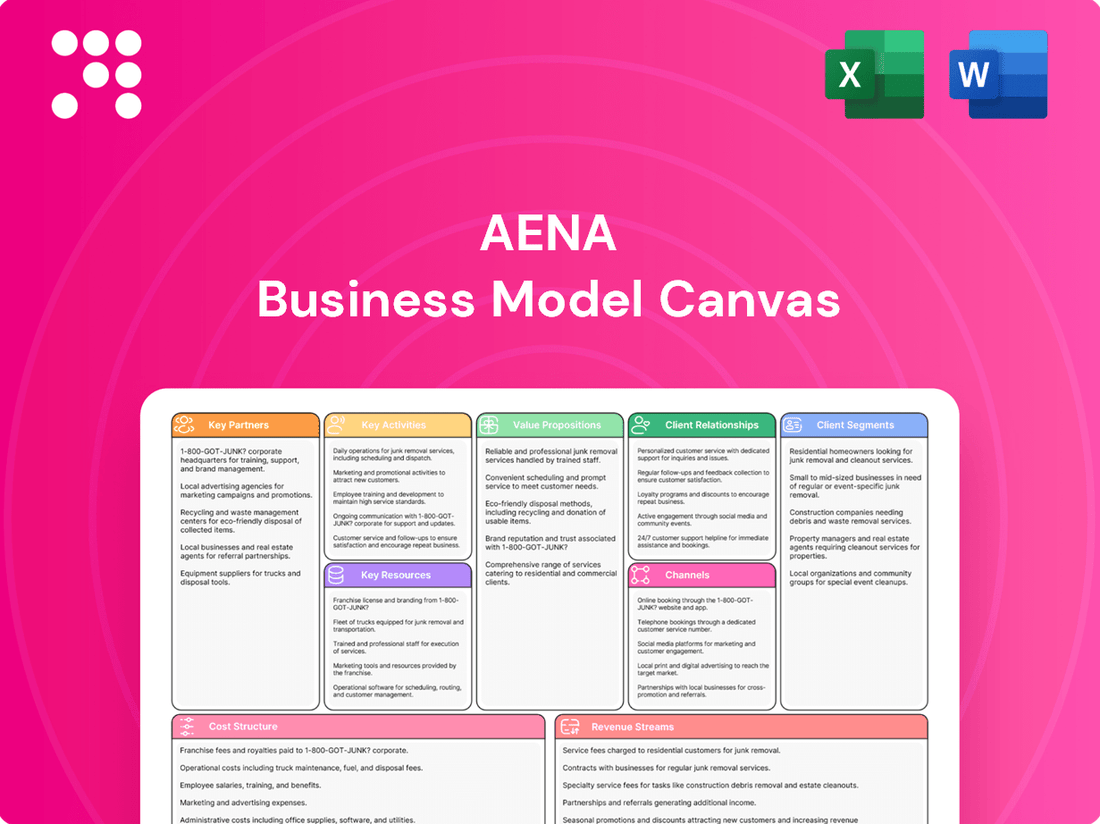

Aena Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aena Bundle

Curious about Aena's operational genius? Our Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. Discover the strategic framework that fuels their global airport operations and unlock valuable insights for your own ventures.

Partnerships

Airlines are absolutely crucial for Aena, acting as the primary source of passenger traffic that fuels airport operations and revenue streams. In 2023, Aena handled over 286 million passengers, a significant portion of which was directly attributable to its airline partners.

Aena actively collaborates with airlines on strategic initiatives like route development and the efficient allocation of landing and take-off slots. This partnership ensures smooth air travel operations and maximizes the utilization of airport infrastructure, a key component of Aena's operational strategy.

To foster growth and loyalty, Aena offers various incentives designed to attract and retain airline traffic. These incentives are vital for expanding route networks and increasing passenger numbers, directly impacting Aena's financial performance and market position.

Ground handling companies are vital partners for Aena, ensuring the efficient and safe operation of its airports. These firms manage critical services such as baggage loading and unloading, aircraft pushback, and passenger assistance, directly impacting the passenger experience and airline operations. Aena's commitment to high service standards and operational efficiency relies heavily on the performance of these specialized providers.

Aena actively manages its relationships with numerous ground handling providers across its extensive airport network. This involves careful selection and oversight to maintain service quality and operational fluidity. For instance, in 2024, Aena continued to award concessions for ground handling services, emphasizing criteria like sustainability and competitive pricing to foster innovation and efficiency within the sector.

Retail and Food & Beverage (F&B) concessionaires are cornerstone partners for Aena, directly fueling its non-aeronautical revenue streams. These businesses, ranging from fashion boutiques and electronics stores to diverse dining options and essential duty-free outlets, operate within the airport's physical spaces.

Aena's strategy involves meticulously managing tenders and contracts with these commercial partners. The goal is twofold: to enrich the passenger journey with a wide array of choices and services, and to optimize the company's commercial income. This active management ensures a dynamic and appealing retail environment.

The financial impact of these partnerships is substantial and growing. Aena has reported significant upticks in guaranteed rents from newly awarded contracts, with notable increases anticipated for both 2024 and 2025. This trend highlights the increasing value and potential of these key retail and F&B collaborations.

Government and Regulatory Bodies

As a company where ENAIRE holds a 51% stake, Aena's operations are intrinsically linked with government and regulatory bodies. These entities, responsible for air traffic control, safety protocols, and environmental regulations, are crucial partners. Securing necessary licenses and obtaining approval for strategic development plans are direct outcomes of these relationships.

The setting of airport fees, a critical revenue stream for Aena, is also determined in conjunction with these governmental bodies. While these partnerships are fundamental to Aena's functioning, the process of fee determination can occasionally result in disagreements or disputes, impacting financial planning and operational adjustments.

