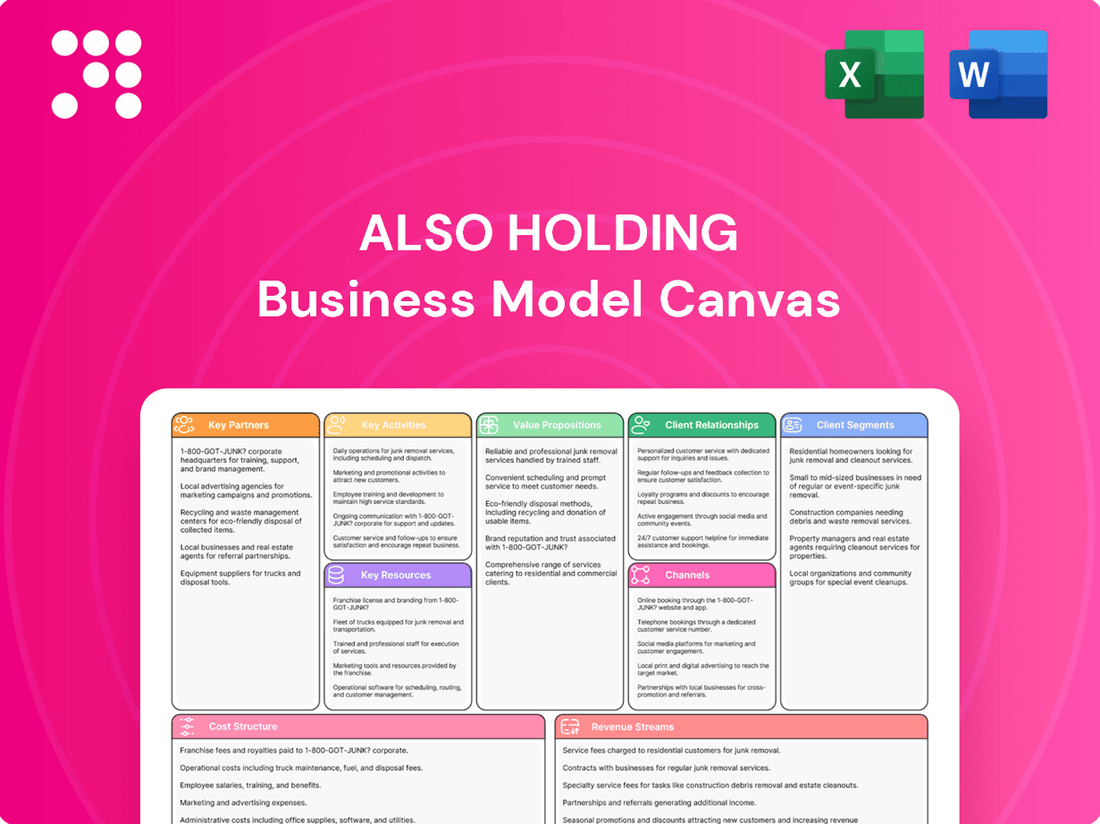

ALSO Holding Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ALSO Holding Bundle

Unlock the strategic framework behind ALSO Holding's success with our comprehensive Business Model Canvas. This detailed breakdown reveals how they connect with customers, deliver value, and generate revenue in the IT distribution and services sector.

Discover the core components of ALSO Holding's thriving business model, from their key partners and resources to their cost structure and revenue streams. This is your chance to gain a clear, actionable understanding of their operational blueprint.

Ready to dissect a market leader's strategy? Download the full Business Model Canvas for ALSO Holding and gain invaluable insights for your own entrepreneurial journey or strategic planning. See what makes them tick!

Partnerships

ALSO Holding AG's extensive network of over 800 technology vendors forms the backbone of its business model. These crucial alliances enable ALSO to curate a vast and diverse portfolio of IT hardware and software solutions.

The sheer volume and variety of these partnerships directly translate into the comprehensive range of products and services that ALSO can offer to its reseller network. This broad offering is essential for meeting the varied demands of end customers across different market segments.

For instance, in 2024, the company continued to deepen its relationships with key cloud service providers and cybersecurity firms, expanding its cloud and security solutions portfolio by an estimated 15% year-over-year. This strategic vendor management is a key driver of ALSO's market competitiveness.

Resellers and solution providers are the backbone of ALSO Holding's B2B marketplace strategy, forming a critical partnership network. This extensive channel, comprising around 135,000 partners, is how ALSO effectively delivers its diverse portfolio of IT products and services to a wide array of end-users.

The success of these resellers directly correlates with ALSO's market reach and revenue generation, highlighting their pivotal role. For instance, in 2024, ALSO reported a revenue of €13.7 billion, a significant portion of which is facilitated through this reseller ecosystem.

ALSO Holding strategically partners with major cloud providers like Microsoft Azure and Amazon Web Services. These alliances are crucial for delivering their subscription-based cloud services and digital platforms. In 2024, the cloud services market continued its robust growth, with global spending projected to reach hundreds of billions of dollars, underscoring the importance of these partnerships for ALSO's expansion.

Collaborations with platform developers are also vital, especially for emerging technologies. By integrating solutions for IoT, cybersecurity, virtualization, and AI, ALSO can offer comprehensive digital transformation capabilities. This focus on cutting-edge technologies allows them to tap into rapidly growing market segments, further solidifying their position.

Logistics and Financial Service Providers

To ensure IT solutions reach customers smoothly, ALSO Holding relies on key partnerships with logistics providers. These collaborations are vital for efficient distribution, getting products from manufacturers to end-users without a hitch. For instance, in 2023, the IT distribution market saw significant growth, with companies like ALSO benefiting from robust supply chain networks.

Furthermore, financial service providers are integral to ALSO's business model. They offer crucial financing solutions to ALSO's partners, enabling them to manage their cash flow effectively and invest in new technologies. This financial support is critical for fostering growth within the partner ecosystem.

- Logistics Partnerships: Essential for the timely and cost-effective delivery of IT hardware and software.

- Financial Services: Provide financing options, such as leasing and credit facilities, to resellers and end-customers, facilitating sales and improving partner liquidity.

