Koninklijke Ahold Delhaize PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Koninklijke Ahold Delhaize Bundle

Koninklijke Ahold Delhaize operates within a complex global environment, where political shifts, economic fluctuations, and evolving social trends significantly shape its strategic direction. Understanding these external forces is crucial for anticipating market opportunities and mitigating potential risks within the retail sector. Our comprehensive PESTLE analysis delves deep into these influential factors, providing actionable intelligence for informed decision-making.

Gain a competitive edge by exploring how technological advancements and environmental regulations impact Ahold Delhaize's operations and future growth. This ready-made PESTLE analysis delivers expert-level insights, perfect for investors, consultants, and business planners seeking a thorough understanding of the external landscape. Buy the full version to get the complete breakdown instantly and unlock strategic foresight.

Political factors

Ahold Delhaize navigates a complex web of food safety and labeling regulations across its European and U.S. markets. For instance, in the EU, the General Food Law (Regulation (EC) No 178/2002) sets the foundational principles for food safety, while the U.S. Food Safety Modernization Act (FSMA) imposes rigorous preventive controls. These evolving standards demand constant investment in compliance, impacting everything from supplier audits to packaging design.

These regulatory frameworks directly influence Ahold Delhaize's operational backbone, dictating how products are sourced, processed, and distributed. The company must maintain sophisticated quality assurance protocols to meet requirements like traceability and allergen labeling, which are critical for consumer confidence. Failure to comply can result in significant fines, product recalls, and reputational damage, underscoring the importance of proactive regulatory management.

Koninklijke Ahold Delhaize's extensive international footprint means it's constantly navigating a complex web of trade policies and tariffs. These regulations directly impact the cost of importing goods and the availability of products across its various markets, especially in key regions like the U.S. and Europe. For instance, changes to trade agreements or the imposition of new tariffs can significantly alter supply chain dynamics and necessitate adjustments to pricing strategies to maintain competitiveness.

Governments globally are increasingly providing incentives for businesses adopting sustainable practices. For Ahold Delhaize, this could translate into benefits for its investments in renewable energy sources for its stores and distribution centers, or for initiatives aimed at reducing food waste. For example, the Dutch government, through programs like the Stimulering Duurzame Energieproductie (SDE++) subsidy, supports renewable energy projects, which Ahold Delhaize could tap into for its operational energy needs.

Conversely, governments may introduce new taxes or penalties on activities deemed unsustainable. This could impact Ahold Delhaize if, for instance, carbon taxes are implemented or if regulations tighten around packaging waste. The company's proactive stance on environmental, social, and governance (ESG) reporting, including compliance with the Corporate Sustainability Reporting Directive (CSRD) which mandates detailed sustainability disclosures, positions it well to anticipate and adapt to these evolving regulatory landscapes, potentially mitigating cost increases.

Political Stability and Geopolitical Uncertainty

Koninklijke Ahold Delhaize's global operations mean it navigates a complex web of political landscapes. Fluctuations in political stability and geopolitical tensions can directly impact its supply chains and consumer spending habits. For instance, the company noted in its Q1 2025 earnings that ongoing macroeconomic and geopolitical volatility is affecting markets, citing tariff discussions in the U.S. and regional conflicts in Europe as key concerns.

These geopolitical factors necessitate a resilient and adaptable supply chain. Ahold Delhaize's ability to manage these external pressures is crucial for maintaining consistent operations and consumer trust. The company's strategy must account for potential disruptions stemming from international relations and trade policies.

- Geopolitical Risk Exposure: Ahold Delhaize operates in numerous countries, each with its own political climate, creating diverse risk exposures.

- Supply Chain Vulnerability: Political instability and conflicts can disrupt the flow of goods, impacting product availability and costs.

- Consumer Confidence Impact: Geopolitical uncertainty often leads to reduced consumer spending, affecting Ahold Delhaize's sales performance.

- Trade Policy Sensitivity: Discussions around tariffs and trade agreements, as mentioned in Q1 2025, directly influence the cost of goods and market access.

Labor Laws and Regulations

Labor laws, such as minimum wage, working conditions, and unionization rights, vary considerably across Ahold Delhaize's global operating regions. These differences directly influence workforce management strategies and overall operational expenses. For instance, in 2024, minimum wage adjustments in key markets like the Netherlands and Belgium, where Ahold Delhaize has significant operations, have added to labor cost considerations.

Ahold Delhaize's stated commitment to fostering thriving people and being an employer of choice necessitates a deep understanding and careful adherence to these diverse legal frameworks. Navigating these varied labor regulations is crucial for maintaining positive employee relations and effective recruitment across its international footprint.

Potential shifts in labor legislation present ongoing challenges and opportunities. For example, proposed changes to working hour regulations in some European countries could impact staffing models and necessitate adjustments to operational schedules, potentially affecting recruitment and employee satisfaction.

- Minimum Wage Impact: In 2024, minimum wage increases in countries like Belgium and the Netherlands directly impacted Ahold Delhaize's labor costs, requiring careful budget allocation.

- Unionization Trends: The strength and influence of labor unions differ across regions, affecting collective bargaining agreements and employee relations strategies for the company.

