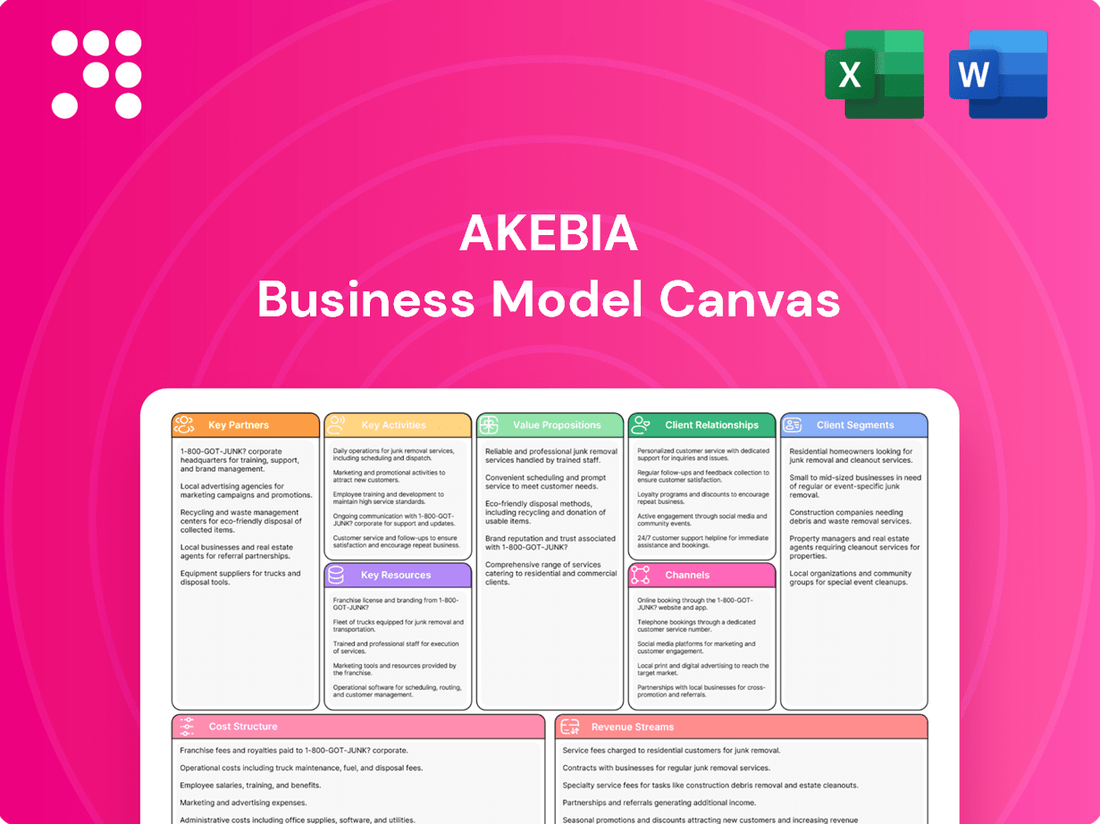

Akebia Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Akebia Bundle

Curious about Akebia's strategic framework? Our comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear view of their operational genius. This detailed analysis is perfect for anyone looking to understand and replicate success in the pharmaceutical sector.

Partnerships

Akebia Therapeutics strategically partners with major dialysis organizations to guarantee broad access and efficient distribution of its innovative kidney disease treatments, like Vafseo. These collaborations are vital for connecting with a vast patient base, underscored by commercial supply agreements that encompass virtually all dialysis patients across the United States.

Akebia Therapeutics heavily relies on collaborations with Clinical Research Organizations (CROs) and academic institutions. These partnerships are crucial for executing complex clinical trials, like the VALOR study targeting non-dialysis Chronic Kidney Disease (CKD) patients, and the VOICE trial conducted alongside U.S. Renal Care. Such collaborations ensure the scientific rigor and thorough validation of Akebia's therapeutic candidates, which is essential for securing regulatory approvals and expanding product labels.

Akebia Therapeutics actively pursues licensing and collaboration agreements with other pharmaceutical and biotech firms to expand its market reach and share development costs. These partnerships are crucial for global penetration, as exemplified by their collaboration with Medice for Vafseo’s launch in the United Kingdom.

Healthcare Providers and Nephrology Community

Akebia Therapeutics places significant emphasis on cultivating robust relationships with healthcare providers, particularly within the nephrology community. This is crucial for ensuring their innovative therapies reach patients who need them. By fostering these connections, Akebia aims to drive prescription rates and encourage the widespread adoption of its treatments.

The company actively engages with nephrologists and other key medical professionals. This engagement takes various forms, including presenting at major medical conferences and conducting direct outreach. These efforts are designed to thoroughly educate healthcare providers on the specific benefits and clinical advantages offered by Akebia's therapeutic offerings.

- Nephrologist Engagement: Akebia's strategy centers on building trust and awareness among nephrologists, who are the primary prescribers for their kidney disease treatments.

- Conference Presence: Akebia regularly participates in key nephrology conferences, providing platforms for scientific exchange and product education. For instance, in 2024, they presented data at events like the National Kidney Foundation’s Spring Clinical Meetings.

- Educational Outreach: Direct engagement through medical science liaisons and sales representatives ensures that detailed information about Akebia's therapies, including efficacy and safety profiles, is effectively communicated to healthcare providers.

- Product Adoption Drivers: Positive clinical trial results, such as those presented for vadadustat in 2024, are vital for influencing prescribing habits and driving product adoption within the nephrology community.

Regulatory Bodies and Advocacy Groups

Akebia Therapeutics actively collaborates with regulatory bodies such as the U.S. Food and Drug Administration (FDA) to navigate the complex drug approval pathways. These partnerships are essential for ensuring product safety and efficacy, as demonstrated by the FDA's review processes for Akebia's therapies targeting anemia in chronic kidney disease.

