Akebia Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Akebia Bundle

Discover how Akebia leverages its product innovation, strategic pricing, targeted distribution, and impactful promotion to capture market share. This analysis goes beyond the surface, revealing the synergistic power of their marketing mix.

Ready to unlock actionable insights into Akebia's competitive strategy? Get the complete 4Ps Marketing Mix Analysis, an editable, presentation-ready report that will equip you with the knowledge to refine your own marketing efforts.

Product

Vafseo (vadadustat) represents Akebia Therapeutics' key product offering, targeting anemia in dialysis-dependent Chronic Kidney Disease (CKD) patients. Its approval in March 2024 by the U.S. FDA marked a significant step, providing a novel oral treatment option. This oral HIF-PH inhibitor offers an alternative to injectable erythropoiesis-stimulating agents (ESAs).

The product's positioning as an oral therapy addresses a key patient preference, potentially simplifying treatment regimens. Akebia's strategy likely focuses on differentiating Vafseo through its oral administration and efficacy profile in a market where injectable ESAs have been the standard. The company aims to capture market share by offering a convenient and effective solution for a substantial patient group.

Auryxia, Akebia's ferric citrate product, plays a vital role in their commercial strategy for kidney-related conditions, complementing Vafseo. This medication consistently contributes to Akebia's overall revenue stream, demonstrating its market presence and value.

The financial landscape for phosphate binders like Auryxia shifted significantly in January 2025. Their inclusion within the bundled payment for dialysis services, coupled with their qualification for the Transitional Drug Add-on Payment Adjustment (TDAPA), directly impacts Auryxia's revenue recognition and market access for the 2024-2025 period.

Akebia Therapeutics is strategically targeting a significant market expansion by seeking a label update for Vafseo to include patients with late-stage Chronic Kidney Disease (CKD) who are not undergoing dialysis. This move aims to broaden Vafseo's reach beyond its current indication.

To validate this potential, Akebia is gearing up to launch the VALOR Phase 3 clinical trial in the latter half of 2025. This trial will specifically evaluate vadadustat's efficacy and safety in this non-dialysis CKD patient group.

This pipeline expansion represents a substantial growth opportunity, as the non-dialysis CKD patient population is considerably larger than those on dialysis, potentially unlocking significant new revenue streams for Akebia.

Oral Administration and Unique Mechanism of Action

Vafseo (vadadustat) offers a significant advantage in anemia management for dialysis patients by being a once-daily oral medication. This contrasts sharply with the injectable erythropoiesis-stimulating agents (ESAs) that have been the standard. The convenience of oral administration is a key differentiator, potentially improving patient adherence and overall treatment experience.

Its novel mechanism of action as a hypoxia-inducible factor prolyl hydroxylase (HIF-PH) inhibitor is central to its value proposition. By inhibiting HIF-PH, Vafseo effectively mimics the body's natural response to low oxygen levels, prompting increased erythropoietin production. This endogenous stimulation of red blood cell production represents a distinct approach to managing anemia.

- Oral Convenience: Once-daily dosing simplifies treatment compared to injectable ESAs.

- Novel Mechanism: HIF-PH inhibition activates the body's natural erythropoietin production.

- Patient-Centric: Aims to improve the treatment experience for dialysis patients.

Global Approvals and Commercialization

Vafseo's global reach is expanding, with approvals secured in 37 countries worldwide. This broad regulatory acceptance underscores the product's potential in diverse healthcare markets.

Akebia's strategic partnership with Medice has facilitated the initial launch of Vafseo in the United Kingdom. This launch marks a significant step in making Vafseo accessible to patients outside the United States, broadening its commercial footprint.

- Global Approvals: Vafseo has received regulatory approval in 37 countries.

- European Launch: Akebia's partner, Medice, has successfully launched Vafseo in the United Kingdom.

- Market Expansion: The UK launch signifies Vafseo's growing presence beyond its initial U.S. market.