- Working Conditions Compliance: Adhering to varying regulations on working hours, safety standards, and employee benefits across different countries is a continuous operational focus for Ahold Delhaize.

- Legislative Adaptability: Proactive monitoring and adaptation to evolving labor laws, such as potential changes to gig worker classifications in some markets, are essential for future workforce planning.

Political stability and government policies significantly influence Ahold Delhaize's operational environment. For instance, the company's Q1 2025 report highlighted concerns regarding macroeconomic volatility and geopolitical tensions, including tariff discussions in the U.S. and regional conflicts in Europe, which directly impact supply chains and consumer spending.

Government incentives for sustainability, such as Dutch subsidies for renewable energy, offer opportunities for Ahold Delhaize to reduce operational costs. Conversely, potential carbon taxes or stricter packaging waste regulations could increase expenses, making proactive ESG reporting, like that mandated by the CSRD, crucial for mitigating financial impacts.

Labor laws, including minimum wage adjustments seen in 2024 in countries like Belgium and the Netherlands, directly affect Ahold Delhaize's labor costs and workforce management strategies. The company must continuously adapt to varying regulations on working conditions and unionization rights across its international markets to maintain positive employee relations.

What is included in the product

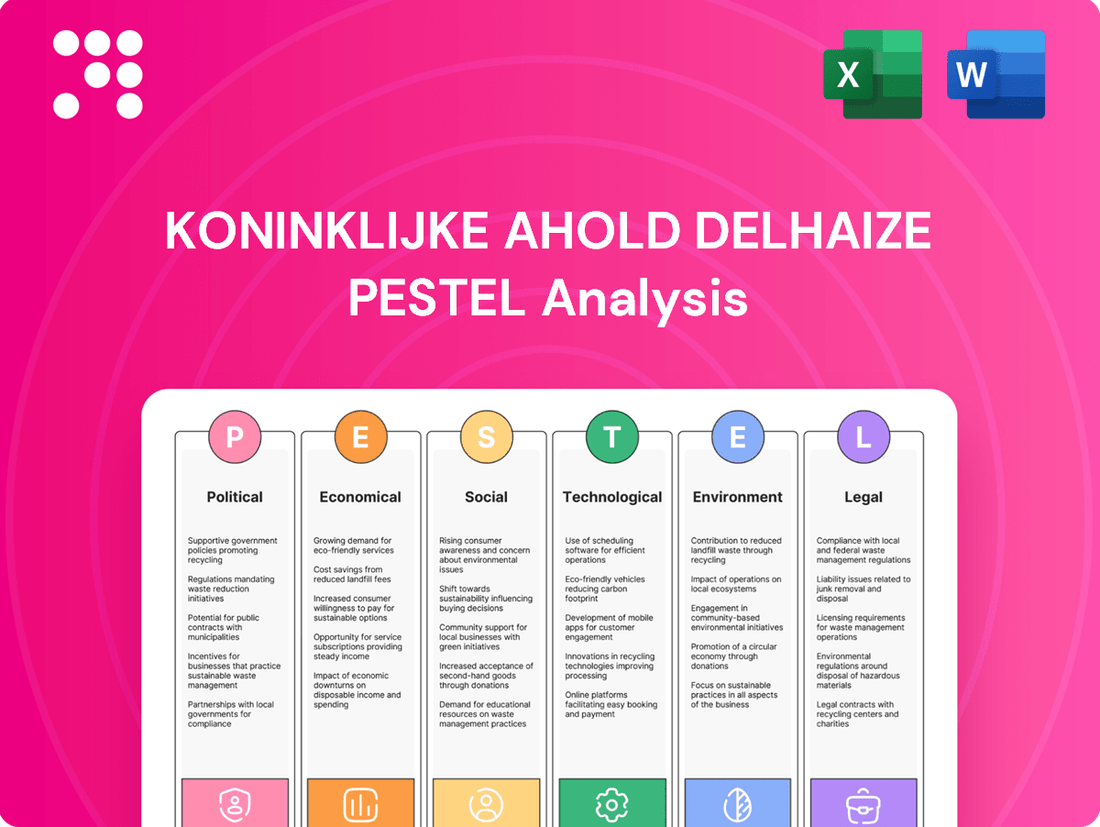

The PESTLE analysis of Koninklijke Ahold Delhaize examines how political, economic, social, technological, environmental, and legal forces impact its operations and strategic planning.

This comprehensive review provides actionable insights into market dynamics and regulatory landscapes, enabling informed decision-making for stakeholders.

A clear, actionable framework that transforms complex external factors into strategic opportunities for Koninklijke Ahold Delhaize, alleviating the pain of navigating market uncertainties.

Economic factors

Inflationary pressures in both the U.S. and Europe have noticeably driven up household expenses, making consumers more attentive to prices. For instance, the U.S. CPI saw a 3.4% increase year-over-year as of April 2024, while European inflation also remained a concern.

In response, Ahold Delhaize has strategically invested in pricing, particularly in its U.S. banners like Food Lion and Stop & Shop, aiming to offer competitive prices. The company also expanded its own-brand offerings, which are typically more affordable, to better serve consumers focused on value during these challenging economic times.

