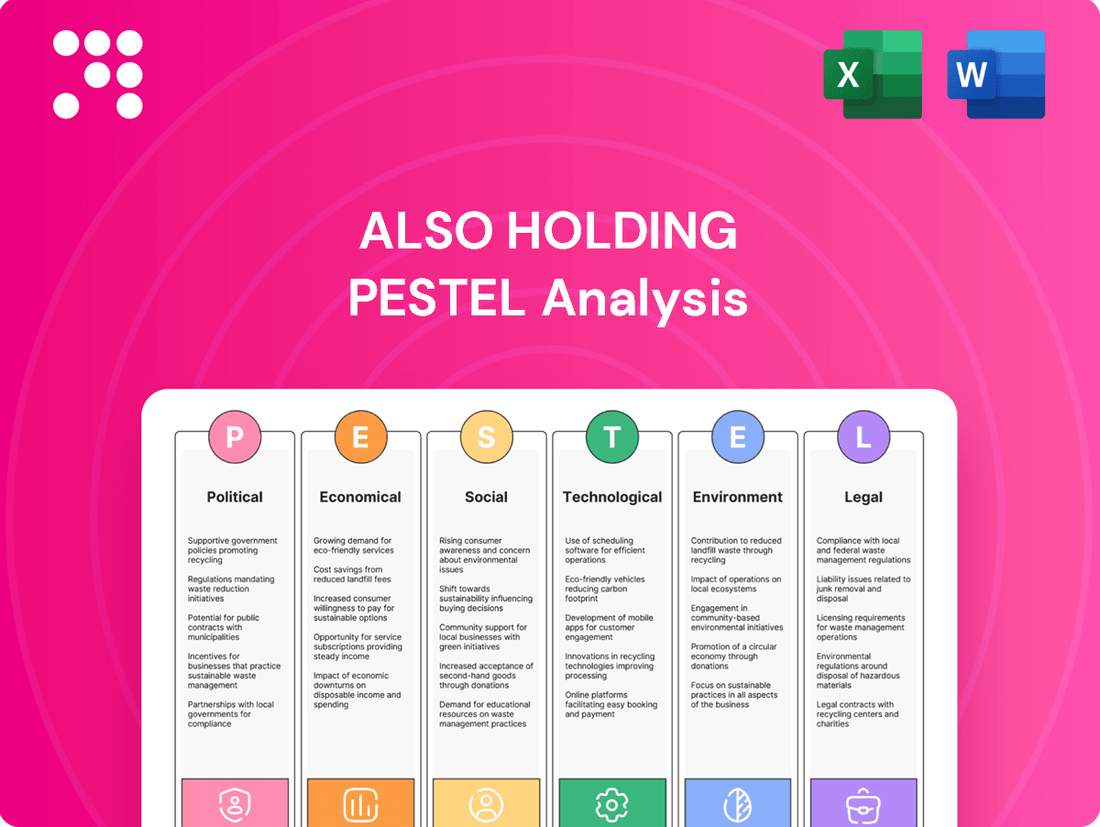

ALSO Holding PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ALSO Holding Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping ALSO Holding's trajectory. Our expertly crafted PESTLE analysis provides the deep insights you need to anticipate market shifts and capitalize on emerging opportunities. Download the full version now to gain a significant competitive advantage.

Political factors

Government policies in the European Union, where ALSO Holding has a significant presence, are increasingly shaping the ICT landscape. Initiatives promoting digital transformation and stringent cybersecurity mandates, like the NIS2 Directive, directly influence how companies such as ALSO and its partners must adapt their operations and service offerings. These regulations, including upcoming legislation like the Cyber Resilience Act, are designed to bolster digital security across the board, impacting everything from product development to data handling practices.

Global trade dynamics, including tariffs and trade agreements, significantly impact ALSO Holding's operational costs and market access. For instance, the ongoing trade friction between major economic blocs can increase the price of imported hardware and software components, directly affecting ALSO's cost of goods sold and potentially its pricing strategies for customers in 2024 and 2025. These trade policies can also influence the competitiveness of products distributed by ALSO in various international markets.

Geopolitical stability is paramount for ALSO's extensive logistics network and predictable business operations across Europe and beyond. Disruptions stemming from regional conflicts or the renegotiation of trade pacts can create supply chain bottlenecks and introduce unforeseen costs. For example, fluctuations in shipping costs due to geopolitical instability, which were observed throughout 2023 and are projected to continue into 2024, directly affect ALSO's ability to deliver products efficiently and maintain stable inventory levels.

The European Union's commitment to bolstering digital security is evident in its evolving cybersecurity legislation. The recent Cyber Solidarity Act, for instance, aims to enhance the EU's capacity to prevent, detect, and respond to cybersecurity threats, which directly impacts the market for cybersecurity solutions like those offered by ALSO.

