ALSO Holding Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ALSO Holding Bundle

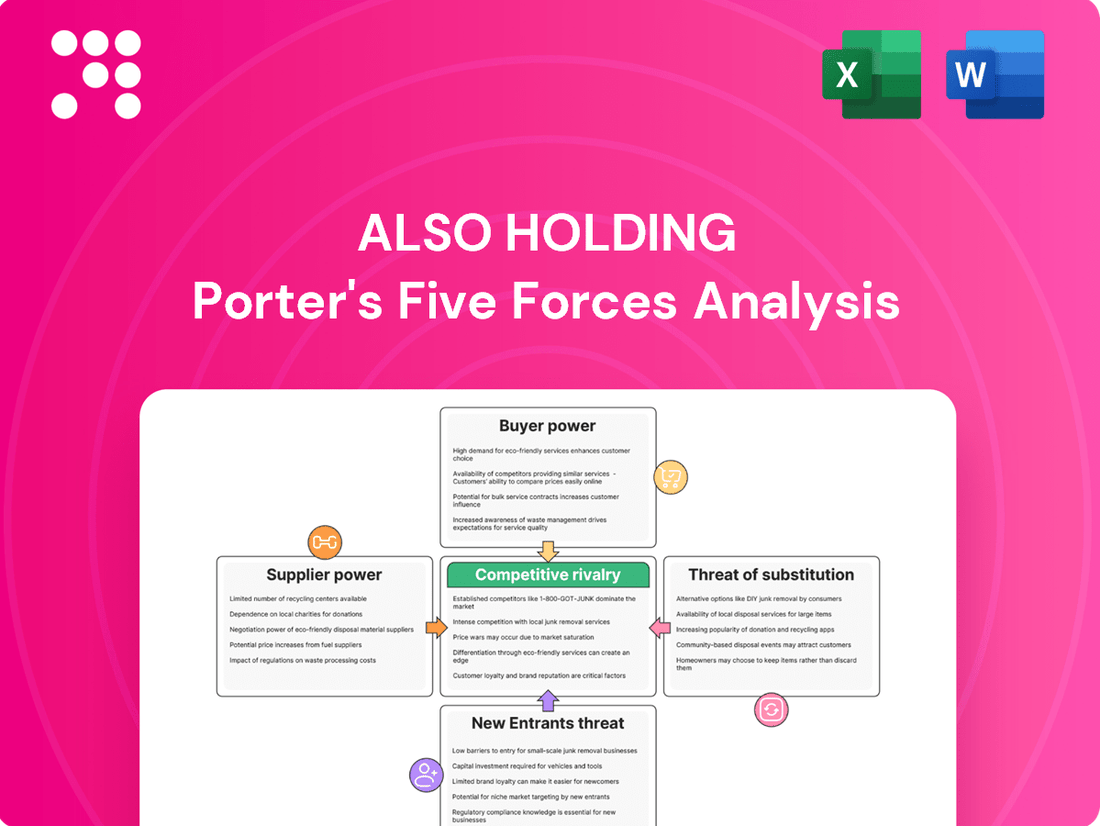

Understand the competitive landscape for ALSO Holding, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry. This analysis highlights key strategic considerations for navigating the IT distribution and services market.

The complete report reveals the real forces shaping ALSO Holding’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers for ALSO Holding AG is significantly shaped by the number and concentration of vendors providing essential hardware, software, and IT services. While ALSO partners with a vast network of over 800 vendors across more than 1,540 product categories, the market dominance of a few key technology giants can shift the balance of power.

For instance, if a handful of major software developers or hardware manufacturers control critical components of the IT ecosystem, these leading suppliers gain considerable leverage. This concentration can lead to situations where distributors like ALSO face increased pressure on pricing, delivery schedules, and contractual terms, directly impacting their operational costs and profitability.

Suppliers offering highly specialized or proprietary products and services wield significant bargaining power. This is because alternative options for ALSO and its resellers are limited, making these unique offerings indispensable. For instance, in 2024, the demand for specialized AI chips from a few key manufacturers remained exceptionally high, driving up costs for hardware distributors.