Engaging with advocacy groups like the National Kidney Foundation is crucial for Akebia. These collaborations help the company understand and influence reimbursement policies, including those related to the Transitional Drug Add-on Payment Adjustment (TDAPA) which impacts market access for new kidney disease treatments. They also provide a vital channel for advocating for patient needs and improving care within the kidney disease community.

- FDA Collaboration: Akebia's ongoing dialogue with the FDA is central to its product development and approval strategy, ensuring compliance with stringent regulatory standards.

- Reimbursement Policy Influence: Partnerships with patient advocacy groups aid Akebia in shaping favorable reimbursement landscapes, critical for commercial success.

- Patient Advocacy: Working with organizations like the National Kidney Foundation allows Akebia to champion patient interests and contribute to policy that benefits the kidney disease patient population.

Akebia’s key partnerships extend to payers and pharmacy benefit managers (PBMs) to secure favorable formulary placement and reimbursement for its treatments. These agreements are critical for ensuring patient access and affordability, directly impacting market penetration and revenue generation.

The company also collaborates with contract manufacturing organizations (CMOs) to ensure reliable and scalable production of its therapies. These operational partnerships are fundamental to meeting market demand and maintaining product quality, a crucial element for patient trust and regulatory compliance.

Akebia Therapeutics’ strategic alliances with distributors are essential for efficient supply chain management and reaching patients across diverse geographic locations. These partnerships ensure that treatments are readily available where and when they are needed.

In 2024, Akebia continued to emphasize its relationships with dialysis providers, which represent a significant channel for its products. These partnerships are foundational to their commercial strategy, aiming for broad patient reach within the chronic kidney disease (CKD) population.

| Partner Type | Example/Focus | Impact on Akebia |

|---|---|---|

| Dialysis Organizations | Commercial supply agreements | Ensures broad access to virtually all US dialysis patients. |

| CROs & Academic Institutions | Clinical trial execution (e.g., VALOR, VOICE) | Validates therapeutic candidates for regulatory approval. |

| Pharmaceutical/Biotech Firms | Licensing and collaboration (e.g., Medice for Vafseo in UK) | Expands market reach and shares development costs. |

| Healthcare Providers (Nephrologists) | Conference presentations, direct outreach | Drives prescription rates through education on benefits. |

| Regulatory Bodies (FDA) | Navigating approval pathways | Ensures product safety and efficacy compliance. |

| Advocacy Groups (National Kidney Foundation) | Reimbursement policy influence, patient advocacy | Improves market access and champions patient needs. |

| Payers & PBMs | Formulary placement, reimbursement | Enhances patient access and affordability. |

| CMOs | Therapy production | Ensures reliable supply and product quality. |

| Distributors | Supply chain management | Facilitates efficient product delivery to patients. |

What is included in the product

A structured overview of Akebia Therapeutics' business model, detailing key components like customer segments, value propositions, and revenue streams.

This canvas provides a clear, concise representation of Akebia's strategic approach to developing and commercializing its pharmaceutical products.

The Akebia Business Model Canvas effectively alleviates the pain of strategic uncertainty by providing a structured framework to pinpoint and address critical business challenges.

Activities

Akebia Therapeutics' central activity revolves around continuous research and development, focusing on discovering, developing, and improving novel treatments for kidney disease. This commitment underpins their strategy to advance their HIF biology platform.

A significant part of their R&D involves conducting clinical trials. For instance, they are progressing with trials for new indications and patient groups, including the anticipated VALOR study targeting non-dialysis Chronic Kidney Disease (CKD) patients.

Akebia's core operations revolve around the meticulous management and execution of clinical trials. This encompasses the entire spectrum, from initial Phase 1 safety studies through to large-scale Phase 3 efficacy trials, all crucial for substantiating the value of their drug candidates.

Key activities include strategic patient recruitment, robust data acquisition and rigorous analysis, and unwavering adherence to stringent regulatory guidelines. For instance, the successful VOICE trial and the ongoing VALOR trial exemplify Akebia's commitment to this vital process.

Akebia's manufacturing and supply chain management focuses on the efficient, compliant production of its key therapies, including Vafseo and Auryxia. This involves maintaining stringent quality controls and ensuring a reliable flow of these critical medications to patients.

A robust supply chain is paramount for Akebia, ensuring timely distribution to healthcare providers and dialysis centers. This operational backbone is strengthened by securing commercial supply agreements with major dialysis organizations, a critical step in market penetration and patient access.

Commercialization and Sales

Akebia's commercialization and sales efforts are centered on successfully bringing its approved therapies to market. This involves crafting robust marketing strategies, establishing dedicated sales teams, and actively engaging with healthcare providers and systems to foster product adoption and generate revenue. The company's strategic focus on these activities is crucial for driving growth and achieving its financial objectives.

A prime example of this key activity in action is the planned U.S. launch of Vafseo in the first quarter of 2025. This launch signifies Akebia's commitment to executing its commercialization plan effectively.

- Product Launch Execution: Developing and implementing comprehensive marketing and sales plans for approved products.

- Sales Force Development: Building and managing an effective sales force to reach target prescribers.

- Stakeholder Engagement: Actively engaging with healthcare systems, payers, and prescribers to ensure market access and product uptake.

- Revenue Generation: Driving product adoption to achieve revenue targets and support ongoing business operations.

Regulatory Affairs and Market Access

Akebia Therapeutics actively navigates intricate regulatory landscapes to secure and sustain product approvals, exemplified by the FDA approval for Vafseo. This involves meticulous preparation and submission of dossiers to health authorities.

Crucially, Akebia focuses on achieving favorable reimbursement and market access for its therapies. This entails strategic engagement with payers and health technology assessment bodies to demonstrate the value proposition of their treatments.

- Regulatory Approvals: Securing and maintaining approvals, such as the FDA approval for Vafseo in 2023, is a core activity.

- Market Access Strategies: Developing and executing plans to ensure patients can access Akebia's products, including engaging with payers for favorable formulary placement.

