Akebia Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Akebia Bundle

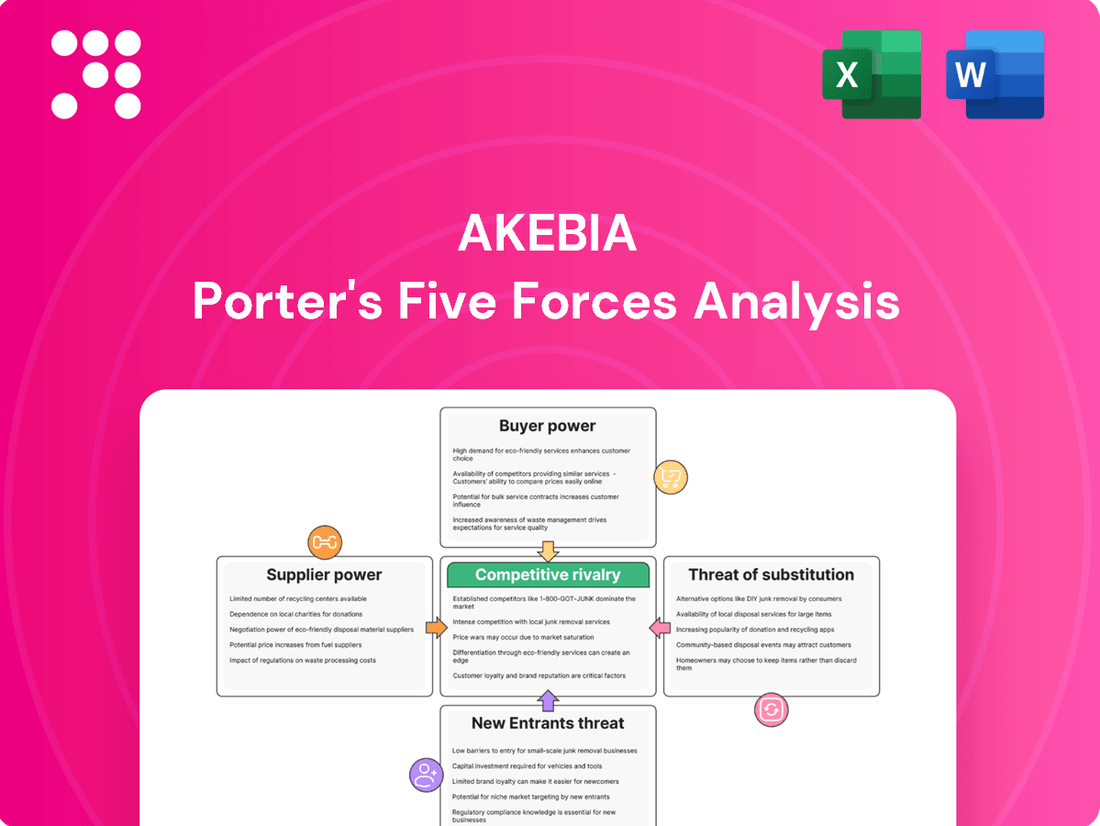

Our Porter's Five Forces analysis for Akebia reveals how buyer bargaining power and the threat of substitutes significantly shape its market. Understanding these dynamics is crucial for navigating its competitive landscape.

The complete report offers a comprehensive, force-by-force breakdown of Akebia's industry, including supplier power and the intensity of rivalry. Gain actionable insights to refine your strategy.

Ready to move beyond the basics? Get a full strategic breakdown of Akebia’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Akebia Therapeutics depends on specialized suppliers for crucial components like active pharmaceutical ingredients (APIs) and for intricate manufacturing processes essential for its biopharmaceutical products, including Vafseo and Auryxia. The highly specialized nature of these inputs often means there are only a few qualified suppliers available.

This limited supplier pool grants these entities considerable bargaining power over Akebia. This leverage is amplified if the costs and complexities associated with switching manufacturing partners are substantial, creating high switching costs for Akebia.

