Andrew Peller SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Andrew Peller Bundle

Andrew Peller's strong brand recognition and diverse product portfolio are significant strengths, but the company faces challenges in a competitive market and evolving consumer preferences. Understanding these dynamics is crucial for strategic planning.

Want the full story behind Andrew Peller's market position, potential threats, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Andrew Peller Limited boasts a diverse product portfolio encompassing a wide array of wines, craft ciders, and spirits. This breadth allows them to cater to a variety of consumer tastes and budgets, from premium VQA wines to more accessible, popularly priced options.

This extensive offering is a significant strength, as it enables Andrew Peller to capture a larger market share by appealing to different segments of the beverage alcohol market. It also mitigates risk by reducing the company's dependence on the success of any single product category.

Andrew Peller boasts an impressive distribution network spanning Canada. This includes sales to provincial liquor stores, restaurants, and hospitality businesses, alongside its 101 retail locations in Ontario, demonstrating significant market presence.

The company has strategically broadened its reach by forging partnerships with major big-box retailers. This expansion, coupled with its involvement in third-party hospitality channels, effectively deepens its market penetration and accessibility.

Andrew Peller Limited boasts a stable of highly regarded and decorated brands, including Peller Estates, Trius, Thirty Bench, and the Wayne Gretzky line. This collection of premium and ultra-premium VQA wines, bolstered by a significant long-term licensing agreement for both wine and whisky with Wayne Gretzky, cultivates robust brand recognition and fosters strong consumer loyalty.

Demonstrated Operational Efficiency

Andrew Peller has actively pursued operational efficiencies, leading to notable cost reductions. In fiscal year 2025, the company achieved savings of $10.7 million through strategic initiatives.

These efforts, which include renegotiating freight rates and enhancing inventory management, directly bolster the company's financial health. Such improvements are crucial for strengthening gross margins and boosting overall profitability.

- Cost Savings: Achieved $10.7 million in savings in FY2025.

- Freight Rate Renegotiation: Successfully reduced transportation costs.

- Inventory Optimization: Improved efficiency in stock management.

- Margin Enhancement: Contributed to stronger gross margins and profitability.

Beneficiary of Government Support Programs

Andrew Peller Limited has been a significant beneficiary of government support programs, particularly in Ontario. Initiatives such as the Ontario VQA Support Program and the more recent Ontario Grape Support Program have directly bolstered the company's financial performance. These programs not only enhanced revenue streams but also positively influenced gross margins, highlighting the strategic importance of the grape and wine sector to Ontario's economy and its role in stimulating domestic grape consumption.

The impact of these government programs is evident in the company's operational results. For instance, the Ontario Grape Support Program, announced in response to market challenges, provided crucial financial relief. This support helps to stabilize the company's cost structure and ensures continued investment in the domestic wine industry. Such governmental backing is instrumental in maintaining the competitiveness of Canadian wine producers on both national and international stages.

- Government Programs Impact: Benefited from Ontario VQA Support Program and Ontario Grape Support Program.

- Financial Benefits: These programs positively affected revenue and gross margins.

- Economic Role: Sector plays a vital role in the provincial economy and supports domestic grape demand.

Andrew Peller's diverse product range, from premium VQA wines to spirits, allows it to appeal to a broad customer base, reducing reliance on any single category. Its extensive Canadian distribution network, including 101 retail locations in Ontario and partnerships with major retailers, ensures significant market reach and accessibility.

The company's portfolio of strong brands, such as Peller Estates and Wayne Gretzky, fosters consumer loyalty and brand recognition. Furthermore, significant operational efficiencies, including $10.7 million in savings achieved in FY2025 through initiatives like freight rate renegotiation and inventory optimization, bolster financial health and profitability.

| Strength | Description | Impact |

| Product Diversification | Wide array of wines, ciders, and spirits catering to various tastes and budgets. | Captures larger market share, reduces risk. |

| Distribution Network | Extensive presence across Canada, including 101 Ontario retail locations and big-box retailer partnerships. | Deepens market penetration and accessibility. |

| Brand Portfolio | Highly regarded brands like Peller Estates, Trius, and Wayne Gretzky line. | Cultivates brand recognition and consumer loyalty. |

| Operational Efficiencies | Achieved $10.7 million in savings in FY2025 through cost reduction initiatives. | Strengthens gross margins and profitability. |