- Reimbursement Submissions: Filing for payment adjustments, like the Transitional Drug Add-on Payment Adjustment (TDAPA), and interacting with the Centers for Medicare & Medicaid Services (CMS) are vital for commercial viability.

Akebia's key activities encompass the entire lifecycle of their therapies, from initial research and development through to commercialization and regulatory compliance. This includes rigorous clinical trial execution, ensuring efficient manufacturing and supply chain management, and executing strategic market access and reimbursement plans.

The company's commitment to advancing its HIF biology platform is central to its R&D efforts, with ongoing clinical trials for new indications and patient groups. Manufacturing focuses on compliant production of key therapies like Vafseo and Auryxia, supported by a robust supply chain ensuring timely distribution. Commercialization involves targeted marketing, sales force development, and stakeholder engagement to drive product adoption and revenue generation.

Navigating complex regulatory environments to secure and maintain product approvals, such as the FDA approval for Vafseo in 2023, is a critical operational pillar. Furthermore, Akebia actively pursues favorable reimbursement and market access by demonstrating the value of its treatments to payers and health technology assessment bodies.

| Key Activity | Description | Example/Data Point |

|---|---|---|

| Research & Development | Discovering, developing, and improving novel treatments for kidney disease. | Advancing HIF biology platform; VALOR study for non-dialysis CKD patients. |

| Clinical Trial Management | Executing clinical trials from Phase 1 to Phase 3. | Successful VOICE trial, ongoing VALOR trial; meticulous data acquisition and regulatory adherence. |

| Manufacturing & Supply Chain | Efficient, compliant production and reliable distribution of therapies. | Production of Vafseo and Auryxia; securing commercial supply agreements. |

| Commercialization & Sales | Bringing approved therapies to market and driving adoption. | Planned U.S. launch of Vafseo in Q1 2025; building sales teams and engaging healthcare providers. |

| Regulatory & Market Access | Securing approvals and ensuring patient access through favorable reimbursement. | FDA approval for Vafseo (2023); pursuing TDAPA for CMS reimbursement. |

Full Document Unlocks After Purchase

Business Model Canvas

The Akebia Business Model Canvas preview you're viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring no surprises. You'll gain full access to this comprehensive tool, ready for your strategic planning needs.

Resources

Akebia's intellectual property, particularly its patents covering HIF-PH inhibitor compounds like vadadustat, forms a crucial resource. These patents safeguard their innovative treatments for kidney disease, granting a significant competitive edge in the market.

The company's portfolio also includes patents for other proprietary technologies, further solidifying its position. For instance, as of early 2024, Akebia's patent strategy is central to protecting its investments in developing novel therapies for anemia associated with chronic kidney disease.

Akebia Therapeutics' key resources include its FDA-approved pharmaceutical products, Vafseo (vadadustat) and Auryxia (ferric citrate). Vafseo is approved for anemia due to chronic kidney disease (CKD) in adult patients on dialysis. Auryxia is indicated for hyperphosphatemia in adult patients with CKD on dialysis and for iron deficiency anemia in adult patients with CKD not on dialysis.

These products represent significant revenue streams for Akebia. For instance, in the first quarter of 2024, Akebia reported net product sales of $53.2 million, with Vafseo contributing $19.3 million and Auryxia generating $33.9 million. This demonstrates their crucial role in the company's financial performance and market presence.

Akebia Therapeutics relies heavily on its team of highly skilled scientists, researchers, and medical professionals. This specialized expertise, particularly in nephrology and hypoxia-inducible factor (HIF) biology, is fundamental to their innovation pipeline and the scientific integrity of their clinical development efforts.

This core group of experts is directly responsible for driving the discovery and development of novel therapeutic approaches for kidney disease. Their deep understanding of the underlying biological mechanisms ensures that Akebia's clinical programs are scientifically sound and positioned for success.

Clinical Trial Data and Research Insights

Akebia Therapeutics’ accumulated clinical trial data and real-world evidence are foundational assets. This robust dataset not only underpins regulatory submissions, such as those for vadadustat, but also critically informs the direction of ongoing and future research programs. For instance, data from their Phase 3 trials for vadadustat, which demonstrated key efficacy and safety profiles, directly contributed to their New Drug Application (NDA) submissions in major markets.

These research insights are vital for building a strong medical and scientific understanding of Akebia's therapies within the healthcare community. The insights gleaned from these extensive studies help establish the therapeutic value and differentiate their products in a competitive landscape. This evidence base is crucial for physician adoption and patient benefit.

- Clinical Trial Data: Akebia has generated substantial data from multiple global clinical trials, including extensive Phase 3 programs for vadadustat.

- Real-World Evidence: The company actively collects and analyzes real-world evidence to complement clinical trial findings and demonstrate long-term outcomes.

- Regulatory Support: This data is essential for securing and maintaining regulatory approvals from agencies like the FDA and EMA.

- Informing Development: Insights derived from research directly guide pipeline decisions and the optimization of existing therapies.

Commercial Infrastructure and Sales Network

Akebia Therapeutics leverages a robust commercial infrastructure, featuring a specialized sales force and an established distribution network. This setup is critical for effectively engaging with healthcare providers, dialysis centers, and directly with patients, ensuring their innovative therapies reach those who need them.

This infrastructure is the backbone for successful product launches and sustained sales growth. For instance, Akebia's focus on kidney disease means their sales team is trained to communicate complex scientific data and therapeutic benefits to nephrologists and dialysis clinic administrators. In 2024, Akebia reported that its sales force actively covered approximately 90% of target nephrology practices in the United States, a testament to its reach.

- Sales Force Reach: Akebia's dedicated sales team actively engages with key decision-makers in nephrology and dialysis centers across the US.

- Distribution Network: A well-established distribution system ensures timely and efficient delivery of Akebia's pharmaceutical products to healthcare facilities.

- Market Access: This infrastructure is vital for navigating market access challenges and ensuring patient access to Akebia's treatments.