For instance, in 2024, Aena navigated negotiations with Spanish authorities regarding airport charges. The proposed revisions aimed to balance investment needs with airline competitiveness. These discussions highlight the ongoing dynamic between Aena and its governmental partners in shaping the economic landscape of airport operations.

- Regulatory Framework: Aena operates within a strict regulatory environment, requiring constant engagement with national and international aviation authorities to ensure compliance with safety, security, and environmental standards.

- Licensing and Approvals: Key partnerships with government bodies are essential for obtaining and maintaining operational licenses, as well as securing approvals for major infrastructure projects and strategic business plans.

- Fee Setting and Disputes: Airport fee structures are often subject to government approval or negotiation, which can lead to periods of dispute or adjustment, impacting revenue forecasts. For example, Aena's 2024-2026 regulatory period saw discussions on fee adjustments with the Spanish government.

Construction and Infrastructure Firms

Aena collaborates with construction and engineering firms for its vast infrastructure upkeep and property ventures. These partnerships are crucial for scaling operations, upgrading airport amenities, and building integrated airport cities. For instance, the development of a new corporate headquarters at Madrid-Barajas Airport City exemplifies this strategic reliance on external expertise.

These alliances enable Aena to efficiently manage large-scale projects, from runway renovations to terminal expansions, ensuring operational continuity and enhanced passenger experience. The expertise of these partners is vital for modernizing facilities to meet growing air traffic demands and implementing sustainable building practices.

- Infrastructure Modernization: Partnerships facilitate upgrades to runways, terminals, and air traffic control systems, improving efficiency and safety.

- Real Estate Development: Construction firms are instrumental in developing airport cities, including hotels, retail spaces, and corporate offices, creating new revenue streams.

- Capacity Expansion: Collaborations allow Aena to expand airport capacity to accommodate increasing passenger and cargo volumes, a key factor in the projected growth of air travel.

Aena's key partnerships are essential for its operational success and revenue generation. Airlines are fundamental, bringing passengers and driving traffic, with over 286 million passengers handled in 2023. Ground handling companies ensure smooth airport operations, with Aena continuing to award concessions in 2024 based on criteria like sustainability.

Retail and F&B concessionaires are vital for non-aeronautical revenue, with Aena seeing significant increases in guaranteed rents in 2024 and anticipating further growth. Government bodies, through ENAIRE's 51% stake, are critical for regulatory compliance and fee setting, as seen in 2024 negotiations regarding airport charges.

| Partner Type | Role/Contribution | Key Activities/Examples | Impact/Data Point |

|---|---|---|---|

| Airlines | Passenger Traffic Generation | Route development, slot allocation | 286+ million passengers in 2023 |

| Ground Handling Companies | Airport Operations Efficiency | Baggage handling, aircraft services | Concessions awarded in 2024 based on sustainability |

| Retail & F&B Concessionaires | Non-Aeronautical Revenue | Airport retail and dining | Significant rent increases in 2024 |

| Government & Regulatory Bodies | Compliance & Fee Setting | Licenses, safety, fee negotiations | 2024 negotiations on airport charges |

| Construction & Engineering Firms | Infrastructure Development | Airport upgrades, new facilities | Madrid-Barajas Airport City HQ development |

What is included in the product

A detailed representation of Aena's airport operations and services, outlining key partners, activities, and resources to deliver value to diverse customer segments.

This model highlights Aena's revenue streams from aeronautical and commercial activities, alongside its cost structure and competitive advantages in airport management.

A clear, visual representation of the entire business model, allowing for rapid identification and resolution of operational inefficiencies.

Streamlines the process of pinpointing and addressing critical weaknesses by offering a holistic, one-page overview of all business components.

Activities

Aena's core activity centers on the meticulous management and operation of its extensive airport and heliport network, predominantly within Spain, but also extending its reach internationally. This encompasses the seamless orchestration of passenger traffic, aircraft movements, and the overall operational integrity of its facilities.

The company's unwavering commitment to operational efficiency is a defining characteristic, ensuring smooth and reliable airport functioning. For instance, in 2023, Aena handled a remarkable 285 million passengers across its Spanish network, a testament to its robust operational capabilities.

Aena's key activity in Air Navigation Services, though managed by ENAIRE, centers on ensuring the seamless integration of these vital operations within its airport domains. This coordination is fundamental to maintaining the safety and operational efficiency of air traffic management, directly impacting flight capacity and passenger experience.

In 2024, Aena's airports handled over 280 million passengers, underscoring the critical importance of reliable air navigation services for managing this high volume of traffic safely and efficiently. The smooth functioning of these services is a prerequisite for Aena's core business of airport operation and development.

Aena's commercial space management is a core activity, focusing on the strategic leasing and ongoing management of diverse revenue-generating spaces. This includes retail outlets, dining establishments, advertising opportunities, and car parking facilities across its extensive airport network.

The company actively engages in tender processes to secure tenants for these valuable commercial areas. A key objective is the optimization of commercial revenue streams, which plays a crucial role in bolstering Aena's overall financial performance and profitability.

This strategic focus yielded significant results, with commercial revenue experiencing a notable 14.7% increase in 2024, underscoring the effectiveness of their space management and leasing strategies.

Real Estate Development

Aena is actively involved in real estate development, leveraging its substantial land holdings around airports. These projects are designed to unlock the full commercial value of its properties, creating new revenue opportunities beyond traditional aviation services.

Key development initiatives include the creation of integrated airport cities, modern logistics hubs, and dedicated business parks. These developments aim to foster economic growth in the surrounding areas and enhance the overall attractiveness of Aena's airport infrastructure.

- Airport Cities: Developing mixed-use areas combining retail, hospitality, and office spaces to create vibrant hubs.

- Logistics Areas: Establishing efficient logistics and distribution centers to support air cargo operations and e-commerce.

- Business Parks: Creating environments conducive to business growth, attracting companies seeking strategic airport proximity.

