Akebia PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Akebia Bundle

Understand the critical external forces shaping Akebia's trajectory, from evolving healthcare regulations to economic shifts impacting patient access. Our PESTLE analysis provides a comprehensive overview of these factors, empowering you to anticipate challenges and identify opportunities. Unlock actionable intelligence for your strategic planning. Download the full version now!

Political factors

Government healthcare policies are a major influence on Akebia. In the U.S., for example, shifts in drug pricing rules and how drugs are paid for, like the Transitional Drug Add-on Payment Adjustment (TDAPA) for Akebia's Vafseo, directly impact revenue and market access.

The TDAPA designation for Vafseo is a critical factor for its successful launch and commercial performance among dialysis patients, highlighting the direct link between policy and Akebia's financial outcomes.

Akebia's success hinges on navigating complex regulatory approval processes, particularly from agencies like the U.S. Food and Drug Administration (FDA). The FDA's approval of Vafseo in March 2024 for dialysis patients marked a significant milestone, demonstrating Akebia's ability to meet stringent requirements.

The company's strategic focus on expanding Vafseo's label to non-dialysis Chronic Kidney Disease (CKD) patients through the ongoing Phase 3 VALOR trial underscores the critical nature of these regulatory pathways. Any unforeseen delays or additional data requests from regulatory bodies could materially affect market entry timelines and, consequently, revenue projections.

Government policies on intellectual property (IP) protection, encompassing patent laws and their enforcement, are paramount for biopharmaceutical firms like Akebia. The strength and scope of patent protection for Akebia's HIF-PHI technology directly influence its market exclusivity and ability to fend off generic challengers.

In 2024, the global biopharmaceutical industry continued to see significant investment in R&D, with IP protection being a key driver. For instance, the United States Patent and Trademark Office (USPTO) reported a steady increase in patent applications for novel drug compounds and delivery systems, underscoring the importance of robust IP frameworks.

Akebia's reliance on patents to safeguard its innovations means that any shifts in patentability criteria or enforcement effectiveness could impact its competitive positioning and long-term revenue streams. Furthermore, the potential for costly and protracted IP litigation, a common occurrence in the sector, presents a material risk that could divert resources from development and commercialization.

International Trade and Market Access

Akebia's global commercialization hinges on international trade policies and agreements. For instance, Vafseo's approval in the European Economic Area and the UK highlights the importance of market access, but evolving trade regulations could impact its expansion and revenue.

Shifts in international trade policies, such as tariffs or non-tariff barriers, can directly affect Akebia's cost of goods sold and the competitiveness of Vafseo in key overseas markets. As of early 2024, the global trade landscape remains dynamic, with ongoing discussions around supply chain resilience and localized manufacturing potentially influencing market access strategies.

- Trade Agreements: Bilateral and multilateral trade agreements can either facilitate or hinder Akebia's access to new markets for Vafseo.

- Regulatory Harmonization: Differences in regulatory approval processes across countries can create significant hurdles for global product launches.

- Market Access Barriers: Protectionist policies or stringent local content requirements could limit Vafseo's market penetration in certain regions.

- Geopolitical Stability: Political instability in key international markets can disrupt supply chains and impact Akebia's sales forecasts.

Lobbying and Advocacy Efforts

Akebia Therapeutics actively engages in lobbying and advocacy to shape healthcare legislation and policies critical to kidney disease treatment and drug development. These efforts focus on influencing key areas such as Medicare program structures, drug pricing regulations, and funding for clinical research, all with the goal of fostering a supportive regulatory and reimbursement landscape for their innovative therapies.

The company's advocacy aims to ensure patient access to necessary treatments and to create an environment conducive to the advancement of kidney disease therapies. For instance, in 2024, discussions around Medicare Part D reforms and potential price controls on pharmaceuticals remained a significant focus for patient advocacy groups and pharmaceutical companies alike, highlighting the ongoing need for industry engagement.

- Medicare Part D Reform: Akebia monitors and influences legislative proposals affecting prescription drug coverage and costs within Medicare Part D, aiming to protect patient access and ensure fair reimbursement for their products.

- Drug Pricing Legislation: The company advocates for policies that balance affordability with the need for continued innovation in pharmaceutical development, particularly concerning treatments for chronic conditions like kidney disease.

- Clinical Trial Support: Akebia supports initiatives and legislation that streamline the clinical trial process and provide funding mechanisms, which are essential for bringing new kidney disease treatments to market.

