ALSO Holding SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ALSO Holding Bundle

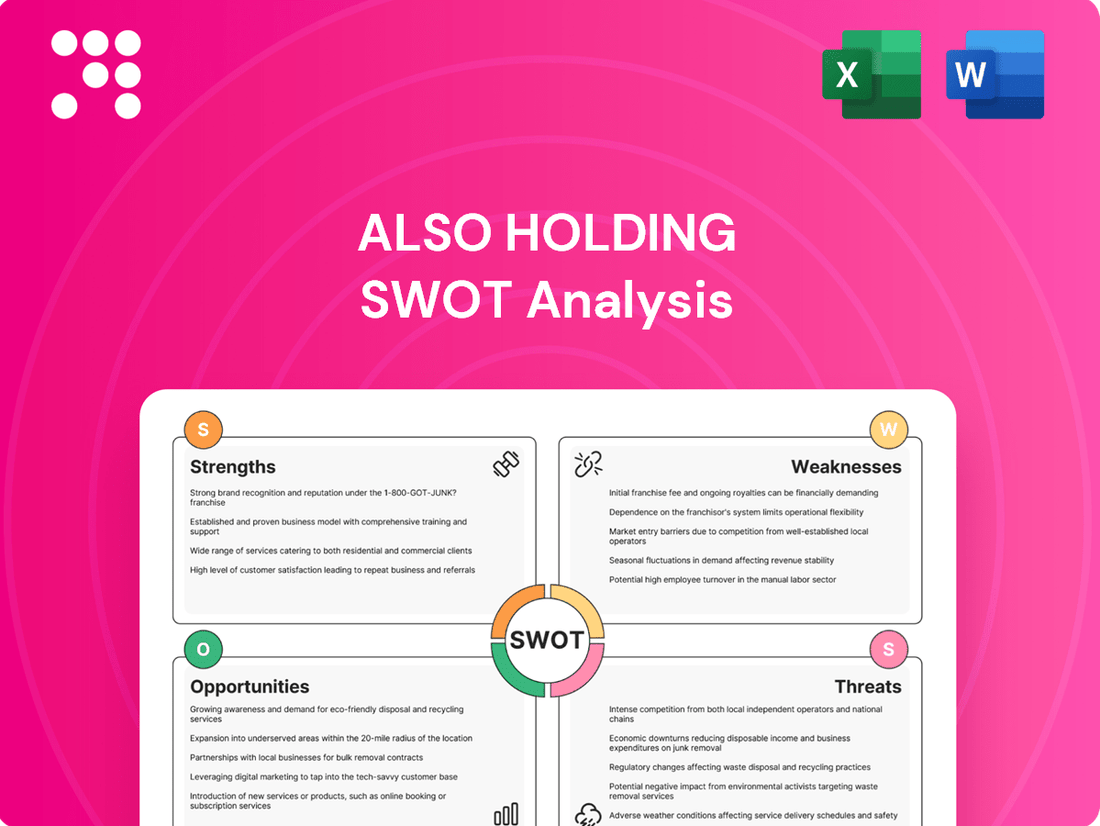

ALSO Holding's strategic positioning is shaped by its strong brand recognition and established distribution networks, yet it faces challenges from evolving market dynamics and intense competition. Understanding these internal capabilities and external pressures is crucial for navigating the future.

Want the full story behind ALSO Holding's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

ALSO Holding AG boasts a robust B2B marketplace, a significant strength that acts as a cornerstone for its operations. This platform effectively bridges the gap between a multitude of vendors and resellers within the Information and Communication Technology (ICT) sector.

The company's expansive reach, spanning 31 European countries and extending globally via PaaS partners, underscores the depth of its ecosystem. This established network, cultivated over 13 years, provides a powerful launchpad for continued expansion and deeper market penetration.

This well-developed ecosystem is designed to cater to an impressive potential of approximately 135,000 resellers. It offers them access to a comprehensive portfolio of ICT products and services, solidifying ALSO Holding's position as a central hub in the industry.

