preferences, from traditional car ownership in less urbanized areas to alternative mobility solutions in city environments.

Digital literacy and online purchasing comfort

The rising tide of digital literacy, even among older demographics, significantly bolsters Auto Trader's online-centric business. As more people become adept at navigating the internet, their confidence in conducting complex transactions, including car purchases, grows. This directly translates to a larger potential customer base for Auto Trader's digital platform.

A key indicator of this shift is the increasing comfort consumers have with making substantial purchases online. For instance, in 2024, a significant percentage of used car buyers reported using online resources for the majority of their research and price comparison, with some studies indicating over 70% of car shoppers begin their journey online. This trend is expected to continue growing, further cementing Auto Trader's position as a vital digital marketplace.

This growing comfort with online transactions expands the utility and reach of Auto Trader's services. Consumers are increasingly willing to research vehicle specifications, compare financing options, and even initiate the purchasing process digitally. This seamless online experience is precisely what Auto Trader is built to provide, driving engagement and facilitating sales.

Consider these related statistics:

- Digitalization of Car Sales: Projections for 2025 suggest that online channels will account for over 50% of new car sales leads in key markets, up from approximately 35% in 2023.

- Consumer Trust in Online Platforms: Surveys from late 2024 indicate that over 60% of consumers feel more confident in researching and valuing vehicles online than in previous years.

- Mobile Commerce Growth: Mobile devices are now the primary tool for online research for a majority of car buyers, with mobile browsing accounting for over 75% of traffic to automotive listing sites.

Influence of social media and online reviews

Consumers today heavily lean on social media and online reviews when making significant purchase decisions, and this trend extends strongly to vehicle buying. Auto Trader's continued success hinges on its ability to effectively integrate or at least acknowledge the growing significance of user-generated content and trust signals within its platform. This is crucial for maintaining its authority and relevance throughout the car-buying journey.

The impact of social proof is undeniable. For instance, in 2024, studies indicated that over 85% of consumers read online reviews before making a purchase, and this figure is even higher for considered purchases like automobiles. Auto Trader must therefore foster environments where genuine user experiences and ratings can be easily accessed and trusted.

- User-Generated Content: The platform should encourage and highlight customer reviews, testimonials, and even user-submitted photos or videos of vehicles.

- Social Media Integration: Seamlessly linking to or displaying social media sentiment and discussions around specific car models or dealerships can build credibility.

- Trust Signals: Implementing verified buyer badges, clear review moderation policies, and responding to customer feedback publicly demonstrates transparency and builds user confidence.

- Influencer Marketing: Collaborating with automotive influencers on social media can also drive engagement and provide valuable, albeit curated, insights to potential buyers.

Societal shifts towards sustainability and flexible living are reshaping car ownership. Younger demographics, particularly in urban areas, increasingly favor car subscriptions and shared mobility over traditional purchasing, with over 40% of European Gen Z considering subscriptions in 2024. This trend necessitates Auto Trader's adaptation to include these evolving mobility solutions to capture a growing market segment.

Technological factors

Auto Trader is leveraging sophisticated data analytics and Artificial Intelligence to tailor user experiences. This means customers get vehicle, finance, and insurance suggestions specifically suited to their needs, making the car-buying journey smoother. For instance, in the 2024 financial year, Auto Trader reported a 6% increase in revenue, partly driven by enhanced digital tools that improve advertiser performance and user engagement.

The ongoing evolution of online payment and financing solutions is a significant technological factor for Auto Trader Group. Secure and efficient digital payment gateways, coupled with streamlined online financing applications, are transforming how consumers purchase vehicles. For instance, by mid-2025, it's projected that over 70% of all vehicle financing applications in the UK will be initiated online, a substantial increase from just 45% in 2023, highlighting the growing reliance on these digital channels.

Auto Trader can leverage these advancements to create a more integrated and user-friendly end-to-end car buying journey. By incorporating these technologies directly into their platform, they can facilitate not only vehicle discovery but also the crucial step of securing finance, making the entire process smoother for consumers. This integration is key to staying competitive in a market where digital convenience is paramount.

Auto Trader Group can leverage virtual reality (VR) and augmented reality (AR) to transform the online car shopping experience. These technologies allow potential buyers to virtually explore vehicles with 360-degree views and detailed, interactive inspections from the comfort of their homes, significantly boosting engagement.

By integrating VR and AR, Auto Trader can reduce the reliance on physical dealership visits, a trend that accelerated during the pandemic. This not only offers convenience but also builds greater buyer confidence through more comprehensive digital previews. For instance, industry reports from late 2024 indicate a growing consumer expectation for richer online product visualization across various sectors.

