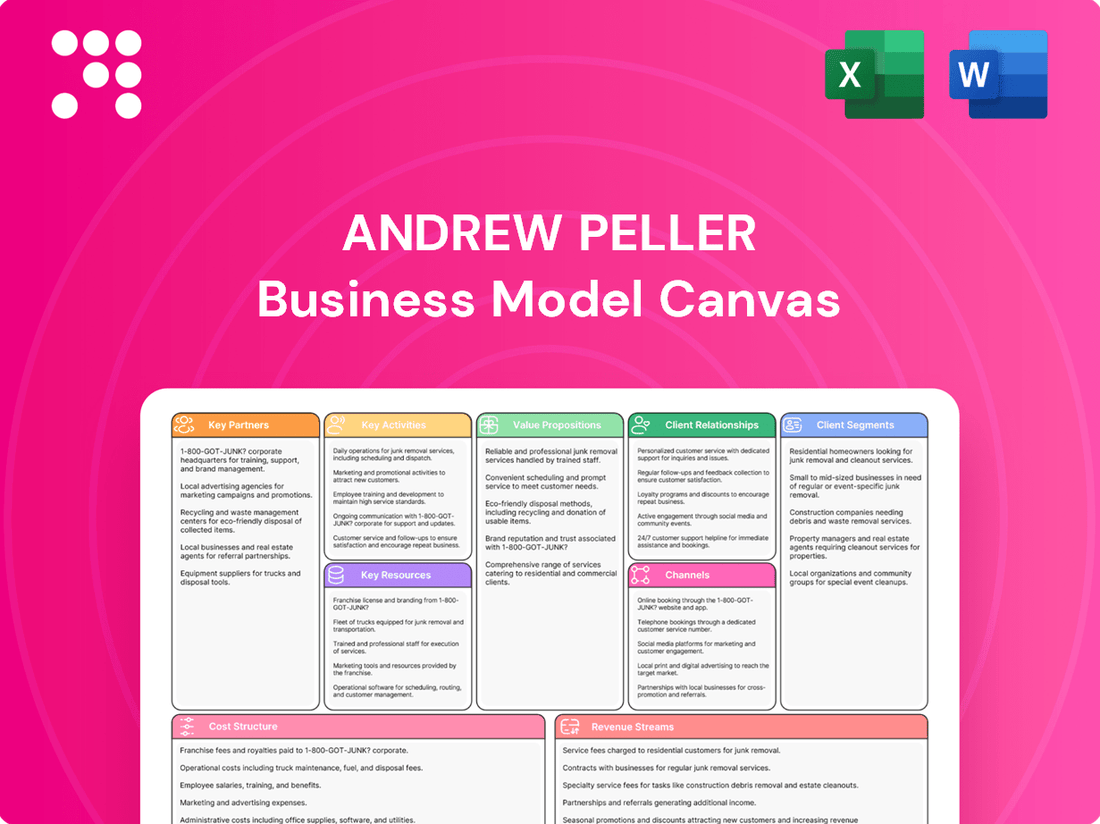

Andrew Peller Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Andrew Peller Bundle

Curious about the strategic framework that fuels Andrew Peller's success in the wine and spirits industry? Our comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market dominance. Download the full version to gain a competitive edge and refine your own business strategy.

Partnerships

Andrew Peller Limited's success hinges on its strategic alliances with Canadian grape growers, particularly in key regions like Ontario's Niagara Peninsula and British Columbia's Okanagan and Similkameen Valleys.

These vital partnerships guarantee a steady supply of premium domestic grapes, a cornerstone for producing their esteemed VQA (Vintners' Quality Alliance) wines.

The company demonstrates a substantial commitment to these growers, with grape purchase commitments projected to reach $41 million in 2025, underscoring the critical nature of these relationships.

Andrew Peller Limited strategically partners with global sourcing specialists to secure a diverse and consistent supply of grapes, bulk wine, juice, and concentrate. These key relationships are crucial for complementing domestic production and catering to a wide array of consumer preferences.

The company's international network spans prominent wine-producing nations including Chile, Argentina, South Africa, Australia, Spain, Italy, and the United States. This geographical diversification mitigates risks associated with localized supply disruptions and broadens the flavor profiles available for their product lines.

By entering into advance purchase contracts with these global partners, Andrew Peller ensures a stable and varied raw material base. This proactive approach underpins the company's ability to maintain its extensive product portfolio and respond effectively to market demands throughout the year.

Andrew Peller collaborates with a wide array of retail and distribution partners, including provincial liquor stores, restaurants, and hospitality venues across Canada. This extensive network is crucial for ensuring their products are readily available to consumers.

The company is also increasingly partnering with big-box retailers and grocery stores, a strategic move that broadens market access significantly, especially as the Ontario retail landscape for alcohol continues to expand. This diversification of distribution channels is key to their reach.

These relationships proved particularly valuable in 2024, as demonstrated by strong performance during the LCBO strike, highlighting the resilience and importance of these diverse retail collaborations for maintaining sales momentum and market presence.

Licensing and Brand Collaborations

Andrew Peller Limited actively pursues licensing and brand collaborations to broaden its market reach and product portfolio. A prime example is their enduring partnership with Wayne Gretzky, which has seen the successful launch of wine and whisky products under his esteemed name. This strategy allows Peller to tap into the established recognition and appeal of prominent personalities.

These strategic alliances are crucial for Peller's diversification efforts, enabling entry into new beverage categories such as spirits, ciders, and seltzers. By leveraging these collaborations, the company effectively appeals to a wider consumer base and enhances overall brand visibility and market penetration.