ALSO Holding boasts a comprehensive portfolio, spanning hardware, software, and IT services across its Supply, Solutions, and Service divisions. This broad range includes subscription-based cloud solutions and digital platforms for key growth areas like IoT, Cybersecurity, Virtualization, and AI, making them a one-stop shop for technology needs.

ALSO Holding's financial performance is a significant strength, highlighted by impressive growth figures. In the first half of 2025, the company reported a substantial 35% increase in revenue and a 34% rise in EBITDA, showcasing its expanding market presence and operational efficiency. This consistent upward trajectory in profitability is further evidenced by a remarkable 13-year streak of consecutive dividend increases, signaling strong financial health and a commitment to shareholder value.

Strategic Focus on Digital Platforms and Emerging Technologies

A significant strength for ALSO Holding lies in its strategic focus and robust performance within digital platforms and cutting-edge technologies. This includes substantial investments and demonstrated success in areas like cloud computing, artificial intelligence (AI), cybersecurity, and the Internet of Things (IoT). This forward-thinking approach is crucial for sustained growth in today's rapidly evolving tech landscape.

The company's cloud platform, in particular, has shown impressive traction. In the first half of 2025, it experienced a notable 34% increase in users, directly contributing to a significant portion of the company's revenue during that period. This highlights the market's strong demand for cloud-based solutions and ALSO's ability to meet that demand effectively.

This strategic emphasis on digital transformation and emerging technologies positions ALSO exceptionally well to capitalize on future market trends. By concentrating on these high-growth sectors, the company is building a strong foundation for long-term competitiveness and market leadership.

- Digital Platform Growth: ALSO's strategic investments in cloud, AI, cybersecurity, and IoT are a core strength.

- Cloud Platform Performance: A 34% user increase in the cloud platform during H1 2025 demonstrates strong market adoption and revenue contribution.

- Future Market Alignment: This focus ensures ALSO is well-positioned to benefit from the increasing demand for advanced technologies.

Proven Acquisition and Integration Capabilities

ALSO Holding demonstrates a robust track record in acquiring and integrating businesses, a core strength that has significantly expanded its market coverage and competitive standing. This strategic approach, often termed a 'Buy&Build' strategy, is complemented by a structured integration process that consistently enhances operational expertise and market penetration.

Looking ahead, the company continues to pursue growth through acquisitions. A notable example is the planned merger with Westcoast, slated for 2025, which is expected to further bolster its market presence and capabilities. This ongoing commitment to strategic M&A underscores its ability to effectively leverage external growth opportunities.

The success of these integrations is a testament to ALSO's developed expertise in managing complex transitions. By systematically absorbing and optimizing acquired entities, ALSO not only broadens its geographical reach but also deepens its service offerings, solidifying its position as a key player in its operating markets.

- Proven Acquisition Success: ALSO has a history of successfully acquiring and integrating companies, enhancing its market position.

- Strategic 'Buy&Build' Approach: The company actively pursues a 'Buy&Build' strategy to expand its market coverage and capabilities.

- Planned 2025 Merger: The proposed merger with Westcoast in 2025 is a key initiative to further expand market presence.

- Enhanced Expertise and Reach: Systematic integration programs consistently improve operational expertise and broaden market reach.

The company's substantial market reach, encompassing 31 European countries and global PaaS partners, is a significant advantage. This extensive network, built over 13 years, supports approximately 135,000 resellers with a broad ICT product and service portfolio.

ALSO Holding's financial performance is a key strength, with H1 2025 revenue up 35% and EBITDA up 34%. This growth is supported by a 13-year streak of consecutive dividend increases, demonstrating financial stability and shareholder value.

A core strength is ALSO's strategic focus on digital platforms and emerging technologies like cloud, AI, cybersecurity, and IoT. The cloud platform saw a 34% user increase in H1 2025, directly contributing to revenue and positioning the company for future growth.

ALSO's proven ability to successfully acquire and integrate businesses, exemplified by the planned 2025 merger with Westcoast, is a significant strength. This 'Buy&Build' strategy consistently expands market coverage and enhances operational expertise.

What is included in the product

Provides a comprehensive assessment of ALSO Holding's internal capabilities and external market dynamics, identifying key strengths, weaknesses, opportunities, and threats to inform strategic decision-making.

