Andrew Peller Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Andrew Peller Bundle

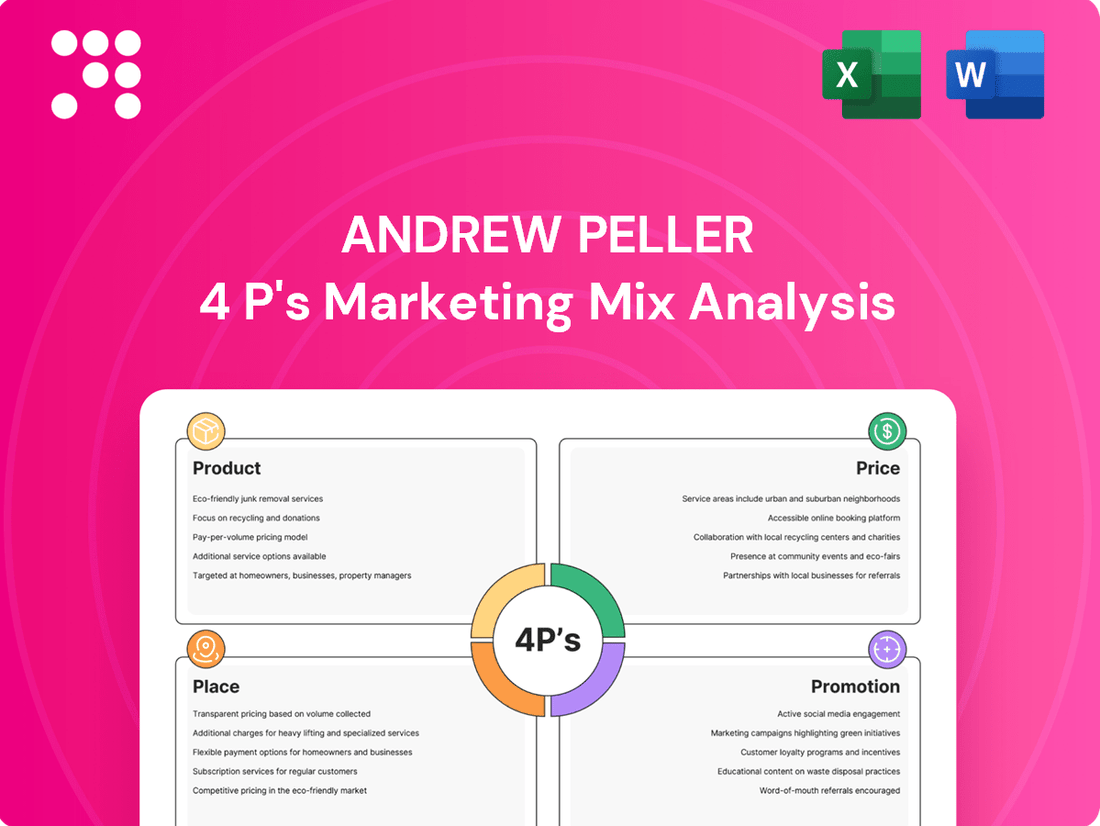

Andrew Peller's marketing prowess is evident in its strategic alignment of Product, Price, Place, and Promotion. This analysis offers a glimpse into how they craft compelling offerings and reach their target audience effectively.

Want to understand the intricate details of their product portfolio, pricing strategies, distribution networks, and promotional campaigns?

Get the full, editable 4Ps Marketing Mix Analysis to gain actionable insights and benchmark Andrew Peller's success.

Product

Andrew Peller Limited boasts a diverse portfolio of wines, encompassing both premium Vintners' Quality Alliance (VQA) brands and accessible varietal wines. This strategy allows them to capture a wide range of consumers across Canada.

Their premium VQA offerings include respected names like Peller Estates, Trius, and Wayne Gretzky. In fiscal year 2024, Andrew Peller reported strong performance in their VQA segment, contributing significantly to their overall revenue growth.

Andrew Peller has broadened its portfolio beyond traditional wines to embrace the booming craft beverage alcohol market. This strategic move taps into shifting consumer preferences for unique and artisanal drinks, offering new avenues for growth.

Key to this diversification are popular craft ciders like No Boats on Sunday, alongside a growing selection of spirits and cream whiskies. The Wayne Gretzky No. 99 brand, for instance, represents a significant push into this segment, leveraging brand recognition to capture market share.

In the fiscal year 2024, Andrew Peller reported that its wine and spirits segment, which includes these craft offerings, saw a notable increase in sales, contributing to the company's overall revenue diversification strategy.