What is included in the product

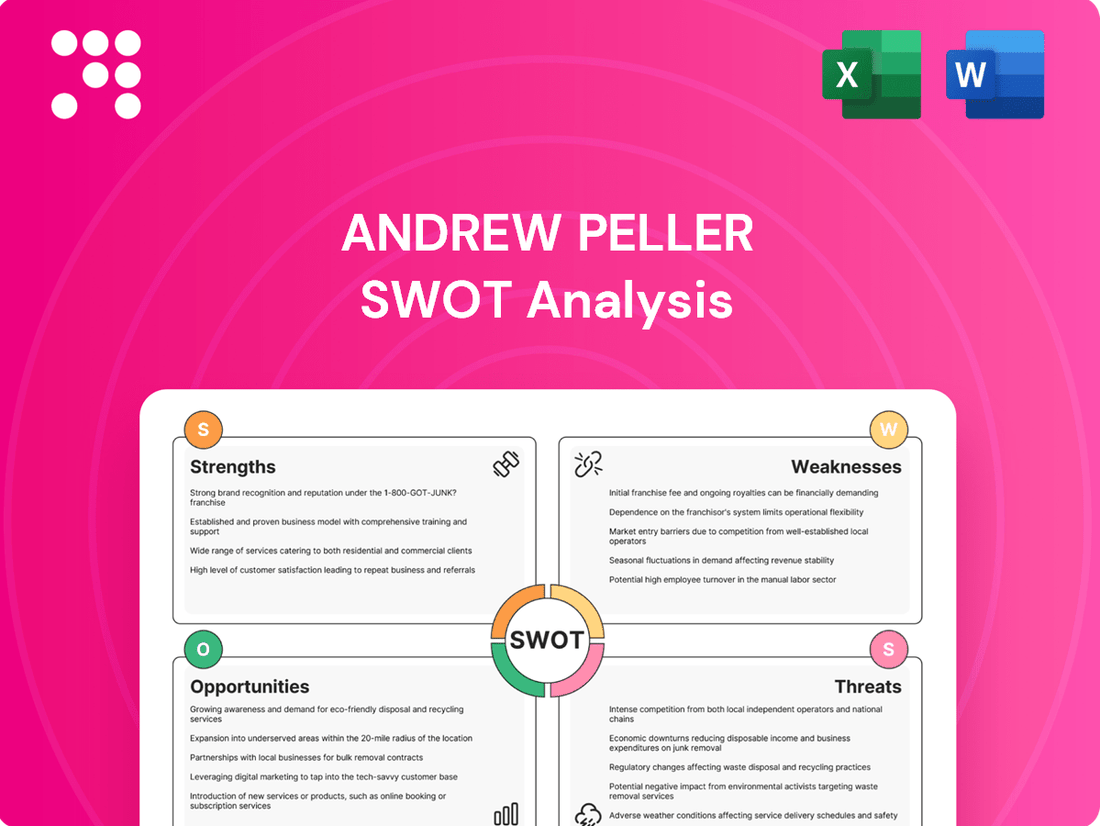

Delivers a strategic overview of Andrew Peller’s internal and external business factors, examining its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework for identifying and addressing Andrew Peller's strategic challenges.

Weaknesses

Andrew Peller faces a significant weakness in its vulnerability to changes in discretionary spending. The company has seen a downturn in sales from its more profitable avenues, like estate wineries and wine clubs. This softness is directly linked to fewer visitors and consumers cutting back on non-essential purchases, highlighting a sensitivity to economic conditions.

This trend is particularly concerning as it impacts high-margin segments. For instance, during the fiscal year ending March 31, 2024, the company noted softness in these channels, impacting overall profitability. This suggests that in tougher economic times, consumers prioritize essential goods over premium wine experiences, directly affecting Andrew Peller's revenue streams.

Andrew Peller's profitability faces a significant headwind from persistent inflation. The company's gross margins are being squeezed by rising costs for crucial inputs like imported wine, glass bottles, and packaging materials. For instance, in Q3 2024, the company noted that these inflationary pressures, coupled with increased international freight costs, continued to impact its financial performance.

While Andrew Peller has implemented cost-saving initiatives, the sustained nature of inflation poses a risk. If these programs cannot fully counteract the escalating expenses, there's a real possibility that profitability could be further eroded, especially if input costs continue their upward trajectory through 2025.