Offers a clear, actionable framework to identify and address strategic challenges, transforming potential weaknesses into opportunities for growth.

Weaknesses

ALSO Holding's revenue is closely tied to the overall health of the Information and Communication Technology (ICT) market. While the ICT sector shows long-term growth, its performance is susceptible to economic fluctuations and investment trends. For instance, in the first half of 2024, some regions experienced reduced consumer spending, which directly impacted revenue streams for certain segments within the ICT market, thereby affecting ALSO's financial outcomes.

The IT distribution landscape is fiercely competitive, with giants like TD Synnex and Ingram Micro holding substantial market shares globally. As the largest European technology provider, ALSO faces significant pressure from these dominant players, alongside numerous specialized and regional distributors who cater to niche markets.

This intense rivalry demands constant adaptation and a strong focus on innovation to maintain a competitive edge. For instance, in 2023, the global IT distribution market size was estimated to be around $450 billion, highlighting the scale of the challenge for any single player to capture significant market share without clear differentiation.

While ALSO Holding's acquisition strategy is a key strength, a high volume of M&A activity inherently brings potential integration challenges. Successfully harmonizing diverse processes, IT systems, and human resources across newly acquired entities demands substantial resources and meticulous management. For instance, in 2023, ALSO Holding completed several acquisitions, and the ongoing integration of these businesses requires careful attention to avoid operational disruptions.

Exposure to Foreign Currency Fluctuations

Operating across numerous European countries and globally means ALSO Holding is naturally exposed to the ups and downs of foreign currency exchange rates. This can make it tricky to keep financial results consistent. For instance, in 2024, negative foreign currency effects played a role in keeping revenues from growing compared to the previous year.

This currency risk can significantly impact the company's reported earnings. When the value of the currencies ALSO deals in shifts, it can either boost or reduce the value of their transactions when translated back into their reporting currency. This is a common challenge for businesses with extensive international operations.

- Geographic Diversification: Operations in multiple European nations and globally create exposure to various currency exchange rates.

- 2024 Revenue Impact: Negative foreign currency movements were cited as a factor limiting revenue growth in 2024.

- Financial Reporting Volatility: Fluctuations can lead to variability in reported financial performance.

Impact of Consumer Spending Restraint

Consumer spending restraint has emerged as a notable weakness for ALSO Holding. For instance, reports from the first half of 2024 highlighted a negative impact on ALSO's revenues, particularly in key markets such as Germany, Poland, and the Netherlands, directly linked to this consumer caution.

While ALSO projects an improvement in market conditions for the second half of 2024, the persistence of consumer hesitancy could continue to dampen sales for specific product segments. This indicates a sensitivity to broader economic sentiment and consumer confidence levels.

- Impact on Revenue: Consumer spending restraint in H1 2024 negatively affected ALSO's revenue streams.

- Geographic Sensitivity: The impact was particularly pronounced in markets like Germany, Poland, and the Netherlands.

- Future Outlook: Continued consumer caution poses a risk to future sales in certain product categories.

The company's reliance on the ICT market makes it vulnerable to economic downturns and shifts in investment. For example, a slowdown in consumer spending observed in early 2024 across key European markets negatively impacted ALSO's revenue, demonstrating this sensitivity.

Intense competition within the IT distribution sector, with major global players and specialized regional firms vying for market share, presents a constant challenge. This necessitates continuous innovation and strategic differentiation to maintain a competitive position in a market valued at approximately $450 billion in 2023.

The company's aggressive acquisition strategy, while a growth driver, introduces significant integration risks. Successfully merging diverse operational systems, processes, and corporate cultures from multiple acquisitions demands substantial management attention and resources to prevent disruption.

