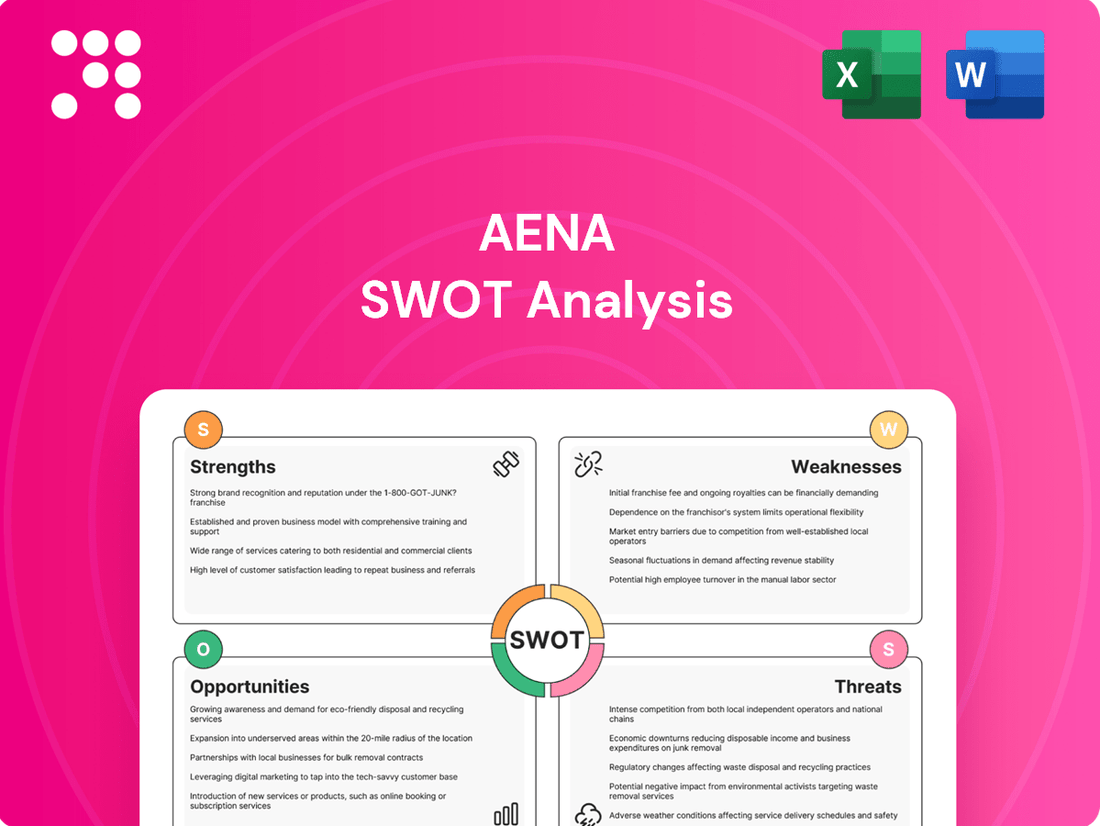

Aena SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aena Bundle

Aena's strategic position is shaped by its robust infrastructure and global reach, but also faces challenges from evolving travel trends and competition. Understanding these dynamics is crucial for navigating the aviation landscape.

Want the full story behind Aena's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Aena's position as the world's premier airport operator, managing a substantial global network, is a significant strength. This includes operations in Spain and stakes in airports across Brazil, London Luton, Mexico, Jamaica, and Colombia, fostering economies of scale and a robust competitive edge through geographical diversification.

In 2024, Aena's extensive network facilitated the movement of close to 370 million passengers worldwide. The Spanish operations alone were particularly strong, recording 309.3 million passengers, marking the second consecutive year of record-breaking figures and underscoring the strength of its domestic market leadership.

Aena showcases exceptional financial strength, marked by record-breaking profits and consistently growing revenues. This robust performance underscores the company's efficient operational management and strategic market positioning.