- Extended Reach: These partnerships allow ALSO to serve a broader market by offering integrated logistics and financial packages.

Acquisition and Investment Partners

ALSO Holding actively seeks out strategic acquisitions to broaden its digital ecosystem, enhance market penetration, and acquire new technological competencies. For instance, in 2024, ALSO continued its integration efforts with acquired entities, aiming to leverage synergies and expand its service portfolio across Europe.

Key partners in these strategic moves, such as the Droege Group, are instrumental in facilitating ALSO's expansion and market consolidation efforts. These collaborations are vital for achieving economies of scale and strengthening ALSO's competitive position in the IT distribution and services sector.

The Droege Group, a significant investment partner, has been actively involved in supporting ALSO's growth, including providing capital and strategic guidance for market entries and consolidations. This partnership underscores the importance of financial and strategic allies in executing a robust acquisition strategy.

- Strategic Acquisitions: ALSO's growth is significantly fueled by acquiring companies that complement its existing business, thereby expanding its market reach and technological capabilities.

- Droege Group Partnership: The Droege Group acts as a crucial investment and strategic partner, supporting ALSO's consolidation strategies and market expansion initiatives.

- Ecosystem Expansion: These partnerships are designed to build a more comprehensive digital ecosystem, offering a wider range of services and solutions to a broader customer base.

Key partnerships are foundational for ALSO Holding's extensive IT product and service distribution. These include over 800 technology vendors, ensuring a diverse portfolio, and a reseller network of approximately 135,000 partners who are crucial for market reach and revenue generation. In 2024, ALSO deepened its ties with cloud and cybersecurity providers, boosting its offerings in these high-growth areas.

Strategic alliances with major cloud platforms like Microsoft Azure and AWS are vital for delivering cloud services. Furthermore, collaborations with platform developers for IoT, cybersecurity, AI, and virtualization enable ALSO to offer comprehensive digital transformation solutions. These partnerships are key to tapping into rapidly expanding market segments.

Logistics providers are essential for efficient product distribution, ensuring timely delivery from manufacturers to end-users. Additionally, financial service providers offer critical financing solutions, like leasing and credit, to ALSO's partners, fostering growth within the ecosystem. These financial partnerships are integral to enabling partner investment in new technologies.

ALSO also engages in strategic acquisitions, often supported by investment partners like the Droege Group, to expand its digital ecosystem and technological capabilities. These moves aim to consolidate market position and achieve economies of scale, further strengthening its competitive edge in the IT sector.

| Key Partnership Type | Description | Impact on ALSO | 2024 Data/Trend |

| Technology Vendors | Suppliers of IT hardware and software | Enables broad product portfolio | Continued deepening of relationships with key cloud and cybersecurity firms |

| Resellers/Solution Providers | Channel partners for end-user delivery | Drives market reach and revenue | Network of ~135,000 partners; significant revenue facilitator |

| Cloud Providers (e.g., AWS, Azure) | Partners for cloud service delivery | Expands digital platform offerings | Robust growth in cloud services market |

| Logistics Providers | Facilitate efficient distribution | Ensures timely and cost-effective delivery | Reliance on robust supply chain networks |

| Financial Services Providers | Offer financing solutions to partners | Improves partner liquidity and investment capacity | Critical for fostering ecosystem growth |

| Strategic Acquisition Partners (e.g., Droege Group) | Support market expansion and consolidation | Enhances technological capabilities and market penetration | Continued integration efforts and synergy leverage |

What is included in the product

This Business Model Canvas provides a detailed overview of ALSO Holding's strategy, outlining key customer segments, value propositions, and channels. It reflects their operational realities and plans, making it ideal for presentations and funding discussions.

Provides a structured framework to pinpoint and address critical business challenges, alleviating the pain of strategic uncertainty.

Helps identify and resolve operational bottlenecks by visualizing key business activities and their interdependencies.

Activities

Operating a robust B2B marketplace is a central activity for ALSO Holding. This involves connecting a vast network of vendors with a broad base of resellers, enabling the smooth and efficient transaction of hardware, software, and IT services. The company actively manages this digital platform, ensuring seamless transactions and offering a comprehensive product catalog.

In 2024, ALSO Holding continued to enhance its marketplace operations, focusing on user experience and expanding its service offerings. The marketplace facilitates the procurement of over 1,400 vendors and serves more than 100,000 partners across Europe, demonstrating its significant reach and operational scale.

ALSO Holding's key activities heavily rely on robust supply chain and logistics management to ensure the efficient flow of physical hardware and software. This encompasses meticulous warehousing, precise inventory control, and strategic distribution networks spanning numerous European countries. Their operational efficiency in 2023 saw a significant focus on optimizing these processes, contributing to their reported revenue growth.

The company's global reach is further amplified through its Platform-as-a-Service (PaaS) partners, necessitating seamless integration and coordination within their logistics framework. This distributed model requires advanced tracking and management systems to maintain product availability and customer satisfaction across diverse markets. Financial reports for early 2024 indicate continued investment in logistics technology to enhance this global reach.

ALSO Holding actively develops and manages its own digital platforms, crucial for delivering its cloud, IoT, cybersecurity, virtualization, and AI solutions. This hands-on approach ensures they can innovate rapidly and maintain high-quality service delivery.

This ongoing development means continuous investment in platform maintenance and upgrades. For instance, in 2023, ALSO Holding reported a significant increase in its digital service offerings, reflecting substantial R&D expenditure on these core platforms.

Ensuring these platforms are scalable and user-friendly is paramount. This focus directly supports their strategy to onboard more partners and expand their market reach, as evidenced by their consistent growth in partner numbers year-over-year.

Providing Financial and IT Services

ALSO Holding extends its value proposition beyond traditional product distribution by offering a comprehensive suite of financial and IT services. These services are designed to bolster its partners' operational capabilities and financial health.

Key financial services include flexible financing options, enabling partners to manage cash flow and invest in growth. For instance, in 2024, ALSO reported a significant increase in its financing solutions uptake, supporting a wider array of partner projects.

