Koninklijke Ahold Delhaize Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Koninklijke Ahold Delhaize Bundle

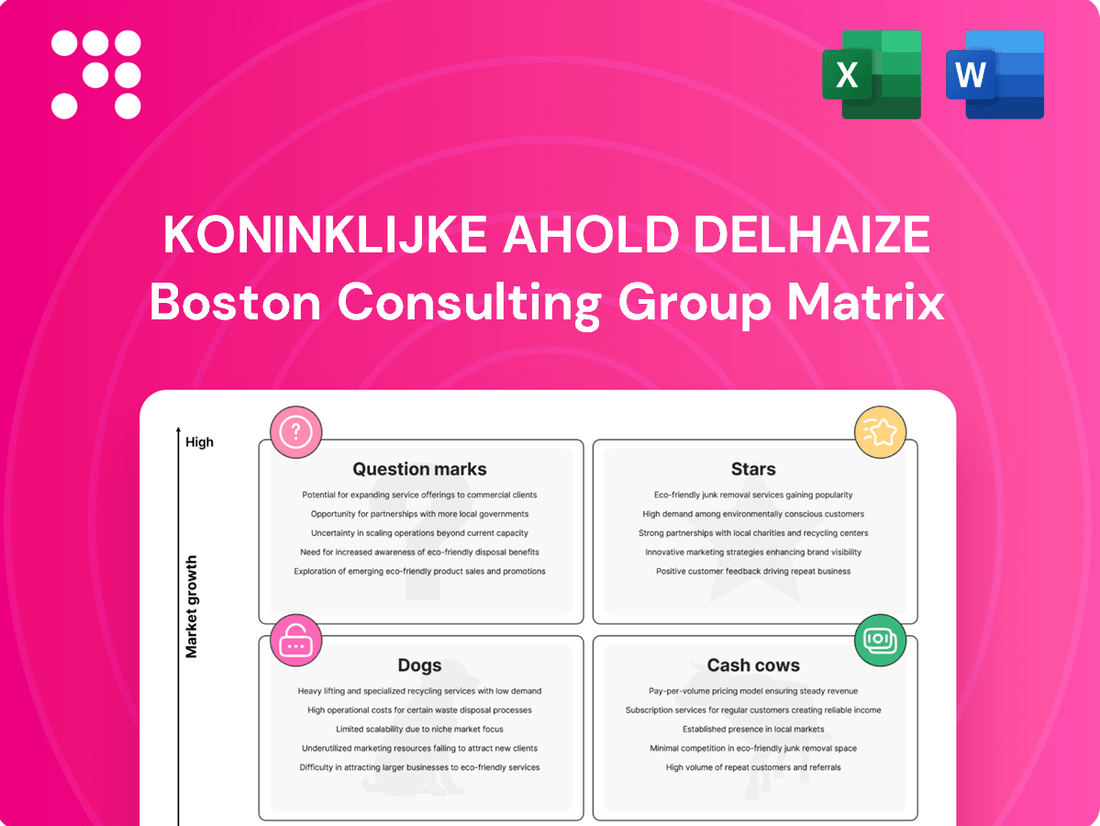

Curious about Koninklijke Ahold Delhaize's strategic positioning? Our BCG Matrix preview highlights key areas, but to truly understand their market dominance and growth potential, you need the full picture. Dive into the complete analysis to uncover which brands are their Stars, Cash Cows, Dogs, and Question Marks.

Unlock the full Koninklijke Ahold Delhaize BCG Matrix and gain a comprehensive understanding of their product portfolio's performance. This detailed report will equip you with the insights needed to make informed decisions about resource allocation and future investments. Purchase the complete matrix today for actionable strategic clarity.

Stars

Food Lion, a key player in Koninklijke Ahold Delhaize's portfolio, continues to shine as a strong performer. In the first quarter of 2025, the company celebrated its 50th consecutive quarter of comparable sales growth. This impressive streak underscores Food Lion's robust market presence and its ability to maintain customer loyalty.