The overall economic health of the markets where Ahold Delhaize operates significantly influences consumer purchasing power and retail sales performance. Despite reporting robust Q1 2025 sales growth, the company continues to navigate an economic climate marked by uncertainty.

For instance, in the US, inflation, while showing signs of moderation, remained a key concern throughout 2024, impacting household budgets. Similarly, European economies faced varying degrees of slowdown, with some countries experiencing near-stagnation, affecting discretionary spending on groceries and household items.

Ahold Delhaize's capacity to adjust its product offerings and pricing strategies to suit diverse economic conditions is paramount for maintaining consistent financial results and market share.

Koninklijke Ahold Delhaize, operating globally, is significantly exposed to exchange rate fluctuations. As a substantial portion of its business is conducted outside the Eurozone, movements in currencies like the US dollar directly affect its reported financial performance. For instance, a stronger dollar can reduce the Euro-denominated value of its US sales and profits, and vice versa.

These currency shifts directly impact key financial metrics. In Q1 2025, Ahold Delhaize noted that exchange rate movements had a notable effect on its reported net sales and operating income, underscoring the importance of currency translation. Managing this inherent currency risk remains a crucial aspect of the company's financial strategy and treasury operations.

Commodity Price Volatility

Fluctuations in the prices of essential commodities like coffee, olives, and cocoa significantly impact Koninklijke Ahold Delhaize's cost of goods sold and overall profitability. For instance, cocoa prices surged to unprecedented levels in 2024, underscoring the potent influence of global supply and demand dynamics on procurement costs.

Ahold Delhaize actively employs strategies to navigate this commodity price volatility. These include diversifying its sourcing channels to reduce reliance on single suppliers and fostering closer relationships with its producers to better anticipate and manage price swings.

- Cocoa Price Surge: Cocoa futures reached record highs in early 2024, exceeding $10,000 per metric ton, a stark increase from previous years, directly impacting confectionery costs for retailers like Ahold Delhaize.

- Diversified Sourcing: The company aims to mitigate risks by sourcing key ingredients from multiple geographic regions, reducing vulnerability to localized supply disruptions or price spikes.

- Supplier Collaboration: Engaging directly with suppliers allows for better forecasting and potential hedging strategies, helping to stabilize procurement costs for critical commodities.

Interest Rates and Investment Environment

Changes in interest rates directly affect Ahold Delhaize's cost of capital, influencing its ability to fund crucial investments in supply chain upgrades, technological advancements, and store modernization. For instance, higher borrowing costs could temper the pace of these strategic initiatives.

Despite potential macroeconomic challenges, Ahold Delhaize demonstrated financial resilience by announcing a €1 billion share buyback program in early 2024. This move signals management's confidence in the company's financial health and its capacity to return value to shareholders even amidst fluctuating economic conditions.

A supportive interest rate environment is a key enabler for Ahold Delhaize's ambitious growth plans. Lower rates can make it more attractive and affordable to finance expansion projects, acquisitions, and other strategic ventures that are vital for maintaining its competitive edge in the evolving retail landscape.

- Impact on Borrowing Costs: Higher interest rates increase the expense of debt financing for capital expenditures like supply chain transformation and technology investments.

- Share Buyback Program: Ahold Delhaize's €1 billion share buyback in 2024 highlights financial strength, potentially allowing for continued investment even if rates rise.

- Strategic Growth Support: Favorable interest rates reduce the cost of capital, making it easier for the company to pursue growth initiatives and maintain competitive investment levels.

- 2024 Financial Outlook: While specific 2025 interest rate forecasts are dynamic, the company's 2024 actions suggest a strategic approach to managing capital in a variable rate environment.

Inflationary pressures in both the U.S. and Europe continue to impact consumer spending, with U.S. CPI at 3.4% year-over-year in April 2024. Ahold Delhaize is strategically investing in competitive pricing and expanding its own-brand offerings to address value-conscious consumers. The company's Q1 2025 sales growth indicates resilience amidst economic uncertainty, though varying economic slowdowns in Europe affect discretionary spending.

Exchange rate fluctuations, particularly the US dollar's impact on Euro-denominated results, are a key concern, as noted in Q1 2025 financial reports. Commodity price volatility, exemplified by record cocoa prices exceeding $10,000 per metric ton in early 2024, necessitates diversified sourcing and supplier collaboration to manage procurement costs effectively.

Rising interest rates increase Ahold Delhaize's cost of capital, potentially slowing investments in modernization. However, the company's €1 billion share buyback in early 2024 signals financial confidence and a commitment to shareholder value, even within a fluctuating rate environment.

| Economic Factor | Impact on Ahold Delhaize | Relevant Data/Action |

|---|---|---|

| Inflation | Reduced consumer purchasing power, increased operating costs | U.S. CPI: 3.4% (April 2024); Strategic pricing investments; Own-brand expansion |

| Exchange Rates | Affects reported sales and profits from international operations | Q1 2025: Noted impact of currency movements on net sales and operating income |

| Commodity Prices | Impacts cost of goods sold and profitability | Cocoa prices > $10,000/metric ton (early 2024); Diversified sourcing, supplier collaboration |

| Interest Rates | Influences cost of capital for investments and financing | €1 billion share buyback (early 2024); Higher rates increase borrowing costs |

Preview Before You Purchase

Koninklijke Ahold Delhaize PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Koninklijke Ahold Delhaize covers all key external factors influencing its business strategy. You'll gain insights into the political, economic, social, technological, legal, and environmental landscape shaping the company's future.