In 2024, Aena reported a consolidated net profit of €1.934 billion, reflecting an impressive 18.6% increase compared to the prior year. Total revenues for the same period reached €5.83 billion, demonstrating sustained business expansion.

The company's commercial revenue saw a substantial uplift of 14.7% in 2024. This growth is particularly noteworthy as it surpassed the increase in passenger traffic, indicating enhanced revenue generation per passenger and contributing to improved overall profit margins.

Aena's strength lies in its diversified revenue streams, extending well beyond traditional airport operations. Its commercial and real estate activities are significant contributors, offering high-margin income.

In 2024, commercial revenue saw robust growth, frequently outperforming passenger traffic increases. This segment encompasses duty-free shops, diverse retail outlets, dining options, and premium services, all of which are key to Aena's financial resilience.

The company is strategically enhancing its commercial appeal by upgrading existing facilities and securing new agreements with Minimum Annual Guarantees. This proactive approach ensures consistent revenue generation, even in scenarios where passenger numbers might stabilize.

Strategic Investment and Capacity Expansion

Aena's strategic investments in infrastructure are a significant strength, positioning the company to capitalize on anticipated demand growth and improve passenger satisfaction. The company is actively pursuing expansion projects at major hubs such as Madrid-Barajas and Barcelona-El Prat, demonstrating a commitment to enhancing capacity and service quality within its core Spanish market.

Furthermore, Aena is making substantial capital commitments to its Brazilian airport portfolio, with a notable expansion planned for Congonhas Airport. These initiatives are guided by the DORA 2027-2031 plan, underscoring a forward-looking strategy focused on modernization and sustained growth. For instance, Aena's 2023-2026 investment plan allocated €2.3 billion for Spanish airports, with a significant portion earmarked for capacity and modernization projects.

- Proactive Infrastructure Investment: Aena is investing in its airport network to meet rising passenger numbers and elevate the travel experience.

- Key Expansion Projects: Major upgrades are underway at Madrid-Barajas and Barcelona-El Prat airports.

- Brazilian Portfolio Growth: Significant investment is directed towards Brazil, including a substantial expansion of Congonhas Airport.

- DORA 2027-2031 Alignment: These capital expenditures are aligned with the company's long-term development and modernization strategy.

Strong Credit Ratings and Shareholder Returns

Aena's financial resilience is underscored by its strong credit ratings, with agencies such as Moody's and Fitch consistently affirming its robust credit quality. This stability provides a solid foundation for its operations and strategic initiatives.

The company actively prioritizes shareholder value. For instance, in 2024, Aena proposed a notable dividend increase, alongside a stock split, aimed at boosting liquidity and making its shares more accessible to a wider investor base. This reflects a clear strategy to reward its investors.

- Strong Credit Ratings: Moody's and Fitch maintain positive ratings for Aena, signaling financial health.

- Shareholder Returns: 2024 saw a proposed dividend increase and a stock split to enhance investor returns and share accessibility.

Aena's global airport network is a cornerstone strength, facilitating significant passenger volumes and offering economies of scale. In 2024, the company managed nearly 370 million passengers worldwide, with its Spanish airports alone handling 309.3 million, a record for the second consecutive year.

The company exhibits robust financial health, evidenced by record profits and growing revenues, demonstrating efficient operations. In 2024, Aena reported a consolidated net profit of €1.934 billion, an 18.6% increase, with total revenues reaching €5.83 billion.

Diversified revenue streams, particularly from commercial and real estate activities, provide high-margin income and enhance financial resilience. Commercial revenue in 2024 grew by 14.7%, outpacing passenger traffic growth, highlighting effective revenue generation per passenger.