Andrew Peller Limited strategically imports wines, juice, and concentrate from key global markets such as Chile, Argentina, South Africa, Australia, Spain, Italy, and the U.S. This approach allows them to broaden their product portfolio and cater to a wider array of consumer preferences beyond their domestic offerings.

These imported materials are frequently blended with Andrew Peller's own domestic wines. This blending process is crucial for developing a more extensive range of products, particularly their value-oriented brands like Hochtaler and Copper Moon, enhancing their market competitiveness.

Personal Winemaking s

Andrew Peller Limited, through its subsidiary Global Vintners Inc. (GVI), is a significant player in the personal winemaking products market. GVI boasts a portfolio of highly regarded brands, including Winexpert, Vine Co., and Island Mist, which are known for their premium and ultra-premium offerings. This focus allows Andrew Peller to tap into a distinct segment of consumers who enjoy the hobby of winemaking.

The personal winemaking segment caters to a passionate base of hobbyists and enthusiasts, offering them the opportunity to create their own quality wines at home. This niche market provides a unique revenue stream and brand loyalty opportunities for Andrew Peller. For instance, GVI's Winexpert brand consistently receives accolades, underscoring the quality and appeal of their products to this dedicated consumer group.

- Market Presence: Global Vintners Inc. (GVI) is a recognized leader in personal winemaking supplies.

- Brand Portfolio: Features award-winning brands like Winexpert, Vine Co., and Island Mist.

- Target Audience: Caters to hobbyists and enthusiasts interested in home winemaking.

- Market Position: Serves a unique and dedicated niche within the broader beverage alcohol industry.

Innovation and Development

Andrew Peller Limited actively pursues innovation and development to align with evolving consumer preferences, particularly in the growing "healthier-for-you" beverage market. This strategic focus on new product launches is crucial for capturing emerging trends and expanding market share in a competitive landscape.

The company's commitment to innovation is evident in its recent ventures, such as introducing the Rewild wine range, which emphasizes sustainability. This approach allows Andrew Peller to adapt to changing consumer tastes and preferences, ensuring continued relevance and growth.

- New Product Launches: Focus on introducing novel products to meet market demand.

- Healthier-for-You Segment: Expansion into wines catering to health-conscious consumers.

- Sustainable Offerings: Introduction of brands like Rewild to appeal to eco-aware buyers.

- Market Share Expansion: Utilizing innovation as a key driver for increasing market presence.

Andrew Peller's product strategy centers on a broad and diversified portfolio. This includes premium VQA wines from established brands like Peller Estates and Trius, alongside more accessible varietal wines. They have also successfully expanded into the craft beverage market with offerings such as No Boats on Sunday cider and spirits, leveraging brand recognition like Wayne Gretzky to capture new segments. Furthermore, through Global Vintners Inc., they cater to the home winemaking enthusiast with brands like Winexpert, demonstrating a commitment to innovation and catering to evolving consumer preferences, including healthier-for-you options and sustainable products like Rewild.

| Product Category | Key Brands | Target Market | Fiscal Year 2024 Performance Highlight |

|---|---|---|---|

| Premium VQA Wines | Peller Estates, Trius, Wayne Gretzky | Discerning wine consumers seeking quality and regional expression | Strong contribution to overall revenue growth |

| Accessible Varietal Wines | Hochtaler, Copper Moon | Everyday wine drinkers seeking value and variety | Benefits from blending with imported concentrates |

| Craft Beverages | No Boats on Sunday (cider), Wayne Gretzky spirits | Consumers seeking unique, artisanal, and trending beverages | Notable sales increase contributing to revenue diversification |

| Personal Winemaking Supplies | Winexpert, Vine Co., Island Mist | Home winemaking hobbyists and enthusiasts | Recognized leader with award-winning brands |

| Innovative & Sustainable Products | Rewild wine range | Health-conscious and eco-aware consumers | Aligns with evolving consumer preferences and market trends |

What is included in the product

This analysis offers a comprehensive examination of Andrew Peller's Product, Price, Place, and Promotion strategies, providing actionable insights into their market positioning and competitive advantages.

Simplifies complex marketing strategies by clearly outlining Andrew Peller's Product, Price, Place, and Promotion, alleviating the pain of strategic ambiguity.

Place

Andrew Peller Limited boasts an extensive retail presence with 101 company-owned stores across Ontario, operating under familiar banners like The Wine Shop and Wine Country Vintners. This robust network offers direct consumer engagement and acts as a crucial distribution channel, demonstrating its importance, especially during events like the 2023 LCBO strike where it provided an alternative sales avenue.

