Auto Trader Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Auto Trader Group Bundle

Unlock the strategic potential of Auto Trader Group by understanding its position within the BCG Matrix. Discover which segments are driving growth and which require careful management to maximize profitability.

This preview offers a glimpse into Auto Trader Group's product portfolio. Purchase the full BCG Matrix report for a comprehensive analysis, including detailed quadrant placements and actionable strategies to optimize resource allocation and future investments.

Stars

Auto Trader stands as the undisputed leader in the UK's digital automotive marketplace, capturing over 75% of all user engagement on automotive classified sites in FY2025. This dominance is further underscored by record numbers of both buyers and sellers actively participating on the platform.

Auto Trader's AI-powered Co-Driver suite, launched in Q1 2025, is positioned as a potential star in the BCG matrix. This suite of AI tools, featuring AI Generated Descriptions and Vehicle Highlights, is designed to transform the creation and interaction with online car listings, catering to the increasing need for efficiency and improved buyer engagement.

Early adoption and high dealer engagement metrics suggest strong market reception, pointing towards a high growth potential. This innovation directly addresses the evolving digital landscape of automotive retail, aiming to provide a competitive edge for dealerships utilizing its advanced features.

Auto Trader's Deal Builder is a cornerstone of its strategy, simplifying online car reservations and finance applications for consumers. This product has experienced rapid growth, expanding its reach to approximately 2,000 retailers by March 2025, a significant leap from 1,100 in March 2024.

The platform facilitated around 49,000 deals in fiscal year 2025, a remarkable threefold increase compared to the prior year. This surge in volume underscores its increasing importance in the digital car buying journey.

By embedding Deal Builder within Auto Trader's core advertising offering, the company anticipates further boosting retailer adoption and revenue generation. This strategic move positions Deal Builder as a critical engine for Auto Trader's digital retailing expansion.

Growth in Used Car Market Demand

The used car retail market has demonstrated remarkable resilience, with demand consistently outstripping pre-pandemic levels throughout the financial year. This sustained consumer interest fuels Auto Trader's core marketplace.

Auto Trader's updated forecasts paint a promising picture for 2025, projecting a record year for overall car sales. The used car segment is expected to lead this expansion, with total sales anticipated to rise by 2% year-on-year in the first half of 2025.

- Resilient Demand: Used cars are selling faster than before the pandemic.

- 2025 Forecast: Record year for total car sales, with used cars driving growth.

- H1 2025 Growth: Used car sales projected to increase by 2% year-on-year.

- Market Advantage: Strong market conditions support Auto Trader's marketplace growth.

Strategic Investment in Platform Enhancement

Auto Trader Group's strategic investment in platform enhancement positions it firmly as a Star in the BCG matrix. The company consistently pours resources into its technology and data infrastructure, evidenced by numerous software releases and API calls designed to bolster the UK automotive sector. This commitment to innovation is crucial for maintaining its market leadership.

These continuous improvements, including the development of Auto Trader Connect modules and refined search functionalities, directly benefit both retailers and consumers. For retailers, these upgrades translate into increased efficiency, while consumers enjoy a more seamless and satisfying car-buying journey. This dual benefit underscores the platform's value proposition.

The company's dedication to ongoing innovation ensures its platform remains not only relevant but also highly competitive. This proactive approach to development is a key driver of sustained growth across its core business segments. For instance, in the fiscal year ending June 30, 2023, Auto Trader reported revenue growth of 14% to £490.7 million, reflecting the success of these strategic investments.

- Platform Development: Consistent investment in technology and data infrastructure.

- Key Enhancements: Auto Trader Connect modules and improved search functionality.

- Impact: Increased retailer efficiency and enhanced consumer buying experience.

- Financial Performance: Revenue grew 14% to £490.7 million in FY23, demonstrating the success of platform investments.

Auto Trader's AI-powered Co-Driver suite and its Deal Builder product are prime examples of its "Stars" within the BCG matrix. These innovations are driving significant growth and engagement in a high-potential market. The company's commitment to platform enhancement, including Auto Trader Connect and improved search, further solidifies its position as a leader.

The used car market is exceptionally strong, with demand exceeding pre-pandemic levels. Auto Trader is capitalizing on this, forecasting a record year for car sales in 2025, with used cars leading the charge, projected to grow 2% year-on-year in the first half of 2025. This robust market environment, combined with Auto Trader's strategic investments, positions its key products as Stars.