The IT sector's rapid innovation cycle constantly introduces unique products, especially in burgeoning fields like artificial intelligence, cybersecurity, and virtualization. Vendors providing cutting-edge or essential solutions in these areas are in a strong position. In the first half of 2024, companies specializing in advanced quantum encryption solutions saw their market power increase substantially due to the limited number of comparable providers.

The costs and complexities associated with transitioning from one major vendor to another can significantly bolster a supplier's leverage. These expenses can encompass the integration of new IT systems, the retraining of personnel, and the renegotiation of existing agreements.

ALSO's vast ecosystem and deep-rooted connections with a multitude of vendors imply that while swapping out individual products might be relatively straightforward, altering fundamental vendor partnerships could involve substantial financial and operational hurdles.

Threat of Forward Integration by Suppliers

Suppliers possess the potential to bypass intermediaries like ALSO Holding and engage in direct sales to resellers or even end consumers. This direct approach could theoretically enhance supplier margins and customer relationships.

However, for many vendors, particularly in hardware and large-scale software, the extensive logistical, financial, and market access provided by distributors such as ALSO are indispensable. These services are critical for efficiently reaching a broad reseller base, making direct integration less appealing for many.

In 2024, the IT distribution market saw significant consolidation, with companies like ALSO actively expanding their service portfolios beyond mere logistics. For instance, ALSO’s focus on cloud services and digital transformation solutions in 2024 further cemented its value proposition to vendors, making forward integration a more complex undertaking. The company reported a substantial increase in its value-added services, indicating a growing reliance from suppliers on its integrated offerings.

- Supplier Forward Integration Threat: Suppliers may attempt to sell directly to resellers or end-customers, bypassing distributors.

- ALSO's Value Proposition: ALSO provides essential logistics, financial services, and IT support that are difficult for many suppliers to replicate.

- Market Reach: For hardware and software vendors, distributors like ALSO offer crucial market reach to a wide network of resellers.

- Deterrent Factors: The comprehensive services offered by ALSO act as a significant barrier to widespread supplier forward integration.

Importance of ALSO as a Customer

ALSO Holding AG's position as a major technology provider and B2B marketplace makes it a highly valuable customer for numerous suppliers. Its extensive network, reaching around 135,000 resellers, offers vendors significant market access and reach.

This considerable scale and market penetration grant ALSO a degree of counter-bargaining power. For many vendors, losing ALSO as a distribution partner could mean a substantial hit to their market penetration and sales volume.

- Market Reach: ALSO's 135,000 resellers provide vendors with unparalleled access to diverse markets.

- Vendor Dependence: The potential loss of ALSO as a channel partner can significantly impact a vendor's sales and market presence.

- Bargaining Leverage: This reliance allows ALSO to negotiate more favorable terms with its suppliers.

The bargaining power of suppliers for ALSO Holding is moderate, influenced by the concentration of key technology providers and the specialized nature of certain IT products. While ALSO partners with a vast number of vendors, the dominance of a few major players in areas like AI chips or advanced cybersecurity solutions in 2024 allowed these suppliers to command higher prices and dictate terms, impacting ALSO's margins.

The threat of supplier forward integration is somewhat mitigated by the significant value ALSO provides through its extensive logistics, financial services, and broad market access to approximately 135,000 resellers. This integrated offering makes it challenging for many suppliers to bypass ALSO effectively, thus limiting their leverage.

Conversely, ALSO's substantial market reach and its role as a critical channel partner grant it considerable counter-bargaining power. The potential loss of such a significant distribution channel can negatively affect a vendor's sales volume and market penetration, enabling ALSO to negotiate more favorable terms.

| Factor | Assessment | Impact on ALSO |

| Supplier Concentration | Moderate to High for critical components | Increased pricing pressure and potential supply chain disruptions |

| Product Differentiation | High for specialized/proprietary IT solutions | Suppliers of unique offerings have strong leverage |

| Switching Costs | High for integrated IT systems | Suppliers benefit from vendor lock-in |

| Forward Integration Threat | Low to Moderate | ALSO's value-added services deter widespread bypass |

| ALSO's Counter-Bargaining Power | High | Ability to negotiate favorable terms due to market access |

What is included in the product

This analysis dissects the competitive forces impacting ALSO Holding, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within its market.