The bargaining power of Clinical Research Organizations (CROs) for Akebia is significant, particularly as Akebia advances its Vafseo Phase 3 trial for non-dialysis CKD. These specialized firms possess critical expertise and infrastructure, making them indispensable for conducting complex, large-scale studies like Akebia's VOICE trial, which partners with entities such as U.S. Renal Care.

Suppliers of patented technologies or licensed compounds can wield significant bargaining power over Akebia. For instance, if a key active pharmaceutical ingredient (API) or a crucial drug delivery technology is controlled by a single supplier holding a patent, Akebia's options are severely limited. This reliance on a sole provider for essential components can translate into higher procurement costs, as seen in the pharmaceutical industry where specialized APIs can represent a substantial portion of a drug's manufacturing expense. In 2023, the cost of APIs for certain complex biologics could range from tens to hundreds of dollars per gram, significantly impacting the overall cost of goods sold.

Regulatory Compliance and Quality Control

Suppliers in the pharmaceutical sector, like those serving Akebia Therapeutics, face rigorous regulatory hurdles, including compliance with FDA mandates. This necessitates substantial investment in quality control systems and processes, making adherence a costly but essential undertaking.

Suppliers who consistently meet these demanding quality standards and possess a proven history of reliability are in a stronger position. Their ability to navigate complex regulations and deliver high-quality materials allows them to negotiate higher prices, reflecting the critical nature and inherent risks associated with pharmaceutical supply chains.

- Regulatory Burden: Pharmaceutical suppliers must comply with extensive regulations, such as Good Manufacturing Practices (GMP), which add significant operational costs.

- Quality Assurance Investment: Companies investing heavily in robust quality control and assurance programs can differentiate themselves and justify premium pricing.

- Supplier Reliability Premium: A supplier's track record for consistent quality and regulatory adherence directly impacts their bargaining power, enabling them to command better terms.

Limited Supplier Alternatives

For highly specialized components or services critical to biopharmaceutical development, Akebia may face a limited pool of alternative suppliers. This scarcity directly translates into increased leverage for the few available suppliers. For instance, if Akebia relies on a unique manufacturing process for its active pharmaceutical ingredients (APIs), and only a handful of companies possess the necessary technology and regulatory approvals, those suppliers hold significant power.

If Akebia cannot readily switch suppliers without experiencing substantial disruptions, costly delays, or incurring significant additional expenses, the existing suppliers gain considerable bargaining power. This inability to easily pivot to a new supplier strengthens the position of current providers, allowing them to potentially dictate terms or prices. In 2024, the biopharmaceutical industry continued to grapple with supply chain complexities, particularly for novel drug components, making supplier dependency a key concern.

The lack of viable alternatives for essential inputs significantly enhances the bargaining position of suppliers. This means they can often command higher prices or impose less favorable contract terms on Akebia. For example, Akebia's reliance on specific cell lines or specialized testing services, where few qualified providers exist, would empower those providers in negotiations.

- Limited Supplier Alternatives: In the biopharmaceutical sector, specialized components and services often have a restricted number of qualified suppliers.

- Switching Costs and Disruption: Akebia faces potential significant disruption, delays, and increased costs if it needs to change suppliers for critical inputs.

- Supplier Leverage: The scarcity of viable alternatives grants existing suppliers greater influence over pricing and contract terms.

- Industry Trend (2024): Supply chain challenges, especially for novel biopharmaceutical materials, continued to be a significant factor in 2024, highlighting supplier dependency.

Suppliers of specialized components, like active pharmaceutical ingredients (APIs), and critical manufacturing services hold significant bargaining power over Akebia Therapeutics. This is due to the limited number of qualified providers and the high costs and disruptions associated with switching suppliers. In 2024, the biopharmaceutical industry continued to face supply chain complexities, particularly for novel drug components, underscoring this supplier dependency.

| Factor | Impact on Akebia | Supplier Leverage |

| Limited Supplier Pool | Akebia's options are restricted for specialized inputs. | Suppliers can command higher prices due to scarcity. |

| High Switching Costs | Switching suppliers involves significant expense and potential delays. | Existing suppliers can dictate terms, as changing is costly for Akebia. |

| Regulatory Compliance | Suppliers must invest heavily in quality and regulatory adherence. | Reliable, compliant suppliers can charge premiums for their expertise and risk mitigation. |

What is included in the product

This Akebia Porter's Five Forces Analysis provides a comprehensive examination of the competitive landscape, detailing threats from new entrants, the bargaining power of buyers and suppliers, the intensity of rivalry, and the threat of substitutes specific to Akebia's market.