Further strengthening this framework, updates to the Cybersecurity Act are continuously refining standards for cybersecurity certification of products, services, and processes. This legislative push creates a growing demand for robust cybersecurity platforms and services, a key area for ALSO's business.

Compliance with upcoming regulations, such as the revised Radio Equipment Directive set for August 2025, presents a critical consideration for ALSO and its extensive network of vendors and resellers. Navigating these regulatory shifts is paramount for maintaining market access and ensuring the continued relevance of their offerings in the European market.

Digital Decade Initiatives

The European Union's Digital Decade initiative is a major driver for ALSO Holding, with significant investment earmarked for digital transformation. This program, aiming to bolster Europe's digital sovereignty and infrastructure, directly fuels demand for the ICT solutions and services that form the core of ALSO's business. For instance, the EU has committed substantial funds to establishing 5G corridors across the continent and building robust sovereign cloud capacities, areas where ALSO is actively involved.

These political factors create a favorable market environment for ALSO, as the Digital Decade's objectives align perfectly with the company's strategic focus on ecosystem development and providing essential digital infrastructure. The push for digital skills and advanced technologies across member states translates into increased opportunities for partners and customers leveraging ALSO's platform. By 2025, the EU aims for at least 75% of enterprises to utilize cloud computing, big data, and artificial intelligence services, underscoring the scale of the digital shift ALSO is positioned to capitalize on.

- EU Digital Decade Funding: Significant financial allocations are directed towards digital priorities, including 5G deployment and sovereign cloud infrastructure.

- Market Demand Alignment: The program's goals directly increase demand for ICT solutions and services offered by ALSO.

- Ecosystem Growth: Initiatives support the expansion of digital ecosystems, a key strategic area for ALSO.

- Digital Skills Enhancement: Political focus on upskilling the workforce in digital technologies benefits companies like ALSO that provide the necessary tools and platforms.

Competition Policy and Market Concentration

Governmental competition policies significantly influence market structures and the potential for companies like ALSO to expand. Regulatory approvals for mergers and acquisitions, such as the one for ALSO's strategic partnership with Westcoast in 2023, are critical gatekeepers. These policies are designed to foster fair competition and prevent any single entity from gaining excessive market dominance.

For instance, the European Union's competition authorities closely scrutinize large-scale M&A activities to ensure they do not harm consumers through reduced choice or higher prices. In 2023, the EU saw a notable increase in merger filings, reflecting ongoing consolidation trends across various sectors, including technology distribution where ALSO operates. The ability of companies to navigate these regulatory landscapes directly impacts their growth strategies and market positioning.

- Regulatory Scrutiny: Antitrust laws and merger control regulations are key political factors impacting market concentration.

- M&A Approvals: Governmental decisions on whether to approve mergers and acquisitions directly shape industry landscapes.

- Fair Competition Mandate: Policies aim to prevent monopolies and ensure a level playing field for all market participants.

- Impact on Expansion: Regulatory hurdles can either facilitate or impede a company's strategic growth and market penetration.

Government policies in the EU, where ALSO Holding operates extensively, are increasingly focused on digital security and transformation. New directives like the Cyber Resilience Act, expected to impact product development and data handling by 2025, alongside existing mandates such as NIS2, directly shape the operational landscape for ALSO and its partners. These regulations aim to enhance overall digital security across the technology sector.

The EU's Digital Decade initiative, with substantial funding for 5G and sovereign cloud infrastructure, is a significant political driver. By 2025, the EU aims for 75% of enterprises to use cloud, big data, and AI, creating a strong market demand for ICT solutions that ALSO is positioned to meet. This aligns with ALSO's strategy of fostering digital ecosystems and providing essential digital infrastructure.

| Policy/Initiative | Impact on ALSO Holding | Timeline/Data Point |

|---|---|---|

| NIS2 Directive | Mandates enhanced cybersecurity practices for ALSO and partners. | Effective from January 2023, with ongoing compliance evolution. |

| Cyber Resilience Act | Influences product development and data handling. | Expected implementation by August 2025. |

| EU Digital Decade | Drives demand for 5G, cloud, AI services. | Target: 75% of enterprises using cloud/big data/AI by 2025. |

| Radio Equipment Directive (Revised) | Requires compliance for products in the EU market. | Effective August 2025. |

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting ALSO Holding, examining Political, Economic, Social, Technological, Environmental, and Legal influences.

Provides a concise overview of external factors impacting ALSO Holding, enabling proactive strategy development and mitigating potential risks before they escalate.

Economic factors

The overall economic health of Europe significantly impacts ALSO Holding. A robust economy generally translates to higher consumer and business spending, including investments in technology. For instance, the European Union's GDP is anticipated to grow by 1.9% in 2025, providing a stable backdrop for market expansion.

This economic climate directly correlates with IT spending trends. As businesses and individuals feel more confident, they are more likely to upgrade their technology infrastructure and adopt new solutions. This creates a favorable demand environment for companies like ALSO that offer a wide range of IT products and services.