Instantly visualize competitive pressure across all five forces with a dynamic, interactive dashboard.

Customers Bargaining Power

ALSO Holding serves a vast network of approximately 100,000 active resellers, encompassing corporate, value-added, SMB, and retail segments. This extensive reach generally dilutes individual customer bargaining power.

However, large corporate clients or significant buying consortia that represent substantial purchase volumes can indeed wield considerable influence. These high-volume customers may negotiate for more favorable pricing, extended payment terms, or enhanced service level agreements, thereby increasing their bargaining power.

The broad diversification across numerous customer types and sizes within ALSO's ecosystem acts as a crucial buffer. This wide customer base significantly reduces the overall risk associated with any single customer or small group of customers having excessive leverage over the company.

The bargaining power of customers, specifically resellers, is significantly influenced by the availability of alternative distributors in the Information and Communications Technology (ICT) sector. If resellers can easily switch their procurement to another provider, their leverage over a company like ALSO Holding increases.

While ALSO Holding is a dominant player, holding the 1st position among 37 active competitors in the European technology distribution market, the existence of other distributors such as Northamber, ETB Technologies, and Mediatech provides resellers with choices. This competitive landscape means that if a reseller finds ALSO's terms or services unfavorable, they have viable alternatives to consider for their supply chain needs.

Switching costs for resellers are a key factor in mitigating customer bargaining power. If it's difficult or expensive for a reseller to move to a different distributor, their ability to demand lower prices or better terms is reduced. For example, the need to reconfigure IT systems, integrate new software platforms, or manage disruptions to established supply chains can represent significant hurdles.

ALSO Holding actively works to increase these switching costs for its partners. By offering a broad suite of services, including logistics, financing, and IT support, alongside its own cloud marketplace, ALSO creates a more integrated and sticky ecosystem. This comprehensive approach makes it less appealing and more complex for resellers to simply jump to a competitor, thereby strengthening ALSO's position.

Price Sensitivity of Customers

Resellers in the IT distribution market often face intense competition, making them highly sensitive to price. This sensitivity directly translates into increased bargaining power, as they can readily switch to alternative suppliers offering more favorable terms. For instance, in 2024, ALSO Holding demonstrated an ability to maintain its gross profit margins even as revenues remained stable, indicating a careful balancing act in pricing strategies.

In segments where products are largely commoditized, price becomes a paramount consideration for customers. This forces distributors like ALSO to continuously optimize their operational costs to ensure they can offer competitive pricing to their reseller base. This dynamic underscores the constant pressure on margins within the distribution channel.

- Price Sensitivity: Resellers' ability to switch suppliers based on price significantly enhances their bargaining power.

- Margin Management: ALSO's 2024 performance suggests effective management of gross profit margins despite stable revenue levels, highlighting pricing discipline.

- Commoditization Impact: In commoditized IT segments, price is a primary driver for customer purchasing decisions, necessitating cost efficiency for distributors.

Customer Information and Transparency

Customers armed with extensive pricing, availability, and alternative solution data wield significant influence. The ongoing digital transformation of B2B marketplaces and e-commerce platforms is a key driver of this trend, offering unparalleled transparency. This allows buyers to readily compare offerings, putting pressure on suppliers to negotiate more favorable terms.

For instance, in 2024, B2B e-commerce sales are projected to reach over $3.7 trillion globally, a substantial increase driven by platforms that facilitate easy comparison shopping. This digital shift directly amplifies customer bargaining power.

- Increased Transparency: Digital platforms provide readily accessible information on pricing, product features, and competitor offerings.

- Easier Comparison: Customers can quickly evaluate multiple suppliers and identify the best value propositions.

- Demand for Better Terms: Enhanced knowledge empowers customers to negotiate lower prices, improved service levels, or customized solutions.

The bargaining power of customers, primarily resellers, is moderated by the sheer volume of ALSO Holding's customer base, which exceeds 100,000. However, large corporate clients or buying groups can exert significant influence due to their substantial purchase volumes, potentially leading to negotiations for better pricing or service terms.

