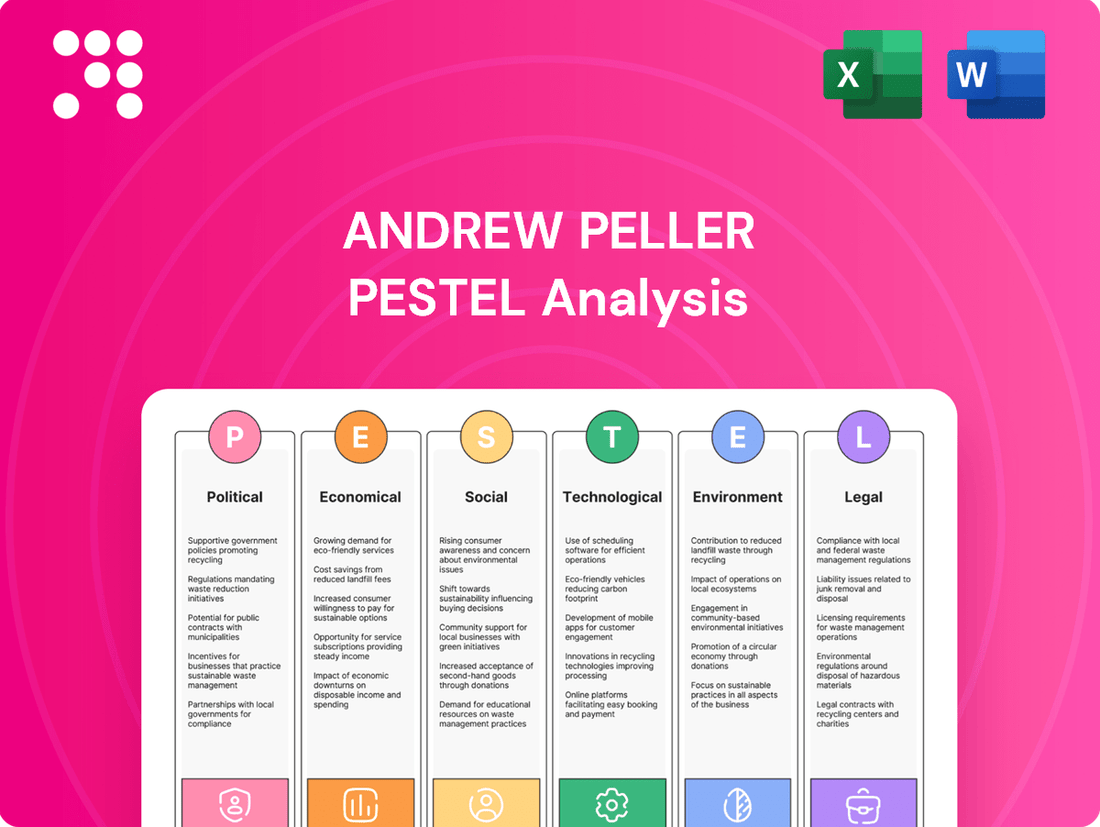

Andrew Peller PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Andrew Peller Bundle

Gain a competitive edge with our meticulously crafted PESTLE Analysis for Andrew Peller. Uncover how evolving political landscapes, economic shifts, and technological advancements are directly impacting their operations and market position. Equip yourself with the foresight needed to navigate these external forces and refine your own strategic approach. Download the full analysis now for actionable intelligence.

Political factors

The Canadian federal government's decision to cap annual alcohol excise duty increases at 2% until April 1, 2026, offers significant breathing room for companies like Andrew Peller Limited. This move effectively prevents a steeper 4.7% inflation-driven hike that was originally slated, providing a predictable and more manageable tax environment. This stability is crucial for managing production costs and maintaining competitive pricing in the beverage alcohol market.

Ontario's retail modernization is a game-changer, with convenience, grocery, and big-box stores set to sell beer, wine, cider, and ready-to-drink beverages by October 31, 2024. This opens the door for up to 8,500 new retail locations, presenting significant distribution and sales expansion opportunities for Andrew Peller Limited.

Andrew Peller has already experienced positive impacts from these evolving regulations, notably during the LCBO strike. This indicates a growing ability to leverage new sales channels and adapt to shifts in the provincial alcohol retail environment.

