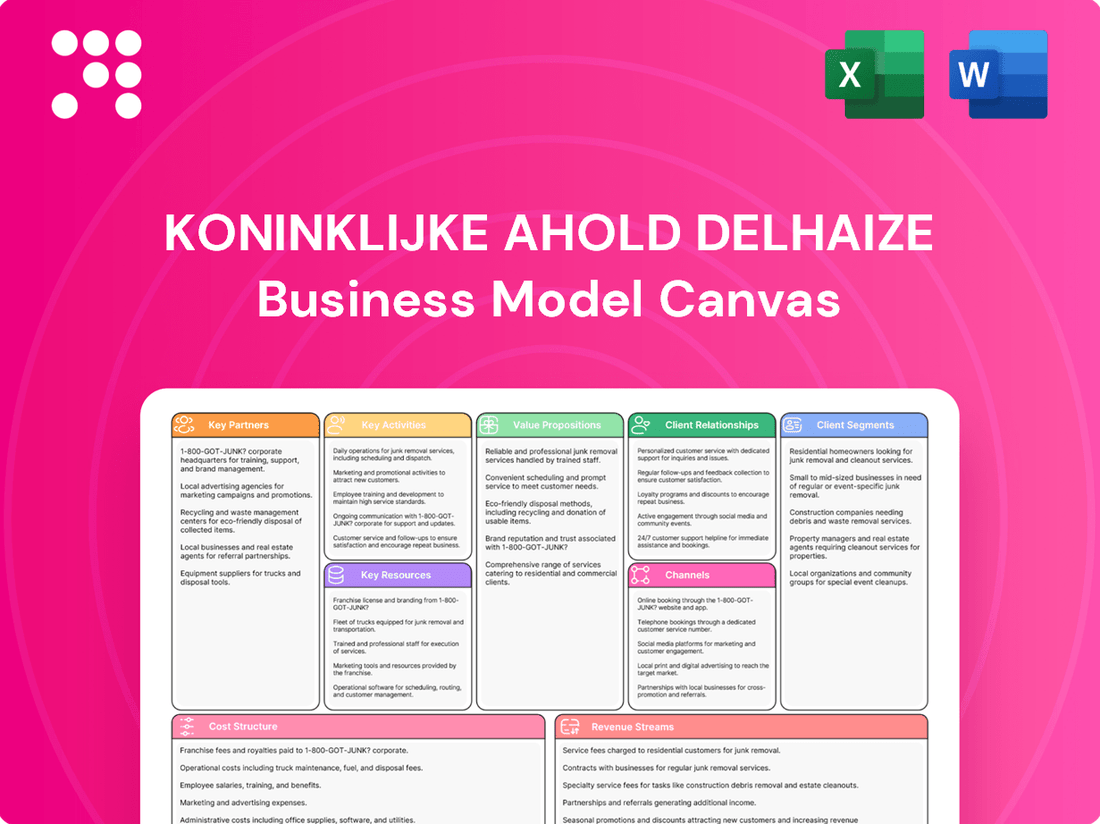

Koninklijke Ahold Delhaize Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Koninklijke Ahold Delhaize Bundle

Discover the strategic framework behind Koninklijke Ahold Delhaize's success with our comprehensive Business Model Canvas. This detailed analysis unpacks their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market dominance. Ready to gain a competitive edge? Download the full canvas now!

Partnerships

Koninklijke Ahold Delhaize works closely with a broad array of local and international suppliers. This collaboration ensures a consistent supply of high-quality fresh produce, meats, dairy, baked goods, and everyday household items for its customers.

These supplier relationships are fundamental to Ahold Delhaize's ability to maintain product excellence and optimize its supply chain. In 2024, the company continued to focus on strengthening these ties, recognizing their importance in delivering diverse product assortments that cater to specific regional tastes and demands.

Koninklijke Ahold Delhaize actively collaborates with technology and digital service providers to bolster its e-commerce capabilities and mobile applications. These partnerships are crucial for integrating advanced data analytics and artificial intelligence, aiming to personalize customer experiences and streamline operations. For instance, in 2024, the company continued to invest in its retail media platforms, leveraging partnerships to offer targeted advertising and enhance customer engagement.

Koninklijke Ahold Delhaize strategically partners with logistics and delivery providers to ensure efficient fulfillment across its diverse store formats and robust online presence. These alliances are crucial for delivering on customer expectations for speed and convenience.

A prime example is the collaboration with DoorDash in the United States, a partnership that significantly bolsters Ahold Delhaize's home delivery capabilities. This allows for rapid fulfillment of online orders, thereby expanding market reach and attracting a broader customer base.

In 2023, Ahold Delhaize reported that its online sales grew by 10.1% compared to 2022, reaching €10.6 billion, underscoring the critical role these logistics partnerships play in its overall business performance and customer satisfaction.

Retail Venture Funds and Innovative Start-ups

Koninklijke Ahold Delhaize actively collaborates with retail venture capital funds, notably W23 Global. This strategic engagement allows for direct investment in cutting-edge start-ups and scale-ups, fostering rapid integration of novel technologies and business approaches within the food retail landscape.

These partnerships are crucial for Ahold Delhaize's innovation strategy. By investing in and working with these agile companies, Ahold Delhaize can more effectively explore and pilot new business models, thereby accelerating its adaptation to evolving consumer demands and market trends.

This proactive approach ensures Ahold Delhaize remains a leader in the food retail sector. The company benefits from these collaborations by gaining early access to disruptive innovations and developing new revenue opportunities that complement its core operations.

- Partnership Focus: Investments in innovative start-ups and scale-ups through venture capital funds like W23 Global.

- Innovation Driver: Accelerates exploration of new business models and drives innovation in food retail.

- Strategic Benefit: Positions Ahold Delhaize at the forefront of industry trends and creates complementary income streams.

Local Communities and Non-Profit Organizations

Koninklijke Ahold Delhaize fosters strong ties with local communities and non-profit organizations, aligning with its commitment to social responsibility and healthy living. These collaborations are central to its strategy, ensuring that the company actively contributes to addressing societal needs within the areas it serves.

- Local Food Donations: In 2024, Ahold Delhaize's brands collectively donated an impressive 75,000 tons of food to food banks and charities, significantly impacting food security and reducing waste.

- Community Engagement: These partnerships underscore the company's dedication to its 'local matters' philosophy, reinforcing its presence as a supportive member of the communities where its stores operate.