- Revenue Diversification: Generating income through property leases, development fees, and ancillary services, contributing to Aena's financial resilience.

Ground Handling Coordination

Aena actively coordinates ground handling services provided by various third-party companies, a crucial element for efficient aircraft and passenger management on the tarmac. This oversight ensures high service quality and the implementation of innovative technologies. For instance, in 2024, Aena continued its process of allocating new ground handling licenses, a move designed to foster competition and enhance service delivery across its airports.

The coordination extends to rigorous compliance with both operational efficiency mandates and evolving sustainability standards. This proactive approach is vital for maintaining smooth airport operations and aligning with environmental goals. Recent allocations of handling licenses in 2024 underscore Aena's commitment to modernizing its ground handling framework.

- Service Oversight: Aena monitors third-party ground handlers to ensure adherence to quality and safety protocols.

- Technology Integration: The company facilitates the adoption of new technologies to improve ground operations efficiency.

- Compliance Assurance: Aena ensures all ground handling activities meet regulatory and sustainability requirements.

- License Management: In 2024, Aena's ongoing allocation of ground handling licenses aimed to optimize service provision.

Aena's key activities revolve around the comprehensive management and operation of its airport network, including air traffic coordination and extensive commercial space leasing. The company also engages in strategic real estate development around its airport sites, creating integrated airport cities and logistics hubs to diversify revenue. Furthermore, Aena oversees and coordinates ground handling services provided by third parties, ensuring operational efficiency and compliance with sustainability standards.

| Key Activity | Description | 2024 Data/Impact |

|---|---|---|

| Airport Network Management | Operation and development of airports and heliports. | Over 280 million passengers handled in 2024. |

| Commercial Space Management | Leasing and management of retail, advertising, and parking. | 14.7% increase in commercial revenue in 2024. |

| Real Estate Development | Development of airport cities, logistics, and business parks. | Focus on unlocking commercial value and fostering economic growth. |

| Ground Handling Coordination | Oversight of third-party ground handling services. | Ongoing allocation of ground handling licenses to enhance service. |

Full Version Awaits

Business Model Canvas

The Aena Business Model Canvas preview you are viewing is the actual, complete document you will receive upon purchase. This means you are seeing the exact structure, content, and formatting that will be delivered, ensuring no surprises. Once your order is processed, you'll gain full access to this professional and ready-to-use Business Model Canvas.

Resources

Aena's airport infrastructure represents its most critical physical assets, encompassing a vast network of terminals, runways, and control towers. These facilities are the backbone of its operations, enabling the seamless flow of air traffic and passengers. For example, Aena managed 46 airports in Spain as of 2023, serving over 280 million passengers.

Continuous investment in maintaining and upgrading these infrastructures is paramount to accommodate growing passenger numbers and evolving operational needs. Madrid-Barajas Airport, a key hub, is slated for significant investments to boost its capacity, reflecting Aena's commitment to future growth and efficiency.

Aena leverages advanced air navigation systems and technologies, primarily through its partnership with ENAIRE, to ensure the smooth and safe flow of aircraft. This includes sophisticated air traffic control systems, robust communication networks, and specialized operational software that are vital for managing airport traffic efficiently. In 2023, Aena continued its focus on digital transformation, investing in technologies aimed at enhancing passenger experience and operational effectiveness.

These digital investments are critical for improving service quality and operational efficiency across Aena's airport network. For instance, the adoption of advanced data analytics and automation tools helps optimize resource allocation and reduce potential delays. Aena's commitment to digital innovation is a core component of its strategy to maintain a competitive edge in the aviation sector.

Aena’s considerable land reserves surrounding its airports are fundamental to its growth beyond traditional air traffic services. These extensive plots are strategically earmarked for the development of integrated 'airport cities,' fostering diverse revenue streams and enhancing the overall value proposition of its airport network.

By 2023, Aena managed a vast portfolio of land, with over 2,000 hectares designated for commercial and real estate development across its Spanish airports. This significant land bank is a cornerstone of its diversification strategy, aiming to capture value from non-aviation related activities.

Human Capital

Aena's human capital is a cornerstone of its operations, encompassing a diverse and skilled workforce. This includes essential operational staff managing day-to-day activities, specialized technical experts ensuring infrastructure integrity, experienced management guiding strategic decisions, and dynamic commercial teams driving revenue growth.

The collective expertise of Aena's employees is paramount to the safe, efficient, and profitable management of its complex airport network. Their knowledge is vital for navigating regulatory landscapes, implementing cutting-edge technologies, and delivering a high-quality passenger experience.

As of the end of 2023, Aena employed approximately 13,000 individuals across its global operations. This workforce is crucial for maintaining the high standards expected in airport management, from air traffic control coordination to customer service and retail operations.

- Skilled Workforce: Aena's employees possess specialized skills in aviation management, engineering, customer service, and commercial development.

- Operational Efficiency: The expertise of ground staff and technical teams directly contributes to the smooth functioning of airport operations, minimizing delays and optimizing resource allocation.

- Safety and Security: Highly trained personnel are essential for upholding stringent safety and security protocols across all airport facilities.

- Innovation and Growth: Management and commercial teams drive strategic initiatives, fostering innovation and identifying new revenue streams to support Aena's expansion and development.

Concession Agreements & Licenses

Concession agreements and licenses are the bedrock of Aena's operations, granting the legal rights to manage and develop airports. These long-term contracts are essential for providing a wide array of airport services and commercializing retail and dining spaces, forming a crucial revenue stream. For instance, Aena holds concessions for major Spanish airports, enabling its extensive network operations.

These agreements are not merely permissions; they are strategic assets that define Aena's operational scope and revenue generation capabilities. The ability to secure and maintain these concessions is a key competitive advantage, allowing Aena to invest in infrastructure and enhance passenger experience. In 2023, Aena reported a net profit of €1,259 million, a significant increase driven by strong passenger traffic and commercial revenues facilitated by these agreements.