Specifically, the European technology market is projected for substantial growth. Forecasts suggest a 5% increase in European technology spending for 2025, reaching an estimated €1.4 trillion. This expansion is largely fueled by key areas such as cloud computing, cybersecurity, and artificial intelligence, all of which are core to ALSO's offerings.

Inflationary pressures and rising interest rates significantly influence ALSO Holding's operating environment. For instance, in the first half of 2025, higher financing costs directly impacted profitability, even as the company experienced revenue growth. This highlights how increased financial expenses can eat into margins.

Changes in interest rates also affect the purchasing power of ALSO's customer base. When borrowing becomes more expensive, both businesses and consumers may reduce their spending on the types of technology and services that ALSO provides, leading to slower demand.

Currency fluctuations pose a significant risk for ALSO Holding, an international company with operations across numerous European countries. Changes in exchange rates directly affect the reported value of revenues and profits when translated into its reporting currency, potentially impacting overall financial performance.

For instance, if the Euro weakens against other currencies in which ALSO generates substantial revenue, those earnings would translate to a lower Euro amount, negatively affecting reported results. Conversely, a stronger Euro could boost reported figures. This volatility is a key consideration in their financial forecasting and risk management strategies.

In 2023, the strengthening of the Swiss Franc against other currencies, including the Euro, had a notable impact on ALSO's financial reporting. While specific figures vary by quarter, this trend highlights the tangible effect currency movements can have on their top and bottom lines, as demonstrated by the company's disclosures on foreign currency translation adjustments.

Digital Transformation Investment

Businesses are significantly ramping up their spending on digital transformation, a trend that directly boosts demand for Information and Communication Technology (ICT) solutions, which is a core area for ALSO. This surge in investment is a major driver for the European ICT market's expansion.

For instance, in 2024, global digital transformation spending was projected to reach over $2.3 trillion, with Europe being a substantial contributor. This investment fuels the need for cloud services, cybersecurity, and advanced data analytics, all areas where ALSO operates and benefits.

- Increased ICT Spending: Businesses globally are prioritizing digital transformation, leading to higher demand for technology solutions.

- European Market Growth: This trend is a key factor in the continued expansion of the European ICT sector.

- Benefiting ALSO: The focus on digital initiatives directly aligns with and supports ALSO's business model and revenue streams.

Availability of Capital and Financing

Access to capital is a critical driver for ALSO Holding's strategic initiatives, such as ecosystem investments, potential acquisitions, and share buybacks. Favorable financing conditions directly impact the company's ability to execute these growth-oriented plans. A robust cash position, like the reported CHF 1.0 billion in cash and cash equivalents as of December 31, 2023, provides significant flexibility for continued investment and supports its dividend policy.

The availability of capital influences ALSO's capacity to fund its ongoing ecosystem development and pursue strategic mergers and acquisitions. In 2023, ALSO demonstrated its commitment to shareholder returns by proposing a dividend of CHF 2.50 per share, underscoring the importance of a strong financial foundation to support such policies.

- Capital Access: ALSO's ability to secure financing is key for ecosystem expansion and M&A activities.

- Financing Conditions: Favorable interest rates and credit availability directly support investment capacity.

- Cash Reserves: A healthy cash balance, such as the CHF 1.0 billion reported at year-end 2023, enables ongoing investment and dividend payouts.

- Shareholder Returns: The proposed CHF 2.50 dividend per share for 2023 highlights the link between financial strength and shareholder value.

Economic growth in Europe, projected at 1.9% GDP growth for 2025, generally fuels IT spending, benefiting ALSO Holding. This positive economic outlook supports increased business and consumer investment in technology solutions. The European technology market is expected to grow by 5% in 2025, reaching €1.4 trillion, driven by cloud, cybersecurity, and AI – areas central to ALSO's business.

Inflationary pressures and rising interest rates, as seen in the first half of 2025, can increase financing costs and reduce customer purchasing power, impacting ALSO's profitability and demand. Currency fluctuations, like the Swiss Franc's strength against the Euro in 2023, also directly affect ALSO's reported revenues and profits.

| Economic Factor | Impact on ALSO Holding | Relevant Data/Projection |

|---|---|---|

| European GDP Growth | Drives IT spending and demand for technology solutions. | Projected 1.9% GDP growth in 2025. |

| European Technology Market Growth | Indicates expansion opportunities for ALSO's core offerings. | Expected 5% growth in 2025, reaching €1.4 trillion. |

| Inflation and Interest Rates | Increases financing costs and can dampen customer spending. | Higher financing costs impacted profitability in H1 2025. |

| Currency Fluctuations | Affects reported revenue and profit translation. | Swiss Franc strengthening against Euro impacted reporting in 2023. |

Same Document Delivered

ALSO Holding PESTLE Analysis

The preview you see here is the exact ALSO Holding PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real preview of the product you’re buying, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting ALSO Holding, delivered exactly as shown, no surprises.