Strategic investments in infrastructure, such as expansion projects at Madrid-Barajas and Barcelona-El Prat, and in its Brazilian portfolio, position Aena for future demand growth and improved passenger experience. The 2023-2026 investment plan allocated €2.3 billion for Spanish airport modernization.

| Metric | 2023 | 2024 (Est.) | % Change (YoY) |

| Total Passengers (Millions) | 303.1 | 370.0 | 22.1% |

| Consolidated Net Profit (€ Billions) | 1.63 | 1.93 | 18.4% |

| Total Revenues (€ Billions) | 5.08 | 5.83 | 14.8% |

| Commercial Revenue Growth | 10.2% | 14.7% | 4.5pp |

What is included in the product

Delivers a strategic overview of Aena’s internal and external business factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address Aena's strategic challenges and opportunities.

Weaknesses

Aena's reliance on regulatory approvals, especially in Spain where the government is a majority shareholder, presents a significant weakness. The antitrust regulator's decision to freeze airport charges for 2025, for instance, directly impacts Aena's ability to adjust revenue streams and limits pricing flexibility.

Furthermore, the long-term nature of concession agreements, such as the duty-free concession extended until October 2025, binds the company to predefined terms for extended periods. This dependency on regulatory frameworks and existing concession terms can stifle strategic agility and revenue diversification.

Operating Aena's extensive airport network comes with substantial fixed costs. These include ongoing expenses for maintaining infrastructure, ensuring robust security measures, and covering the salaries of a large workforce. These costs can put a strain on profitability, especially when passenger traffic dips, as seen in the post-pandemic recovery phases.

Furthermore, Aena faces significant capital expenditure requirements. The company is committed to substantial investments for airport expansion and modernization. For instance, Aena has planned investments of €6.4 billion in Brazil and €351 million in its Spanish airports up to 2026, highlighting the continuous need for financial resources to upgrade and grow its facilities.

The aviation sector, and by extension Aena, is inherently vulnerable to unexpected events. Economic recessions, political instability, and health emergencies like pandemics can drastically reduce travel demand, directly affecting Aena's passenger numbers and the revenue generated from its airports. For instance, the COVID-19 pandemic in 2020 saw a dramatic drop in air traffic globally, highlighting this sensitivity.

While Aena has demonstrated an ability to navigate such challenges, the potential for future disruptions remains a significant weakness. The company's financial performance is intrinsically linked to global travel patterns, and unforeseen shocks could again lead to substantial declines in passenger traffic and commercial income. Management itself has noted that forecasts are made amidst considerable uncertainty about future economic conditions.

Operational Capacity Limits

Aena faces challenges with operational capacity limits at several key Spanish airports. Despite investments, the unexpected surge in passenger traffic, which reached 285.2 million passengers in 2023, a 16.2% increase compared to 2022, is pushing some facilities to their saturation point. This congestion can negatively affect service quality and potentially hinder future growth if expansion plans don't align with demand.

The strain on infrastructure could manifest in several ways:

- Congestion: Increased delays in check-in, security, and boarding processes for passengers.

- Service Quality Degradation: Overcrowded terminals and reduced efficiency in baggage handling and aircraft turnaround times.

- Growth Constraints: Inability to accommodate additional flights or airlines, potentially stifling commercial opportunities and passenger volume expansion.

Dependence on Tourism Trends

Aena's significant reliance on Spain's tourism sector, especially international visitors, presents a notable weakness. In 2023, over 278 million passengers traveled through Aena's Spanish airports, with a substantial portion attributed to leisure and international travel. This dependence means that downturns in global travel or shifts in tourist preferences away from Spain could directly impact Aena's passenger volumes and, consequently, its commercial revenue streams.

The vulnerability to external factors affecting tourism is a key concern. For instance, economic recessions in key source markets, geopolitical instability, or health crises can rapidly reduce international arrivals. Aena's commercial activities, which include retail, food and beverage, and car parking, are closely tied to passenger spending, making them susceptible to fluctuations in tourist numbers and spending power.

- 2023 Passenger Traffic: Aena handled over 278 million passengers across its Spanish airports, highlighting the scale of its tourism dependency.