Government healthcare policies significantly shape Akebia's market access and revenue. The Transitional Drug Add-on Payment Adjustment (TDAPA) for Vafseo, for instance, directly impacts its financial performance in the U.S. dialysis market.

Navigating stringent regulatory approvals, such as the FDA's March 2024 clearance for Vafseo, is crucial. Expansion to non-dialysis CKD patients, pending Phase 3 VALOR trial results, highlights the ongoing reliance on regulatory pathways for market entry and revenue projections.

Intellectual property protection, including patent laws, is vital for Akebia's competitive edge and market exclusivity against potential generic competition. The USPTO's continued increase in patent applications in 2024 underscores the importance of robust IP frameworks for biopharma innovation.

International trade policies and agreements influence Akebia's global expansion and market access, as seen with Vafseo's approval in the EEA and UK. Dynamic global trade environments in 2024, focusing on supply chain resilience, could affect market penetration strategies.

What is included in the product

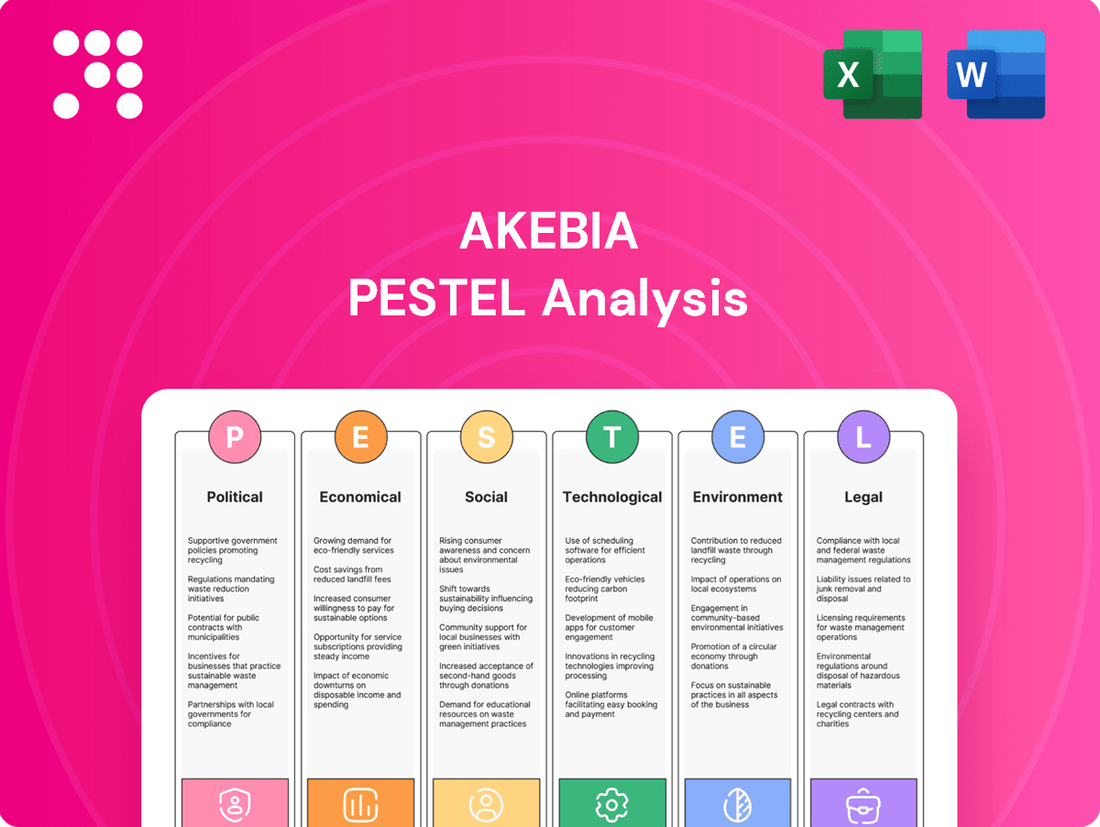

This Akebia PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key opportunities and threats within the current market landscape.

The Akebia PESTLE analysis offers a structured approach to identifying and mitigating external threats, thereby reducing the anxiety associated with market uncertainties and enabling proactive strategic planning.

Economic factors

Healthcare expenditure and reimbursement models for kidney disease treatments are critical economic drivers for Akebia. The company's revenue is directly tied to how much is spent on healthcare and how providers are reimbursed for services, particularly for products like Vafseo.