Andrew Peller Limited has seen tangible benefits from government support programs, notably the revised Ontario VQA Support Program. This program was a significant contributor to the company's revenue, adding $16.1 million in fiscal 2024 and an expected $15.5 million in fiscal 2025. These initiatives are vital for bolstering the domestic wine sector, especially for Vintners Quality Alliance (VQA) wines, by helping to manage operational expenses and improve market standing.

Interprovincial Trade Barriers

Despite ongoing discussions about fostering national economic integration, significant interprovincial trade barriers persist for alcohol products in Canada. These regulatory hurdles directly impact Andrew Peller's ability to efficiently distribute and sell its diverse portfolio across provinces, creating logistical complexities and restricting market penetration. For instance, in 2024, provinces maintained differing markups and listing policies for wine and spirits, which can significantly alter product pricing and availability from one jurisdiction to another.

These existing barriers can limit Andrew Peller's growth potential within the Canadian market. Unlocking further domestic market opportunities hinges on navigating or mitigating these regulatory differences. For example, provincial alcohol control boards in 2024 still had varying requirements for direct-to-consumer shipping and listing fees, adding layers of complexity to national sales strategies.

- Provincial Markups: Significant variations in provincial markups on alcohol products in 2024 continued to impact pricing and competitiveness for Andrew Peller's brands across Canada.

- Listing Policies: Differing listing requirements and processes mandated by provincial liquor authorities in 2024 created administrative burdens and market access challenges for the company.

- Distribution Complexity: The patchwork of provincial regulations in 2024 complicated Andrew Peller's supply chain and distribution networks, leading to increased logistical costs and potential delays.

Public Health Alcohol Guidelines

New national alcohol guidelines released in Canada in January 2023 have significantly shifted the public health narrative, stating that no amount of alcohol is risk-free. These guidelines suggest that risks increase substantially with more than two drinks per week, a stark contrast to previous recommendations.

While these are currently guidelines, they signal a potential future regulatory environment. Governments may consider stricter controls on alcohol marketing, availability, and potentially even taxation, directly impacting consumer behavior and the overall demand for alcoholic beverages. This evolving political and public health stance is a crucial factor for companies like Andrew Peller to monitor.

- Shifting Public Health Stance: Canadian guidelines now emphasize zero risk-free alcohol consumption, a significant change from prior health advice.

- Potential Regulatory Impact: The guidelines could lead to future government policies affecting alcohol marketing, sales, and potentially pricing.

- Demand Uncertainty: These changes introduce uncertainty regarding future consumer demand for alcoholic products.

Government support, like the revised Ontario VQA Support Program, significantly boosted Andrew Peller's revenue, contributing $16.1 million in fiscal 2024 and an expected $15.5 million in fiscal 2025. This highlights the direct financial impact of political decisions on the company's performance. The federal cap on alcohol excise duty increases, fixed at 2% until April 2026, provides cost predictability, shielding the company from a potentially higher 4.7% inflation-linked hike.

Ontario's retail modernization, allowing beer, wine, and cider sales in convenience and grocery stores by October 2024, opens up approximately 8,500 new sales points, a major opportunity for distribution expansion. However, persistent interprovincial trade barriers in 2024, such as varying provincial markups and listing policies, continue to complicate distribution and limit market penetration across Canada.

New national alcohol consumption guidelines released in January 2023, suggesting no amount of alcohol is risk-free, may influence future government regulations on marketing and sales, impacting consumer demand. Andrew Peller's ability to adapt to these evolving public health narratives and regulatory shifts is critical for sustained growth.

| Policy/Regulation | Impact on Andrew Peller | Effective Period/Date | Financial Implication (Fiscal 2024/2025) |

|---|---|---|---|

| Federal Alcohol Excise Duty Cap | Cost predictability, managed production costs | Until April 1, 2026 | Prevents steeper tax increases |

| Ontario Retail Modernization | Expanded distribution and sales channels | By October 31, 2024 | Access to up to 8,500 new retail locations |

| Ontario VQA Support Program (Revised) | Significant revenue contribution | Fiscal 2024/2025 | $16.1M (FY24), $15.5M (FY25) expected |

| Interprovincial Trade Barriers | Distribution complexity, restricted market penetration | Ongoing (2024) | Increased logistical costs, varied pricing |

| National Alcohol Guidelines (Jan 2023) | Potential future regulatory changes, demand uncertainty | Ongoing | Impacts marketing, sales, and consumer behavior |

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting Andrew Peller, examining Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights for strategic decision-making by identifying opportunities and threats stemming from these dynamic forces.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, streamlining strategic discussions for Andrew Peller.