Sociological factors

Consumers are increasingly prioritizing healthy, locally sourced, and sustainably produced food. This strong preference directly influences Ahold Delhaize's product selection and how it sources its goods. For instance, by 2023, Ahold Delhaize reported that 60% of its own-brand products were considered healthier options, a testament to this evolving demand.

Ahold Delhaize has woven this consumer shift into its overarching 'Growing Together' strategy. The company is actively working to boost sales of its healthier own-brand products and encourage customers to make more sustainable choices. This strategic alignment is crucial for staying competitive in a market where ethical and health-conscious consumption is on the rise.

This evolving demand is a significant catalyst for innovation within the company, pushing for new product development and more targeted marketing campaigns. Ahold Delhaize's commitment to sustainability, including initiatives like reducing food waste and increasing plant-based offerings, directly addresses these shifting consumer values.

Customers now expect to move effortlessly between online browsing, mobile apps, and physical stores. This shift means Ahold Delhaize must offer a unified experience, whether a shopper is using their app to order groceries for pickup or visiting a local Albert Heijn or Stop & Shop. By 2024, it's estimated that over 60% of retail sales will have an online component, underscoring the urgency of this trend.

Ahold Delhaize is actively responding by boosting its omnichannel investments. This includes enhancing their digital platforms, expanding click-and-collect options at many of their banners, and forging strategic alliances with third-party delivery providers. These efforts are designed to make shopping more convenient and build stronger customer relationships.

The financial impact is substantial: studies consistently show that customers who engage with retailers across multiple channels, or omnichannel shoppers, typically spend considerably more than single-channel customers. For instance, some research indicates omnichannel customers can spend up to 30% more annually, making this a critical area for Ahold Delhaize's growth strategy in 2024 and beyond.

Demographic shifts, particularly an aging population and a shrinking workforce in many of its operating regions, pose significant challenges for Ahold Delhaize. For instance, in Europe, the dependency ratio is projected to increase, meaning fewer working-age individuals supporting a larger elderly population, potentially exacerbating labor shortages. This trend directly impacts the availability of talent needed for roles across its supermarkets and distribution centers.

The company is actively addressing these dynamics by focusing on creating an attractive work environment. Ahold Delhaize's commitment to being a 'caring place to work,' coupled with initiatives that promote employee growth and collaboration, aims to counter the effects of a tighter talent market. This strategic focus on employee well-being and development is key to attracting and retaining the skilled workforce necessary for sustained operational success.

Community Engagement and Social Responsibility

Koninklijke Ahold Delhaize positions itself as a network of strong local brands, deeply woven into the fabric of the communities it serves. This approach centers on offering accessible, nutritious food and actively participating in local development. For instance, in 2023, the company facilitated the donation of over 100 million meals to food banks and charitable organizations across its operating regions, underscoring its commitment to social responsibility.

This dedication to community engagement extends to strategic partnerships with non-profits and local groups. By supporting initiatives that address food insecurity and promote well-being, Ahold Delhaize not only fulfills its social obligations but also cultivates a reservoir of goodwill. This fosters robust trust and significantly enhances its overall brand image and customer loyalty.

- Community Focus: Ahold Delhaize operates under the ethos of being a 'family of great local brands,' emphasizing its integration within community structures.

- Food Security Initiatives: In 2023, the company facilitated the donation of over 100 million meals to food banks and charitable organizations, directly addressing food insecurity.

- Partnerships: Collaborations with non-profit organizations are a key strategy to support local community needs and strengthen brand reputation.

- Brand Trust: Active involvement in community support and the provision of affordable, healthy food options contribute to enhanced consumer trust and brand loyalty.

Demand for Personalized Offers and Loyalty Programs

Consumers today really want things to feel special and just for them. They expect personalized deals and experiences, and Ahold Delhaize is stepping up to meet this demand. They're using smart data analysis and loyalty programs to make shopping more tailored.

Ahold Delhaize's commitment to personalization is evident in its strong performance. In 2024 alone, the company's brands in the United States distributed more than 12 billion personalized offers. This massive number highlights a strategic focus on driving sales through loyalty programs.

This data-driven strategy isn't just about handing out discounts; it's about building deeper connections. By understanding customer preferences, Ahold Delhaize can boost engagement and encourage shoppers to come back more often. It's a smart way to foster lasting customer relationships in a competitive market.

- Personalization Demand: Consumers increasingly seek tailored offers and unique shopping experiences.

- Data-Driven Approach: Ahold Delhaize leverages advanced data analytics to understand and cater to customer needs.