The Chronic Kidney Disease (CKD) market is experiencing significant growth, with substantial investments pouring into healthcare infrastructure. This expansion presents both opportunities and challenges for Akebia as it navigates the evolving landscape of kidney disease care and treatment accessibility.

A key economic factor for Akebia is the Transitional Drug Add-on Payment Adjustment (TDAPA) for Vafseo. This policy ensures reimbursement for the drug in dialysis centers, significantly influencing its market adoption and overall commercial success. For instance, in 2024, Medicare Part B drug spending saw an increase, underscoring the importance of such add-on payments for innovative therapies.

Drug pricing policies and the competitive landscape are critical for Akebia. Vafseo's initial pricing is set, but its future pricing will likely mirror that of established erythropoiesis-stimulating agents (ESAs).

The potential introduction of authorized generics for drugs like Auryxia poses a revenue risk. Akebia must engage in strategic contracting with payors to mitigate these impacts and maintain market share.

Akebia's financial health is directly linked to its investment in research and development, particularly in advancing its HIF inhibitor pipeline. The company’s strategic focus on exploring HIF biology and launching new clinical trials, like the VALOR Phase 3 trial for non-dialysis CKD patients, necessitates significant R&D funding.

The company's ability to fund these crucial R&D initiatives is bolstered by its recent financial trajectory. Akebia reported a net loss of $27.2 million for the first quarter of 2024, a notable improvement from a net loss of $57.4 million in the same period of 2023. This trend towards profitability provides a stronger foundation for sustained R&D investment.

Global Economic Conditions

Global economic conditions significantly influence Akebia Therapeutics' operational landscape. Rising inflation and fluctuating interest rates, for instance, directly impact manufacturing costs and the expense of capital, potentially affecting supply chain stability and investment in research and development. Market stability is crucial for investor confidence, which in turn affects Akebia's ability to raise funds for growth initiatives.

The broader economic climate, including potential recessions or periods of robust growth, shapes consumer spending on healthcare and the reimbursement landscape for pharmaceuticals. For example, in early 2024, many developed economies continued to grapple with persistent inflation, although rates began to moderate. This environment necessitates careful financial planning and cost management for companies like Akebia.

- Inflationary Pressures: Persistent inflation in 2024-2025 can increase raw material and labor costs for pharmaceutical manufacturing.

- Interest Rate Sensitivity: Higher interest rates make borrowing more expensive, impacting Akebia's capacity for debt financing and the valuation of future cash flows in DCF analyses.

- Market Volatility: Fluctuations in equity markets, influenced by global economic sentiment, can affect Akebia's stock price and its ability to conduct secondary offerings.

Akebia's strategic move in May 2024 to complete a public offering of common stock, raising approximately $150 million before expenses, underscores the importance of a strong balance sheet in navigating uncertain economic times. This capital infusion is intended to bolster its financial resilience and support its ongoing clinical development programs and commercialization efforts.

Access to Capital and Funding

Akebia Therapeutics relies heavily on its access to capital to fuel its ambitious growth plans. The company's capacity to tap into public markets or forge strategic partnerships directly influences its ability to fund vital clinical trials, successfully launch new products, and execute strategic acquisitions, all of which are critical for its long-term success.

Demonstrating its improved financial footing, Akebia reported a robust cash position at the close of the first quarter of 2025. This strengthened balance sheet was notably bolstered by proceeds from a recent public offering, providing Akebia with greater financial flexibility.

- Strengthened Cash Position: Akebia's cash and cash equivalents stood at $374.2 million as of March 31, 2025, a significant increase from $278.1 million at the end of 2024.

- Public Offering Success: In April 2025, Akebia completed a successful follow-on public offering, raising approximately $100 million in gross proceeds.

- Impact on Operations: This enhanced access to capital is expected to support Akebia's ongoing clinical development programs and commercialization efforts for its lead product candidate.

Global economic conditions, including inflation and interest rates, directly impact Akebia's manufacturing costs and capital expenses. Market volatility can also affect investor confidence, influencing the company's ability to secure funding for growth. For instance, persistent inflation in 2024-2025 increases raw material costs, while higher interest rates make debt financing more expensive.