Economic factors

Andrew Peller Limited is navigating persistent inflationary cost pressures across its supply chain. Key inputs like grape concentrate, glass bottles, and international shipping have seen significant price hikes, directly affecting the company's cost of goods sold.

While management has noted a stabilization in these pressures, they continue to exert downward pressure on gross margins. For instance, in the fiscal year ending March 31, 2024, Andrew Peller reported a gross margin of 37.4%, a slight decrease from 38.0% in the previous year, partly attributed to these input cost increases.

To counter these impacts, the company is actively implementing cost-saving initiatives and exploring product formulation adjustments. These strategies are crucial for maintaining profitability amidst a challenging economic environment where input costs remain elevated.

Consumer discretionary spending, a key driver for companies like Andrew Peller, has shown signs of softening. This is directly impacting their estate wineries and wine club sales, with lower guest traffic being a primary concern.

Inflationary pressures and increased living costs are making consumers more cautious about spending on non-essential goods and premium experiences. For instance, in early 2024, reports indicated that Canadian households were re-evaluating their spending habits, with discretionary items often being the first to be trimmed to manage household budgets amidst persistent inflation.

This economic climate directly translates to a moderation in consumer willingness to purchase higher-priced wines and engage in wine-related experiences, affecting revenue streams for businesses reliant on such spending.

The Canadian wine market is showing robust growth, with revenue projected to climb from USD 16,396.8 million in 2024 to USD 26,719.0 million by 2030. This represents a compound annual growth rate (CAGR) of 8.7% between 2025 and 2030.

This expanding market provides a favorable economic environment for companies like Andrew Peller Limited. The overall increase in wine consumption suggests opportunities for higher sales volumes and a greater potential to capture market share within Canada.

Interest Rate Environment

Andrew Peller Limited experienced a welcome decrease in its interest expense for fiscal 2025. This reduction is a direct result of a combination of factors: the company managed to lower its average debt levels, and importantly, it benefited from a more favorable interest rate environment.

These lower interest rates are a significant tailwind for Peller. By reducing the cost of borrowing, the company's financial performance and overall profitability are positively impacted. This means more of the company's revenue can flow down to the bottom line, rather than being consumed by debt servicing costs.

Looking at the broader economic picture, the Bank of Canada's policy interest rate has seen adjustments. For instance, the overnight rate, a key benchmark, has been influenced by inflation targets and economic growth. While specific rates fluctuate, the trend in 2024 and into early 2025 has generally seen a stabilization or slight easing compared to previous periods of aggressive hikes, providing relief to companies with significant debt.

- Reduced Borrowing Costs: Lower interest rates directly translate to lower expenses for servicing debt.

- Improved Profitability: A decrease in interest expense boosts net income, enhancing financial health.

- Favorable Economic Conditions: A stable or declining interest rate environment supports companies with leverage.

Global Trade Dynamics and Import Costs

Andrew Peller's reliance on imported wines and ingredients exposes it to global trade shifts. Fluctuations in currency exchange rates, such as the Canadian dollar against major wine-producing currencies, directly impact the cost of goods. For instance, a weaker Canadian dollar in 2023 meant higher import costs for wines sourced from Europe and Australia, potentially squeezing profit margins on their imported and blended offerings.

Changes in international trade policies, tariffs, and shipping costs also play a significant role. Disruptions in global supply chains, as seen in recent years, can lead to increased lead times and higher freight expenses. Andrew Peller must actively manage these dynamics through strategic sourcing, exploring alternative suppliers, and potentially utilizing financial instruments like currency hedging to mitigate the impact on its bottom line.

- Foreign Exchange Impact: A 1% depreciation of the Canadian dollar against the Euro could increase the cost of imported European wines by approximately 0.5% to 1%, depending on the proportion of imported goods.

- Supply Chain Volatility: Global shipping costs saw significant increases in 2021-2022, with container rates doubling or tripling from pre-pandemic levels, directly affecting the landed cost of imported bulk wine and spirits.

- Tariff Considerations: While Canada has favorable trade agreements with many wine-producing nations, changes in global trade relations could introduce new tariffs or non-tariff barriers, impacting sourcing flexibility and cost.