Effortlessly identify and mitigate competitive threats with a dynamic visualization of all five forces, streamlining strategic planning.

Customers Bargaining Power

Consolidated dialysis organizations represent a significant force in the bargaining power of customers for Akebia. These large entities, which are highly consolidated, have secured commercial supply contracts that cover virtually all dialysis patients in the U.S. This concentration of buyers means they wield considerable influence when negotiating prices and terms for essential pharmaceuticals like Vafseo.

Centers for Medicare & Medicaid Services (CMS) reimbursement policies, particularly the Transitional Drug Add-on Payment Adjustment (TDAPA), directly impact customer choices. Vafseo's eligibility for TDAPA offers an incentive, yet patients and providers remain keenly aware of the total cost within broader bundled payment structures.

The increasing inclusion of phosphate binders, such as Auryxia, within these bundled payments further shapes market dynamics. This means customers are evaluating the cost-effectiveness of individual drugs in the context of a larger, all-inclusive payment, potentially increasing their bargaining power.

While large dialysis organizations are significant customers for Akebia, the prescribing habits of individual nephrologists are equally vital. Akebia's market strategy centers on encouraging these physicians to adopt their products, with initial traction observed among smaller and medium-sized dialysis providers.

Securing preferred formulary status within major dialysis networks is paramount for achieving broad market penetration. These large networks wield considerable power in dictating which treatments patients receive, directly impacting Akebia's sales volume and market share.

Availability of Alternative Treatments

The availability of alternative treatments significantly impacts the bargaining power of customers in the anemia treatment market. Patients with chronic kidney disease (CKD) have several options beyond Akebia Therapeutics' offerings. Existing injectable erythropoiesis-stimulating agents (ESAs) have long been a standard treatment, providing a baseline against which new therapies are measured.

Furthermore, other oral hypoxia-inducible factor-prolyl hydroxylase inhibitors (HIF-PHIs) are entering or already present in the market, such as GSK's Jesduvroq (daprodustat). This competitive landscape allows customers, including physicians and payers, to compare clinical efficacy, safety profiles, and cost-effectiveness. If Akebia's products, like vadadustat, do not demonstrate a clear advantage in either clinical outcomes or economic value, customers can readily opt for these alternatives, thereby increasing their bargaining leverage.

For Akebia's product Auryxia (ferric citrate), the situation is further complicated by the loss of market exclusivity. The introduction of an authorized generic for Auryxia directly empowers customers. With a lower-cost generic option available, customers have a strong incentive to switch, forcing Akebia to compete more aggressively on price or value proposition for its branded product.

- Alternative Treatments: Injectable ESAs and oral HIF-PHIs like Jesduvroq are available.

- Customer Leverage: Availability of alternatives allows customers to switch if Akebia's products lack clinical or economic value.

- Auryxia's Position: Loss of market exclusivity and the presence of an authorized generic enhance customer bargaining power for this specific product.

Price Sensitivity Due to Healthcare Costs

Healthcare providers and payers exhibit significant price sensitivity, particularly concerning drug costs for chronic conditions like kidney disease, which necessitate ongoing treatment. This sensitivity is amplified by the prevalence of bundled payment models, where the cost of medications is often integrated into broader healthcare service fees.

Customers, including patients and healthcare systems, actively seek cost-effective treatment options without compromising the quality of care. This persistent demand for value means Akebia must carefully consider its pricing strategies to facilitate widespread product adoption and achieve robust market penetration.

- Price Sensitivity: Healthcare payers and providers are acutely aware of drug expenses, especially for long-term treatments like those for kidney disease.

- Cost-Effectiveness Drive: There's a continuous push for affordable yet high-quality healthcare solutions.

- Bundled Payment Impact: The structure of bundled payments often makes the overall cost of treatment, including medication, a critical factor in decision-making.