Akebia's financial health is bolstered by its access to capital, demonstrated by a $150 million public offering in May 2024. This improved financial footing, with cash reserves reaching $374.2 million by March 31, 2025, supports ongoing clinical development and commercialization efforts.

The company's R&D investment is crucial, with a focus on its HIF inhibitor pipeline, including the VALOR Phase 3 trial. Akebia's net loss narrowed to $27.2 million in Q1 2024 from $57.4 million in Q1 2023, indicating progress towards profitability and enabling sustained R&D funding.

The Transitional Drug Add-on Payment Adjustment (TDAPA) for Vafseo is a key economic enabler, ensuring reimbursement in dialysis centers. This policy is vital for Vafseo's market adoption, especially as Medicare Part B drug spending saw an increase in 2024.

What You See Is What You Get

Akebia PESTLE Analysis

The preview you see here is the exact Akebia PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. This comprehensive analysis breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Akebia. You can trust that the detailed insights and strategic considerations presented are precisely what you'll be working with.

Sociological factors

The growing global burden of chronic kidney disease (CKD) and heightened awareness of its associated health issues significantly influence Akebia Therapeutics' market landscape. Millions worldwide suffer from CKD and the anemia it often causes, creating a substantial patient pool actively seeking effective treatment solutions.

By 2024, it's estimated that over 850 million people globally have some form of kidney disease, with CKD being a leading cause of mortality. This escalating prevalence, coupled with increased public and medical awareness, directly translates into a greater demand for innovative therapies like those developed by Akebia.

Enhanced awareness campaigns and improved diagnostic capabilities are leading to earlier detection of CKD and anemia, further expanding the addressable market for Akebia's products. This trend is projected to continue, driving market growth as more patients become aware of their condition and seek appropriate medical interventions.

Akebia's commitment to enhancing the quality of life for individuals battling kidney disease resonates with society's increasing focus on patient-centric healthcare approaches. This aligns with a growing demand for treatments that not only manage disease but also improve daily living.

The introduction of oral therapies such as Vafseo is designed to meet critical unmet needs and expand treatment accessibility. This is particularly important for patients experiencing anemia related to chronic kidney disease (CKD), whether they are currently on dialysis or not yet receiving it.

While Vafseo offers a new treatment option, it is important to note that its direct impact on improving patient quality of life has not yet been definitively demonstrated through clinical trials. Further research will be crucial to assess this aspect.

Healthcare professionals and patients weigh treatment efficacy, safety, and ease of use when adopting new therapies. Akebia's Vafseo has experienced robust initial uptake from prescribers, driven by targeted education within the nephrology sector.

The company's strategy to embed Vafseo within dialysis organizations underscores its commitment to facilitating broad patient access and professional integration, aiming for widespread clinical acceptance.

Aging Population and Disease Burden

The world's population is getting older, and this demographic shift is a significant factor influencing healthcare. As people age, there's a greater likelihood of developing chronic conditions, and chronic kidney disease (CKD) is a prime example. This trend directly translates into an increased demand for treatments and therapies that can manage or alleviate kidney-related health issues, creating a burgeoning market for companies like Akebia that specialize in this area.

The rising prevalence of CKD is closely tied to the aging demographic. For instance, by 2050, it's projected that over 1.5 billion people will be aged 65 and older globally. This growing elderly population often experiences a higher incidence of comorbidities like diabetes and hypertension, which are major drivers of CKD progression. Consequently, the market for CKD therapeutics is expected to see substantial growth, with some analyses predicting it to reach tens of billions of dollars in the coming years.

- Growing Elderly Population: Global population aged 65+ is projected to reach 1.5 billion by 2050, increasing the at-risk demographic for CKD.

- Disease Burden Correlation: Aging is a key risk factor for CKD; the number of individuals diagnosed with CKD has been steadily increasing worldwide.

- Market Opportunity: The increasing demand for effective CKD treatments presents a significant and expanding market opportunity for Akebia Therapeutics.

Health Equity and Disparities

Societal focus on health equity and disparities significantly shapes healthcare policy and market opportunities. Concerns about unequal access to quality treatment, particularly for chronic conditions like kidney disease, drive demand for innovative solutions. This creates a favorable environment for companies like Akebia that are committed to addressing these gaps.

Akebia's mission to develop treatments for kidney disease directly tackles these disparities. By focusing on conditions that disproportionately affect certain demographics, the company aligns with broader societal goals of fairness in healthcare. This patient-centric approach can lead to stronger market positioning and support from policymakers.