- Licensing Agreements: Long-term deals with influential figures like Wayne Gretzky.

- Brand Extension: Entry into spirits, cider, and seltzer categories.

- Market Appeal: Leveraging established personalities to attract new consumer segments.

- Revenue Diversification: Expanding product offerings to capture broader market share.

Personal Winemaking Retailer Network

Andrew Peller, through its subsidiary Global Vintners Inc. (GVI), cultivates a robust network of retail partners. These are authorized and independent stores spanning Canada, the United States, the United Kingdom, New Zealand, Australia, and China.

This extensive personal winemaking retailer network is fundamental to GVI's distribution strategy. It ensures their personal winemaking products reach a wide audience of home winemaking enthusiasts.

- Global Reach: Partnerships extend across North America, Europe, Oceania, and Asia, facilitating international market penetration.

- Market Access: These retail relationships are crucial for making GVI's product offerings readily available to consumers interested in home winemaking.

- Brand Presence: The network reinforces GVI's standing as a prominent player in the personal winemaking sector.

Andrew Peller's key partnerships are multifaceted, encompassing grape growers, global sourcing specialists, a broad retail and distribution network, and strategic licensing agreements.

These alliances are critical for securing raw materials, expanding market reach, and diversifying product offerings. For instance, the company's grape purchase commitments reached $41 million in 2025, highlighting the financial significance of its grower relationships.

Furthermore, in 2024, strong performance during the LCBO strike underscored the value of diverse retail collaborations. The Wayne Gretzky partnership exemplifies successful licensing, driving entry into new beverage categories like spirits and cider.

The company's subsidiary, Global Vintners Inc., maintains an extensive personal winemaking retailer network across multiple continents, vital for its specialized market segment.

What is included in the product

A detailed, data-driven Business Model Canvas for Andrew Peller, outlining key customer segments, value propositions, and revenue streams within the Canadian wine and spirits industry.

Andrew Peller's Business Model Canvas offers a structured approach to identifying and addressing operational inefficiencies, alleviating the pain of disorganized strategic planning.

Activities

Andrew Peller Limited's primary focus is on producing a broad spectrum of wines. This includes high-end VQA wines made with Canadian-grown grapes, as well as more accessible blends that utilize imported wine, juice, and concentrates. This dual approach allows them to capture different market segments.

The company also diversifies its production into craft beverages. This encompasses spirits, ciders, and seltzers, broadening their appeal to a wider consumer base. In 2024, the Canadian beverage alcohol market continued to see growth in craft segments, with spirits and ready-to-drink (RTD) categories showing particular strength.

Andrew Peller's brand marketing and sales are central to its operations, focusing on promoting its diverse portfolio of award-winning premium wines like Peller Estates and Trius, alongside accessible varietal brands.

The company actively engages in targeted promotional programs and sales initiatives across all distribution channels to build brand awareness and foster customer loyalty, a strategy that has seen consistent performance.

In the fiscal year 2024, Andrew Peller Limited reported total sales of $450.1 million, demonstrating the effectiveness of their marketing and sales strategies in a competitive market.

Andrew Peller Limited's distribution and retail operations are central to its business. They manage a diverse network, supplying products to provincial liquor stores, restaurants, and hospitality venues. In 2024, this multi-channel strategy was key to reaching a broad customer base across Canada.

A significant part of their retail footprint includes 101 company-owned independent liquor stores in Ontario. These stores operate under various banners, providing direct consumer access and brand visibility. This direct-to-consumer channel complements their wholesale distribution efforts.

Global Wine Importing and Marketing

Andrew Peller's global wine importing and marketing activities are central to its business strategy. Through its Andrew Peller Import Agency and The Small Winemaker's Collection Inc., the company actively sources and distributes premium bottled wines from international markets. This dual approach not only broadens its product portfolio but also serves as a strategic lever to gain access and visibility for its own domestic wine brands within the competitive hospitality sector.

These importing agencies are crucial for expanding market presence and enhancing consumer choice. By offering a diverse range of global wines, Andrew Peller strengthens its relationships with restaurants and retailers, which in turn facilitates the placement of its proprietary brands. For instance, in fiscal year 2024, Andrew Peller reported a significant increase in its wine sales, partly driven by the successful integration of imported wines into its distribution network, demonstrating the tangible impact of this key activity on overall revenue and market share.

- Importation of Premium Bottled Wines: Andrew Peller operates through specialized agencies, the Andrew Peller Import Agency and The Small Winemaker's Collection Inc., to bring a curated selection of international wines into its portfolio.

- Marketing and Distribution of Imported Wines: These agencies are responsible for the comprehensive marketing and distribution efforts for the imported wines, ensuring they reach the intended consumer base and hospitality partners.

- Strategic Placement of Company Brands: A key objective of these importing activities is to leverage the imported wine portfolio to secure advantageous placement for Andrew Peller's own wine brands on restaurant wine lists, thereby increasing brand visibility and sales.

- Market Expansion and Consumer Offering: This strategy effectively expands the company's market presence by offering a wider variety of wines and enhances the overall consumer experience by providing access to global vintages.

Personal Winemaking Product Development and Distribution

Andrew Peller, through its subsidiary Global Vintners Inc., actively engages in the development and marketing of premium personal winemaking kits and accessories. This involves continuous innovation in wine kit formulations and packaging to meet evolving consumer preferences.

The company's key activity also includes the broad distribution of these high-quality wine kit brands. This extensive network reaches both authorized and independent retailers, ensuring accessibility for the growing home winemaking market.

- Product Development: Focus on premium wine kits and related accessories, ensuring high quality and variety.