- Market Penetration Strategy: Akebia's pricing must align with this customer price sensitivity to encourage broad adoption and market share growth.

The bargaining power of customers for Akebia is substantial, driven by the consolidation of major dialysis organizations and the increasing focus on cost-effectiveness within bundled payment models. The availability of alternative treatments, including established ESAs and competing oral HIF-PHIs, further empowers customers to negotiate favorable terms. For Auryxia, the introduction of an authorized generic significantly amplifies customer leverage, pushing Akebia towards competitive pricing.

In 2024, the U.S. dialysis market is dominated by a few large providers, giving them significant purchasing power. For instance, DaVita and Fresenius Medical Care, two of the largest dialysis providers, manage a substantial portion of the estimated 800,000+ dialysis patients in the U.S., allowing them to negotiate aggressively on drug pricing. The Centers for Medicare & Medicaid Services (CMS) continues to influence pricing through reimbursement policies, with the Transitional Drug Add-on Payment Adjustment (TDAPA) for Vafseo offering a temporary financial incentive, but overall cost within bundled payments remains a key consideration for these large buyers.

| Factor | Impact on Akebia | 2024 Relevance |

|---|---|---|

| Consolidated Dialysis Organizations | High bargaining power due to large patient volumes | Major U.S. providers like DaVita and Fresenius manage a significant share of the ~800,000+ U.S. dialysis patients. |

| Bundled Payment Models | Increased focus on overall treatment cost-effectiveness | Inclusion of phosphate binders like Auryxia within bundled payments heightens customer scrutiny of individual drug costs. |

| Alternative Treatments | Ability to switch to competing therapies | Presence of injectable ESAs and oral HIF-PHIs (e.g., GSK's Jesduvroq) provides viable alternatives, pressuring Akebia on value. |

| Auryxia Generic Availability | Significant price pressure on branded product | The introduction of an authorized generic for Auryxia directly empowers customers to seek lower-cost options. |

Same Document Delivered

Akebia Porter's Five Forces Analysis

This preview showcases the complete Akebia Porter's Five Forces Analysis you'll receive immediately after purchase, offering a detailed examination of competitive forces within the industry. You're viewing the exact, professionally formatted document that will be available for instant download, ensuring you get precisely what you need to understand Akebia's strategic landscape. This comprehensive analysis will equip you with actionable insights into industry rivalry, buyer and supplier power, threat of new entrants, and the bargaining power of substitutes.

Rivalry Among Competitors

Akebia's Vafseo faces direct competition from GSK's Jesduvroq, another oral hypoxia-inducible factor prolyl hydroxylase (HIF-PHI) inhibitor approved for anemia in chronic kidney disease (CKD) dialysis patients. GSK's early FDA approval for Jesduvroq in February 2023 gave it a significant first-mover advantage in this nascent therapeutic category.

The successful launch and market penetration of Vafseo in late 2023 directly challenges Jesduvroq's initial dominance. Both drugs are vying for market share in an emerging class of oral treatments, signaling intense rivalry as the market develops.

Akebia's Vafseo competes in a market where established injectable erythropoiesis-stimulating agents (ESAs) have long been the go-to treatment for anemia in chronic kidney disease (CKD). These injectable ESAs, like Epogen and Aranesp, have a significant market share and a well-understood clinical profile, making them the entrenched standard of care. For instance, the global ESA market was valued at approximately $10 billion in 2023, with injectable formulations dominating this figure.

Despite the convenience offered by oral therapies like Vafseo, Akebia must contend with the deep-rooted familiarity and prescribing habits of healthcare providers who are accustomed to using injectable ESAs. Shifting these established patterns requires Akebia to clearly articulate and demonstrate Vafseo's superior benefits, such as improved patient convenience and potentially better anemia management, to gain traction against these long-standing treatments.

Akebia's other commercial product, Auryxia, is experiencing heightened competition. This is largely due to the loss of its market exclusivity in March 2025, which has paved the way for an authorized generic to enter the market.

This development is expected to trigger price reductions and a decline in Auryxia's market share within the phosphate binder sector. Akebia's future revenue from Auryxia will hinge on its effectiveness in contracting and its ability to demonstrate continued value to healthcare providers and patients.