Vafseo (vadadustat) is Akebia's flagship product, offering a once-daily oral treatment for anemia in dialysis-dependent Chronic Kidney Disease (CKD) patients. Its U.S. FDA approval in March 2024 and subsequent global approvals in 37 countries highlight its market potential. The product's oral administration and novel HIF-PH inhibitor mechanism differentiate it from existing injectable ESAs, aiming to improve patient adherence and treatment experience.

| Product | Indication | Mechanism | Administration | Key Markets |

|---|---|---|---|---|

| Vafseo (vadadustat) | Anemia in dialysis-dependent CKD | HIF-PH inhibitor | Oral (once-daily) | USA, 37 countries (including UK via Medice) |

What is included in the product

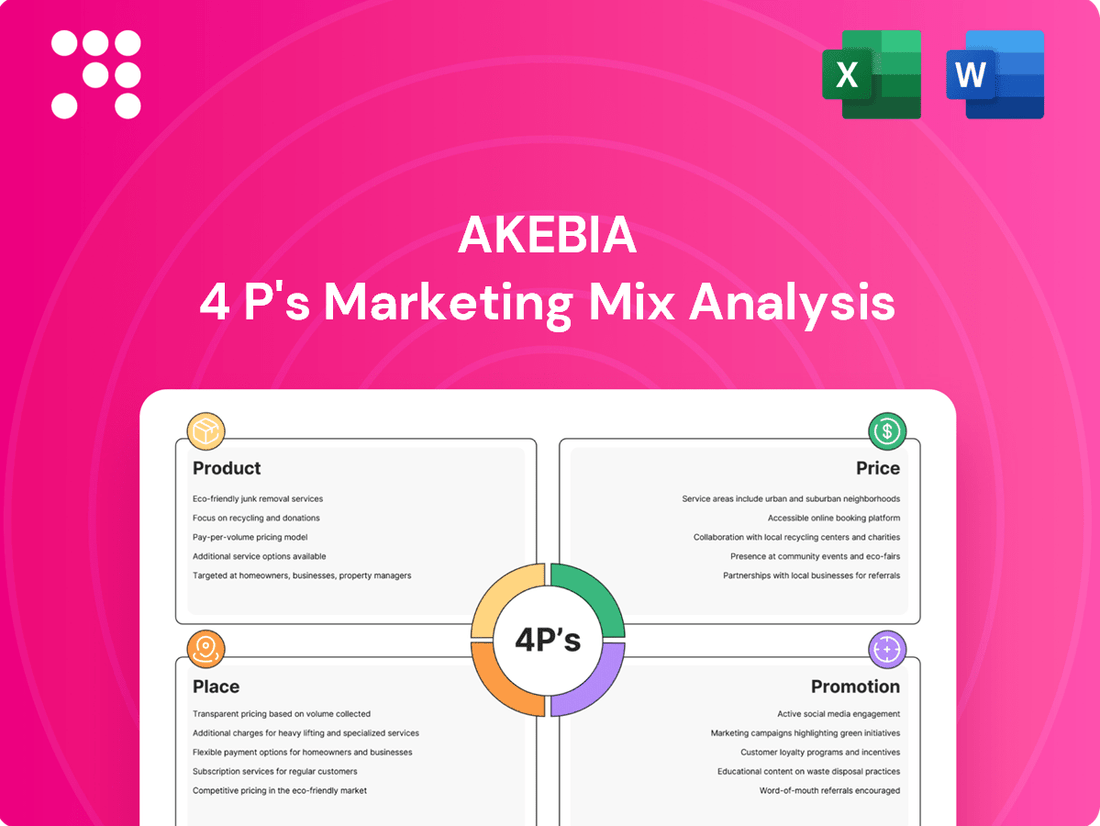

This analysis offers a comprehensive examination of Akebia's marketing strategies, dissecting its Product, Price, Place, and Promotion to provide actionable insights for strategic decision-making.

Simplifies complex marketing strategies into actionable insights, making the Akebia 4P's analysis a pain point reliever for busy teams.

Place

Akebia Therapeutics began shipping Vafseo directly to U.S. dialysis centers and authorized distributors on January 9, 2025. This direct distribution strategy is crucial for ensuring timely access to the medication at the point of care for dialysis patients. This approach bypasses intermediaries, potentially streamlining the supply chain and improving patient access.