Operating internationally exposes ALSO Holding to currency exchange rate fluctuations, which can create volatility in financial reporting. For instance, negative currency effects in 2024 contributed to slower revenue growth compared to the prior year.

| Weakness | Description | Relevant Data/Impact |

| Market Dependence | Vulnerability to ICT market fluctuations and economic cycles. | H1 2024: Reduced consumer spending impacted revenue in key markets. |

| Intense Competition | Pressure from global and regional IT distributors. | Global IT distribution market size ~ $450 billion (2023). |

| Acquisition Integration | Challenges in merging newly acquired entities. | Ongoing integration of multiple 2023 acquisitions requires careful management. |

| Currency Risk | Exposure to foreign exchange rate volatility. | 2024: Negative currency effects limited revenue growth. |

Full Version Awaits

ALSO Holding SWOT Analysis

You’re viewing a live preview of the actual SWOT analysis file for ALSO Holding. The complete version becomes available after checkout, ensuring you receive the full, in-depth report you see here.

Opportunities

The global IT market is experiencing robust expansion, with projections indicating continued growth through 2025. This surge is fueled by widespread digital transformation initiatives and the adoption of key technologies like artificial intelligence (AI), the Internet of Things (IoT), and advanced cybersecurity solutions. For instance, the global AI market alone was valued at over $200 billion in 2023 and is expected to grow significantly in the coming years.

Businesses worldwide are channeling substantial investments into these transformative technologies to enhance efficiency, innovate services, and maintain competitive advantages. This trend creates a fertile ground for ALSO to broaden its portfolio of solutions and services, catering to this escalating demand.

ALSO's strategic alignment with these burgeoning technological trends, including its focus on cloud services and digital solutions, positions it favorably to capture a larger share of this expanding market. The company's ability to offer integrated solutions across these domains will be crucial for capitalizing on these opportunities.

ALSO Holding AG is actively pursuing expansion into new geographic markets, with stated intentions to bolster its presence in the UK, Ireland, and France. This strategic push is exemplified by planned acquisitions, such as the significant Westcoast merger anticipated in 2025.

This geographical diversification is designed to tap into previously unreached customer segments, thereby broadening ALSO Holding's overall market share. Such strategic market entries are crucial for unlocking substantial growth potential and solidifying the company's competitive standing in the European IT distribution landscape.

The B2B e-commerce and information services sectors are seeing strong expansion, with a notable move towards cloud solutions and online marketplaces. These digital platforms are transforming how businesses buy and sell, and this trend is projected to accelerate.

B2B marketplaces are fundamentally changing procurement processes. For instance, the global B2B e-commerce market was valued at approximately $10.7 trillion in 2023 and is expected to grow significantly in the coming years, driven by digital transformation initiatives.

ALSO's existing B2B marketplace and its comprehensive cloud service portfolio are perfectly positioned to capitalize on these evolving market dynamics. This alignment presents substantial opportunities for ALSO to expand its reach and revenue streams within these growing segments.

Further Strategic Acquisitions and Partnerships

ALSO Holding's proven track record in successful acquisitions, coupled with its explicit 'Buy&Build' strategy for 2025 and beyond, presents a significant opportunity. This approach allows the company to strategically expand its ecosystem and capitalize on emerging market trends.

By identifying and integrating synergistic businesses, ALSO can accelerate its market penetration and diversify its revenue streams. For instance, a successful acquisition in a high-growth sector could immediately bolster its market share and introduce new customer segments.

- Accelerated Market Penetration: Integrating acquired companies can provide immediate access to new customer bases and distribution channels.

- Revenue Diversification: Expanding into complementary service areas or geographies through acquisitions reduces reliance on single markets.

- Ecosystem Enhancement: Strategic acquisitions strengthen ALSO's end-to-end service offering, creating a more comprehensive value proposition for customers.

- Exploiting Market Opportunities: The 'Buy&Build' strategy enables rapid response to market shifts and the consolidation of fragmented sectors.

Shift Towards Subscription-Based and As-a-Service Models

The IT industry's pronounced move towards subscription-based cloud services and 'as-a-service' models, encompassing SaaS and PaaS, represents a substantial growth avenue. ALSO's dedicated Service division is strategically positioned to capitalize on this trend, which is key to its expansion plans.

This market evolution offers the advantage of more consistent and predictable revenue streams, alongside fostering stronger, more enduring relationships with customers.

For instance, the global cloud computing market, including SaaS, PaaS, and IaaS, was projected to reach over $1.3 trillion by 2024, highlighting the immense scale of this opportunity.