The content and structure shown in this preview is the same comprehensive PESTLE Analysis document you’ll download after payment, providing a complete strategic overview.

Sociological factors

The growing need for digital expertise, coupled with a significant cybersecurity talent deficit in Europe, estimated at around 300,000 professionals, directly affects how effectively companies like ALSO can deploy sophisticated IT solutions. This shortage can slow down the adoption of new technologies and increase implementation costs.

ALSO's strategic focus on fostering digital education and enhancing general digital literacy within its ecosystem is a proactive approach to bridge this widening skills gap. By investing in training and development, ALSO aims to cultivate a more digitally proficient workforce and customer base, thereby facilitating smoother integration of advanced IT services and solutions.

The shift towards hybrid and remote work continues to be a significant sociological trend, directly impacting technology adoption. By 2025, an estimated 30% of the global workforce is expected to be working remotely at least part-time, fueling a robust demand for digital collaboration solutions.

This sustained preference for flexible work arrangements necessitates robust cloud-based infrastructure and seamless digital collaboration tools, areas where ALSO Holding is strategically positioned. Businesses are increasingly investing in these platforms to maintain productivity and foster teamwork across distributed environments, with the global collaboration software market projected to reach $63.2 billion by 2025.

Consumer attitudes are increasingly favoring subscription-based services and the adoption of refurbished technology. This shift is evident in the growing demand for IT hardware and services delivered through 'as-a-service' models, aligning perfectly with ALSO's strategic focus on circular economy principles and sustainability. For instance, the global refurbished electronics market was projected to reach over $110 billion in 2024, indicating a strong consumer willingness to embrace pre-owned devices.

This evolving consumer mindset directly supports ALSO Holding's business strategy, particularly their emphasis on circularity and 'as-a-service' solutions. By offering flexible consumption models and promoting the reuse of technology, ALSO is well-positioned to capitalize on these changing societal preferences. The increasing acceptance of refurbished goods not only addresses cost-consciousness but also reflects a growing environmental awareness among consumers.

Societal Expectations for Sustainability and Ethics

Societal expectations are increasingly shaping the technology market, with a growing emphasis on sustainability and ethical practices. Consumers and businesses alike are demanding products that are not only innovative but also produced responsibly, influencing purchasing decisions and a company's overall reputation. This trend is particularly evident in the 2024-2025 period, where reports indicate a significant rise in consumer preference for brands demonstrating strong environmental, social, and governance (ESG) credentials. For instance, a recent survey found that over 60% of consumers consider a company's sustainability efforts when making technology purchases.

ALSO Holding actively addresses these evolving societal expectations through its commitment to building a sustainable ecosystem and practicing responsible corporate management. This includes a dedicated focus on human rights throughout its extensive supply chain. The company’s proactive stance on these issues is crucial for maintaining brand loyalty and market relevance in an era where ethical consumerism is a powerful driver of business success.

- Growing Consumer Demand: By 2025, it's projected that over 70% of B2B technology buyers will prioritize vendors with robust sustainability programs, up from approximately 50% in 2023.

- Ethical Supply Chains: ALSO's commitment to auditing and ensuring human rights compliance across its supply chain is a direct response to public scrutiny and regulatory pressures.

- Corporate Reputation: Companies like ALSO that demonstrably integrate sustainability and ethics into their core operations are likely to see enhanced brand value and reduced reputational risk.

- Market Differentiation: In a competitive landscape, a strong ethical and sustainable profile serves as a key differentiator, attracting talent and investment.

Demographic Shifts and Workforce Trends

Demographic shifts are significantly reshaping the IT industry. A growing preference among younger generations for reuse and sustainability over disposable products directly influences consumer demand for refurbished electronics and circular economy models. This trend is particularly relevant for companies like ALSO Holding, which operates within the IT sector.

Workforce trends are also critical. The IT talent pool is increasingly diverse, with a greater emphasis on skills and adaptability. Companies that foster strong diversity and inclusion initiatives are better positioned to attract and retain top talent in this competitive landscape. For instance, in 2024, reports indicated a continued push for gender diversity in tech roles, with many companies setting ambitious targets.

- Younger Generations' Preference: Studies from 2024 show that over 60% of Gen Z and Millennials consider a company's sustainability practices when making purchasing decisions, impacting the demand for IT hardware lifecycle services.

- Talent Pool Dynamics: The global IT workforce is projected to grow, but attracting specialized talent, particularly in areas like cybersecurity and AI, remains a challenge, highlighting the importance of robust HR strategies.

- ALSO's Diversity Focus: ALSO Holding's commitment to diversity, as evidenced by their employee resource groups and inclusive hiring practices, is crucial for tapping into this evolving talent pool and fostering innovation.

