Andrew Peller Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Andrew Peller Bundle

Andrew Peller navigates a dynamic beverage industry, facing significant buyer power from large retailers and intense rivalry among established wineries. Understanding these forces is crucial for any stakeholder.

The complete report reveals the real forces shaping Andrew Peller’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of suppliers for essential inputs like grapes, glass bottles, and other raw materials significantly impacts their bargaining power. When there are only a limited number of suppliers for a crucial component, they gain considerable leverage in dictating prices and terms.

Andrew Peller Limited's reliance on both domestically sourced grapes and imported wines, alongside packaging materials, exposes it to potential price hikes and disruptions. For instance, in 2024, the cost of glass bottles saw an increase of approximately 8-10% due to energy and transportation costs, directly affecting the beverage industry's input expenses.

The availability of substitutes for key inputs like grapes, glass bottles, and packaging materials directly influences Andrew Peller's bargaining power with its suppliers. If there are many alternative suppliers offering similar products, Andrew Peller can more easily switch, thus reducing supplier leverage.

For example, the wine industry relies heavily on grape supply. In 2023, Canada's wine production was valued at approximately $6.1 billion, with grapes being a primary input. However, events like the severe winter freezes in British Columbia in late 2022 and early 2023, which damaged a significant portion of the vineyards, can reduce the availability of domestic grapes. This scarcity can force wineries like Andrew Peller to rely more on imported grapes or other regions, potentially strengthening the bargaining power of those alternative suppliers.

The costs Andrew Peller Limited might incur when switching suppliers for crucial inputs like raw materials or imported wines can be substantial. These include the expenses related to qualifying new suppliers, adapting production processes to new specifications, and the potential risk of impacting product quality or consistency, which could affect brand reputation.

In 2024, Andrew Peller has been actively implementing cost-saving initiatives and investigating alternative sourcing options for key inputs. For instance, the company has been exploring different suppliers for glass bottles, aiming to mitigate the impact of inflationary pressures and reduce potential switching costs associated with securing these essential materials.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers, where they might start producing wine and craft beverages themselves, is a consideration for Andrew Peller. This would mean they need fewer of their current inputs. While grape growers are unlikely to integrate forward, larger suppliers of packaging or key ingredients could potentially pose a greater risk, although this is generally considered a low threat in the Canadian wine industry.

Andrew Peller's strategy of operating across various beverage categories, including wine, spirits, and ready-to-drink products, inherently diversifies its supplier relationships and product lines. This diversification helps to spread the risk associated with any single supplier potentially integrating forward. For instance, in 2024, Andrew Peller's revenue streams were bolstered by its strong presence in both the wine and spirits segments, reducing reliance on any one input category.

- Low Likelihood of Forward Integration: Agricultural suppliers, such as grape growers, typically lack the capital and expertise to enter the complex beverage production market.

- Potential for Larger Suppliers: Suppliers of specialized packaging or unique ingredients might have a higher capacity for forward integration, though this remains a limited concern.

- Diversification as a Mitigator: Andrew Peller's broad portfolio across different beverage types (wine, spirits, RTDs) reduces dependence on any single supplier or input, thereby lowering the overall impact of this threat.

Importance of Andrew Peller to Suppliers

Andrew Peller Limited's importance as a customer directly impacts its suppliers' bargaining power. If Andrew Peller constitutes a significant portion of a supplier's revenue, that supplier may be more inclined to offer favorable terms to retain the business, thereby reducing their leverage.

Conversely, suppliers providing highly specialized or scarce inputs, such as unique grape varietals or proprietary fermentation yeasts, may retain considerable bargaining power irrespective of Andrew Peller's overall size as a client. For instance, in 2024, the demand for premium Okanagan Valley grapes, a key input for some of Andrew Peller's premium wines, outstripped supply, giving those growers increased negotiating strength.

- Customer Dependence: Andrew Peller's purchasing volume influences supplier willingness to negotiate.

- Input Scarcity: Suppliers of unique or limited inputs possess greater bargaining power.

- Market Dynamics: High demand for specific inputs, like premium Okanagan grapes in 2024, amplifies supplier leverage.

Andrew Peller's bargaining power with suppliers is influenced by the concentration of suppliers for key inputs like grapes and packaging. When few suppliers exist for essential materials, their leverage to dictate prices and terms increases. For example, in 2024, the cost of glass bottles rose by 8-10%, impacting beverage producers.