- Loyalty Program Impact: The company utilizes loyalty programs to enhance customer engagement and drive repeat business.

- 2024 U.S. Performance: Over 12 billion personalized offers were delivered by U.S. brands in 2024, demonstrating significant scale.

The increasing demand for healthier, locally sourced, and sustainable products significantly shapes Ahold Delhaize's offerings and sourcing strategies. By 2023, the company reported that 60% of its own-brand products met healthier criteria, reflecting a direct response to these evolving consumer preferences and aligning with its 'Growing Together' strategy.

Demographic shifts, such as aging populations and shrinking workforces in key regions, present talent acquisition challenges for Ahold Delhaize. The company is actively addressing this by fostering an attractive work environment and investing in employee growth and well-being to retain a skilled workforce.

Ahold Delhaize's commitment to community is demonstrated through its role as a network of local brands, prioritizing accessible, nutritious food and community development. In 2023, it facilitated over 100 million meal donations to food banks, underscoring its social responsibility and building strong community trust.

Consumers expect personalized experiences, which Ahold Delhaize is addressing through data analytics and loyalty programs. In 2024, its U.S. brands alone distributed over 12 billion personalized offers, a testament to its strategy of driving sales and fostering deeper customer relationships.

| Sociological Factor | Ahold Delhaize Response/Impact | Key Data/Fact (2023-2024) |

|---|---|---|

| Health & Sustainability Demand | Increased focus on healthier own-brand products and sustainable sourcing. | 60% of own-brand products were healthier options (2023). |

| Demographic Shifts | Focus on employee well-being and development to attract/retain talent amidst labor shortages. | Aging populations and shrinking workforces are key challenges in operating regions. |

| Community Engagement | Operating as local brands, supporting communities through food donations and partnerships. | Over 100 million meals donated to food banks (2023). |

| Personalization Expectations | Leveraging data analytics and loyalty programs for tailored customer experiences. | Over 12 billion personalized offers distributed by U.S. brands (2024). |

Technological factors

Koninklijke Ahold Delhaize is significantly boosting its digital offerings and online capabilities, with a clear focus on making its e-commerce business profitable. This strategic push is evident in its robust online sales growth during the first quarter of 2025, fueled by strong results in both the United States and European markets. A key driver of this success includes its collaboration with DoorDash, enhancing delivery options and customer reach.

The ongoing development of Ahold Delhaize's own e-commerce platforms and digital applications is a cornerstone of its overarching 'Growing Together' strategy. This commitment to proprietary technology ensures greater control over the customer experience and allows for more agile adaptation to evolving market demands. The company's investment in these digital tools is designed to drive customer loyalty and expand its market share in the increasingly competitive online retail landscape.

Koninklijke Ahold Delhaize is making significant investments in supply chain automation, including the deployment of automated storage and retrieval systems (AS/RS) in its distribution centers. This strategic move is designed to boost operational efficiency and achieve cost reductions across its logistics network.

The company's broader organizational simplification efforts are intrinsically linked to technological advancement, aiming to foster innovation and elevate the customer experience. A key aspect of this is the enhanced use of technology for more accurate demand forecasting and optimized inventory management, crucial for meeting consumer needs effectively.

Koninklijke Ahold Delhaize is making significant strides in adopting data analytics, AI, and predictive analytics. These technologies are central to their strategy for improving customer engagement and operational efficiency. For instance, AI-powered tools are being used to personalize promotions, with a reported uplift in campaign effectiveness for targeted offers.

The integration of these advanced analytics extends to crucial business functions like assortment planning and procurement. By analyzing vast datasets, Ahold Delhaize can better predict consumer demand, leading to optimized inventory management and stronger negotiation positions with suppliers. This data-driven approach aims to reduce waste and increase profitability.

Ahold Delhaize's commitment to data is evident in its investments in AI capabilities, particularly within its loyalty programs. These programs are designed to gather granular customer data, which is then analyzed to create highly personalized shopping experiences and offers. This focus on data allows them to better understand and anticipate customer needs, a key driver for growth in the competitive retail landscape.

In-Store Technology Enhancements

Koninklijke Ahold Delhaize is actively investing in in-store technology to boost efficiency and customer satisfaction. For instance, the company has been rolling out electronic shelf labels across its European operations. These digital labels provide real-time price updates and promotional information, reducing manual labor and potential errors. In the U.S., associates are being equipped with handheld devices, streamlining tasks like inventory management and checkout, thereby freeing them to focus more on customer interactions. This modernization of the physical store environment is a core element of their strategy to enhance the overall shopping experience and maintain competitiveness.

These technological upgrades are designed to create a more seamless and engaging in-store journey. By automating certain processes, Ahold Delhaize aims to improve the speed and accuracy of operations. For example, the use of handheld technology for associates can significantly cut down on time spent on tasks such as price checks or stock replenishment, allowing them to dedicate more attention to assisting shoppers. This focus on enhancing the physical store experience is crucial, as it remains a vital touchpoint in their customer value proposition. In 2024, continued investment in these areas is expected to yield tangible benefits in operational performance and customer loyalty.