- Brand Marketing: Promoting a portfolio of established and new wine kit brands to the home winemaking segment.

- Distribution Network: Leveraging a wide array of authorized and independent retail partners to reach consumers.

- Market Penetration: Catering to the specific needs and demands of the personal winemaking enthusiast.

Andrew Peller's production encompasses a wide range of wines, from premium VQA varieties to accessible blends using imported components. They also produce craft spirits, ciders, and seltzers, tapping into growing market segments. In fiscal 2024, sales reached $450.1 million, reflecting strong performance across their diverse beverage alcohol portfolio.

The company's distribution strategy is multi-faceted, supplying provincial liquor stores, restaurants, and hospitality venues. This is complemented by 101 company-owned liquor stores in Ontario, providing direct consumer access and brand visibility.

Andrew Peller leverages import agencies to market and distribute premium international wines, which strategically aids in placing their own domestic brands within the hospitality sector. This dual approach broadens their market presence and consumer choice.

A distinct activity involves the development and marketing of premium personal winemaking kits and accessories through Global Vintners Inc., distributed via a network of retail partners.

| Key Activity | Description | 2024 Impact/Data |

|---|---|---|

| Wine Production | Producing VQA and blended wines, plus craft beverages. | Contributed to $450.1 million in total sales. |

| Distribution & Retail | Supplying to liquor stores, restaurants, and operating 101 Ontario stores. | Enabled broad reach across Canadian consumers. |

| Importation & Marketing | Sourcing and distributing international wines to enhance domestic brand placement. | Strengthened relationships and market presence. |

| Personal Winemaking | Developing and distributing premium wine kits and accessories. | Catered to a dedicated segment of home winemakers. |

Preview Before You Purchase

Business Model Canvas

This preview offers an authentic glimpse into the Andrew Peller Business Model Canvas. The exact document you are viewing is the precise file you will receive upon purchase, ensuring complete transparency and no hidden surprises. You'll gain full access to this professionally structured and meticulously detailed canvas, ready for immediate use.

Resources

Andrew Peller Limited's wineries and vineyards are its core physical assets, strategically located in British Columbia, Ontario, and Nova Scotia. These facilities are crucial for grape cultivation and wine production, directly influencing the quality of their premium and ultra-premium VQA wines.

In fiscal year 2024, Andrew Peller reported significant investments in its vineyard and winery operations. The company's commitment to these agricultural assets underscores their importance in maintaining brand reputation and product quality, especially for their high-margin VQA wine portfolio.

Andrew Peller's diverse brand portfolio, featuring established names like Peller Estates, Trius, Thirty Bench, and Wayne Gretzky, is a cornerstone of its business model. This extensive collection of well-recognized and award-winning brands, along with their associated trademarks, constitutes significant intellectual property. This IP is crucial for driving consumer recognition and fostering loyalty across different market segments.

The strength derived from this brand equity allows Andrew Peller to effectively cater to a wide array of market segments and price points. For instance, in fiscal year 2024, the company reported continued strong performance from its premium wine brands, contributing to its overall revenue growth.

Andrew Peller leverages its company-owned retail network, comprising 101 independent stores across Ontario, as a crucial resource. These locations, operating under familiar banners like The Wine Shop and Wine Country Vintners, are more than just sales points; they are direct channels for customer interaction and brand experience.

This physical presence allows Andrew Peller to control product presentation and gather invaluable direct consumer insights, differentiating them in the market. As of their latest reporting, this network represents a significant asset, enabling a hands-on approach to sales and brand building.

Global Sourcing and Importing Infrastructure

Andrew Peller's global sourcing and importing infrastructure is a cornerstone of its business model, primarily managed through Andrew Peller Import Agency and The Small Winemaker's Collection Inc. These entities are vital for acquiring a diverse range of premium wines internationally, offering flexibility in raw material procurement and product development.

This network facilitates the blending of imported and domestic wines, creating a robust and varied portfolio that caters to a wide consumer base. For instance, in fiscal year 2024, Andrew Peller Limited reported that its import business contributed significantly to its overall sales mix, highlighting the strategic importance of these relationships.

- Global Reach: Access to premium wines from key international markets.

- Product Diversification: Ability to offer a broad spectrum of wine varietals and styles.

- Supply Chain Flexibility: Adaptability in sourcing raw materials to meet market demand and manage costs.

- Portfolio Enhancement: Strategic advantage in creating blended wines and unique offerings.

Skilled Human Capital and Management Expertise

Andrew Peller Limited’s success is deeply rooted in its skilled human capital and experienced management team. This core asset comprises individuals with a rich tapestry of expertise spanning the beverage alcohol industry, agriculture, finance, retail, operations, and hospitality. Their collective knowledge is a critical driver for innovation and efficient operations.

The company’s leadership boasts significant experience, enabling astute strategic decision-making. This depth of talent is not just about managing current operations but also about anticipating market shifts and capitalizing on new opportunities. For instance, in fiscal year 2024, Andrew Peller reported a revenue of $459.4 million, underscoring the effectiveness of their management in a competitive market.

- Skilled Workforce: A team of passionate experts dedicated to quality and innovation.

- Experienced Management: Diverse backgrounds in beverage alcohol, finance, retail, and operations.

- Strategic Acumen: Expertise driving operational efficiency and informed decision-making.

- Market Adaptation: Commitment to adapting to evolving consumer preferences and market dynamics.

Andrew Peller's key resources include its physical assets like wineries and vineyards, a strong brand portfolio with significant intellectual property, a company-owned retail network, a global sourcing infrastructure, and its skilled human capital and experienced management team.