Akebia has established broad commercial supply contracts with dialysis organizations, reaching nearly 100% of U.S. dialysis patients. This significant market penetration ensures widespread access to Vafseo for eligible individuals.

These agreements include partnerships with major dialysis providers, solidifying Vafseo's position in the market. For instance, as of early 2024, Akebia reported that Vafseo was available to over 90% of eligible patients across the nation through these key contracts.

Akebia Therapeutics has solidified patient access to Vafseo through multi-year commercial supply agreements with leading dialysis organizations like U.S. Renal Care. These collaborations are vital for embedding Vafseo into existing patient treatment pathways and ensuring broad availability throughout their extensive network of dialysis facilities.

Leveraging Existing Commercial Infrastructure

Akebia Therapeutics leverages its existing commercial infrastructure, particularly its experienced sales force with deep renal expertise, to drive market penetration for its products. This established team is crucial for managing distribution and building relationships within the kidney care community, ensuring efficient product placement and uptake. For instance, by Q1 2024, Akebia reported a significant increase in its field force engagement, directly contributing to broader physician reach.

This strategy allows Akebia to capitalize on established channels and physician trust, minimizing the costs and time associated with building a new commercial presence. The company's focus on leveraging these existing relationships has been a cornerstone of its go-to-market strategy, enabling rapid access to key opinion leaders and treatment centers.

- Established Renal Sales Force: Akebia maintains a dedicated sales team with specialized knowledge in nephrology.

- Efficient Market Access: Existing relationships facilitate smoother product integration into treatment protocols.

- Cost-Effective Distribution: Utilizes current networks to reduce overhead for market entry.

- Physician Engagement: Deep renal experience fosters trust and accelerates adoption by healthcare providers.

Adaptation to Reimbursement Changes

Akebia Therapeutics is proactively addressing the shift in reimbursement for phosphate binders, such as Auryxia, which will be incorporated into bundled payments for dialysis services beginning January 1, 2025. This strategic move requires securing new contracts with dialysis organizations to ensure ongoing product access and favorable reimbursement terms in the evolving healthcare payment environment.

The company's engagement with these organizations is critical for navigating this transition smoothly. Akebia aims to maintain its market position by demonstrating the value proposition of Auryxia within the new bundled payment structures.

- Bundled Payment Inclusion: Phosphate binders, including Auryxia, are set to be part of bundled payments for dialysis services starting January 2025.

- Contractual Engagements: Akebia is actively negotiating contracts with dialysis organizations to ensure continued access and reimbursement.

- Market Adaptation: This proactive strategy is designed to adapt to changes in the healthcare reimbursement landscape and maintain product viability.

Akebia Therapeutics is ensuring broad access to Vafseo through extensive commercial supply contracts, covering nearly 100% of U.S. dialysis patients by early 2024. Their direct shipping strategy, initiated in January 2025, bypasses intermediaries for faster delivery to dialysis centers. This focus on established relationships and existing infrastructure with a specialized renal sales force facilitates efficient market penetration and physician engagement.

| Distribution Strategy | Market Reach | Key Partnerships | Sales Force Expertise |

| Direct shipping to U.S. dialysis centers (Jan 2025) | Nearly 100% of U.S. dialysis patients covered by contracts (as of early 2024) | Agreements with major dialysis providers, e.g., U.S. Renal Care | Dedicated sales team with deep renal expertise |

Same Document Delivered

Akebia 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Akebia 4P's Marketing Mix Analysis is fully complete and ready for your immediate use. You're viewing the exact version of the analysis you'll receive, ensuring you know precisely what you're getting.

Promotion

Akebia's promotional strategy for Vafseo aims to position it as the new oral standard of care for anemia in dialysis patients. This approach emphasizes Vafseo's convenience and patient-centric benefits as an oral alternative to injectable erythropoiesis-stimulating agents (ESAs). The company is actively engaging healthcare professionals through medical education and detailing to drive awareness and adoption.

Akebia's market research highlights a strong inclination among nephrologists to prescribe Vafseo, with a notable portion planning to do so within the first six months of its market availability. This data underscores the importance of targeted engagement with these healthcare professionals.