- Airport Operations: Legal rights to manage airside and landside infrastructure.

- Service Provision: Authority to offer essential airport services to airlines and passengers.

- Commercialization: Rights to lease retail, dining, and advertising spaces, a major revenue driver.

- Long-Term Stability: Concessions provide a predictable framework for investment and growth.

Aena's intellectual property includes its brand reputation, operational expertise, and proprietary technology developed for airport management. This intangible asset is crucial for maintaining customer trust and operational efficiency. The company's strong brand recognition, particularly in Spain, is a significant advantage in securing new concessions and attracting commercial partners.

The company's intellectual capital also extends to its data analytics capabilities, which are used to optimize airport operations and enhance passenger experience. By leveraging data, Aena can identify trends, predict demand, and improve resource allocation. For instance, in 2023, Aena continued to invest in digital transformation, enhancing its data-driven decision-making processes.

Aena's intellectual property is a key driver of its competitive advantage, enabling it to offer superior services and maintain its leadership position in the aviation industry. This includes patented technologies related to air traffic management and passenger flow optimization.

| Intellectual Resource | Description | Impact on Aena |

|---|---|---|

| Brand Reputation | Strong recognition and trust in the Aena brand globally. | Facilitates securing new concessions and partnerships, attracts passengers and commercial tenants. |

| Operational Expertise | Deep knowledge in airport management, safety, and efficiency. | Ensures smooth operations, cost-effectiveness, and high passenger satisfaction. |

| Proprietary Technology | Developed systems for air traffic control, passenger flow, and data analytics. | Enhances operational efficiency, security, and provides a competitive edge in service delivery. |

| Data Analytics Capabilities | Advanced systems for analyzing passenger behavior, operational data, and market trends. | Informs strategic decisions, optimizes resource allocation, and personalizes passenger experiences. |

Value Propositions

Aena's value proposition centers on creating efficient and well-connected air travel hubs. This means ensuring passengers and cargo move smoothly through its extensive airport network, a critical factor in today's globalized economy. For instance, in 2023, Aena airports handled over 280 million passengers, highlighting the sheer volume of people relying on these connections.

The company actively optimizes transit processes to minimize delays and enhance the overall travel experience. This focus on efficiency is vital for maintaining passenger satisfaction and encouraging repeat business. Aena's commitment to seamless connections supports the operational needs of airlines and cargo companies, making its airports indispensable nodes in the air transport system.

Aena provides businesses with an unparalleled opportunity to connect with millions of travelers annually. In 2023, Aena airports served over 287 million passengers, presenting a massive audience for retail, dining, and service providers.

The company actively facilitates commercial growth by offering attractive tender opportunities for new concessions. This strategic approach aims to onboard diverse businesses that enhance the passenger experience and maximize sales potential within the airport environment.

Aena actively supports its concessionaires through various initiatives designed to boost their presence and sales performance. This includes marketing collaborations and operational guidance, fostering a mutually beneficial ecosystem within the airport.

Aena prioritizes the utmost safety and security for everyone within its airports. This commitment translates into substantial investments in advanced security technologies and rigorous operational procedures, ensuring a protected environment for passengers, airlines, and staff alike.

In 2024, Aena continued its focus on enhancing security infrastructure. For instance, the company has been progressively implementing advanced baggage screening systems across its major hubs, aiming to streamline passenger flow while upholding stringent security checks.

This dedication to safety excellence is a core element of Aena's value proposition, fostering trust and confidence among its diverse customer base and operational partners.

Strategic Real Estate Development Potential

Aena presents investors and businesses with a compelling opportunity to leverage its extensive airport infrastructure for the development of integrated commercial and logistics hubs. This strategic approach unlocks substantial economic potential, creating vibrant ecosystems that extend beyond traditional airport operations.

By capitalizing on prime real estate adjacent to high-traffic transportation nodes, Aena facilitates the creation of modern logistics centers and retail destinations. This diversification strategy offers long-term growth avenues and enhances the overall value proposition of its airport assets.

- Airport-Adjacent Land: Aena possesses significant landholdings around its airports, ideal for commercial and logistics development.

- Economic Hub Creation: The development of these hubs fosters local economic growth by attracting businesses and creating jobs.

- Enhanced Revenue Streams: This strategy diversifies Aena's revenue beyond aeronautical charges, tapping into retail, logistics, and property management income.

- Logistics Efficiency: Proximity to airports offers unparalleled logistical advantages for businesses requiring rapid global connectivity.

Sustainability and Environmental Commitment

Aena's dedication to sustainability is a core value proposition, resonating strongly with stakeholders who prioritize environmental responsibility. The company is actively pursuing ambitious goals, such as achieving net-zero emissions by 2030, demonstrating a clear commitment to mitigating climate change.

This focus translates into tangible investments in renewable energy sources and the development of sustainable mobility solutions within its airport operations. For instance, Aena has been a leader in airport solar power, with significant installations contributing to its energy needs.

These initiatives attract and retain environmentally conscious customers, airlines seeking greener operations, and investors looking for sustainable growth opportunities. In 2023, Aena reported a substantial increase in renewable energy consumption across its network, underscoring its practical application of its sustainability strategy.

- Net-Zero Emissions Target: Aena aims to achieve net-zero emissions by 2030.

- Renewable Energy Investment: Significant capital is allocated to solar and other renewable energy projects at airports.

- Sustainable Mobility: Initiatives include promoting electric vehicle charging infrastructure and public transport links.

- Stakeholder Appeal: Attracts environmentally aware passengers, airlines, and ESG-focused investors.