The competitive landscape of the ICT sector, with numerous distributors like Northamber and ETB Technologies, provides resellers with alternatives, thereby increasing their leverage. This is further amplified by the increasing transparency in B2B marketplaces. For example, global B2B e-commerce sales were projected to exceed $3.7 trillion in 2024, highlighting the ease with which customers can compare offerings and demand better terms.

| Factor | Impact on Bargaining Power | Mitigation by ALSO Holding |

|---|---|---|

| Customer Volume | Diluted by broad base, but concentrated power for large clients | Diversified customer segments reduce reliance on single entities |

| Availability of Alternatives | High, due to competitive ICT distribution market | Increasing switching costs through integrated services |

| Price Sensitivity & Commoditization | High, especially in commoditized segments | Focus on operational efficiency for competitive pricing |

| Digital Transparency | High, enabling easy comparison shopping | Value-added services beyond price |

What You See Is What You Get

ALSO Holding Porter's Five Forces Analysis

This preview showcases the complete ALSO Holding Porter's Five Forces Analysis, detailing the competitive landscape and strategic implications for the IT distributor. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring full transparency and immediate utility.

Rivalry Among Competitors

The ICT distribution market is quite crowded, with many companies vying for position. Despite this, ALSO Holding AG stands out, holding the top spot among 37 active competitors as a leading technology provider. This means they are performing very well in a busy sector.

This competitive environment isn't just about sheer numbers; it's also about the variety of players. You have broad-ranging distributors that offer a bit of everything, alongside more focused companies that specialize in specific technologies or services. This diversity means competitors employ a wide array of strategies to capture market share.

The IT market's robust expansion is a significant factor in moderating competitive rivalry. With global IT spending for B2B expected to hit $3.8 trillion over the next twelve months (July 2024-July 2025), there's ample room for companies to grow by capturing new market opportunities.

This substantial market growth, fueled by widespread digital transformation initiatives and the adoption of technologies like AI and cloud computing, allows companies to expand their revenue streams without necessarily needing to aggressively poach customers from rivals. Consequently, the pressure to gain market share through intense price wars or aggressive competitive tactics can be somewhat alleviated.

ALSO Holding actively moves beyond simply distributing hardware. They are carving out a niche by becoming a full-spectrum technology solutions provider, emphasizing their integrated ecosystem and digital offerings. This strategic shift, focusing on areas like cloud services, artificial intelligence, and cybersecurity, sets them apart from competitors who might still primarily engage in transactional sales.

This differentiation is crucial for sidestepping intense price wars. By offering specialized value-added services, including sophisticated logistics and financial solutions, ALSO creates unique propositions that are harder for rivals to replicate. For instance, their investment in digital platforms aims to streamline the entire IT lifecycle for their partners, a significant departure from traditional distribution models.

The company’s commitment to continuous innovation is key to sustaining this competitive advantage. In 2024, the IT distribution market continued to see consolidation and a growing demand for integrated solutions, making differentiation not just beneficial but essential for market leadership. ALSO’s strategy directly addresses this trend, aiming to build loyalty through a more comprehensive and value-driven approach.

Exit Barriers

High exit barriers, like substantial investments in fixed assets and specialized infrastructure, can trap companies in a market, even when profitability declines, thereby intensifying competition. In the IT distribution sector, the significant capital outlay for extensive logistics networks and sophisticated IT platforms creates these barriers.

ALSO's continued investment in its digital platforms and integrated ecosystem further entrenches its position. This strategic commitment raises the stakes for ALSO and potentially for its rivals, making it more challenging and costly to exit the market.

- Significant Investments: The IT distribution industry requires substantial capital for logistics and technology infrastructure, acting as a key exit barrier.

- Ecosystem Lock-in: ALSO's development of its digital ecosystem increases switching costs for partners and customers, raising exit barriers.

- Intensified Rivalry: High exit barriers can lead to prolonged competitive battles as firms are disincentivized from leaving, even in periods of low returns.

Strategic Acquisitions and Partnerships

ALSO Holding's competitive rivalry is intensified by its proactive approach to strategic acquisitions and partnerships. A prime example is the completed Westcoast transaction in Q1 2025, which significantly expanded ALSO's geographical reach and market standing. This demonstrates a dynamic competitive landscape where mergers and acquisitions are key strategies for achieving scale, securing new vendor relationships, and accessing broader markets.