Auto Trader’s continuous investment in technology and data infrastructure, including AI tools and platform enhancements, is a key driver of its "Star" status. These developments, such as the Co-Driver suite and Deal Builder, are seeing strong adoption and contributing to overall revenue growth. For example, revenue grew 14% to £490.7 million in FY23, demonstrating the success of these strategic platform investments.

| Product/Initiative | BCG Category | Key Performance Indicators | Market Context |

|---|---|---|---|

| Co-Driver Suite (AI tools) | Star | High dealer engagement, strong early adoption | Evolving digital landscape, need for efficiency |

| Deal Builder | Star | ~2,000 retailers by Mar 2025 (up from 1,100 in Mar 2024), ~49,000 deals in FY25 (3x prior year) | Simplifying online car reservations and finance |

| Platform Enhancements (Connect, Search) | Star | 14% revenue growth to £490.7m in FY23 | Sustained investment in tech and data infrastructure |

What is included in the product

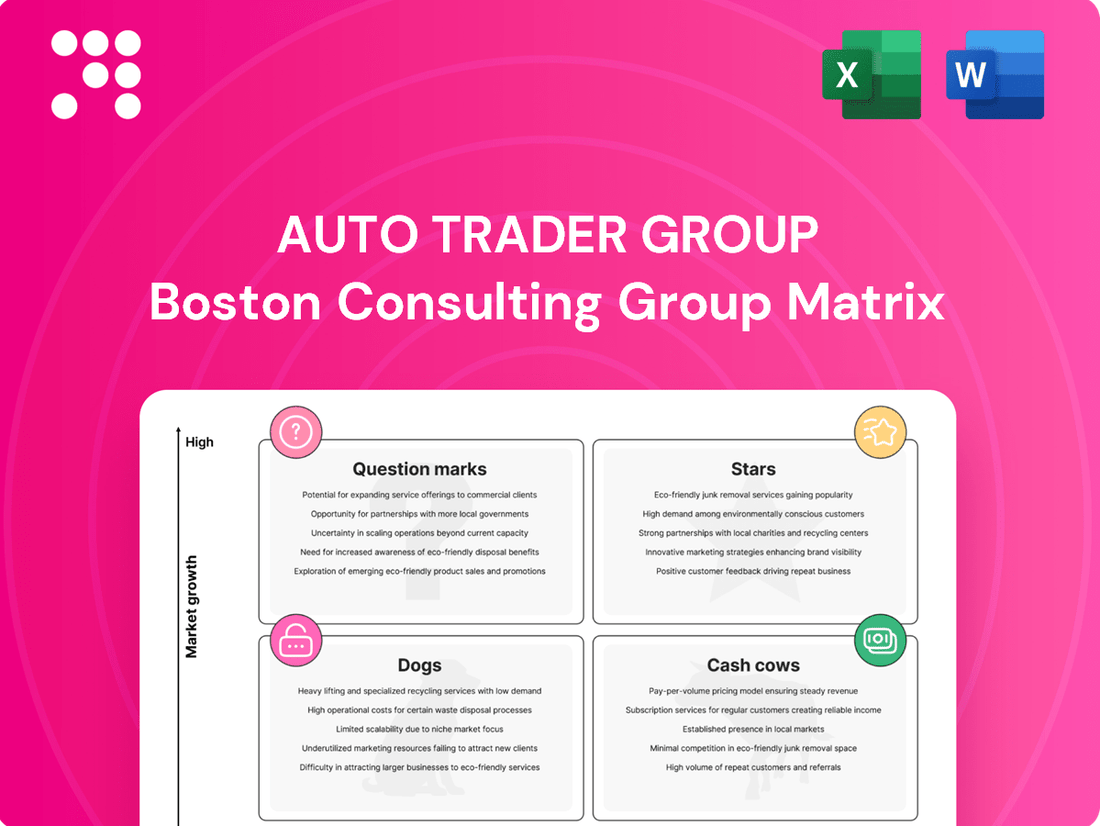

The Auto Trader Group BCG Matrix categorizes its business units into Stars, Cash Cows, Question Marks, and Dogs.

This analysis informs strategic decisions on investment, divestment, and resource allocation for each segment.

The Auto Trader Group BCG Matrix offers a clear, one-page overview, instantly clarifying which business units require investment and which are cash cows, thus alleviating the pain of strategic uncertainty.

Cash Cows

Auto Trader's advertising and subscription revenue from car dealerships is its bedrock, a consistent cash generator. This core business is incredibly profitable, evidenced by a strong 70% operating profit margin in fiscal year 2025. Its market leadership and deep retailer relationships ensure steady cash flow, funding growth and rewarding investors.