The brand's strategic emphasis on value pricing and a well-developed private label selection are significant drivers of its ongoing success. These factors allow Food Lion to effectively compete and thrive, even in a dynamic retail environment.

Hannaford stands out as a star within Ahold Delhaize's portfolio, demonstrating robust and consistent performance. Its remarkable achievement of 15 consecutive quarters of comparable sales growth, including Q1 2025, underscores its dominant market position and successful customer engagement strategies.

Albert Heijn, the flagship brand of Koninklijke Ahold Delhaize in the Netherlands, stands as a prominent Star in the BCG Matrix. In 2024, it achieved a remarkable 37.7% market share, a new record, underscoring its dominant position in a mature European market.

This consistent market share growth, coupled with robust online sales expansion, highlights Albert Heijn's status as a high-growth, high-market-share entity. Its ongoing investment in e-commerce and digital innovation signals continued potential for growth within the grocery sector.

Bol.com (Europe E-commerce)

Bol.com, a key player in Europe's e-commerce landscape and a subsidiary of Koninklijke Ahold Delhaize, has demonstrated robust performance. In 2024, its online sales continued to experience double-digit growth, reflecting strong momentum in the European market. This growth trajectory is further supported by accelerating sales figures and record-high app engagement, signaling a dynamic and expanding share within the competitive e-commerce sector.

The platform's success is a testament to its ability to capture a significant and growing portion of the online retail market. Bol.com's strategic positioning and operational efficiency have allowed it to capitalize on the increasing consumer shift towards digital shopping channels.

- Bol.com's online sales in Europe achieved double-digit growth throughout 2024.

- Record app engagement highlights increasing customer interaction and loyalty.

- The platform is solidifying its position in a high-growth e-commerce market.

- Bol.com contributes significantly to Ahold Delhaize's overall digital strategy and market presence.

Omnichannel and Digital Capabilities

Koninklijke Ahold Delhaize is making significant investments in its omnichannel and digital capabilities, recognizing them as key drivers of future growth. The company aims to achieve over 80% of its loyalty sales through omnichannel channels by 2028, a testament to its commitment to integrating online and in-store experiences.

This strategic push is further supported by ambitious targets for digital engagement, with a goal of reaching 30 million monthly active users across its platforms. Initiatives like the AI-powered Prism app and collaborations with DoorDash highlight Ahold Delhaize's focus on leveraging technology to enhance customer convenience and expand its reach.

- Omnichannel Sales Target: Over 80% loyalty sales penetration by 2028.

- Digital Engagement Goal: 30 million monthly active users.

- Key Digital Initiatives: Prism app (AI-powered), DoorDash partnership.

- Strategic Focus: Digital transformation and AI integration for growth.

Albert Heijn's dominant 37.7% market share in the Netherlands in 2024 solidifies its Star status, driven by consistent growth and online expansion.

Bol.com's double-digit online sales growth in 2024, coupled with record app engagement, positions it as a key Star in the e-commerce sector.

Food Lion's 50 consecutive quarters of comparable sales growth and Hannaford's 15 quarters demonstrate their strength as Stars within the US market.

These brands represent Ahold Delhaize's high-growth, high-market-share segments, crucial for the company's strategic focus on digital and omnichannel capabilities.

| Brand | Market Position | Growth Trajectory | Key Performance Indicator (2024/Q1 2025) |

|---|---|---|---|

| Albert Heijn | Star | High | 37.7% market share (Netherlands) |

| Bol.com | Star | High | Double-digit online sales growth, record app engagement |

| Food Lion | Star | High | 50 consecutive quarters of comparable sales growth |

| Hannaford | Star | High | 15 consecutive quarters of comparable sales growth |

What is included in the product

This BCG Matrix overview highlights Ahold Delhaize's strategic positioning of its brands, identifying growth opportunities and areas for optimization.