The availability of substitutes for inputs such as grapes or packaging materials also plays a crucial role. If Andrew Peller can easily switch to alternative suppliers, it reduces the bargaining power of existing ones. However, disruptions like the 2022-2023 winter freezes in British Columbia, which damaged vineyards, can limit domestic grape supply, potentially increasing the bargaining power of suppliers of imported grapes.

Switching costs, such as qualifying new suppliers or adapting production processes, can be substantial for Andrew Peller, influencing its ability to negotiate favorable terms. The company's diversification across wine, spirits, and ready-to-drink products in 2024 helps mitigate risks associated with any single supplier, as its revenue streams are supported by multiple segments.

Andrew Peller's significance as a customer can lead to more favorable terms from suppliers who rely heavily on its business. Conversely, suppliers of scarce inputs, like premium Okanagan grapes in 2024, hold greater power due to high demand and limited availability, as seen with the 2024 Okanagan grape market.

| Factor | Impact on Andrew Peller | Example/Data Point (2024 unless specified) |

|---|---|---|

| Supplier Concentration | Increases supplier leverage | 8-10% increase in glass bottle costs due to energy/transportation |

| Availability of Substitutes | Decreases supplier leverage | BC vineyard damage (late 2022/early 2023) increased reliance on imported grapes |

| Switching Costs | Can limit negotiation flexibility | Costs include supplier qualification and process adaptation |

| Customer Importance | Can increase Andrew Peller's leverage | N/A (company-specific impact) |

| Input Scarcity | Increases supplier leverage | High demand for premium Okanagan grapes in 2024 |

What is included in the product

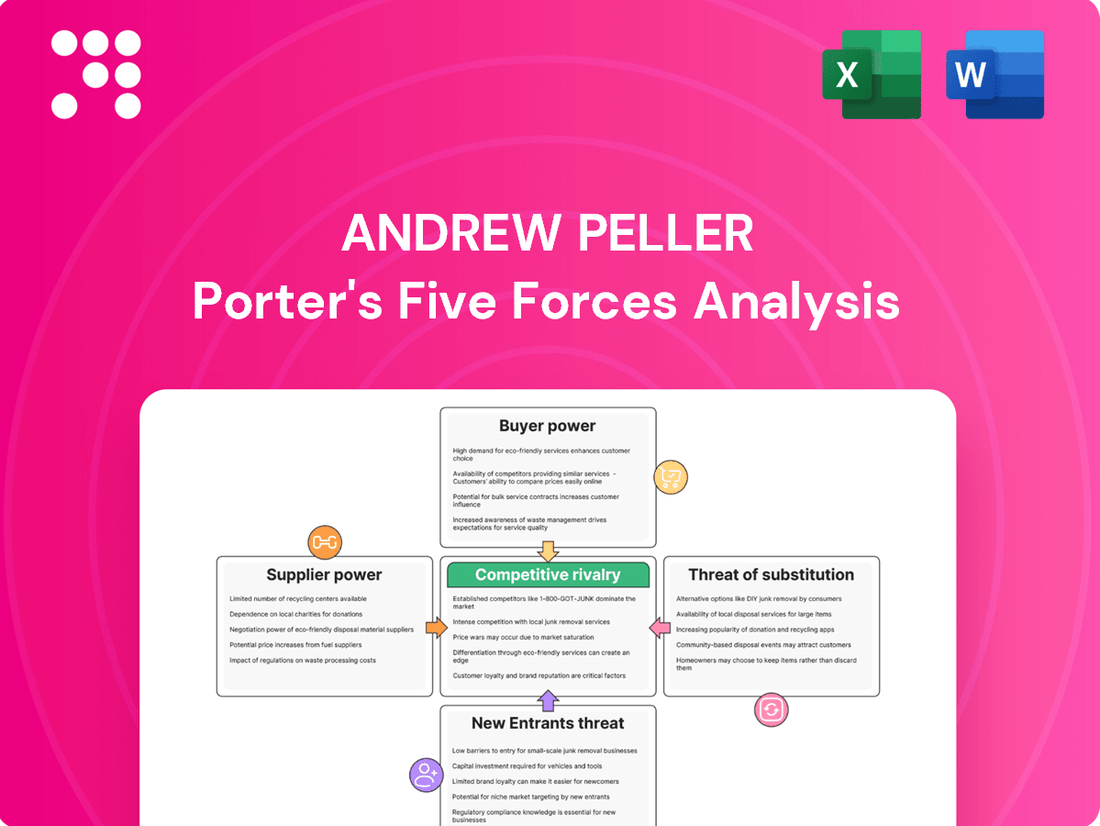

This analysis of Andrew Peller's competitive landscape leverages Porter's Five Forces to illuminate the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants and substitutes, all within the context of the Canadian wine and spirits industry.