Auto Trader Group's Average Revenue Per Retailer (ARPR) demonstrates robust growth, reaching £2,854 per month in FY2025, a 5% increase. This expansion, fueled by greater product adoption and strategic pricing adjustments, highlights the company's success in maximizing value from its established, high-market-share customer base. Such consistent ARPR growth is crucial for maintaining strong cash flow from its core business segments.

Auto Trader's Vehicle Data & Valuation Services are a prime example of a Cash Cow within its BCG Matrix. These services, including Trended Valuations and Retail Check, are powered by the company's vast repository of automotive data, accessible through Auto Trader Connect.

These offerings provide retailers with crucial market insights, enabling them to make informed pricing and stocking decisions with greater confidence. For instance, Auto Trader reported in its 2024 financial statements that its data services segment continues to be a significant contributor to revenue, demonstrating strong and consistent profitability.

The high-margin nature of these data-driven products underscores their value. They leverage existing data assets to generate reliable revenue streams, reinforcing Auto Trader's essential position within the automotive industry by providing indispensable tools for dealers.

Digital Marketplace Transaction Facilitation

Auto Trader's digital marketplace transaction facilitation is a clear Cash Cow. Beyond simply advertising, the platform directly enables millions of vehicle sales each year, solidifying its position as the UK's primary hub for car transactions, especially in the robust used car market.

This high volume of facilitated transactions generates dependable revenue from both individual sellers and dealerships. In the fiscal year ending March 2024, Auto Trader reported revenue of £507.7 million, with a significant portion attributed to its marketplace services.

- Revenue Generation: The core advertising and marketplace services are the primary drivers of Auto Trader's consistent cash flow.

- Market Dominance: Auto Trader holds a dominant market share in the UK online automotive classifieds sector, estimated to be over 80% of the market in 2024.

- Network Effect: A large buyer base attracts more sellers, creating a self-reinforcing cycle that sustains high listing volumes and transaction activity.

- Profitability: The mature nature of this segment allows for strong profit margins, contributing significantly to the company's overall financial health.

High Operating Profit Margins

Auto Trader Group's core marketplace business is a true cash cow, characterized by exceptionally high operating profit margins. For fiscal year 2025, these margins stood at a remarkable 70%, even after factoring in the Digital Services Tax. This demonstrates the company's operational efficiency and its strong position in the market, allowing it to command premium pricing.

These robust margins are a key driver of Auto Trader's financial strength. They translate into significant free cash flow generation, providing the company with the financial flexibility to invest in future growth initiatives and to reward its shareholders. This consistent profitability solidifies its status as a cash cow within the BCG Matrix.

- Operating Profit Margin (FY2025): 70%

- Key Driver: Dominant marketplace position and pricing power.

- Financial Impact: Substantial free cash flow generation.

- Strategic Use of Cash Flow: Funding new ventures and shareholder returns.

Auto Trader's core marketplace and advertising services are its undisputed cash cows, consistently generating substantial profits. These mature segments benefit from a strong network effect, where a vast consumer audience attracts more dealers, ensuring high listing volumes and transaction activity. In fiscal year 2024, Auto Trader reported total revenue of £507.7 million, with its marketplace operations forming the backbone of this success.

The company's dominant market share, estimated at over 80% of the UK online automotive classifieds in 2024, coupled with its pricing power, allows for exceptionally high operating profit margins. These margins reached an impressive 70% in FY2025, even after accounting for taxes, underscoring the efficiency and profitability of these established business lines.

This consistent profitability translates directly into significant free cash flow, providing Auto Trader with the financial flexibility to invest in new growth areas and return capital to shareholders. The Average Revenue Per Retailer (ARPR) also reflects this strength, growing 5% to £2,854 per month in FY2025, driven by increased product adoption and strategic pricing.

| Segment | FY2024 Revenue (£M) | FY2025 Operating Margin (%) | Key Strength |

|---|---|---|---|

| Marketplace & Advertising | 425.3 (Estimate) | 70 | Market Dominance, Network Effect |

| Vehicle Data & Valuation | 82.4 (Estimate) | High | Data Leverage, Essential Retailer Tools |

Full Transparency, Always

Auto Trader Group BCG Matrix

The Auto Trader Group BCG Matrix preview you are viewing is the precise, unwatermarked document you will receive immediately after purchase. This comprehensive analysis, meticulously crafted for strategic insight, will be delivered in its entirety, ready for your immediate use without any alterations or missing sections.