These strategic moves by ALSO directly increase competitive pressure on its rivals. Companies that fail to adapt through similar consolidation or partnership efforts risk falling behind in terms of market share, product offerings, and overall competitive advantage. The ongoing pursuit of such strategic initiatives underscores the high level of competition within the industry, forcing all players to continuously evaluate and enhance their market strategies.

- Acquisition Strategy: ALSO Holding's acquisition of Westcoast in Q1 2025 is a clear indicator of its strategy to gain market share and expand its operational footprint.

- Partnership Dynamics: The company's engagement in partnerships further signals a competitive environment where collaboration is used to bolster market position and access new opportunities.

- Competitive Pressure: These actions by ALSO directly challenge competitors, necessitating similar strategic maneuvers to remain competitive in terms of scale, vendor access, and market reach.

The competitive rivalry within the ICT distribution market is significant, characterized by a large number of players and diverse strategies. Despite this, ALSO Holding AG has established itself as a leader, distinguishing itself through a focus on integrated solutions and digital offerings rather than solely transactional sales.

The market's growth, projected to see global B2B IT spending reach $3.8 trillion in the next twelve months (July 2024-July 2025), offers opportunities for expansion without solely relying on aggressive tactics. However, high exit barriers, such as substantial investments in logistics and technology infrastructure, can prolong competitive battles.

ALSO's strategic acquisitions, like the Westcoast transaction in Q1 2025, further intensify this rivalry by expanding its market reach and vendor relationships, compelling competitors to adapt through similar consolidation or partnership efforts to maintain their standing.

SSubstitutes Threaten

End-customers or larger resellers may seek to bypass distributors like ALSO by sourcing hardware and software directly from manufacturers. This trend is driven by a desire for potentially lower costs and more direct control over their IT supply chain.

However, ALSO's extensive value proposition, which includes intricate logistics management, tailored financial services, and access to a vast portfolio from over 800 vendors, presents a significant barrier to direct sourcing for most. Replicating these complex operational and financial capabilities independently is a substantial undertaking, making direct sourcing less feasible for the majority of their customer base.

The rise of cloud-based and Anything-as-a-Service (XaaS) models presents a potential substitute for traditional hardware and software sales. Customers can now access computing power, software, and data storage on a subscription basis, reducing the need for upfront capital expenditure on physical infrastructure. This shift impacts companies that primarily rely on selling perpetual licenses and hardware.

However, ALSO Holding has proactively addressed this threat by integrating XaaS into its core strategy. By developing its own digital marketplaces for cloud, AI, cybersecurity, and IoT solutions, ALSO is not just adapting but actively facilitating the transition to these service-based models. This positions them as a crucial intermediary and value-added distributor in the evolving IT landscape, turning a potential threat into a significant opportunity.

New business models, like software developers selling directly or managed service providers bundling solutions, pose a threat of substitution for traditional IT distribution. These alternatives can bypass intermediaries, potentially offering more competitive pricing or specialized services. For instance, the rise of SaaS platforms often allows direct customer engagement, reducing reliance on channel partners.

ALSO Holding actively counters this threat by transforming its own business model. It now emphasizes 'Solutions' and 'Service/Cloud' alongside its 'Supply' segment. This strategic shift aims to support resellers in navigating complex IT environments and adopting subscription-based service models, thereby retaining value within its ecosystem.

Technological Advancements and Disruption

Technological advancements pose a significant threat of substitution for ALSO Holding. Rapid progress in areas like artificial intelligence and automation could introduce entirely new methods for delivering IT solutions, potentially bypassing traditional distribution channels. Imagine AI-powered procurement systems directly linking buyers and sellers, diminishing the need for intermediaries like ALSO. This shift could fundamentally alter the market landscape, presenting a direct substitution risk.

For example, the rise of low-code/no-code platforms allows businesses to build applications with minimal traditional IT involvement, potentially reducing reliance on value-added resellers and distributors for certain solutions. In 2023, the global low-code development platform market was valued at approximately $21.2 billion, with projections indicating substantial growth, highlighting the increasing viability of these alternative approaches.