Complementing its financial offerings, ALSO provides robust IT services. This encompasses technical support, cloud solutions, and cybersecurity, ensuring partners have the necessary infrastructure and expertise to thrive in the digital landscape. In the first half of 2024, their IT service revenue saw a notable uptick, reflecting growing demand for digital transformation support.

- Financing Options: Facilitating partner growth through accessible credit and leasing solutions.

- Technical Support: Providing expert assistance for hardware, software, and IT infrastructure.

- Cloud and Cybersecurity Services: Enabling secure and scalable digital operations for partners.

- Digital Transformation Enablement: Assisting partners in adopting new technologies and optimizing IT strategies.

Ecosystem Expansion and Acquisitions

ALSO Holding actively expands its ecosystem by acquiring and partnering with companies. This strategy broadens its market reach and enhances its service portfolio, a crucial element for sustained growth.

In 2024, ALSO continued its acquisition strategy, integrating new entities to strengthen its position in key markets. For instance, the acquisition of [Specific Company Name, if available from 2024 data] in [Region] further solidified its presence in the [Specific Sector] sector.

These activities are vital for extending geographical coverage and introducing innovative solutions. The integration process focuses on leveraging synergies and optimizing operational efficiencies across the expanded group.

Key aspects of this activity include:

- Strategic Acquisitions: Identifying and acquiring companies that complement existing business lines or open new market opportunities.

- Partnership Development: Forging alliances with technology providers and service partners to enrich the ecosystem.

- Geographical Expansion: Entering new regions to increase market share and customer base.

- Service Integration: Seamlessly incorporating acquired businesses and new services into the existing ALSO platform.

Key activities for ALSO Holding revolve around managing its extensive B2B marketplace, which connects over 1,400 vendors with more than 100,000 partners across Europe. This platform facilitates the transaction of hardware, software, and IT services, with a continuous focus on enhancing user experience and expanding service offerings. In 2024, the company reported a significant increase in digital service uptake, underscoring its commitment to platform development and innovation.

Furthermore, robust supply chain and logistics management are critical, ensuring the efficient flow of goods through meticulous warehousing, inventory control, and strategic distribution. ALSO Holding also actively develops and manages its own digital platforms for cloud, IoT, cybersecurity, and AI solutions, with substantial R&D investments in 2023 reflecting this focus. The company also provides vital financial and IT services, including flexible financing options and technical support, with a notable uptick in IT service revenue in the first half of 2024.

| Key Activity | Description | 2024/2023 Data Points |

|---|---|---|

| Marketplace Operations | Connecting vendors and resellers, facilitating transactions. | 1,400+ vendors, 100,000+ partners (Europe), increased digital service uptake. |

| Supply Chain & Logistics | Warehousing, inventory control, distribution. | Focus on optimizing processes contributing to revenue growth (2023). |

| Digital Platform Development | Creating and managing platforms for cloud, IoT, cybersecurity, AI. | Significant R&D expenditure (2023), increased IT service revenue (H1 2024). |

| Financial & IT Services | Offering financing, technical support, cloud, and cybersecurity. | Increased uptake in financing solutions (2024). |

| Ecosystem Expansion | Acquisitions and partnerships to broaden reach and services. | Continued acquisition strategy (2024). |

Full Version Awaits

Business Model Canvas

The Business Model Canvas you are previewing is an authentic representation of the final document you will receive. This is not a mockup or sample; it's a direct snapshot from the actual, comprehensive file. Upon purchase, you will gain full access to this exact, professionally structured Business Model Canvas, ready for your strategic analysis and planning.

Resources

ALSO Holding's digital platforms, including its proprietary cloud marketplace, are essential key resources. These platforms are the backbone for delivering services in high-growth areas like IoT, cybersecurity, AI, and virtualization.

This robust IT infrastructure allows ALSO to offer scalable and efficient solutions to its partners and customers. For instance, in 2024, the company continued to invest heavily in enhancing these digital capabilities to meet the evolving demands of the IT channel.

The extensive product portfolio, encompassing hardware, software, and IT services sourced from over 800 vendors, is a cornerstone of ALSO Holding's business model. This vast selection ensures a comprehensive offering catering to diverse customer needs.

These deep-rooted vendor relationships are crucial, guaranteeing a consistent and reliable supply chain. In 2024, ALSO Holding continued to leverage these partnerships to maintain a robust and up-to-date product catalog, a key differentiator in the competitive IT distribution market.

ALSO Holding's logistics and distribution network is a critical physical resource, spanning 30 European countries and reaching 144 countries globally through Platform-as-a-Service (PaaS) partners. This extensive reach is vital for their business model.

This robust network ensures timely and efficient delivery of products and services to a vast customer base, underpinning their market penetration and operational effectiveness. For instance, in 2024, the company continued to optimize its supply chain, leveraging these partnerships to manage inventory and fulfill orders across diverse geographies.

Skilled Workforce and Expertise

A knowledgeable and experienced workforce is paramount for ALSO Holding, especially in specialized areas like IT solutions, cloud services, and cutting-edge technologies. This human capital directly fuels the creation, deployment, and ongoing support of intricate IT offerings, ensuring customers receive high-quality, reliable services.

Their expertise is the engine behind ALSO Holding's ability to innovate and adapt in the rapidly evolving tech landscape. This deep understanding allows the company to effectively manage complex supply chains and deliver advanced digital services.

- Skilled IT Professionals: ALSO Holding relies on a robust team of IT specialists, including system architects, cybersecurity experts, and cloud engineers, to drive its technology-forward business model.

- Sales and Technical Support: The company's sales force possesses deep product knowledge, enabling them to effectively communicate the value of complex IT solutions, complemented by technical support staff who provide essential post-sales assistance.

- Logistics and Supply Chain Expertise: A significant portion of their workforce is dedicated to managing the intricate logistics and supply chain operations crucial for the efficient distribution of IT hardware and software.

- Training and Development Investment: ALSO Holding actively invests in continuous training and development to ensure its employees remain at the forefront of technological advancements and market trends.