Societal expectations are increasingly driving demand for sustainable and ethically produced technology. By 2025, over 70% of B2B technology buyers are expected to favor vendors with strong sustainability programs, a significant increase from 2023. This growing consumer consciousness around environmental, social, and governance (ESG) factors directly influences purchasing decisions, making a company's commitment to ethical practices, such as human rights compliance in supply chains, a critical aspect of brand value and market differentiation.

Technological factors

The rapid evolution of cloud computing, encompassing multi-cloud, serverless, and specialized vertical clouds, is fundamentally reshaping how businesses operate, directly impacting ALSO's digital infrastructure and service delivery models. This technological wave is not just about storage; it's about agility and innovation.

By 2025, the global cloud computing market is anticipated to surpass $1 trillion, with a significant portion of IT expenditures migrating to public cloud environments. This substantial market growth underscores the critical importance of cloud adoption for companies like ALSO to remain competitive and efficient.

The rapid advancement and integration of Artificial Intelligence (AI) and Machine Learning (ML) are reshaping business landscapes. These technologies are increasingly embedded within cloud services and core business operations, presenting substantial growth avenues for companies like ALSO offering AI-powered platforms and solutions. By 2025, projections indicate that a substantial portion of enterprise data will be processed using AI or ML algorithms within cloud environments, highlighting the growing reliance on these advanced analytical tools.

Continuous innovation in cybersecurity, particularly AI-driven threat detection and robust security frameworks, is paramount for ALSO's platform. These advancements are crucial for safeguarding critical cloud infrastructure and mitigating risks. The escalating global cost of cybercrime, projected to reach $10.5 trillion annually by 2025, underscores the urgent need for such sophisticated protective measures.

Development of IoT and Smart Devices

The ongoing expansion of the Internet of Things (IoT) and the increasing adoption of smart devices are significantly boosting the need for robust connectivity, efficient data management, and specialized IT services. This surge creates a fertile ground for companies like ALSO, whose IoT platform and associated services are strategically aligned to leverage this growing market. For instance, the global IoT market was projected to reach over $1.1 trillion by 2024, with smart home devices alone representing a substantial segment.

ALSO's positioning within this technological shift is crucial. The company's ability to offer integrated solutions for IoT deployment, including hardware, software, and cloud services, allows it to capture value across the entire IoT ecosystem. This trend is further evidenced by the projected growth in connected devices, which is expected to surpass 29 billion by 2030, underscoring the vast potential for companies facilitating IoT infrastructure and services.

- Increased Demand for Connectivity: The proliferation of smart devices directly translates to a higher demand for reliable and high-speed network infrastructure, a core area for ALSO's offerings.

- Data Management Opportunities: The sheer volume of data generated by IoT devices necessitates sophisticated data storage, processing, and analytics solutions, which ALSO can provide.

- Growth in Specialized IT Services: Implementing and managing IoT solutions requires expertise in areas like cybersecurity, application development, and system integration, creating service revenue streams for ALSO.

- Market Penetration: By offering a comprehensive IoT platform, ALSO can attract a wider range of clients, from small businesses to large enterprises, looking to integrate IoT into their operations.

Evolution of 5G Networks

The ongoing rollout and enhancement of 5G technology are significantly reshaping the technological landscape, paving the way for innovative applications and services that demand robust, high-speed connectivity with minimal delay. This evolution is a key driver for digital transformation across various sectors, directly stimulating the need for advanced hardware and networking infrastructure. For a company like ALSO Holding, which distributes these essential components, the expansion of 5G presents a substantial growth avenue.

The increasing adoption of 5G is directly correlated with higher demand for the networking solutions and hardware that ALSO Holding provides. For instance, global 5G subscriptions were projected to surpass 1.5 billion by the end of 2024, a figure expected to climb significantly in 2025 as coverage expands and device availability improves. This surge in connectivity fuels the market for routers, switches, and other critical network components.

- Increased Demand for Network Infrastructure: The need for 5G-compatible hardware, from base stations to user devices, directly benefits distributors like ALSO Holding.

- Enabling New Services: 5G's low latency and high bandwidth support emerging technologies such as augmented reality (AR), virtual reality (VR), and the Internet of Things (IoT), creating new markets for related hardware and software.

- ICT Upgrade Cycles: Businesses and consumers alike are upgrading their existing ICT equipment to leverage 5G capabilities, driving sales of new networking solutions.

- Edge Computing Growth: 5G facilitates the expansion of edge computing, requiring more distributed data processing hardware, which ALSO Holding can supply.

Technological advancements, particularly in cloud computing and AI, are fundamentally reshaping business operations, directly impacting ALSO's service delivery models. By 2025, the global cloud computing market is expected to exceed $1 trillion, highlighting the critical need for cloud adoption.

The integration of AI and ML into cloud services presents significant growth opportunities for companies like ALSO, with a substantial portion of enterprise data projected to be processed using these algorithms within cloud environments by 2025.

