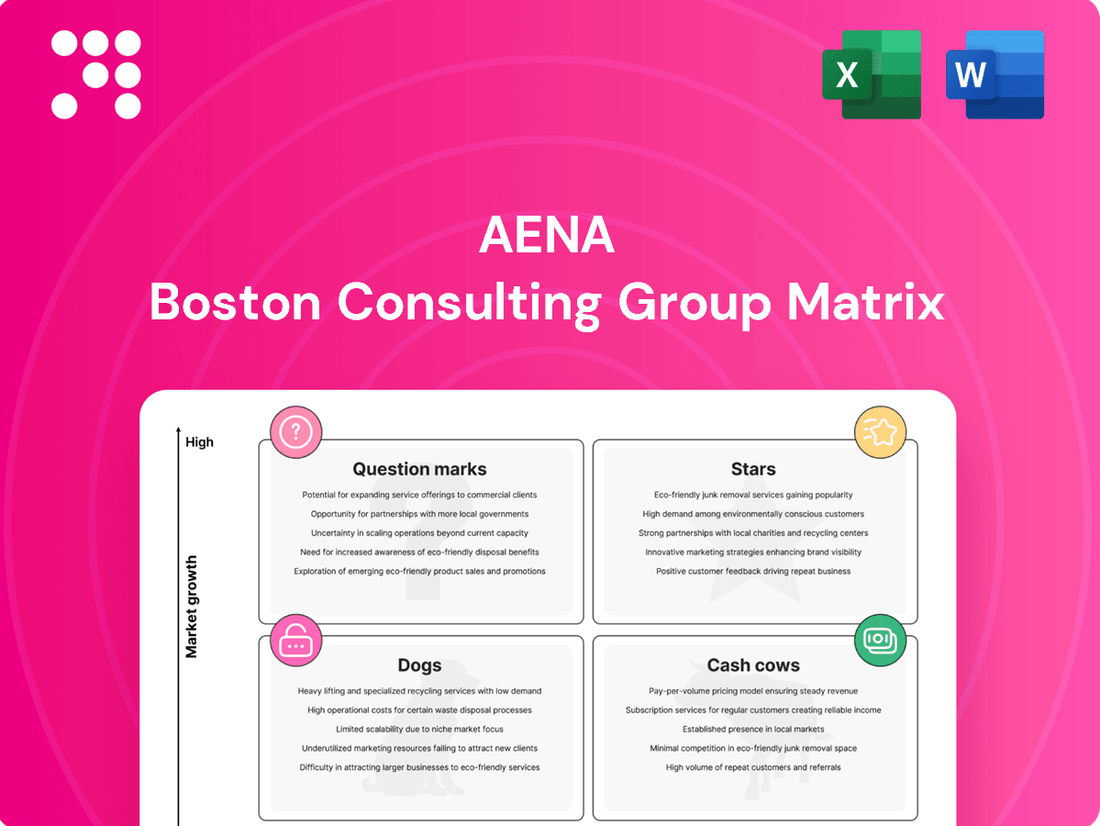

Aena Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aena Bundle

Curious about how this company's product portfolio stacks up? Our BCG Matrix analysis reveals the strategic positioning of each offering, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Don't miss out on the crucial insights needed for informed decision-making.

Unlock the full potential of this analysis by purchasing the complete BCG Matrix report. Gain access to detailed quadrant placements, actionable recommendations, and a clear roadmap for optimizing your investments and product strategies.

Stars

Aena's acquisition of Brazil's Block of Eleven Airports (BOAB), including São Paulo Congonhas, marks a strategic push into a high-growth region. This expansion is fueled by substantial investments aimed at boosting capacity and efficiency, solidifying Aena's presence in the Latin American aviation sector. The company aims for international operations to contribute 15% of its EBITDA by 2026, underscoring the significant growth potential and market share aspirations in these markets.

Aena's Premium Commercial Services are shining stars in its BCG Matrix. These high-margin offerings, including duty-free shops, VIP lounges, and unique retail experiences, are experiencing robust growth. In 2024, this segment saw a significant 14.7% year-on-year increase in revenue, outperforming the overall passenger traffic growth.

