ALSO Holding Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ALSO Holding Bundle

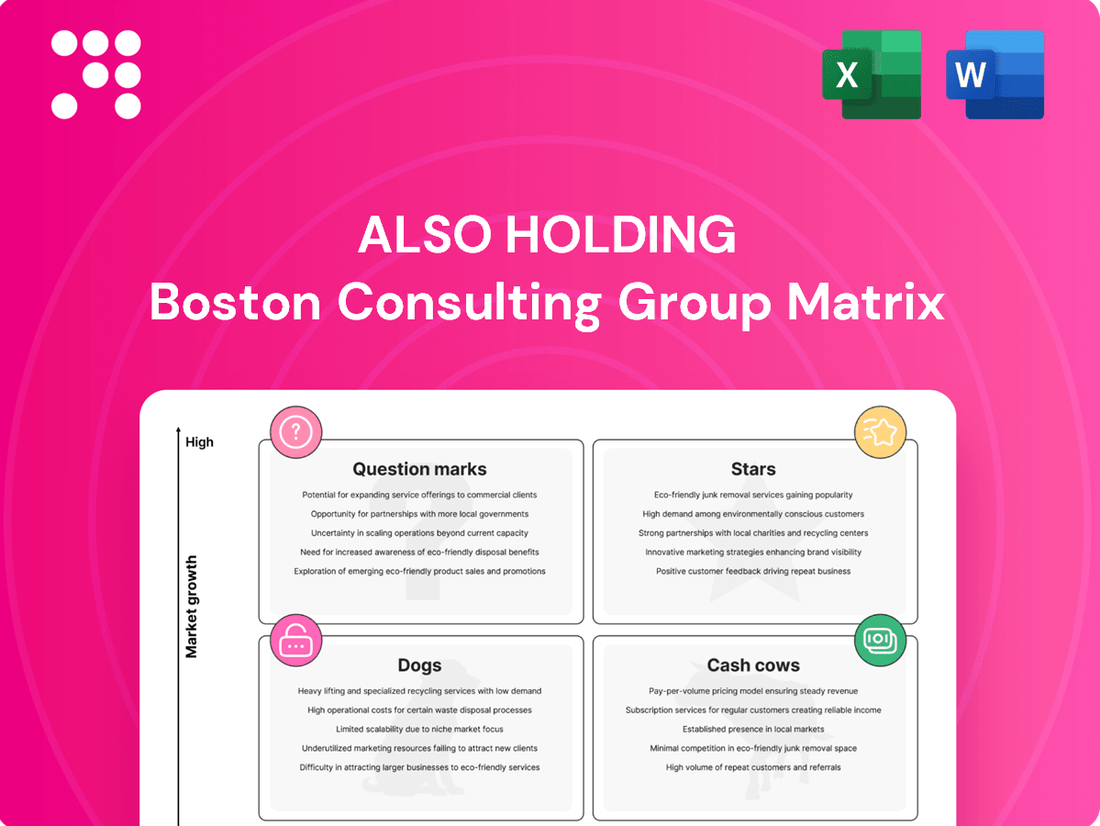

Understand how ALSO Holding's product portfolio stacks up with our BCG Matrix analysis, identifying Stars, Cash Cows, Dogs, and Question Marks. This preview offers a glimpse into their strategic positioning.

Unlock the full potential of this analysis by purchasing the complete BCG Matrix report for a detailed breakdown, actionable insights, and a clear roadmap to optimize ALSO Holding's product strategy and resource allocation.

Stars

ALSO's cloud and digital platforms are undeniably stars in the BCG matrix. Their cloud platform revenue surged by an impressive 28% to €845 million in the first half of 2025. This growth is fueled by a 34% increase in unique users, reaching 5.5 million, showcasing strong market adoption and engagement.

This stellar performance aligns perfectly with the booming cloud computing market, which is projected to exceed $1 trillion in 2025. The high growth rate and strong user base for ALSO's digital offerings firmly place them in the Star quadrant, indicating significant current success and future potential.

ALSO Holding is strategically positioning its artificial intelligence (AI) solutions as a Star within its BCG Matrix. This classification is driven by the AI market's robust growth trajectory and the increasing integration of AI into burgeoning sectors like the Internet of Things (IoT) and edge computing. The company's deliberate focus on innovating in AI, alongside virtualization and cybersecurity, underscores its commitment to capturing this high-potential segment.