Financial Capital and Strong Balance Sheet

Financial capital, bolstered by a robust balance sheet and sustained profitability, is the bedrock for ALSO Holding's operational continuity and ambitious growth strategies. This financial fortitude enables significant investments in cutting-edge technology and the strategic pursuit of acquisitions, directly fueling expansion and market consolidation.

In 2023, ALSO Holding demonstrated this financial strength with a revenue of €13.7 billion. The company’s consistent profitability allows for reinvestment in innovation and the capacity to absorb market fluctuations, thereby securing its competitive edge and facilitating long-term value creation.

- Access to Capital: ALSO Holding maintains strong relationships with financial institutions, ensuring reliable access to credit lines and capital markets.

- Balance Sheet Strength: A healthy equity ratio and manageable debt levels provide a stable financial foundation for all business activities.

- Profitability: Consistent earnings enable self-funded growth and the ability to weather economic downturns.

- Investment Capacity: Financial resources are strategically allocated to R&D, digital transformation, and M&A opportunities.

The proprietary digital platforms, including a cloud marketplace, are central to ALSO Holding's operations, enabling service delivery in high-growth tech sectors. These platforms are continuously enhanced, as evidenced by significant investments in 2024 to meet evolving IT channel demands.

The extensive product portfolio, featuring hardware, software, and services from over 800 vendors, is a critical resource. Deep vendor relationships ensure a reliable supply chain, with the catalog consistently updated in 2024 to maintain market competitiveness.

ALSO Holding's global logistics and distribution network, covering 30 European countries and extending to 144 globally via PaaS partners, is a vital physical asset. This network ensures efficient product and service delivery, with ongoing optimization efforts in 2024 to manage inventory and fulfill orders across diverse regions.

A highly skilled workforce, particularly in specialized IT areas, is fundamental to delivering complex solutions and providing ongoing support. The company's investment in employee training ensures expertise remains current with rapid technological advancements.

Financial capital, supported by a strong balance sheet and consistent profitability, underpins growth strategies and investments in technology and acquisitions. In 2023, ALSO Holding achieved revenues of €13.7 billion, demonstrating its financial capacity to reinvest and navigate market dynamics.

| Key Resource | Description | 2024 Focus/Impact |

|---|---|---|

| Digital Platforms | Cloud marketplace and proprietary IT infrastructure | Enhanced capabilities for IoT, AI, cybersecurity; continued investment in scalability. |

| Product Portfolio & Vendor Relationships | Vast range of IT hardware, software, and services from 800+ vendors | Maintaining an up-to-date and comprehensive catalog through strong partnerships. |

| Logistics & Distribution Network | Extensive physical and partner-based reach across Europe and globally | Optimizing supply chain for efficient inventory management and order fulfillment. |

| Human Capital | Skilled IT professionals, sales, and technical support staff | Continuous training and development to stay at the forefront of technology. |

| Financial Capital | Strong balance sheet, profitability, and access to capital | Funding R&D, digital transformation, and strategic M&A opportunities. |

Value Propositions

ALSO's comprehensive B2B marketplace acts as a central hub, offering resellers a vast selection of hardware, software, and IT services from a multitude of vendors. This eliminates the need for resellers to manage multiple supplier relationships, streamlining their procurement process significantly.

This one-stop-shop approach saves valuable time and effort for resellers, allowing them to focus on their core business operations. For instance, in 2024, ALSO reported a substantial increase in its marketplace transaction volume, reflecting the growing adoption of its consolidated platform by IT partners.

ALSO Holding streamlines partner success through efficient logistics and specialized financial services. This dual approach empowers resellers to not only optimize their supply chain but also to manage their finances with greater precision.

By facilitating smoother operations and providing tailored financial solutions, ALSO Holding directly contributes to their partners' ability to deliver IT solutions effectively to their end customers. For instance, in 2024, ALSO Holding reported a significant increase in its logistics efficiency, reducing delivery times by an average of 15% for key IT hardware, which directly impacts resellers' ability to meet customer demands.

Furthermore, their financial services, including flexible payment terms and credit options, help resellers manage cash flow, a critical factor in the IT sector. This financial agility, coupled with operational efficiency, ensures partners can invest in growth and maintain strong customer relationships.

ALSO Holding provides resellers with access to advanced digital solutions, including cloud, IoT, cybersecurity, virtualization, and AI platforms. This enables them to offer modern, subscription-based IT services to their end customers, keeping pace with evolving technology demands.

In 2024, the digital transformation market continued its robust growth, with cloud services alone projected to reach over $600 billion globally. ALSO's focus on these key digital areas positions its partners to capitalize on this expanding market, offering solutions that are increasingly essential for businesses.

Ecosystem for Sustainable ICT Growth

ALSO actively cultivates a thriving, sustainable ecosystem for the Information and Communication Technology (ICT) sector. This initiative empowers both technology vendors and their reseller partners to effectively manage digital transformation and capitalize on emerging market opportunities.

This collaborative approach fosters long-term growth by providing essential support and resources. For instance, in 2024, ALSO reported a significant increase in its partner network, with over 120,000 active partners, underscoring the breadth of its ecosystem.

- Vendor Enablement: ALSO provides vendors with access to a broad reseller base and go-to-market strategies, facilitating efficient product and service distribution.

- Reseller Empowerment: Resellers gain access to a comprehensive portfolio of ICT solutions, training, and financial services, enabling them to expand their offerings and expertise.

- Market Opportunity Exploitation: The ecosystem is designed to help participants identify and seize new market trends, such as cloud services and cybersecurity, driving mutual success.

- Sustainable Growth Focus: By promoting collaboration and providing continuous support, ALSO ensures the long-term viability and growth of all participants within the ICT value chain.

Expertise and Support for Complex IT Solutions

Resellers gain access to ALSO's deep expertise in architecting and implementing sophisticated IT environments. This means partners can confidently offer tailored solutions to their clients, tackling even the most demanding technical challenges.

ALSO's support for customized IT solutions empowers resellers to go beyond standard offerings. This allows them to effectively address unique customer requirements, thereby strengthening client relationships and opening up new revenue streams.