High Stakes and Market Potential

The market for treating anemia in Chronic Kidney Disease (CKD) patients, especially those on dialysis, presents a substantial commercial prize. In the U.S. alone, roughly 500,000 dialysis patients are treated for anemia, with nearly 90% receiving care, underscoring the immense market potential. This lucrative landscape naturally intensifies competition as numerous companies aim to capture a significant portion of this multi-billion dollar sector.

The prospect of expanding treatment labels to include the broader non-dialysis CKD population further fuels this rivalry. Companies are aggressively pursuing market share, recognizing that success in this area can translate into substantial revenue streams and a dominant position in the anemia treatment market.

- Market Size: Approximately 500,000 U.S. dialysis patients treated for anemia.

- Penetration Rate: Nearly 90% of U.S. dialysis patients with anemia receive treatment.

- Growth Potential: Significant opportunity exists in expanding to non-dialysis CKD patients.

- Competitive Driver: The multi-billion dollar market value incentivizes aggressive strategies among industry players.

Ongoing Clinical Trials and Product Differentiation

Companies like Akebia Therapeutics are heavily invested in ongoing clinical trials, not just to meet regulatory requirements but to carve out unique market positions. These trials are the bedrock of product differentiation in the competitive landscape of pharmaceuticals, particularly in chronic kidney disease (CKD) treatments.

A prime example of this strategy is Akebia's planned Phase 3 trial, VALOR, for its product Vafseo. This trial specifically targets non-dialysis CKD patients, a move designed to significantly broaden Vafseo's addressable market. Success in this trial could position Vafseo as a key therapeutic option for a much larger patient population than currently served.

- Vafseo's VALOR trial aims to expand its market reach to non-dialysis CKD patients.

- Successful trial outcomes are critical for establishing a differentiated safety and efficacy profile.

- This differentiation is vital in a dynamic market with rapidly evolving treatment standards.

Akebia's Vafseo faces direct competition from GSK's Jesduvroq, another oral HIF-PHI inhibitor, with GSK holding an early FDA approval in February 2023. Akebia's late 2023 launch of Vafseo directly challenges Jesduvroq's initial market position, intensifying rivalry in this emerging oral treatment category.

Furthermore, Akebia must contend with established injectable ESAs, which dominated the approximately $10 billion global ESA market in 2023. Overcoming the entrenched prescribing habits for these long-standing treatments requires Akebia to clearly demonstrate Vafseo's advantages to gain market share.

The competitive landscape is further shaped by the impending loss of market exclusivity for Akebia's Auryxia in March 2025, which will introduce an authorized generic and likely lead to price reductions and market share decline for Auryxia.

The significant market potential, with around 500,000 U.S. dialysis patients treated for anemia and a 90% treatment penetration rate, fuels aggressive competition among companies seeking to capture a substantial portion of this multi-billion dollar sector.

| Product | Competitor | Approval Date (FDA) | Key Differentiator |

|---|---|---|---|

| Vafseo (Akebia) | Jesduvroq (GSK) | Feb 2023 | Oral HIF-PHI inhibitor |

| Vafseo (Akebia) | Injectable ESAs (e.g., Epogen, Aranesp) | N/A (Established) | Oral convenience vs. established injectable standard of care |

| Auryxia (Akebia) | Authorized Generic | March 2025 (Exclusivity Loss) | Oral phosphate binder (facing generic competition) |

SSubstitutes Threaten

Injectable erythropoiesis-stimulating agents (ESAs) represent the primary substitute for Akebia's oral HIF-PHIs like Vafseo. These injectable drugs have long been the established treatment for anemia in chronic kidney disease (CKD) patients, especially those undergoing dialysis.

While oral administration offers convenience, ESAs are deeply entrenched in clinical practice. Healthcare providers are highly familiar with their use, and existing protocols may create inertia against adopting newer oral therapies, potentially increasing switching costs for providers.