Andrew Peller has experienced non-cash losses from financial instruments, specifically mark-to-market adjustments on interest rate swaps and foreign exchange contracts. For instance, in the fiscal third quarter of 2024, the company reported a $3.6 million unrealized loss on these instruments. While these losses don't involve immediate cash outflows, they do create fluctuations in reported net earnings, impacting the company's financial statement appearance.

Dependence on Evolving Ontario Retail Market

Andrew Peller's significant reliance on the Ontario retail market, despite its adaptability, presents a notable weakness. The company's operations are intrinsically linked to the regulatory shifts and competitive pressures within this key provincial market.

This dependence means that ongoing adjustments to distribution channels and shipment schedules are often necessary, introducing operational complexities. Such changes can directly influence revenue streams, highlighting the vulnerability to market evolution.

For example, in fiscal year 2024, Andrew Peller reported that its Ontario operations represented a substantial portion of its total sales, underscoring the market's critical role. The company's ability to navigate evolving consumer preferences and provincial alcohol sales regulations in Ontario remains a key factor for its financial performance.

- Market Concentration: A large segment of sales is tied to Ontario's retail environment.

- Operational Agility Required: Constant adaptation to market changes can strain resources.

- Revenue Sensitivity: Fluctuations in Ontario's market dynamics can impact overall financial results.

Overall Decline in Canadian Wine Consumption

The Canadian wine market is facing a general slowdown in consumption. This decline, observed across the broader industry, is driven by consumers becoming more health-conscious and by the increasing cost of living, which impacts discretionary spending on items like wine. For Andrew Peller, this overall market contraction represents a significant long-term headwind for its primary wine operations.

While Andrew Peller has demonstrated an ability to navigate these shifts, the persistent downward volume trend in the Canadian wine sector challenges the organic growth potential of its foundational wine business. This makes it harder to expand sales volume in a shrinking market.

- Market Volume Decline: Canadian wine consumption volume has been on a downward trajectory.

- Consumer Drivers: Health consciousness and rising cost-of-living pressures are key contributors to this trend.

- Impact on Peller: This overarching market weakness presents a sustained challenge to the growth of Andrew Peller's core wine segment.

Andrew Peller's reliance on specific markets, particularly Ontario, creates a significant weakness. The company's sales are heavily concentrated in this province, making it vulnerable to changes in local regulations and competitive dynamics. This dependence necessitates constant operational adjustments to distribution and shipment schedules, impacting revenue streams.

The overall Canadian wine market is experiencing a slowdown in consumption, driven by health consciousness and cost-of-living pressures. This broad market contraction presents a long-term challenge for Andrew Peller's core wine business, limiting organic growth opportunities.

Persistent inflation continues to squeeze Andrew Peller's gross margins due to rising costs for key inputs like glass bottles and packaging. While the company is implementing cost-saving measures, sustained inflation could further erode profitability if cost increases outpace savings.

Non-cash losses from financial instruments, such as mark-to-market adjustments on interest rate swaps, create volatility in reported earnings. For instance, in Q3 2024, the company reported a $3.6 million unrealized loss from these instruments, impacting the appearance of net earnings without immediate cash impact.

What You See Is What You Get

Andrew Peller SWOT Analysis

This is the actual Andrew Peller SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing a genuine excerpt of the comprehensive report. Once purchased, you'll gain access to the complete, detailed analysis.

Opportunities

Ontario's move to allow more grocery and convenience stores to sell wine and spirits is a game-changer. This liberalization, which began its phased rollout in 2023, significantly expands potential sales channels for Andrew Peller. By 2024, we anticipate this trend will continue to unlock new opportunities for increased distribution and market penetration across the province.

The Canadian craft spirits market is experiencing robust expansion, with projections indicating continued strong growth through 2025. Andrew Peller is well-positioned to leverage this trend, given its established portfolio in craft ciders, seltzers, and spirits, notably featuring the Wayne Gretzky No. 99 brand. This existing footprint allows the company to directly tap into increasing consumer demand for artisanal and premium beverage options.

Consumers in Canada are increasingly seeking out premium and ultra-premium wine and spirits, alongside healthier beverage choices. This shift presents a significant opportunity for growth.