A clear BCG matrix visualizes Ahold Delhaize's portfolio, easing strategic decision-making by highlighting growth and market share.

Cash Cows

The core U.S. supermarket operations, featuring well-known banners like Food Lion, Hannaford, and Giant Food, represent a significant portion of Ahold Delhaize's overall business. This segment consistently generates over 60% of the company's total net sales, highlighting its dominant role.

Despite ongoing investments in pricing to remain competitive, these mature grocery brands are reliable generators of substantial and steady cash flow. The U.S. market, while established, provides a stable environment for these operations to thrive.

Delhaize in Belgium has successfully navigated its affiliate model transition, not only regaining but exceeding its pre-restructuring market share. This achievement, evident in their performance through early 2024, points to a robust and stable position within the mature Belgian grocery market.

The positive outcomes from this strategic shift translate into a reliable cash flow generator for Koninklijke Ahold Delhaize. With operational overheads potentially reduced due to the affiliate structure, Delhaize Belgium is a prime example of a cash cow, contributing steady earnings to the parent company.

Ahold Delhaize is strategically focusing on its own-brand products, aiming to boost their share to 45% of total store sales by 2028. This initiative directly targets the Cash Cows quadrant of the BCG Matrix.

These private label offerings are crucial cash generators because they typically yield higher profit margins than national brands. This allows them to consistently fund other business areas, even within a slower-growth market segment.

'Save for Our Customers' Program

The 'Save for Our Customers' program within Koninklijke Ahold Delhaize's BCG Matrix functions as a significant Cash Cow. This initiative is designed to generate substantial cost savings, directly bolstering the company's financial strength and cash flow generation capabilities.

The program's core strategy involves achieving €5 billion in cumulative savings between 2025 and 2028. This ambitious target is pursued through a multi-pronged approach, focusing on enhancing operational efficiencies, leveraging joint sourcing opportunities across its vast network, and implementing automation technologies.

These cost reductions translate into improved profitability and a consistent internal cash generator for the business. The program's success in driving down expenses allows Ahold Delhaize to reinvest in its core operations or return value to shareholders, characteristic of a mature and highly profitable business unit.

- Program Focus: Operational efficiencies, joint sourcing, and automation.

- Savings Target: €5 billion in cumulative savings from 2025 to 2028.

- Financial Impact: Directly contributes to improved profitability and cash flow.

- BCG Matrix Classification: Acts as a Cash Cow due to consistent internal cash generation.

Established Supply Chain and Logistics Infrastructure

Ahold Delhaize's established supply chain and logistics infrastructure, a significant strength, particularly in the US and Europe, represents a mature asset. These networks are crucial for the company's ability to efficiently move goods, contributing directly to its "Cash Cow" status within the BCG Matrix.

Continued investments in optimizing these operations through advanced technologies like AI and automation are key. For example, in 2024, Ahold Delhaize continued to leverage its extensive distribution center network, which handles millions of items daily, to drive efficiencies. These technological enhancements lead to sustained cost reductions and robust cash generation from its well-established business segments.

- Mature Infrastructure: Ahold Delhaize benefits from extensive and well-developed supply chain and logistics networks across its key markets, primarily the US and Europe.

- Efficiency Gains: Investments in AI and automation within these logistics operations are actively improving efficiency, leading to lower operational costs.

- Cash Generation: The optimized and efficient supply chain directly contributes to strong, consistent cash flow from its established business lines, solidifying its Cash Cow position.

- Strategic Advantage: This robust infrastructure provides a significant competitive advantage, enabling reliable product availability and cost-effective operations.

The core U.S. supermarket operations, including banners like Food Lion and Hannaford, are Ahold Delhaize's primary cash cows, consistently generating over 60% of the company's net sales. These mature businesses, despite competitive pricing pressures, provide substantial and steady cash flow, underpinning the company's financial stability.