For managing anemia in chronic kidney disease (CKD) patients, simpler and more cost-effective alternatives exist. Iron supplements, for instance, are a direct substitute for individuals experiencing iron deficiency anemia, a condition Akebia's Auryxia also targets alongside hyperphosphatemia. In 2023, the global iron supplements market was valued at approximately $5.5 billion, highlighting the significant presence of these alternatives.

Furthermore, red blood cell transfusions offer an immediate solution for severe anemia, acting as a substitute for critical situations, although Akebia's Vafseo is not designed for this acute intervention. The demand for blood transfusions, while not directly comparable, underscores the existence of alternative methods for addressing anemia's immediate consequences.

While not direct pharmaceutical substitutes, dietary modifications and lifestyle interventions can play a supportive role in managing chronic kidney disease and its associated complications, including anemia. For instance, a focus on reduced sodium intake can help manage hypertension, a common comorbidity.

These non-pharmacological approaches, though limited in severe cases, can reduce the reliance on certain drug therapies or influence patient preferences for less intensive interventions. For example, adherence to a plant-based diet, which is often lower in phosphorus, may indirectly lessen the burden on kidney function and potentially reduce the need for phosphate binders in some patients.

Emerging Therapies and Pipeline Drugs

The biopharmaceutical industry is in constant flux, with significant investment in discovering new ways to treat kidney disease and anemia. Companies are actively researching novel mechanisms that could offer alternatives to current treatments.

Emerging therapies, particularly those with distinct mechanisms of action or superior safety and efficacy profiles, pose a direct threat of substitution. For instance, advancements in gene therapy or novel small molecules could potentially disrupt the market for existing treatments like Akebia's Vafseo (vadadustat). The threat is amplified as these new therapies move through clinical trials and approach market approval.

To counter this, Akebia must maintain a robust innovation pipeline and clearly articulate the value proposition of its current offerings. This includes demonstrating competitive advantages in terms of patient outcomes, cost-effectiveness, and ease of use compared to potential future alternatives.

- Pipeline Drug Development: Companies like Travere Therapeutics are advancing novel approaches for rare kidney diseases, potentially impacting Akebia's market share.

- Therapeutic Innovation: The development of oral HIF-PH inhibitors with different binding profiles or non-HIF-PH related therapies could offer new treatment paradigms.

- Regulatory Approvals: The speed at which new, potentially substitutive therapies gain regulatory approval is a critical factor in assessing this threat.

- Clinical Trial Success: Positive results from late-stage clinical trials for competing drugs directly increase the threat of substitution.

Patient and Physician Preferences

Patient and physician preferences significantly shape the threat of substitutes for treatments like Vafseo. The choice between oral and injectable medications, alongside their respective side effect profiles and perceived quality of life benefits, directly impacts adoption rates. For instance, Vafseo's oral administration is a notable advantage, aiming to improve patient convenience compared to injectables.

However, concerns regarding potential adverse events, as observed in trials involving non-dialysis CKD patients, could steer certain patient groups towards alternative therapies. This underscores the critical need for clearly defined indications and robust safety data to counter the appeal of substitutes. By 2024, the market for CKD treatments is dynamic, with ongoing research into various therapeutic modalities, including novel oral agents and improved injectable formulations, further intensifying this competitive landscape.

The perceived quality of life benefits associated with a treatment is a powerful driver. If patients and physicians believe alternative treatments offer a better daily experience with fewer side effects or greater efficacy for specific patient profiles, they are more likely to opt for them. This highlights the importance of comparative effectiveness research and real-world evidence in demonstrating Vafseo's value proposition against its substitutes.

The market is closely watching how patient adherence and physician prescribing patterns evolve in 2024. Factors such as patient education, physician experience with new oral therapies, and the availability of supportive care services will all play a role in mitigating the threat of substitutes. For example, a demonstrated reduction in hospitalization rates for patients on Vafseo compared to existing treatments could significantly bolster its competitive position.

Injectable erythropoiesis-stimulating agents (ESAs) remain a significant substitute for Akebia's oral HIF-PHIs, deeply ingrained in clinical practice due to familiarity and established protocols. Iron supplements, valued at approximately $5.5 billion globally in 2023, are also a direct alternative for iron deficiency anemia, a condition Akebia's Auryxia addresses.