Expanding access to care and ensuring equitable reimbursement are key to realizing health equity. Initiatives that promote fair pricing and coverage for kidney disease treatments, like those Akebia offers, resonate with public sentiment and can influence regulatory decisions. For example, ongoing discussions around Medicare Part D reform in 2024-2025 aim to improve affordability for beneficiaries, which could positively impact Akebia's patient reach.

- Growing Awareness: Public discourse around health disparities, particularly in chronic diseases, is at an all-time high, influencing legislative priorities.

- Underserved Populations: Kidney disease disproportionately impacts minority groups and lower-income individuals, making Akebia's focus on these areas socially impactful.

- Policy Alignment: Government efforts to reduce healthcare costs and improve access for chronic conditions, such as potential adjustments to reimbursement rates for dialysis alternatives in 2025, create opportunities for Akebia.

- Patient Advocacy: Strong patient advocacy groups actively campaign for equitable treatment access and fair insurance coverage, creating a supportive environment for companies addressing these needs.

Societal values increasingly prioritize patient well-being and quality of life, directly impacting the demand for Akebia's therapies. As awareness of kidney disease and its associated anemia grows, so does the desire for treatments that improve daily living for patients. This societal shift encourages the development and adoption of innovative solutions like Akebia's Vafseo, which aims to address unmet patient needs.

The growing elderly population is a significant demographic driver for Akebia's market. By 2050, over 1.5 billion people are expected to be aged 65 and older, a group more susceptible to chronic kidney disease. This demographic trend, coupled with the increasing prevalence of comorbidities like diabetes and hypertension, fuels the demand for effective kidney disease treatments, presenting a substantial market opportunity.

Health equity concerns are shaping healthcare policy and creating market opportunities for Akebia. The disproportionate impact of kidney disease on minority and lower-income populations aligns with societal goals for fairness in healthcare. Initiatives focusing on equitable access and reimbursement, such as potential Medicare Part D reforms in 2024-2025, can positively influence Akebia's patient reach and market penetration.

| Sociological Factor | Impact on Akebia | Supporting Data/Trend |

|---|---|---|

| Aging Population | Increased demand for CKD treatments | Global population aged 65+ projected to reach 1.5 billion by 2050. |

| Health Equity Focus | Favorable policy environment, patient support | Kidney disease disproportionately affects minority groups; ongoing discussions for healthcare affordability reforms (2024-2025). |

| Patient-Centric Care | Demand for improved quality of life therapies | Growing awareness of CKD and anemia drives need for treatments enhancing daily living. |

Technological factors

Akebia's technological edge lies in its deep understanding of hypoxia-inducible factor (HIF) biology. This Nobel Prize-winning science underpins their development of innovative oral therapies, such as vadadustat (Vafseo).

Vafseo, a HIF-PHI, emulates the body's natural response to low oxygen, presenting a compelling alternative to conventional injectable anemia treatments. This approach offers significant patient convenience and potentially improved adherence.

In 2023, Akebia reported net sales of Vafseo in the U.S. were $142 million, demonstrating market traction for their novel HIF-based therapy.

Advancements in drug development and clinical trial execution are paramount for Akebia Therapeutics. The company is currently investing heavily in pivotal Phase 3 trials, like the VALOR study, to broaden the approved uses for Vafseo and evaluate its effectiveness in more diverse patient groups. These trials are designed using sophisticated scientific and statistical methodologies, reflecting the cutting edge of pharmaceutical research.

Technological advancements are significantly reshaping pharmaceutical manufacturing and supply chain operations, directly impacting companies like Akebia Therapeutics. Innovations in areas such as continuous manufacturing and advanced analytics offer the potential to boost production efficiency and lower operational costs. For Akebia, ensuring a consistent and cost-effective supply of its key products, including Vafseo and Auryxia, is paramount to maintaining and expanding its market position. For instance, the global pharmaceutical manufacturing market was valued at approximately $467.9 billion in 2023 and is projected to grow, highlighting the competitive landscape driven by technological adoption.

Data Analytics and Precision Medicine

The healthcare sector, including areas relevant to Akebia's focus on chronic kidney disease (CKD), is increasingly leveraging data analytics and precision medicine. This trend aims to tailor treatments to individual patient profiles, potentially leading to more effective outcomes.

