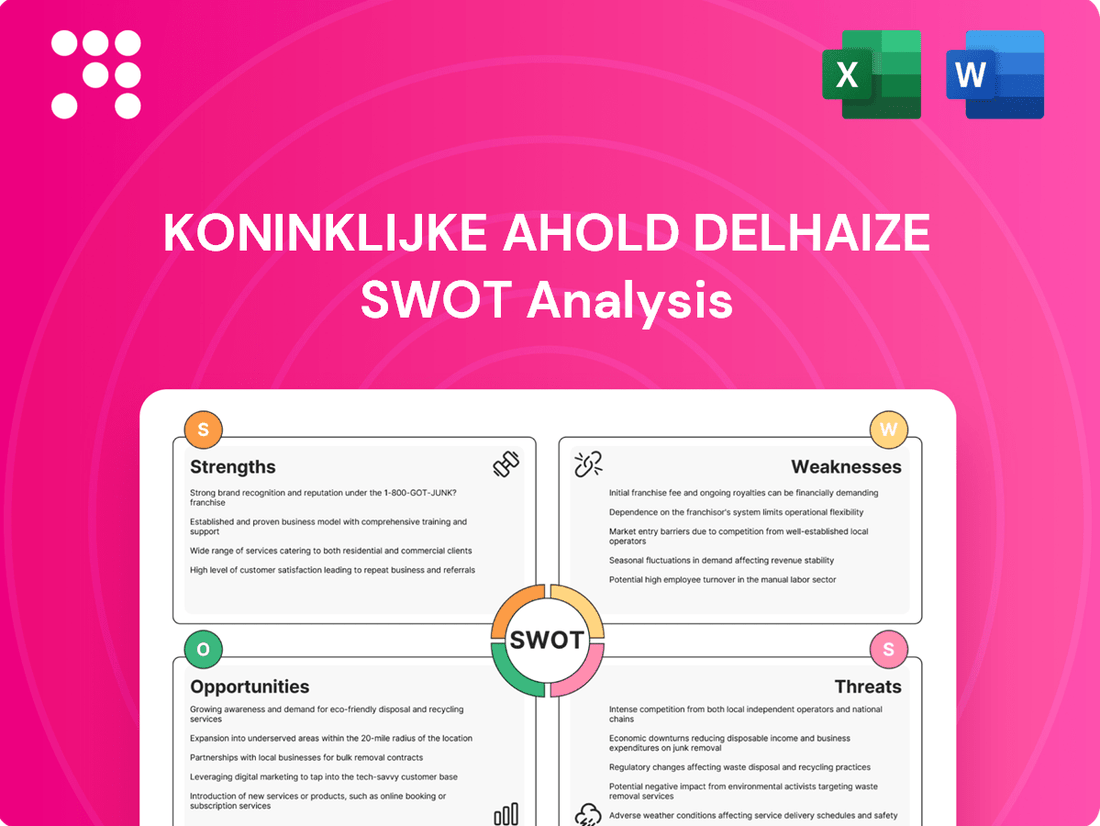

Koninklijke Ahold Delhaize SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Koninklijke Ahold Delhaize Bundle

Koninklijke Ahold Delhaize boasts strong brand recognition and a vast store network, but faces intense competition and evolving consumer preferences. Our comprehensive SWOT analysis delves into these critical areas, revealing the strategic advantages and potential pitfalls for this retail giant.

Want the full story behind Ahold Delhaize's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Koninklijke Ahold Delhaize boasts an extensive portfolio of 17 local brands, strategically positioned across the United States, Europe, and Indonesia. This diverse offering allows the company to serve approximately 72 million customers each week, reflecting a substantial and deeply embedded market presence.

With well-recognized brands such as Food Lion, Hannaford, Albert Heijn, and Delhaize, Ahold Delhaize leverages strong local recognition and consumer trust. This allows for tailored approaches to meet specific regional preferences and needs, a crucial factor in driving and maintaining market share.