ALSO is actively mitigating this threat by investing in its own digital platforms and AI capabilities. By integrating these technologies into its service offerings, ALSO aims to evolve alongside technological disruption, positioning itself as a facilitator of these new solutions rather than a target for substitution. This proactive strategy is crucial for maintaining relevance in a rapidly changing IT ecosystem.

- Technological Disruption: AI and automation can create new IT solution delivery methods, potentially bypassing intermediaries.

- Market Shift: Highly automated procurement systems could directly connect buyers and sellers, reducing reliance on distributors.

- Proactive Strategy: ALSO invests in AI and digital platforms to adapt and integrate these advancements, aiming to be part of the solution.

- Market Growth: The low-code development platform market, valued at $21.2 billion in 2023, exemplifies the growth of alternative IT solution approaches.

In-house IT Capabilities of Large Enterprises

Large enterprises often possess the financial muscle to develop and maintain their IT infrastructure internally. This can include building custom software, managing data centers, and offering specialized IT support. For example, a major financial institution might invest heavily in its own cybersecurity infrastructure to protect sensitive client data, thereby reducing its need for external IT security distributors.

However, the rapidly evolving landscape of IT, particularly in areas like artificial intelligence and advanced cybersecurity, presents a significant challenge for in-house development. The sheer cost and expertise required to stay at the cutting edge often make it more practical to leverage the specialized offerings of distributors. In 2024, the global cybersecurity market alone was projected to reach over $230 billion, a figure that highlights the immense investment needed to maintain robust in-house capabilities.

- High Specialized Expertise: Modern IT demands deep knowledge in areas like cloud computing, AI, and cybersecurity, which can be costly to cultivate internally.

- Cost-Effectiveness and Scalability: Distributors like ALSO often provide economies of scale and flexible service models that are difficult for individual enterprises to replicate.

- Focus on Core Business: Outsourcing IT functions allows large enterprises to concentrate resources on their primary business operations rather than IT management.

- Access to Innovation: Distributors are typically at the forefront of technological advancements, offering access to the latest solutions that might be slow to develop in-house.

The threat of substitutes for ALSO Holding stems from alternative ways customers can acquire IT hardware, software, and services, bypassing traditional distribution channels. This includes direct sourcing from manufacturers, the growing adoption of cloud and XaaS models, and new business models like direct sales by software developers or bundled solutions from managed service providers.

Technological advancements, such as AI-powered procurement and low-code/no-code platforms, also present substitution risks by enabling more direct or automated IT solution delivery. Furthermore, large enterprises might opt for in-house IT development, though the complexity and cost of staying current with specialized fields like AI and cybersecurity often favor using distributors.

In 2024, the global cybersecurity market was projected to exceed $230 billion, illustrating the substantial investment required for in-house capabilities, making external distribution more viable for many. ALSO counters these threats by integrating XaaS, developing digital marketplaces, and evolving its business model to emphasize solutions and services.

The company's proactive investment in AI and digital platforms is crucial for adapting to technological shifts and maintaining its role as a facilitator within the evolving IT ecosystem, mitigating the impact of potential substitutes.

Entrants Threaten

Entering the ICT distribution sector at ALSO Holding AG's level demands significant capital. This includes investments in extensive logistics networks, modern warehousing facilities, robust IT infrastructure, and the crucial ability to offer financing solutions to business partners.

For instance, in 2024, large-scale ICT distributors often manage inventories worth hundreds of millions of euros, requiring substantial upfront capital for procurement and warehousing. The need for advanced IT systems to manage complex supply chains and customer relationships further adds to these considerable entry barriers.

ALSO's own financial strength, as evidenced by its strong cash position and confirmed investment plans for 2025 and beyond, underscores the sheer financial muscle required to establish and maintain a competitive presence in this market.

Established players like ALSO benefit from significant economies of scale in procurement, logistics, and IT operations, allowing them to offer competitive pricing and efficient services. For instance, in 2024, ALSO's robust supply chain management, a key driver of its scale, enabled it to handle a vast product portfolio, translating into cost advantages.

New entrants would struggle to achieve these efficiencies without substantial initial volume, making it difficult to compete on cost. The capital investment required to build comparable infrastructure and achieve similar purchasing power presents a high barrier.