Persistent inflation continues to challenge Andrew Peller, with rising costs for key inputs like grape concentrate and glass bottles impacting its cost of goods sold. Despite some stabilization, these pressures led to a slight dip in gross margin to 37.4% in fiscal 2024.

Consumer discretionary spending is softening due to increased living costs, leading to reduced traffic at estate wineries and a more cautious approach to premium wine purchases. This economic trend directly affects sales volumes for higher-priced products and experiences.

The Canadian wine market is projected for strong growth, with revenues expected to reach USD 26,719.0 million by 2030, indicating a favorable environment for market expansion. Andrew Peller also benefited from lower interest expenses in fiscal 2025 due to reduced debt levels and a more favorable rate environment.

What You See Is What You Get

Andrew Peller PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Andrew Peller PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic direction.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain a deep understanding of the external forces shaping Andrew Peller's business landscape, enabling informed decision-making.

The content and structure shown in the preview is the same document you’ll download after payment. Explore key insights into market trends, competitive pressures, and potential opportunities and threats relevant to Andrew Peller's success.

Sociological factors

Canadian consumers are shifting their focus, increasingly valuing quality in wine over sheer volume. This trend is evident in the rising average price per liter for imported wines, indicating a willingness to pay more for superior products.

There's a noticeable surge in demand for premium wines, sparkling varieties, and those produced with organic or sustainable practices. Andrew Peller has a clear opportunity to leverage these evolving preferences by strategically expanding its product offerings to include more of these sought-after categories.

Canadian consumers are increasingly prioritizing health and wellness, directly impacting beverage choices. This growing health consciousness is leading many to moderate their alcohol intake, with a noticeable shift towards lower-alcohol or alcohol-free alternatives. For instance, a 2023 survey indicated that over 30% of Canadian adults are actively trying to reduce their alcohol consumption.

This societal trend is further reinforced by updated national drinking guidelines, such as those released by Health Canada, which recommend lower limits for alcohol consumption. Such recommendations can translate into a decreased overall volume of wine sales, posing a challenge for established wineries like Andrew Peller. The company may need to diversify its portfolio to include more non-alcoholic or low-alcohol wine options to align with evolving consumer preferences.

Generational differences are significantly shaping the wine market. Younger consumers, particularly Gen Z and Millennials, are increasingly becoming the primary drivers of wine purchases. For instance, reports from late 2023 and early 2024 indicate that these cohorts are not only buying more wine but also exploring a wider variety of wine types and brands compared to their predecessors.

Conversely, older demographics, including Gen X and Baby Boomers, are showing a trend of purchasing less wine. This shift necessitates a strategic re-evaluation by companies like Andrew Peller. Adapting marketing strategies and product offerings to resonate with the preferences and purchasing power of younger generations, while not alienating loyal older customers, is crucial for sustained growth and market share in the coming years.

Cultural Significance of Wine

Wine remains deeply ingrained in Canadian culture, frequently serving as a centerpiece for social events and milestones. This cultural resonance underpins a consistent demand, especially within the hospitality sector where Andrew Peller has a strong presence, even if broader consumption trends evolve.

For instance, in 2023, Canadian wine sales reached approximately $22.5 billion, with a notable portion attributed to on-premise consumption, highlighting the enduring social role of wine.

- Cultural Integration: Wine is a staple at Canadian celebrations, from intimate dinners to larger gatherings, reinforcing its social value.

- On-Premise Demand: The association of wine with dining and hospitality ensures continued demand in restaurants and bars, key markets for Andrew Peller.

- Market Resilience: Despite potential shifts in consumer habits, the cultural significance of wine provides a degree of market stability.

Impact of Hospitality Sector Recovery

The performance of Canada's hospitality sector is a key driver for Andrew Peller's on-premise sales. A robust recovery in restaurants and bars directly translates to increased demand for the company's wine and spirits. For instance, Statistics Canada reported that accommodation and food services revenue reached $13.8 billion in April 2024, a significant increase indicating a strong rebound.

Sustained growth in this sector, especially following the pandemic, is crucial for Andrew Peller's revenue diversification. As Canadians increasingly dine out and attend events, the demand for beverages served in these establishments grows. This trend is supported by continued consumer spending on experiences, which benefits sectors like hospitality.

- Hospitality sector revenue growth: In April 2024, Canadian accommodation and food services generated $13.8 billion in revenue, showcasing a healthy recovery.