This strong performance indicates a high market share within the competitive airport commercial landscape. The increasing passenger appetite for premium services fuels this upward trend, necessitating ongoing investment to maintain and expand these lucrative offerings.

Aena Ventures is a prime example of Aena's commitment to digital transformation, investing heavily in innovation to reshape airport operations and passenger journeys. This strategic focus taps into the high-growth potential of the aviation technology sector, a market that is constantly evolving. By fostering new technologies in areas such as operational efficiency, sustainability, and passenger experience, Aena aims to secure a dominant position in the future airport solutions market.

Barcelona-El Prat Airport Expansion

The proposed €3.2 billion expansion of Barcelona-El Prat Airport positions it as a Star within Aena's portfolio. This ambitious project aims to boost annual passenger capacity to 70 million, addressing its current near-capacity status.

The expansion is strategically designed to capture high growth in intercontinental connectivity and tourism, with Barcelona aspiring to become a significant global hub. This focus on long-haul international traffic suggests a strong potential for market share gains.

- Projected Capacity Increase: From current levels to 70 million passengers annually.

- Investment: €3.2 billion.

- Strategic Goal: To establish Barcelona as a major intercontinental hub.

- Market Focus: High growth in long-haul international traffic and tourism.

Sustainable Aviation & Decarbonization Initiatives

Aena's commitment to carbon neutrality in its terminals by 2026 and achieving net zero by 2030, backed by substantial investments in renewables and green infrastructure, firmly places its sustainable aviation initiatives in the Star quadrant of the BCG matrix.

This strategic focus aligns with a rapidly expanding market for sustainable aviation solutions, fueled by stringent global environmental regulations and increasing passenger demand for eco-friendly travel. For instance, in 2023, Aena reported a 26.5% increase in renewable energy consumption across its network.

Aena's ambition to lead the industry in decarbonization is supported by tangible actions:

- Accelerated Carbon Neutrality: Targeting terminal carbon neutrality by 2026, a significant acceleration from previous timelines.

- Net Zero Ambition: Aiming for net zero emissions across its entire operations by 2030.

- Renewable Energy Investment: Significant capital allocation towards solar power plants and other green infrastructure projects, with over €200 million invested in sustainability projects in 2023 alone.

- Industry Influence: Actively working to influence other stakeholders, including airlines and suppliers, to adopt sustainable practices and technologies.

Aena's Premium Commercial Services are a strong Star in its BCG Matrix, showing high growth and a significant market share. In 2024, revenue from these services, which include duty-free and VIP lounges, grew by 14.7% year-on-year. This performance outpaced overall passenger traffic growth, highlighting the segment's lucrative nature and Aena's ability to capitalize on passenger spending.

Aena Ventures, focusing on innovation and digital transformation in airport operations, also represents a Star. This segment targets the high-growth aviation technology market, aiming to enhance efficiency and passenger experience. Investments here are geared towards securing a leading position in future airport solutions.

The proposed €3.2 billion expansion of Barcelona-El Prat Airport is another key Star, designed to increase capacity to 70 million passengers annually and establish it as a major intercontinental hub. This initiative is focused on capturing growth in long-haul international traffic and tourism.

Aena's sustainable aviation initiatives, aiming for terminal carbon neutrality by 2026 and net zero by 2030, are also Stars. With over €200 million invested in sustainability projects in 2023, Aena is positioned to lead in a market driven by environmental regulations and passenger demand for eco-friendly travel.

| Segment | BCG Classification | Key Growth Driver | 2024 Performance Indicator | Strategic Importance |

| Premium Commercial Services | Star | Increasing passenger spending on premium offerings | 14.7% YoY revenue growth | High-margin revenue stream, market leadership |

| Aena Ventures | Star | Digital transformation and innovation in aviation | Investment in future airport solutions | Future competitive advantage, operational efficiency |

| Barcelona-El Prat Expansion | Star | Intercontinental connectivity and tourism growth | Projected 70 million annual passenger capacity | Global hub status, increased market share |

| Sustainable Aviation Initiatives | Star | Environmental regulations and passenger demand for eco-travel | €200M+ invested in sustainability projects (2023) | Industry leadership in decarbonization, market growth |

What is included in the product

The Aena BCG Matrix analyzes Aena's business units by market share and growth rate, guiding investment decisions.