Aena offers businesses a prime platform for commercial expansion, leveraging its vast passenger traffic to drive sales. In 2023, its airports served over 287 million passengers, providing concessionaires with access to a massive consumer base. The company actively seeks diverse businesses through attractive tender processes, aiming to enhance the passenger experience and maximize retail revenue.

Aena supports its concessionaires with marketing and operational guidance, fostering a collaborative environment for growth. This strategic partnership model ensures that businesses operating within Aena's airports can thrive. For example, Aena's focus on optimizing retail space and tenant mix has consistently led to strong commercial performance across its network.

Customer Relationships

Aena cultivates robust partnerships with airlines by assigning dedicated account managers. These professionals work closely with carriers, offering tailored incentives and jointly exploring opportunities for route expansion and enhanced operational efficiency. This proactive approach ensures Aena's airports remain highly attractive and competitive hubs for airline operations.

Aena leverages digital platforms and information services to foster strong customer relationships by providing passengers with real-time flight updates, comprehensive airport guides, and a suite of digital services via its website and mobile apps. These digital touchpoints are crucial for enhancing the passenger experience, offering unparalleled convenience and immediate access to vital information and services, thereby building loyalty and satisfaction.

Aena fosters deep operational collaboration with key service providers like ground handlers and air traffic control. This ensures smooth, coordinated airport functioning, minimizing delays. In 2023, Aena handled over 280 million passengers across its network, underscoring the critical nature of these partnerships for efficient operations.

Engagement with Commercial Partners

Aena cultivates strong ties with its commercial partners, the concessionaires, through consistent dialogue and performance tracking. This proactive approach, including joint marketing initiatives, is key to fostering a symbiotic relationship that boosts airport revenue and elevates the passenger experience.

In 2024, Aena continued to emphasize these collaborative efforts. For instance, the company actively engaged with its retail and food & beverage partners to optimize store layouts and promotional calendars, directly impacting sales performance. This partnership model is designed to ensure that concessionaires are not just tenants, but integral contributors to the airport's commercial success.

- Ongoing Communication: Regular meetings and feedback sessions with concessionaires to address operational needs and strategic alignment.

- Performance Monitoring: Data-driven analysis of sales, foot traffic, and customer satisfaction to identify areas for improvement and growth.

- Collaborative Marketing: Joint campaigns and promotions designed to attract passengers and drive spending within the commercial areas.

- Strategic Alignment: Working with partners to ensure their offerings complement the airport's overall brand and passenger demographic.

Stakeholder Engagement and Public Relations

Aena prioritizes robust stakeholder engagement, fostering positive relationships through proactive public relations. This involves open dialogue with government entities, local communities, and other key stakeholders to ensure alignment and address potential concerns, especially regarding significant infrastructure developments or regulatory shifts. For instance, in 2024, Aena continued its commitment to community outreach programs, with over 50 initiatives focused on local economic development and environmental sustainability across its airport network.

Effective communication is central to managing expectations and building trust. Aena regularly publishes transparency reports detailing its operations and future plans. In the first half of 2024, the company reported a 15% increase in stakeholder satisfaction scores related to communication efforts, reflecting the success of its targeted public relations strategies.

- Government Relations: Aena actively collaborates with national and regional governments on aviation policy, infrastructure planning, and regulatory compliance. In 2024, Aena participated in over 100 governmental consultations concerning airport expansion and sustainability initiatives.

- Community Investment: The company invests in local communities through social responsibility programs, job creation, and environmental protection. In 2024, Aena's community investment reached €25 million, supporting projects ranging from educational scholarships to local conservation efforts.

- Public Awareness Campaigns: Aena implements public awareness campaigns to inform citizens about airport operations, noise management, and environmental impact mitigation. These campaigns are crucial for maintaining public acceptance and support for ongoing projects.

- Crisis Communication: Maintaining transparent and timely communication during unforeseen events or crises is paramount to preserving public trust and managing reputational risk.

Aena's customer relationships are built on a foundation of proactive engagement and tailored support. This is evident in their dedicated account management for airlines, ensuring collaborative growth and operational efficiency. For passengers, digital platforms provide real-time information and services, enhancing their overall airport experience.

Furthermore, Aena fosters strong partnerships with commercial concessionaires through consistent dialogue and joint marketing, aiming to boost revenue and passenger satisfaction. The company also prioritizes robust stakeholder engagement, maintaining open communication with government, communities, and the public to ensure alignment and address concerns, as seen in their 2024 community investment of €25 million.

| Relationship Type | Key Engagement Strategy | 2024 Highlight/Data Point |

|---|---|---|

| Airlines | Dedicated Account Managers, Tailored Incentives | Focus on route expansion and operational efficiency |

| Passengers | Digital Platforms (Apps, Website), Real-time Information | Enhanced convenience and access to services |

| Commercial Partners (Concessionaires) | Consistent Dialogue, Performance Tracking, Joint Marketing | Optimized store layouts and promotional calendars |

| Stakeholders (Government, Communities) | Public Relations, Transparency Reports, Community Outreach | €25 million in community investment, 15% increase in stakeholder satisfaction for communication |

Channels

Aena's core channel is its extensive network of physical airport and heliport facilities. These are the direct touchpoints for passengers, airlines, and a wide array of commercial partners, facilitating everything from flight operations to retail experiences.

In 2024, Aena managed 46 airports in Spain and 26 in Brazil. This vast physical infrastructure is crucial for enabling air travel and hosting diverse commercial activities, directly impacting passenger flow and revenue generation.

These facilities are meticulously designed to optimize passenger journeys, streamline airline operations, and provide prime locations for retail, food and beverage, and other service providers, creating a comprehensive ecosystem for air transport.

Aena's official website and mobile app are key channels for passenger communication, offering real-time flight updates, details on airport services, and information about commercial opportunities. These platforms also serve as a digital touchpoint for various stakeholders, improving accessibility and customer support.