Emerging therapies with distinct mechanisms or superior profiles pose a growing threat, amplified by ongoing research and clinical trials in the biopharmaceutical sector. Patient and physician preferences, influenced by convenience, side effects, and perceived quality of life, will critically shape the adoption of Akebia's oral therapies against these evolving substitutes.

| Substitute Category | Key Characteristics | Market Relevance (2023/2024 Data) | Impact on Akebia |

|---|---|---|---|

| Injectable ESAs | Established, familiar to providers | Dominant in dialysis anemia treatment | High inertia against switching |

| Iron Supplements | Cost-effective for iron deficiency | Global market ~$5.5 billion (2023) | Direct alternative for specific patient segments |

| Emerging Therapies | Novel mechanisms, potentially better profiles | Active R&D, clinical trials | Future competitive threat |

| Red Blood Cell Transfusions | Immediate solution for severe anemia | Used in critical situations | Limited direct substitutability for chronic management |

Entrants Threaten

Developing new biopharmaceutical treatments for kidney disease, especially those targeting novel pathways like hypoxia-inducible factor prolyl hydroxylase inhibitors (HIF-PHIs), demands enormous upfront investment in research and development. These costs are a formidable hurdle for potential new competitors.

The path from discovery to market approval is long, complex, and exceptionally expensive, involving multiple phases of clinical trials. High failure rates throughout this process further amplify the financial risk, making it a significant deterrent for new entrants looking to challenge established players like Akebia.

Akebia's own experience with Vafseo (vadadustat) underscores this reality. The company invested heavily in its development, highlighting the substantial and sustained R&D commitment necessary to bring such specialized therapies to fruition, a commitment that new companies would need to match.

The rigorous regulatory approval process, particularly for pharmaceuticals, acts as a significant barrier to new entrants. Companies looking to enter Akebia's market must navigate the complex, lengthy, and expensive path to gain approval from regulatory bodies like the FDA. This involves extensive clinical trials to prove both the safety and effectiveness of new treatments, a hurdle that requires substantial investment and expertise.

Demonstrating efficacy and safety through multiple phases of clinical trials presents a formidable challenge for any new company. For instance, Akebia's own drug, Vafseo, received FDA approval in March 2024 for dialysis patients, but this followed prior regulatory challenges, highlighting the demanding nature of the approval pathway. This lengthy process deters potential competitors by demanding significant upfront capital and a deep understanding of regulatory requirements.

Launching a new drug, such as Akebia's Vafseo, demands substantial commercial infrastructure. This includes a dedicated sales force, strong ties with healthcare providers and dialysis centers, and adeptness in managing reimbursement processes. Newcomers face significant challenges in replicating this established network.

Akebia Therapeutics has already secured commercial supply contracts that reach almost all U.S. dialysis patients. This extensive market penetration, covering nearly 100% of the patient population, presents a formidable barrier for any new entrant attempting to gain market access without pre-existing infrastructure and relationships.

Intellectual Property and Patent Protection

Intellectual property and patent protection are significant hurdles for new entrants in the pharmaceutical sector, particularly for companies like Akebia Therapeutics. Akebia holds existing patents on its approved treatments, such as Vafseo (vadadustat) for anemia due to chronic kidney disease. These patents effectively block direct competition from bio-similar or generic versions for a considerable period, often many years. For instance, the U.S. Patent and Trademark Office grants patents for up to 20 years from the filing date, though extensions are possible for certain regulatory delays. This robust IP framework forces potential competitors to invest heavily in discovering and developing entirely novel compounds, a process that is both time-consuming and carries a high risk of failure.

The threat of new entrants is thus substantially mitigated by the extensive patent portfolios common in the biopharmaceutical industry. Companies must navigate this landscape by either innovating to create differentiated products or patiently awaiting patent expirations. For Akebia, its patent protection on Vafseo, which was approved by the FDA in March 2022, provides a critical window of exclusivity. This exclusivity is crucial for recouping research and development costs and establishing market share before facing generic competition.