The strategic focus on increasing own-brand product share to 45% by 2028 directly enhances these cash cows, as private labels offer higher profit margins. Similarly, the 'Save for Our Customers' program, targeting €5 billion in savings by 2028 through operational efficiencies and automation, further bolsters cash generation from these established segments.

Ahold Delhaize's highly developed supply chain and logistics infrastructure, particularly in the U.S. and Europe, also functions as a cash cow. Continued optimization using AI and automation in 2024, leveraging a vast distribution network, drives efficiency and robust cash flow from these mature operations.

| Business Segment | BCG Matrix Classification | Key Characteristics | 2024 Data/Impact |

|---|---|---|---|

| U.S. Supermarkets (Food Lion, Hannaford) | Cash Cow | Mature, high sales contribution, stable cash flow | Contributes over 60% of net sales; ongoing investments in pricing |

| Own-Brand Products | Cash Cow (Strategic Focus) | Higher profit margins, funding other areas | Targeting 45% of sales by 2028 |

| 'Save for Our Customers' Program | Cash Cow (Efficiency Driver) | Cost savings, improved profitability | Targeting €5 billion cumulative savings (2025-2028) |

| Supply Chain & Logistics | Cash Cow | Mature infrastructure, operational efficiency | Leveraging AI/automation for cost reduction and cash generation |

Delivered as Shown

Koninklijke Ahold Delhaize BCG Matrix

The preview you see is the definitive Koninklijke Ahold Delhaize BCG Matrix report you will receive upon purchase. This means no watermarks, no sample data, and no hidden surprises; you get the complete, professionally formatted analysis ready for immediate strategic application.

Rest assured, the BCG Matrix visualization and accompanying analysis you are currently viewing is the exact document that will be delivered to you after completing your purchase. It's a fully realized strategic tool, meticulously prepared for your business planning needs.

What you are previewing is the actual, uncompromised Koninklijke Ahold Delhaize BCG Matrix file that will be yours to download immediately after purchase. This ensures you receive a polished, actionable report designed for clarity and professional presentation.

Dogs

Stop & Shop, a key player in the US market for Koninklijke Ahold Delhaize, has been navigating a challenging retail environment. In 2024, the company made the difficult decision to close 32 underperforming stores. This strategic move is expected to impact reported net sales in 2025, reflecting a recalibration of their market presence.

These closures highlight specific locations within the Stop & Shop brand that exhibit characteristics of Stars or Cash Cows that have transitioned into Dogs. They represent a low market share in their respective areas and are facing limited growth prospects, making them prime candidates for divestment or substantial operational restructuring to potentially revive their performance or be phased out.

FreshDirect, divested by Ahold Delhaize at the close of 2023, represented a business unit that likely struggled with profitability and cash generation. Its sale negatively impacted U.S. online sales figures for the company, underscoring its underperformance.

The divestment suggests Ahold Delhaize acknowledged FreshDirect's limited market share within the highly competitive online grocery sector and its diminished potential for future growth. This strategic move allowed Ahold Delhaize to reallocate resources to more promising areas of its business portfolio.

The cessation of tobacco sales in Albert Heijn and Delhaize stores across the Netherlands and Belgium, driven by evolving regulations, will indeed present a headwind for comparable sales. This strategic shift, while aligned with broader societal trends, removes a category that, while declining, still contributed to top-line figures.

While not a typical product, the tobacco category represented a shrinking revenue stream for Ahold Delhaize. In 2023, tobacco sales, though not broken out separately in the main financial reports, were a small but present part of the overall retail revenue. The decision to cease sales reflects a proactive stance on future-oriented business, even if it means a short-term dip in reported sales.

Legacy IT Systems and Manual Processes

Legacy IT systems and manual processes within Koninklijke Ahold Delhaize can be viewed as 'dogs' in a BCG matrix context. These areas typically exhibit low efficiency and limited growth potential, often requiring significant resource allocation without generating substantial returns. For instance, in 2024, while the company heavily invested in digital transformation and AI, some operational functions still relied on older systems, impacting speed and accuracy.