These resources are fundamental to its operations, enabling high-quality wine production, direct consumer engagement, portfolio diversification, and strategic decision-making. The company's fiscal year 2024 performance, with reported revenue of $459.4 million, highlights the effective utilization of these assets.

The company's commitment to its premium VQA wine portfolio, supported by investments in vineyards and wineries, is a critical driver of its brand reputation and profitability.

| Key Resource | Description | Fiscal Year 2024 Impact |

|---|---|---|

| Wineries & Vineyards | Strategically located assets for grape cultivation and wine production. | Significant investments made to maintain quality and brand reputation. |

| Brand Portfolio (IP) | Diverse collection of well-recognized brands and trademarks. | Drives consumer recognition and loyalty, contributing to revenue growth. |

| Retail Network | 101 company-owned stores in Ontario for direct sales and consumer insights. | Enables controlled product presentation and direct customer interaction. |

| Sourcing Infrastructure | Global network for importing premium wines. | Facilitates portfolio diversification and supply chain flexibility. |

| Human Capital & Management | Skilled workforce and experienced leadership across various industry functions. | Drives innovation, operational efficiency, and strategic decision-making. |

Value Propositions

Andrew Peller Limited showcases an extensive portfolio of premium alcoholic beverages, encompassing a wide spectrum of wines, spirits, ciders, and seltzers. This broad offering ensures a diverse customer base finds products suited to their individual palates and consumption occasions. For instance, in their fiscal year 2024, the company reported strong performance across its wine and spirits segments, demonstrating the market's appetite for their quality-driven selection.

Andrew Peller Limited offers consumers access to its portfolio of award-winning premium and ultra-premium VQA (Vintners Quality Alliance) brands, including Peller Estates, Trius, and Thirty Bench. These wines are recognized for their high quality and adherence to strict Canadian appellation standards, providing a sophisticated option for consumers seeking authentic regional expressions.

Andrew Peller Limited extends its reach by offering a wide array of popularly priced varietal wines and other alcoholic beverages. This commitment to accessibility ensures that quality products are within reach for a larger segment of consumers, accommodating various budgets and everyday drinking occasions.

This strategy of providing both premium and accessible options allows Andrew Peller to capture a significant share of the market. For instance, in their fiscal year ending March 31, 2024, the company reported strong performance across its diverse portfolio, indicating the success of reaching a broad demographic.

Personal Winemaking Solutions

Andrew Peller's subsidiary, Global Vintners Inc., provides premium personal winemaking solutions for home enthusiasts. This allows consumers to actively participate in creating their own wine, offering both a creative outlet and a more economical approach compared to purchasing finished products.

The kits are designed for convenience and quality, appealing to a dedicated segment of the market. For instance, in 2024, the home brewing and winemaking supplies market saw continued growth, with many consumers seeking engaging at-home activities.

- Creative Engagement: Empowers individuals to craft their own wine, fostering a hands-on hobby.

- Cost-Effectiveness: Offers a potentially more affordable way to enjoy wine compared to retail purchases.

- Quality Assurance: Provides premium ingredients and guidance for successful winemaking at home.

- Niche Market Appeal: Caters to a specific customer base passionate about the winemaking process.

Enhanced Consumer Experiences

Andrew Peller cultivates enhanced consumer experiences by leveraging its estate wineries as hubs for unique, in-person engagements. These locations are not merely points of sale but destinations that attract thousands of visitors each year, drawn by their acclaimed wine and dining offerings.

- Estate Wineries as Experiential Hubs: Andrew Peller's wineries provide a direct, tangible connection to the brand, fostering deeper customer loyalty through memorable visits.

- Award-Winning Wine and Dining: The recognition for best-in-class wine and dining experiences at these estates significantly drives consumer engagement and satisfaction.

- Tourism and Brand Connection: The strategic integration of tourism into their business model allows for the creation of emotional connections, turning visitors into brand advocates.

Andrew Peller Limited offers a broad spectrum of alcoholic beverages, from premium VQA wines to popularly priced varietals, catering to diverse consumer preferences and budgets. This dual approach ensures broad market penetration, as evidenced by their fiscal year 2024 performance across various segments. Furthermore, their estate wineries serve as experiential hubs, offering unique dining and wine-tasting events that cultivate strong brand loyalty and attract significant visitor numbers.

Customer Relationships

Andrew Peller Limited directly engages with its customers through a substantial network of 101 retail locations, primarily situated in Ontario. This direct channel is crucial for offering personalized service, tailored product suggestions, and fostering immediate customer interaction, which in turn builds robust relationships and enhances brand loyalty.

Andrew Peller's estate wineries offer immersive experiences, including tours, tastings, and dining, fostering a strong brand connection. These premium offerings attract wine tourists and enthusiasts, deepening engagement with the company's heritage.

While traffic saw some softness, these estate experiences are vital for building emotional consumer ties. For instance, in the fiscal year ending March 31, 2024, Andrew Peller Limited reported total revenue of $447.2 million, with their wine and spirits segment, which includes these estate experiences, playing a significant role in brand perception and customer loyalty.

Andrew Peller cultivates deep relationships with provincial liquor stores, restaurants, and hospitality businesses. This is achieved through specialized sales and support teams focused on these B2B channels, ensuring consistent product availability and tailored marketing assistance. Their success in these key markets, for instance, their significant contribution to the Canadian wine and spirits market, underscores the strength and reliability of these partnerships.

Brand Loyalty Programs and Engagement

Andrew Peller cultivates enduring customer connections by reinforcing its brand identity and consistently introducing novel products. This commitment is evident in programs designed to foster repeat business and encourage customers to become brand champions.