- Sustainability Goals: The engagement with non-profits supports Ahold Delhaize's broader sustainability ambitions, particularly in areas of social impact and responsible business practices.

Key partnerships for Koninklijke Ahold Delhaize extend to collaborations with technology providers and digital service firms. These alliances are vital for enhancing e-commerce platforms and mobile applications, integrating advanced analytics, and personalizing customer experiences. In 2024, the company continued to invest in its retail media platforms, leveraging these partnerships for targeted advertising and improved customer engagement.

The company also strategically partners with logistics and delivery providers to ensure efficient order fulfillment and timely delivery, crucial for meeting customer expectations for convenience. A notable example is the collaboration with DoorDash in the United States, which significantly enhances Ahold Delhaize's home delivery capabilities and expands its market reach.

Furthermore, Ahold Delhaize actively engages with retail venture capital funds, such as W23 Global, to invest in and integrate innovative start-ups and scale-ups. This approach accelerates the adoption of new technologies and business models, keeping Ahold Delhaize at the forefront of the evolving food retail landscape.

| Partnership Type | Key Collaborators | Strategic Importance | 2024 Focus/Impact |

| Suppliers | Local & International Providers | Product quality, supply chain optimization, diverse assortment | Strengthening ties for regional tastes |

| Technology & Digital Services | E-commerce & AI Providers | E-commerce capabilities, data analytics, personalization | Investment in retail media platforms |

| Logistics & Delivery | DoorDash, etc. | Efficient fulfillment, home delivery, customer convenience | Expanding market reach via enhanced delivery |

| Venture Capital & Innovation | W23 Global | Investment in start-ups, new technologies, business models | Accelerating innovation in food retail |

| Community & Non-Profit | Food Banks, Charities | Social responsibility, healthy living, community support | 75,000 tons food donated in 2024 |

What is included in the product

This Business Model Canvas outlines Koninklijke Ahold Delhaize's strategy of serving diverse customer segments through a multi-channel approach, emphasizing fresh, healthy, and affordable food offerings.

It details key partnerships, core activities, and resource requirements to deliver value propositions across its retail banners, supported by a robust cost structure and revenue streams.

Quickly identify core components of Koninklijke Ahold Delhaize's strategy with a one-page business snapshot, effectively addressing the pain point of information overload.

Condenses Koninklijke Ahold Delhaize's complex strategy into a digestible format for quick review, relieving the pain point of understanding intricate business operations.

Activities

Omnichannel retail operations are central to Ahold Delhaize's strategy, seamlessly blending physical stores with online channels. This integration ensures customers can shop how and when they prefer, whether visiting a local supermarket, a convenience store, or utilizing their extensive e-commerce platforms.

The company manages a complex network of store formats and pick-up points, alongside sophisticated online ordering systems. This infrastructure is designed to meet varied customer needs, from quick grocery runs to planned online orders for home delivery or in-store collection.

Ahold Delhaize consistently invests in enhancing both its in-store environments and digital capabilities. For instance, in 2024, the company reported significant progress in its omnichannel growth, with online sales contributing substantially to overall revenue, demonstrating the success of these integrated efforts in fostering customer loyalty.

Koninklijke Ahold Delhaize's supply chain management is a core activity, focusing on efficient logistics and distribution to guarantee product availability and minimize expenses. In 2024, the company continued to invest heavily in AI and automation to enhance operational efficiency across its network, including its numerous distribution centers.

This strategic focus on optimization is evident in initiatives like the 'Save for Our Customers' program, which targets substantial cost reductions. By streamlining processes through technology, Ahold Delhaize aims to translate these savings into competitive pricing for consumers, reinforcing its market position.

Ahold Delhaize is actively driving customer innovation by using data and artificial intelligence to create a more engaging shopping experience. This includes offering personalized promotions and expanding their loyalty programs, aiming to deepen customer relationships and encourage repeat business.

The company is making a significant push to transition customers onto digital loyalty programs and boost the number of monthly active users across its various apps. This digital focus is crucial for understanding customer behavior and tailoring offers more effectively.

Key to this strategy is the development of new digital services and robust retail media platforms. For instance, in 2023, Ahold Delhaize reported that its digital businesses, including online sales, grew by 10.4% to €11.9 billion, demonstrating the increasing importance of these channels.

Product Assortment and Own-Brand Development

Koninklijke Ahold Delhaize actively manages its product assortment, focusing on a broad selection of grocery items, with a significant emphasis on fresh produce. The company is committed to expanding its own-brand offerings, which are crucial for differentiation and value creation.

This strategy includes a deliberate push to increase the availability of healthy product options and maintain competitive price points, particularly for entry-level items. Ahold Delhaize aims to deliver both high quality and affordability across its private label portfolio.

- Own-brand sales grew by 6.2% in 2023, reaching €9.7 billion, representing 32% of total sales.

- In 2024, the company plans to introduce over 500 new own-brand products, with a focus on sustainable and healthy options.

- The "Albert Heijn" private label in the Netherlands saw a 7% sales increase in the first quarter of 2024.

- Ahold Delhaize's private label penetration in Belgium reached 35% by the end of 2023.

Sustainability and Community Engagement

Ahold Delhaize actively pursues a healthy and sustainable food system. Key activities involve significant efforts to cut greenhouse gas emissions, a major focus for the company. For instance, in 2023, they achieved a 17.5% reduction in absolute Scope 1 and 2 GHG emissions compared to 2018 levels.

Minimizing food waste is another critical area. Ahold Delhaize aims to halve food waste in its own operations by 2030. In 2023, they reported a 32% reduction in food waste in their own operations compared to 2016.

The company is also dedicated to reducing virgin plastic in its packaging. By the end of 2023, 70% of their own-brand plastic packaging was designed to be recyclable, and they are working towards 100% by 2025.

Community engagement is also vital, with initiatives like food donations playing a key role. In 2023, Ahold Delhaize donated 23.2 million meals to food banks and local charities across its operating countries.

- Reducing Greenhouse Gas Emissions: Achieved a 17.5% reduction in absolute Scope 1 and 2 GHG emissions by the end of 2023 compared to 2018.

- Minimizing Food Waste: Reduced food waste in own operations by 32% by the end of 2023 compared to 2016, targeting a 50% reduction by 2030.

- Reducing Virgin Plastic: 70% of own-brand plastic packaging was designed to be recyclable by end of 2023, with a goal of 100% by 2025.

- Community Engagement: Donated 23.2 million meals to food banks and charities in 2023.