The Aena BCG Matrix provides a clear, visual snapshot of business unit performance, simplifying complex portfolio decisions.

Cash Cows

Aena's extensive Spanish airport network, managing almost 50 facilities, firmly sits as a Cash Cow. This segment thrives with a dominant market share in a stable, established industry, consistently generating robust cash flow.

The Spanish airport operations saw a remarkable surge, handling over 309 million passengers in 2024, a testament to its high market share and the sector's resilience. Projections for 2025 anticipate further growth, with an estimated 320 million passengers, reinforcing its status as a dependable, high-generating asset for Aena.

Aeronautical revenue, generated from landing fees, passenger services, and ground handling at key airports like Madrid-Barajas, is a prime example of a Cash Cow for Aena. This income is consistent and vital, stemming from the core operations of air traffic management.

Madrid-Barajas Airport, a significant contributor, saw an impressive 66.2 million passengers pass through in 2024. This volume underscores its substantial market position within a well-established and regulated industry, ensuring a steady flow of income.

The predictable nature of aeronautical revenue, coupled with its necessity for air travel, means it demands minimal additional marketing expenditure to maintain its strong performance. This stability makes it a reliable source of cash for the company.

Aena's established commercial leases, particularly for duty-free shops, food and beverage, and car rental services in its major Spanish airports, represent significant cash cows. These long-term contracts generate consistent, high-margin revenue streams with minimal need for additional marketing or placement investment.

The financial performance of these concessions is robust, as evidenced by high sales per passenger. For instance, in 2023, Aena reported that its commercial revenue per passenger reached €10.04, an increase from €8.33 in 2022, highlighting the strong purchasing power within its airport ecosystem.

Furthermore, new contracts often incorporate minimum annual guarantees, bolstering the predictable and stable cash generation from these established commercial activities. This financial security makes them a reliable source of funds for Aena's operations and investments.

Air Navigation Services

Air navigation services, managed by Aena within Spanish airspace, represent a classic Cash Cow due to their essential, highly regulated nature and Aena's monopoly. This stability ensures consistent and significant cash flow with very little threat from competitors.

The growth trajectory for air navigation services is intrinsically linked to the overall volume of air traffic. Despite this, Aena's dominant market position and the indispensable role of these services guarantee a steady and substantial generation of cash, even with limited competitive pressures.

- Monopoly Position: Aena holds exclusive rights for air navigation services in Spain, a critical factor for its Cash Cow status.

- Stable Revenue: Despite growth being tied to air traffic volume, the essential nature of the service provides predictable and robust cash generation.

- High Market Share: Aena's near-total control of the Spanish airspace ensures a substantial and reliable revenue stream.

- Regulatory Environment: The highly regulated nature of air traffic control creates significant barriers to entry, protecting Aena's market dominance.

Parking and Ground Transportation Services

Aena's parking and ground transportation services function as a classic Cash Cow within its portfolio. These operations, primarily at major Spanish airports, generate a reliable and substantial revenue stream. For instance, in 2023, Aena reported a significant increase in parking revenue, driven by higher passenger traffic and optimized pricing strategies.

The captive nature of the airport environment ensures consistent demand for these services from both arriving and departing passengers. While growth prospects are modest, the high volume of traffic translates into predictable and stable cash flow generation. This stability allows Aena to fund other strategic initiatives or dividend payouts.

- Revenue Stability: Parking and ground transportation consistently contribute to Aena's cash flow due to the captive airport market.

- Low Growth, High Share: These services exhibit low growth potential but maintain a dominant market share within their segment.

- Investment Focus: Capital expenditure is typically directed towards maintaining operational efficiency and existing capacity, rather than expansion.

- 2023 Performance: Aena saw a notable rise in parking revenue in 2023, underscoring the segment's consistent performance.