The disproportionately strong performance of ALSO's digital platforms, particularly those incorporating AI, further solidifies AI solutions' Star status. For instance, in 2024, ALSO reported significant revenue growth in its cloud and digital services, with AI-powered solutions being a key contributor to this upward trend. This demonstrates a clear market demand and ALSO's successful execution in delivering value through AI.

The cybersecurity market is a rapidly expanding sector, with projections indicating it could reach approximately €70 billion in Europe by 2030 and a global market size of USD 549.96 billion by 2033. This robust growth trajectory positions cybersecurity as a star in the BCG Matrix.

ALSO is strategically capitalizing on this trend by enhancing its cybersecurity platform. Recent initiatives, including partnerships with companies like CYE, aim to broaden access to sophisticated cybersecurity tools for Managed Service Providers (MSPs) and Small and Medium-sized Businesses (SMBs). This expansion into a high-growth, high-potential market segment is a key driver for its star status.

IoT Solutions and Platform

The Internet of Things (IoT) market presents a significant growth opportunity, with projections indicating a substantial expansion. Global market size was estimated at USD 76.97 billion in 2025 and is anticipated to surge to approximately USD 356.23 billion by 2034.

ALSO actively cultivates partnerships to broaden its IoT solutions portfolio. This strategic focus within its Solutions and Service business models positions the company to capture a substantial share in this high-growth sector.

- Market Growth: The IoT market is expected to grow from USD 76.97 billion in 2025 to USD 356.23 billion by 2034.

- Strategic Focus: ALSO views IoT as a key strategic area within its business.

- Partnership Expansion: The company is actively forming partnerships to enhance its IoT offerings.

Strategic Acquisitions and Geographical Expansion

ALSO Holding actively pursues strategic acquisitions and geographical expansion to bolster its market presence. This approach involves consistent investment in its ecosystem, enabling the company to capitalize on emerging market opportunities and solidify its standing in both established and new territories.

A prime example of this strategy in action is the successful acquisition of businesses in the Czech Republic and Slovakia during 2024. These moves are designed to significantly increase ALSO's market share within these growing European regions. Furthermore, the company's commitment to strategic partnerships, such as the one with Westcoast completed in Q1 2025, underscores its proactive stance in expanding its operational footprint and service offerings.

- Strategic Acquisitions: ALSO's 2024 acquisitions in the Czech Republic and Slovakia are key to its expansion.

- Geographical Expansion: The company aims to strengthen its position in existing and new markets through these strategic moves.

- Partnership Integration: The Westcoast partnership, finalized in Q1 2025, highlights ALSO's focus on ecosystem enhancement.

- Market Share Growth: These initiatives are directly linked to increasing ALSO's overall market share in targeted regions.

ALSO's cloud and digital platforms are performing exceptionally well, making them clear stars in the BCG Matrix. Their cloud platform revenue saw a substantial 28% increase, reaching €845 million in the first half of 2025, driven by a 34% rise in unique users to 5.5 million. This strong market adoption and engagement place these offerings in a high-growth, high-market-share position.

The company's AI solutions are also positioned as stars, benefiting from the booming AI market and its integration into areas like IoT. In 2024, AI-powered solutions were a significant contributor to the strong revenue growth in ALSO's cloud and digital services, indicating high demand and successful delivery.

Cybersecurity is another star, with the European market projected to reach €70 billion by 2030. ALSO's efforts to expand its cybersecurity platform, including partnerships with firms like CYE, are designed to capture this high-growth segment, particularly by serving MSPs and SMBs.

The Internet of Things (IoT) market, expected to grow from USD 76.97 billion in 2025 to USD 356.23 billion by 2034, is also a star. ALSO's strategic focus on IoT within its Solutions and Service business models, bolstered by partnerships, aims to secure a significant market share in this rapidly expanding area.

| Business Unit | BCG Quadrant | Key Performance Indicators (2024-H1 2025) | Market Outlook |

|---|---|---|---|

| Cloud & Digital Platforms | Stars | Revenue: +28% (H1 2025) to €845M; Unique Users: +34% to 5.5M | Global Cloud Market > $1 Trillion (2025) |

| AI Solutions | Stars | Key contributor to strong cloud/digital revenue growth (2024) | High growth, integration with IoT & Edge Computing |

| Cybersecurity | Stars | Partnerships with CYE for MSP/SMB access | Europe Market: €70B by 2030; Global Market: $549.96B by 2033 |

| IoT Solutions | Stars | Focus within Solutions & Service models; Partnership expansion | Market Size: $76.97B (2025) to $356.23B (2034) |

What is included in the product

Detailed analysis of ALSO Holding's product portfolio using the BCG Matrix, identifying Stars, Cash Cows, Question Marks, and Dogs.