Koninklijke Ahold Delhaize's key activities revolve around creating and maintaining a robust omnichannel retail experience, managing an efficient supply chain, driving customer engagement through digital initiatives, curating a diverse product assortment with a focus on own brands, and championing a healthy and sustainable food system. These pillars work in concert to deliver value to customers and stakeholders.

The company's operational focus includes the seamless integration of physical and online shopping channels, supported by advanced logistics and distribution networks. Furthermore, Ahold Delhaize actively invests in data analytics and AI to personalize customer experiences and expand its digital loyalty programs and retail media offerings.

A significant aspect of their strategy involves growing their own-brand portfolio, emphasizing healthy and sustainable options, and managing costs to offer competitive pricing. This is complemented by a strong commitment to environmental sustainability, including reducing emissions and food waste, and increasing the recyclability of packaging.

| Key Activity | Description | 2023/2024 Data/Focus |

|---|---|---|

| Omnichannel Retail | Integrating physical stores and online platforms for seamless customer shopping. | Continued investment in digital capabilities; online sales contributing substantially in 2024. |

| Supply Chain Management | Efficient logistics and distribution to ensure product availability and cost minimization. | Heavy investment in AI and automation for operational efficiency in distribution centers in 2024. |

| Customer Engagement | Personalizing experiences via data and AI, expanding loyalty programs and digital services. | Focus on transitioning customers to digital loyalty programs; 10.4% growth in digital businesses in 2023. |

| Product Assortment & Own Brands | Offering a broad selection, with emphasis on fresh produce and own-brand expansion. | Own-brand sales grew 6.2% in 2023 to €9.7 billion; over 500 new own-brand products planned for 2024. |

| Sustainability & Health | Promoting a healthy food system, reducing emissions, food waste, and plastic. | 17.5% reduction in Scope 1 & 2 GHG emissions (vs. 2018) by end of 2023; 32% food waste reduction in own operations (vs. 2016) by end of 2023. |

What You See Is What You Get

Business Model Canvas

The preview you're seeing is a direct representation of the Koninklijke Ahold Delhaize Business Model Canvas you will receive upon purchase. This is not a sample or mockup; it's an authentic snapshot from the complete, ready-to-use document. Once your order is processed, you'll gain full access to this exact file, allowing you to immediately leverage its insights for strategic planning and analysis.

Resources

Ahold Delhaize leverages a powerful portfolio of strong local brands, such as Albert Heijn in the Netherlands and Stop & Shop in the U.S. These brands possess deep local expertise and foster strong community connections, acting as a key differentiator.

The company's extensive retail network, comprising approximately 9,400 stores globally as of the end of 2023, provides significant market presence and broad customer reach. This vast physical footprint is a cornerstone of their operational strategy.

This emphasis on local brand strength and a widespread retail network is integral to Ahold Delhaize's overarching 'Growing Together' strategy, enabling them to effectively serve diverse customer needs across different regions.

Koninklijke Ahold Delhaize's nearly 393,000 associates globally represent a cornerstone of its business model, injecting invaluable experience and a genuine passion for serving customers.

The company actively cultivates a supportive environment that encourages professional development and teamwork, recognizing that a diverse and inclusive workforce is key to innovation and customer satisfaction.

This commitment to its people directly translates into the exceptional customer experiences and seamless operational efficiency that define Ahold Delhaize's market presence.

Ahold Delhaize's technological backbone, including its advanced data and AI capabilities, is a critical resource. These elements are fundamental to delivering personalized customer offers, refining product selections in stores, and ensuring smooth, efficient day-to-day operations.

The company leverages its proprietary data platform, Fiona, which acts as a central hub for consolidating customer information. This allows Ahold Delhaize to gain deeper insights into consumer habits and preferences, driving more effective marketing and merchandising strategies.

Ahold Delhaize consistently prioritizes investments in modernizing its technology infrastructure. This includes the swift adoption and integration of new technological advancements to maintain a competitive edge and enhance operational efficiency.

Supply Chain and Logistics Assets

Koninklijke Ahold Delhaize's supply chain and logistics assets are the backbone of its operations, ensuring products reach customers efficiently. This includes a vast network of distribution centers and a self-distributed supply chain, crucial for managing the flow of goods for both its physical stores and booming online sales.

These logistical capabilities are essential for maintaining optimal inventory levels and guaranteeing timely deliveries, a key factor in customer satisfaction. Ahold Delhaize consistently invests in modernizing these assets, with a focus on automation and advanced logistics infrastructure to drive further efficiency gains.

For instance, in 2023, the company continued its strategic investments in its supply chain network. These investments are designed to support the growing demand from its omnichannel offerings, ensuring resilience and speed.

- Distribution Centers: A comprehensive network of strategically located distribution centers supports efficient product flow across all brands.

- Self-Distribution: A significant portion of the supply chain is self-distributed, allowing for greater control and optimization.

- Omnichannel Support: These assets are vital for fulfilling orders from both in-store and online channels, ensuring timely product availability.

- Automation & Technology: Ongoing investments in automation and advanced logistics technology aim to enhance speed, accuracy, and cost-efficiency.

Financial Capital and Investment Capacity

Koninklijke Ahold Delhaize boasts a robust financial position, underpinned by consistent free cash flow generation. This financial muscle is crucial for funding growth initiatives and strategic investments. In 2023, the company reported a free cash flow of €1.9 billion, demonstrating its capacity to generate substantial liquidity.

This financial strength directly translates into significant capital expenditure capabilities, enabling Ahold Delhaize to invest in key areas. These investments cover essential store remodels, the adoption of advanced technologies to enhance customer experience and operational efficiency, and strategic acquisitions. For instance, the acquisition of Profi in Romania, a significant move in 2024, highlights the company's strategic use of its financial capital to expand its market presence.

- Financial Stability: Consistent free cash flow generation provides a stable financial foundation.

- Investment Capacity: Strong liquidity supports capital expenditures for growth and modernization.

- Strategic Acquisitions: Financial resources enable targeted acquisitions to enhance market position, such as the Profi acquisition in Romania.

- Operational Enhancements: Funding for store remodels and technology upgrades improves customer experience and efficiency.

Ahold Delhaize's key resources include its strong local brands, extensive retail network, dedicated associates, advanced technology, and robust supply chain. These elements collectively enable the company to deliver value to customers and shareholders.