Effortlessly identify and prioritize competitive threats with a visual breakdown of each Porter's Five Forces, simplifying complex market dynamics.

Customers Bargaining Power

Canadian consumers are increasingly mindful of price when purchasing wine and craft beverages, directly affecting Andrew Peller's pricing power. Inflationary pressures and a general economic slowdown in 2024 have made consumers more cautious with their discretionary spending, pushing them towards value options.

Factors such as rising inflation, a tightening economic environment, and increased taxes on alcohol have contributed to reduced consumer discretionary spending. This trend is evident in the declining alcohol consumption by volume observed across Canada, making customers more price-sensitive and less willing to absorb price increases.

Customers today face an expansive beverage market, offering a vast selection of alcoholic and non-alcoholic choices. This includes a wide spectrum of wines, spirits, beers, ciders, and increasingly popular ready-to-drink (RTD) and non-alcoholic alternatives. In 2024, the global non-alcoholic beverage market alone was valued at over $1.1 trillion, highlighting the sheer breadth of options available.

This extensive availability of substitutes significantly amplifies customer bargaining power. If a particular product, like a wine from Andrew Peller, becomes too expensive or less appealing, consumers can effortlessly pivot to a competitor's wine, a different type of spirit, or even a non-alcoholic beverage. This ease of switching means customers are less tied to any single brand or category.

Customers today have unprecedented access to information, thanks to the internet and social media. This means they can easily compare prices, read reviews about product quality, and even find out about ingredients. For instance, in 2024, a significant portion of consumers actively researched products online before making a purchase, directly impacting how companies market and price their offerings.

This heightened transparency significantly boosts customer bargaining power. When consumers are well-informed about alternatives and potential value, they are more likely to negotiate or switch to competitors if they feel they are not getting a fair deal. This forces businesses to be more competitive in their pricing and to focus on delivering superior quality and value to retain their customer base.

Furthermore, a growing trend sees consumers actively seeking out distinctive, handcrafted, and locally produced goods. Transparency regarding sourcing and production methods is becoming a key factor in their purchasing decisions. For example, in the craft beverage sector, which Andrew Peller operates within, consumers often prioritize brands that openly share their production processes and ingredient origins, influencing their loyalty and willingness to pay a premium.

Distribution Channel Power

Provincial liquor boards in Canada, along with the growing presence of wine and spirits in grocery, convenience, and big-box stores, grant these distribution channels significant leverage over producers like Andrew Peller. This is particularly true as these channels can dictate shelf space and pricing strategies.

For instance, in 2024, the Ontario government continued to explore expanding private retail access for alcohol, a move that could further shift bargaining power towards retailers. Such policy shifts can force producers to accept lower margins to maintain visibility and sales volume.

- Provincial Liquor Boards: Historically dominant, these entities still control a substantial portion of alcohol sales, giving them considerable sway over producers' market access and pricing.

- Retail Landscape Expansion: Increased availability in diverse retail formats (grocery, convenience) in 2024 provides consumers with more choices and strengthens the negotiating position of these retailers with suppliers.

- Margin Pressure: Retailers can leverage their market access to demand better terms, potentially squeezing producer profit margins through volume discounts or promotional support requirements.

Andrew Peller's Customer Concentration

Andrew Peller's bargaining power of customers is influenced by its distribution channels. While serving many consumers, the company's dependence on large retailers and provincial liquor boards means these entities can wield significant influence. For example, in fiscal 2024, Andrew Peller's sales to provincial liquor stores and its own retail operations were critical trade channels.

- Distribution Dependence: Andrew Peller's reliance on a limited number of large retail partners and provincial liquor boards for product placement and sales grants these customers considerable bargaining power.

- Channel Importance: Sales to provincial liquor stores and the company's wholly-owned retail outlets are identified as key trade channels, highlighting their strategic importance and the leverage customers within these channels possess.