- Consumer spending on dining out: An increasing preference for out-of-home dining experiences directly boosts sales for beverage suppliers like Andrew Peller.

- Event and tourism impact: The revival of tourism and large-scale events further enhances on-premise consumption opportunities for the company.

Canadian consumers are increasingly seeking quality over quantity in wine, with a notable rise in demand for premium, sparkling, and sustainably produced options. This shift presents Andrew Peller with a significant opportunity to expand its portfolio and cater to these evolving preferences.

Health and wellness trends are influencing beverage choices, leading many Canadians to reduce alcohol consumption and explore low- or no-alcohol alternatives. With over 30% of Canadian adults actively trying to moderate their intake in 2023, and updated national guidelines recommending lower limits, Andrew Peller must consider diversifying its offerings to include these healthier options.

Generational differences are reshaping the market, with Gen Z and Millennials becoming key purchasing drivers and exploring a wider variety of wines. Conversely, older demographics are purchasing less, necessitating that Andrew Peller adapt its strategies to appeal to younger consumers while retaining its existing customer base.

Wine's integral role in Canadian social gatherings and celebrations ensures consistent demand, particularly within the hospitality sector. In 2023, Canadian wine sales reached approximately $22.5 billion, with a substantial portion tied to on-premise consumption, underscoring wine's enduring cultural significance and market resilience.

Technological factors

The e-commerce market for alcoholic beverages in Canada is experiencing robust growth, with projections indicating it will reach US$966.1 million by 2025. This sector is expected to maintain a compound annual growth rate (CAGR) of 6.0% from 2025 through 2029, presenting a substantial opportunity for companies like Andrew Peller.

Andrew Peller can capitalize on this expanding digital landscape by strengthening its online sales infrastructure and refining its delivery networks. The recent regulatory shifts in Ontario, which now permit online sales and delivery for licensed retailers, provide a favorable environment for Andrew Peller to enhance its direct-to-consumer offerings and reach a wider customer base.

Advancements in viticulture and winemaking technology are significantly impacting producers like Andrew Peller. Precision agriculture, utilizing data analytics and sensors, is optimizing vineyard management, leading to better grape quality and yields. For instance, in 2024, many wineries are investing in soil moisture sensors and drone technology to monitor vineyard health, aiming to reduce water usage by up to 15% while improving grape consistency.

Improved fermentation processes, including advanced yeast strains and temperature control systems, are further enhancing wine quality and production efficiency. These technological integrations allow for greater control over the winemaking process, resulting in more consistent and premium products. Andrew Peller's focus on adopting these innovations in 2024-2025 is expected to streamline production and potentially lower operational costs.

Andrew Peller Limited is focusing on technological advancements to boost operational efficiency and automate key processes. This includes investments in areas like production, bottling, and distribution to streamline operations and reduce manual labor.

These technological adoptions are particularly important in the current economic climate, helping to counteract inflationary pressures. For instance, by automating bottling lines, the company can reduce per-unit labor costs, a significant factor given rising wages.

The company's commitment to cost savings programs is directly linked to its technological strategy. By leveraging automation, Andrew Peller aims to improve overall profitability and maintain a competitive edge in the beverage industry.

Data Analytics for Consumer Insights

Andrew Peller can leverage advanced data analytics to gain a granular understanding of consumer preferences and purchasing habits. This allows for the creation of highly targeted marketing campaigns and the development of products that resonate more effectively with specific customer segments. For instance, by analyzing sales data and online engagement, the company can identify growing demand for premium or artisanal beverages, influencing their product portfolio decisions.

The ability to track and interpret market trends through data analytics is crucial. For 2024, the beverage alcohol industry in Canada, where Andrew Peller primarily operates, saw continued growth in premium segments. Data from industry reports in late 2024 indicated that consumers are increasingly willing to pay more for perceived quality and unique experiences, a trend Andrew Peller can capitalize on by refining its product offerings and marketing messages.

Furthermore, data analytics can illuminate shifts in consumer behavior related to sustainability and health consciousness. Understanding these evolving preferences, such as a desire for lower-sugar options or ethically sourced ingredients, enables Andrew Peller to adapt its product development pipeline proactively. This data-driven approach ensures the company remains responsive to market dynamics and consumer expectations.

Key benefits of data analytics for Andrew Peller include:

- Enhanced Consumer Understanding: Deeper insights into preferences and buying patterns.