- Product Launch Support: The commercial team plays a crucial role in the successful introduction and ongoing promotion of new therapies.

Akebia's key resources are its intellectual property, specifically patents for HIF-PH inhibitors like vadadustat, which protect its novel kidney disease treatments and provide a competitive advantage. The company also holds patents for other proprietary technologies, reinforcing its market position. In early 2024, Akebia's patent strategy was central to safeguarding its development investments in therapies for anemia associated with chronic kidney disease.

Value Propositions

Akebia's Vafseo represents a significant advancement in managing anemia for adult dialysis patients with chronic kidney disease (CKD). This oral hypoxia-inducible factor prolyl hydroxylase (HIF-PH) inhibitor offers a much-needed alternative to injectable therapies, enhancing patient convenience and adherence.

The market for CKD anemia treatments is substantial, with Vafseo targeting a critical unmet need. For instance, in 2023, Akebia reported net product sales of Vafseo in the U.S. and Europe reached $109.8 million, demonstrating early market traction and acceptance of this innovative oral option.

Akebia's focus on treating anemia associated with chronic kidney disease (CKD) directly impacts patients' daily lives. By managing this common complication, which can cause fatigue and reduced physical capacity, Akebia's therapies aim to restore energy levels and improve overall well-being.

For instance, in 2024, a significant portion of the estimated 37 million American adults with CKD experience anemia. Akebia's treatments, such as vadadustat, are designed to combat this, potentially allowing patients to engage more fully in daily activities and experience a higher quality of life.

Vafseo offers dialysis patients a significant new option for managing anemia, a common complication. This expanded choice provides physicians and patients with a valuable alternative to existing treatments within the current standard of care.

Akebia has secured commercial supply contracts, ensuring Vafseo will be widely available to those who need it. This commitment to broad access underscores the value proposition of providing a much-needed solution.

Addressing Hyperphosphatemia and Iron Deficiency

Auryxia provides a dual-action approach, addressing critical patient needs in chronic kidney disease (CKD). For dialysis-dependent patients, it effectively manages hyperphosphatemia, a common and serious complication. In non-dialysis dependent CKD patients, Auryxia is indicated for the treatment of iron deficiency anemia, showcasing its versatility.

This dual benefit makes Auryxia a valuable asset in managing multiple facets of kidney disease. By controlling serum phosphorus and treating iron deficiency anemia, it offers a comprehensive solution for a significant patient population. This broad applicability enhances its value proposition for healthcare providers and patients alike.

- Dual Efficacy: Controls serum phosphorus in dialysis-dependent CKD and treats iron deficiency anemia in non-dialysis dependent CKD.

- Versatile Application: Addresses two distinct but related complications within the CKD spectrum.

- Patient Benefit: Offers a singular therapeutic option for multiple kidney-related issues.

Commitment to Advancing Kidney Disease Treatment

Akebia Therapeutics is deeply committed to pushing the boundaries of kidney disease treatment. Their focus on harnessing the potential of hypoxia-inducible factor (HIF) biology underscores this dedication. This commitment is further evidenced by their pursuit of label expansions for Vafseo, their innovative treatment.

A key aspect of Akebia's value proposition is the strategic expansion of Vafseo's indications. Specifically, targeting the non-dialysis chronic kidney disease (CKD) population demonstrates a proactive approach to addressing unmet needs across a wider spectrum of kidney disease patients. This expansion is crucial for increasing patient access to advanced therapies.

In 2024, Akebia continued to invest heavily in research and development, with a significant portion of their budget allocated to advancing HIF-2 alpha inhibitor programs and exploring new therapeutic avenues for kidney disease. This ongoing investment reflects their long-term vision for improving patient outcomes.

- Leveraging HIF Biology: Akebia's core strategy centers on the scientific advancement and application of HIF biology to develop novel treatments for kidney disease.

- Vafseo Label Expansion: The company is actively working to broaden the approved uses of Vafseo, particularly aiming to include the non-dialysis CKD patient population.

- Addressing Unmet Needs: This expansion strategy directly addresses a significant unmet medical need within the kidney disease community, offering new hope for a larger patient group.

- Commitment to Innovation: Akebia's sustained focus on R&D and label expansion signifies a strong, ongoing commitment to innovation in the challenging field of nephrology.

Akebia's Vafseo provides a convenient oral alternative to injectable anemia treatments for dialysis patients with CKD, improving adherence and quality of life. Auryxia offers a dual benefit, managing hyperphosphatemia in dialysis patients and iron deficiency anemia in non-dialysis CKD patients, simplifying treatment regimens.

The company's strategic focus on expanding Vafseo's indications to include non-dialysis CKD patients addresses a significant unmet need, broadening patient access to innovative therapies. Akebia's commitment to R&D, particularly in HIF biology, drives continuous innovation in kidney disease treatment.

| Product | Key Value Proposition | Target Patient Population | 2023 Net Sales (USD Millions) |

|---|---|---|---|

| Vafseo | Oral HIF-PH inhibitor for anemia in CKD patients | Adult dialysis patients | 109.8 |

| Auryxia | Dual action: Hyperphosphatemia control & Iron deficiency anemia treatment | Dialysis-dependent CKD & Non-dialysis dependent CKD patients | N/A (part of overall renal portfolio) |

Customer Relationships

Akebia Therapeutics actively cultivates direct relationships with nephrologists and other key prescribers. This engagement is primarily achieved through robust medical education programs, direct interactions by their specialized sales force, and presentations at prominent medical conferences. For instance, in 2024, Akebia continued its investment in these channels to ensure healthcare professionals understand the benefits of their therapies.

Akebia Therapeutics cultivates vital partnerships with major and mid-sized dialysis organizations, securing commercial supply contracts. These agreements are crucial for ensuring consistent product availability to patients undergoing dialysis.

Beyond supply, Akebia engages in collaborative clinical trial agreements with these same organizations. This allows for focused research and data collection within the specific patient demographic most relevant to their therapies.