- Predictable Revenue: Subscription models create recurring income, enhancing financial stability.

- Customer Loyalty: Ongoing service delivery fosters deeper customer engagement and retention.

- Scalability: 'As-a-service' offerings allow for flexible scaling to meet evolving client needs.

- Market Growth: The continued expansion of cloud services provides a fertile ground for new customer acquisition.

The expanding global IT market, driven by digital transformation and emerging technologies like AI and IoT, offers significant growth potential for ALSO. The company's focus on cloud services and digital solutions aligns perfectly with this trend, allowing it to capture a larger market share. For example, the global AI market exceeded $200 billion in 2023, indicating substantial demand for advanced IT solutions.

ALSO's strategic geographical expansion into markets like the UK, Ireland, and France, coupled with its 'Buy&Build' strategy, presents a clear path for increased market penetration and revenue diversification. The B2B e-commerce and information services sectors are also growing rapidly, with a strong shift towards online marketplaces and cloud solutions, areas where ALSO is already well-positioned.

The IT industry's increasing adoption of subscription-based cloud services, such as SaaS and PaaS, provides predictable revenue streams and fosters stronger customer relationships. The global cloud computing market was projected to surpass $1.3 trillion by 2024, underscoring the immense opportunity in 'as-a-service' models.

ALSO's successful acquisition track record and its strategic 'Buy&Build' approach for 2025 are key opportunities to expand its ecosystem and respond swiftly to market changes. This strategy enables the company to integrate synergistic businesses, accelerate market entry, and diversify its revenue base.

| Opportunity | Description | Market Data (2024/2025 Projections) |

| Global IT Market Growth | Digital transformation and adoption of AI, IoT, and cybersecurity are driving IT market expansion. | Global AI market valued over $200 billion in 2023, with continued strong growth expected. |

| Geographical Expansion | Entering new markets like UK, Ireland, and France through acquisitions (e.g., Westcoast merger in 2025). | Targeting untapped customer segments to broaden market share and competitive standing. |

| B2B E-commerce & Cloud Services | Growth in online marketplaces and cloud solutions transforming B2B procurement. | Global B2B e-commerce market valued at approx. $10.7 trillion in 2023; cloud services market projected over $1.3 trillion by 2024. |

| 'Buy&Build' Strategy | Leveraging acquisitions to expand ecosystem, diversify revenue, and capitalize on market trends. | Strategic integration of businesses to accelerate market penetration and respond to market shifts. |

| Subscription-Based Services | Shift towards SaaS, PaaS, and 'as-a-service' models for predictable revenue and customer loyalty. | Consistent revenue streams and stronger customer relationships through recurring service delivery. |

Threats

Ongoing macroeconomic uncertainty, including persistent inflation and the looming threat of recessionary pressures across key markets, alongside significant geopolitical turbulence, presents a considerable challenge. These external forces directly influence IT spending and investment cycles for businesses, potentially leading to more cautious expenditure. For instance, the International Monetary Fund (IMF) revised its global growth forecast downwards for 2024, citing these very factors.

This cautious business spending environment can directly impact ALSO Holding's revenue growth and profitability as demand for technology solutions may soften. The broader economic climate, characterized by volatility and unpredictable events, remains a significant concern for technology distributors like ALSO, impacting their ability to forecast and manage inventory effectively.

ALSO Holding faces a significant threat from vendors bypassing traditional distribution channels to sell directly to end-users. This trend, amplified by the rise of e-commerce, directly challenges ALSO's established market position. For instance, many major technology vendors are expanding their direct-to-customer (DTC) sales initiatives, aiming to capture a larger share of the profit margin.

Furthermore, the competitive landscape is being reshaped by new digital platforms and specialized niche providers. These players often offer highly targeted solutions or innovative business models that can attract specific customer segments away from broader-based distributors. This dynamic requires ALSO to continually adapt and demonstrate unique value, particularly as the IT market sees an increasing number of specialized service providers emerging, potentially fragmenting the market and intensifying margin pressure.