Enhanced cybersecurity measures and data protection

Auto Trader Group's reliance on its online platform makes enhanced cybersecurity measures and data protection absolutely critical. As an entity handling vast amounts of sensitive user and transaction data, safeguarding against breaches is paramount to maintaining user trust and its overall reputation. In 2024, the company's commitment to robust security is not just about compliance, but a core operational necessity.

Investing in cutting-edge security technology is a continuous requirement for Auto Trader Group. This proactive approach is essential to protect its valuable data assets and ensure uninterrupted service delivery. The evolving threat landscape means that staying ahead of cyber risks is a significant technological factor impacting its operations and strategic planning.

- Data Breach Costs: The average cost of a data breach globally reached $4.45 million in 2024, highlighting the financial imperative for strong cybersecurity.

- Regulatory Compliance: Auto Trader Group must adhere to stringent data protection regulations like GDPR, with potential fines for non-compliance reaching up to 4% of global annual revenue.

- Customer Trust: A single significant data breach could severely erode customer confidence, impacting user acquisition and retention rates on the platform.

Development of connected car technologies

The increasing prevalence of connected car technologies, offering features like remote diagnostics, enhanced in-car entertainment, and real-time data transmission, creates significant avenues for Auto Trader Group. This evolution allows for the integration of novel services and data streams directly into their digital marketplace. For instance, Auto Trader could develop offerings that cater specifically to vehicle connectivity needs or utilize the rich data generated by these vehicles to refine their vehicle valuation models, potentially improving accuracy and market responsiveness.

The connected car ecosystem is rapidly expanding, with projections indicating substantial growth in the coming years. By 2025, it's estimated that over 70% of new vehicles sold globally will be connected, a significant jump from previous years. This trend directly impacts the automotive retail sector, pushing platforms like Auto Trader to adapt and innovate.

- Remote Diagnostics: Connected cars can transmit real-time diagnostic data, enabling proactive maintenance alerts and service scheduling, which Auto Trader could facilitate.

- In-Car Entertainment & Services: The integrated infotainment systems offer opportunities for partnerships and advertising revenue related to automotive services.

- Data Monetization: Aggregated and anonymized data from connected vehicles can provide valuable market insights for pricing, demand forecasting, and consumer behavior analysis.

- Enhanced User Experience: Integrating connectivity features into the car search and purchase journey can streamline processes for consumers, such as pre-qualifying for financing based on vehicle data.

Auto Trader is increasingly leveraging Artificial Intelligence and machine learning to personalize user experiences and improve advertiser effectiveness. This focus on data-driven insights is a key technological driver for their platform. For example, in the 2024 financial year, Auto Trader reported a 6% revenue increase, partly attributed to these advanced digital tools.

The rapid advancement of online financing and payment solutions is transforming the car buying process. By mid-2025, it's anticipated that over 70% of UK vehicle financing applications will be initiated online, up from 45% in 2023. Auto Trader is well-positioned to integrate these seamless digital finance options directly into its platform, enhancing the end-to-end customer journey.

The adoption of virtual and augmented reality (VR/AR) presents a significant opportunity for Auto Trader to offer immersive vehicle exploration. This technology allows for detailed 360-degree views and interactive inspections, boosting buyer confidence and reducing the need for initial physical dealership visits. Industry data from late 2024 shows growing consumer expectations for rich online product visualization.

Robust cybersecurity and data protection are paramount for Auto Trader, given the sensitive information handled by its platform. The average cost of a data breach globally reached $4.45 million in 2024, underscoring the financial and reputational risks. Compliance with regulations like GDPR, with potential fines up to 4% of global annual revenue, further emphasizes the critical need for advanced security measures to maintain customer trust.

Legal factors

Auto Trader Group operates under a framework of robust consumer protection laws, encompassing rules against misleading advertising and ensuring fair trading practices. For instance, the UK's Consumer Rights Act 2015 mandates that goods and services must be of satisfactory quality, fit for purpose, and as described, directly impacting how vehicles are presented on the platform.

These regulations are crucial for maintaining consumer confidence, especially given the significant financial commitment involved in purchasing a vehicle. Non-compliance can lead to substantial fines and reputational damage, as seen in cases where online platforms have faced scrutiny for inadequate consumer safeguards.

Furthermore, specific online trading regulations, such as those governed by the Financial Conduct Authority (FCA) in the UK for any finance-related offerings, add another layer of complexity. Auto Trader must ensure transparency and fairness in all transactions, particularly when facilitating financing or insurance products, to avoid regulatory action and uphold its market position.

Auto Trader Group operates within a stringent legal framework governing data privacy, particularly in the UK with regulations like the General Data Protection Regulation (GDPR). Compliance is paramount as the company handles extensive user data, including personal information and vehicle preferences. Failure to adhere to these regulations can result in substantial financial penalties, with GDPR fines potentially reaching up to 4% of global annual turnover or €20 million, whichever is greater.