- Customer Concentration Risk: While specific figures for customer concentration are not publicly detailed for fiscal 2024, the nature of the beverage alcohol industry in Canada often involves significant sales volumes through these concentrated channels, inherently creating customer bargaining power.

Customers' bargaining power is elevated due to the vast array of beverage choices available in 2024, from traditional wines and spirits to a booming non-alcoholic market valued at over $1.1 trillion globally. This abundance of substitutes means consumers can easily switch if prices rise or quality falters, forcing producers like Andrew Peller to remain competitive. Informed consumers, empowered by online research and reviews, further amplify this pressure, demanding better value and transparency.

The distribution landscape also significantly bolsters customer power. Provincial liquor boards and expanding private retail channels, such as grocery and convenience stores, hold sway over shelf space and pricing. Policy shifts in 2024, like potential further privatization of alcohol sales in Ontario, could intensify this leverage, compelling producers to accept lower margins to maintain market access and sales volume.

Andrew Peller's reliance on these concentrated distribution channels, including provincial liquor stores and its own retail outlets, grants these entities considerable influence. This dependence highlights the inherent bargaining power of customers within these key trade channels, a factor crucial for the company's fiscal 2024 operations.

| Factor | Impact on Andrew Peller | 2024 Relevance |

|---|---|---|

| Product Substitutability | High; consumers can easily switch to other wines, spirits, beers, or non-alcoholic options. | Global non-alcoholic beverage market over $1.1 trillion, increasing consumer choice. |

| Information Availability | High; online research empowers consumers to compare prices and quality. | Significant consumer research online before purchasing, influencing pricing strategies. |

| Distribution Channel Power | High; provincial liquor boards and expanding private retail hold significant leverage. | Potential for expanded private retail access in provinces like Ontario shifts power to retailers. |

What You See Is What You Get

Andrew Peller Porter's Five Forces Analysis

This preview shows the exact Andrew Peller Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. This comprehensive document thoroughly examines the competitive landscape of the wine and spirits industry, detailing the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors. Understand the strategic positioning of Andrew Peller Limited with this ready-to-use, professionally formatted analysis.

Rivalry Among Competitors

The Canadian wine and craft beverage alcohol market is a crowded space, with many domestic and international companies vying for consumer attention. Andrew Peller Limited faces competition from both large, well-established beverage alcohol producers and a rapidly expanding segment of smaller, artisanal craft breweries and wineries.

The Canadian wine market is expected to see revenue growth, but this is happening alongside a general decline in alcohol consumption by volume, especially for beer and wine. This trend means companies are increasingly vying for a larger piece of a market that isn't necessarily expanding in terms of sheer volume. For instance, Statistics Canada data from 2023 indicated a slight dip in overall alcohol consumption per capita.

This pressure on volume growth intensifies competitive rivalry. When the overall pie isn't getting bigger, businesses must aggressively compete to capture existing demand. This can lead to more aggressive pricing strategies, increased marketing spend, and a greater focus on product innovation to differentiate and attract consumers away from competitors. Andrew Peller Limited, like other major players, must navigate this environment where market share gains are crucial.

Andrew Peller Limited differentiates itself through a broad portfolio, encompassing premium VQA wines, spirits, ciders, and ready-to-drink (RTD) beverages. This product diversity, coupled with strong brand recognition, serves as a shield against intense industry competition.

The market increasingly favors unique, artisanal products, pushing Peller to innovate and maintain its premium image. Furthermore, a growing consumer sentiment favoring Canadian-made goods, exemplified by the 'Buy Canadian' movement, can significantly bolster brand loyalty for domestic producers like Andrew Peller.

Exit Barriers

High exit barriers in the wine industry, like specialized vineyards and wineries, along with long-term grape supply contracts, can trap even struggling competitors. This means companies might stay in the market longer than they otherwise would, even if they aren't performing well.

These persistent, less profitable players can contribute to sustained price competition and market overcapacity. For example, in 2024, the Canadian wine market, a significant sector for companies like Andrew Peller, continued to see intense promotional activity, a direct result of such pressures.

- Specialized Assets: Wineries and vineyards represent significant capital investments that are difficult to divest or repurpose.

- Long-Term Contracts: Agreements for grape supply often span many years, obligating companies to continue operations.

- Distribution Networks: Established relationships with distributors and retailers are valuable and hard to replicate, making it costly to exit.

- Brand Reputation: Years of building a brand can be lost if a company exits abruptly, impacting future ventures.