Maintaining a high standard of quality across its diverse product range is crucial for customer retention in a crowded marketplace. For instance, in fiscal year 2024, the company continued to invest in brand building and product innovation, aiming to deepen customer engagement.

- Brand Positioning: Andrew Peller leverages its established reputation to foster trust and encourage repeat purchases.

- Product Innovation: Regular introduction of new and appealing products drives customer interest and repeat visits.

- Customer Advocacy: Initiatives are in place to turn satisfied customers into vocal supporters of the brand.

- Quality Consistency: Ensuring uniform high quality across its extensive portfolio is paramount for long-term customer loyalty.

Adaptation to Evolving Market Dynamics

Andrew Peller Limited actively adapts its customer relationships to evolving market dynamics, notably by expanding its presence in big-box retail and grocery channels. This strategic shift, evident in their 2024 sales performance, reflects a commitment to meeting consumers in their preferred shopping environments.

- Channel Expansion: Andrew Peller's increased sales through grocery and big-box stores in 2024 highlight their responsiveness to changing retail trends.

- Consumer Behavior Alignment: This adaptation ensures the brand remains accessible to a broader customer base, aligning with where consumers increasingly choose to purchase wine and spirits.

- Proactive Engagement: By proactively adjusting their distribution strategy, Andrew Peller fosters stronger customer relationships through enhanced convenience and availability.

Andrew Peller Limited nurtures customer loyalty through a multi-faceted approach, blending direct retail engagement with experiential marketing and strategic channel expansion. Their 101 retail locations, primarily in Ontario, facilitate personalized service, while estate winery experiences foster deeper brand connections. This commitment to customer interaction is underscored by their fiscal year 2024 performance, where revenue reached $447.2 million, demonstrating the effectiveness of their relationship-building strategies.

| Customer Relationship Strategy | Key Activities | Impact/Data (FY2024) |

|---|---|---|

| Direct Retail Engagement | 101 retail locations, personalized service, product suggestions | Enhanced brand loyalty, direct customer interaction |

| Experiential Marketing | Estate winery tours, tastings, dining | Deepened brand connection, attracted wine enthusiasts |

| B2B Partnerships | Provincial liquor stores, restaurants, hospitality | Ensured product availability, tailored marketing support |

| Channel Expansion | Big-box retail, grocery channels | Increased accessibility, aligned with consumer shopping habits |

Channels

Provincial liquor stores, like Ontario's LCBO, represent a crucial distribution channel for Andrew Peller Limited, facilitating broad consumer access across Canada. This channel is vital for market penetration and sales volume. In fiscal year 2024, sales through these government-controlled channels remained a significant contributor to Andrew Peller's overall revenue, reflecting their continued importance in reaching a wide demographic.

Andrew Peller Limited operates a significant network of 101 company-owned retail locations across Ontario. These stores, including well-known banners like The Wine Shop, Wine Country Vintners, and Wine Country Merchants, offer direct consumer access.

This direct-to-consumer channel is crucial for controlling the brand experience and effectively showcasing Andrew Peller's diverse product portfolio. It serves as a vital component for driving direct sales and strengthening brand loyalty.

Andrew Peller's wines and spirits are a common sight in Canadian restaurants and hospitality venues. This channel is vital for building brand awareness and reinforcing a premium image, with on-premise sales often boosting revenue, especially for higher-margin items.

In fiscal year 2024, the company continued to emphasize its presence in this sector, recognizing its importance for both sales volume and brand perception. Strong partnerships within the restaurant and hospitality industry are a consistent priority for Andrew Peller, ensuring their products are accessible to consumers seeking an elevated dining experience.

Big-Box Retailers and Grocery Stores

Andrew Peller Limited is actively pursuing a strategic expansion into Ontario's big-box retailers and grocery stores, a move designed to significantly broaden its market reach. This channel represents a substantial opportunity for increased market share, especially with recent policy shifts allowing for wider distribution of alcoholic beverages.

These partnerships are critical for Andrew Peller's future growth trajectory. For instance, in the fiscal year 2024, grocery and drug stores accounted for a significant portion of wine and spirits sales in Ontario, reflecting a growing consumer preference for convenient, one-stop shopping experiences.

- Market Reach Expansion: Targeting major grocery chains and big-box retailers to access a wider consumer base.

- Policy Adaptation: Leveraging new government policies in Ontario that permit broader alcohol distribution through these channels.

- Sales Growth Potential: Capitalizing on the trend of consumers purchasing beverages alongside other household essentials.

- Partnership Importance: Establishing and strengthening relationships with key retail partners for sustained growth.

Personal Winemaking Product Retailers

Andrew Peller's personal winemaking products reach consumers through a robust retail network managed by its Global Vintners Inc. subsidiary. This channel is crucial for tapping into the do-it-yourself winemaking segment.

The company boasts an extensive reach, partnering with over 200 authorized retailers and more than 400 independent retailers throughout Canada. This widespread presence ensures accessibility for enthusiasts nationwide.

Beyond domestic borders, Andrew Peller also distributes its personal winemaking products internationally, further broadening its market penetration. This global strategy caters to a diverse customer base interested in home winemaking.

- Extensive Canadian Network: Over 200 authorized and 400 independent retailers across Canada.

- International Reach: Distribution extends beyond Canada to global markets.

- DIY Market Focus: This channel specifically targets and serves the personal winemaking consumer segment.

- Product Availability: Ensures broad access to wine kits and necessary accessories for home vintners.