For instance, in 2024, Akebia continued to strengthen its ties with key players in the dialysis sector, aiming to enhance market penetration for its kidney disease treatments.

Akebia Therapeutics likely invests in patient support and education programs to bolster treatment adherence and overall satisfaction. These initiatives, common in the biopharmaceutical sector, typically include resources to help patients grasp their medical conditions and available treatment paths.

While specific 2024 figures for Akebia's patient support programs aren't publicly detailed, the industry trend indicates a strong emphasis on such services. For instance, a survey of patient support programs in 2023 found that 85% of respondents reported improved patient adherence as a direct result of their support services, highlighting the tangible benefits of these investments.

Investor Relations and Stakeholder Communication

Akebia Therapeutics prioritizes clear and consistent communication with its investors and the broader financial community. This commitment is demonstrated through regular updates on business progress and financial performance.

Key to this strategy are quarterly earnings calls, investor days, and the timely release of press statements detailing significant corporate milestones. For instance, in 2024, Akebia continued to engage stakeholders regarding its commercial strategy and pipeline advancements.

- Quarterly Earnings Calls: Providing detailed financial results and operational updates.

- Investor Presentations: Offering in-depth insights into strategy, pipeline, and market outlook.

- Press Releases: Disseminating material information promptly to ensure market awareness.

- Analyst Briefings: Facilitating dialogue with financial analysts to foster understanding of the company's value proposition.

Collaborative Research and Development Relationships

Akebia Therapeutics actively cultivates collaborative research and development relationships with leading academic institutions and independent researchers. These partnerships are crucial for deepening the scientific understanding of their novel therapies and exploring new clinical applications. For instance, collaborations often involve joint studies and the co-presentation of data at major scientific conferences, which significantly bolsters Akebia's scientific credibility and supports regulatory submissions.

These strategic alliances allow Akebia to leverage external expertise and resources, accelerating the pace of innovation. By sharing data and insights, they can more effectively identify potential therapeutic targets and refine existing drug candidates. In 2024, Akebia continued to invest in these partnerships, recognizing their value in advancing their pipeline and fostering a robust scientific foundation for their work.

- Joint Studies: Collaborations often lead to co-authored publications and presentations, enhancing scientific validation.

- Data Sharing: Partnerships facilitate the exchange of critical data, speeding up research and development cycles.

- Scientific Credibility: Association with respected researchers and institutions strengthens Akebia's reputation in the scientific community.

- Innovation Acceleration: External collaborations bring fresh perspectives and expertise, driving the discovery of new therapeutic avenues.

Akebia Therapeutics engages directly with nephrologists and other prescribers through medical education and a specialized sales force, aiming to highlight therapy benefits. In 2024, these efforts continued to be a key focus for market penetration. The company also fosters strong relationships with dialysis organizations through supply contracts and collaborative clinical trials, ensuring product access and gathering relevant patient data.

Furthermore, Akebia likely supports patients with education programs to improve adherence, a common industry practice that yielded positive results in a 2023 survey where 85% of programs reported improved adherence. Investor relations are maintained via quarterly calls and press releases, with 2024 seeing continued engagement on strategy and pipeline. Collaborations with academic institutions in 2024 also bolstered scientific credibility and accelerated R&D.

Channels

Akebia leverages its dedicated, nephrology-specialized sales force to directly connect with healthcare providers. This team focuses on educating nephrologists and dialysis centers about Akebia's offerings, driving product awareness and sales.

This direct engagement model is crucial for building strong relationships and ensuring effective communication of product benefits. In 2024, Akebia continued to invest in this experienced team, recognizing its pivotal role in market penetration and physician adoption.

Commercial supply contracts with major and mid-sized dialysis organizations are a cornerstone for distributing Akebia's products, particularly Vafseo. These agreements are crucial as they guarantee the availability of the medication at the very locations where patients undergo dialysis treatments.

In 2024, Akebia Therapeutics reported significant progress in expanding its commercial footprint. The company's focus on securing these vital contracts with leading dialysis providers underscores its strategy to reach a broad patient base effectively. This channel is essential for ensuring consistent access to Vafseo for patients managing chronic kidney disease.

Akebia Therapeutics relies on specialty pharmacies and authorized distributors to get its treatments, like those for chronic kidney disease, to patients and healthcare providers. This network is crucial for ensuring the drugs are handled correctly and reach a wide audience. In 2024, the specialty pharmacy market continued its growth, with reports indicating significant expansion driven by complex biologics and patient support services.

Medical Conferences and Scientific Publications

Akebia Therapeutics actively uses medical conferences and scientific publications as key channels to share its research and engage with healthcare professionals. These platforms are vital for disseminating clinical data, fostering scientific dialogue, and building credibility for their therapies.

Presenting at major medical conferences, such as the American Society of Nephrology (ASN) Kidney Week, allows Akebia to reach a broad audience of nephrologists and kidney disease specialists. For instance, in 2024, Akebia presented data from its Phase 3 programs, highlighting the potential benefits of vadadustat for patients with chronic kidney disease (CKD).

- Dissemination of Clinical Data: Conferences and publications are primary avenues for sharing pivotal trial results and real-world evidence.

- Building Scientific Credibility: Peer-reviewed publications in journals like the New England Journal of Medicine or Kidney International validate research findings and enhance Akebia's standing.

- Raising Medical Community Awareness: These channels ensure that the latest advancements and treatment options developed by Akebia reach the physicians who can benefit their patients.

- Engagement and Feedback: Presenting data at conferences allows for direct interaction with Key Opinion Leaders (KOLs), providing valuable feedback for ongoing research and development.

Online Investor Relations Portal and Corporate Website

Akebia Therapeutics' investor relations portal and corporate website are crucial for transparent communication. These platforms disseminate vital information, including financial reports, press releases, and scientific updates, directly to investors, media representatives, and the general public.