Key technological factor impacts include:

- Improved Operational Efficiency: Electronic shelf labels and handheld devices reduce manual tasks, leading to faster operations and fewer errors.

- Enhanced Customer Service: By automating back-end tasks, associates can spend more time directly assisting customers, improving the in-store experience.

- Modernized Shopping Environment: Investments in technology contribute to a more contemporary and convenient shopping experience, aligning with evolving consumer expectations.

- Data-Driven Insights: In-store technology can generate valuable data on customer behavior and inventory, informing future strategic decisions.

Cybersecurity and Data Privacy Advancements

As Koninklijke Ahold Delhaize N.V. (AD) continues to grow its digital operations, the importance of strong cybersecurity and data privacy practices cannot be overstated. The company's expanding online presence, including e-commerce platforms and loyalty programs, naturally leads to a greater collection of customer data. Protecting this sensitive information is crucial for maintaining consumer trust and avoiding significant financial and reputational damage.

While specific investment figures for cybersecurity aren't always publicly disclosed, the trend across the retail sector, especially for large players like Ahold Delhaize, points to substantial and ongoing expenditure in this area. For instance, global spending on cybersecurity solutions was projected to reach over $200 billion in 2024, indicating the scale of the challenge and the necessary investment. Ahold Delhaize's commitment to these advancements is vital for safeguarding its operations and customer relationships.

Compliance with stringent data privacy regulations, such as the General Data Protection Regulation (GDPR) in Europe, is a non-negotiable aspect of Ahold Delhaize's technological strategy. The company must ensure its data handling practices align with these legal frameworks to avoid substantial fines and maintain its license to operate. For example, GDPR fines can reach up to 4% of annual global turnover or €20 million, whichever is higher, underscoring the financial implications of non-compliance.

Key considerations for Ahold Delhaize regarding cybersecurity and data privacy include:

- Continuous investment in advanced threat detection and prevention systems to safeguard customer data against evolving cyber threats.

- Ensuring strict adherence to global data privacy regulations like GDPR, CCPA, and others relevant to its operating markets.

- Implementing robust data anonymization and encryption techniques to protect personal information.

- Regular security audits and employee training programs to foster a culture of data security awareness throughout the organization.

Technological advancements are central to Ahold Delhaize's strategy, driving both online and in-store improvements. The company is heavily investing in e-commerce capabilities, with online sales showing robust growth in early 2025, bolstered by partnerships like DoorDash. This digital focus extends to proprietary platforms, enhancing customer experience and market reach.

Automation is a key technological factor, with Ahold Delhaize deploying automated storage and retrieval systems to boost logistics efficiency and reduce costs. Furthermore, the company is leveraging data analytics, AI, and predictive modeling to personalize promotions, optimize inventory, and improve demand forecasting, with AI-powered personalized offers showing a notable uplift in effectiveness.

In-store technology, such as electronic shelf labels and handheld devices for associates, is being rolled out to streamline operations and enhance customer service. These tools reduce manual tasks, improve price accuracy, and allow staff to focus more on customer interactions, contributing to a modernized and more efficient shopping environment. Continued investment in these areas is expected to yield significant operational and customer loyalty benefits through 2024 and beyond.

Cybersecurity and data privacy are paramount given the increased digital footprint and customer data collection. Ahold Delhaize must invest in advanced threat detection and comply with regulations like GDPR, where non-compliance can incur substantial fines, potentially up to 4% of annual global turnover. Robust data protection measures are crucial for maintaining consumer trust and operational integrity.

| Technology Area | Key Initiatives | Impact/Benefit | Data Point/Example |

| E-commerce & Digital Platforms | Online sales growth, proprietary platform development, DoorDash partnership | Increased customer reach, improved customer experience, profitable online business | Strong online sales growth in Q1 2025 (US & Europe) |

| Automation & Supply Chain | Automated Storage and Retrieval Systems (AS/RS) | Boosted operational efficiency, cost reduction in logistics | Deployment in distribution centers |

| Data Analytics & AI | Personalized promotions, demand forecasting, inventory management | Enhanced customer engagement, reduced waste, increased profitability | Uplift in campaign effectiveness for targeted offers via AI |

| In-Store Technology | Electronic shelf labels, handheld devices for associates | Improved operational efficiency, enhanced customer service, modernized shopping environment | Rollout across European operations, associates equipped with devices |

| Cybersecurity & Data Privacy | Threat detection, GDPR compliance, data anonymization | Safeguarding customer data, maintaining consumer trust, avoiding fines | Global cybersecurity spending projected over $200 billion in 2024 |

Legal factors

Ahold Delhaize faces stringent legal mandates for food safety and hygiene across its global operations. In 2024, for instance, the European Union continued to enforce regulations like the General Food Law, requiring comprehensive traceability and risk management systems. Non-compliance can lead to significant fines; for example, a major recall due to a hygiene breach could cost millions in lost product and legal penalties.

Maintaining these high standards involves robust internal processes, including regular supplier audits and continuous product testing. The company's commitment to these legal factors directly impacts consumer trust and brand reputation, as demonstrated by the significant financial and reputational damage incurred by competitors facing foodborne illness outbreaks in past years.