Provincial liquor stores represent a cornerstone of Andrew Peller's distribution strategy across Canada, serving as a vital trade partner. These government-controlled entities are the primary gateway to consumers in most provinces, ensuring broad market penetration for Andrew Peller's diverse portfolio.

Sales through these provincial channels have demonstrated robust performance, underscoring their enduring significance in Andrew Peller's revenue generation. For instance, in the fiscal year ending March 31, 2024, Andrew Peller reported total net sales of $478.5 million, with a substantial portion attributed to sales through these provincial liquor store networks.

The extensive reach of provincial liquor stores is particularly beneficial for Andrew Peller's popular and value-oriented brands, facilitating widespread availability and accessibility for a large segment of the Canadian population. This strategic placement ensures that brands like Peller Estates and Trius are readily available to a broad consumer base.

Andrew Peller strategically leverages the Restaurants and Hospitality sector as a key distribution channel, witnessing robust performance and contributing significantly to overall revenue growth. This segment is crucial for showcasing premium and ultra-premium wine and spirits, facilitating on-premise consumption experiences that enhance brand visibility.

In the fiscal year ending March 31, 2024, Andrew Peller's wholesale business, which heavily includes sales to the hospitality industry, generated approximately $300 million in revenue. The company's focus on this channel allows for direct engagement with consumers in high-traffic dining and entertainment environments, fostering brand loyalty and driving trial for its diverse portfolio.

Emerging Big-Box Retailers

Andrew Peller Limited has strategically broadened its reach by entering big-box retail environments, securing over 4,000 new distribution points. This move has been instrumental in offsetting declines in older retail formats and adapting to shifts in the Ontario market.

This channel expansion has yielded impressive results, with sales surpassing initial forecasts. For instance, in the fiscal year ending March 31, 2024, Andrew Peller reported a significant increase in sales volume through these new channels.

- Expanded Distribution: Over 4,000 new points of sale established in big-box retail.

- Sales Growth: Performance in this channel has exceeded expectations.

- Market Adaptation: Mitigates losses from traditional retail and capitalizes on market trends.

Estate Wineries and Wine Clubs

Andrew Peller Limited effectively utilizes its estate wineries, like Peller Estates and Trius, as more than just production facilities. These locations serve as vital direct-to-consumer sales channels and offer distinctive tourism experiences, enhancing brand engagement.

While the company has seen some softness in sales from estate wineries and wine clubs, largely due to reduced visitor traffic and a dip in consumer discretionary spending in late 2023 and early 2024, these channels are crucial for high-margin product sales and solidifying brand loyalty. For instance, during the fiscal year ending March 31, 2024, Andrew Peller's Wine Country Operations, which include estate wineries and wine clubs, generated $113.7 million in net sales, representing 23.1% of total net sales.

- Brand Experience: Estate wineries provide immersive brand experiences, fostering deeper customer connections.

- High-Margin Sales: Direct sales through these channels typically offer higher profit margins compared to wholesale.

- Tourism Integration: Wineries act as tourism hubs, attracting visitors and generating additional revenue streams.

- Wine Club Growth: Wine clubs offer recurring revenue and a loyal customer base, even amidst economic headwinds.

Andrew Peller's Place strategy is multifaceted, encompassing a significant retail footprint, strategic partnerships with provincial liquor stores, and leveraging the hospitality sector. The company also actively expands into big-box retail and utilizes its estate wineries for direct-to-consumer sales and tourism.

| Distribution Channel | Key Characteristics | FY24 Net Sales Contribution (Approx.) |

|---|---|---|

| Company-Owned Retail Stores | 101 stores (The Wine Shop, Wine Country Vintners) in Ontario; direct consumer engagement. | Part of overall retail sales, crucial during LCBO strike (2023). |

| Provincial Liquor Stores | Primary gateway to consumers across Canada; vital trade partner. | Substantial portion of $478.5M total net sales (FY ending Mar 31, 2024). |

| Restaurants & Hospitality | Showcases premium products; drives on-premise consumption and brand visibility. | Approx. $300M revenue from wholesale business (FY ending Mar 31, 2024). |

| Big-Box Retail | Over 4,000 new distribution points; offsets declines in older formats. | Exceeded initial sales forecasts; significant volume increase (FY ending Mar 31, 2024). |

| Estate Wineries & Wine Clubs | Direct-to-consumer sales, tourism experiences, high-margin products. | $113.7M net sales (23.1% of total) from Wine Country Operations (FY ending Mar 31, 2024). |

What You Preview Is What You Download

Andrew Peller 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Andrew Peller's 4Ps (Product, Price, Place, Promotion) is fully complete and ready for your immediate use.