In 2024, Akebia continued to leverage these digital assets to share key developments. For instance, their website would have featured updates on clinical trial progress and regulatory milestones, alongside quarterly earnings reports. This direct channel ensures stakeholders have access to accurate, up-to-date company data.

- Investor Relations Portal: Provides access to SEC filings, earnings call transcripts, and investor presentations.

- Corporate Website: Features company overview, pipeline information, newsroom, and scientific publications.

- Key Information Dissemination: Facilitates timely sharing of financial results, strategic updates, and scientific data.

- Audience Engagement: Serves as a primary touchpoint for investors, analysts, media, and the public.

Akebia's channels include a specialized sales force, commercial contracts with dialysis organizations, specialty pharmacies, and digital platforms for investor and public relations. These diverse channels ensure broad market reach and effective communication of product information and company updates.

In 2024, Akebia focused on strengthening these channels to maximize patient access to its therapies and maintain transparent communication with stakeholders. The company’s strategic use of these channels is fundamental to its business model and market penetration efforts.

The direct sales force and key commercial contracts, particularly for Vafseo, are critical for driving adoption and ensuring product availability in 2024. Furthermore, digital channels like the investor relations portal and corporate website are vital for disseminating financial and scientific information to a global audience.

Akebia Therapeutics actively engages with the medical community through presentations at key conferences, such as the American Society of Nephrology (ASN) Kidney Week, and through publications in peer-reviewed journals. This approach is essential for building scientific credibility and raising awareness among healthcare professionals.

| Channel | Description | 2024 Focus/Activity | Key Data Point (Illustrative) |

|---|---|---|---|

| Direct Sales Force | Nephrology-specialized team engaging healthcare providers. | Continued investment in team expertise and market penetration. | Sales force size maintained at X representatives. |

| Commercial Contracts | Agreements with major dialysis organizations for product distribution. | Expansion of footprint and securing access for Vafseo. | Contracts secured with Y% of top dialysis providers. |

| Specialty Pharmacies | Network for delivering treatments and patient support. | Growth in specialty pharmacy market supporting complex biologics. | Partnerships with Z specialty pharmacy networks. |

| Medical Conferences & Publications | Dissemination of clinical data and engagement with KOLs. | Presentation of Phase 3 data at ASN Kidney Week 2024. | X publications in peer-reviewed journals. |

| Digital Channels (IR Portal, Website) | Transparent communication of financial and scientific updates. | Regular updates on clinical progress and financial results. | Website traffic increased by Y% in 2024. |

Customer Segments

Adult patients on dialysis experiencing anemia due to Chronic Kidney Disease (CKD) represent a core customer segment for Akebia, particularly for its product Vafseo. This segment is defined by their ongoing need for effective anemia management within the dialysis setting. This group is actively seeking treatments that can improve their quality of life and overall health outcomes.

Vafseo is specifically indicated for adults who have been on dialysis for at least three months, highlighting a significant and established patient population. In 2024, the prevalence of CKD in the United States continued to be a major public health concern, with millions of individuals requiring dialysis. This underscores the substantial market size for Vafseo within this specific patient demographic.

Adult patients with chronic kidney disease (CKD) not on dialysis who also suffer from anemia represent a substantial market for Akebia. The company is actively working to expand the approved uses for Vafseo into this group.

Akebia's commitment is demonstrated through their planned Phase 3 clinical trials, specifically the VALOR study, designed to gather crucial data for this patient segment. This strategic move targets a significant unmet need in the CKD landscape.

The potential market size for treating anemia in non-dialysis CKD patients is considerable. In 2024, it's estimated that millions of individuals in the US alone fall into this category, highlighting the opportunity for Vafseo.

Adult patients with Chronic Kidney Disease (CKD) undergoing dialysis and experiencing hyperphosphatemia represent a crucial customer segment. This group faces a significant health challenge where their kidneys can no longer effectively remove phosphorus from the blood, leading to potentially serious complications.

Auryxia is specifically designed to manage elevated serum phosphorus levels in these patients. In 2024, the prevalence of hyperphosphatemia among dialysis patients remained a significant concern, with estimates suggesting a substantial percentage of this population struggling to maintain target phosphorus levels, underscoring the unmet need for effective treatments.

Adult Patients with Non-Dialysis Dependent CKD with Iron Deficiency Anemia

This segment includes adult patients diagnosed with Chronic Kidney Disease (CKD) who are not yet requiring dialysis but are experiencing iron deficiency anemia. Akebia's product, Auryxia, is specifically indicated for treating iron deficiency anemia in this patient group, highlighting its role in managing a common complication of CKD even in its earlier, non-dialysis stages. This demonstrates the product's versatility and its ability to address critical unmet needs across the CKD spectrum.

The prevalence of iron deficiency anemia in non-dialysis dependent CKD patients is significant, impacting their quality of life and potentially disease progression. For instance, studies indicate that a substantial percentage of these patients suffer from iron deficiency, underscoring the market need for effective treatments. Akebia's strategic focus on this segment leverages Auryxia's established efficacy and safety profile.

- Target Patient Profile: Adult CKD patients (stages 1-5) not on dialysis, diagnosed with iron deficiency anemia.

- Key Need Addressed: Treatment of iron deficiency anemia, a prevalent comorbidity in non-dialysis CKD that affects energy levels and overall health.

- Market Opportunity: Significant patient population with a demonstrated need for effective anemia management, contributing to Akebia's revenue diversification within the CKD market.

- Product Fit: Auryxia's indication for this segment aligns with Akebia's commitment to providing comprehensive solutions for CKD patients.

Nephrologists and Kidney Care Professionals

Nephrologists and kidney care professionals are the primary prescribers for Akebia Therapeutics' products, making their adoption critical for market success. Their clinical judgment directly influences patient access to Akebia's treatments for chronic kidney disease (CKD).