Cost Structure and Fixed Costs

Industries characterized by substantial fixed costs, such as winemaking with its significant investments in vineyards, production facilities, and the extended aging process for inventory, often face heightened price competition. This is particularly true when market demand softens.

Andrew Peller's strategic emphasis on achieving cost savings and enhancing operational efficiencies is therefore a critical component in navigating these competitive pressures. For instance, in its fiscal year 2023, Andrew Peller reported a cost of goods sold of $291.5 million, highlighting the substantial ongoing expenses inherent in its operations.

- High Fixed Costs: Winemaking requires significant upfront and ongoing investment in land, vineyards, wineries, equipment, and inventory aging, creating a substantial fixed cost base.

- Price Competition: When demand falters, companies with high fixed costs are incentivized to lower prices to cover these costs, leading to intense price wars.

- Operational Efficiency: Andrew Peller's focus on streamlining operations and reducing costs, such as managing its $291.5 million cost of goods sold in FY2023, is essential for maintaining profitability amidst this rivalry.

- Inventory Management: The long lead times and aging requirements for wine add complexity and cost to inventory management, further impacting the cost structure.

Competitive rivalry within the Canadian wine and craft beverage sector is fierce, with Andrew Peller Limited facing numerous domestic and international players. This intense competition is exacerbated by a market where overall alcohol consumption by volume is declining, as indicated by a slight per capita decrease reported by Statistics Canada in 2023. Consequently, companies are aggressively fighting for market share, often resorting to aggressive pricing and increased marketing efforts.

The presence of high exit barriers, such as specialized winery assets and long-term grape supply contracts, means that even less profitable competitors can remain in the market, contributing to sustained price competition and market overcapacity. This dynamic was evident in 2024 with continued aggressive promotional activities across the Canadian wine market.

Andrew Peller's broad product portfolio, including premium VQA wines, spirits, and RTDs, along with its focus on operational efficiencies, are key strategies to navigate this challenging competitive landscape. For instance, managing its cost of goods sold, which stood at $291.5 million in fiscal year 2023, is crucial for maintaining profitability amidst these pressures.

| Competitor Type | Key Characteristics | Impact on Andrew Peller |

|---|---|---|

| Large Beverage Alcohol Producers | Established brands, extensive distribution, significant marketing budgets | Requires strong brand differentiation and efficient operations to compete on scale and reach. |

| Artisanal Craft Wineries/Breweries | Niche products, focus on local sourcing, strong regional appeal | Drives innovation and premiumization; Peller must leverage its diverse portfolio and brand equity. |

| International Brands | Global recognition, diverse product offerings, potential for economies of scale | Peller relies on its strong Canadian identity and premium VQA positioning to counter international dominance. |

SSubstitutes Threaten

Consumers in Canada face a broad spectrum of beverage alcohol substitutes for Andrew Peller's offerings, including various wine types, spirits, beer, and ciders. The non-alcoholic beverage market is also a significant competitor, increasingly appealing due to competitive pricing and growing health consciousness among consumers.

The price-performance trade-off is a key factor here. For instance, while a premium bottle of wine might cost $30, a comparable volume of craft beer or a spirit could be significantly less, offering a different value proposition. In 2024, the Canadian beverage alcohol market saw continued growth in spirits and ready-to-drink (RTD) categories, indicating a consumer willingness to explore alternatives that offer convenience and novelty at various price points.

The growing consumer interest in moderation and health, coupled with evolving cultural attitudes, is significantly increasing the inclination to swap alcoholic drinks for non-alcoholic options. This shift is evident in trends like Dry January, which saw a notable rise in participation, and the expanding market for sophisticated alcohol-free beverages.

In 2024, the global non-alcoholic beverage market is projected to reach substantial figures, with some reports indicating growth that could see it surpass $1.7 trillion by 2030. This expansion directly reflects a heightened consumer propensity to substitute, as more individuals actively seek alternatives that align with wellness goals and changing lifestyle preferences.

The threat of substitutes for Andrew Peller Limited is significant due to the vast array of alcoholic and non-alcoholic beverages readily available. Consumers can easily switch to alternatives like craft beers, spirits from competing wineries, or even non-alcoholic options, especially given the broad distribution through provincial liquor stores, grocery stores, convenience stores, and online platforms.