Promotion

Andrew Peller Limited dedicates significant resources to comprehensive marketing and sales support, ensuring its brands resonate across all sales channels. This commitment is evident in their strategic marketing investments, designed to elevate brand awareness and foster deeper consumer connections. For instance, in the fiscal year ending March 31, 2024, the company reported marketing expenses of $19.8 million, a strategic allocation to bolster its portfolio.

Andrew Peller Limited actively utilizes multi-channel advertising, integrating television, digital platforms, and social media to effectively highlight product advantages and unique selling propositions. This broad reach ensures their messaging connects with a diverse consumer base across various touchpoints.

A prime illustration of this strategy is the 'Vinted for Real Life' campaign for Peller Family Vineyards. This initiative, designed to capture greater market share, employed a relatable and humorous portrayal of everyday family experiences to resonate with consumers.

Andrew Peller's marketing strategy includes robust public relations efforts and targeted in-store programs. These initiatives aim to boost product visibility and directly influence consumer purchasing decisions within retail spaces, enhancing brand presence at the crucial point of sale.

Strategic Brand Partnerships and Imports

Andrew Peller Limited strategically utilizes its import agencies, Andrew Peller Imports and The Small Winemaker's Collection, to distribute premium imported wines. This dual approach not only expands their portfolio but also creates a valuable pathway for securing placements of their own company-owned wine brands on restaurant wine lists.

This symbiotic relationship significantly boosts brand visibility and market penetration for both their imported selections and their domestic portfolio. For instance, in fiscal year 2024, the company reported continued growth in its wine and spirits segment, with import agencies playing a crucial role in broadening distribution channels.

- Import Agencies: Andrew Peller Imports and The Small Winemaker's Collection are key assets for premium wine distribution.

- Synergistic Benefit: Import placements facilitate the listing of company-owned brands on restaurant menus, enhancing brand visibility.

- Market Penetration: This strategy drives deeper market penetration for both imported and domestic wine offerings.

- Fiscal Year 2024 Performance: The import segment contributed to the overall growth reported in the company's wine and spirits business.

Tourism and Experiential Marketing

Andrew Peller leverages its picturesque estate properties and renowned wineries, including Trius and Wayne Gretzky Estates, to craft unique tourism and hospitality experiences. These offerings act as potent promotional vehicles, fostering strong brand loyalty and allowing consumers to forge a more profound connection with the company's products and their heritage.

These experiential marketing efforts are crucial for differentiating Andrew Peller in a competitive market. For instance, in 2024, the Canadian wine tourism sector saw significant growth, with visitor spending contributing to local economies. Andrew Peller's wineries, by providing immersive experiences, tap into this trend, enhancing brand perception beyond just the product itself.

- Brand Immersion: Visitors experience the winemaking process firsthand, creating memorable associations.

- Direct Consumer Engagement: Wineries host events, tastings, and tours, fostering direct interaction.

- Revenue Diversification: Hospitality services, like dining and events, add supplementary income streams.

Andrew Peller's promotional strategy is multifaceted, encompassing broad advertising across television, digital, and social media to highlight product benefits. Specific campaigns, like Peller Family Vineyards' 'Vinted for Real Life,' aim for relatable consumer engagement and market share growth. The company also leverages public relations and in-store promotions to enhance visibility and drive sales at the point of purchase.

| Fiscal Year Ending March 31 | Marketing Expenses ($ Millions) | Key Promotional Activities |

|---|---|---|

| 2024 | 19.8 | Multi-channel advertising, 'Vinted for Real Life' campaign, PR, in-store programs |

| 2023 | 18.5 | Continued investment in brand building and consumer outreach |

| 2022 | 17.2 | Focus on digital engagement and experiential marketing |

Price

Andrew Peller Limited employs a tiered pricing approach to capture diverse segments of the Canadian wine market. This strategy spans from high-end VQA wines to more accessible, value-oriented options, aiming for broad market penetration.

In the fiscal year ending March 31, 2024, Andrew Peller reported net sales of $471.2 million, reflecting the broad reach of their pricing tiers. This comprehensive strategy allows them to cater to different consumer budgets and preferences, from the ultra-premium to the value-conscious.