Koninklijke Ahold Delhaize's robust omnichannel capabilities are a significant strength, bolstered by substantial investments in its digital ecosystem. This strategy has allowed the company to effectively integrate online and in-store shopping experiences, a crucial advantage in today's retail landscape.

The expansion of services like click-and-collect and strategic partnerships, such as the one with DoorDash for faster grocery delivery, directly addresses evolving consumer demands. These initiatives are designed to enhance customer convenience and foster loyalty, contributing to sustained growth.

Furthermore, the development of proprietary e-commerce platforms, exemplified by Prism, allows Ahold Delhaize to maintain greater control over customer data and the overall shopping journey. This technological edge is vital for personalizing offers and improving operational efficiency, as seen in their continued digital sales growth throughout 2024.

Ahold Delhaize demonstrates a robust commitment to cost savings and operational efficiency, notably through its 'Save for Our Customers' program. This initiative is designed to achieve significant cost reductions, which are then strategically reinvested. For instance, in 2023, the company achieved €1.1 billion in savings, with a target of €2.2 billion by 2025.

These savings are crucial for enhancing customer value, driving technological advancements, and supporting sustainability efforts. This focus not only bolsters the company's financial performance but also helps maintain healthy profit margins, as seen in their consistent underlying operating margin of around 4.0% in recent reporting periods.

Strong Financial Performance and Shareholder Returns

Koninklijke Ahold Delhaize has demonstrated robust financial performance, consistently achieving its targets. In 2024, the company reported an underlying operating margin of 4.0% and generated €2.5 billion in free cash flow, underscoring its operational efficiency and strong cash generation capabilities. This financial strength directly translates into enhanced shareholder value.

The company's dedication to rewarding its shareholders is evident in its capital allocation strategy. Ahold Delhaize actively returns capital through a combination of increasing dividend payouts and substantial annual share buyback programs, reinforcing its commitment to delivering attractive returns to its investors.

- Consistent Financial Achievements: Met or exceeded key financial goals in 2024, including a 4.0% underlying operating margin.

- Strong Free Cash Flow Generation: Produced €2.5 billion in free cash flow in 2024, providing financial flexibility.

- Shareholder Value Focus: Actively returns capital through proposed dividend increases and annual share buyback programs.

Leadership in Sustainability and ESG Initiatives

Koninklijke Ahold Delhaize stands out for its robust leadership in sustainability and Environmental, Social, and Governance (ESG) initiatives. The company has set ambitious targets, including a commitment to reduce absolute Scope 1 and 2 greenhouse gas emissions by 50% by 2030 compared to a 2018 baseline. This focus on a healthy and sustainable food system is not just an ethical imperative but a strategic advantage, enhancing long-term business resilience and fostering deep customer trust.

Ahold Delhaize’s dedication to ESG is further evidenced by its financial strategies, such as the issuance of sustainability-linked bonds. In 2023, the company successfully issued €500 million in sustainability-linked bonds, with the coupon linked to achieving specific targets in reducing food waste and increasing the sale of healthier products. This financial instrument directly supports their sustainability agenda, demonstrating a commitment that is both operational and financial.

The company's proactive approach to environmental stewardship is multifaceted:

- Greenhouse Gas Emission Reduction: Aiming for a 50% absolute reduction in Scope 1 and 2 GHG emissions by 2030 (vs. 2018).

- Food Waste Reduction: Targeting a 50% reduction in food waste across its own operations by 2030.

- Plastic Packaging: Committing to 100% of own-brand plastic packaging being recyclable, reusable, or compostable by 2025.

- Sustainable Food System: Actively promoting healthier diets and sustainable sourcing practices across its product portfolio.

Koninklijke Ahold Delhaize possesses a significant competitive edge through its extensive network of 17 well-established local brands spanning the US, Europe, and Indonesia, serving approximately 72 million customers weekly. This broad reach, coupled with strong brand recognition like Food Lion and Albert Heijn, allows for effective adaptation to diverse regional consumer preferences.