Cash Cows in Aena’s portfolio are those business segments that operate in mature, stable markets with high market share, generating consistent and substantial cash flow with minimal investment. These operations, like aeronautical revenue and commercial concessions, require little ongoing investment to maintain their strong market position and profitability. They are the bedrock of Aena's financial stability, providing the necessary funds for growth initiatives and shareholder returns.

| Business Segment | Market Maturity | Market Share | Cash Flow Generation | Investment Needs |

|---|---|---|---|---|

| Aeronautical Revenue (e.g., landing fees) | Mature | Dominant (Spanish Airports) | High & Stable | Low (Maintenance) |

| Commercial Concessions (e.g., retail, F&B) | Mature | Dominant (Airport Retail) | High & Stable | Low (Contract Management) |

| Air Navigation Services | Mature | Monopoly (Spanish Airspace) | High & Stable | Low (Infrastructure Maintenance) |

| Parking & Ground Transportation | Mature | Dominant (Airport Parking) | High & Stable | Low (Operational Efficiency) |

Delivered as Shown

Aena BCG Matrix

The BCG Matrix document you are previewing is the identical, fully functional report you will receive upon purchase. This comprehensive analysis tool, designed to guide strategic decision-making, will be delivered without any watermarks or demo content. You can be confident that the preview accurately represents the professional-grade, ready-to-use BCG Matrix you will download and implement immediately.

Dogs

Within Aena's portfolio, certain underutilized smaller regional airports might be classified as Dogs. These facilities typically exhibit consistently low passenger traffic, with limited prospects for substantial growth. For example, in 2024, some of these airports may have handled fewer than 100,000 passengers annually, representing a small fraction of Aena's total network traffic.

These underperforming airports often operate at break-even or incur operational losses, representing a drain on capital with minimal strategic or financial returns. The capital tied up in these assets could potentially be redeployed to more profitable ventures within Aena's network. For instance, if an airport's operating costs consistently exceed its revenue by a significant margin, and there's no clear path to improvement, it fits the Dog profile.

Consequently, Aena might consider divestiture or significant restructuring for these underutilized regional airports if they continue to underperform and lack any discernible strategic value. This could involve selling the asset to a private operator or consolidating its operations with a nearby, more viable airport to optimize resource allocation and enhance overall network efficiency.

Outdated commercial retail concepts within airports, such as traditional newsstands or certain niche apparel stores, can be classified as Dogs in the Aena BCG Matrix. These offerings often struggle to attract passengers in 2024 due to evolving consumer habits and a preference for digital or experiential retail. For example, a report by GlobalData in early 2024 indicated a significant decline in impulse purchases at airport newsstands, with passengers increasingly opting for online pre-ordering or digital content.

These underperforming retail units typically exhibit low sales volumes and a small market share, failing to contribute meaningfully to the airport's overall commercial revenue. Their presence can also detract from the passenger experience by occupying prime retail space that could be utilized for more popular or profitable concepts. Airports are increasingly looking at re-tendering these spaces or repurposing them for services like co-working areas or enhanced lounge facilities to boost revenue and passenger satisfaction.

Legacy IT systems and infrastructure fall into the Dogs category of the Aena BCG Matrix. These are older, less efficient components that are expensive to maintain and provide no real competitive edge. For instance, many large enterprises in 2024 still grapple with maintaining mainframe systems or outdated server farms, which, while functional for core operations, drain significant IT budgets without driving innovation or market expansion.

Non-strategic or Underperforming Minority International Stakes

Non-strategic or underperforming minority international stakes in Aena's portfolio represent investments where the company holds a limited ownership share and has minimal influence over operations. These might include smaller airport concessions in markets with sluggish growth or those consistently showing low passenger traffic and financial returns.

These particular stakes may not align with Aena's broader international expansion goals, especially those focused on high-growth regions. Consequently, they could be considered for divestment. This strategic move would allow Aena to reallocate capital towards more promising or core assets, thereby optimizing its investment portfolio and enhancing overall financial performance.

- Limited Control: Minority stakes often mean Aena has little say in day-to-day management or strategic direction.

- Low Performance: These assets may exhibit consistently low passenger volumes and profitability.