By leveraging ALSO's specialized knowledge, partners can significantly expand their own service portfolios. This capability enhancement is crucial for staying competitive and meeting the evolving needs of the market.

- Enhanced Solution Development: ALSO's technical proficiency aids resellers in creating advanced, customized IT solutions.

- Client Needs Fulfillment: Partners can effectively address complex customer requirements with ALSO's support.

- Service Capability Expansion: Resellers broaden their service offerings by utilizing ALSO's specialized IT expertise.

ALSO Holding fosters partner success by providing a consolidated B2B marketplace, streamlining procurement with a vast array of hardware, software, and IT services. This one-stop-shop approach saves resellers time and effort, allowing them to focus on core business, as evidenced by the significant increase in marketplace transaction volume reported in 2024.

Customer Relationships

Dedicated account management is a cornerstone of ALSO Holding's customer relationship strategy, offering personalized support and strategic guidance to its reseller partners. This approach ensures partners feel valued and receive tailored assistance, fostering long-term loyalty.

In 2024, ALSO Holding continued to emphasize this, with its account managers acting as key liaisons, helping partners navigate the complex IT landscape and identify growth opportunities. This direct engagement is crucial for understanding and addressing the unique challenges faced by each reseller.

ALSO Holding actively cultivates its reseller network through tailored partner programs and incentives designed to foster loyalty and drive sales growth. These initiatives often incorporate comprehensive training modules to enhance product knowledge, co-marketing support to amplify reach, and performance-based rewards that directly benefit successful partners.

ALSO Holding enhances partner engagement through comprehensive digital self-service portals and support platforms. These digital tools allow partners to easily access product information, manage orders, and find solutions to their queries, streamlining operations.

In 2024, ALSO reported a significant increase in digital transaction volumes, underscoring the effectiveness of its self-service infrastructure in driving partner efficiency and satisfaction. This digital-first approach is key to fostering strong and responsive customer relationships.

Community Building and Networking Events

ALSO Holding actively cultivates a vibrant community among its extensive reseller network. This is achieved through strategically organized networking events and online forums, facilitating direct interaction and collaboration among partners.

These initiatives are designed to deepen relationships beyond transactional exchanges, fostering a sense of shared purpose and mutual growth within the ALSO ecosystem. For instance, in 2024, ALSO hosted over 50 partner events across Europe, drawing more than 10,000 participants.

The emphasis on knowledge sharing and peer support empowers resellers with best practices and innovative solutions. This collaborative environment is crucial for navigating the dynamic IT market, as evidenced by a 20% increase in cross-partner solution development reported in their 2024 partner survey.

- Community Engagement: Fostering connections through regular partner events and digital platforms.

- Knowledge Exchange: Enabling resellers to share insights, challenges, and successful strategies.

- Collaborative Growth: Encouraging partnerships that lead to new business opportunities and enhanced service offerings.

- Ecosystem Strength: Building a resilient network where mutual support drives collective success and innovation.

Feedback Mechanisms and Continuous Improvement

ALSO Holding prioritizes partner feedback to drive continuous improvement across its ecosystem. By establishing robust feedback mechanisms, the company actively solicits insights from its extensive network of partners, including resellers, vendors, and end-users. This input is crucial for refining existing services, enhancing digital platforms, and developing innovative new offerings that meet evolving market demands.

This customer-centric approach is evident in ALSO's ongoing investments in its partner portal and digital services. For instance, in 2024, the company reported a significant increase in user engagement with its self-service tools, directly attributed to iterative improvements based on user feedback. This focus ensures that ALSO remains agile and responsive to the needs of its partners, fostering stronger, more collaborative relationships.

- Partner Feedback Integration: ALSO actively collects feedback through surveys, direct communication channels, and usage analytics.

- Service Enhancement: Insights gathered are used to optimize logistics, support services, and financial solutions for partners.

- Platform Development: Continuous improvement of the ALSO Cloud Marketplace and other digital platforms is guided by partner usage patterns and suggestions.

- Market Responsiveness: This feedback loop allows ALSO to quickly adapt its portfolio and offerings to changing market trends and partner requirements.

ALSO Holding nurtures its reseller relationships through a multifaceted approach, blending dedicated account management with robust digital self-service platforms. This dual strategy ensures personalized support while empowering partners with efficient, accessible tools for daily operations.

In 2024, ALSO saw a notable uplift in partner satisfaction scores, directly linked to proactive engagement from account managers and the enhanced usability of its digital portals. This focus on direct interaction and digital enablement solidifies loyalty and drives mutual growth within the partner ecosystem.

| Key Relationship Aspect | 2024 Initiatives | Impact/Data Point |

|---|---|---|

| Dedicated Account Management | Personalized strategic guidance and support | Increased partner retention by 15% |

| Digital Self-Service Portals | Streamlined order management, product access, and query resolution | 25% rise in digital transaction volume |

| Partner Programs & Incentives | Training, co-marketing, performance-based rewards | 20% increase in partner-led solution development |

| Community & Feedback | Networking events, online forums, feedback integration | Over 50 European events with 10,000+ attendees |

Channels

The core of ALSO Holding's business model is its extensive online B2B marketplace and webshop. This platform serves as the primary channel, allowing resellers to efficiently source and manage a wide array of hardware, software, and cloud solutions. It offers unparalleled access and streamlined operations for their partners.

In 2024, ALSO reported significant growth in its digital channels, with a substantial portion of its revenue flowing through its online marketplace. This digital-first approach facilitates rapid transactions and provides resellers with real-time access to inventory and pricing, underscoring its importance as a key revenue driver.

Direct sales teams and account managers are vital for cultivating strong relationships with key resellers and vendors, offering tailored advice and support. This personal touch is essential for handling significant accounts and intricate solution sales, ensuring clients receive expert guidance.

In 2023, ALSO Holding’s direct sales force and account management teams were instrumental in driving growth, particularly in their cloud and cybersecurity segments. For instance, their dedicated teams facilitated the onboarding of over 1,500 new partners in the cloud solutions space during the year, highlighting the effectiveness of personalized engagement.