Ahold Delhaize's substantial market share in both Europe and the United States necessitates strict adherence to competition and antitrust regulations. These rules are in place to prevent monopolies, ensure fair competition, and maintain a balanced market for all businesses. For instance, in 2023, the company continued to navigate regulatory scrutiny across various jurisdictions, particularly concerning its market position in specific food retail segments.

Any strategic moves, such as mergers, acquisitions, or initiatives aimed at increasing market dominance, undergo rigorous review to confirm compliance. Failure to comply can result in significant fines and operational restrictions, impacting Ahold Delhaize's ability to expand or operate freely. The company's ongoing investment in technology and supply chain efficiency is also monitored to ensure it does not create anti-competitive advantages.

Koninklijke Ahold Delhaize navigates a complex landscape of labor laws across its operating countries, encompassing minimum wage regulations, defined working hours, mandatory employee benefits, and the right to collective bargaining. These legal frameworks directly influence employment costs and operational strategies.

The company's stated priority of 'thriving people' reflects a commitment to upholding fair labor practices and ensuring compliance with all applicable employment legislation for its vast workforce, which numbered over 400,000 associates as of the end of 2023.

Anticipated shifts in labor legislation, such as potential increases in minimum wages or new regulations on employee benefits, could necessitate adjustments to Ahold Delhaize's operational models and impact its overall cost structure in the 2024-2025 period.

Environmental Regulations and Reporting

Governments globally are tightening environmental rules, impacting areas like emissions, waste, and packaging. For instance, the EU's Corporate Sustainability Reporting Directive (CSRD) mandates detailed environmental disclosures. Ahold Delhaize is proactively aligning with these, setting targets such as a 40% reduction in absolute Scope 1 and 2 GHG emissions by 2030 compared to a 2018 baseline, and aiming for 100% of its own-brand plastic packaging to be recyclable or reusable by 2025.

These evolving legal landscapes require companies like Ahold Delhaize to invest in operational changes and robust, transparent reporting mechanisms. Failure to comply can lead to fines and reputational damage. The company's commitment to these standards is demonstrated by its participation in initiatives like the Science Based Targets initiative (SBTi).

- Stricter Emissions Standards: Governments are enforcing tighter limits on greenhouse gas and other pollutant emissions.

- Waste Management and Circular Economy: New laws focus on reducing landfill waste and promoting recycling and reuse, influencing packaging choices.

- Sustainable Sourcing and Supply Chains: Regulations increasingly scrutinize the environmental impact of sourcing raw materials and supply chain operations.

- Mandatory ESG Reporting: Directives like the CSRD require detailed and standardized reporting on environmental, social, and governance performance.

Data Protection and Privacy Laws

Operating extensive e-commerce platforms and loyalty programs means Ahold Delhaize handles substantial customer data, making adherence to regulations like the EU's General Data Protection Regulation (GDPR) paramount. These regulations govern data collection, storage, and usage, necessitating strong data governance and cybersecurity to safeguard customer information and prevent significant penalties.

In 2024, the focus on data privacy intensified globally, with ongoing enforcement actions and potential fines for non-compliance. For instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher. Ahold Delhaize's commitment to data protection is therefore a crucial legal and operational consideration.

- GDPR Fines: Potential penalties up to 4% of global annual revenue or €20 million.

- Customer Trust: Robust data protection builds and maintains customer confidence in Ahold Delhaize's handling of personal information.

- Data Governance: Implementing clear policies for data collection, processing, and retention is essential for legal compliance.

- Cybersecurity Investment: Continuous investment in advanced cybersecurity measures is required to protect against data breaches.

Ahold Delhaize must navigate evolving consumer protection laws, ensuring product labeling accuracy and fair advertising practices. Regulations in 2024 continued to emphasize transparency regarding ingredients, nutritional information, and origin, particularly for private label brands. Non-compliance can result in product recalls and significant fines, impacting brand trust and sales.

The company's legal obligations extend to ensuring product safety and quality throughout its supply chain, from sourcing to point of sale. Adherence to these mandates is critical for maintaining consumer confidence and avoiding costly legal battles or reputational damage. For instance, in 2023, stricter enforcement of allergen labeling rules in several European markets highlighted the need for meticulous internal controls.

Ahold Delhaize operates under a complex web of international and national laws governing its business activities, including food safety, competition, labor, environmental, and data privacy regulations. These legal factors directly influence operational costs, strategic decisions, and overall market strategy. For 2024-2025, key legal considerations include adapting to new sustainability reporting mandates and strengthening data protection measures in line with global trends.

Environmental factors

The intensifying climate crisis poses significant threats to the global food system, directly impacting crop yields and driving up commodity prices. This necessitates rapid adaptation throughout the value chain, a challenge Ahold Delhaize acknowledges. For instance, extreme weather events in 2024 have already led to an estimated 10-15% reduction in certain staple crop yields in key agricultural regions, impacting raw material availability and cost for retailers.