While specific impacts on Akebia's current operations aren't publicly detailed, the broader CKD market is experiencing a significant shift. Companies are exploring how data-driven insights can inform future research and refine commercial strategies for therapies. For instance, advancements in analyzing patient genetic data and treatment response patterns are becoming crucial for drug development in complex diseases.

- Data-driven personalized treatments: The CKD market is moving towards tailoring therapies based on individual patient data, enhancing treatment efficacy.

- Optimizing patient care: Advanced analytics can help identify patient subgroups who are most likely to benefit from specific interventions, improving overall care.

- Influence on R&D: The rise of precision medicine is expected to shape future research and development pipelines for companies like Akebia, focusing on targeted therapies.

- Market adaptation: Companies that effectively integrate data analytics into their strategies are better positioned to navigate evolving treatment paradigms and competitive landscapes.

Biotechnology and Research Collaboration

Collaborations in biotechnology are crucial for speeding up the development of new treatments. Akebia actively engages in global partnerships to foster innovation in research and development, pooling scientific knowledge to bring better solutions for kidney disease patients. For instance, in 2024, Akebia announced a significant collaboration with a leading European biotech firm to explore novel therapeutic targets for anemia associated with chronic kidney disease, aiming to build on their existing pipeline advancements.

These strategic alliances allow Akebia to access specialized expertise and cutting-edge technologies that might be difficult or time-consuming to develop internally. By leveraging these external capabilities, the company can more efficiently advance its clinical pipeline. This approach is particularly vital in the rapidly evolving field of kidney disease research, where interdisciplinary collaboration can unlock breakthroughs. The company's R&D expenditure in 2024 was reported to be $150 million, with a significant portion allocated to collaborative projects.

- Global Partnerships: Akebia collaborates with research institutions and biotech companies worldwide to accelerate innovation in kidney disease treatments.

- Access to Expertise: These collaborations provide access to specialized scientific knowledge and advanced technologies, enhancing R&D capabilities.

- Pipeline Advancement: By leveraging collective expertise, Akebia aims to pioneer new areas of research and development, bringing novel clinical solutions to market faster.

- R&D Investment: The company's commitment to collaborative research is reflected in its substantial R&D budget, with a focus on strategic partnerships.

Akebia's technological foundation is built on its expertise in hypoxia-inducible factor (HIF) biology, which is key to developing oral anemia treatments like Vafseo. This scientific approach allows for a more convenient alternative to traditional injectable therapies, potentially improving patient adherence and outcomes.

The company is actively investing in clinical trials, such as the VALOR study in 2024, to expand Vafseo's approved uses. These trials employ advanced methodologies, underscoring Akebia's commitment to cutting-edge pharmaceutical research and development.

Technological advancements in manufacturing, like continuous processing, are crucial for Akebia to optimize production efficiency and manage costs for products like Vafseo and Auryxia. The global pharmaceutical manufacturing market's growth to an estimated $467.9 billion in 2023 highlights the importance of technological adoption in this competitive sector.

The increasing use of data analytics and precision medicine in the chronic kidney disease (CKD) sector, a key area for Akebia, is driving a shift towards personalized treatments. This trend is expected to influence future R&D pipelines and commercial strategies within the industry.

Legal factors

Akebia operates in the heavily regulated pharmaceutical sector, necessitating strict adherence to FDA and global standards for drug development, production, and sales. Failure to comply can result in significant penalties, product recalls, or stalled market entry.

In 2023, the FDA issued over $25 million in fines for manufacturing and compliance violations across the pharmaceutical industry, highlighting the financial risks associated with non-compliance. Akebia's commitment to regulatory excellence is therefore crucial for its operational integrity and financial stability.

Akebia Therapeutics has faced legal hurdles concerning intellectual property, particularly patent disputes. For instance, the company was involved in litigation with Vifor Pharma regarding patents for its anemia drug, vadadustat. These legal battles underscore the critical need for strong patent protection and effective legal strategies to safeguard Akebia's innovations and market position.

Laws governing drug pricing and reimbursement significantly influence Akebia's financial performance and market reach. Policies from major government payers, such as Medicare and Medicaid, directly shape how much Akebia can earn and how easily its products can be accessed by patients.

A key legal and regulatory factor impacting Akebia is the Transitional Drug Add-on Payment Adjustment (TDAPA) for Vafseo. This specific mechanism is crucial for determining the reimbursement levels and thus the revenue generated by this important product.