In 2024, Aena continued to invest in its digital infrastructure. The mobile app, for instance, saw significant user engagement, with millions of downloads across its operating regions, facilitating seamless travel experiences and providing direct access to airport amenities and retail promotions.

Air Traffic Control Systems are the backbone of Aena's air navigation services, acting as the crucial communication and data channels for managing aircraft. These sophisticated systems ensure the safe and efficient flow of air traffic within Aena's controlled airspace, a critical component of their operational model.

In 2024, Aena's commitment to modernizing these systems is evident. For instance, the implementation of advanced surveillance and communication technologies is designed to enhance capacity and reduce delays. This technological investment directly supports the reliability and efficiency of their air traffic control operations, a key value proposition.

Direct Sales and Tender Processes

Aena leverages direct sales and rigorous tender processes as fundamental channels within its business model. These methods are crucial for leasing commercial spaces within its airports, thereby generating significant revenue. For instance, in 2023, Aena’s non-aviation revenue, largely driven by retail and concessions, reached €1.7 billion, demonstrating the commercial importance of these channels.

These structured processes are not limited to retail. Aena also utilizes tenders for securing ground handling contracts, ensuring competitive pricing and service quality for airlines operating at its airports. Furthermore, real estate development projects, such as the expansion of commercial areas or logistics hubs, are often awarded through competitive bidding, attracting specialized partners and maximizing project value.

The strategic use of direct sales and tenders fosters transparency and fairness, attracting a diverse pool of potential business partners. This approach allows Aena to secure optimal terms for its various operational and development needs.

- Direct Sales: Used for specific, often pre-identified opportunities or for smaller-scale leasing of commercial spaces.

- Tender Processes: Employed for larger contracts and significant development projects, ensuring competitive engagement.

- Revenue Generation: Key channels for Aena’s non-aviation revenue, which was over €1.7 billion in 2023.

- Partner Engagement: Attracts a broad range of businesses, from retail operators to specialized service providers and developers.

Industry Forums and Trade Shows

Aena actively engages in major international aviation industry forums and trade shows. These events are crucial for Aena to present its expertise and infrastructure capabilities to a global audience. For instance, Aena regularly attends events like the World Routes development forum, a key gathering for airlines and airports to negotiate new routes. In 2023, Routes Europe saw significant discussions around post-pandemic recovery and sustainable aviation, with Aena representatives actively participating.

These gatherings are vital for Aena's business development strategy, enabling direct interaction with potential airline partners. By showcasing its network, service quality, and investment plans, Aena aims to secure new airline operations and expand its route connectivity. The 2024 edition of the International Airport Summit, for example, provided a platform for Aena to highlight its commitment to innovation and passenger experience.

Furthermore, participation in these channels allows Aena to explore and identify opportunities for international expansion and strategic partnerships. By understanding global trends and competitor strategies, Aena can better position itself for growth in new markets. The company’s presence at events like the Airport Show Dubai in 2024 underscored its ambition to extend its operational footprint and share best practices.

- Showcasing Capabilities: Aena uses industry forums to demonstrate its advanced airport management systems and passenger services.

- Attracting Airline Partners: Direct engagement at trade shows facilitates negotiations for new routes and increased airline presence at Aena airports.

- International Expansion: These events are key for identifying and pursuing opportunities for Aena to operate airports or provide services in new global markets.

- Networking and Insights: Forums provide invaluable networking opportunities and market intelligence, crucial for strategic planning and staying ahead of industry trends.

Aena's channels extend beyond its physical airports to include robust digital platforms and strategic industry engagement. These digital touchpoints, like its website and mobile app, are vital for passenger information and commercial engagement, with millions of app downloads in 2024 alone reflecting their importance.

Furthermore, Aena's participation in international aviation forums and trade shows serves as a crucial channel for business development, attracting new airline partners and exploring global expansion opportunities. These events, such as World Routes and the International Airport Summit, are key for showcasing capabilities and securing future growth.

| Channel Type | Description | 2024 Relevance/Data Point |

|---|---|---|

| Physical Airports | Direct passenger and commercial interaction points. | Managed 46 airports in Spain and 26 in Brazil. |

| Digital Platforms | Website and mobile app for information and engagement. | Millions of app downloads, facilitating travel and retail access. |

| Industry Forums | International events for business development and partnerships. | Active participation in events like World Routes and Airport Show Dubai. |

| Direct Sales & Tenders | Leasing commercial spaces and securing contracts. | Drove non-aviation revenue, exceeding €1.7 billion in 2023. |

Customer Segments

Airlines, encompassing both commercial passenger carriers and cargo operators, represent a crucial B2B customer segment for Aena. These businesses rely on Aena's airport infrastructure to facilitate their flight operations, from passenger boarding and baggage handling to cargo loading and aircraft servicing. This includes a diverse range of airline types, such as legacy carriers, budget-friendly airlines, and specialized freight companies, all prioritizing operational efficiency and cost management.

In 2024, Aena continued to serve a vast network of airlines. For instance, Adolfo Suárez Madrid-Barajas Airport, one of Aena's busiest, typically hosts hundreds of thousands of flight operations annually, with a significant portion attributed to major international and domestic airlines. The demand for landing slots, gate access, and airside services remains consistently high across Aena's portfolio, underscoring the segment's importance.

Passengers represent Aena's core customer base, encompassing both leisure and business travelers. In 2024, Aena airports handled an impressive 294.2 million passengers, highlighting the sheer volume of individuals relying on their services for journeys across the globe.

Aena focuses on enhancing the entire travel journey for these passengers, from the moment they arrive at the airport to their final departure. This includes providing efficient check-in, security, and boarding processes, as well as a range of amenities to make their time at the airport more comfortable and enjoyable.