The company's strategic investments in its digital ecosystem have fostered robust omnichannel capabilities, seamlessly integrating online and in-store experiences. This digital advancement, including enhanced click-and-collect services and partnerships like DoorDash, directly addresses evolving customer convenience demands. Ahold Delhaize's proprietary e-commerce platforms, such as Prism, further solidify this by enabling greater control over customer data and personalized shopping journeys, contributing to continued digital sales growth observed throughout 2024.

Ahold Delhaize demonstrates a strong commitment to financial prudence and shareholder returns. The company achieved €1.1 billion in savings in 2023, with a target of €2.2 billion by 2025, reinvesting these savings to enhance customer value and technological innovation. This focus on efficiency is reflected in its consistent underlying operating margin of around 4.0%, as reported in 2024, and a robust free cash flow generation of €2.5 billion in the same year. Furthermore, Ahold Delhaize actively returns capital to shareholders through increasing dividends and substantial share buyback programs.

| Key Strength Area | Description | Supporting Data (2023/2024) |

| Brand Portfolio & Market Reach | Extensive network of 17 local brands across multiple continents. | Serves approx. 72 million customers weekly. |

| Omnichannel Capabilities | Integrated online and in-store shopping experiences, digital investments. | Continued digital sales growth in 2024. |

| Financial Performance & Efficiency | Strong cost savings initiatives and consistent financial results. | €1.1 billion savings in 2023 (target €2.2 billion by 2025). 4.0% underlying operating margin (2024). €2.5 billion free cash flow (2024). |

| Shareholder Returns | Commitment to capital allocation through dividends and buybacks. | Active dividend increases and annual share buyback programs. |

What is included in the product

Delivers a strategic overview of Koninklijke Ahold Delhaize’s internal and external business factors, highlighting its strong brand portfolio and market presence while also considering competitive pressures and evolving consumer preferences.

Offers a clear, actionable framework to identify and address Ahold Delhaize's key strategic challenges and opportunities.

Weaknesses

Koninklijke Ahold Delhaize faced a setback in its U.S. online sales growth during fiscal year 2024. This slowdown was exacerbated by the strategic divestment of FreshDirect, a key digital player.

Despite significant omnichannel investments, the company's U.S. digital sales saw a dip. This trend follows a three-year period where overall online sales and market penetration in the U.S. have remained largely stagnant, even as some individual banners reported robust double-digit growth.

Koninklijke Ahold Delhaize has encountered difficulties with its Stop & Shop brand in the United States. Several Stop & Shop locations have underperformed, necessitating store closures and the implementation of revitalization initiatives. These programs aim to enhance customer value, optimize costs, and refine the store portfolio, highlighting a clear need for strategic adjustments within its U.S. market presence.

Inflationary pressures and volatility in commodity prices and supply chains are significant weaknesses for Ahold Delhaize. These external factors can directly squeeze profit margins, especially in markets like the U.S. where the company has made substantial price investments to remain competitive.

The company's underlying operating margin has been impacted by these pressures, with the U.S. market showing a particular sensitivity. While European operations have demonstrated strength, the overall effect of these economic headwinds is a notable concern.

Furthermore, strategic decisions, such as the cessation of tobacco sales in certain European stores, while potentially aligning with evolving consumer preferences, directly reduce net sales figures, presenting another challenge to top-line growth.

Competitive Landscape and Price Pressure

The retail sector is incredibly crowded, with established players and online disruptors constantly vying for consumer attention. This intense competition often forces retailers like Ahold Delhaize to engage in price wars, which can significantly squeeze their profit margins. To stay competitive and retain customers, the company must continuously invest in price reductions, a strategy that directly impacts profitability.

For instance, in the dynamic grocery market, maintaining competitive pricing is paramount. Ahold Delhaize's commitment to price investments, as seen in its ongoing efforts to offer value to customers, directly addresses this weakness. The company's ability to manage these price pressures while investing in its store formats and online capabilities is crucial for its sustained market position.

- Intense Competition: Ahold Delhaize faces strong rivalry from both brick-and-mortar grocers and rapidly growing e-commerce platforms.