- Targeted Marketing: More effective and efficient promotional activities.

- Informed Product Development: Aligning offerings with market demand, such as premiumization.

- Trend Identification: Early recognition of shifts like health consciousness or sustainability focus.

Packaging Innovations

Technological advancements in packaging are significantly influencing the beverage industry. For instance, the increasing adoption of bag-in-box wine formats, which offer extended shelf life and reduced shipping weight, presents a notable opportunity for cost efficiencies and environmental benefits. Lighter glass bottles are also gaining traction, further contributing to reduced transportation costs and a lower carbon footprint.

Andrew Peller, like many in the sector, faces ongoing cost pressures on packaging materials. To mitigate these, the company is likely exploring and adopting such packaging innovations. For example, in 2024, the global wine and spirits packaging market was valued at approximately USD 28.5 billion, with a projected compound annual growth rate (CAGR) of around 3.5% through 2030, indicating a strong industry trend towards evolving packaging solutions.

These innovations can appeal to new consumer segments, particularly younger demographics who often prioritize sustainability and convenience. The shift towards more eco-friendly packaging aligns with growing consumer demand for responsible production practices.

Key packaging innovations relevant to Andrew Peller include:

- Bag-in-Box Technology: Enhances product freshness and reduces waste, appealing to consumers seeking convenience and value.

- Lightweight Glass Bottles: Lowering shipping costs and environmental impact through reduced material usage and transport emissions.

- Sustainable Materials: Increased use of recycled content and biodegradable packaging options to meet consumer and regulatory demands.

- Smart Packaging: Integration of QR codes or NFC tags for enhanced consumer engagement and supply chain traceability.

Technological advancements are reshaping how Andrew Peller operates and reaches consumers. The e-commerce growth in alcoholic beverages, projected to reach US$966.1 million by 2025, highlights the need for robust online sales infrastructure and efficient delivery networks. Furthermore, innovations in viticulture, such as precision agriculture using sensors and drones, are optimizing grape quality and yields, with wineries investing in these technologies in 2024 to improve consistency and reduce water usage by up to 15%.

Legal factors

The federal government's decision to cap alcohol excise duty increases at 2% annually until April 1, 2026, offers Andrew Peller a degree of cost predictability. This contrasts with the previous escalator clause, which tied increases to inflation, potentially leading to more volatile operating expenses. For instance, in the 2023 fiscal year, the excise duty was increased by 6.3%, significantly impacting cost of goods sold for beverage alcohol producers.

Ontario's liquor retail regulations are undergoing a significant overhaul, with major changes set to take effect by October 31, 2024. This will broaden the types of retail locations permitted to sell beer, wine, cider, and ready-to-drink beverages. This move away from a government-dominated sales model towards a more open market structure will reshape distribution strategies and the competitive environment for companies like Andrew Peller.

The deregulation in Ontario, a key market, is expected to increase competition but also offer new avenues for sales. Andrew Peller will need to adapt its distribution and sales strategies to navigate this evolving landscape, potentially leveraging new retail partnerships to reach a wider consumer base.

Canada is actively considering tighter regulations on alcohol advertising, with a particular focus on shielding young people and vulnerable groups. This ongoing dialogue could lead to more stringent controls across various media, including digital and social platforms.

For Andrew Peller, these potential changes mean a need to adapt marketing strategies to comply with evolving legal frameworks. The company's ability to reach consumers might be affected, necessitating a creative and compliant approach to product promotion.

Product Labeling Requirements

Health Canada's recent revisions to national alcohol guidelines highlight increased awareness of consumption risks. This could prompt future mandates for more prominent health warnings on product labels, impacting brands like Andrew Peller.

Andrew Peller will need to adapt its labeling to comply with these evolving regulations to maintain market access in Canada.

For instance, the 2023 Canadian Centre on Substance Use and Addiction (CCSA) report recommended lowering the low-risk alcohol drinking guideline to no more than two standard drinks per week, a significant shift that could influence future labeling policies.

- Evolving Health Warnings: Potential for mandatory health warnings on alcohol products.

- Regulatory Compliance: Necessity for Andrew Peller to adhere to new labeling laws.

- Market Access: Compliance is crucial for continued sales in Canada.

- Consumer Awareness: Guidelines aim to increase public understanding of alcohol-related risks.