The ALSO Holding BCG Matrix offers a clear, visual overview of business unit performance, simplifying complex portfolio analysis for strategic decision-making.

Cash Cows

ALSO's traditional hardware and software distribution, or 'Supply' business, remains a robust revenue engine. Despite operating in a mature market, this segment consistently generates significant cash flow, with revenues holding steady around €11 billion in 2024. This stability points to a strong market position and reliable cash generation.

Logistics and financial services within the ICT sector are a cornerstone for ALSO Holding, acting as a true cash cow. These offerings are not just supplementary; they are fundamental to the smooth operation of the entire B2B marketplace, facilitating transactions between vendors and a vast network of resellers.

As a B2B marketplace, ALSO's logistics and financial services are indispensable, ensuring the efficient flow of goods and capital within the ICT supply chain. This critical role translates into a stable, high-market-share segment for ALSO, consistently generating robust cash flow thanks to their essential nature and deep-rooted reseller relationships.

In 2023, ALSO reported a significant increase in its services segment, with revenue growing by 12.8% to EUR 2.1 billion, underscoring the strength of these cash-generating operations. This segment benefits from the essential nature of its services, maintaining a strong market position and providing a reliable income stream.

Within ALSO Holding's portfolio, their Established IT Services represent a classic Cash Cow. These are services that have achieved significant market penetration and are now generating consistent, reliable revenue streams.

These mature services, integrated into ALSO's Solutions and Service segments, likely require minimal ongoing investment for growth. Their established market position allows them to capture a substantial share, translating into strong profitability and cash flow for the company.

For instance, in 2023, ALSO Holding reported a gross profit of €1,384.7 million, with their Services segment contributing significantly to this. This demonstrates the financial muscle of their established service offerings.

European Market Dominance

European Market Dominance is a key element of ALSO Holding's position, highlighting its status as the largest technology provider for the ICT industry across Europe. The company operates in 31 European countries, solidifying its extensive reach and market penetration.

This significant presence in a mature market translates into a substantial market share for ALSO's traditional distribution and service offerings. These established regional operations consistently generate strong cash flow, acting as the company's cash cows.

- Market Share: ALSO commands a leading position in the European ICT distribution market.

- Geographic Reach: Operations span 31 European countries, demonstrating broad market coverage.

- Revenue Contribution: Traditional distribution and services in Europe are significant cash generators.

- 2024 Performance Indicator: While specific 2024 cash cow figures are proprietary, the ongoing strength in European distribution is a consistent driver of profitability for ALSO Holding.

Managed Services and Infrastructure as a Service (IaaS)

Managed Services and Infrastructure as a Service (IaaS) are strong contenders for Cash Cows within ALSO Holding's portfolio. These 'as-a-service' models are built on recurring revenue streams, offering a predictable and stable financial foundation. The IT services market, while evolving, sees established managed services and IaaS providers benefiting from loyal customer relationships, generating consistent cash flow from a mature but reliable segment.

In 2024, the global managed services market was projected to reach over $300 billion, with IaaS forming a substantial part of that growth. Companies continue to rely on these services for operational efficiency and cost management, making them a dependable revenue source. This stability is crucial for funding investments in other, higher-growth areas of the business.

- Stable Recurring Revenue: Managed services and IaaS provide a predictable income stream through ongoing contracts.

- Mature Market Segment: These offerings operate in a well-established part of the IT services landscape, ensuring consistent demand.

- Client Retention: Existing client bases in these segments typically exhibit high retention rates, solidifying cash flow.

- Foundation for Investment: The consistent profits generated can be reinvested into areas with higher growth potential.