- Price Wars: The need to match competitor pricing can lead to reduced profit margins, impacting overall financial performance.

- Margin Pressure: Continuous price investments, while necessary for market share, put sustained pressure on the company's profitability.

Data Availability and Quality for Sustainability Reporting

Ahold Delhaize acknowledges that enhancing the availability and quality of data is crucial for robust sustainability reporting, even as they voluntarily adhere to emerging directives. This points to a need for strengthening their internal data management systems to ensure the comprehensiveness and accuracy of their sustainability disclosures.

The company's commitment to improving data for sustainability statements highlights potential weaknesses in current data collection and verification processes. This focus on internal enhancement suggests that while the intent is strong, the execution of data management for sustainability metrics may require significant development.

- Data Gaps: Potential inconsistencies or incompleteness in data across various sustainability metrics.

- Quality Assurance: Challenges in ensuring the accuracy and reliability of data collected from diverse operational units.

- Reporting Standardization: Efforts needed to standardize data collection and reporting methodologies across all sustainability initiatives.

Ahold Delhaize's U.S. online sales growth experienced a slowdown in fiscal year 2024, partly due to the divestment of FreshDirect. This trend follows a period of stagnant U.S. online sales and market penetration, despite investments in omnichannel capabilities. The Stop & Shop brand in the U.S. has also faced underperformance, leading to store closures and revitalization efforts, indicating challenges in optimizing its U.S. store portfolio.

Inflationary pressures and supply chain volatility continue to impact profit margins, particularly in the U.S. market where significant price investments are made to stay competitive. These economic headwinds have affected the company's underlying operating margin, with the U.S. showing particular sensitivity. Additionally, strategic decisions like ceasing tobacco sales in some European stores, while aligned with consumer trends, directly reduce net sales.

| Weakness | Description | Impact |

| U.S. Online Sales Slowdown | Fiscal year 2024 saw a dip in U.S. online sales growth, exacerbated by the FreshDirect divestment. | Reduced digital revenue stream and potential loss of market share in a key growth area. |

| Stop & Shop Underperformance | Several Stop & Shop locations are underperforming, necessitating closures and revitalization. | Negative impact on brand perception, operational efficiency, and profitability in the U.S. |

| Margin Pressure from Inflation | Volatile commodity prices and supply chain issues squeeze profit margins, especially with U.S. price investments. | Reduced profitability and potential strain on financial performance, impacting investment capacity. |

Preview Before You Purchase

Koninklijke Ahold Delhaize SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of Koninklijke Ahold Delhaize's Strengths, Weaknesses, Opportunities, and Threats, offering valuable insights for strategic planning.

Opportunities

The online grocery sector is experiencing robust growth, fueled by shifting consumer habits towards digital convenience. Ahold Delhaize is well-positioned to benefit from this trend by expanding its e-commerce capabilities.

By investing in user-friendly online platforms and utilizing data analytics for tailored customer experiences, the company aims to achieve 80% of its sales through an omnichannel approach by 2028. This strategic focus on digital expansion represents a significant opportunity for increased market share and revenue.

Koninklijke Ahold Delhaize's 'Growing Together' strategy actively seeks inorganic growth through strategic acquisitions and expanding its geographical footprint. A key focus area for this expansion is Central and Southeastern Europe, markets showing strong potential for development.

The recent acquisition of Profi is a prime example of this strategy in action, with projections indicating a significant boost to net sales in 2025. This move is expected to solidify Ahold Delhaize's market position in the region.

Koninklijke Ahold Delhaize is strategically expanding its own-brand product lines, a move that typically offers better profit margins compared to national brands. This focus also aligns with a growing consumer preference for healthier options, with the company actively promoting healthier choices across its stores. For instance, in 2023, own brands represented a significant portion of sales, contributing to improved profitability.