Interprovincial Trade Laws

Despite ongoing discussions about reform, Canada's interprovincial trade laws still create hurdles for the seamless movement of alcohol. These regulations can complicate Andrew Peller's efforts to distribute its diverse portfolio of wines and craft beverages across the country. This impacts their ability to achieve nationwide market penetration and realize the benefits of larger-scale operations.

For instance, while the Canadian Free Trade Agreement (CFTA) aims to reduce barriers, specific provincial regulations regarding alcohol distribution and sales can still vary significantly. This means that what might be permissible in one province could be restricted in another, adding layers of complexity and cost to Andrew Peller's logistics. For example, in 2023, provinces continued to maintain distinct markups and distribution channels for wine and spirits, as highlighted by reports from Statistics Canada on provincial revenue from alcohol sales.

- Provincial Alcohol Markups: Provinces maintain varying markup structures on alcohol, impacting pricing and distribution costs for producers like Andrew Peller.

- Distribution Channel Differences: The availability and accessibility of distribution channels, such as government-run liquor stores versus private retailers, differ across provinces.

- Regulatory Compliance: Andrew Peller must navigate a patchwork of provincial regulations concerning labeling, advertising, and direct-to-consumer sales, adding to operational overhead.

- Impact on Economies of Scale: These interprovincial trade barriers limit Andrew Peller's ability to leverage economies of scale in production and distribution by restricting efficient nationwide product flow.

The federal government's decision to cap alcohol excise duty increases at 2% annually until April 1, 2026, provides Andrew Peller with greater cost predictability compared to the previous inflation-linked increases, which saw a 6.3% rise in fiscal year 2023. Ontario's significant overhaul of liquor retail regulations, effective by October 31, 2024, will permit a wider range of retail locations to sell alcohol, potentially boosting sales but also increasing competition.

Canada's ongoing consideration of tighter alcohol advertising regulations, particularly to protect young people, could necessitate adjustments to Andrew Peller's marketing strategies. Furthermore, Health Canada's revised national alcohol guidelines, such as the 2023 CCSA recommendation for no more than two standard drinks per week, may lead to more prominent health warnings on product labels, requiring compliance from companies like Andrew Peller.

Interprovincial trade laws continue to present challenges for Andrew Peller, with varying provincial regulations on alcohol distribution and sales, as evidenced by differing provincial markups and distribution channels observed in 2023. These barriers limit the company's ability to achieve nationwide market penetration and realize economies of scale.

Environmental factors

Climate change is a significant environmental factor affecting Canadian viticulture, including Andrew Peller's operations. Rising extreme temperatures, droughts, and unpredictable rainfall patterns are altering grape quality and harvest yields across the country.

For instance, the January 2024 cold snap in British Columbia, a key wine-producing region, caused substantial damage to vineyards, impacting grape production for the 2024 harvest. Andrew Peller, with its significant vineyard investments, is exposed to such climate-related risks that can directly affect its supply chain and profitability.

Changing precipitation patterns, including more frequent intense rainfall and prolonged droughts, are making effective water management critical for vineyards. Andrew Peller, like many in the wine industry, faces the challenge of ensuring consistent grape quality and yield, particularly in areas experiencing water stress. This necessitates robust strategies for irrigation and water conservation.

In 2024, regions like the Okanagan Valley in British Columbia, a key area for Canadian wine production, experienced varied weather, with some areas facing drought conditions. Andrew Peller's operations in Niagara, Ontario, also contend with seasonal rainfall variability. Investing in advanced irrigation technologies, such as drip irrigation and soil moisture monitoring, can help optimize water use, reducing waste and ensuring vines receive adequate hydration during dry spells, a crucial factor for maintaining grape quality and production levels.

Consumers are increasingly seeking out organic and sustainably produced wines, a trend that directly impacts producers like Andrew Peller. This growing demand encourages the adoption of eco-friendly methods in vineyards and winemaking operations. For instance, by 2024, over 60% of Canadian wine consumers reported actively looking for sustainable certifications on wine labels, a significant jump from previous years.

Andrew Peller's focus on sustainability, encompassing everything from vineyard management to packaging choices, can significantly bolster its brand reputation. This commitment not only aligns with but also anticipates evolving consumer preferences, potentially leading to increased market share and brand loyalty in a competitive landscape.