Data Privacy and Security Regulations

Akebia must navigate a complex web of data privacy and security regulations, impacting how it handles sensitive patient and clinical trial information. This includes adhering to frameworks like the General Data Protection Regulation (GDPR) in Europe and various state-level privacy laws across the United States, such as the California Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA).

Non-compliance carries substantial financial penalties; for instance, GDPR violations can lead to fines of up to 4% of global annual revenue or €20 million, whichever is higher. For Akebia, a breach of patient data could not only result in these significant fines but also severely damage its reputation among patients, healthcare providers, and regulatory bodies, impacting trust and future business opportunities.

- GDPR Fines: Up to 4% of global annual revenue or €20 million.

- CCPA/CPRA Impact: Increased consumer rights over personal data, requiring robust consent mechanisms and data handling policies.

- Reputational Risk: Data breaches can erode patient and partner trust, leading to long-term business consequences.

- Operational Costs: Investing in advanced cybersecurity measures and compliance training is essential to mitigate risks.

Anti-Kickback and Fraud and Abuse Laws

Akebia, operating within the pharmaceutical sector, is subject to stringent anti-kickback statutes and fraud and abuse laws. These regulations are critical for governing relationships with healthcare professionals and the marketing of its therapies, including those for kidney disease. Failure to comply can result in substantial penalties, impacting financial stability and operational capacity.

Non-compliance with these laws can manifest in various ways, such as improper inducements to physicians for prescribing Akebia's products or fraudulent billing practices. The Office of Inspector General (OIG) actively enforces these statutes, and violations can lead to significant fines, exclusion from federal healthcare programs, and even criminal charges. For instance, in 2023, the Department of Justice reported billions in settlements related to healthcare fraud and abuse, underscoring the high stakes involved.

- Regulatory Scrutiny: Pharmaceutical companies like Akebia face intense scrutiny regarding marketing practices and physician relationships to prevent illegal inducements.

- Financial Penalties: Violations of anti-kickback and fraud laws can result in substantial fines, potentially reaching millions of dollars, as seen in numerous healthcare settlements.

- Program Exclusion: A severe consequence of non-compliance is exclusion from participating in Medicare and Medicaid, severely limiting a company's market access.

- Reputational Damage: Legal entanglements can significantly harm Akebia's reputation among patients, healthcare providers, and investors, impacting future business prospects.

Akebia's operations are deeply intertwined with evolving legal frameworks governing drug approval, manufacturing standards, and market access. Adherence to FDA regulations, for example, is paramount, with significant fines levied for non-compliance; the industry saw over $25 million in FDA fines in 2023 for such violations. Intellectual property law is also a critical battleground, as seen in Akebia's patent disputes, such as those involving vadadustat, which directly impact market exclusivity and revenue potential.

Pricing and reimbursement laws, particularly those from government payers like Medicare and Medicaid, directly influence Akebia's financial viability. The Transitional Drug Add-on Payment Adjustment (TDAPA) for Vafseo is a prime example of how specific legal mechanisms dictate product revenue. Furthermore, data privacy regulations like GDPR and CCPA/CPRA impose strict requirements on handling sensitive patient information, with potential fines reaching up to 4% of global annual revenue for breaches.

Akebia must also navigate anti-kickback statutes and fraud and abuse laws, which govern interactions with healthcare professionals and marketing practices. Violations can lead to substantial financial penalties, exclusion from federal healthcare programs, and severe reputational damage, as evidenced by billions in healthcare fraud settlements reported by the Department of Justice in 2023.

Environmental factors

The biopharmaceutical sector, including companies like Akebia, is under growing pressure to adopt greener manufacturing. This means cutting down on waste, using energy more efficiently, and making sure raw materials are sourced responsibly. For instance, many pharmaceutical companies are setting targets to reduce their carbon footprint by a specific percentage by 2030, aiming for a more sustainable supply chain.

This focus on environmental responsibility is becoming a key part of broader Environmental, Social, and Governance (ESG) strategies. Companies are increasingly reporting on their environmental performance, with investors paying close attention to these metrics. In 2024, a significant portion of institutional investors indicated that ESG factors heavily influence their investment decisions in the healthcare sector.

Akebia must navigate stringent environmental regulations concerning the disposal of biopharmaceutical waste, which includes chemical byproducts from manufacturing and expired medications. Failure to comply with these rules, such as those set by the EPA, can lead to significant fines and operational disruptions.