Leveraging AI and Automation for Efficiency and Innovation

Ahold Delhaize is actively integrating artificial intelligence and automation across its operations, from logistics and distribution to in-store processes and administrative functions. This strategic investment aims to significantly boost efficiency and achieve substantial cumulative cost savings. For instance, by the end of 2023, the company reported that its automation initiatives in distribution centers were on track to deliver significant operational improvements.

Beyond cost efficiencies, AI is a key enabler for enhancing customer engagement. By analyzing vast amounts of data, Ahold Delhaize can deliver more personalized shopping experiences and tailored insights to its customers, fostering greater loyalty and satisfaction. This focus on AI-driven personalization is a critical component of their strategy to stay competitive in the evolving retail landscape.

The company's commitment to AI and automation is expected to yield tangible benefits, including:

- Enhanced supply chain visibility and reduced delivery times through AI-powered route optimization.

- Improved inventory management and reduced waste via predictive analytics.

- Streamlined in-store operations, such as automated checkout systems and shelf-stocking robots.

- Development of hyper-personalized marketing campaigns and product recommendations.

Strengthening Local Connections and Community Engagement

Ahold Delhaize's philosophy of 'being big, starts small' truly shines through its ability to tap into deep local expertise across its diverse brands. This allows the company to swiftly adjust to evolving market dynamics and consumer preferences. By further solidifying these local ties, Ahold Delhaize can expect to see continued growth in market share and a deeper well of customer loyalty.

For example, in 2023, Ahold Delhaize's local brands, like Albert Heijn in the Netherlands and Food Lion in the US, consistently reported strong performance, with Food Lion specifically highlighting its focus on local sourcing and community engagement as a key driver of customer preference. This strategy directly translates into increased sales and a more resilient customer base, especially when facing economic uncertainties.

Key opportunities stemming from enhanced local connections include:

- Tailored Product Offerings: Developing and promoting products that specifically cater to regional tastes and dietary habits, increasing appeal and basket size.

- Community Partnerships: Collaborating with local suppliers, charities, and events to build goodwill and brand affinity, fostering a sense of shared community.

- Localized Marketing Campaigns: Implementing marketing strategies that resonate with the unique cultural nuances and values of specific geographic areas, boosting engagement.

- Enhanced Customer Service: Empowering local store teams to make decisions that best serve their immediate customer base, leading to more personalized and satisfying shopping experiences.

The expanding online grocery market presents a significant avenue for growth, with Ahold Delhaize aiming for 80% of sales through an omnichannel approach by 2028. Inorganic growth, particularly in Central and Southeastern Europe through acquisitions like Profi, is expected to boost net sales in 2025. Furthermore, a strategic emphasis on higher-margin own-brand products and the integration of AI and automation for efficiency and personalized customer experiences are key opportunities.

| Opportunity Area | Description | Key Data/Projections |

|---|---|---|

| E-commerce Expansion | Leveraging digital convenience and data analytics for tailored customer experiences. | Target: 80% omnichannel sales by 2028. |

| Inorganic Growth | Acquisitions and geographical expansion, focusing on Central and Southeastern Europe. | Profi acquisition expected to boost net sales in 2025. |

| Own-Brand Development | Focus on higher-margin products and healthier options. | Own brands contributed significantly to profitability in 2023. |

| AI & Automation | Boosting efficiency in logistics, operations, and enhancing customer engagement. | Initiatives on track for significant operational improvements by end of 2023. |

Threats

Koninklijke Ahold Delhaize contends with formidable competition from e-commerce behemoths like Amazon and Walmart, whose vast reach and sophisticated logistics can siphon market share. This intense rivalry, coupled with the aggressive pricing strategies of discount retailers, exerts significant pressure on Ahold Delhaize's profit margins, necessitating constant innovation and operational efficiency.

Consumer preferences are a moving target, and Ahold Delhaize must stay agile. For instance, the surge in demand for plant-based options and sustainable sourcing means the company needs to constantly refresh its product offerings. In 2024, reports indicate that over 60% of consumers are actively seeking out healthier and more environmentally friendly food choices, a trend Ahold Delhaize must actively address.