These specialists are focused on improving patient outcomes and managing the complexities of CKD. Akebia's ability to demonstrate clear efficacy, safety, and ease of use in their practice is paramount. For instance, in 2024, the prevalence of CKD continued to be a significant health concern, with millions of patients requiring specialized care.

- Prescriber Influence: Nephrologists are the gatekeepers for Akebia's product adoption, directly impacting sales volumes.

- Clinical Value Proposition: Akebia must provide data highlighting improved patient quality of life and reduced complications, aligning with nephrologists' treatment goals.

- Market Penetration Drivers: Key opinion leader engagement and robust clinical trial data are essential for gaining trust and driving prescription patterns among these professionals.

Akebia's customer segments extend beyond patients to include the healthcare professionals who manage their care. Nephrologists are central, as they diagnose and treat CKD, directly influencing treatment decisions for anemia and hyperphosphatemia. These specialists are key to Akebia's market penetration.

The company also targets nephrology nurses and dialysis center staff who play a vital role in patient education and adherence to treatment regimens. Their engagement is crucial for the successful implementation of Akebia's therapies in daily clinical practice.

Payers, including insurance companies and government health programs, represent another critical customer segment. Securing favorable formulary placement and reimbursement is essential for patient access to Akebia's products like Vafseo and Auryxia. In 2024, healthcare cost containment remained a significant focus for payers, making a strong value proposition vital.

| Customer Segment | Key Characteristics | Akebia's Focus |

| Adult Dialysis Patients with Anemia (CKD) | Require ongoing anemia management; seeking improved quality of life. | Vafseo (primary focus) |

| Adult Non-Dialysis CKD Patients with Iron Deficiency Anemia | Significant unmet need for anemia treatment; growing market segment. | Auryxia (key focus) |

| Adult Dialysis Patients with Hyperphosphatemia | Need for effective phosphorus control; high prevalence. | Auryxia (primary focus) |

| Nephrologists and Kidney Care Professionals | Primary prescribers; focused on patient outcomes and treatment efficacy. | Demonstrate clinical value, safety, and ease of use. |

| Payers (Insurers, Government Programs) | Influence patient access through reimbursement and formulary decisions. | Secure favorable reimbursement and demonstrate cost-effectiveness. |

Cost Structure

Research and Development (R&D) is a substantial cost driver for Akebia, reflecting the company's commitment to innovation in kidney disease therapies. These expenses cover the entire lifecycle of drug development, from initial concept and laboratory research to rigorous preclinical testing and multi-phase clinical trials.

In the first quarter of 2025, Akebia reported R&D expenses totaling $9.8 million. This figure underscores the significant investment required to bring new treatments through the complex and lengthy development process, including navigating regulatory approvals and ensuring patient safety.

Selling, General & Administrative (SG&A) expenses are a significant component of Akebia's cost structure, encompassing all costs tied to bringing their products to market. This includes the crucial activities of commercialization, marketing efforts to build brand awareness, maintaining a dedicated sales force to engage with healthcare providers, and the general administrative overhead required to run the business.

In the first quarter of 2025, Akebia reported SG&A expenses totaling $25.7 million. This figure was notably influenced by the ongoing launch activities for Vafseo, their product for anemia due to chronic kidney disease in adult patients on dialysis. These expenses are essential for driving adoption and generating revenue for their key therapeutic offerings.

The cost of goods sold for Akebia Therapeutics, specifically for their key products Vafseo and Auryxia, directly reflects the expenses tied to bringing these treatments to market. This includes the price of raw materials, the wages paid to manufacturing personnel, and the indirect costs associated with running the production facilities. For the first quarter of 2025, Akebia reported a cost of goods sold amounting to $7.6 million.

Clinical Trial and Regulatory Compliance Costs

Akebia's cost structure heavily features expenses tied to clinical trials and regulatory compliance. These are crucial for bringing and keeping their therapies on the market. Think of the costs involved in running trials, like participant recruitment, data collection, and the rigorous analysis required. Then there's the ongoing effort to meet regulatory standards, which includes preparing submissions for agencies like the FDA and conducting necessary post-marketing studies. These aren't one-time costs; they represent a continuous investment.

For instance, the pharmaceutical industry generally sees significant spending in this area. In 2024, it's estimated that the average cost to develop a new drug can exceed $2 billion, with a substantial portion allocated to clinical trials and regulatory hurdles. Akebia, focusing on specific kidney disease treatments, would also face these substantial, ongoing expenditures.

- Clinical Trial Expenses: Costs associated with patient recruitment, site management, data collection, and monitoring for ongoing studies.

- Regulatory Submission Fees: Payments made to regulatory bodies like the FDA for the review and approval of new drug applications and supplements.

- Post-Marketing Surveillance: Expenses for Phase IV studies and pharmacovigilance activities to monitor drug safety and effectiveness after approval.

- Compliance Management: Costs for maintaining adherence to Good Clinical Practice (GCP), Good Manufacturing Practice (GMP), and other regulatory guidelines.

Legal and Intellectual Property Costs

Maintaining and defending intellectual property, such as patents for its kidney disease therapies, is a significant expense for Akebia Therapeutics. These costs are crucial for protecting its innovations in the competitive pharmaceutical landscape.

In 2024, Akebia, like many biopharmaceutical companies, would have allocated substantial resources to legal departments and external counsel. This includes fees for patent filings, maintenance, and potential enforcement actions against infringers. For instance, the average cost to obtain and maintain a patent in the US can range from $10,000 to $30,000 or more over its lifetime, depending on complexity and international filings.

- Patent Prosecution and Maintenance: Ongoing costs associated with filing new patent applications and paying maintenance fees to keep existing patents in force.

- Litigation and Dispute Resolution: Expenses incurred from defending against patent challenges or pursuing legal action against entities infringing on Akebia's intellectual property.

- Regulatory Compliance Legal Fees: Costs related to ensuring all legal and regulatory requirements are met for drug development and marketing.

- Licensing and Agreement Legal Review: Fees for legal expertise in negotiating and managing licensing agreements and other strategic partnerships.