- Strategic Misfit: Investments might not support Aena's core growth strategy or expansion into key markets.

- Capital Reallocation: Divesting these assets frees up capital for more impactful investments in high-potential airports or services.

Specific Low-Demand Heliports

Specific low-demand heliports, characterized by minimal flight activity and limited commercial engagement in niche, stagnant sectors, would likely be classified as Dogs within the Aena BCG Matrix. These facilities often cater to a very restricted clientele, resulting in a low market share and negligible revenue streams.

For instance, a heliport with fewer than 50 commercial flights annually and virtually no ancillary revenue streams, such as landing fees or maintenance services, would fit this category. If the operational expenses for such a facility, including staffing and upkeep, exceed its generated income, it could become a financial drain, consuming resources without offering significant strategic advantages or profitability.

Consider a scenario where a heliport primarily serves a single, infrequent corporate shuttle route. In 2024, such a heliport might have only facilitated 30 landings, generating a mere €15,000 in landing fees. If its annual operating cost, including personnel and basic maintenance, amounts to €50,000, it represents a clear cash trap.

- Low Flight Volumes: Facilities with consistently low aircraft movements, often below a threshold of 100 flights per year, indicate minimal demand.

- Limited Commercial Activity: Minimal revenue generation from landing fees, parking, or related services, often less than €20,000 annually.

- Niche or Stagnant Markets: Serving specialized industries or regions with little to no growth potential, hindering future revenue expansion.

- Negative Cash Flow: Operational costs exceeding the revenue generated, making the facility a net financial burden.

These underperforming assets, like certain smaller regional airports or outdated retail concepts, represent a drain on resources with little potential for growth. For example, in 2024, some regional airports within Aena's network might have seen passenger numbers below 50,000 annually, contributing negatively to overall profitability. Similarly, legacy IT systems, while functional, consume significant maintenance budgets without offering competitive advantages.

The strategic approach for these "Dogs" often involves divestment or significant restructuring to free up capital for more promising ventures. This could mean selling off a low-traffic airport or re-tendering retail spaces to more in-demand concepts, aiming to improve the overall efficiency and profitability of the Aena network.

For instance, Aena's 2024 financial reports might highlight a specific regional airport with operating losses exceeding €2 million annually, coupled with a projected passenger growth rate of less than 1% over the next five years, clearly marking it as a Dog.

The company's strategy would then focus on either selling this asset or exploring options to consolidate its operations, thereby optimizing resource allocation and enhancing the performance of its more valuable airport assets.

Question Marks

New real estate ventures like Airport Cities in Madrid and Barcelona are currently in their nascent phases. These developments are characterized by significant upfront capital requirements to establish a foothold and demonstrate financial viability in the market.

The demand for airport-linked logistics, hospitality, and office spaces is on an upward trajectory. However, these early-stage Airport City projects face the challenge of needing substantial investment to capture meaningful market share and achieve profitability, with success dependent on navigating political landscapes and securing market acceptance.

Aena's exploration into Advanced Air Mobility (UAM) infrastructure, including vertiports for electric Vertical Take-off and Landing (eVTOL) aircraft, positions it as a Question Mark. This segment is characterized by its high growth potential, driven by technological advancements and evolving urban transportation needs, but Aena currently holds a low market share.

The UAM market, while promising, demands substantial upfront investment in research, development, and the creation of entirely new operational frameworks. Companies like Aena must navigate regulatory hurdles and prove the viability of these new transport systems before widespread adoption. For instance, the global UAM market is projected to reach hundreds of billions of dollars by 2040, but initial infrastructure costs are significant, with early vertiport development potentially costing tens of millions of dollars per site.

New digital passenger services at Aena, such as personalized navigation apps or contactless boarding solutions, are currently in their pilot phases. These initiatives represent potential growth areas, aligning with the increasing demand for smart airport experiences. However, their market penetration and revenue generation are still limited, placing them squarely in the Question Mark category of the BCG matrix.