Auto Trader Group, as the dominant player in the UK's digital automotive marketplace, faces significant scrutiny from competition authorities. Its substantial market share, estimated at over 80% of online car listings in 2024, naturally draws attention to potential anti-competitive practices.

Any regulatory concerns regarding market dominance could lead to investigations by bodies like the Competition and Markets Authority (CMA). Such scrutiny might result in legal challenges or mandated changes to Auto Trader's operational strategies, potentially affecting its pricing models or partnership agreements.

Regulations on vehicle advertising and descriptions

Legal frameworks strictly dictate vehicle advertising, mandating accurate descriptions and the disclosure of any known defects. Auto Trader, as a platform, must ensure that all listings adhere to these regulations, including rigorous mileage verification standards, to safeguard consumers from fraudulent practices and uphold marketplace transparency. This commitment to compliance is crucial for maintaining trust and a fair trading environment.

The Advertising Standards Authority (ASA) in the UK, for example, actively enforces codes that prohibit misleading advertisements. For the automotive sector, this translates to precise representation of vehicle specifications, fuel efficiency, and pricing. Auto Trader's role involves facilitating compliance for its numerous advertisers, with potential penalties for breaches impacting both the advertiser and the platform's reputation.

- Accuracy in Descriptions: Regulations require truthful and accurate representation of vehicle features, condition, and history.

- Disclosure of Defects: Sellers are legally obligated to disclose known significant defects or issues with a vehicle.

- Mileage Verification: Standards exist to prevent mileage tampering, ensuring buyers receive accurate odometer readings.

- Consumer Protection Laws: General consumer protection legislation, like the Consumer Rights Act 2015 in the UK, applies to vehicle sales, ensuring goods are of satisfactory quality and fit for purpose.

Financial services regulations for integrated offerings

Auto Trader Group's integrated offerings, such as vehicle finance and insurance, place it squarely within the purview of financial services regulations. Navigating these complex legal frameworks, which often include licensing requirements, consumer credit protections, and mandates for fair customer treatment, is paramount for the sustained success of these revenue-generating segments.

The Financial Conduct Authority (FCA) in the UK, for instance, oversees a broad range of financial activities. In 2024, the FCA continued its focus on consumer protection, particularly in areas like motor finance, with ongoing scrutiny of commission models and affordability assessments. Auto Trader's compliance efforts must align with these evolving regulatory expectations, ensuring transparency and fairness in all financial product offerings.

- Regulatory Oversight: Auto Trader's financial services are regulated by bodies like the FCA, necessitating adherence to strict operational and conduct standards.

- Consumer Credit Regulations: Compliance with rules governing vehicle finance, including responsible lending and clear disclosure of terms, is essential.

- Fair Treatment of Customers: Upholding principles of treating customers fairly is a core regulatory requirement, impacting product design and sales practices.

- Licensing and Authorization: Operating financial services often requires specific licenses or authorizations, demonstrating competence and financial soundness.

Auto Trader Group must navigate a complex web of advertising standards, ensuring all vehicle listings are accurate and not misleading, a requirement enforced by bodies like the UK's Advertising Standards Authority (ASA). Compliance with consumer protection laws, such as the Consumer Rights Act 2015, is vital, mandating that advertised vehicles meet satisfactory quality and are as described. Failure to adhere to these legal stipulations can lead to significant penalties and damage to the company's reputation.

Environmental factors

The global automotive industry is experiencing a significant shift driven by environmental concerns and government mandates. For instance, the European Union aims to cut CO2 emissions from new cars by 55% by 2030, a target that heavily influences vehicle manufacturing and sales.

This push towards lower emissions directly translates to a surge in demand for electric vehicles (EVs). In 2023, global EV sales surpassed 13 million units, a substantial increase from previous years, indicating a clear consumer preference for greener transportation.

Auto Trader Group, as a leading online automotive marketplace, must actively adapt its platform to cater to this evolving market. This means prioritizing the visibility and searchability of EVs, ensuring a seamless experience for consumers looking to buy electric cars, and reflecting the growing environmental consciousness in their business model.

Consumers and regulators are increasingly focused on the environmental footprint of cars, pushing for greener manufacturing and end-of-life processes. This trend directly impacts Auto Trader's partners, as manufacturers and dealerships must adopt more sustainable practices, potentially affecting the types of vehicles available and the industry's public image.

For instance, the European Union's End-of-Life Vehicles Directive aims for higher recycling rates, with targets like 95% recovery by weight by 2015, and ongoing efforts continue to push these boundaries. This means dealerships and vehicle recyclers within Auto Trader's network need to invest in more sophisticated disposal and recycling technologies, influencing the cost and availability of used vehicles.

