Akebia Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Akebia Bundle

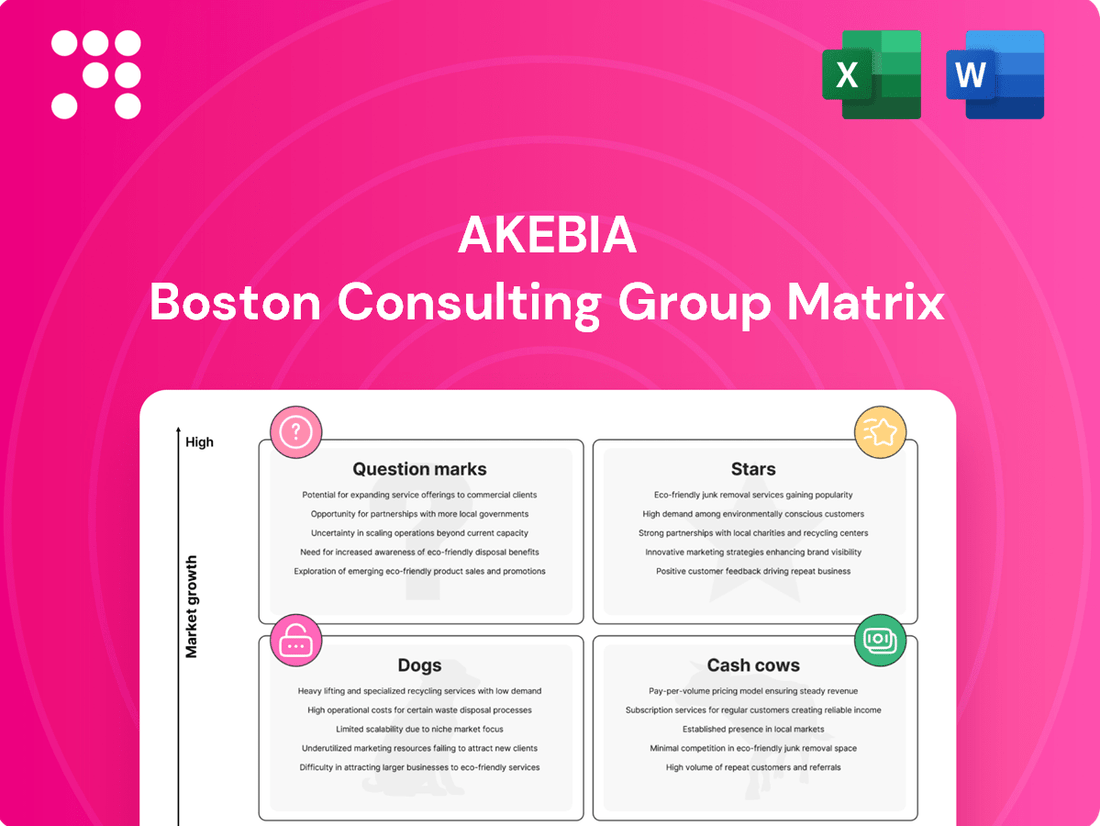

Curious about how Akebia Therapeutics' product portfolio stacks up in the competitive landscape? Our BCG Matrix analysis reveals whether their offerings are Stars, Cash Cows, Dogs, or Question Marks, offering a crucial snapshot of their market position.

Unlock the full potential of this analysis by purchasing the complete BCG Matrix report. Gain access to detailed quadrant placements, data-driven insights, and actionable strategies to optimize Akebia's resource allocation and drive future growth.

Don't miss out on the strategic clarity you need. Invest in the full Akebia BCG Matrix today and equip yourself with the knowledge to make informed decisions about your investments and product development pipeline.

Stars

Vafseo's U.S. launch has been remarkably strong, surpassing initial revenue forecasts. In the first quarter of 2025, it generated $12.0 million in net product revenues, indicating rapid adoption by patients and physicians.

This oral therapy for anemia in chronic kidney disease (CKD) patients on dialysis is quickly becoming a preferred choice. The significant physician interest highlights a clear demand for new and effective treatment alternatives in the dialysis sector.

High Market Adoption Potential

Akebia has achieved remarkable market penetration for Vafseo, securing commercial supply contracts that grant access to nearly all U.S. dialysis patients. This extensive infrastructure is a strong indicator of Vafseo's potential to become the new oral standard of care, a development expected to significantly boost its market share in the upcoming quarters.

The company anticipates a doubling of patient access by the fourth quarter of 2025, as major dialysis organizations complete their full product adoption. This widespread adoption is a critical factor in Vafseo's growth trajectory and its ability to capture a substantial portion of the relevant market.