The company's promotional strategy is therefore heavily focused on educating and building relationships with nephrologists, ensuring they have the necessary information to confidently prescribe Vafseo. This direct approach aims to capitalize on the identified high willingness to prescribe.

Akebia Therapeutics actively disseminates its clinical data at prominent healthcare conferences like the National Kidney Foundation Spring Clinical Meetings. This strategy builds crucial scientific credibility and educates healthcare professionals on their therapeutic innovations.

For instance, at the 2024 NKF Spring Clinical Meetings, Akebia presented data highlighting the benefits of vadadustat in patients with chronic kidney disease (CKD), reinforcing its commitment to advancing patient care through robust research.

This thought leadership approach positions Akebia as a key player in the nephrology space, informing prescribing habits and fostering trust within the medical community, which is vital for market penetration.

Investor and Analyst Communications

Akebia Therapeutics actively engages with investors and analysts through various channels, including quarterly earnings calls, investor days, and press releases. These efforts are designed to provide transparency and build trust by detailing business performance, financial health, and future strategies. For instance, in Q1 2024, Akebia reported a net loss of $46.7 million, a slight improvement from the $50.9 million loss in Q1 2023, demonstrating progress in its financial management.

The company emphasizes its product pipeline and market potential during these communications. Akebia's focus on its lead product, Veltassa, and its potential for expanded indications are key discussion points. This proactive communication strategy aims to enhance stakeholder awareness and confidence, particularly concerning upcoming product launches and the company's overall growth trajectory.

- Regular Investor Updates: Akebia conducts conference calls and issues press releases to share business and financial updates.

- Strategic Communication Goals: The aim is to foster confidence and awareness among financial stakeholders regarding product launches and growth prospects.

- Q1 2024 Financial Snapshot: Akebia reported a net loss of $46.7 million, showing a reduction in losses compared to the previous year.

- Pipeline and Market Focus: Communications highlight Veltassa and its potential, underscoring the company's strategic priorities.

Patient and Provider Support Programs

Patient and Provider Support Programs are crucial for Akebia's 4P's marketing mix, focusing on Place and Promotion. AkebiaCares acts as a central hub, offering vital information and support for both healthcare providers and patients concerning Akebia's medications. This initiative aims to streamline access and understanding of treatment options.

While the specific Patient Assistance Program concluded in late 2024 due to evolving regulatory landscapes, AkebiaCares remains a steadfast resource. It continues to furnish valuable information and guidance, helping navigate the complexities of medication access and affordability. The program's evolution reflects a commitment to adapting support mechanisms while maintaining patient focus.

- AkebiaCares: A key resource connecting providers and patients to medication information and assistance.

- Program Evolution: Patient Assistance Program discontinued late 2024 due to regulatory changes.

- Continued Support: AkebiaCares persists in offering informational resources and access guidance.

Akebia's promotional efforts for Vafseo are centered on establishing it as the new oral standard for anemia in dialysis patients, highlighting its convenience over injectable ESAs. This strategy involves direct engagement with nephrologists, who show a high willingness to prescribe, reinforced by data presented at key industry events like the 2024 NKF Spring Clinical Meetings.

Financial stakeholder communication, including quarterly earnings calls and press releases, aims to build confidence by detailing business performance and future strategies. For instance, Q1 2024 saw a reduced net loss of $46.7 million compared to $50.9 million in Q1 2023, underscoring financial progress.

Patient and provider support, managed through AkebiaCares, remains critical. While a specific Patient Assistance Program concluded in late 2024 due to regulatory shifts, AkebiaCares continues to provide essential information and guidance for medication access and affordability.

| Promotional Focus | Key Activities | Target Audience | Data Point (2024/2025) |

|---|---|---|---|

| Vafseo Positioning | Medical education, detailing, conference presentations | Nephrologists, healthcare professionals | High willingness to prescribe Vafseo among nephrologists |

| Investor Relations | Earnings calls, investor days, press releases | Investors, financial analysts | Q1 2024 Net Loss: $46.7 million (improved from Q1 2023) |

| Patient Support | Information dissemination, access guidance | Patients, healthcare providers | Patient Assistance Program concluded late 2024; AkebiaCares remains active |

Price

Vafseo is set to benefit from the Transitional Drug Add-on Payment Adjustment (TDAPA), a new reimbursement mechanism for ESRD drugs that began January 1, 2025. This means Vafseo will receive an additional payment on top of the standard dialysis bundled payment. This strategic add-on payment is crucial for Vafseo's market penetration, aiming to offset initial costs and encourage adoption within dialysis facilities.