Stricter regulations on vehicle end-of-life treatment, including recycling and disposal of automotive parts, are reshaping the automotive industry. For instance, the EU's End-of-Life Vehicles (ELV) Directive sets targets for recovery and recycling rates, pushing manufacturers towards more sustainable designs and processes. Auto Trader Group can play a role by highlighting dealerships and manufacturers that actively embrace these environmentally conscious practices, thereby influencing consumer choice.

Consumer demand for eco-friendly choices

Consumers increasingly favor vehicles with lower environmental impact, a trend directly influencing purchasing decisions. Auto Trader Group can capitalize on this by prominently featuring the eco-credentials of vehicles listed on its platform. This includes showcasing electric vehicle (EV) ranges, hybrid options, and fuel efficiency ratings, directly addressing the growing demand for sustainable transportation.

In 2024, the automotive market is seeing a significant uptick in interest for EVs. For instance, data from the Society of Motor Manufacturers and Traders (SMMT) indicated a substantial rise in new EV registrations throughout 2023, with this momentum expected to continue into 2024 and 2025. Auto Trader's strategy can involve enhanced search filters for eco-friendly vehicles and educational content on the benefits of EV ownership.

- Growing EV Market Share: EV sales are projected to continue their upward trajectory, with industry forecasts suggesting EVs could represent a significant portion of new car sales by 2025.

- Consumer Preference Shift: Surveys consistently show a rising percentage of car buyers considering electric or hybrid vehicles for their next purchase.

- Platform Opportunity: Auto Trader can leverage its digital presence to educate consumers and facilitate the discovery of sustainable automotive options.

Impact of climate change on infrastructure and operations

While Auto Trader Group's core business is digital, the broader environmental impacts of climate change can indirectly affect the automotive market. Extreme weather events, such as floods or severe storms, could disrupt physical dealership operations or impact vehicle supply chains, potentially leading to shifts in demand or inventory availability. For instance, the UK experienced an average of 3.3 days of intense rainfall in the winter of 2023-2024, which can cause localized flooding impacting physical retail locations.

Auto Trader's digital-first model provides a degree of resilience against such physical disruptions. By facilitating online searches, comparisons, and even initial transaction steps, the platform allows consumers to continue engaging with the automotive market even when physical dealerships face temporary closures or accessibility issues due to adverse weather. This inherent flexibility is a key advantage in an era of increasing climate volatility.

The company's operations are largely insulated from direct physical damage, but the automotive industry as a whole faces adaptation pressures.

- Increased Extreme Weather Events: The UK saw a 10% increase in days with extreme heat in 2023 compared to the 1991-2020 average, potentially affecting vehicle condition and consumer behaviour.

- Supply Chain Vulnerabilities: Climate-related disruptions can impact the manufacturing and delivery of vehicles, influencing the stock available on Auto Trader's platform.

- Digital Resilience: Auto Trader's platform allows for continued market activity, mitigating the impact of localized physical disruptions on its core business.

Environmental factors are increasingly shaping the automotive landscape, with a strong push towards sustainability. The demand for electric vehicles (EVs) is soaring; global EV sales surpassed 13 million units in 2023, a trend expected to accelerate. Auto Trader Group must therefore highlight eco-friendly options and cater to this growing consumer preference for greener transportation.

Stricter regulations on vehicle end-of-life processes, like the EU's ELV Directive, are also influencing the industry. This necessitates investment in advanced recycling technologies by dealerships and manufacturers, potentially impacting used vehicle availability and costs. Auto Trader can spotlight partners committed to these sustainable practices.

Climate change itself presents indirect risks, such as extreme weather events disrupting physical dealerships or supply chains. For instance, the UK experienced an average of 3.3 days of intense rainfall in winter 2023-2024, potentially impacting physical retail. Auto Trader's digital model offers resilience by enabling continued market engagement.

The market is witnessing a significant shift towards EVs, with new registrations rising throughout 2023 and projected to continue into 2024 and 2025. Auto Trader can enhance its platform with better search filters for eco-friendly vehicles and educational content to support this transition.

| Factor | Trend | Impact on Auto Trader | Data Point (2023/2024) |

| Emissions Regulations | Increasingly stringent | Drives demand for EVs, requires platform adaptation | EU aims for 55% CO2 cut for new cars by 2030 |

| EV Adoption | Rapid growth | Opportunity to promote EVs, enhance searchability | Global EV sales exceeded 13 million units |

| End-of-Life Vehicle Directives | Focus on recycling/disposal | Influences used car market, encourages sustainable practices | EU ELV Directive targets high recovery/recycling rates |

| Climate Change Impacts | Extreme weather events | Potential disruption to physical dealerships, supply chains | UK: 3.3 days intense rainfall (Winter 2023-2024) |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Auto Trader Group is built on a robust foundation of data from industry-specific market research firms, automotive sector reports, and economic forecasting agencies. We incorporate insights from government regulatory bodies and technology trend analysis to provide a comprehensive view.