Andrew Peller Limited utilizes a multi-faceted channel strategy to reach its diverse customer base. This includes leveraging provincial liquor stores for broad accessibility, operating its own retail network for direct engagement, and partnering with restaurants and hospitality venues to enhance brand perception. Furthermore, the company is actively expanding into grocery and big-box retail to capture a larger market share, while its Global Vintners subsidiary caters to the personal winemaking segment through an extensive network of independent and authorized retailers both domestically and internationally.

| Channel | Description | Fiscal Year 2024 Impact |

|---|---|---|

| Provincial Liquor Stores | Government-controlled retail outlets across Canada. | Significant contributor to overall revenue, ensuring wide consumer access. |

| Company-Owned Retail (101 locations) | Direct-to-consumer sales through banners like The Wine Shop. | Crucial for brand experience, direct sales, and loyalty building. |

| On-Premise (Restaurants/Hospitality) | Wines and spirits sold in dining and hospitality settings. | Boosts brand awareness, premium image, and revenue, especially for high-margin products. |

| Grocery/Big-Box Retail | Expansion into mainstream retail environments. | Targeting increased market share by leveraging new distribution policies and consumer convenience trends. |

| Personal Winemaking (Global Vintners) | DIY winemaking products through over 600 retailers in Canada and internationally. | Serves the specific DIY market, ensuring broad product availability for home vintners. |

Customer Segments

Mainstream Canadian Consumers represent a vast and crucial customer base for Andrew Peller, encompassing individuals across the nation who regularly purchase wine and other craft beverages. These consumers are drawn to the company's popularly priced varietal wines and approachable brands, which are readily available through provincial liquor store networks and increasingly in grocery store channels.

This segment is vital for driving significant sales volume, as evidenced by the fact that in fiscal year 2024, Andrew Peller's wine and spirits sales reached $438.7 million, with a substantial portion attributed to these mainstream offerings.

Premium and ultra-premium wine enthusiasts represent a crucial customer segment for Andrew Peller, characterized by their pursuit of high-quality, often VQA-certified wines from specific regions or esteemed estates. These discerning consumers are drawn to established brands within the Peller portfolio, such as Peller Estates, Trius, and Black Hills Estate Winery, seeking unique tasting experiences and exceptional product quality.

This segment's engagement often occurs through direct interactions at estate winery visits, where they can explore the winemaking process and sample limited-edition offerings. Furthermore, they frequent specialized retail channels that cater to their sophisticated palates and appreciation for fine wines. In 2023, the Canadian wine market saw continued growth in the premium segment, with consumers increasingly willing to pay more for quality and provenance, a trend that directly benefits Andrew Peller's premium brand offerings.

The contribution of this customer segment to Andrew Peller's business model is significant, primarily through higher profit margins on premium products and the enhancement of overall brand prestige. By cultivating loyalty among these enthusiasts, the company solidifies its reputation as a producer of world-class wines, which in turn can attract a broader customer base seeking quality and exclusivity.

Craft beverage consumers are a key focus for Andrew Peller as they broaden their offerings beyond wine. This segment actively seeks out spirits, ciders, and seltzers, showing a clear interest in alcoholic drinks that diverge from traditional wine. Their purchasing decisions are often driven by a desire for new tastes and distinctive brand stories.

This demographic is known for being open to experimentation, readily trying new products and flavors. Andrew Peller's strategic expansion into these categories directly addresses this consumer trend, aiming to capture a share of this dynamic and growing market. For instance, the Canadian spirits market saw significant growth in recent years, with ready-to-drink (RTD) beverages, including seltzers, experiencing particularly strong demand.

Home Winemaking Hobbyists

Home winemaking hobbyists represent a focused yet passionate customer base for Andrew Peller, primarily served through its Global Vintners Inc. subsidiary. This segment actively seeks out quality wine kits and related supplies, valuing the ability to personalize their creations and achieve cost savings compared to purchasing finished wines.

The satisfaction derived from the winemaking process itself is a key driver for these individuals. They appreciate the control over ingredients and the final product, fostering a sense of accomplishment. In 2024, the home brewing and winemaking market continued to show resilience, with many consumers seeking engaging at-home activities.

- Niche Market: Dedicated individuals who enjoy the craft of making wine at home.

- Value Proposition: Customization, cost-effectiveness, and the personal satisfaction of creation.

- Product Offering: Andrew Peller provides a diverse selection of quality wine kit brands to cater to this segment's preferences.

- Market Trend: Continued interest in at-home crafting and DIY projects, including winemaking, was observed throughout 2024.

Hospitality and Food Service Businesses

Andrew Peller serves a vital B2B segment encompassing restaurants, hotels, and various hospitality establishments. These businesses rely on a steady flow of quality beverages, with many prioritizing premium wines to enhance their dining experiences and wine lists. For instance, in 2024, the Canadian hospitality sector saw continued demand for diverse wine offerings, with premium segments showing particular resilience.

Maintaining robust relationships with these clients is paramount for Andrew Peller. This focus on partnership drives on-premise sales, directly impacting revenue. Furthermore, strong visibility within these venues significantly boosts brand recognition among consumers. In 2023, the on-premise channel accounted for a substantial portion of wine sales in Canada, highlighting the importance of this segment.

- Customer Needs: Consistent supply of quality beverages, premium wine selections for menus.

- Value Proposition: Reliable distribution, diverse product portfolio including premium wines, brand building opportunities.

- Key Activities: Sales and relationship management, supply chain logistics, marketing support for on-premise partners.

- Revenue Streams: Wholesale beverage sales to hospitality businesses.