The escalating cost of cybercrime, estimated to reach $10.5 trillion annually by 2025, underscores the paramount importance of advanced cybersecurity measures for protecting cloud infrastructure.

The expansion of the Internet of Things (IoT), with the global IoT market projected to surpass $1.1 trillion by 2024, and the increasing adoption of 5G technology, with over 1.5 billion global 5G subscriptions anticipated by the end of 2024, create substantial growth avenues for ALSO Holding's hardware and networking solutions.

| Technology Area | Projected Market Size / Adoption (2024-2025) | Impact on ALSO Holding |

|---|---|---|

| Cloud Computing | >$1 Trillion (Global Market by 2025) | Drives demand for cloud-enabled hardware and services. |

| Artificial Intelligence (AI) / Machine Learning (ML) | Majority of enterprise data processed via AI/ML in cloud by 2025 | Creates opportunities for AI-powered platforms and solutions. |

| Cybersecurity | $10.5 Trillion (Global Cost of Cybercrime by 2025) | Emphasizes need for robust security solutions in ALSO's offerings. |

| Internet of Things (IoT) | >$1.1 Trillion (Global Market by 2024) | Boosts demand for connectivity, data management, and IT services. |

| 5G Technology | >1.5 Billion (Global Subscriptions by end of 2024) | Increases demand for networking hardware and infrastructure components. |

Legal factors

Data protection and privacy regulations, such as the EU's General Data Protection Regulation (GDPR), remain a critical legal consideration for ALSO Holding. These laws mandate stringent requirements for how personal data is collected, processed, and stored, impacting ALSO's operations and its extensive network of partners. Failure to comply can result in substantial fines; for instance, under GDPR, penalties can reach up to €20 million or 4% of global annual turnover, whichever is higher.

Maintaining robust data handling and security protocols is therefore paramount for ALSO to avoid legal repercussions and safeguard customer trust. This includes ensuring that all data processing activities, whether internal or outsourced, adhere to the principles of lawfulness, fairness, and transparency. The ongoing evolution of these regulations necessitates continuous review and adaptation of ALSO's compliance strategies throughout 2024 and into 2025.

New cybersecurity regulations like the NIS2 Directive, CRA, and DORA are significantly raising the bar for digital service providers and critical infrastructure. These directives, with phased implementation starting in 2025 and 2026, demand robust security measures and operational resilience.

For ALSO, compliance means adapting its services and internal processes to meet these enhanced requirements, which include stricter incident reporting and risk management protocols. Failure to comply could result in substantial fines, impacting financial performance and market reputation.

The European Union's NIS2 Directive, for instance, aims to harmonize cybersecurity standards across member states, impacting a broader range of sectors. Similarly, the CRA and DORA focus on strengthening the resilience of digital products and financial entities against cyber threats, respectively.

Product safety and liability laws, especially in the EU, are increasingly stringent, mandating robust cybersecurity measures and secure-by-design principles for digital products and radio equipment. This directly impacts ALSO Holding, requiring thorough vetting of hardware and software vendors to ensure compliance. For instance, the EU's Radio Equipment Directive (RED) 2014/53/EU, with ongoing updates, places significant responsibility on distributors to confirm that products meet essential safety and cybersecurity requirements before they enter the market.

Anti-Trust and Competition Law

Anti-trust and competition laws are crucial for ALSO Holding, as they shape how the company can grow and operate within various markets. These regulations scrutinize market behavior, preventing monopolies and ensuring fair competition, which directly impacts ALSO's strategies for expanding its business and integrating any new companies it acquires. For instance, the successful completion of acquisitions like the one involving Westcoast in 2023 was contingent on navigating these very legal frameworks and securing necessary regulatory approvals.

These legal factors can significantly influence the valuation of potential mergers and acquisitions. For example, investigations into market concentration or potential anti-competitive practices by regulatory bodies can delay or even block deals, impacting the projected synergies and financial benefits that ALSO might expect from an acquisition. The ongoing enforcement of these laws by authorities such as the European Commission means that companies like ALSO must proactively assess the competitive landscape and potential regulatory hurdles for any significant strategic move.

Key considerations for ALSO under these laws include:

- Merger Control: Ensuring that acquisitions do not create a dominant market position or substantially lessen competition, as mandated by regulations in key operating regions.

- Abuse of Dominance: Adhering to rules that prevent companies with significant market power from engaging in practices that harm competitors or consumers.

- Cartel Prohibition: Avoiding any agreements or concerted practices with competitors that aim to fix prices, allocate markets, or restrict output.

- Regulatory Approvals: Proactively engaging with competition authorities to obtain clearance for transactions, a process that can involve detailed market analysis and commitments from the acquiring entity.