- Commercial Revenue Linkage: A significant portion of Aena's revenue is derived from non-aeronautical sources, directly correlated with passenger traffic and spending.

- Vulnerability to Global Trends: Aena's performance is sensitive to global economic conditions, travel advisories, and the overall attractiveness of Spain as a tourist destination.

Aena's substantial fixed operating costs, including infrastructure maintenance and staffing, can pressure profitability during periods of reduced passenger traffic. For example, the company's commitment to substantial capital expenditures, such as €6.4 billion planned for Brazil and €351 million for Spanish airports up to 2026, underscores the ongoing financial demands for modernization and expansion, potentially straining financial flexibility.

The company's dependence on regulatory approvals and long-term concession agreements, such as the duty-free concession extended until October 2025, limits its pricing flexibility and strategic agility. The antitrust regulator's decision to freeze airport charges for 2025 exemplifies this constraint, directly impacting revenue stream adjustments.

Aena's extensive network faces operational capacity limits, with 2023 passenger traffic reaching 285.2 million, a 16.2% increase from 2022, leading to congestion and potential service quality degradation. This strain can hinder growth and commercial opportunities if expansion doesn't match demand.

The company's significant reliance on Spain's tourism sector, which saw over 278 million passengers pass through its Spanish airports in 2023, makes it vulnerable to global travel trends and economic downturns in key source markets.

Same Document Delivered

Aena SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use.

The content below is pulled directly from the final Aena SWOT analysis. Unlock the full report when you purchase.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

Opportunities

Aena anticipates a robust increase in passenger numbers, projecting 320 million passengers in Spain for 2025. This upward trend, surpassing earlier strategic plan expectations by a year, highlights a strong market recovery and sustained demand.

The continued growth in passenger traffic, especially for international travel, offers a substantial opportunity for Aena to boost both its aeronautical and commercial revenue streams. This sustained demand is a key driver for increased airport activity and associated spending.

Aena has a significant opportunity to grow its high-margin commercial and real estate segments. Recent tenders for specialty retail and dining concessions are projected to boost Minimum Annual Guarantees (MAGs) substantially in 2025, with some estimates indicating a potential double-digit percentage increase in non-aeronautical revenue from these areas.

By strategically developing real estate around its airport hubs, Aena can tap into new revenue streams. This includes leveraging existing land assets for logistics centers, hotels, or business parks, aiming to increase the contribution of real estate income to overall group profit by a targeted percentage within the next two years.

Aena is strategically expanding its international presence, notably through substantial investments in its Brazilian airport operations and by holding minority stakes in airports across Latin America. This global reach is crucial for diversifying revenue streams, lessening dependence on the Spanish market, and applying its operational expertise in emerging aviation hubs.

Digitalization and Technological Advancements

Aena can leverage digitalization to significantly boost its operational efficiency and passenger satisfaction. Investing in areas like automated check-in, baggage handling, and advanced air traffic management systems can streamline processes and reduce wait times. For instance, by 2024, Aena aims to have 90% of its boarding processes digitized, a move expected to cut processing times by an average of 15% per passenger.

Embracing technological advancements presents a prime opportunity for Aena to differentiate itself in the competitive airport landscape. This includes adopting AI for predictive maintenance of infrastructure, enhancing cybersecurity to protect sensitive data, and implementing remote control systems for boarding bridges, which can improve response times and resource allocation. Aena's commitment to innovation saw them invest over €100 million in technology upgrades in 2023 alone, focusing on smart airport solutions.

- Enhanced Operational Efficiency: Automation of check-in, baggage, and boarding processes.

- Improved Passenger Experience: Reduced wait times and seamless travel through digital touchpoints.

- Cost Reduction: Streamlined operations and optimized resource utilization through technology.

- Leadership in Innovation: Positioning Aena as a leader in smart airport solutions and emerging technologies.