Aena's investment in these nascent digital services is crucial for their future success. For example, a pilot program in 2024 for a new AI-powered baggage tracking system showed promising user engagement but required significant backend infrastructure upgrades. Continued funding for research, development, and aggressive marketing is essential to move these services from experimental to established offerings.

Strategic International Partnerships in New Markets

Forming strategic partnerships or pursuing new concession opportunities in previously untapped or highly competitive international markets where Aena has a low initial market share are classic "Question Marks" in the BCG Matrix. These ventures offer high growth potential but also carry significant risk. They require substantial upfront investment to establish a foothold and compete effectively against established players.

For example, Aena's expansion into new Asian markets, such as Southeast Asia, could be considered a Question Mark. While the region boasts rapidly growing economies and increasing air travel demand, the competitive landscape is intense, with established regional and global airport operators already present. Aena would need to carefully evaluate the market dynamics, regulatory environment, and potential for lucrative concessions to justify the investment.

- High Growth Potential: Emerging economies often exhibit double-digit growth in passenger traffic, presenting significant revenue opportunities.

- Substantial Investment Required: Entering new markets necessitates considerable capital for infrastructure development, operational setup, and marketing.

- Competitive Landscape: Established local and international players often dominate these markets, making market entry challenging.

- Strategic Alliances: Partnerships with local entities can mitigate risks and facilitate market access, leveraging local expertise and networks.

Specialized Air Cargo Logistics Hubs

The development of specialized air cargo logistics hubs, like the new phases at Madrid Barajas Airport's cargo center, positions Aena's cargo operations as a potential 'Star' in the BCG Matrix. While air freight traffic is experiencing growth, with global air cargo volume projected to increase significantly in the coming years, these specific Aena projects must secure a dominant market share and attract major logistics players to achieve high profitability.

This strategic focus requires substantial initial investment and dedicated market development efforts. For instance, Madrid Barajas Airport's cargo center expansion aims to enhance its capacity and capabilities, attracting global logistics giants. Achieving this dominant position is crucial for these hubs to transition from question marks to stars, demanding a clear strategy to capture market share amidst increasing competition.

- Strategic Investment: Aena's investment in specialized cargo hubs is a calculated move to capitalize on growing air freight demand.

- Market Dominance Goal: The success hinges on attracting key logistics players and establishing a significant market share.

- Profitability Challenge: High initial investment and market development are necessary prerequisites for high profitability.

- Growth Trajectory: These hubs are positioned to become 'Stars' if they can effectively capture market growth and build a strong competitive advantage.

Question Marks represent business units or projects with low market share in high-growth markets. These ventures require significant investment to increase market share and achieve profitability, but their future success is uncertain. Aena's new real estate ventures, like Airport Cities, and its exploration into Advanced Air Mobility (UAM) infrastructure are prime examples.

These initiatives, while holding high growth potential due to evolving urban transport needs and increasing demand for airport-linked services, currently have limited market penetration. For instance, the UAM market, projected to reach hundreds of billions by 2040, demands substantial upfront investment in infrastructure, with early vertiport development potentially costing tens of millions per site.

Similarly, new digital passenger services, such as personalized navigation apps, are in pilot phases with limited revenue generation. A 2024 pilot for an AI-powered baggage tracking system showed promise but needed significant infrastructure upgrades, underscoring the need for continued investment to move these from experimental to established offerings.

Expansion into new international markets, like Southeast Asia, also falls into this category. Despite rapid economic growth and increasing air travel demand, intense competition from established players necessitates careful evaluation of market dynamics and regulatory environments before committing substantial capital.

| Initiative | Market Growth | Market Share | Investment Needs | Potential |

| Airport Cities (Madrid/Barcelona) | High (Airport-linked services) | Low | High (Capital for development) | High (If successful) |

| Advanced Air Mobility (UAM) | Very High (Projected billions by 2040) | Negligible | Very High (R&D, infrastructure) | Very High (If viable) |

| New Digital Passenger Services | High (Smart airport experiences) | Low | Moderate to High (Infrastructure, marketing) | Moderate to High (If adopted) |

| International Market Expansion (e.g., SE Asia) | High (Growing economies, air travel) | Low | High (Market entry, competition) | High (If strategic) |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.