Andrew Peller's established portfolio, featuring numerous award-winning premium brands, is perfectly positioned to capture this evolving consumer demand. This alignment can lead to enhanced profit margins and overall financial performance.

For instance, in the fiscal year ending March 31, 2024, Andrew Peller reported a notable increase in sales for its premium and ultra-premium wine and spirits segments, demonstrating market receptiveness to these higher-value offerings.

Product Innovation and Category Expansion

Andrew Peller's commitment to continuous product innovation, particularly in premium wines and craft beverages, presents a significant opportunity. By introducing new offerings, especially within emerging growth categories, the company can attract a broader consumer base and boost sales. For instance, their focus on 'healthier-for-you' beverage options directly addresses evolving consumer preferences for wellness-oriented products.

This strategy is crucial for staying competitive. In 2024, the Canadian beverage alcohol market saw continued growth in premium segments and a notable rise in demand for ready-to-drink (RTD) cocktails and hard seltzers, areas where Peller can leverage its innovation capabilities. The company's ability to adapt to these trends and expand its portfolio accordingly will be key to capitalizing on these market shifts.

Key opportunities stemming from product innovation and category expansion include:

- Capturing new consumer segments through the introduction of novel and on-trend beverage alcohol products.

- Driving sales growth by expanding into high-demand categories, such as premium wines and RTDs.

- Enhancing brand perception by aligning with consumer desires for 'healthier-for-you' options and sustainable practices.

- Increasing market share by differentiating through unique product offerings and innovative packaging.

Leveraging E-commerce and Direct-to-Consumer Channels

Andrew Peller can capitalize on the growing e-commerce trend in alcohol sales, a sector that saw significant digital acceleration. For instance, in 2024, online alcohol sales in Canada were projected to reach over $3 billion, indicating a substantial shift in consumer purchasing habits.

Developing direct-to-consumer (DTC) channels, where permitted by provincial regulations, offers a direct line to customers, fostering brand loyalty and potentially improving margins by bypassing some traditional distribution layers. This approach allows for more personalized marketing and direct feedback loops.

- Expand online sales presence: Leverage existing e-commerce platforms and explore new ones to reach a wider customer base.

- Invest in DTC capabilities: Build or enhance direct-to-consumer infrastructure for wine and spirits, where regulations allow.

- Personalized digital marketing: Utilize data analytics from online channels to tailor marketing messages and offers to individual consumers.

Ontario's liberalization of alcohol sales in grocery and convenience stores, which began in 2023 and continues to expand, offers Andrew Peller significant new distribution avenues. The company is also poised to benefit from the robust growth in the Canadian craft spirits market through 2025, leveraging its existing portfolio including the Wayne Gretzky brand. Consumers are increasingly seeking premium, ultra-premium, and healthier beverage options, aligning perfectly with Peller's award-winning brands and innovation focus. Furthermore, the substantial growth in e-commerce for alcohol sales, projected to exceed $3 billion in Canada by 2024, presents a prime opportunity for Andrew Peller to enhance its direct-to-consumer channels and online presence.

Threats

Persistent economic challenges, such as elevated inflation and diminished consumer purchasing power, are directly curtailing spending on discretionary items like wine and spirits. This economic climate often prompts consumers to opt for more budget-friendly alternatives or simply buy less, which can negatively impact Andrew Peller's revenue streams, particularly in its premium product categories. For instance, in the fiscal year ending March 31, 2024, Canadian inflation averaged 3.9%, impacting household budgets and discretionary spending across various sectors.

Andrew Peller operates in a Canadian wine and spirits market characterized by intense competition from numerous domestic producers and global brands. This crowded landscape means the company must constantly innovate and differentiate its offerings to capture and retain consumer attention.

The retail environment is also shifting, with new distribution channels emerging and traditional ones evolving, potentially altering how consumers access and purchase beverages. This dynamic could lead to increased pressure on pricing as companies compete for shelf space and consumer loyalty, or necessitate higher marketing investments to maintain brand visibility.

Andrew Peller faces significant risks from fluctuating raw material costs, particularly for key inputs like grapes and imported wine. The price of glass bottles, a crucial packaging component, also adds to this exposure. These input cost variations directly affect production expenses and can squeeze gross margins.

Supply chain disruptions, amplified by volatile international freight and shipping charges, present another major threat. These disruptions can lead to delays, increased logistics costs, and ultimately impact the company's ability to meet demand efficiently, further pressuring profitability.