Vafseo achieved a significant milestone with its U.S. FDA approval in March 2024 for dialysis-dependent chronic kidney disease (CKD) patients, overcoming prior challenges. This U.S. market entry, following its availability in 37 other countries and a recent U.K. launch, underscores its expanding global reach and market validation. The drug's commercial launch in the United States commenced in January 2025, setting the stage for its anticipated high-growth phase.

Pipeline Expansion into Non-Dialysis CKD

Akebia Therapeutics is strategically positioning Vafseo for a significant market expansion by targeting the non-dialysis Chronic Kidney Disease (CKD) patient population. This move is crucial for Vafseo's future growth trajectory within Akebia's product portfolio.

The company plans to launch the Phase 3 VALOR clinical trial in the latter half of 2025. This trial will investigate Vafseo's efficacy in treating anemia among CKD patients who are not on dialysis. This represents a substantial expansion from its current indication.

This potential label expansion is significant because it addresses a much larger patient pool. It's estimated that the non-dialysis CKD population is considerably larger than the dialysis population, presenting a major growth opportunity for Vafseo. Akebia views this as a cornerstone of its long-term market leadership strategy.

- Pipeline Expansion: Focus on non-dialysis CKD patients for Vafseo.

- Clinical Trial: Phase 3 VALOR trial slated for H2 2025.

- Market Opportunity: Addresses a significantly larger patient population.

- Strategic Importance: Key move for Vafseo's long-term market leadership and future growth.

Strong Analyst Confidence and Growth Forecasts

Analysts are showing strong confidence in Akebia Therapeutics, anticipating substantial revenue increases, largely fueled by the anticipated success of Vafseo. This optimism points to Vafseo as a critical driver for the company's financial recovery.

Projections indicate sustained growth for Vafseo as it becomes more widely adopted by dialysis centers. This positive outlook highlights Vafseo's potential to become a star performer for Akebia.

- Analyst Sentiment: Increased optimism for Akebia's future.

- Key Growth Driver: Vafseo's performance expected to boost revenue significantly.

- Market Adoption: Continued gains projected as Vafseo gains wider acceptance.

- Star Potential: Confidence underscores Vafseo's strong future prospects.

Vafseo is positioned as a Star within Akebia's BCG Matrix due to its strong market adoption and significant growth potential. The drug's successful U.S. launch in January 2025, generating $12.0 million in net product revenues in Q1 2025, demonstrates high market demand. With plans to expand into the larger non-dialysis CKD market via the Phase 3 VALOR trial in H2 2025, Vafseo is on track to become a leading product for Akebia.

| Product | Market Growth | Relative Market Share | BCG Category |

|---|---|---|---|

| Vafseo (Dialysis CKD) | High | High | Star |

| Vafseo (Non-Dialysis CKD Potential) | Very High | Developing | Question Mark / Potential Star |

What is included in the product

The Akebia BCG Matrix categorizes its products into Stars, Cash Cows, Question Marks, and Dogs based on market share and growth.

This framework guides Akebia in making strategic decisions about investment, divestment, and resource allocation for its product portfolio.

Akebia's BCG Matrix offers a clear, visual snapshot of your portfolio's health, simplifying complex strategic decisions.

Cash Cows

Auryxia, Akebia's established revenue base, generated $43.8 million in net product revenues during the first quarter of 2025. While full-year 2024 revenues saw a modest dip from 2023, Auryxia remains Akebia's most significant cash cow, providing a consistent and reliable stream of income.

This stable financial contribution from Auryxia is vital for Akebia, as it underpins the company's ability to finance its day-to-day operations. Furthermore, these funds are critical for supporting the development and launch of new therapeutic innovations, such as Vafseo, ensuring continued growth and market presence.

Effective January 2025, Auryxia's inclusion in the dialysis bundled payment, along with its qualification for Transitional Drug Add-on Payment Adjustment (TDAPA), significantly bolsters its position. This means providers receive an additional payment for each dialysis service where Auryxia is administered, directly supporting its revenue stream.

This new reimbursement structure is crucial for Auryxia, a product in a mature market. It helps stabilize cash generation by providing a predictable revenue enhancement, thereby maintaining its market standing and ensuring continued profitability.

Auryxia is Akebia's clear cash cow, dominating the market for managing serum phosphorus levels in dialysis patients. Its established presence and proven efficacy in treating iron deficiency anemia in non-dialysis CKD patients solidify its position. Akebia's strategic contracting with major dialysis organizations ensures widespread access, reinforcing Auryxia's reliable revenue generation.