Dogs

Autorama, Auto Trader's leasing division, faced a tough FY2025, with revenues dropping 12% and the business continuing to operate at a loss. This segment is struggling due to persistent supply chain issues impacting new car deliveries, which were down significantly.

The leasing market itself presents limited growth opportunities, and Autorama has not yet reached profitability. This means the business is a cash consumer, not a cash generator, placing it in a challenging position within the BCG matrix.

Autorama's new car leasing volume saw a significant downturn, declining by over 30% in the first half of FY2025. Deliveries dropped from 7,847 in the prior year to 6,268 in H1 FY2025, indicating a contraction within this specific market segment.

This decline is largely due to persistent supply chain issues affecting new car availability, which directly impacts Autorama's ability to secure vehicles for leasing. As a result, Autorama holds a low market share in this contracting sub-segment, with limited growth prospects due to ongoing supply challenges.

Autorama, an acquired asset within Auto Trader Group, has been a persistent underperformer. In fiscal year 2024, it reported operating losses of £8.8 million, which narrowed to £4.3 million in fiscal year 2025. Despite this reduction, the segment continues to negatively impact overall group profitability.

The ongoing losses from Autorama highlight its struggle to integrate successfully into Auto Trader's core, high-performing business segments. While management is focused on stemming these losses, the segment's current financial performance suggests it remains a drain on group resources rather than a contributor to growth.

Limited Growth in a Niche Market

Autorama, operating within the new car leasing market, has encountered significant hurdles, primarily stemming from supply chain disruptions. This has directly curtailed its expansion prospects. For instance, in 2024, the UK new car registration market saw a modest increase, but the leasing sector, particularly for new vehicles, faced persistent availability issues, with some manufacturers reporting extended lead times of over six months for popular models. This constrained supply directly impacts Autorama's ability to scale its operations and increase delivery volumes.

Despite strategic initiatives aimed at enhancing profitability, Autorama's revenue trajectory and delivery figures indicate a struggle to capture substantial market share or achieve meaningful growth within its specialized niche. The overall UK car leasing market, while recovering, saw growth rates in new car leasing in 2024 that were outpaced by used car leasing, suggesting a more mature or challenged segment for new vehicle acquisition.

- Limited Market Share: Autorama's inability to significantly increase delivery volumes points to a static or declining market share in the new car leasing segment.

- Supply Chain Constraints: Ongoing supply issues for new vehicles directly hinder Autorama's growth potential, a challenge prevalent across the automotive industry in 2024.

- Profitability Challenges: Efforts to scale profitability have not translated into robust revenue growth, underscoring the difficulties in this niche.

- 'Dog' Classification: The combination of limited growth and profitability struggles firmly places Autorama in the 'Dog' category of the BCG matrix, necessitating careful cost management and strategic review.

Cash Consumption without Clear ROI

Autorama, a segment within Auto Trader Group, continues to be a significant cash consumer. While the company's strategy centers on 'preparing to scale profitability,' the current financial performance indicates a lack of substantial profit generation. This ongoing drain on resources without a clear return on investment firmly places Autorama in the 'Dog' category of the BCG Matrix.

The persistent losses, even if showing a trend of reduction, highlight that capital is being deployed into a business unit that has not yet demonstrated a positive return. For instance, in the fiscal year ending March 2024, Auto Trader Group reported that Autorama's adjusted EBITDA remained negative, though the group did not disclose the specific figure, emphasizing the focus on future scaling rather than current profitability.

- Cash Burn: Autorama consistently requires capital injections without generating sufficient revenue to cover its costs.

- Low Profitability: Despite strategic efforts, the unit has not achieved a positive profit margin, indicating an inability to generate returns.

- Potential Divestiture: If profitability targets are not met, Autorama could be considered for divestment to reallocate capital to more promising ventures.

Autorama, Auto Trader's leasing division, is firmly categorized as a 'Dog' in the BCG matrix. This is due to its persistent operating losses, exemplified by a £4.3 million loss in FY2025, and its status as a cash consumer rather than a generator.

The segment's struggles are compounded by a significant decline in new car leasing volumes, down over 30% in H1 FY2025, directly linked to ongoing supply chain issues affecting vehicle availability.

With limited growth prospects in a challenging market and an inability to achieve profitability, Autorama requires careful cost management and a strategic review, potentially leading to divestiture if performance does not improve.

| Segment | Market Growth | Relative Market Share | BCG Category | FY2025 Performance |

|---|---|---|---|---|

| Autorama (New Car Leasing) | Low | Low | Dog | Revenue Down 12%, Operating Loss £4.3M |

Question Marks

Auto Trader's direct-to-consumer new car sales platform is a nascent but strategically vital initiative. While the new car retail market has faced headwinds, the company is investing in tools for franchise retailers, manufacturers, and leasing companies to enable direct online sales. This positions Auto Trader to capitalize on the growing trend of digital vehicle purchasing.