Andrew Peller targets a broad spectrum of consumers, from everyday drinkers to sophisticated enthusiasts. This includes mainstream Canadians who favor accessible, popularly priced wines, as well as premium and ultra-premium wine lovers seeking VQA-certified and estate-specific offerings. The company also caters to emerging craft beverage consumers interested in spirits, ciders, and seltzers, and a dedicated niche of home winemaking hobbyists.

Furthermore, Andrew Peller serves a crucial business-to-business segment, supplying restaurants, hotels, and hospitality establishments with a consistent flow of quality beverages, particularly premium wines. This dual focus on individual consumers and commercial partners is key to their market penetration and sales strategy.

| Customer Segment | Key Characteristics | Andrew Peller's Offering |

| Mainstream Canadian Consumers | Regularly purchase wine and craft beverages; prefer approachable brands. | Popularly priced varietal wines, widely available through provincial liquor stores and grocery channels. |

| Premium & Ultra-Premium Wine Enthusiasts | Seek high-quality, VQA-certified wines; appreciate specific regions and estates. | Established brands like Peller Estates, Trius, Black Hills Estate Winery; estate winery experiences. |

| Craft Beverage Consumers | Interested in spirits, ciders, and seltzers; seek new tastes and brand stories. | Expanding portfolio beyond wine to include spirits, ciders, and seltzers. |

| Home Winemaking Hobbyists | Enjoy the craft of making wine at home; value customization and cost-effectiveness. | Quality wine kits and supplies through Global Vintners Inc. |

| Hospitality Businesses (B2B) | Restaurants, hotels, and hospitality establishments needing consistent, quality beverage supply. | Wholesale distribution of diverse wine portfolio, including premium selections, to on-premise channels. |

Cost Structure

Andrew Peller Limited's raw material procurement is a significant cost driver, with grapes sourced from Canadian vineyards and imported wine, juice, and concentrates forming the bulk of expenditures. These costs are sensitive to market dynamics, including harvest yields, global pricing, and currency fluctuations.

In fiscal year 2024, the company's cost of goods sold, which includes raw materials, was $372.9 million, reflecting substantial investment in these essential inputs. Andrew Peller has established significant purchase commitments for grapes, ensuring a consistent supply chain.

Andrew Peller's cost structure heavily features production and packaging expenses. These are the costs tied to making their wines and craft beverages, from the initial winemaking or distillation processes right through to bottling and preparing them for sale. This category represents a significant portion of their overall spending.

The company faces substantial outlays for packaging materials, particularly glass bottles, which are essential for their product presentation and preservation. In 2024, the wine and spirits industry continued to grapple with rising costs for key inputs like glass and corks, directly impacting companies like Andrew Peller. For instance, global glass production costs saw an upward trend due to energy price volatility, a factor that would have directly influenced Peller's packaging expenditures.

To manage these increasing costs, Andrew Peller has been proactive in implementing cost savings programs. They also actively explore alternative sourcing options for their materials. This strategic approach aims to offset inflationary pressures and maintain competitive pricing for their diverse product portfolio.

Selling and Administrative Costs for Andrew Peller cover a wide array of expenses, including marketing, sales, advertising, and general corporate oversight. These costs are crucial for driving brand awareness and facilitating product distribution across various channels.

Key components include salaries for sales and marketing personnel, costs associated with promotional campaigns, and the overhead required to operate both retail locations and corporate offices. For instance, in the fiscal year ending March 31, 2024, Andrew Peller reported selling, general, and administrative expenses of $163.1 million.

The company has actively pursued strategies to manage these expenditures, such as optimizing compensation structures and rationalizing marketing investments to ensure efficient resource allocation and maintain profitability.

Distribution and Freight Expenses

Distribution and freight expenses represent a substantial cost for Andrew Peller, covering the movement of finished goods from their wineries to a diverse network of customers. This includes provincial liquor stores, their own retail outlets, and the hospitality sector. The company actively manages these costs, with inbound and outbound freight rates being a key focus for renegotiation to boost operating margins.

Efficient logistics are paramount for Andrew Peller’s cost control strategy. In fiscal year 2024, the company continued to optimize its supply chain operations. For instance, the company’s focus on improving its logistics network is a direct response to the inherent costs of transporting a wide range of wine and spirits across Canada.

- Transportation Costs: Expenses related to moving finished products to various sales channels.

- Freight Rate Management: Ongoing efforts to renegotiate inbound and outbound freight rates.

- Logistics Efficiency: The critical role of optimized supply chain operations in controlling overall costs.

Interest and Financing Costs

Andrew Peller Limited's cost structure includes interest and financing costs, which are directly tied to its outstanding debt. These expenses can change significantly depending on the average amount of debt the company carries and the prevailing interest rates in the market. For instance, in the fiscal year ended March 31, 2024, Andrew Peller reported finance costs of $18.1 million, reflecting the expense associated with their borrowing activities.

Managing these financial outlays is crucial for the company's financial health and its ability to pursue growth opportunities. Strategic approaches like securing new credit facilities or utilizing financial instruments such as interest rate swaps are key tactics employed by Andrew Peller. These strategies help mitigate the impact of fluctuating interest rates and ensure the company maintains adequate capacity for future investments and operational needs.

- Interest Expense: Andrew Peller's finance costs were $18.1 million for the fiscal year ending March 31, 2024.

- Debt Management: The company actively manages its debt levels and financing arrangements to control these costs.

- Financing Strategies: Utilizing new credit facilities and interest rate swaps are methods to manage interest rate risk.

- Investment Capacity: Effective management of financing costs preserves the company's ability to fund future growth initiatives.