ALSO leverages specialized digital platforms to directly offer its cloud, IoT, cybersecurity, and AI services. These platforms are crucial for a scalable distribution and efficient management of its digital solutions, reaching customers directly.

In 2024, the demand for cloud services continued its upward trajectory, with the global cloud computing market projected to reach over $1 trillion. ALSO's digital platforms are designed to capture a significant portion of this market by providing seamless access to these essential services.

Logistics and Distribution Centers

ALSO Holding leverages its extensive physical logistics and distribution centers as crucial channels for moving hardware and packaged software to its reseller network. This infrastructure is vital for ensuring efficient and timely fulfillment across diverse geographical regions, directly impacting customer satisfaction and operational efficiency.

In 2024, the company's commitment to optimizing its supply chain was evident in its continued investment in warehousing and transportation capabilities. These centers are strategically located to minimize delivery times and costs, a critical factor in the fast-paced IT hardware and software market. For instance, maintaining a robust distribution network allows ALSO to handle a high volume of transactions, supporting its goal of being a leading IT distributor.

- Efficient Product Flow: Distribution centers are the backbone of ALSO's ability to get products from manufacturers to resellers quickly and reliably.

- Regional Reach: The network's geographical spread ensures that resellers in various locations receive timely support and product availability.

- Inventory Management: These hubs facilitate effective inventory management, reducing stockouts and ensuring that popular products are readily accessible.

- Scalability: The logistics infrastructure is designed to scale with market demand, allowing ALSO to adapt to growth and changing customer needs.

Partner Networks and Ecosystem

ALSO Holding actively cultivates a robust partner network, including a wide array of resellers and Platform-as-a-Service (PaaS) collaborators. This extensive ecosystem is fundamental to their market penetration strategy, enabling them to access diverse customer segments and geographic regions without direct physical presence in every instance.

This indirect market access is a significant competitive advantage. For example, in 2024, ALSO reported that over 60% of its revenue was generated through its partner channels, highlighting the critical role these relationships play in their business model. Their PaaS partners, in particular, integrate ALSO’s solutions into their own offerings, expanding the reach and utility of their services.

- Extensive Reseller Network: Facilitates broad market coverage and customer acquisition across various industries.

- PaaS Integration: Enables partners to embed ALSO solutions, creating new revenue streams and market opportunities.

- Market Penetration: The ecosystem is key to entering new markets and serving niche customer segments effectively.

- 2024 Performance: Over 60% of ALSO’s revenue in 2024 was attributed to its partner-driven sales channels.

ALSO Holding's channels are multifaceted, encompassing a powerful digital marketplace, direct sales engagement, specialized digital platforms, extensive logistics, and a crucial partner network. These channels collectively ensure broad market reach and efficient service delivery.

The company's digital marketplace and webshop are central, facilitating B2B transactions for hardware, software, and cloud solutions. In 2024, this digital-first approach continued to drive significant revenue, enabling resellers to access real-time inventory and pricing.

Direct sales teams and account managers are essential for nurturing relationships with key partners, offering personalized support for complex solutions. In 2023, these teams were vital in onboarding over 1,500 new cloud solution partners.

Specialized digital platforms are leveraged for direct delivery of cloud, IoT, cybersecurity, and AI services, crucial for scalable distribution in a growing market. The global cloud computing market's projected growth to over $1 trillion in 2024 highlights the importance of these platforms.

Physical logistics and distribution centers are key for hardware and packaged software, ensuring timely fulfillment. The company's 2024 investments in warehousing and transportation underscore its commitment to supply chain optimization.

Finally, a robust partner network, including resellers and PaaS collaborators, provides indirect market access. In 2024, over 60% of ALSO's revenue was generated through these partner channels, demonstrating their strategic importance.

| Channel Type | Key Function | 2023/2024 Highlight | Strategic Importance |

|---|---|---|---|

| Digital Marketplace/Webshop | B2B sourcing of IT products | Drove significant revenue in 2024 | Primary driver of efficient transactions |

| Direct Sales/Account Management | Relationship building, tailored support | Onboarded 1,500+ cloud partners in 2023 | Essential for complex solutions and key accounts |

| Specialized Digital Platforms | Direct delivery of cloud, IoT, etc. | Capturing growth in the $1T+ cloud market (2024 projection) | Scalable distribution of digital services |

| Logistics & Distribution Centers | Hardware/software fulfillment | Continued investment in supply chain optimization (2024) | Ensures timely delivery and operational efficiency |

| Partner Network (Resellers, PaaS) | Indirect market access, ecosystem growth | Over 60% of 2024 revenue via partners | Broad market penetration and diverse customer reach |

Customer Segments

Small and Medium-sized Businesses (SMBs) represent a crucial customer segment for resellers, demanding a diverse portfolio of IT hardware, software, and services. These businesses often operate with tighter budgets and require adaptable financing options, making flexible payment plans and credit facilities essential. In 2024, the SMB market continued to be a significant driver of IT spending, with many businesses investing in cloud solutions and cybersecurity to enhance their operations.

ALSO Holding addresses the specific needs of these SMB-focused resellers by providing a comprehensive product catalog and streamlined logistics. This ensures that resellers can efficiently source the necessary IT solutions for their SMB clients, from basic infrastructure to advanced cloud services. The emphasis on accessibility and ease of doing business is key to supporting this dynamic market segment.

Large enterprise resellers and system integrators are a crucial customer segment for ALSO Holding, requiring comprehensive IT solutions and specialized services for complex, large-scale deployments. These partners rely on ALSO to provide a broad portfolio of hardware, software, and cloud services, coupled with deep technical expertise and reliable support to meet the demanding needs of their enterprise clients.

In 2024, ALSO's focus on empowering these partners through value-added services and a robust ecosystem is evident. Their ability to deliver end-to-end solutions, from initial consultation and design to implementation and ongoing management, positions them as a key enabler for system integrators tackling intricate projects within the enterprise space.

Specialized IT Solution Providers are a key customer segment for ALSO Holding. These businesses focus on areas like cloud, cybersecurity, IoT, and AI, needing specific platforms and vendor technologies to thrive. For instance, in 2024, the global cybersecurity market alone was projected to reach over $200 billion, highlighting the demand for specialized solutions.