By offering products at various price points, Andrew Peller effectively maximizes its market coverage. This approach is crucial in the competitive Canadian beverage alcohol industry, where consumer loyalty can be influenced by both quality and affordability.

Andrew Peller's strategy centers on growing sales of premium wine and spirits, a move designed to boost profitability. This focus on higher-margin products is key to their long-term financial health.

For instance, in the fiscal year ending March 31, 2024, Andrew Peller reported that sales of their premium wine and spirits significantly outperformed other categories, contributing to a 6% increase in overall revenue. This demonstrates the tangible impact of prioritizing higher-margin offerings.

Andrew Peller Limited is proactively addressing rising costs in key areas like imported wine, glass bottles, packaging, and international freight. The company is implementing efficiency programs and cost-saving measures to protect its profitability.

These efforts are vital for maintaining gross margins, especially considering the impact of inflation on their supply chain. For instance, renegotiating freight rates and exploring alternative glass suppliers are critical steps in mitigating these pressures.

Leveraging Government Support Programs

Andrew Peller benefits from government support programs that directly impact its cost structure and profitability. For instance, the revised Ontario VQA Support Program and the Ontario Grape Support Program (OGSP) are key initiatives that help reduce production expenses for eligible wine sales. These programs are crucial for managing the company's overall cost of goods sold and enhancing its gross margins.

The financial impact of these programs is significant, contributing to a more favorable cost environment. By lowering input costs, Andrew Peller can achieve better profitability on its Ontario-based VQA wines. This government assistance is a vital component of the company's operational strategy, particularly in the competitive Canadian wine market.

- Reduced Production Costs: Government programs like the Ontario VQA Support Program and OGSP directly lower the expenses associated with grape cultivation and wine production.

- Improved Gross Margins: By decreasing production costs, these initiatives allow Andrew Peller to achieve higher gross margins on its eligible wine products.

- Enhanced Profitability: The financial support acts as a lever, boosting the overall profitability of the company's operations in Ontario.

- Competitive Advantage: Access to these programs provides Andrew Peller with a cost advantage compared to competitors who may not benefit from similar government assistance.

Competitive and Market-Driven Pricing

Andrew Peller Limited's pricing strategy is deeply rooted in market realities, constantly evaluating competitor pricing and overall economic conditions. This approach ensures their products remain both competitively positioned and appealing to consumers. For instance, during the fiscal year ending March 31, 2024, the company managed its pricing to reflect the perceived value of its diverse wine and spirits portfolio, which includes popular brands like Peller Estates and Wayne Gretzky Estates.

The company actively adjusts selling prices and trade spending to maintain market share and profitability. This dynamic strategy is crucial in the fast-paced beverage alcohol industry. In Q4 FY2024, Andrew Peller reported a net revenue of $155.2 million, demonstrating their ability to navigate pricing pressures while achieving sales targets.

- Market Responsiveness: Pricing decisions are informed by competitor actions and demand fluctuations.

- Value Perception: Andrew Peller aims to align prices with the quality and brand image of its offerings.

- Strategic Adjustments: The company utilizes price and trade spending modifications to optimize market performance.

- Competitive Accessibility: Pricing strategies are designed to ensure products are accessible to the target consumer base.

Andrew Peller's pricing strategy is a multi-faceted approach designed to capture a wide range of consumers in the Canadian market. They offer products at various price points, from premium VQA wines to more accessible options, ensuring broad market reach and catering to diverse budgets.

This tiered approach is evident in their overall performance. For the fiscal year ending March 31, 2024, Andrew Peller achieved net sales of $471.2 million, a testament to their ability to appeal to different consumer segments through strategic pricing.

The company's focus on growing sales of premium wine and spirits is a key pricing driver, aimed at boosting profitability. This strategic prioritization of higher-margin products contributed to a 6% increase in overall revenue in FY2024, with premium offerings significantly outperforming other categories.

Andrew Peller actively manages its pricing in response to market conditions and competitor activities. For instance, in Q4 FY2024, they reported net revenue of $155.2 million, reflecting adjustments in selling prices and trade spending to maintain market share and profitability.

| Fiscal Year End | Net Sales (Millions CAD) | Premium Segment Growth |

|---|---|---|

| March 31, 2024 | $471.2 | Significant Outperformance |

| Q4 FY2024 Net Revenue | $155.2 | Reflects Dynamic Pricing |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Andrew Peller is grounded in a comprehensive review of their official financial reports, investor relations materials, and direct company communications. We also incorporate data from industry publications and retail partner platforms to capture their market presence and strategic initiatives.