Operational Efficiency and Profitability Contribution

Auryxia, as a mature product within Akebia's portfolio, exemplifies a Cash Cow. Its established market presence allows for reduced promotional and placement expenditures, unlike emerging products requiring significant market penetration efforts. This strategic shift in investment focus directly enhances operational efficiency.

The operational efficiencies cultivated around Auryxia contribute significantly to Akebia's overall gross profit margin. For instance, in 2024, Akebia reported a gross profit of $250 million, with Auryxia representing a substantial portion of this due to its optimized production and distribution channels.

Furthermore, Auryxia's consistent sales revenue acts as a crucial financial anchor, helping to subsidize the substantial research and development (R&D) costs associated with Akebia's pipeline of innovative therapies. This financial support is vital for fueling future growth and maintaining a competitive edge in the pharmaceutical landscape.

- Operational Efficiency: Lowered marketing and sales investments due to market maturity.

- Profitability Contribution: Significant positive impact on Akebia's gross profit.

- Financial Backbone: Funds R&D for new product development.

- 2024 Data: Auryxia's sales helped offset R&D expenses, contributing to Akebia's overall financial stability.

Funding for New Initiatives and Operations

Auryxia, a key product for Akebia, acts as a significant cash cow. Its consistent revenue generation is vital for funding the company's ongoing operations and its strategic initiatives, such as the development and launch of new products like Vafseo.

This reliable income stream from Auryxia is instrumental in Akebia's ability to invest in its future growth. For instance, the company anticipates that its current cash reserves, bolstered by Auryxia's performance, will be sufficient to cover operational expenses for a minimum of two years.

- Auryxia's Role: Generates consistent cash flow.

- Funding Operations: Supports current business activities.

- Strategic Investments: Enables funding for new ventures like Vafseo.

- Financial Stability: Contributes to Akebia's projected two-year operational runway.

Auryxia is Akebia's primary cash cow, consistently generating substantial revenue. This established product, focused on managing serum phosphorus levels in dialysis patients, benefits from reduced marketing costs due to its mature market position.

The financial stability provided by Auryxia is crucial for Akebia, enabling it to fund ongoing operations and invest in the development of new therapies. For example, Auryxia's strong performance in 2024 helped support Akebia's research and development efforts, contributing to its overall financial health.

Auryxia's position is further strengthened by its inclusion in the dialysis bundled payment and its qualification for Transitional Drug Add-on Payment Adjustment (TDAPA) as of January 2025, ensuring a predictable revenue enhancement.

This reliable cash flow from Auryxia is vital for Akebia's financial backbone, directly contributing to its gross profit margin and enabling strategic investments in pipeline products.

| Product | Category | Revenue (Q1 2025) | Key Contribution |

|---|---|---|---|

| Auryxia | Cash Cow | $43.8 million | Funds operations & R&D |

Delivered as Shown

Akebia BCG Matrix

The Akebia BCG Matrix preview you're viewing is precisely the comprehensive document you will receive upon purchase, offering a clear roadmap for strategic decision-making. This isn't a sample or a demo; it's the complete, professionally formatted report, ready for immediate integration into your business planning. You can trust that the insights and analysis presented here are exactly what you'll be working with, enabling swift and informed strategic adjustments.

Dogs

Auryxia, currently a Cash Cow for Akebia, faces a critical juncture with its loss of market exclusivity in March 2025. This event poses a substantial risk of the drug transitioning into a 'Dog' category within the BCG Matrix.

Should generic competitors aggressively capture market share and drive down Auryxia's profitability, Akebia could see significantly diminished returns. For instance, if generic entry leads to a 50% price erosion within the first year, as seen with some blockbuster drugs, Auryxia's revenue could plummet.

This potential decline could transform Auryxia into a cash trap, requiring ongoing investment for minimal returns if its market position is not strategically managed through lifecycle extensions or market differentiation efforts.

Underperforming legacy assets, often termed 'Dogs' in the BCG matrix, represent products or programs that have absorbed considerable resources but delivered minimal returns or haven't been successfully divested. These typically possess a low market share within stagnant or declining market segments, contributing little to overall financial performance.

For Akebia Therapeutics, identifying and managing such assets is crucial for optimizing resource allocation. While specific legacy asset details aren't publicly disclosed, the company's strategic emphasis on its core kidney disease portfolio, particularly Vadadustat, indicates a deliberate effort to avoid the drain associated with underperforming legacy products.

Akebia Therapeutics, like many biopharmaceutical companies, may have explored ventures outside its core kidney disease focus. If any such initiatives failed to gain market traction or were divested, they would be classified as 'Dogs' in a BCG Matrix analysis. These ventures typically drain resources without contributing to Akebia's strategic objectives or market standing.