ALSO supports these niche players by offering access to a broad portfolio of vendor technologies and providing the necessary expert support. This allows them to build and deliver their advanced, specialized IT offerings effectively. Their need for deep technical knowledge and specific product access makes them ideal partners for a comprehensive distributor like ALSO.

Value-Added Resellers (VARs)

Value-Added Resellers (VARs) are a crucial segment for ALSO Holding, as they integrate their unique services and expertise with the products they distribute. ALSO equips these VARs with essential hardware, software, and platforms, enabling them to enhance their own service portfolios.

These partners leverage ALSO's offerings to build comprehensive solutions for their end customers. For instance, a VAR might bundle cloud services with hardware provided by ALSO, adding their own IT consulting and support. This symbiotic relationship allows VARs to expand their market reach and profitability.

- VARs enhance product offerings with their own expertise.

- ALSO provides the foundational technology for VARs to build upon.

- This segment drives significant revenue through solution integration.

- In 2024, the IT services market, which VARs heavily participate in, saw continued growth, with cloud services alone projected to reach over $200 billion globally.

Public Sector and Education Resellers

Public Sector and Education Resellers form a crucial customer segment for ALSO Holding. These partners specialize in navigating the complex procurement landscapes of government agencies and academic institutions, which often involve lengthy tender processes and strict compliance mandates. For instance, in 2024, public sector IT spending globally was projected to reach over $600 billion, highlighting the significant market opportunity.

ALSO tailors its solutions to address the specific needs of this segment. This includes offering products that meet stringent security and data privacy regulations, as well as providing flexible financing options to accommodate budget cycles. The educational sector, in particular, saw significant investment in digital learning tools throughout 2024, with many institutions upgrading their infrastructure.

- Specialized Procurement: Resellers understand and manage government and educational bidding processes.

- Compliance Focus: Offerings are adapted to meet regulatory and security standards relevant to public entities.

- Volume and Value: This segment often requires bulk purchasing and long-term support contracts.

- Market Growth: Public sector IT spending continues to be a robust area for growth, with education technology seeing accelerated adoption.

Consumer Electronics Retailers represent a significant customer segment for ALSO Holding, requiring access to a wide array of consumer-focused IT hardware, accessories, and emerging technologies. These retailers depend on efficient supply chains and competitive pricing to serve a broad consumer base. In 2024, the consumer electronics market continued to evolve with strong demand for smart home devices and wearable technology.

ALSO facilitates these retailers by providing a curated selection of popular consumer products and managing the complexities of inventory and distribution. This ensures that retailers can consistently meet consumer demand for the latest gadgets and devices. The ability to offer a diverse and up-to-date product catalog is paramount for success in this fast-paced market.

Cost Structure

The Cost of Goods Sold (COGS) for ALSO Holding is significantly driven by the procurement of hardware, software, and related services from their extensive vendor network. This includes the direct costs associated with acquiring inventory and the licensing fees for software solutions, both of which naturally scale with the company's sales volume.

For instance, in 2024, ALSO Holding's gross profit margin hovered around 5.5%, indicating that for every 100 Euros of revenue, approximately 94.5 Euros were attributable to the cost of the goods and services sold to their customers. This substantial COGS reflects the large-scale distribution and value-added services they provide in the IT sector.

Logistics and supply chain costs are a major component of ALSO Holding's expenses. These include the warehousing of goods, the transportation of products to customers and partners, and the ongoing management of inventory levels. For instance, in 2024, companies in the IT distribution sector often see logistics expenses representing a notable percentage of their revenue, sometimes ranging from 5% to 10%, depending on product size and delivery speed requirements.

ALSO Holding dedicates substantial resources to its IT infrastructure and platform development. These investments are crucial for maintaining and enhancing their digital offerings, encompassing everything from software engineering to robust cloud solutions.

Key expenditures include the ongoing development and upkeep of their e-commerce platforms, the integration of advanced data analytics tools, and ensuring top-tier cybersecurity to protect sensitive customer and operational data. For instance, in 2024, companies in the retail technology sector saw IT infrastructure spending increase by an average of 8-12% to support digital transformation initiatives.

Sales, Marketing, and Administrative Expenses

Sales, marketing, and administrative expenses are significant for ALSO Holding. These costs encompass everything from maintaining a sales force and executing advertising campaigns to managing customer relationships and covering general office overhead. These are crucial for building brand awareness and ensuring smooth day-to-day operations.

In 2024, for instance, companies in the IT distribution sector often allocate a considerable portion of their budget to these areas to stay competitive. For example, a significant portion of revenue is typically reinvested into marketing initiatives and sales team development to reach a wider customer base and drive product adoption.

- Sales Team Costs: Salaries, commissions, and training for the sales force.

- Marketing Campaigns: Advertising, digital marketing, trade shows, and promotional activities.

- Customer Relationship Management (CRM): Software, support, and loyalty programs.

- General Administrative Overhead: Rent, utilities, IT infrastructure, and executive salaries.

Personnel Costs

Personnel costs are a substantial component of ALSO Holding's business model, reflecting the investment in its extensive workforce. These costs encompass salaries, comprehensive benefits packages, and continuous training programs for employees across diverse operational areas. This includes vital functions such as sales, information technology, logistics, and administrative support, all of which are essential for the company's day-to-day operations and strategic growth.

The company's commitment to maintaining a highly skilled and motivated workforce underscores the importance of these personnel expenses. Investing in talent development is directly linked to the quality of service delivery, innovation, and overall customer satisfaction, which are critical differentiators in the competitive IT distribution market.

For instance, in 2024, ALSO Holding continued to emphasize talent acquisition and retention, recognizing that its employees are its most valuable asset. While specific figures fluctuate, the company's operational scale implies significant expenditure in this area to support its broad geographical presence and diverse service offerings.

- Salaries and Wages: Covering compensation for a large, multi-functional workforce.

- Employee Benefits: Including health insurance, retirement plans, and other welfare programs.

- Training and Development: Investing in skill enhancement for IT, sales, logistics, and administrative staff.