The company's financial strength, evidenced by its consistent free cash flow, is a critical resource that fuels strategic investments and acquisitions, ensuring continued growth and market competitiveness.

These resources are fundamental to executing Ahold Delhaize's strategy of driving profitable growth through a focus on customer-centricity, operational excellence, and innovation.

| Key Resource | Description | Impact |

| Strong Local Brands | Albert Heijn, Stop & Shop, etc. | Deep customer loyalty, market differentiation |

| Extensive Retail Network | ~9,400 stores (end of 2023) | Broad customer reach, market presence |

| Dedicated Associates | ~393,000 globally | Customer service, operational efficiency |

| Advanced Technology | Data & AI capabilities, Fiona platform | Personalized offers, operational optimization |

| Supply Chain & Logistics | Distribution centers, self-distribution | Efficient product flow, omnichannel support |

| Financial Strength | €1.9 billion free cash flow (2023) | Investment capacity, strategic acquisitions (e.g., Profi in 2024) |

Value Propositions

Ahold Delhaize is committed to making shopping easy and budget-friendly for everyone. They achieve this by offering a mix of physical stores and digital channels, ensuring customers can shop how and when they prefer.

To keep prices competitive, Ahold Delhaize is actively expanding its 'Price Favorites' program across its European operations. In the United States, the company has made substantial price investments in its brands, directly addressing the need for value in today's economic climate. For instance, in 2023, the company noted significant progress in its price competitiveness in the U.S., a trend that continued into early 2024.

Koninklijke Ahold Delhaize offers customers an extensive selection of grocery items, encompassing fresh fruits and vegetables, quality meats, dairy products, and freshly baked goods. This broad assortment caters to a wide array of consumer needs and preferences.

The company places a strong emphasis on delivering reliable products, actively growing its own-brand offerings. A key focus is on healthy and sustainable choices, reflecting a commitment to consumer well-being and environmental responsibility.

For the fiscal year 2023, Ahold Delhaize reported net sales of €87.7 billion. The company continues to invest in its private label brands, which are crucial for differentiating its offerings and driving customer loyalty.

Koninklijke Ahold Delhaize offers a seamless omnichannel experience, ensuring customers enjoy a consistent journey whether they're browsing in a physical store, on their website, or through their mobile app. This integration means you can shop on your terms, choosing between visiting a store, picking up your online order, or having it delivered right to your door.

In 2024, Ahold Delhaize continued to invest in enhancing its digital platforms and customer service. For instance, their focus on improving the user experience for online grocery shopping, including faster checkout processes and more intuitive navigation, aims to make every interaction smooth and efficient. This commitment is crucial for retaining customers in an increasingly competitive market.

Personalized Offers and Loyalty Programs

Koninklijke Ahold Delhaize enhances customer loyalty and satisfaction through highly personalized offers and promotions delivered via its extensive loyalty programs. By harnessing advanced data analytics, the company strives to provide customers with relevant savings and customized shopping experiences, encouraging repeat business and deeper engagement.

The strategic objective is to significantly increase the adoption of digital loyalty programs among its customer base. This digital shift allows for more sophisticated data collection and analysis, enabling even more precise personalization. For instance, in 2024, Ahold Delhaize continued to refine its data-driven approach, aiming to understand individual purchasing habits to curate offers that resonate most effectively.

- Personalized Savings: Delivers tailored discounts and promotions based on individual shopping behavior.

- Digital Loyalty Focus: Encourages customers to engage through digital platforms for enhanced program benefits.

- Data-Driven Insights: Leverages analytics to understand customer preferences and improve offer relevance.

- Customer Engagement: Aims to foster stronger customer relationships through consistent, relevant value.

Commitment to Health and Sustainability

Koninklijke Ahold Delhaize is deeply committed to fostering a healthier future for both people and the planet. This commitment is a cornerstone of their business, translating into a focus on offering sustainable food choices and actively promoting healthier eating habits among their customers. They understand that consumer choices have a ripple effect, and by providing these options, they empower customers to contribute to a more responsible and sustainable food system.

Their efforts extend across the entire value chain, aiming to minimize environmental impact. This includes initiatives to reduce waste, lower carbon emissions, and source products more sustainably. A key metric they track is the increasing percentage of their own-brand healthy food sales, demonstrating a tangible shift towards healthier product offerings. For instance, by the end of 2023, Ahold Delhaize reported that 60% of their own-brand products met their health and sustainability criteria, a testament to their ongoing progress.

- Healthier Choices: Offering a growing range of own-brand products that meet specific health criteria.

- Sustainable Sourcing: Implementing practices to reduce environmental impact in sourcing and production.

- Customer Empowerment: Enabling consumers to make choices that support a sustainable food system.

- Environmental Footprint Reduction: Setting targets and reporting on progress in areas like carbon emissions and waste.

Ahold Delhaize provides value through competitive pricing, a wide product selection, and a strong emphasis on own-brand, healthy, and sustainable options. Their commitment to making shopping easy and budget-friendly is evident in their ongoing price investments and the expansion of their 'Price Favorites' program. In 2023, net sales reached €87.7 billion, underscoring their market position.

The company enhances customer loyalty through personalized offers and a focus on digital engagement, leveraging data analytics to tailor promotions. A significant portion of their own-brand products, 60% by the end of 2023, meet their health and sustainability criteria, reflecting a dedication to both consumer well-being and environmental responsibility.

| Value Proposition | Description | Supporting Data/Initiatives |

|---|---|---|

| Convenient and Affordable Shopping | Making groceries accessible and budget-friendly through a mix of physical and digital channels. | Expansion of 'Price Favorites' program; substantial price investments in U.S. brands (noted in 2023 and continuing into 2024). |

| Extensive Product Assortment | Offering a broad range of fresh and quality grocery items to meet diverse consumer needs. | Wide selection of fruits, vegetables, meats, dairy, and baked goods. |

| Healthy and Sustainable Choices | Prioritizing own-brand products that are both healthy and environmentally responsible. | 60% of own-brand products met health and sustainability criteria by end of 2023. |

| Personalized Customer Engagement | Building loyalty through tailored offers and promotions via digital loyalty programs. | Data-driven insights used to refine offer relevance and customer understanding (ongoing refinement in 2024). |

Customer Relationships

Koninklijke Ahold Delhaize cultivates robust customer connections via personalized loyalty initiatives, delivering customized discounts and savings. This strategy aims to foster deeper engagement and provide more relevant content to shoppers.