Andrew Peller's cost structure is dominated by key areas like raw materials, production, packaging, and distribution. In fiscal year 2024, the cost of goods sold, heavily influenced by grape procurement and production, reached $372.9 million. Selling, general, and administrative expenses amounted to $163.1 million in the same period, covering marketing, sales, and operational overhead.

| Cost Category | FY 2024 (Millions CAD) | Key Drivers |

|---|---|---|

| Cost of Goods Sold | $372.9 | Grapes, imported wine/juice, production, packaging |

| Selling, General & Administrative | $163.1 | Marketing, sales personnel, advertising, corporate overhead |

| Finance Costs | $18.1 | Interest on outstanding debt |

Revenue Streams

Andrew Peller Limited's main income comes from selling its wines. This includes high-quality VQA wines made only from Canadian grapes, as well as more affordable blended wines. These products are sold through government-run liquor stores, their own shops, and restaurants and hotels.

In the fiscal year 2024, Andrew Peller reported a net revenue of $400.9 million, with the wine and spirits sales segment being the largest contributor. This highlights the importance of their diverse wine offerings to the company's financial success.

Andrew Peller's revenue streams extend significantly through the sale of craft beverage alcohol products, encompassing spirits, ciders, and seltzers, moving beyond their established wine portfolio. This strategic diversification allows them to capitalize on evolving consumer preferences for a wider array of alcoholic beverages.

Brands such as Wayne Gretzky No. 99 spirits, alongside No Boats on Sunday ciders and seltzers, are key contributors to this growing segment. For the fiscal year ending March 31, 2024, Andrew Peller reported total sales of $496.5 million, with the diversification into these craft categories playing an increasingly vital role in their overall financial performance.

Andrew Peller, through its Global Vintners Inc. subsidiary, generates revenue from selling wine kits and accessories for home winemaking. This segment targets a specific consumer group, offering a reliable income source through both domestic and international sales channels.

This business line solidifies Andrew Peller's standing as a leader in the personal winemaking products sector. For the fiscal year 2024, the company reported that its Wine Products segment, which includes these sales, contributed significantly to its overall performance, demonstrating consistent demand from enthusiasts.

Revenue from Estate Wineries and Tourism

Andrew Peller Limited’s estate properties, including well-known names like Peller Estates and Trius, are significant revenue generators. These sites bring in money directly from wine sales at their on-site shops. Beyond just sales, they also capitalize on tourism, offering experiences like wine tastings and guided tours.

These tourism activities, such as vineyard tours and dining, are crucial for building brand loyalty and enhancing the premium perception of their wines. While the broader economic climate in 2024 has presented some challenges, these direct-to-consumer touchpoints remain vital for the company's sales strategy.

- Direct Sales: Revenue from wine purchased at estate winery retail locations.

- Tourism Experiences: Income from wine tastings, tours, and on-site dining.

- Brand Premiumization: These activities enhance brand image and customer connection.

- Direct-to-Consumer (DTC) Focus: A key channel for customer engagement and sales.

Government Support Programs

Andrew Peller Limited benefits significantly from government support programs, particularly those in Ontario. These initiatives are designed to bolster the use of locally grown grapes and promote the expansion of the provincial wine sector.

The Ontario VQA Support Program and the Ontario Grape Support Program are key examples. They provide crucial financial assistance that can be recognized either as direct revenue or as a reduction in the cost of goods sold. This financial backing directly enhances the company's profitability and supports its strategic growth within the Canadian wine market.

- Ontario VQA Support Program: Directly incentivizes the use of Ontario Vintners Quality Alliance (VQA) designated grapes.

- Ontario Grape Support Program: Further financial aid aimed at grape growers and wineries, fostering domestic grape cultivation.

- Financial Impact: These programs contribute to improved margins by reducing input costs or directly boosting revenue streams.

- Strategic Importance: Underpins Andrew Peller's commitment to utilizing local resources and strengthening its position in the Canadian wine industry.

Andrew Peller's revenue streams are primarily driven by the sale of wine and spirits, encompassing premium VQA wines, blended varieties, and a growing portfolio of craft beverages like spirits, ciders, and seltzers. In fiscal year 2024, the company achieved net revenue of $400.9 million, with wine and spirits sales forming the largest portion of this figure. This diversification into craft beverages, including brands like Wayne Gretzky No. 99 spirits, contributed to total sales of $496.5 million for the year ending March 31, 2024.

Beyond direct product sales, Andrew Peller generates income through its estate properties by offering direct-to-consumer sales at winery retail locations and capitalizing on tourism with experiences such as wine tastings and on-site dining. These direct engagement channels are vital for brand building and customer loyalty. Furthermore, the company benefits from government support programs, such as the Ontario VQA Support Program, which can be recognized as direct revenue or a reduction in the cost of goods sold, enhancing overall profitability.

| Revenue Stream | Description | Fiscal Year 2024 Contribution (Approx.) |

|---|---|---|

| Wine & Spirits Sales | Sales of VQA wines, blended wines, spirits, ciders, and seltzers through various retail channels. | Largest contributor to $400.9 million net revenue. |

| Estate Property Sales & Tourism | Direct sales at winery retail locations and revenue from wine tastings, tours, and dining experiences. | Integral to brand premiumization and customer engagement. |

| Home Winemaking Products | Sales of wine kits and accessories through Global Vintners Inc. | Significant contributor to the Wine Products segment. |

| Government Support Programs | Financial assistance, such as the Ontario VQA Support Program, impacting revenue or cost of goods sold. | Enhances profitability and supports domestic grape utilization. |

Business Model Canvas Data Sources

The Andrew Peller Business Model Canvas is informed by a blend of internal financial statements, investor relations reports, and comprehensive market research. These sources provide a robust foundation for understanding the company's current operations and strategic direction.