The company's strategic focus on AI and automation, as highlighted in their 2024 investor updates, indicates a deliberate effort to move away from these less productive assets. This shift aims to streamline operations and enhance customer experience, moving resources towards areas with higher growth and profitability potential.

The impact of these legacy systems can be seen in areas where manual data handling persists, potentially leading to increased operational costs and slower decision-making compared to more automated competitors. Ahold Delhaize's ongoing digital transformation projects are designed to address these inefficiencies.

- Low Efficiency: Manual processes in areas like inventory management or customer service can lead to higher error rates and slower throughput.

- Limited Growth Potential: Outdated IT infrastructure restricts the ability to scale operations or introduce new digital services effectively.

- Resource Drain: Maintaining and working around legacy systems consumes valuable IT and operational resources that could be better utilized elsewhere.

- Strategic Shift: Ahold Delhaize's investment in AI and automation in 2024 signals a clear strategy to divest from or modernize these 'dog' assets.

Geographically Fragmented or Niche Brands with Limited Scale

Koninklijke Ahold Delhaize's portfolio may include smaller, geographically fragmented brands that operate in niche markets. These brands, while potentially strong locally, might exhibit limited overall growth potential and market share. If these niche brands lack clear synergies with the broader Ahold Delhaize network or have no concrete expansion strategies, they could be classified as 'dogs' within the BCG matrix, especially if their profitability contribution is minimal.

Ahold Delhaize's strategic focus on strengthening and expanding its core, high-performing brands suggests a potential reallocation of resources away from smaller, less impactful entities. This strategic pruning could lead to a reduction in investment for these niche brands, further solidifying their 'dog' status if they do not demonstrate a path to improved performance or strategic alignment.

- Limited Scale Impact: Brands with a small operational footprint and minimal market penetration across Ahold Delhaize's overall business.

- Low Growth Potential: Niche markets may inherently limit the scalability and future growth trajectory of these brands.

- Synergy Deficit: Lack of integration or cross-promotional opportunities with Ahold Delhaize's larger, more dominant brands.

- Resource Reallocation: Strategic decisions prioritizing investment in high-growth, high-market-share brands could deem these 'dogs' as non-core assets.

Within Koninklijke Ahold Delhaize's portfolio, certain underperforming store locations, like those recently closed by Stop & Shop in 2024, can be categorized as Dogs. These are businesses with a low market share in their respective segments and face limited growth prospects, often requiring significant attention without yielding substantial returns.

The divestment of FreshDirect in late 2023 also points to a business unit that likely fell into the Dog category, characterized by its struggle to gain significant market traction and profitability in the competitive online grocery space.

Legacy IT systems and manual processes represent operational 'dogs' for Ahold Delhaize, hindering efficiency and growth potential. The company's 2024 investments in AI and automation are a direct strategy to modernize or divest these less productive assets.

Smaller, niche brands within Ahold Delhaize's broader network, if lacking clear synergies and growth strategies, may also be classified as Dogs. The company's focus on strengthening core brands suggests a potential reallocation of resources away from such entities.

Question Marks

The acquisition of Profi in Romania, finalized in January 2025, is a substantial move for Ahold Delhaize, expected to boost net sales by €3 billion. This strategic entry into a high-growth market positions Profi as a question mark within Ahold Delhaize's BCG matrix.

While the potential is evident, Profi's long-term market share and profitability are still developing. This means Ahold Delhaize needs to closely monitor its performance and integration to determine its future strategic direction within the company's portfolio.

Koninklijke Ahold Delhaize's 'Growing Together' strategy specifically targets expansion in Central and Southeastern Europe, identifying these regions as key growth frontiers. The company views these markets as having significant potential, though its current market share is relatively modest.