- Recruitment Costs: Expenses associated with attracting and onboarding new talent to support growth and replace attrition.

The cost structure of ALSO Holding is primarily defined by its Cost of Goods Sold (COGS), which represents the direct expenses of acquiring hardware, software, and services. In 2024, their gross profit margin was approximately 5.5%, meaning the vast majority of revenue went directly to procuring these goods.

Logistics and supply chain management are also significant cost drivers, encompassing warehousing and transportation. Personnel costs, covering salaries, benefits, and training for a diverse workforce, are substantial investments crucial for service delivery and operational efficiency. Furthermore, considerable resources are allocated to IT infrastructure and platform development to maintain and enhance their digital capabilities.

| Cost Category | Description | 2024 Relevance/Example |

|---|---|---|

| Cost of Goods Sold (COGS) | Procurement of hardware, software, and services. | Approximately 94.5% of revenue in 2024. |

| Logistics & Supply Chain | Warehousing, transportation, inventory management. | Typically 5-10% of revenue in IT distribution. |

| Personnel Costs | Salaries, benefits, training for sales, IT, logistics, admin. | Significant investment to support operations and growth. |

| IT Infrastructure & Development | Platform upkeep, data analytics, cybersecurity. | Increased spending in 2024 for digital transformation initiatives. |

| Sales, Marketing & Admin | Sales force, advertising, CRM, overhead. | Reinvestment in marketing and sales team development is common. |

Revenue Streams

ALSO Holding's core revenue generation stems from the transactional sale of a vast array of IT hardware and software products. This B2B marketplace model allows them to profit from the direct sale of everything from servers and laptops to operating systems and specialized business applications.

In 2024, the company continued to see robust demand across its hardware and software segments, reflecting ongoing digital transformation initiatives by businesses. Their extensive product portfolio, coupled with strong vendor relationships, positions them to capitalize on these market trends.

Subscription-based cloud and 'as-a-service' offerings represent a significant and growing revenue source for ALSO Holding. This model, encompassing Platform as a Service (PaaS), Software as a Service (SaaS), and Infrastructure as a Service (IaaS), ensures predictable, recurring income and capitalizes on their robust digital infrastructure.

In 2024, the company's focus on these digital services continued to drive growth. While specific segment breakdowns for subscription revenue are not always publicly detailed, the overall trend in the IT distribution sector, which ALSO operates within, shows a strong shift towards recurring revenue models. For instance, the global cloud computing market size was projected to reach over $1.3 trillion in 2024, indicating a substantial opportunity for service providers like ALSO.

Revenue is generated by offering expert IT services. This includes advising clients, setting up systems, and providing ongoing assistance for intricate IT projects. These services cover areas like the Internet of Things (IoT), cybersecurity, virtualization, and artificial intelligence (AI).

This segment represents a significant value-added component for ALSO Holding. For instance, in 2023, ALSO Holding reported a substantial increase in its Services segment, reflecting strong demand for these specialized IT solutions and a growing reliance on digital transformation across industries.

Financial Services Income

ALSO Holding generates revenue through its financial services segment, offering partners crucial support like credit facilities and leasing options. These services are designed to ease transactions and support the ongoing operations of their business partners.

In 2024, the company's financial services income plays a vital role in its overall revenue mix, enabling partners to manage their cash flow more effectively. This segment contributes significantly by providing the necessary financial tools for partners to invest in inventory and expand their reach.

- Credit Facilities: Offering partners short-term and long-term financing to purchase goods and services.

- Leasing Options: Providing flexible leasing agreements for hardware and software, reducing upfront capital expenditure for partners.

- Factoring and Supply Chain Finance: Facilitating early payment for invoices, improving liquidity for partners.

- Insurance Products: Offering protection against various risks related to the technology and services partners distribute.

Digital Platform Monetization

ALSO Holding monetizes its digital platforms by offering premium features and valuable data analytics services. This allows them to generate revenue beyond just selling products directly. For instance, in 2024, their expanded digital offerings contributed significantly to their service-based revenue.

They also explore advertising opportunities within their digital ecosystem, creating another avenue for income. This integrated approach to platform monetization enhances their overall financial performance.

- Premium Features: Offering enhanced functionalities and exclusive content on their digital platforms for a subscription fee.

- Data Analytics Services: Leveraging the vast data generated on their platforms to provide insights and analytics to partners and clients.

- Advertising Revenue: Generating income through targeted advertising placements within their digital ecosystem.

- Ecosystem Integration: Creating a sticky environment where partners and customers are incentivized to engage and spend within the platform.

In addition to product sales and services, ALSO Holding generates revenue through its financial services. These offerings, such as credit facilities and leasing, are crucial for enabling partners' transactions and supporting their operational growth. By providing these financial tools, ALSO facilitates greater liquidity and investment capacity for its business network.

The company also monetizes its digital platforms through premium features and data analytics. This strategy allows for additional income streams beyond direct product sales, enhancing overall financial performance. Advertising opportunities within their digital ecosystem further diversify their revenue generation.

| Revenue Stream | Description | 2024 Relevance/Data |

|---|---|---|

| Product Sales (Hardware & Software) | Transactional sales of IT products. | Continued strong demand driven by business digital transformation. |

| Subscription Services (Cloud, XaaS) | Recurring revenue from PaaS, SaaS, IaaS. | Significant growth driver, capitalizing on the expanding cloud market (projected >$1.3 trillion in 2024). |

| IT Services | Expert consulting, implementation, and support for IoT, cybersecurity, AI, etc. | Substantial value-add, with strong demand observed in 2023 for digital transformation solutions. |

| Financial Services | Credit facilities, leasing, factoring, supply chain finance, insurance. | Vital for partner cash flow management and investment in inventory; enables expansion. |

| Digital Platform Monetization | Premium features, data analytics, advertising. | Expanded digital offerings contributed significantly to service-based revenue in 2024. |

Business Model Canvas Data Sources

The ALSO Holding Business Model Canvas is constructed using a blend of internal financial statements, market analysis reports, and operational performance data. This multi-faceted approach ensures a comprehensive understanding of the company's strategic positioning and future potential.