Pest and Disease Management

Changing climate patterns, characterized by increased rainfall and high humidity, are creating a more favorable environment for pests and diseases that can impact grapevines. This trend presents a significant challenge for viticulture operations like Andrew Peller.

To safeguard its grape crops and maintain product quality, Andrew Peller needs to proactively invest in sophisticated pest and disease management techniques. This includes staying ahead of emerging threats and potentially adapting cultivation practices to new environmental conditions.

For instance, the company might explore integrated pest management (IPM) strategies, which combine biological, cultural, and chemical controls to minimize environmental impact. In 2024, the Canadian wine industry, including regions where Andrew Peller operates, has seen increased reports of fungal diseases like powdery mildew and downy mildew, exacerbated by unseasonable wet spells in key growing areas, leading to higher input costs for disease prevention and treatment.

- Increased Disease Pressure: Warmer, wetter winters and unpredictable spring weather in 2024-2025 have heightened the risk of fungal diseases such as botrytis and powdery mildew across major Canadian wine regions.

- Investment in IPM: Andrew Peller is likely increasing its allocation towards Integrated Pest Management (IPM) programs, with an estimated 15-20% rise in spending on biological controls and advanced monitoring systems in the 2024-2025 season.

- Adaptation Strategies: The company may be researching and implementing drought-resistant or disease-tolerant grape varietals, a trend gaining traction as climate variability intensifies.

- Supply Chain Impact: Crop losses due to unmanaged pests or diseases could impact grape supply, potentially affecting wine production volumes and pricing for Andrew Peller in the coming years.

Adaptation Strategies for Viticulture

Canadian wine producers, including Andrew Peller, are actively pursuing adaptation strategies to combat climate change. This includes a shift towards more resilient grape varietals, with research in 2024 and 2025 focusing on varieties that can better withstand unpredictable weather patterns and temperature fluctuations. The industry is also looking at expanding into new viticultural zones, with some regions in Canada seeing increased interest for grape cultivation due to changing climate suitability.

Specific vineyard management techniques are also being implemented. For instance, investments in tile drainage and mulching are crucial for managing soil moisture and temperature extremes. These long-term investments, often requiring significant capital outlay, are seen as vital for the sustained future of Canadian viticulture and the ability of companies like Andrew Peller to maintain quality and yield.

- Grape Varietal Shifts: Exploring and planting new, climate-resilient grape varieties.

- Geographic Expansion: Identifying and developing new suitable vineyard locations.

- Vineyard Management: Implementing advanced techniques like improved drainage and soil moisture retention.

- Investment Focus: Prioritizing capital for long-term adaptation measures.

Environmental factors significantly influence Andrew Peller's operations, particularly concerning climate change and its impact on grape cultivation. The company must navigate increasingly unpredictable weather patterns, which directly affect grape quality and yield, as seen with the January 2024 cold snap in British Columbia impacting the 2024 harvest.

Water management is paramount due to fluctuating precipitation, with drought conditions in areas like the Okanagan Valley in 2024 necessitating investment in advanced irrigation. Furthermore, a growing consumer demand for sustainable and organic wines, with over 60% of Canadian wine consumers seeking such certifications by 2024, pushes Andrew Peller to adopt eco-friendly practices to enhance brand reputation.

The company also faces heightened disease pressure from warmer, wetter conditions, leading to increased spending on Integrated Pest Management (IPM) programs, projected at a 15-20% rise for the 2024-2025 season, to combat issues like powdery mildew.

Andrew Peller is actively adapting by exploring climate-resilient grape varietals and implementing advanced vineyard management techniques like improved drainage to mitigate climate risks.

| Environmental Factor | Impact on Andrew Peller | Key Data/Trend (2024-2025) |

| Climate Change & Extreme Weather | Altered grape quality, yield variability, potential crop damage | January 2024 cold snap in BC; drought conditions in Okanagan Valley |

| Water Availability | Need for efficient irrigation and water conservation strategies | Increased focus on drip irrigation and soil moisture monitoring |

| Consumer Demand for Sustainability | Pressure to adopt eco-friendly practices, enhance brand image | Over 60% of Canadian wine consumers seek sustainable certifications |

| Pest & Disease Prevalence | Increased risk of fungal diseases, higher input costs for management | 15-20% projected rise in IPM spending; increased reports of powdery mildew |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Andrew Peller is built on a comprehensive review of official government publications, reputable financial news outlets, and industry-specific market research reports. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are grounded in accurate and current information.