Adverse Regulatory Changes and Trade Policies

Andrew Peller faces significant risks from evolving federal and provincial regulations concerning alcohol production, distribution, and sales. For instance, changes in excise taxes or retail licensing could directly affect profitability. The company also needs to navigate potential trade disputes or tariffs, which could impact the cost of imported goods or the competitiveness of its export markets.

The company's adaptability to these policy shifts is crucial for sustained success. A prime example is the ongoing discussion around potential changes to direct-to-consumer shipping laws in various Canadian provinces, which could alter distribution channels. Furthermore, international trade tensions, such as those that have previously affected the wine industry, could introduce unforeseen cost increases or market access challenges, as seen with past retaliatory tariffs on agricultural products.

- Regulatory Impact: Potential increases in excise duties or changes to provincial liquor board markups could squeeze profit margins.

- Trade Policy Uncertainty: Tariffs on imported wine bottles or corks, or retaliatory measures affecting Canadian wine exports, pose a financial threat.

- Compliance Costs: Adapting operations to new labeling requirements or environmental standards adds to overhead expenses.

- Market Access: Shifts in trade agreements or the imposition of non-tariff barriers could limit access to key international markets.

Long-Term Decline in Wine Consumption

The overall decline in wine consumption volume in Canada, influenced by changing consumer habits and heightened health consciousness, poses a significant long-term threat to Andrew Peller's core wine business. For instance, Statistics Canada data from 2023 indicated a slight dip in per capita alcohol consumption, with wine experiencing a more pronounced slowdown compared to other categories. This trend, if sustained, could necessitate substantial strategic adjustments for the company.

While Andrew Peller is actively diversifying its portfolio, a persistent downturn in its primary wine segment could impact revenue streams and profitability. This long-term erosion of market share in wine, driven by evolving consumer preferences and a growing focus on wellness, presents a fundamental challenge that requires ongoing strategic evaluation and potential adaptation.

- Declining Volume: Canadian wine consumption volume has seen a gradual decrease in recent years, impacting the core market for producers like Andrew Peller.

- Health Consciousness: A growing consumer emphasis on health and wellness is leading some individuals to reduce or moderate their alcohol intake, including wine.

- Diversification Necessity: The company's efforts to diversify into spirits and ready-to-drink beverages are crucial to mitigate the risks associated with a shrinking wine market.

- Market Share Pressure: Sustained declines in wine consumption can put pressure on market share and necessitate innovative product development and marketing strategies.

Intensifying competition from both domestic and international players, coupled with evolving retail landscapes, pressures Andrew Peller's market share and pricing power. Supply chain volatility, including rising shipping costs and potential disruptions, directly impacts operational efficiency and profitability. Furthermore, shifts in consumer preferences towards health-conscious choices and a general decline in wine consumption volume in Canada pose a significant long-term threat to the company's core business, necessitating ongoing diversification and adaptation strategies.

| Threat Category | Specific Risk | Impact on Andrew Peller | Relevant Data/Example (2023-2024) |

|---|---|---|---|

| Economic Headwinds | Inflation and reduced consumer spending | Decreased demand for premium products, potential shift to lower-priced alternatives. | Canadian inflation averaged 3.9% in FY2024, impacting discretionary spending. |

| Competitive Landscape | Intense competition from domestic and global brands | Pressure on pricing, need for continuous innovation and differentiation. | The Canadian beverage alcohol market is highly fragmented. |

| Supply Chain & Costs | Fluctuating raw material and packaging costs | Squeezed gross margins due to increased production expenses. | Glass bottle prices and grape costs are subject to market volatility. |

| Regulatory Environment | Changes in excise taxes and distribution regulations | Potential impact on profitability and market access. | Ongoing discussions regarding direct-to-consumer shipping laws across provinces. |

| Consumer Trends | Declining wine consumption volume and health consciousness | Long-term threat to the core wine business, requiring portfolio diversification. | Slight dip in per capita alcohol consumption noted in 2023, with wine showing a slowdown. |

SWOT Analysis Data Sources

This Andrew Peller SWOT analysis is built upon a foundation of comprehensive data, including the company's official financial statements, detailed market research reports, and expert opinions from industry analysts to ensure a well-rounded and accurate assessment.