The biopharmaceutical industry, in general, faces increasing scrutiny over its environmental footprint. For instance, a 2024 report highlighted that pharmaceutical manufacturing waste can contain active pharmaceutical ingredients (APIs) that pose risks if not properly contained and treated before disposal, impacting water quality.

Climate change poses a significant threat to Akebia's supply chain. Extreme weather events, like the increased frequency of hurricanes and droughts observed in recent years, can severely disrupt the sourcing of raw materials and the timely delivery of pharmaceuticals. For instance, a severe drought in a key agricultural region could impact the availability of plant-derived compounds used in drug manufacturing.

Businesses are now prioritizing climate risk assessments to build resilience. Akebia, like its peers in the pharmaceutical sector, is likely evaluating how events such as floods or heatwaves could affect its manufacturing facilities or transportation networks. This proactive approach is crucial for maintaining business continuity and ensuring uninterrupted access to essential medicines for patients.

Resource Scarcity and Water Usage

Water scarcity is a significant environmental challenge, impacting industries that rely heavily on this resource. Biopharmaceutical manufacturing, including companies like Akebia Therapeutics, often requires substantial amounts of water for various processes, from cleaning to cooling.

The growing awareness of responsible resource management is pushing companies to adopt more efficient water usage strategies. Akebia, like others in the sector, must consider the environmental footprint of its operations and implement measures to minimize water consumption and wastewater discharge.

Recent data highlights the increasing pressure on global water resources. For example, the World Resources Institute reported in 2023 that over 2 billion people live in countries experiencing high water stress. This underscores the critical need for water conservation across all industries.

- Water Intensity: Biopharmaceutical production can be highly water-intensive, necessitating careful planning and investment in water-saving technologies.

- Regulatory Scrutiny: Environmental regulations concerning water usage and discharge are becoming stricter globally, impacting operational costs and compliance requirements.

- Corporate Responsibility: Stakeholders, including investors and consumers, increasingly expect companies to demonstrate strong environmental stewardship, particularly regarding water management.

- Operational Efficiency: Implementing advanced water recycling and treatment systems can not only reduce environmental impact but also lead to cost savings in the long run.

Corporate Environmental Governance and Reporting

Akebia Therapeutics demonstrates a commitment to environmental, social, and governance (ESG) principles, with its Nominating and Corporate Governance Committee specifically tasked with overseeing these critical areas. This structure highlights the company's acknowledgment of its environmental stewardship responsibilities.

While specific quantitative data on Akebia's environmental performance isn't detailed, the increasing stakeholder demand for transparent environmental reporting means companies like Akebia are expected to provide such disclosures. For instance, in 2023, the S&P 500 ESG Index saw a notable increase in constituent companies reporting on climate-related risks and opportunities, reflecting this growing trend.

- ESG Oversight: Akebia's Nominating and Corporate Governance Committee actively monitors ESG matters, including environmental responsibilities.

- Stakeholder Expectations: Public reporting on environmental performance is becoming a standard expectation from investors and other stakeholders.

- Industry Trend: Many companies are enhancing their environmental disclosures to meet evolving market demands and regulatory pressures.

Environmental factors significantly influence Akebia's operations, particularly concerning its manufacturing processes and supply chain resilience. The biopharmaceutical industry faces increasing pressure to adopt sustainable practices, including waste reduction and efficient energy use, with many companies setting ambitious carbon footprint targets for 2030.

Regulatory compliance regarding biopharmaceutical waste disposal is critical, as non-adherence can result in substantial fines. Furthermore, climate change poses risks to supply chains through extreme weather events, impacting raw material sourcing and product delivery, making climate risk assessment a priority for business continuity.

Water scarcity is another key environmental challenge, as biopharmaceutical manufacturing is water-intensive. Companies like Akebia must implement efficient water usage strategies and consider the environmental impact of wastewater discharge, especially given that over 2 billion people live in water-stressed regions as of 2023.

Akebia's commitment to ESG principles, overseen by its Nominating and Corporate Governance Committee, reflects the growing stakeholder demand for transparent environmental reporting. This trend is evident with a notable increase in S&P 500 companies reporting on climate-related risks and opportunities in 2023.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Akebia is built on comprehensive data from leading healthcare industry reports, regulatory filings from agencies like the FDA and EMA, and economic indicators from reputable financial institutions. This ensures a thorough understanding of the external factors influencing the company's operations and strategy.