The company is strategically shifting customers from traditional physical loyalty cards to its digital applications. This move is designed to streamline the customer experience and unlock greater opportunities for individualized communication and offers.

Evidence of this personalization's reach is substantial; in 2024 alone, Ahold Delhaize distributed over 12 billion tailored offers across its U.S. operations, highlighting the scale of its customer-centric approach.

Ahold Delhaize cultivates customer loyalty through a seamless omnichannel approach, ensuring consistent experiences whether customers shop in-store, online via their website, or through their mobile app. This integrated strategy aims to enhance the customer journey, making it easy to switch between different shopping methods.

The company actively works to boost omnichannel loyalty by consistently refining customer interactions across all touchpoints. This focus on a smooth, connected experience encourages repeat business and deeper engagement with the brand.

Data indicates that customers who engage with Ahold Delhaize through multiple channels, or omnichannel customers, exhibit significantly higher spending patterns. For instance, in 2024, omnichannel customers are projected to spend notably more than single-channel shoppers, underscoring the value of this integrated engagement strategy.

Koninklijke Ahold Delhaize champions a community-centric approach, positioning itself as a local food retailer deeply integrated into the neighborhoods it serves. This involves a keen understanding and responsiveness to the specific needs of local customers, fostering trust and strengthening community ties.

The company actively supports local initiatives, reflecting its commitment to the well-being of the areas where it operates. This dedication to local engagement is a cornerstone of its customer relationship strategy, building loyalty and a sense of shared purpose.

Proactive Customer Service and Support

Ahold Delhaize emphasizes proactive customer service, aiming to resolve issues and gather feedback efficiently. This commitment is reflected in their efforts to streamline support functions and elevate the overall shopping journey for customers. For instance, in 2024, the company continued to invest in digital tools and training for its associates to ensure responsive and helpful interactions.

The company's focus on enhancing the customer experience through responsive service is a key driver of satisfaction and loyalty. By actively listening to and addressing customer needs, Ahold Delhaize aims to build lasting relationships. This approach is crucial in a competitive retail landscape where positive interactions directly impact repeat business.

- Streamlined Support: Investment in efficient customer service channels to handle inquiries and feedback promptly.

- Enhanced Shopping Experience: Initiatives focused on improving the overall interaction customers have with Ahold Delhaize brands.

- Customer Retention: The direct link between responsive service and increased customer loyalty and repeat purchases.

Value-Driven Communication

Koninklijke Ahold Delhaize's customer relationships are built on value-driven communication, consistently highlighting their core value proposition. This includes emphasizing competitive pricing, a wide range of affordable options, and a growing focus on healthy choices. For instance, their 'Fresh Low Prices' campaigns directly communicate this commitment to value.

The company reinforces this message through programs like 'Save for Our Customers,' which provides tangible benefits and savings. This transparent communication about the value they offer is crucial for building and maintaining customer confidence and loyalty.

- Competitive Pricing: Ahold Delhaize actively promotes competitive pricing across its banners, a key element of its value proposition.

- Affordable Options: The company ensures a broad selection of affordable products to cater to diverse customer needs and budgets.

- Healthy Choices: There's a growing emphasis on offering and communicating healthy food options, aligning with evolving consumer preferences.

- 'Save for Our Customers' Program: This initiative directly translates value communication into tangible savings for shoppers, fostering trust.

Koninklijke Ahold Delhaize prioritizes customer loyalty through personalized offers and a seamless omnichannel experience, enhancing engagement across all shopping channels. The company's commitment to community and responsive customer service further solidifies these relationships, building trust and encouraging repeat business.

In 2024, Ahold Delhaize distributed over 12 billion tailored offers in the U.S. alone, demonstrating the scale of its personalization efforts. Omnichannel customers, those engaging across multiple touchpoints, are noted to have significantly higher spending patterns compared to single-channel shoppers.

The company actively communicates its value proposition through competitive pricing and affordable options, exemplified by campaigns like 'Fresh Low Prices.' This focus on tangible benefits, such as savings through programs like 'Save for Our Customers,' is central to maintaining customer confidence.

| Customer Relationship Driver | 2024 Focus/Data | Impact |

|---|---|---|

| Personalized Offers | Over 12 billion U.S. offers distributed | Deeper engagement, increased relevance |

| Omnichannel Experience | Seamless integration of physical, online, and mobile | Higher spending by omnichannel customers |

| Community Integration | Support for local initiatives | Strengthened community ties, increased trust |

| Customer Service | Investment in digital tools and associate training | Enhanced shopping journey, improved satisfaction |

| Value Communication | 'Fresh Low Prices' campaigns, 'Save for Our Customers' | Customer confidence, loyalty |

Channels

Koninklijke Ahold Delhaize maintains a robust presence through its extensive network of physical supermarkets and stores. These outlets, ranging from traditional supermarkets to convenience formats, are fundamental to their customer engagement and revenue generation across Europe and the United States.

The company is actively investing in upgrading its physical store footprint. This includes modernizing existing locations to improve the customer experience and strategically opening new stores. Ahold Delhaize plans to accelerate these new store openings and remodels throughout 2025, underscoring the continued importance of these physical channels.

Ahold Delhaize leverages its e-commerce platforms, including brand-specific websites and mobile apps, as vital channels for online sales, order fulfillment, and delivering personalized promotions. These digital touchpoints are central to customer engagement and convenience.

The company reported a notable increase in online sales, reflecting the growing consumer preference for digital shopping experiences. For instance, in the first quarter of 2024, online sales for Ahold Delhaize showed continued resilience, contributing significantly to overall revenue growth.

Key examples of these platforms include bol.com, a leading online retailer in the Netherlands, and Albert Heijn's robust online grocery service, both of which have experienced substantial user adoption and transaction volume. These platforms are continuously enhanced to improve user experience and expand product offerings.

Click-and-collect points serve as a crucial customer relationship channel for Ahold Delhaize, offering a seamless blend of online ordering and in-person pickup. This strategy directly addresses the need for convenience, allowing customers to schedule their grocery collection at their own pace. In the United States, Ahold Delhaize significantly expanded this offering, operating 1,558 click-and-collect points by the end of 2023.

Home Delivery Services

Koninklijke Ahold Delhaize leverages home delivery services as a crucial channel within its business model, directly connecting with consumers by bringing groceries to their doorsteps.