ALSO's established IT services and logistics operations are prime examples of cash cows. These mature offerings benefit from strong market positions and consistent demand, generating reliable cash flow with minimal need for further investment. This stability is crucial for funding growth initiatives in other parts of the business.

The company's European distribution network, a significant revenue driver, consistently delivers robust cash flow due to its extensive reach and market penetration. Similarly, managed services and Infrastructure as a Service (IaaS) leverage recurring revenue models, ensuring a predictable and stable income stream.

In 2023, ALSO's services segment saw a notable 12.8% revenue increase to EUR 2.1 billion, highlighting the financial strength of these established operations. This consistent performance underscores their role as dependable cash generators within the ALSO Holding portfolio.

| Business Segment | Market Position | Cash Flow Generation | 2024 Revenue Trend (Estimated) |

|---|---|---|---|

| Traditional Hardware & Software Distribution | Strong European Market Leader | High & Stable | Steady, around €11 billion |

| Logistics & Financial Services (ICT) | Indispensable B2B Marketplace Facilitator | Robust & Consistent | Continued strong contribution |

| Established IT Services | Mature, High Market Penetration | Reliable & Predictable | Significant contributor to gross profit |

| Managed Services & IaaS | Growing, Recurring Revenue Models | Predictable & Stable | Benefiting from global market expansion |

What You’re Viewing Is Included

ALSO Holding BCG Matrix

The BCG Matrix preview you are currently viewing is the identical, fully unlocked document you will receive upon purchase. This means you can confidently assess the depth of analysis and strategic insights, knowing that the final version will be exactly as presented, ready for immediate application in your business planning.

Dogs

Certain legacy IT hardware, such as older desktop computers or specific types of networking equipment not supporting current speeds, fall into this category. These products are increasingly being bypassed for more advanced solutions driven by cloud computing and AI integration. For instance, sales of traditional desktop PCs saw a slight decline in early 2024 compared to the pandemic-driven surge, indicating a shift in demand.

Products with declining demand and low market share offer minimal returns for distributors like ALSO. These might include older server components or specialized peripherals that have been superseded by more versatile or integrated technologies. The focus has shifted heavily towards solutions enabling digital transformation, leaving these legacy items with stagnant or shrinking market relevance.

Software licenses that are outdated and offer minimal updates often find themselves in the Dogs quadrant of the BCG Matrix. These products typically have low market demand and are frequently superseded by newer, more adaptable cloud-based solutions. For instance, a legacy on-premise software solution from 2018, with its last significant update in 2020, might struggle to compete with subscription-based software offering continuous feature enhancements and cloud integration.

These offerings generally require very little ongoing investment from a company like ALSO, but consequently, they also contribute minimally to revenue and market share. Imagine a specialized design software package, once popular but now facing intense competition from AI-powered design platforms that are significantly more efficient and accessible. Such a product would likely generate low sales figures, perhaps only a few thousand euros annually, and hold a negligible percentage of the overall market.

Underperforming regional operations or niche markets within ALSO Holding could be classified as Dogs in the BCG Matrix. These segments might represent areas where the company has a low market share and faces limited growth opportunities. For instance, if a specific country's IT distribution market is saturated with strong local competitors, ALSO's presence there might be minimal, and future expansion could be challenging.

These Dog segments, while potentially consuming valuable resources and management attention, often contribute little to the company's overall revenue or profit. In 2024, it’s crucial for companies like ALSO to identify such underperforming units. For example, if a particular niche market, like specialized industrial software distribution in a less developed region, shows declining sales and minimal market penetration for ALSO, it would fit the Dog profile.

Non-Strategic or Underutilized Value-Added Services

In the context of the BCG Matrix, non-strategic or underutilized value-added services within a company like ALSO Holding can be categorized. These are services that may have been relevant in previous market conditions but no longer fit the current ICT landscape, or those that simply haven't attracted enough customers to be profitable. They represent resources that are tied up without generating significant returns.

These underperforming services often require ongoing investment in maintenance, marketing, or personnel, yet yield low returns. Identifying and addressing these "dogs" is crucial for optimizing resource allocation and focusing on more promising growth areas. For instance, a service designed for a now-obsolete technology or a niche offering that failed to scale would fall into this category.

- Tied-up Capital: Services with low market share and low growth represent inefficient use of capital.

- Resource Drain: These offerings consume management attention and operational resources that could be better deployed elsewhere.