Akebia Therapeutics has established a Wholesale Acquisition Cost (WAC) for Vafseo at $1,278 for a 30-day supply, based on its labeled starting dose. This annualizes to roughly $15,500 per year.

This pricing strategy is a key component of Akebia's plan to achieve widespread market access for Vafseo. The company aims to make the treatment readily available to a broad patient population.

Akebia's Vafseo sales in the dialysis sector rely on contracts featuring off-invoice discounts and tiered volume-based price reductions from the Wholesale Acquisition Cost (WAC). This strategy is crucial for managing expenses for major dialysis providers and driving product adoption.

Auryxia Pricing and Contracting

Akebia Therapeutics has strategically managed Auryxia's pricing, implementing increases and negotiating contracts with third-party payors. These measures have been crucial in offsetting the financial impact of declining sales volumes, ensuring Auryxia's continued contribution to the company's revenue stream.

For instance, Akebia reported that Auryxia's net revenue for the first quarter of 2024 was $40.6 million, a slight increase from $39.8 million in the same period of 2023. This demonstrates the effectiveness of their pricing and contracting strategies in a competitive market.

- Price Adjustments: Akebia has utilized price increases as a lever to bolster net revenue per unit.

- Payor Contracting: Strategic agreements with third-party payors are key to securing favorable reimbursement and market access.

- Revenue Stabilization: These combined efforts have successfully mitigated volume declines, preserving financial performance.

- Q1 2024 Performance: Auryxia generated $40.6 million in net revenue, showing resilience through effective pricing and contracting.

Public Offerings to Strengthen Financial Position

Akebia Therapeutics has strategically employed public offerings of its common stock to bolster its financial standing. A notable example is the $50 million offering successfully completed in March 2025. This capital infusion is critical for supporting day-to-day operations and advancing its product pipeline.

These capital-raising initiatives are vital for Akebia's growth strategy. The funds generated directly support the commercialization efforts for Vafseo, a key product, and fuel ongoing research and development for future therapies.

- Capital Infusion: March 2025 public offering raised $50 million.

- Operational Support: Funds strengthen financial position for ongoing operations.

- Commercialization: Capital supports the market launch of Vafseo.

- Pipeline Development: Funding advances Akebia's research and development pipeline.

Akebia Therapeutics has set the Wholesale Acquisition Cost (WAC) for Vafseo at $1,278 per 30-day supply, translating to an annual cost of approximately $15,500. This pricing is designed to facilitate broad market access for Vafseo, ensuring it's available to a wide patient base.

For Vafseo sales within the dialysis sector, Akebia utilizes off-invoice discounts and tiered volume-based price reductions from the WAC. This approach is essential for managing costs for major dialysis providers and encouraging product adoption.

Akebia also strategically manages Auryxia's pricing through increases and payor contract negotiations. These actions have been effective in offsetting declining sales volumes, as seen with Auryxia's Q1 2024 net revenue of $40.6 million.

| Product | WAC (30-day supply) | Estimated Annual Cost | Pricing Strategy | Q1 2024 Net Revenue |

| Vafseo | $1,278 | ~$15,500 | WAC with discounts/rebates | N/A (New Launch) |

| Auryxia | N/A | N/A | Price increases, payor contracts | $40.6 million |

4P's Marketing Mix Analysis Data Sources

Our Akebia 4P's Marketing Mix Analysis is grounded in a comprehensive review of official company disclosures, including SEC filings and investor presentations. We also integrate insights from industry reports, competitive intelligence, and publicly available product information to ensure accuracy.