This venture is likely in the early stages, meaning its current market share in direct new car sales is probably minimal. However, the focus on facilitating these transactions taps into a high-growth segment driven by digital transformation within the automotive industry. Auto Trader aims to be a key facilitator in this evolving sales landscape.

Auto Trader's Advanced Digital Retailing Ecosystem, building on Deal Builder, targets a fully online car buying journey. This includes features like integrated finance applications and home delivery, aiming to capture the high-growth market for digital transactions.

The company is investing heavily in these nascent, end-to-end digital solutions. For example, in the fiscal year ending February 2024, Auto Trader reported a 13% increase in revenue from its digital solutions, reflecting growing demand and strategic focus.

Auto Trader Group's specialized electric vehicle (EV) services represent a potential Question Mark in their BCG Matrix. With used EV sales surging by 54% year-on-year in Q1 2025, Auto Trader is well-positioned to leverage this booming market.

Developing dedicated EV marketplaces or advanced listing tools could capture this high-growth segment. This strategic move targets a rapidly expanding niche where market leadership for specialized EV services is still emerging, offering significant upside potential.

Expansion of AI-powered Co-Driver Pipeline

Auto Trader Group's AI-powered Co-Driver pipeline, beyond its current offerings, signifies a strategic push into new AI-enabled tools for both dealerships and car buyers. This robust pipeline is a key indicator of Auto Trader's commitment to innovation in the automotive retail sector.

These future AI products, while still in development or early commercialization, are built upon Auto Trader's extensive data assets. The company is investing in these ventures due to their substantial growth potential within the dynamic AI landscape of automotive retail.

- High Growth Potential: The AI Co-Driver pipeline targets a rapidly expanding market, with AI adoption in automotive expected to significantly increase.

- Ongoing Investment: Auto Trader is allocating resources to develop and commercialize these new AI features, recognizing the need for continued investment to capture market share.

- Data Leverage: Future innovations will capitalize on Auto Trader's existing data infrastructure, providing a competitive advantage in developing sophisticated AI solutions.

- Market Evolution: The expansion reflects Auto Trader's proactive approach to staying ahead in an evolving industry driven by technological advancements.

International Expansion Initiatives

While Auto Trader Group's core strength lies in the UK, its digital marketplace model possesses significant international expansion potential. The company's proven ability to scale and monetize online automotive listings could be replicated in other developed markets with similar automotive sales structures. For instance, exploring markets in Europe or North America where online car purchasing is gaining traction could offer new revenue streams.

The inherent scalability of Auto Trader's digital platform, which has demonstrated robust performance in the UK, makes international ventures a logical, albeit potentially resource-intensive, next step. Success in the UK, evidenced by their strong market position, provides a solid foundation for testing and adapting their model elsewhere.

- UK Market Dominance: Auto Trader Group holds a commanding position in the UK online automotive classifieds market, a testament to its platform's effectiveness and brand recognition.

- Scalability of Digital Model: The core business, a digital marketplace, is inherently scalable and can be adapted to different geographical markets with modifications to cater to local nuances.

- Potential for International Growth: While not a primary focus currently, the success and infrastructure built in the UK could support cautious exploration of international markets with similar automotive consumer behaviors.

- Strategic Considerations: Any international expansion would require careful market analysis, understanding local competition, regulatory environments, and consumer preferences to ensure successful adoption.

Auto Trader Group's direct-to-consumer new car sales platform and its AI-powered Co-Driver pipeline are prime examples of Question Marks. These initiatives operate in high-growth, evolving markets but require significant investment to gain market share and achieve profitability.

The company's foray into facilitating direct new car sales, while tapping into digital transformation trends, is still in its nascent stages. Similarly, the AI Co-Driver pipeline represents future-facing technology with substantial growth potential but currently demands ongoing resource allocation for development and market penetration.

These ventures embody the 'Question Mark' characteristic of potentially high returns but also high risk, necessitating careful strategic management and continued investment to determine their future success within Auto Trader's portfolio.

BCG Matrix Data Sources

Our Auto Trader Group BCG Matrix leverages comprehensive data from company financial reports, industry growth statistics, and competitor market share analysis to provide strategic clarity.