Sustainability Initiatives and Green Airport Development

Aena's accelerated commitment to achieving 'zero emissions' by 2030, a significant shift from previous targets, positions it to capitalize on the growing demand for sustainable travel. This proactive approach, backed by substantial investments in electrifying ground operations and promoting sustainable aviation fuels (SAF), is already resonating. For instance, Aena's 2023 sustainability report highlighted a 15% reduction in Scope 1 and 2 emissions compared to 2019, demonstrating tangible progress.

This focus on green initiatives offers a distinct competitive advantage. By enhancing its brand image as an environmentally responsible operator, Aena can attract a larger segment of travelers increasingly prioritizing sustainability. Furthermore, airlines seeking to meet their own emissions reduction goals are likely to favor airports with robust green infrastructure and policies, potentially leading to new route development and increased passenger traffic. The company's proactive stance also opens doors to specialized green financing and investment opportunities, further bolstering its financial flexibility for future development.

- Accelerated Zero Emissions Target: Aena's revised goal of achieving zero emissions by 2030, a notable advancement from earlier timelines.

- Investment in Electrification and SAF: Significant capital allocation towards electrifying airport operations and supporting the adoption of sustainable aviation fuels.

- Enhanced Brand Reputation: The sustainability drive is expected to bolster Aena's image, attracting environmentally conscious travelers and airlines.

- Access to Green Financing: The commitment to sustainability can unlock new funding avenues and investment opportunities in green infrastructure projects.

Aena is well-positioned to capitalize on the projected 320 million passengers in Spain by 2025, a figure that surpasses earlier expectations. This robust recovery in travel demand presents a significant opportunity to enhance both aeronautical and commercial revenues, particularly from international routes. The company is also actively expanding its high-margin commercial and real estate segments, with projected double-digit growth in non-aeronautical revenue from new concessions in 2025. Strategic development of real estate around airport hubs, including logistics centers and hotels, aims to further diversify income streams and increase real estate's contribution to overall profits.

Aena's international expansion, notably in Brazil and minority stakes in Latin American airports, diversifies revenue and leverages its operational expertise in growing markets. Digitalization efforts, targeting 90% digitized boarding processes by 2024, are expected to improve efficiency and passenger experience, reducing processing times by an estimated 15%. The company's commitment to sustainability, with an accelerated zero emissions target for 2030 and investments in electrification and SAF, enhances its brand reputation and can attract environmentally conscious travelers and airlines, potentially opening doors to green financing.

| Opportunity Area | Key Initiative/Driver | Projected Impact/Benefit | Data Point/Target |

|---|---|---|---|

| Passenger Growth | Post-pandemic travel recovery | Increased aeronautical and commercial revenue | 320 million passengers in Spain by 2025 |

| Commercial & Real Estate | New concessions and strategic land development | Double-digit growth in non-aeronautical revenue; new income streams | Projected MAG increase in 2025; target to increase real estate income contribution |

| International Expansion | Investments in Brazil and Latin America | Revenue diversification; application of operational expertise | Ongoing investments in Brazilian operations |

| Digitalization & Technology | Automation and smart airport solutions | Enhanced operational efficiency; improved passenger experience | 90% digitized boarding by 2024; 15% reduction in processing time |

| Sustainability | Zero emissions target and green investments | Improved brand image; attraction of eco-conscious travelers and airlines | Zero emissions by 2030; 15% reduction in Scope 1 & 2 emissions (2023 vs 2019) |

Threats

Economic downturns pose a significant threat to Aena by reducing discretionary travel, which directly impacts passenger volumes and ancillary revenue streams like retail and parking. A global or regional economic slowdown in 2024 or 2025 could lead to fewer people choosing to fly, directly affecting Aena's top-line performance.

Inflationary pressures are another major concern, as rising costs for materials, supplies, maintenance, and particularly energy can significantly squeeze profit margins. For instance, European airports have already experienced this erosion of profitability due to these cost increases, a trend that is likely to persist through 2024 and 2025, impacting Aena's operational expenses.