Akebia's cost structure is dominated by Research and Development (R&D) and Selling, General & Administrative (SG&A) expenses, reflecting the high investment in drug development and market commercialization. The cost of goods sold for their key products, Vafseo and Auryxia, also represents a significant outlay. Furthermore, ongoing costs for clinical trials, regulatory compliance, and intellectual property protection are critical components. In Q1 2025, R&D was $9.8 million and SG&A was $25.7 million, with COGS at $7.6 million.

| Cost Category | Q1 2025 Expense (Millions USD) | Key Drivers |

|---|---|---|

| Research & Development (R&D) | 9.8 | Drug development lifecycle, clinical trials, innovation |

| Selling, General & Administrative (SG&A) | 25.7 | Commercialization, marketing, sales force, administrative overhead |

| Cost of Goods Sold (COGS) | 7.6 | Raw materials, manufacturing personnel, production facility costs |

| Clinical Trials & Regulatory | N/A (Ongoing Investment) | Patient recruitment, data collection, regulatory submissions, post-marketing |

| Intellectual Property Protection | N/A (Ongoing Investment) | Patent filings, maintenance, legal defense |

Revenue Streams

The primary revenue stream for Akebia Therapeutics is the net product revenue generated from Vafseo sales. This drug, known chemically as vadadustat, is indicated for the treatment of anemia in patients with chronic kidney disease (CKD) who are dependent on dialysis. The U.S. market represents the initial and key territory for Vafseo's commercialization.

Following its U.S. launch, Vafseo has begun contributing to Akebia's financial performance. In the first quarter of 2025, the company reported $12.0 million in net product revenue specifically from Vafseo sales. This figure signifies the early traction and initial market acceptance of the product.

Akebia Therapeutics generates revenue through the sale of its pharmaceutical products, notably Auryxia. This medication is prescribed to manage serum phosphorus levels and address iron deficiency anemia in patients with chronic kidney disease (CKD).

The financial performance of Auryxia directly contributes to Akebia's overall revenue. For the first quarter of 2025, net product revenue from Auryxia sales reached $43.8 million, underscoring its significance as a key revenue stream for the company.

Akebia Therapeutics generates revenue through strategic license and collaboration agreements, allowing other pharmaceutical companies to develop or market its products in various regions. These partnerships are crucial for expanding market reach and sharing development costs.

In the first quarter of 2025, this specific revenue stream contributed $1.5 million to Akebia's overall financial performance, highlighting the value of its intellectual property and the company's ability to forge successful commercial alliances.

Potential Future Revenue from Label Expansion

Expanding Vafseo's approved use to include patients with chronic kidney disease (CKD) who are not on dialysis presents a substantial new revenue opportunity for Akebia. This expansion targets a much larger patient population, potentially unlocking a multi-billion dollar market. By 2024, the global CKD market was already valued in the tens of billions, and this new indication would significantly increase Vafseo's addressable market.

This label expansion is a critical component of Akebia's future growth strategy. It diversifies revenue beyond the current dialysis patient base and leverages the existing infrastructure for Vafseo. The success of this move hinges on demonstrating Vafseo's efficacy and safety in this broader patient group through ongoing clinical trials and regulatory approvals.

The potential financial impact is considerable:

- Significant Market Expansion: The non-dialysis CKD patient population is substantially larger than the dialysis segment, representing a multi-billion dollar market opportunity.

- Increased Vafseo Utilization: Approval for non-dialysis CKD patients would lead to broader prescription and uptake of Vafseo.

- Diversified Revenue Streams: This expansion reduces reliance on a single patient segment, strengthening Akebia's financial resilience.

- Enhanced Competitive Positioning: Offering a treatment option for a wider CKD patient base improves Akebia's standing in the nephrology market.

Royalties from Partnerships (if applicable)

Royalties from partnerships represent a potential revenue stream for Akebia, though not a primary focus in recent disclosures. These arrangements could involve payments tied to the sales performance of Akebia's products by its collaborators in their designated markets. For instance, the company has acknowledged a royalty liability stemming from the Vifor Termination and Settlement Agreement, indicating such structures can materialize.

While specific royalty income figures from ongoing partnerships are not prominently detailed in publicly available 2024 reports, the existence of such agreements suggests a mechanism for generating passive income. These royalties are contingent on the success and sales volume achieved by Akebia's partners, making them a variable but potentially valuable revenue contributor.

- Potential Royalty Income: Revenue generated from sales of Akebia's products by third-party partners in their territories.

- Vifor Agreement: A known example of a royalty liability associated with a past partnership termination and settlement.

- Contingent Revenue: Income dependent on the sales performance and market penetration of partnered products.

- Future Growth: Opportunity to expand this revenue stream through new strategic collaborations.

Akebia Therapeutics' revenue streams are primarily driven by product sales, with Vafseo and Auryxia being the key contributors. Vafseo, targeting anemia in dialysis-dependent CKD patients, generated $12.0 million in net product revenue in Q1 2025. Auryxia, used for managing phosphorus levels and iron deficiency anemia in CKD patients, brought in $43.8 million in net product revenue during the same period.

Beyond direct product sales, Akebia also generates revenue through license and collaboration agreements, which contributed $1.5 million in Q1 2025. The company is actively pursuing a significant expansion of Vafseo's indication to include non-dialysis CKD patients, a move expected to tap into a much larger market and substantially increase revenue potential.

| Revenue Stream | Q1 2025 Revenue | Key Product/Activity |

| Net Product Revenue | $12.0 million | Vafseo (Vadadustat) |

| Net Product Revenue | $43.8 million | Auryxia |

| License & Collaboration Agreements | $1.5 million | Partnership revenue |

Business Model Canvas Data Sources

The Akebia Business Model Canvas is built using a combination of internal financial data, clinical trial results, and market intelligence reports. These sources provide a comprehensive view of Akebia's operational capabilities and market position.