The accessibility of these substitutes has been further amplified by recent regulatory changes. For instance, the expansion of alcohol sales into more retail outlets in Ontario, a key market for Andrew Peller, means consumers have even more convenient access to a wider range of competing products, potentially diverting sales away from the company's wine and spirits.

Marketing and Innovation by Substitute Producers

Producers of substitute beverages, especially within the rapidly expanding craft beer and non-alcoholic drink markets, are aggressively innovating. They are introducing a constant stream of new flavors, unique styles, and engaging marketing campaigns designed to capture consumer attention and loyalty. This relentless innovation directly challenges traditional wine and spirits by offering consumers fresh and exciting alternatives.

For instance, the global non-alcoholic beverage market is projected to reach over $1.7 trillion by 2028, indicating a significant shift in consumer preferences. This growth is fueled by a desire for healthier options and a wider variety of taste experiences, directly impacting the demand for alcoholic beverages.

- Innovation in Craft Beer: Craft breweries consistently release limited-edition brews and experimental flavors, drawing consumers seeking novelty.

- Rise of Non-Alcoholic Options: The market for sophisticated non-alcoholic spirits and wines is booming, offering complex taste profiles without alcohol.

- Aggressive Marketing: Substitute producers often employ targeted digital marketing and influencer collaborations to reach younger demographics.

- Price Sensitivity: In some segments, substitute products can be more affordably priced, appealing to budget-conscious consumers.

Regulatory and Tax Environment for Substitutes

Changes in government regulations and taxes can significantly alter the competitive landscape for substitutes. For example, in 2024, Canadian federal excise taxes on alcohol remained a key factor influencing consumer choices. If these taxes were to increase, it could further boost the appeal of non-alcoholic beverage substitutes.

Conversely, government support programs can bolster domestic industries against substitutes. In 2024, various provincial programs aimed at supporting Canadian wine producers, such as marketing grants and tax incentives, were in place. These initiatives could enhance the competitiveness of Canadian wines against imported alternatives, thereby mitigating the threat of substitutes.

- Taxation Impact: Federal and provincial alcohol taxes in Canada directly influence the price point of alcoholic beverages, making tax increases a potential catalyst for shifting consumer preference towards non-alcoholic substitutes.

- Government Support: Initiatives like the Ontario VQA (Vintners Quality Alliance) program and similar provincial efforts in British Columbia and other wine-producing regions aim to strengthen the market position of Canadian wines against international competition.

- Regulatory Shifts: Evolving regulations around alcohol advertising, labelling, and distribution can also indirectly affect the threat of substitutes by altering market access and consumer perception.

The threat of substitutes for Andrew Peller is substantial, given the wide array of alcoholic and non-alcoholic beverages available. Consumers can easily switch to craft beers, spirits, or even non-alcoholic options, especially with expanded retail access in key markets like Ontario. This broad availability, coupled with aggressive innovation from substitute producers, presents a continuous challenge.

| Substitute Category | Key Differentiators | 2024 Market Trend Impact |

| Craft Beer | Novelty, experimental flavors, community appeal | Continued growth, capturing younger demographics seeking unique experiences. |

| Spirits | Versatility, premiumization, ready-to-drink (RTD) formats | Strong growth, offering convenience and diverse flavor profiles. |

| Non-Alcoholic Beverages | Health consciousness, moderation, sophisticated taste profiles | Rapid expansion, projected to significantly impact traditional alcoholic beverage markets. |

Entrants Threaten

The wine and craft beverage industry, particularly for businesses like Andrew Peller that operate with a vertically integrated model, demands considerable upfront investment. This includes acquiring vineyard land, building and equipping wineries, and stocking inventory, creating a significant financial hurdle for potential new competitors.

For instance, establishing a new vineyard can cost upwards of $10,000 to $30,000 per acre, and winery construction can easily run into millions of dollars. Andrew Peller's extensive portfolio, encompassing numerous brands and production facilities across Canada, represents a capital base built over decades, making it difficult for newcomers to match this scale and scope without substantial financial backing.

Newcomers face a significant challenge in securing shelf space within Canada's highly controlled provincial liquor boards and major retail chains. Andrew Peller's established relationships and extensive network provide a substantial advantage, making it difficult for emerging brands to compete for consumer visibility and market penetration. For instance, in 2024, the vast majority of wine and spirits sales in Canada are still channeled through these government-controlled entities, underscoring the importance of existing distribution access.