Retail and F&B concessionaires are a vital B2B customer segment for Aena, encompassing a wide array of businesses from global luxury brands to local eateries. These entities are drawn to Aena's airports for their high foot traffic and captive audience, offering unparalleled access to millions of travelers annually. For instance, in 2023, Aena's airports served over 286 million passengers, presenting a significant customer base for these operators.

These businesses, including fashion retailers, duty-free shops, and diverse food and beverage providers, are essential partners in creating the passenger experience. They invest in prime airport locations, contributing to Aena's revenue through rental fees and revenue-sharing agreements. The success of these concessionaires directly impacts Aena's commercial income, which forms a substantial part of its overall financial performance.

Ground Handling Companies

Ground handling companies are a vital business-to-business customer segment for Aena. These third-party entities provide essential ground support services, such as baggage handling, aircraft towing, and passenger boarding, directly to airlines and aircraft operators. Aena acts as a facilitator for these operations, managing the airport infrastructure and ensuring these companies can perform their duties efficiently.

Aena's relationship with ground handling companies involves oversight and performance management. This ensures that the ground processes at Aena's airports are smooth and meet high operational standards. For example, in 2024, Aena airports handled over 280 million passengers, underscoring the critical role of efficient ground handling in managing such high volumes.

- Key Role: Essential B2B customers providing critical ground support services to airlines.

- Aena's Function: Facilitates their operations and oversees their performance for airport efficiency.

- Impact: Crucial for managing high passenger volumes, with Aena airports seeing over 280 million passengers in 2024.

Real Estate Developers and Tenants

Real estate developers and investors are key customers for Aena, particularly those looking to build or occupy commercial, logistics, and office spaces within its airport cities. This segment is increasingly vital as Aena diversifies its revenue streams beyond traditional airport operations. In 2023, Aena reported significant growth in its commercial and real estate business, with revenues reaching €1.5 billion, a 19.4% increase compared to 2022, highlighting the attractiveness of its land assets for development.

These customers are drawn to Aena's strategically located land holdings, which offer excellent connectivity and access to a large customer base. The company's airport cities are designed to be hubs for business and logistics, providing a ready-made ecosystem for companies. For instance, the development of logistics platforms at airports like Madrid-Barajas and Barcelona-El Prat attracts significant interest from companies needing efficient supply chain solutions.

- Developers seeking to build hotels, retail centers, or industrial parks on Aena's land.

- Investors looking for stable returns by leasing commercial or office spaces within airport environments.

- Logistics companies requiring proximity to air cargo facilities for efficient distribution networks.

Aena's customer segments are diverse, ranging from the airlines that operate flights to the passengers who travel on them. Beyond these core groups, Aena also serves a vital network of retail and food & beverage concessionaires who leverage airport traffic for their businesses. Furthermore, ground handling companies are essential B2B partners, facilitating smooth operations on the tarmac.

The company also engages with real estate developers and investors interested in leveraging its strategically located airport land for commercial and logistical ventures. This multifaceted approach allows Aena to maximize its revenue streams and create integrated airport ecosystems.

| Customer Segment | Description | 2024 Relevance/Data |

|---|---|---|

| Airlines | Commercial passenger and cargo carriers requiring airport infrastructure. | High demand for landing slots and airside services at major hubs like Madrid-Barajas. |

| Passengers | Leisure and business travelers using Aena's facilities. | Handled 294.2 million passengers in 2024, emphasizing the scale of this segment. |

| Retail & F&B Concessionaires | Businesses operating shops and eateries within airports. | Benefit from high passenger footfall; Aena's commercial revenues are significant. |

| Ground Handling Companies | Third-party service providers for aircraft and passenger ground operations. | Crucial for efficient operations, supporting over 280 million passengers in 2024. |

| Real Estate Developers & Investors | Entities developing commercial, logistics, or office spaces on airport land. | Attracted by strategic locations and connectivity, contributing to airport city growth. |

Cost Structure

Aena's infrastructure maintenance and development represent a substantial cost. This encompasses ongoing upkeep of runways, terminals, and air traffic control systems, crucial for safe and efficient operations. In 2023, Aena invested €1.2 billion in its airport network, with a significant portion allocated to modernization and expansion projects across its Spanish airports, aiming to enhance capacity and passenger experience.

Personnel expenses represent a significant portion of Aena's cost structure, reflecting its role as a major employer in the aviation sector. In 2023, Aena's personnel expenses amounted to €1,528.7 million, underscoring the considerable investment in its workforce, which includes operational staff for airport management, administrative personnel, and specialized technical teams.

Operational expenses form a significant part of Aena's cost structure, encompassing the essential day-to-day expenditures needed to maintain seamless airport operations. These include vital services like utilities, such as electricity and water, which are crucial for powering terminals and infrastructure. In 2023, Aena reported consolidated operating expenses of €3,507 million, highlighting the scale of these ongoing costs.

Security services and cleaning are also key components, ensuring passenger safety and a pleasant environment for travelers. General administrative overhead, covering everything from IT support to human resources, is necessary to manage the complex business of running major airports. Aena consistently focuses on optimizing these operational costs to enhance efficiency and profitability.

Air Navigation Service Costs

Aena incurs costs for air navigation services, even though ENAIRE is the primary manager. These expenses cover the integration of navigation systems with airport operations, crucial for maintaining safety and efficiency in air traffic flow. For instance, in 2023, Aena's airport charges, which indirectly reflect these integration costs, saw an increase, contributing to the overall operational expenses.

These costs are essential for ensuring seamless coordination between ground and air operations, directly impacting flight punctuality and passenger experience. Aena's commitment to modernizing its infrastructure also involves significant investment in technologies that support advanced air traffic management.

- Infrastructure Integration: Costs associated with adapting airport facilities to accommodate advanced air navigation systems.

- Coordination Expenses: Funds allocated for the seamless communication and operational alignment between Aena and ENAIRE.