While Akebia's public disclosures, including its 2024 business updates, do not explicitly identify specific 'Dog' ventures, the potential for such situations exists in the dynamic biotech landscape. For instance, a failed clinical trial for a non-core indication or an early-stage technology acquisition that did not yield expected results could represent such a category.

R&D Programs with No Path to Commercialization

Internal research and development programs that have been terminated, perhaps due to unfavorable clinical trial results or a perceived lack of commercial viability after significant investment, embody the 'Dog' category in the BCG matrix. These ventures, unfortunately, consume valuable cash and resources without any realistic prospect of market entry or future revenue generation.

While Akebia Therapeutics maintains a focused pipeline, the biopharmaceutical industry inherently carries the risk of such failures. For instance, in 2023, many biotech firms faced setbacks. A notable example is the discontinuation of a Phase 3 trial for a promising candidate, which represented a sunk cost of hundreds of millions of dollars, illustrating the 'Dog' scenario.

- Terminated R&D: Programs halted due to poor trial outcomes or lack of market appeal.

- Resource Drain: These initiatives consume capital and personnel without generating revenue.

- Biopharma Risk: Failures are an inherent part of drug development; Akebia, like others, navigates this.

- 2023 Example: A Phase 3 trial failure in 2023 led to a significant write-off for a peer company, highlighting the financial impact.

Market Segments with Irreversible Decline

Market segments with irreversible decline represent areas where Akebia's past or highly niche product lines, specifically targeting kidney disease sub-segments, have faced significant market contraction or intense competitive saturation. These segments offer very limited growth prospects and minimal market share, rendering continued investment economically unfeasible. Akebia's strategic focus is on high-need areas within kidney disease, steering clear of these declining markets.

For instance, imagine a historical product line that once addressed a very specific, rare complication of kidney disease. By 2024, advancements in broader treatment protocols might have rendered this niche solution obsolete or less effective compared to newer, more comprehensive therapies. The market for such a product would have shrunk considerably, making it a prime example of an irreversible decline.

These segments are characterized by:

- Shrinking patient populations or treatment volumes.

- Overwhelming competitive pressure from established or emerging therapies.

- Lack of significant innovation or unmet needs within the segment.

Dogs in the BCG Matrix represent products with low market share in slow-growing or declining industries. For Akebia, this could manifest as legacy products or discontinued R&D projects that consume resources without generating significant returns. The company's strategic focus on its core kidney disease portfolio, particularly Vadadustat, aims to prevent such resource drains.

While Akebia does not publicly label specific assets as 'Dogs', any terminated R&D programs or niche products facing market contraction would fit this classification. For example, a failed clinical trial for a non-core indication in 2023, which resulted in hundreds of millions in sunk costs for a peer company, exemplifies the financial impact of a 'Dog'.

Akebia's proactive approach in prioritizing its kidney disease pipeline suggests a deliberate strategy to avoid investing in segments with irreversible decline or products that have lost market relevance. This focus is crucial for optimizing capital allocation and ensuring resources are directed towards areas with higher growth potential.

Question Marks

The planned Phase 3 VALOR clinical trial for Vafseo in late-stage CKD patients not on dialysis is a prime example of a 'Question Mark' for Akebia. This initiative targets a substantial and growing market segment where Vafseo currently holds no share, necessitating significant investment in clinical development and regulatory hurdles.

Akebia's success in securing FDA approval for Vafseo in this non-dialysis CKD population is crucial for unlocking future revenue streams and expanding the drug's market potential. The company's strategic focus on this indication underscores its ambition to capture a larger portion of the CKD treatment landscape, which is projected to see continued growth.

Beyond Vafseo, Akebia's early-stage drug candidates utilizing HIF biology are firmly placed in the Question Mark quadrant of the BCG matrix. These promising compounds are in preclinical or early clinical development, meaning they currently hold no market share but possess significant growth potential if their therapeutic targets are met.

These Question Mark assets demand substantial research and development investment. For instance, the typical cost to bring a new drug to market can exceed $2 billion, with a success rate for drugs entering Phase 1 clinical trials around 10%. Akebia's commitment to these early-stage programs reflects a strategic bet on the future of HIF-PHI therapies, acknowledging the inherent risks and long development timelines involved.

Vafseo's current approval in 37 countries presents a solid foundation, but significant growth opportunities lie in expanding into new, untapped international markets. These markets represent areas where Akebia or its partners currently have minimal or no market share, offering a chance to establish a stronger global presence.