Andrew Peller Limited, like many established players in the beverage industry, leverages significant economies of scale. This means they can spread their fixed costs, such as those for bottling plants and marketing campaigns, over a much larger volume of production. For instance, in 2023, Andrew Peller's total revenue was CAD 445.7 million, indicating a substantial operational footprint that allows for cost efficiencies.

New entrants face a considerable hurdle in matching these cost advantages. They often start with smaller production volumes, meaning their per-unit costs for manufacturing, raw material sourcing, and distribution are inherently higher. This cost disadvantage makes it difficult for newcomers to compete on price with established companies that have already invested in large-scale infrastructure and optimized their supply chains.

Brand Loyalty and Differentiation

Andrew Peller benefits from strong brand loyalty, a significant barrier for new entrants. Their portfolio includes well-established names like Peller Estates and Trius, which have cultivated consumer trust and preference over time. This loyalty means newcomers must invest heavily in marketing to even begin to gain traction.

Building brand recognition and trust in the competitive Canadian wine and spirits market is a formidable hurdle. New companies entering this space in 2024 would need substantial capital for advertising and promotional activities to compete with established players like Andrew Peller. For instance, the Canadian beverage alcohol market is mature, with significant marketing spend by existing brands.

- Brand Equity: Andrew Peller's brands, such as Peller Estates, have consistently won awards, reinforcing their market standing and consumer preference.

- Marketing Investment: New entrants face a high cost of entry, requiring significant financial resources for advertising and brand-building campaigns to challenge established loyalty.

- Market Saturation: The Canadian beverage alcohol market is well-developed, making it difficult for new brands to differentiate and capture market share from established, trusted names.

- Time to Build Trust: Establishing a reputation and earning consumer trust takes years, a timeline that new entrants must account for in their strategic planning.

Government Policy and Regulations

Government policy and regulations significantly impact the threat of new entrants in the Canadian alcohol industry. Both federal and provincial governments impose stringent rules on production, marketing, advertising, and distribution, creating substantial hurdles for newcomers. For instance, obtaining the necessary licenses and ensuring compliance with evolving regulations requires considerable investment and expertise, acting as a strong deterrent.

While recent policy shifts in Ontario, such as expanding retail distribution channels, might slightly ease market access for new players, the overarching regulatory landscape remains intricate. This complexity in navigating licensing, compliance, and distribution networks acts as a powerful barrier, effectively limiting the ease with which new companies can enter and compete.

- Federal and Provincial Regulations: The Canadian alcohol sector is governed by a dual layer of federal and provincial laws affecting every stage from production to sales.

- Licensing and Compliance Costs: New entrants face significant upfront costs and ongoing efforts to meet licensing requirements and adhere to complex compliance mandates.

- Distribution Network Barriers: Established distribution channels, often controlled or heavily influenced by existing regulations, present a challenge for new companies seeking broad market reach.

- Policy Evolution Impact: While some policy changes, like Ontario's retail expansion, may offer marginal relief, the fundamental regulatory complexity persists as a key barrier to entry.

The threat of new entrants for Andrew Peller is moderate, primarily due to high capital requirements and established distribution networks. Significant upfront investment is needed for vineyards, wineries, and inventory, creating a substantial financial barrier. For example, establishing a new vineyard can cost $10,000 to $30,000 per acre, and winery construction easily runs into millions. Newcomers also struggle to gain shelf space within Canada's controlled provincial liquor boards and major retail chains, where Andrew Peller's established relationships offer a distinct advantage.

Economies of scale further deter new entrants, as Andrew Peller's large production volumes allow for lower per-unit costs. With CAD 445.7 million in revenue in 2023, their operational footprint provides significant cost efficiencies that smaller new companies cannot easily match. Brand loyalty is another critical factor; established names like Peller Estates require substantial marketing investment for new brands to gain traction in a mature market where consumer trust is built over years.

Government regulations also act as a significant barrier, with stringent federal and provincial rules on production, marketing, and distribution. Navigating licensing and compliance demands considerable expertise and capital, making entry complex. While some policy shifts, like Ontario's retail expansion, may offer minor relief, the overall regulatory environment remains intricate and challenging for new players seeking broad market reach.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Andrew Peller leverages data from their annual reports and investor presentations, alongside industry-specific market research from firms like IBISWorld and Statista. We also incorporate insights from financial news outlets and government economic data to provide a comprehensive view of the competitive landscape.