The way people shop is also changing dramatically. The expectation for a smooth, integrated experience between online and physical stores is no longer a nice-to-have, but a must-have. If Ahold Delhaize doesn't nail this omnichannel approach, they risk losing customers to competitors who offer more convenient digital interactions and faster delivery options, a challenge highlighted by a 2025 market analysis showing a 15% year-over-year increase in online grocery penetration.

Koninklijke Ahold Delhaize faces significant headwinds from ongoing economic volatility. High inflation, projected to remain elevated in 2024 and potentially into 2025, directly impacts consumer purchasing power and increases operational costs. For instance, in the first quarter of 2024, food inflation in key markets like the US and Europe remained a concern, forcing Ahold Delhaize to absorb some of these costs.

This inflationary environment, coupled with fluctuating interest rates, heightens price sensitivity among customers. To maintain market share, the company may need to undertake further price investments, which could compress profit margins. For example, in 2023, Ahold Delhaize reported an increase in promotional activities to offset rising prices, impacting its underlying operating margin.

Supply Chain Disruptions and Geopolitical Conflicts

Global supply chain volatility remains a significant concern for retailers like Ahold Delhaize. Geopolitical tensions, such as ongoing conflicts and trade disputes, can create unpredictable disruptions, impacting the availability and cost of goods. For instance, in 2024, many companies continued to navigate the lingering effects of the Red Sea shipping disruptions, which led to increased transit times and freight costs for goods moving between Asia and Europe.

Natural disasters, including extreme weather events exacerbated by climate change, also pose a threat. These events can directly damage suppliers' facilities, interrupt transportation networks, and affect agricultural output. Climate change's impact on crop yields and commodity prices, particularly for staples like grains and produce, directly influences Ahold Delhaize's sourcing and pricing strategies, as seen in the fluctuating costs of certain agricultural products throughout 2024.

These combined factors create a challenging operating environment:

- Supply Chain Volatility: Continued disruptions in global shipping and logistics networks in 2024 led to extended lead times and higher transportation expenses for many retailers.

- Geopolitical Risks: Ongoing international conflicts and trade tensions create uncertainty around sourcing and can lead to import restrictions or increased tariffs.

- Climate Change Impact: Adverse weather events in key agricultural regions during 2024 affected crop yields, contributing to price volatility for essential food commodities.

Cybersecurity Risks and Data Privacy Concerns

As a major retail conglomerate with extensive online operations and a vast customer database, Koninklijke Ahold Delhaize is particularly vulnerable to evolving cybersecurity threats. Ransomware attacks, for instance, can cripple operations and lead to significant financial losses. Protecting sensitive customer information and maintaining robust data privacy protocols are therefore critical for preserving brand reputation and ensuring continued customer loyalty.

The increasing reliance on digital infrastructure exposes Ahold Delhaize to a range of cyber risks, including data breaches and system disruptions. In 2023, the retail sector experienced a notable rise in cybersecurity incidents, with the average cost of a data breach reaching millions of dollars globally. For Ahold Delhaize, a successful cyberattack could not only result in direct financial penalties but also erode the trust built with millions of customers who share their personal data.

- Increased threat landscape: Retailers are prime targets for cybercriminals due to the volume of transaction data they handle.

- Data privacy regulations: Strict adherence to GDPR and similar regulations is essential to avoid substantial fines and reputational damage.

- Operational disruption: A successful cyberattack could halt sales, disrupt supply chains, and impact in-store and online services.

Koninklijke Ahold Delhaize faces significant threats from intense competition, especially from agile online retailers and aggressive discount chains, which can pressure profit margins. Evolving consumer demands for healthier, sustainable options require constant product innovation, a challenge underscored by over 60% of consumers in 2024 seeking such choices. Furthermore, the critical need for seamless omnichannel experiences, with a 15% year-over-year increase in online grocery penetration by 2025, presents a significant operational hurdle if not met effectively.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, incorporating Ahold Delhaize's official financial reports, comprehensive market intelligence, and expert industry analyses to provide a well-rounded strategic perspective.