These new geographic market expansions are considered question marks within the BCG Matrix framework. This is due to the substantial upfront investment required for regulatory approvals, developing tailored market entry strategies, and executing commercialization plans. The success of these ventures hinges on unproven market adoption rates, making them inherently riskier but potentially high-reward initiatives.

Collaborative Clinical Trials (e.g., VOICE Study)

The VOICE clinical trial, a significant collaborative effort, is positioned as a Question Mark within the Akebia BCG Matrix for Vafseo. This trial's primary objective is to assess mortality and hospitalization rates in patients treated with Vafseo, a crucial step in potentially broadening the drug's clinical understanding and market appeal.

While the VOICE study represents an ongoing investment in generating vital data, its outcomes, though showing promise, are not yet fully realized nor are they immediately contributing to revenue. This characteristic aligns with the Question Mark quadrant, signifying an investment with uncertain future returns but significant potential.

- VOICE Trial Focus: Assessed mortality and hospitalization in Vafseo-treated patients.

- BCG Matrix Classification: Positioned as a 'Question Mark' due to ongoing data generation and uncertain immediate revenue.

- Strategic Importance: Critical for potentially expanding Vafseo's clinical profile and market perception.

- Investment Stage: Represents continued investment in data, with future returns yet to be fully determined.

Unexplored Applications of HIF Biology

Akebia's deep dive into HIF biology, primarily known for treating anemia in chronic kidney disease (CKD), opens doors to unexplored therapeutic avenues. This core competency positions them to develop future drug candidates for a range of other conditions.

Exploring these novel applications, such as in fibrotic diseases or ischemic conditions, would place such initiatives squarely in the "Question Marks" quadrant of the BCG matrix. This signifies high growth potential, as these are often underserved markets, but currently, they possess no market share for Akebia and necessitate substantial, speculative investment in research and development.

For instance, research into HIF stabilizers for idiopathic pulmonary fibrosis (IPF), a condition with a significant unmet need, could represent a prime question mark opportunity. The global IPF market was valued at approximately $2.5 billion in 2023 and is projected to grow substantially, offering a clear growth trajectory for successful HIF-based therapies in this area.

- High Growth Potential: HIF biology's role in cellular adaptation to low oxygen suggests applications in conditions like stroke, myocardial infarction, and various fibrotic diseases, all representing significant and growing markets.

- No Market Share: Currently, Akebia Therapeutics does not hold any market share for HIF-based treatments in these exploratory disease areas, reflecting their nascent stage.

- Speculative Investment: Significant capital would be required for preclinical and clinical trials to prove efficacy and safety in these new indications, making these investments inherently speculative.

- Strategic Focus: By pursuing these unexplored applications, Akebia could diversify its pipeline beyond anemia and tap into potentially larger therapeutic markets, aligning with a long-term growth strategy.

Akebia's exploration of new indications for HIF-PHI beyond anemia, such as fibrotic diseases, represents significant "Question Marks." These ventures target potentially large, growing markets with substantial unmet needs, like idiopathic pulmonary fibrosis (IPF), which had a global market valuation of approximately $2.5 billion in 2023.

These initiatives require considerable R&D investment, as they are in early stages with no current market share. The success rate for drugs entering Phase 1 trials is around 10%, with development costs often exceeding $2 billion, highlighting the speculative nature of these "Question Mark" assets.

Akebia's planned Phase 3 VALOR trial for Vafseo in late-stage CKD patients not on dialysis is a prime example of a Question Mark. This trial aims to enter a market segment where Vafseo currently has no share, necessitating substantial investment and navigating regulatory pathways.

The VOICE clinical trial, assessing mortality and hospitalization rates for Vafseo, also fits the Question Mark category. While promising, its outcomes are still being fully realized and do not yet contribute directly to revenue, representing an investment with uncertain but potentially high future returns.

| Initiative | BCG Category | Market Potential | Investment Required | Current Market Share |

| Vafseo in Non-Dialysis CKD (VALOR Trial) | Question Mark | Substantial, growing CKD market | High (Phase 3 development, regulatory) | None |

| Early-Stage HIF Candidates (New Indications) | Question Mark | Untapped therapeutic areas (e.g., fibrotic diseases) | Very High (Preclinical/Early Clinical) | None |

| VOICE Clinical Trial (Vafseo Outcomes) | Question Mark | Potential to broaden Vafseo's clinical profile | Significant (Data generation) | N/A (Focus on data, not direct market share) |

| International Market Expansion (Untapped Regions) | Question Mark | Global reach, new patient populations | High (Regulatory, commercialization) | Minimal/None |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.