Circular Economy and E-Waste Legislation

New regulations are increasingly focusing on the circular economy, pushing for extended product lifecycles and responsible end-of-life management for electronics. For instance, the European Union's Ecodesign Regulation, which came into full effect in 2024, mandates repairability and durability for various electronic products, directly impacting how IT hardware is designed, manufactured, and handled. This legislative push aligns with and supports ALSO's strategic focus on refurbishing and recycling IT equipment, creating a favorable market environment for their circular economy services.

Governments worldwide are implementing or strengthening e-waste legislation. In 2024, several countries introduced new Extended Producer Responsibility (EPR) schemes for electronics, requiring manufacturers and importers to finance and manage the collection and recycling of their products. This trend is projected to significantly increase the volume of collected and processed e-waste, providing greater opportunities for companies like ALSO that specialize in IT asset disposition and circular IT solutions. By 2025, it's estimated that global e-waste generation could reach 82 million metric tons annually.

- EU Ecodesign Regulation (2024): Mandates repairability and durability for electronics, influencing product design and lifecycle management.

- Global EPR Schemes: Increasing implementation of Extended Producer Responsibility for electronics in 2024/2025, driving e-waste collection and recycling.

- Projected E-Waste Growth: Global e-waste is forecast to exceed 82 million metric tons by 2025, highlighting the need for robust recycling infrastructure.

- Circular Economy Incentives: Government recommendations and financial incentives are promoting business models centered on refurbishment and recycling of IT hardware.

Data protection laws like GDPR continue to be a major legal factor, requiring strict handling of personal data. Penalties for non-compliance can be severe, reaching up to €20 million or 4% of global annual turnover. New cybersecurity regulations such as NIS2, CRA, and DORA, with phased implementation from 2025, are increasing demands for operational resilience and robust security measures.

Product safety and liability laws, particularly in the EU, are tightening, emphasizing secure-by-design principles for digital products. This means ALSO must rigorously vet its hardware and software suppliers to ensure they meet essential safety and cybersecurity standards, like those outlined in the EU's Radio Equipment Directive.

Anti-trust and competition laws significantly shape market operations and growth strategies, including mergers and acquisitions. Regulatory scrutiny ensures fair competition, impacting deal approvals and potential synergies. For example, the 2023 Westcoast acquisition required navigating these legal frameworks.

Circular economy regulations, like the EU's Ecodesign Regulation effective in 2024, promote product repairability and durability, aligning with ALSO's refurbishment services. Growing e-waste legislation and Extended Producer Responsibility (EPR) schemes globally, with e-waste projected to exceed 82 million metric tons by 2025, create opportunities for IT asset disposition and recycling.

| Legal Factor | Key Regulation/Impact | 2024/2025 Relevance for ALSO |

| Data Protection | GDPR, NIS2, CRA, DORA | Enhanced data handling, cybersecurity, and incident reporting; fines up to €20M or 4% turnover. |

| Product Safety & Liability | EU Radio Equipment Directive (RED) | Stricter vetting of hardware/software vendors for security and safety compliance. |

| Competition Law | Merger Control, Abuse of Dominance | Navigating regulatory approvals for acquisitions, ensuring fair market practices. |

| Circular Economy | EU Ecodesign, E-waste/EPR | Supports refurbishment/recycling services; increased e-waste volume (projected 82M tons by 2025) offers growth opportunities. |

Environmental factors

The escalating global issue of electronic waste (e-waste) presents a significant environmental challenge. As of 2023, the world generated an estimated 62 million tonnes of e-waste, a figure projected to reach 82 million tonnes by 2030, highlighting the urgent need for robust management and reduction strategies. ALSO Holding’s focus on circular economy principles directly addresses this by promoting responsible practices.

Implementing initiatives such as refurbishing and recycling electronic equipment is crucial for minimizing waste and extending the lifespan of valuable resources. For instance, a significant portion of discarded electronics still contains usable components. By prioritizing these circular economy approaches, ALSO can contribute to reducing the environmental burden associated with rapid technological obsolescence.

Growing concerns over climate change are significantly shaping the IT sector, pushing demand for energy-efficient solutions and greener supply chains. Companies like ALSO are responding by focusing on reducing their carbon footprint, with initiatives aimed at optimizing processes and lowering CO2e emissions. For instance, in 2023, ALSO reported a 12% reduction in its Scope 1 and 2 CO2e emissions compared to 2022, demonstrating a commitment to sustainability.

The ICT sector, like many others, faces increasing pressure from the finite nature of global resources, particularly critical materials like rare earth metals essential for advanced electronics. This scarcity underscores the growing imperative for adopting circular economy principles. For instance, the European Union has identified 30 critical raw materials, many of which are vital for ICT hardware, highlighting the need for sustainable sourcing and end-of-life management.

ALSO Holding actively contributes to this shift by championing the refurbishment and reuse of IT equipment, extending product lifecycles and reducing the demand for virgin materials. Their engagement with vendors to promote responsible resource extraction and utilization is also a key element in fostering a more sustainable ICT ecosystem.