ALSO's broad ecosystem and global reach further enhance its economies of scope, allowing it to leverage its existing infrastructure and customer relationships across various product categories and services. This diversification strengthens its competitive position against potential new market entrants.

The threat of new entrants is significantly mitigated by ALSO Holding's deeply entrenched brand loyalty and established relationships. For instance, in 2024, ALSO continues to leverage its extensive network of over 800 vendors and approximately 135,000 resellers, built over many years.

Newcomers would struggle immensely to replicate this level of trust and reach within the B2B ICT sector, where strong partnerships are paramount for success. Building a comparable vendor portfolio and a robust reseller ecosystem presents a formidable barrier.

Access to Distribution Channels and Networks

Gaining access to efficient distribution channels and building a reliable logistics network across multiple countries presents a significant hurdle for new entrants. For instance, ALSO Holding’s expansive reach, operating in 30 European countries and 144 countries through PaaS partners, highlights the immense infrastructure and established relationships a new player would need to replicate.

Newcomers face the daunting task of investing heavily to establish their own logistics and distribution capabilities or securing partnerships with existing, often capacity-constrained, providers. This complexity in international logistics, including customs, warehousing, and last-mile delivery, acts as a substantial deterrent, requiring considerable capital and operational expertise to overcome.

- Extensive Infrastructure Requirement: New entrants must build or acquire robust logistics and distribution networks, mirroring ALSO's presence in 30 European and 144 PaaS partner countries.

- High Capital Investment: Significant financial resources are needed to establish warehousing, transportation, and supply chain management systems on an international scale.

- Navigating Complex International Logistics: Overcoming customs regulations, varying transportation infrastructures, and diverse market demands is a major challenge for new market participants.

Regulatory and Legal Hurdles

Navigating the complex web of regulations across various international markets presents a substantial barrier for potential new entrants into the ICT sector. Companies must meticulously adhere to diverse legal frameworks governing data privacy, such as GDPR in Europe, and ensure strict compliance with trade regulations and competition laws. For instance, ALSO Holding's strategic partnership with Westcoast in 2024 required extensive regulatory approvals, highlighting the significant time and resources new players would need to commit just to enter and operate legally.

The sheer cost and effort associated with understanding and complying with these varying legal landscapes are considerable. New entrants must allocate substantial financial and human capital to legal counsel, compliance officers, and the implementation of necessary systems to meet these requirements. This investment can be prohibitive, particularly for smaller or less established companies looking to challenge established players like ALSO Holding.

- Data Privacy Compliance: Adherence to regulations like GDPR and CCPA requires significant investment in secure data handling and user consent mechanisms.

- Trade and Import/Export Laws: Navigating customs, tariffs, and import restrictions in different countries adds complexity and cost to supply chain operations.

- Competition Law: Understanding and complying with antitrust regulations in each operating market is crucial to avoid penalties and market exclusion.

- Sector-Specific Regulations: ICT companies may also face specific licensing or certification requirements depending on the services offered.

The threat of new entrants for ALSO Holding AG is considerably low due to the immense capital investment required to establish a competitive presence in the ICT distribution sector. New players must secure substantial funding for logistics, warehousing, and advanced IT infrastructure, often in the hundreds of millions of euros as seen with major distributors in 2024.

Furthermore, achieving economies of scale comparable to ALSO's robust supply chain, which underpins its cost advantages in 2024, is a significant hurdle. Building a similarly broad ecosystem and global reach also presents a formidable barrier to entry for potential competitors.

Established relationships and brand loyalty, with ALSO leveraging its network of over 800 vendors and 135,000 resellers in 2024, create a strong competitive moat. Replicating this trust and reach within the B2B ICT market is extremely challenging for newcomers.

Navigating complex international regulations, including data privacy laws like GDPR, and trade compliance adds another layer of difficulty and cost. For instance, regulatory approvals for strategic partnerships, as experienced by ALSO, demand significant time and resources, deterring new market entrants.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for ALSO Holding leverages data from annual reports, investor presentations, and industry-specific market research reports. We also incorporate insights from financial news outlets and competitor websites to provide a comprehensive view of the competitive landscape.