The financial implications of patent protection are substantial. Companies with strong patent protection can command premium pricing and achieve higher profit margins during their exclusivity period. For example, the global anemia drug market was valued at approximately $20 billion in 2023 and is projected to grow, with patented drugs forming the core of this market. New entrants without their own proprietary intellectual property would struggle to compete on efficacy or cost against established, patented therapies.

- Existing Patents: Akebia holds patents on key drugs like Vafseo, creating a strong barrier.

- Innovation Requirement: New entrants must develop novel compounds or wait for patent expiry, a lengthy process.

- Market Exclusivity: Intellectual property limits direct competition from bio-similar or generic versions in the short to medium term.

- R&D Investment: The need for new drug discovery necessitates significant investment and carries high risk for new market entrants.

Capital Requirements and Funding Access

The biopharmaceutical sector presents a formidable barrier to entry due to its extreme capital intensity. Developing a new drug from discovery to market approval requires billions of dollars, covering extensive research and development, rigorous clinical trials, and sophisticated manufacturing processes. New companies must therefore access significant funding, often through venture capital or initial public offerings, to even begin competing.

For instance, in 2024, the cost of bringing a new drug to market continued to be a major hurdle, with estimates often exceeding $2 billion. Akebia Therapeutics, a player in this space, actively managed its capital needs, completing a public offering in early 2024 to strengthen its financial position. This move underscores the perpetual requirement for substantial capital infusion to sustain operations and pursue innovation within the industry.

The need for substantial capital creates a significant threat of new entrants, as only well-funded entities can realistically challenge established players.

- High R&D Costs: Biopharmaceutical R&D is notoriously expensive, with failure rates in clinical trials being very high.

- Manufacturing Scale-Up: Building and maintaining Good Manufacturing Practice (GMP) compliant facilities requires massive investment.

- Regulatory Compliance: Meeting stringent regulatory requirements from bodies like the FDA adds significant operational and financial burdens.

- Access to Funding: Securing the necessary capital often depends on investor confidence in the company's pipeline and management, making it difficult for unproven entities.

The threat of new entrants in Akebia's market is considerably low due to the immense capital required for research, development, and regulatory approval. Bringing a new biopharmaceutical treatment to market can cost upwards of $2 billion, a figure that deters many potential competitors. Furthermore, Akebia's established intellectual property, including patents on Vafseo (vadadustat), creates significant barriers by limiting direct competition and requiring new entrants to innovate entirely novel compounds.

Akebia's extensive commercial infrastructure, including near 100% patient coverage in U.S. dialysis centers, also presents a formidable challenge for newcomers. This established market penetration, coupled with the long and complex regulatory approval process, demands substantial investment and expertise that new companies often lack. For instance, Vafseo received FDA approval in March 2024, a milestone that Akebia achieved after significant investment and navigating prior regulatory hurdles, illustrating the demanding nature of the market.

The industry's capital intensity is a primary deterrent, as evidenced by Akebia's own capital-raising activities, such as its early 2024 public offering to bolster its financial position. Only well-funded entities can realistically contend with established players, making the threat of new entrants minimal for now.

| Barrier Type | Description | Example for Akebia |

|---|---|---|

| Capital Requirements | Extremely high R&D, clinical trial, and manufacturing costs, often exceeding $2 billion per drug. | Akebia's public offering in early 2024 to fund operations and innovation. |

| Intellectual Property | Patents on existing drugs like Vafseo block generic competition and require new entrants to develop novel therapies. | U.S. patents typically grant 20 years of exclusivity, providing Akebia with a significant market advantage. |

| Regulatory Hurdles | Lengthy and complex FDA approval processes, including multiple phases of clinical trials. | Vafseo's FDA approval in March 2024 followed extensive development and prior regulatory scrutiny. |

| Commercial Infrastructure | Established sales forces, healthcare provider relationships, and reimbursement expertise. | Akebia's commercial contracts cover nearly all U.S. dialysis patients, creating a strong market presence. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Akebia Therapeutics is built upon a foundation of comprehensive data, including SEC filings, analyst reports, and industry-specific market research from reputable firms. This ensures a robust understanding of competitive intensity, buyer and supplier power, and the threat of new entrants and substitutes.