- Opportunity Cost: By maintaining underperforming services, the company misses opportunities to invest in or develop more lucrative offerings.

- Strategic Review Needed: Companies should regularly evaluate their service portfolio to divest or re-evaluate services that are no longer strategically viable or profitable.

Commoditized IT Products with Intense Price Competition

Commoditized IT products, characterized by intense price competition and minimal differentiation, often fall into the Dogs category within the BCG Matrix. These items, while potentially still part of a company's offerings, typically yield very thin profit margins. For instance, basic networking cables or standard USB drives are prime examples where price is the primary differentiator, leading to a constant downward pressure on profitability.

These products can act as cash traps, tying up valuable inventory and operational resources with little return. In 2024, the global market for basic IT peripherals, a segment heavily populated by commoditized products, continued to see aggressive pricing strategies from numerous vendors, making it difficult to achieve significant profit growth. Companies must carefully manage their investment in these areas to avoid draining resources that could be better allocated to higher-potential products.

- Low Profitability: Intense price wars in commoditized IT segments mean profit margins can be as low as 1-3% for many hardware components.

- High Inventory Costs: Holding stock of low-margin, undifferentiated IT products incurs significant warehousing and obsolescence costs.

- Limited Growth Potential: The market for many commoditized IT products is mature, with growth rates often mirroring overall economic expansion, typically in the low single digits.

- Resource Drain: Operational focus and capital expenditure on these products divert resources from innovation and higher-margin business units.

Products classified as Dogs in the BCG Matrix, such as legacy IT hardware or outdated software, are characterized by low market share and low growth prospects. These offerings often require minimal investment but also generate negligible returns, consuming resources that could be better utilized elsewhere. For instance, in early 2024, the market for older model printers saw a significant drop in demand as businesses increasingly adopted multifunction devices and digital workflows, making them a prime example of a Dog product.

Companies like ALSO Holding must strategically manage these Dog products, which can include underperforming regional operations or niche services that no longer align with market trends. The focus for these items is typically on minimizing losses and eventually divesting or phasing them out. For example, a specialized IT support service for a particular legacy operating system, with only a handful of remaining clients by mid-2024, would fit this profile.

Commoditized IT items, like basic cables or unbranded memory sticks, also fall into the Dog category due to intense price competition and low differentiation. These products, while still present in the market, offer very slim profit margins, often in the 1-3% range, and can tie up capital in inventory without significant upside. The challenge lies in efficiently managing their lifecycle to avoid becoming a drain on overall profitability.

| Product/Service Category | Market Share | Market Growth | Profitability | Strategic Implication |

|---|---|---|---|---|

| Legacy Desktop PCs | Low | Declining | Low | Divest or phase out |

| Outdated Software Licenses | Low | Stagnant | Very Low | Transition to cloud alternatives |

| Underperforming Regional Operations | Low | Limited | Minimal | Restructure or exit |

| Commoditized Peripherals (e.g., basic cables) | Low | Low Single Digits | 1-3% | Minimize inventory, focus on volume |

Question Marks

Emerging AI/ML niche applications for ALSO, such as AI-powered cybersecurity threat intelligence or specialized AI for industrial automation diagnostics, represent potential stars in the BCG matrix. These areas are characterized by high growth potential within the rapidly expanding AI market. For instance, the global AI in cybersecurity market was projected to reach $38.9 billion in 2024, indicating substantial opportunity.

However, these nascent offerings currently hold a low market share for ALSO. Significant upfront investment in research, development, and talent acquisition is necessary to establish a strong foothold and gain traction in these specialized niches. This investment is crucial for developing proprietary algorithms and building a competitive edge against established players.

New geographic market entries with low initial penetration, such as ALSO's recent foray into the US cloud market, are classic examples of question marks in the BCG matrix. These markets are characterized by high growth potential but also by a low current market share for the company. For instance, in 2024, the global cloud computing market was projected to reach over $600 billion, indicating significant opportunity, yet ALSO's initial penetration in the US was minimal.

Entering these markets requires substantial investment to build brand awareness, establish distribution channels, and gain customer adoption. The US cloud market, in particular, is highly competitive, with established players dominating. ALSO's strategy here involves significant capital expenditure to carve out a niche and drive future growth, aiming to transform these question marks into stars over time.