This is often facilitated through strategic alliances with third-party logistics providers, such as DoorDash, ensuring efficient and widespread reach, especially in densely populated urban environments and during peak demand periods. In 2023, Ahold Delhaize reported a significant increase in online sales, with its omnichannel strategy, including robust home delivery, playing a key role in this growth.

- Convenience: Home delivery offers unparalleled convenience, saving customers time and effort.

- Partnerships: Collaborations with services like DoorDash expand delivery capabilities and reach.

- Urban Focus: This channel is particularly effective in urban centers where logistical challenges are often more manageable.

- Sales Driver: Expanded delivery options are a significant contributor to the company's online sales growth trajectory.

Specialty Stores and Other Formats

Beyond its core supermarket operations, Koninklijke Ahold Delhaize leverages a diversified retail strategy. This includes specialty stores such as Gall & Gall, its Dutch liquor store chain, and Etos, a prominent drugstore brand also in the Netherlands. These formats allow Ahold Delhaize to target niche consumer segments and enhance its overall market presence.

The company's retail footprint extends to fuel stations, further broadening its customer touchpoints. This multi-format approach is crucial for capturing a wider share of consumer spending. For instance, in 2023, Ahold Delhaize reported net sales of €88.9 billion, demonstrating the scale of its operations across various retail channels.

The strategic acquisition of Profi in Romania significantly bolstered its presence in Eastern Europe. This move, completed in early 2024, added over 1,000 stores, primarily supermarkets and convenience stores, to Ahold Delhaize's portfolio. This expansion underscores the company's commitment to growing its market share in key international regions.

- Specialty Stores: Gall & Gall (liquor) and Etos (drugstores) in the Netherlands cater to specific consumer needs.

- Expanded Footprint: Gasoline stations and the acquisition of Profi in Romania increase market penetration.

- Strategic Growth: The Profi acquisition in early 2024 added over 1,000 stores, enhancing Ahold Delhaize's presence in Romania.

- Financial Scale: Ahold Delhaize achieved net sales of €88.9 billion in 2023, reflecting the success of its diverse retail formats.

Ahold Delhaize utilizes a multi-channel strategy, blending physical stores with robust online platforms and convenient pickup options. This approach caters to diverse customer preferences, driving engagement and sales across its European and U.S. markets.

The company's online presence is a significant growth driver, with platforms like bol.com and Albert Heijn's online grocery service experiencing strong adoption. Click-and-collect points, numbering 1,558 in the U.S. by the end of 2023, further enhance convenience.

Home delivery, often supported by partnerships like DoorDash, is a key component of their omnichannel offering, contributing to increased online sales. The company's net sales reached €88.9 billion in 2023, reflecting the effectiveness of this diversified channel strategy.

| Channel Type | Key Brands/Platforms | 2023/2024 Data Points |

|---|---|---|

| Physical Stores | Albert Heijn, Delhaize, Food Lion | Continued investment in upgrades and new openings planned for 2025. |

| E-commerce | bol.com, Albert Heijn online | Online sales showed continued resilience in Q1 2024; significant user adoption and transaction volume. |

| Click-and-Collect | Albert Heijn, Food Lion | 1,558 points in the U.S. by end of 2023. |

| Home Delivery | Via own platforms and partners (e.g., DoorDash) | Key driver of online sales growth; significant increase reported in 2023. |

| Specialty Retail | Gall & Gall, Etos | Target niche consumer segments to enhance market presence. |

Customer Segments

Koninklijke Ahold Delhaize's core customer base consists of local households and communities. The company strives to be the most local retailer, tailoring its product assortments and services to meet the unique demands of each market it serves. This approach ensures that brands like Albert Heijn in the Netherlands or Stop & Shop in the United States feel deeply connected to their immediate surroundings.

These local customers prioritize convenience, value, and health. They seek readily accessible stores offering a wide range of affordable, high-quality food and everyday essentials. Ahold Delhaize's commitment to fresh produce, healthy options, and private label brands that offer good value directly addresses these priorities. In 2023, Ahold Delhaize reported that its own brands represented over 30% of sales in the Netherlands, highlighting customer trust in their quality and affordability.

Omnichannel shoppers are a key focus for Ahold Delhaize, representing customers who seamlessly blend in-store and online shopping experiences. These individuals are highly valued because they typically spend considerably more than those who stick to a single channel. For instance, in 2023, Ahold Delhaize reported that omnichannel customers contributed a significant portion to their overall sales, demonstrating the strategic importance of this segment.

The company is actively working to deepen its engagement with these customers, aiming to boost the penetration of omnichannel loyalty sales. This involves ensuring a consistent and convenient experience across all touchpoints, from mobile apps and websites to physical store locations. By nurturing these relationships, Ahold Delhaize seeks to foster greater loyalty and increase the lifetime value of its omnichannel customer base.

Price-sensitive consumers represent a crucial segment for Ahold Delhaize, especially in the current economic climate marked by rising household expenses. The company actively works to retain these customers by focusing on competitive pricing and broadening its range of budget-friendly options.

Ahold Delhaize's 'Save for Our Customers' program, which aims to lower prices on everyday essentials, directly appeals to this group. In 2024, the company continued to emphasize value, with initiatives designed to provide tangible savings on a wide array of products, reinforcing its commitment to affordability.

Health-Conscious Consumers

Health-conscious consumers represent a vital customer segment for Ahold Delhaize, actively seeking out nutritious and ethically produced food. This group is drawn to Ahold Delhaize's efforts in expanding its own-brand healthy product lines and its dedication to sustainable sourcing practices. The company's focus on building a healthier food system resonates strongly with these consumers, driving their purchasing decisions.

Ahold Delhaize's strategy to appeal to health-conscious individuals is evident in several key areas:

- Expanded Healthy Assortments: The company has been actively increasing the availability of healthier options, including organic, plant-based, and reduced-sugar products across its banners.

- Sustainable Sourcing: Ahold Delhaize prioritizes sourcing ingredients responsibly, focusing on environmental impact and fair labor practices, which aligns with the values of this segment.

- Environmental Footprint Reduction: Initiatives aimed at lowering carbon emissions, reducing food waste, and improving packaging sustainability directly appeal to consumers concerned about the planet.

- Health and Wellness Initiatives: The company often promotes health and wellness through in-store campaigns, educational content, and partnerships, further engaging this customer base.

Digital-First Consumers

Digital-First Consumers represent a growing and crucial customer base for Ahold Delhaize. This segment actively engages with the company's digital channels, favoring mobile applications and online platforms for their shopping needs. Ahold Delhaize is strategically investing in its e-commerce infrastructure and digital loyalty programs to cater to and expand this customer group, recognizing their significant contribution to online sales growth.