Ahold Delhaize is proactively integrating climate resilience into its business strategy to mitigate these physical and transition risks. This includes investing in more sustainable sourcing practices and exploring alternative supply chains less vulnerable to climate disruption. The company's 2025 sustainability targets emphasize reducing Scope 3 emissions by 15% by 2030, a move directly linked to building a more robust and climate-resilient supply chain.

Koninklijke Ahold Delhaize has committed to ambitious greenhouse gas emission reduction targets, validated by the Science Based Targets initiative (SBTi). These targets cover both direct operational emissions (Scope 1 and 2) and those throughout their extensive value chain (Scope 3).

The company's roadmap includes achieving net-zero operational emissions by 2040 and net-zero across its entire value chain by 2050, with crucial interim goals set for 2030. These commitments are actively shaping substantial investments in renewable energy sources and the implementation of more sustainable business practices across their operations.

Koninklijke Ahold Delhaize is actively working to eliminate deforestation from its supply chain, with a target date of the end of 2025. This initiative prioritizes high-impact commodities such as soy, palm oil, wood fiber, cocoa, and coffee, aiming to significantly reduce its environmental footprint.

The company collaborates closely with its suppliers, encouraging them to ensure that products meet recognized sustainability certifications or are categorized as low-risk. This proactive approach is crucial for managing the environmental impact across Ahold Delhaize's vast and complex global supply network.

Food Waste Reduction Initiatives

Ahold Delhaize is making significant strides in reducing food waste, a key environmental concern. Their commitment is evident in their reported achievement of a 35% decrease in food waste per food sales, measured against their 2016 baseline. This not only bolsters their environmental credentials but also enhances operational efficiency by minimizing losses.

Their strategy extends beyond internal reductions to actively engage with the community. Ahold Delhaize collaborates with local food banks and non-profit organizations, a crucial step in redistributing edible surplus food to those in need. This partnership approach ensures that food that might otherwise be wasted finds its way to consumers, further contributing to sustainability goals.

- Food Waste Reduction: Achieved a 35% decrease in food waste per food sales compared to a 2016 baseline.

- Environmental Sustainability: Initiatives contribute to a more sustainable operational model.

- Operational Efficiency: Reduced waste leads to cost savings and better resource management.

- Community Collaboration: Partnerships with food banks and non-profits for surplus food redistribution.

Plastic Packaging Reduction and Recyclability Goals

Koninklijke Ahold Delhaize is actively working to reduce its environmental footprint, particularly concerning plastic packaging. The company has set ambitious goals to decrease the amount of virgin plastic used in its own-brand primary packaging. Furthermore, a key objective is to ensure that 100% of its own-brand packaging is either recyclable or reusable by the year 2025.

This strategic focus on sustainable packaging is a direct response to increasing consumer demand for environmentally responsible products and growing regulatory pressure to mitigate plastic waste. Ahold Delhaize has already demonstrated progress, reporting a significant 10% reduction in virgin own-brand primary plastic packaging when compared to 2021 figures. This commitment aligns with broader industry trends and governmental initiatives aimed at promoting a circular economy.

- Virgin Plastic Reduction: Ahold Delhaize aims to significantly cut down on the use of virgin plastic in its own-brand primary packaging.

- Recyclability/Reusability Target: The company is committed to making 100% of its own-brand packaging recyclable or reusable by 2025.

- Progress Achieved: Ahold Delhaize reported a 10% reduction in virgin own-brand primary plastic packaging compared to 2021.

- Market Drivers: These initiatives are driven by growing consumer awareness and regulatory mandates concerning environmental impact.

Environmental factors significantly shape Ahold Delhaize's operational landscape, demanding a proactive approach to sustainability. The company is addressing climate change by setting ambitious emission reduction targets, aiming for net-zero operational emissions by 2040 and net-zero across its value chain by 2050, with interim goals for 2030. These commitments are supported by investments in renewable energy and sustainable practices.

Ahold Delhaize is also tackling plastic waste, targeting 100% recyclable or reusable own-brand packaging by 2025 and having already achieved a 10% reduction in virgin plastic use in own-brand primary packaging compared to 2021. Furthermore, the company has made substantial progress in reducing food waste, achieving a 35% decrease per food sales against a 2016 baseline and actively redistributing surplus food to the community.

| Environmental Focus Area | Target/Status | Key Metrics/Progress | Year |

|---|---|---|---|

| Climate Change & Emissions | Net-zero operational emissions | Scope 1 & 2 emission reduction targets validated by SBTi | 2040 |

| Climate Change & Emissions | Net-zero value chain emissions | Scope 3 emission reduction target of 15% | 2030 |

| Plastic Packaging | 100% own-brand packaging recyclable or reusable | 2025 | |

| Plastic Packaging | Reduction in virgin plastic use | 10% reduction in own-brand primary plastic packaging | vs. 2021 |

| Food Waste | Reduction in food waste | 35% decrease in food waste per food sales | vs. 2016 |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Koninklijke Ahold Delhaize is built on a robust foundation of publicly available data, including official company reports, regulatory filings, and economic indicators from reputable sources like Eurostat and national statistical offices. We also incorporate insights from leading market research firms and industry publications to ensure comprehensive coverage of all PESTLE factors.