Sustainable Supply Chain Management

Environmental factors are increasingly shaping how companies like ALSO operate, especially concerning their supply chains. There's a growing demand for businesses to demonstrate a commitment to sustainability throughout their entire value chain. This means looking beyond just their own operations and ensuring that their suppliers and partners also adhere to environmentally sound practices.

For ALSO, this translates into a need to actively engage with its vendors to promote eco-conscious values and optimize logistics. A key area is transportation, where reducing carbon emissions is paramount. For instance, in 2024, the European Union continued to strengthen its emissions standards for freight, pushing companies to adopt more efficient and lower-emission transport solutions, such as electric or hydrogen-powered vehicles, and optimizing delivery routes to minimize mileage.

- Supply Chain Scrutiny: 75% of consumers in a 2024 survey indicated they would switch brands if a competitor offered a more sustainable product, highlighting the direct impact on ALSO's customer base.

- Logistics Optimization: The global logistics sector is investing heavily in green technologies; by 2025, it's projected that over $100 billion will be invested in sustainable transportation infrastructure and fleet upgrades.

- Vendor Compliance: Companies are increasingly incorporating sustainability metrics into their vendor selection and performance reviews, with over 60% of large corporations now having formal supplier codes of conduct that include environmental clauses.

- Circular Economy Push: Initiatives promoting the circular economy, such as product take-back programs and refurbishment, are gaining traction, with businesses aiming to reduce waste and extend product lifecycles, a trend ALSO will need to integrate.

Climate Change Impact and Adaptation

The escalating impacts of climate change present significant risks, particularly concerning potential disruptions to global logistics and operational continuity. For a company like ALSO Holding, which relies on extensive supply chains, extreme weather events or shifts in resource availability could lead to increased costs and delivery delays. Adapting to these environmental shifts is therefore crucial for maintaining business resilience and efficiency.

ALSO Holding's commitment to sustainability, encapsulated in its 'WIN with LESS' strategy, directly addresses these climate-related challenges. This strategy incorporates concrete measures aimed at mitigating environmental impact and fostering adaptation. For instance, in 2023, ALSO reported a reduction in its Scope 1 and 2 CO2 emissions by 15% compared to 2022, demonstrating tangible progress in its climate action efforts.

The company's approach includes initiatives focused on:

- Energy Efficiency: Implementing energy-saving technologies in warehouses and offices, aiming for a 20% reduction in energy consumption by 2025.

- Sustainable Logistics: Optimizing transportation routes and increasing the use of lower-emission vehicles, with a target of 30% of its fleet being electric or hybrid by the end of 2024.

- Circular Economy Principles: Promoting the reuse and recycling of IT equipment to minimize waste and resource depletion.

Environmental regulations are tightening globally, impacting the IT sector significantly. For instance, the EU's Ecodesign Directive continues to push for greater energy efficiency and repairability in electronic products, influencing product design and lifecycle management. Companies like ALSO must ensure their product portfolios and operational practices align with these evolving standards to maintain market access and compliance.

The increasing focus on sustainability means that businesses face greater scrutiny regarding their environmental footprint. This includes pressure to reduce waste, manage resources responsibly, and mitigate climate change impacts. For ALSO Holding, this translates into a strategic imperative to integrate circular economy principles and reduce emissions across its operations and supply chain.

The drive towards a circular economy is reshaping how electronic goods are managed. Initiatives promoting refurbishment, repair, and recycling are becoming more prevalent, driven by both regulatory pressure and consumer demand. By 2025, it's estimated that the global market for refurbished electronics will exceed $100 billion, underscoring the economic opportunity in sustainable practices.

ALSO Holding's proactive approach to environmental factors, including its commitment to reducing CO2 emissions and promoting circularity, positions it favorably in a market increasingly defined by sustainability. Their reported 15% reduction in Scope 1 and 2 CO2 emissions in 2023 compared to 2022 demonstrates tangible progress.

| Environmental Factor | Impact on ALSO Holding | 2024/2025 Data/Trend |

|---|---|---|

| E-waste Generation | Increased need for recycling and refurbishment services. | Global e-waste projected to reach 82 million tonnes by 2030. |

| Climate Change & Emissions | Demand for energy-efficient products and greener logistics. | ALSO reported a 15% CO2e emission reduction (Scope 1 & 2) in 2023 vs 2022. |

| Resource Scarcity | Emphasis on circular economy to reduce reliance on virgin materials. | EU identifies 30 critical raw materials vital for ICT hardware. |

| Regulatory Compliance | Need to adapt to stricter environmental standards. | EU Ecodesign Directive driving energy efficiency and repairability. |

PESTLE Analysis Data Sources

Our PESTLE analysis for ALSO Holding is built upon a robust foundation of data from official government publications, leading economic institutions like the IMF and World Bank, and reputable industry research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the company.