In 2024, Ahold Delhaize continued to see strong performance from its digital offerings. For instance, in the first quarter of 2024, the company reported a 10.5% increase in online sales for its Dutch operations, highlighting the sustained demand from digitally-savvy shoppers. This trend underscores the importance of these customers in driving the company's overall digital transformation and revenue generation.

- Digital Preference: Customers who primarily use mobile apps and websites for their shopping.

- Engagement Strategy: Ahold Delhaize focuses on robust e-commerce platforms and personalized digital experiences.

- Sales Contribution: This segment is a key driver of online sales growth for the company.

- 2024 Performance: Q1 2024 saw a 10.5% rise in online sales in Dutch operations, reflecting strong digital consumer engagement.

Ahold Delhaize caters to a broad spectrum of customers, from local households seeking everyday essentials to digitally-savvy individuals preferring online convenience. The company's strategy emphasizes being the most local retailer, tailoring offerings to community needs while also focusing on value-conscious and health-aware shoppers. A significant portion of their sales comes from omnichannel customers who utilize both in-store and online channels, demonstrating a strong preference for integrated shopping experiences.

The company actively pursues segments that prioritize health and sustainability, expanding its own-brand healthy product lines and focusing on responsible sourcing. Price-sensitive consumers remain a key focus, addressed through competitive pricing strategies and value-focused programs. Digital-first consumers are also a growing segment, driving online sales growth through increased engagement with the company's e-commerce platforms.

| Customer Segment | Key Characteristics | Ahold Delhaize Strategy | 2024 Data/Insights |

|---|---|---|---|

| Local Households | Value convenience, fresh products, local assortments | Be the most local retailer, tailor offerings | Strong performance in local markets like Albert Heijn |

| Omnichannel Shoppers | Blend in-store and online shopping, higher spend | Seamless experience across channels, loyalty programs | Omnichannel customers contribute significantly to sales |

| Price-Sensitive Consumers | Seek affordability, budget-friendly options | Competitive pricing, 'Save for Our Customers' program | Continued emphasis on value in 2024 initiatives |

| Health-Conscious Consumers | Prioritize nutrition, ethical sourcing, sustainability | Expand healthy own-brands, sustainable sourcing | Growing demand for organic and plant-based options |

| Digital-First Consumers | Prefer mobile apps and online platforms | Invest in e-commerce, digital loyalty programs | Q1 2024: 10.5% online sales increase in Dutch operations |

Cost Structure

Operating expenses represent a substantial part of Ahold Delhaize's cost structure, encompassing the day-to-day running of its diverse retail formats. These costs are essential for maintaining the functionality of its supermarkets, convenience stores, and burgeoning e-commerce platforms.

Key components within these operating expenses include significant investments in personnel, covering staff wages and benefits across its extensive network. Additionally, costs associated with store upkeep, utilities like electricity and water, and crucial marketing initiatives to attract and retain customers are all factored in.

For the fiscal year 2024, Koninklijke Ahold Delhaize reported substantial operating expenses totaling $93.681 billion. This figure underscores the considerable resources required to manage and operate a large-scale, multi-channel retail business in today's competitive market.

Koninklijke Ahold Delhaize's supply chain and logistics represent a significant portion of its cost structure. These expenses encompass the entire journey of products, from sourcing and warehousing to final delivery. In 2024, the company continued to invest heavily in optimizing these operations, recognizing their direct impact on profitability and customer satisfaction.

Key cost drivers include maintaining and upgrading a vast network of warehouses and distribution centers, along with the significant expenditure on transportation fleets and fuel. Ahold Delhaize is also increasingly allocating resources to the implementation of automation and advanced technologies within its logistics centers to enhance efficiency and reduce labor costs. For instance, the company has been progressively rolling out automated picking and packing systems across its facilities to streamline operations.

The company's ongoing supply chain transformation initiatives are specifically designed to tackle these costs head-on. By leveraging data analytics and investing in smarter inventory management, Ahold Delhaize aims to reduce waste, improve delivery times, and ultimately lower the per-unit cost of getting products to its customers. These efforts are crucial for maintaining a competitive edge in the retail sector.

Koninklijke Ahold Delhaize dedicates significant resources to technology and innovation, investing heavily in its digital infrastructure. This includes building and maintaining advanced platforms, leveraging data analytics, and implementing artificial intelligence to improve how customers shop and how the company operates.

These investments cover a broad range of expenses, from creating new software and keeping existing IT systems running smoothly to integrating cutting-edge digital solutions across its brands. For 2025, the company has a target of €2.7 billion for gross capital expenditures, a portion of which fuels these crucial technology advancements.

Store Operations and Remodeling Costs

Operating physical stores represents a substantial portion of Ahold Delhaize's cost structure. These expenses encompass essential elements like rent for store locations, regular maintenance to ensure functionality, and utilities. These ongoing costs are critical for maintaining the company's extensive retail footprint.

Ahold Delhaize consistently invests in remodeling its stores to enhance the shopping environment and align with evolving customer preferences. This commitment to modernization is a key factor in maintaining brand appeal and driving foot traffic. For instance, Food Lion, a prominent banner, allocated $365 million towards store remodels in 2024, underscoring the scale of these investments. The company has signaled an intention to further accelerate these remodeling efforts in 2025.

The strategic decision to remodel stores is driven by the need to provide a vibrant and appealing shopping experience. These upgrades often include aesthetic improvements, layout optimizations, and the integration of new technologies to meet contemporary customer expectations. Such capital expenditures are vital for long-term competitiveness.

- Store Operating Expenses: Includes rent, utilities, and day-to-day maintenance for all physical locations.

- Remodeling Investments: Significant capital allocated to updating store formats and customer-facing elements.

- 2024 Remodeling Spend: Food Lion invested $365 million in store remodels during 2024.

- Future Remodeling Plans: Ahold Delhaize intends to increase the pace of store remodels in 2025.

'Save for Our Customers' Program

The 'Save for Our Customers' program is a cornerstone of Ahold Delhaize's cost management strategy. This initiative focuses on achieving substantial cost reductions through various means, including collaborative sourcing, enhancing operational efficiency, and streamlining the overall business model.