The Information and Communication Technology (ICT) sector is characterized by relentless innovation, meaning hardware, software, and services can become outdated very quickly. For ALSO, this necessitates constant adaptation of its product portfolio and service offerings to stay competitive. For instance, the rapid evolution of cloud computing and AI technologies in 2024-2025 demands continuous investment in new solutions and partner ecosystems.

Failure to align with emerging technological trends, such as the increasing demand for edge computing solutions or advanced cybersecurity protocols, could significantly impact ALSO's market position and customer demand. The company's ability to anticipate and integrate these shifts is crucial for sustained growth and relevance in the dynamic tech landscape.

Data Security and Privacy Concerns

As a major technology provider with extensive digital platforms, ALSO Holding faces significant data security and privacy risks. The sheer volume of data processed makes it a target for cyber threats, and a breach could severely damage its reputation and financial standing. For instance, the global average cost of a data breach reached an all-time high of $4.45 million in 2024, according to IBM's Cost of a Data Breach Report, highlighting the substantial financial implications of such incidents.

Non-compliance with evolving data privacy regulations, such as GDPR or similar frameworks being strengthened globally, could result in hefty fines and legal challenges. These regulatory landscapes are constantly shifting, demanding continuous investment in compliance measures. The increasing global focus on data protection, with many countries enacting stricter laws, presents a notable restraint on market growth for companies handling sensitive information.

- Reputational Damage: A data breach can erode customer trust, leading to significant loss of business and market share.

- Financial Penalties: Fines for non-compliance with data privacy laws can be substantial, impacting profitability. For example, GDPR fines can reach up to 4% of annual global revenue or €20 million, whichever is higher.

- Operational Disruption: Recovering from a security incident can lead to prolonged downtime and operational inefficiencies.

- Loss of Customer Trust: In the digital economy, trust is paramount; security failures directly undermine this trust.

Supply Chain Disruptions

The global ICT supply chain, which ALSO Holding relies on, is inherently susceptible to disruptions. Geopolitical tensions, extreme weather events, or unexpected logistical snags can all create significant challenges. For instance, the semiconductor shortages experienced in 2021-2022, impacting many tech companies, highlighted this vulnerability.

These disruptions can directly affect ALSO by causing product scarcity, driving up component costs, and delaying order fulfillment. Such issues can hinder ALSO's capacity to meet reseller demand, potentially leading to lost sales and a negative impact on its financial performance.

- Geopolitical Instability: Trade wars or regional conflicts can disrupt the flow of goods and components.

- Natural Disasters: Events like earthquakes or floods can halt manufacturing or transportation in key regions.

- Logistical Bottlenecks: Port congestion or a lack of shipping capacity can cause significant delays.

- Component Shortages: A scarcity of critical parts, such as microchips, can halt production lines.

The ongoing global economic uncertainty, marked by persistent inflation and potential recessionary pressures in key markets, poses a significant threat to ALSO Holding. These macroeconomic headwinds can directly dampen IT spending by businesses, leading to slower demand for technology solutions and impacting revenue growth. For example, the World Economic Forum's 2024 outlook highlighted these concerns, projecting a challenging environment for many industries.

Direct sales by vendors, bypassing traditional distributors like ALSO, represent a growing threat. As technology companies increasingly leverage e-commerce and direct-to-customer (DTC) strategies, they can capture a larger share of the profit margin, directly impacting ALSO's business model. Many major tech players are actively expanding their DTC initiatives, aiming to build closer relationships with end-users.

The rapid pace of technological innovation in the ICT sector means that products and services can quickly become obsolete. For ALSO Holding, this necessitates continuous adaptation of its product portfolio and service offerings to remain competitive. The accelerating development in areas like AI and cloud computing in 2024-2025 demands ongoing investment in new solutions and partner ecosystems to avoid market irrelevance.

Data security and privacy risks are substantial for a major technology provider like ALSO. The sheer volume of data handled makes it a prime target for cyber threats, and a breach could severely damage its reputation and financial standing. The global average cost of a data breach reached an estimated $4.45 million in 2024, underscoring the significant financial implications of such incidents.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from ALSO Holding's official financial reports, comprehensive market research studies, and insightful industry expert analyses to provide a well-rounded strategic overview.