Aena faces growing regulatory pressure, particularly regarding environmental impact. New EU rules starting in January 2025 will compel airlines to disclose non-CO2 emissions and utilize a minimum amount of Sustainable Aviation Fuel (SAF). This shift could lead to higher operating expenses for airlines, which may then translate to increased costs for airport services.

Beyond emissions, Aena must also navigate stricter noise pollution standards and evolving waste management policies. Compliance with these increasingly stringent environmental regulations presents a significant operational challenge and potential cost increase for the company.

While Aena enjoys a dominant position in Spain, the wider European aviation sector presents a significant competitive landscape. The strategic expansion of ultra-low-cost carriers (ULCCs) across the continent intensifies this rivalry. For instance, Ryanair and easyJet, major players in the European ULCC market, have consistently grown their market share, often by offering highly competitive fares that pressure legacy carriers and, by extension, airport charges.

This intense competition among airlines translates into increased buyer power for these carriers. They can leverage their market position to negotiate lower airport charges, potentially pushing Aena’s revenue from user fees below its operational break-even point. In 2023, European airports collectively saw a strong recovery in passenger traffic, with many exceeding pre-pandemic levels, yet the pressure on airlines to maintain low fares continues, impacting their willingness to absorb higher airport costs.

Geopolitical Instability and Security Risks

Geopolitical instability poses a significant threat to Aena. Conflicts and tensions can directly disrupt air travel, leading to flight cancellations and a noticeable dip in passenger confidence, which in turn impacts Aena's operational efficiency and financial results. For instance, the ongoing geopolitical landscape in Eastern Europe has already influenced air traffic patterns and fuel costs, indirectly affecting airport operations worldwide.

Maintaining robust security measures in the face of evolving global threats is a constant and costly challenge for Aena. This involves continuous investment in advanced screening technologies and personnel training to ensure passenger safety and compliance with international aviation security standards. The financial burden of these security upgrades and ongoing operational costs can be substantial.

- Geopolitical tensions can lead to route suspensions and reduced passenger demand, impacting Aena's revenue streams.

- Increased security costs, driven by evolving threats, directly affect Aena's operating expenses.

- The risk of terrorism or significant security breaches at airports managed by Aena could have severe financial and reputational consequences.

Infrastructure Capacity Constraints and Investment Delays

Despite Aena's significant planned investments, a critical threat lies in the potential for infrastructure capacity to lag behind the robust recovery and growth in passenger traffic. For instance, if airport expansion projects, such as those at London Luton Airport which saw passenger numbers increase by 15.2% in 2023 compared to 2022, do not keep pace, major hubs could experience severe congestion. This could impact service quality and passenger experience.

Furthermore, delays in securing necessary permits or funding for large-scale infrastructure upgrades pose a substantial risk. Such delays could prevent Aena from fully capitalizing on the strong demand for air travel, potentially impacting revenue streams and its competitive positioning. For example, a delay in a major terminal expansion could mean missing out on peak season passenger volumes.

- Capacity Strain: If airport infrastructure expansion fails to match passenger traffic growth, key Aena airports could face significant capacity constraints, affecting operational efficiency and passenger satisfaction.

- Investment Delays: Delays in obtaining permits or securing funding for critical expansion projects could hinder Aena's ability to meet demand and maintain high service standards.

Aena faces significant threats from intensifying competition within the European aviation market, particularly from the expansion of ultra-low-cost carriers. This competitive pressure can lead to airlines wielding greater buyer power, potentially forcing Aena to accept lower airport charges, impacting revenue generation. For example, a strong recovery in passenger traffic across Europe in 2023, with many airports exceeding pre-pandemic levels, has not diminished the pressure on airlines to keep fares low, affecting their willingness to absorb higher airport costs.

SWOT Analysis Data Sources

This Aena SWOT analysis is built upon a robust foundation of data, drawing from official company financial reports, extensive market research, and expert industry analysis to provide a comprehensive and accurate strategic overview.