Significant investment will be necessary to build a robust presence and achieve market leadership in these emerging territories. For example, in 2023, Ahold Delhaize continued its investment in the region, with its Central and Southeastern European segment reporting net sales of €10.9 billion, a slight increase from the previous year.

Koninklijke Ahold Delhaize is actively exploring and investing in cutting-edge digital and AI-powered innovations beyond its core retail operations. These initiatives aim to revolutionize customer engagement and drive operational efficiency through advanced technologies like generative AI.

While the potential for these new ventures is significant, their long-term scalability and proven profitability are still under evaluation. For instance, the company is testing various AI applications and digital tools, but their ability to generate consistent returns beyond existing successful platforms, such as the Prism app, remains a key question, positioning them within the question mark quadrant of the BCG matrix.

Complementary Income Streams (Retail Media, etc.)

Ahold Delhaize is actively developing complementary income streams, with a significant focus on retail media, aiming to reach approximately €3 billion in revenue by 2028. These ventures represent a strategic move into high-growth areas beyond traditional grocery sales.

The company is investing in scaling these initiatives, which include advertising opportunities on their digital platforms and loyalty programs. While these areas show strong potential, Ahold Delhaize is still working to establish a firm market position and ensure consistent profitability.

- Retail Media Growth: Ahold Delhaize targets €3 billion in complementary income by 2028, with retail media being a key driver.

- Emerging Potential: These new revenue streams offer substantial growth prospects for the company.

- Scaling and Refinement: Efforts are underway to optimize and expand these initiatives for market share and profitability.

New Healthy Food Product Lines and Assortments

Ahold Delhaize is strategically prioritizing the expansion of its own-brand healthy food offerings, a move that aligns with increasing consumer demand for wellness-focused products. This initiative aims to capture a larger share of the growing health food market.

While the company is actively promoting healthy eating and developing new product lines, these specific assortments are still in their nascent stages of market penetration. Their long-term growth potential is yet to be fully realized, placing them in a position that requires further development and market traction.

- Focus on Own-Brand Health Foods: Ahold Delhaize is investing in its private label brands to offer a wider selection of healthy food options.

- Growing Market Demand: The global market for healthy foods continues to expand, driven by consumer awareness of diet's impact on well-being. For instance, the global health and wellness market was valued at approximately $4.5 trillion in 2023 and is projected to grow further.

- Early Stage Market Share: New and expanded healthy food lines are still building their presence and are not yet dominant players in their respective categories.

- Uncertain Growth Trajectory: The long-term success and market share acquisition of these new product lines remain to be seen as they navigate competitive landscapes.

The acquisition of Profi in Romania, finalized in January 2025, positions it as a question mark. While expected to boost net sales by €3 billion, its long-term market share and profitability are still developing, requiring close monitoring and strategic evaluation.

Ahold Delhaize's investments in digital and AI innovations also fall into the question mark category. These ventures, while promising for customer engagement and efficiency, are still being evaluated for scalability and proven profitability beyond existing successful platforms.

New revenue streams like retail media, targeting €3 billion by 2028, and the expansion of own-brand healthy food offerings are also question marks. They represent high-growth potential but are in early stages of market penetration and require further scaling and refinement to ensure consistent profitability and market leadership.

| Business Unit/Initiative | Market Growth | Relative Market Share | BCG Category | Key Considerations |

|---|---|---|---|---|

| Profi (Romania) | High | Low to Medium | Question Mark | Integration, market share growth, profitability |

| Digital & AI Innovations | High | Low | Question Mark | Scalability, proven profitability, competitive differentiation |

| Retail Media | High | Low to Medium | Question Mark | Market position, revenue scaling, profitability |

| Own-Brand Healthy Foods | High | Low | Question Mark | Market penetration, product line development, consumer adoption |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data from company reports, industry research, and expert commentary to ensure reliable insights.