In 2024 alone, Ahold Delhaize achieved over €1.35 billion in cost savings. These savings are strategically reinvested to ensure competitive pricing and bolster the value offered to customers. The company has set an ambitious target to accumulate €5 billion in savings between 2025 and 2028, demonstrating a strong commitment to ongoing cost discipline and customer-centric value creation.

- Joint Sourcing: Leveraging combined purchasing power across different markets to negotiate better terms with suppliers.

- Operational Efficiencies: Implementing process improvements and technological advancements to reduce waste and enhance productivity in stores and distribution centers.

- Simplifying Operating Model: Streamlining organizational structures and business processes to reduce overhead and complexity.

- Reinvestment Strategy: Directing cost savings back into the business to maintain competitive pricing, invest in growth initiatives, and improve the overall customer experience.

The cost structure of Koninklijke Ahold Delhaize is heavily influenced by its extensive store network and the ongoing efforts to modernize these physical locations. These expenditures are crucial for maintaining brand appeal and adapting to evolving consumer shopping habits.

In 2024, Food Lion, a key Ahold Delhaize banner, invested $365 million in store remodels, highlighting the significant capital commitment to enhancing the in-store experience. The company has indicated plans to accelerate these remodeling initiatives further in 2025, reflecting a strategic focus on store upgrades.

| Cost Component | 2024 Impact/Activity | Strategic Relevance |

| Store Remodeling | Food Lion invested $365 million in 2024. Plans for accelerated remodeling in 2025. | Enhances customer experience, maintains brand competitiveness. |

| 'Save for Our Customers' Program | Achieved over €1.35 billion in cost savings in 2024. Target of €5 billion savings by 2028. | Drives competitive pricing and reinvestment in value for customers. |

Revenue Streams

The core of Ahold Delhaize's revenue generation lies in its grocery sales, both through its vast physical store footprint and its expanding online channels. This encompasses everything from fresh produce and meats to pantry staples and household essentials.

In 2024, Ahold Delhaize achieved significant success in this area, reporting net sales of €89.4 billion. This figure underscores the company's strong market position and the consistent demand for its grocery offerings across its diverse brands.

Revenue from online grocery sales, encompassing both click-and-collect and home delivery, represents a substantial and expanding revenue stream for Ahold Delhaize. This digital channel is increasingly vital as customers embrace convenient shopping methods.

The company has consistently reported strong double-digit growth in its online grocery segment, a clear indicator of growing customer reliance on digital platforms for their shopping needs. This trend underscores the success of their e-commerce strategy.

In the fourth quarter of 2024, European online sales experienced a notable increase of 10.9%. This growth was significantly driven by the strong performance of key brands like bol.com and Albert Heijn, showcasing the effectiveness of their digital investments.

Koninklijke Ahold Delhaize is significantly boosting its revenue beyond traditional grocery sales by focusing on retail media and data insights. This strategic move capitalizes on its extensive customer reach and established operational framework to offer tailored advertising and digital solutions.

The company's U.S. retail media segment saw a robust 13% growth in 2023, highlighting the increasing demand for these services. Ahold Delhaize has set an ambitious target to expand its complementary income streams, aiming for approximately €3 billion by 2028, with retail media and data being key drivers of this expansion.

B2B Commercialization and Digital Services

Koninklijke Ahold Delhaize actively pursues B2B commercialization, notably through bol.com's marketplace for third-party sellers, generating fees and commissions. This strategy diversifies revenue streams beyond core grocery operations by monetizing existing digital infrastructure and customer reach. In 2023, bol.com's platform facilitated sales for over 50,000 sellers, contributing significantly to its overall growth.

Beyond the marketplace, Ahold Delhaize is developing other digital services, including data analytics and supply chain solutions, offered to external partners. These ventures leverage the company's extensive operational expertise and technological capabilities. Investments in innovative startups and scale-ups further fuel this diversification, aiming to capture new market opportunities and enhance competitive positioning.

- B2B Marketplace Revenue: bol.com's platform generates income through seller fees and commissions on transactions.

- Digital Service Offerings: Development and sale of data analytics and supply chain solutions to external businesses.

- Startup & Scale-up Investments: Strategic capital allocation to foster innovation and explore new digital business models.

- Revenue Diversification: Reducing reliance on traditional retail by expanding into digital and B2B commercial activities.

Strategic Acquisitions and Market Densification

Koninklijke Ahold Delhaize fuels revenue growth through strategic acquisitions, exemplified by the January 2025 addition of Romanian food retailer Profi. This move is anticipated to contribute approximately €3 billion to annual net sales, showcasing the impact of inorganic expansion on the company's top line.

Beyond acquisitions, Ahold Delhaize prioritizes market densification and expansion in areas where it already possesses a strong presence. This dual approach of acquiring new businesses and deepening penetration in existing markets significantly bolsters overall sales performance.

- Strategic Acquisitions: The acquisition of Profi in January 2025 is projected to add €3 billion in annual net sales.

- Market Densification: Focus on growing sales within existing strong market positions.

- Inorganic Growth Contribution: Acquisitions play a crucial role in the company's overall sales trajectory.

Beyond its core grocery operations, Ahold Delhaize is actively diversifying its revenue streams through retail media and data monetization. This strategy leverages its extensive customer base to offer targeted advertising solutions and valuable data insights to brands.

The company's U.S. retail media segment demonstrated strong growth, increasing by 13% in 2023. Ahold Delhaize aims to significantly expand these complementary income sources, targeting approximately €3 billion by 2028, with retail media and data analytics as key contributors.

Furthermore, Ahold Delhaize is capitalizing on its digital infrastructure, particularly through bol.com's marketplace, which allows third-party sellers to operate on its platform, generating commission and fee-based revenue. This B2B commercialization extends to offering data analytics and supply chain solutions to external partners, further broadening its income base.

| Revenue Stream | Description | Key Data Point |

| Retail Media & Data Insights | Advertising and data services offered to brands leveraging customer data. | U.S. retail media segment grew 13% in 2023. Target of €3 billion in complementary income by 2028. |

| B2B Marketplace (bol.com) | Commissions and fees from third-party sellers on the bol.com platform. | Over 50,000 sellers on bol.com in 2023. |

| Digital Services | Data analytics and supply chain solutions provided to external businesses. | Leverages extensive operational expertise and technological capabilities. |

Business Model Canvas Data Sources

The Business Model Canvas for Koninklijke Ahold Delhaize is informed by a blend of internal financial reports, customer transaction data, and extensive market research. These sources provide a comprehensive view of customer behavior, operational efficiency, and competitive positioning.