Within the broader Internet of Things (IoT) landscape, advanced verticals like Industrial IoT (IIoT) and Smart City Infrastructure represent significant growth opportunities for ALSO Holding. These segments, while part of a strong overall IoT market, can be considered Question Marks. The global IIoT market was valued at approximately $231.4 billion in 2023 and is projected to reach $1,021.2 billion by 2030, demonstrating a compound annual growth rate of 23.7%.

Similarly, the smart city market is expanding rapidly, with an estimated global market size of $1.5 trillion in 2024, expected to grow to $3.2 trillion by 2030, at a CAGR of 13.1%. These advanced areas require substantial upfront investment in specialized hardware, software, and integration services, as well as significant market education to drive adoption.

For ALSO to capture a dominant position in these complex sectors, strategic investment and a focused approach to building expertise and customer relationships are crucial. The high growth potential is undeniable, but the initial investment and market development needed place them in the Question Mark quadrant of the BCG matrix.

Blockchain and Quantum Computing Solutions

Blockchain and quantum computing represent significant growth opportunities for ALSO Holding, aligning with their strategy to leverage megatrends. These are nascent technologies with substantial future potential but require considerable upfront investment, positioning them as question marks in the BCG matrix.

While specific blockchain platforms and early quantum computing explorations are ongoing, the market share for these solutions is currently minimal. For instance, the global blockchain market, projected to reach hundreds of billions by 2030, is still in its early stages of adoption across various industries.

- High Investment, Low Market Share: Both blockchain and quantum computing demand significant R&D and infrastructure spending, with limited current market penetration.

- Future Growth Potential: These technologies are poised for exponential growth as adoption accelerates and capabilities mature, offering substantial long-term rewards.

- Strategic Alignment: ALSO's focus on these areas directly addresses the increasing demand for secure, decentralized solutions and advanced computational power driven by digital transformation.

Bespoke Digital Transformation Consulting Services

Bespoke digital transformation consulting services for ALSO Holding, within a BCG Matrix framework, likely represent a Question Mark. These highly customized solutions cater to specific, complex client needs, demanding substantial upfront investment in specialized expertise and resources. Their market potential is high, driven by the ongoing global digital shift, but ALSO's current market share in this niche might be relatively low due to the bespoke nature and intense competition from specialized firms.

The high growth potential stems from businesses across all sectors needing tailored digital strategies to remain competitive. For example, in 2024, the global digital transformation market was projected to reach trillions of dollars, with consulting services forming a significant portion. However, the bespoke nature means each engagement is unique, limiting scalability and potentially impacting ALSO's ability to capture a large market share quickly compared to more standardized offerings.

- High Investment: Requires deep expertise and significant upfront resource allocation.

- High Growth Potential: Aligns with the strong market demand for digital transformation.

- Low Market Share: Bespoke nature and competition can limit current market penetration for ALSO.

- Strategic Focus: May require careful selection of projects to ensure profitability and build expertise.

New geographic market entries with low initial penetration, such as ALSO's recent foray into the US cloud market, are classic examples of question marks in the BCG matrix. These markets are characterized by high growth potential but also by a low current market share for the company. For instance, in 2024, the global cloud computing market was projected to reach over $600 billion, indicating significant opportunity, yet ALSO's initial penetration in the US was minimal.

Entering these markets requires substantial investment to build brand awareness, establish distribution channels, and gain customer adoption. The US cloud market, in particular, is highly competitive, with established players dominating. ALSO's strategy here involves significant capital expenditure to carve out a niche and drive future growth, aiming to transform these question marks into stars over time.

Emerging AI/ML niche applications for ALSO, such as AI-powered cybersecurity threat intelligence or specialized AI for industrial automation diagnostics, represent potential stars in the BCG matrix. These areas are characterized by high growth potential within the rapidly expanding AI market. For instance, the global AI in cybersecurity market was projected to reach $38.9 billion in 2024, indicating substantial opportunity.

However, these nascent offerings currently hold a low market share for ALSO. Significant upfront investment in research, development, and talent acquisition is necessary to establish a strong foothold and gain traction in these specialized niches. This investment is crucial for developing proprietary algorithms and building a competitive edge against established players.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data, including financial disclosures, market research reports, and industry growth projections, to accurately position each business unit.