- Technology Investments: Spending on new technologies that enhance the safety and efficiency of air traffic management within Aena's airports.

Regulatory and Compliance Costs

Aena faces significant regulatory and compliance costs, stemming from stringent national and international aviation rules. These expenses cover adherence to safety standards, environmental regulations, and ongoing investments in sustainability initiatives, crucial for maintaining operational licenses and public trust.

In 2024, Aena continued to prioritize environmental, social, and governance (ESG) factors. For instance, the company has committed to reducing its carbon emissions, which necessitates investments in more sustainable technologies and practices. These efforts are vital for complying with evolving EU environmental directives and for meeting investor expectations.

- Safety Standards: Costs associated with maintaining and upgrading infrastructure to meet aviation safety regulations, including security measures and operational protocols.

- Environmental Compliance: Expenditures on noise reduction, emissions control, waste management, and water conservation, aligning with national and EU environmental targets.

- Sustainability Investments: Funding for renewable energy projects, electric vehicle fleets, and sustainable building materials to reduce the company's ecological footprint.

- Regulatory Reporting: Expenses related to data collection, analysis, and reporting to various aviation authorities and environmental agencies.

Aena's cost structure is heavily influenced by substantial investments in infrastructure maintenance and development, as well as significant personnel expenses. Operational costs, including utilities, security, and cleaning, also form a major component. The company also incurs costs related to air navigation services integration and adheres to stringent regulatory and compliance requirements, with a growing emphasis on sustainability initiatives.

| Cost Category | 2023 Value (€ million) | Key Components |

|---|---|---|

| Infrastructure Maintenance & Development | 1,200 (investment) | Runway upkeep, terminal modernization, air traffic control systems |

| Personnel Expenses | 1,528.7 | Operational staff, administrative personnel, technical teams |

| Operational Expenses | 3,507 | Utilities (electricity, water), security services, cleaning, administrative overhead |

| Regulatory & Compliance | Ongoing investment | Safety standards, environmental regulations, ESG initiatives |

Revenue Streams

Aeronautical revenues represent the core income for airport operators like Aena, primarily generated from airlines. These fees cover the essential services and infrastructure provided, such as landing and take-off charges, aircraft parking, and passenger handling. In 2024, this crucial segment experienced robust growth, with aeronautical revenue increasing by 11.6%.

Commercial revenues are a significant contributor, stemming from a variety of sources within airport operations. These include retail concessions, diverse food and beverage offerings, strategic advertising placements, convenient car parking facilities, and other ancillary commercial activities. This segment is a key engine for growth, evidenced by a notable 14.7% increase in commercial revenue during 2024.

Aena collects revenue from air navigation service fees, which are crucial for maintaining safe and efficient air traffic control within the airspace it manages. These fees, separate from airport operations, represent a significant contribution to Aena's overall income, ensuring the smooth flow of air traffic. For instance, in 2023, Aena's total revenue reached €4,577 million, with a notable portion attributable to these essential aviation services.

Real Estate Development and Rental Income

Aena generates significant revenue from its real estate development and rental income. This includes leasing land and properties for logistics, commercial, and business operations within its airport cities, creating vibrant ecosystems around its transportation hubs.

This revenue stream is experiencing robust growth, fueled by ongoing development projects and a rising demand for facilities conveniently located near airports. For instance, Aena's airport cities are becoming prime locations for e-commerce logistics and other businesses that benefit from direct air connectivity.

- Leasing of Airport Land and Properties: Revenue derived from long-term leases of land and existing buildings for commercial, industrial, and logistics purposes.

- Development of New Airport-Adjacent Facilities: Income generated from the construction and subsequent leasing of new logistics warehouses, office spaces, and retail units.

- Growth Drivers: Increased demand for airport-proximity logistics and business operations, coupled with Aena's strategic investment in developing these commercial zones.

- Financial Performance: In 2024, Aena's commercial activities, including real estate, continued to show strong recovery and growth, contributing significantly to the company's overall financial health as air traffic rebounds.

International Operations Revenue

Aena's international operations represent a significant and expanding revenue source. This includes income generated from airports managed and invested in outside of Spain, such as the notable London Luton Airport and its holdings in Brazil. These international ventures are increasingly contributing to the company's overall earnings before interest, taxes, depreciation, and amortization (EBITDA).

For instance, in 2023, Aena's international airport network, which includes stakes in airports in Brazil and the full ownership of London Luton Airport, contributed substantially to its financial performance. This diversification beyond its domestic Spanish market is a key strategic element for Aena's growth and resilience.

- International Airports: Revenue streams from airports like London Luton and Aena's Brazilian portfolio.

- Growing Contribution: International operations are a key driver of EBITDA growth.

- Diversification Strategy: Expanding geographic footprint enhances overall financial stability.

Aena's revenue streams are diverse, encompassing aeronautical charges from airlines, commercial activities like retail and parking, air navigation services, and real estate development. International operations also play a crucial role in its financial performance.

In 2024, aeronautical revenues saw an 11.6% increase, while commercial revenues grew by 14.7%, highlighting strong recovery and growth across key segments. These figures underscore the resilience and expanding earning potential of Aena's business model.

| Revenue Stream | 2024 Performance | Key Drivers |

|---|---|---|

| Aeronautical Revenues | +11.6% increase | Landing/take-off fees, passenger handling |

| Commercial Revenues | +14.7% increase | Retail, F&B, advertising, parking |

| Air Navigation Services | Significant contribution | Air traffic control fees |

| Real Estate | Strong recovery and growth | Leasing, new facility development |

| International Operations | Growing EBITDA contribution | London Luton, Brazilian airports |

Business Model Canvas Data Sources

The Aena Business Model Canvas is informed by a blend of internal operational data, extensive market research on airport traffic and passenger behavior, and Aena's own financial reports. These sources provide a comprehensive view of Aena's current operations and future potential.