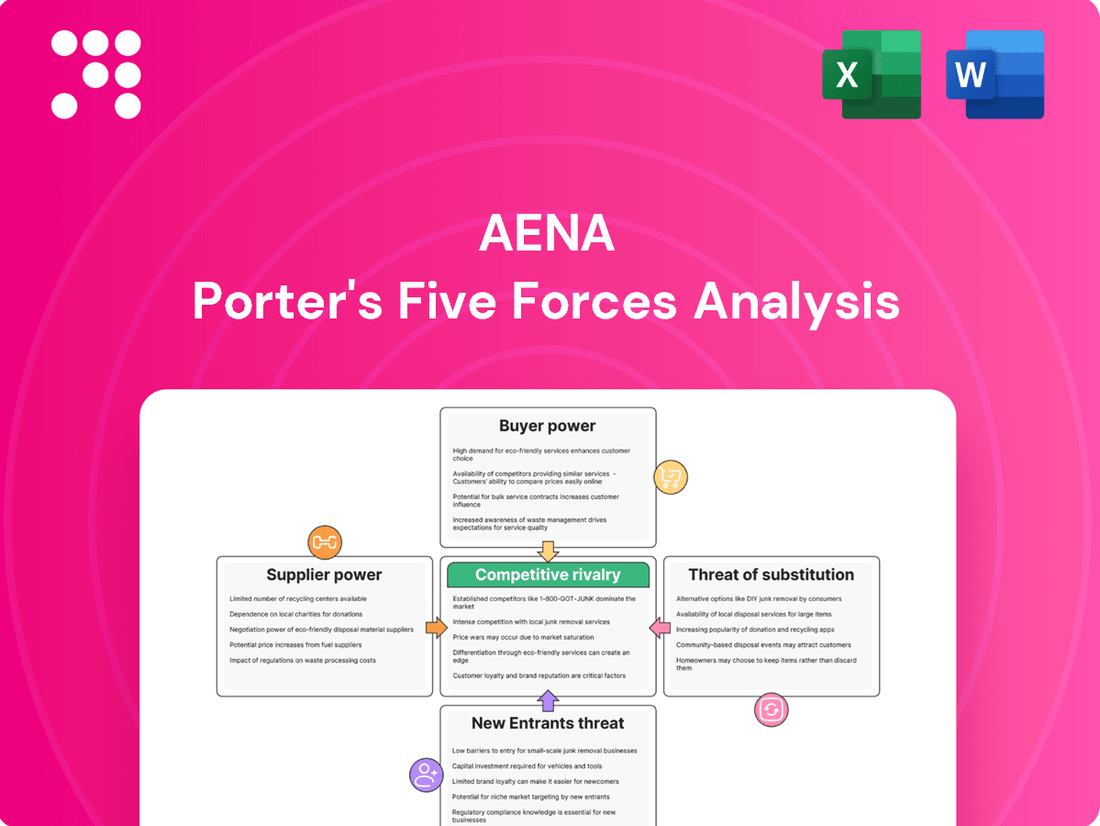

Aena Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aena Bundle

Aena's competitive landscape is shaped by powerful forces, from the intense rivalry among existing players to the significant bargaining power of its customers. Understanding these dynamics is crucial for navigating the aviation industry.

The complete report reveals the real forces shaping Aena’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Suppliers providing highly specialized technology and equipment for air traffic control, baggage handling, security, and runway maintenance hold considerable sway over Aena. Their unique expertise and proprietary systems mean Aena has few alternatives, particularly for crucial upgrades or essential maintenance.

This reliance is evident in Aena's substantial investment plans, such as the €203.1 million allocated in Q1 2025, which often necessitate procuring these specialized solutions. Such dependencies can translate into significant bargaining power for these technology providers.

Major airport expansion and maintenance projects necessitate large-scale construction and engineering firms. The limited pool of companies qualified for these complex, high-value undertakings grants them significant leverage in negotiating project costs and timelines with Aena.

This supplier power is underscored by recent government investments. For instance, the Council of Ministers approved an additional €351 million for Aena's DORA II plan in 2024, highlighting the ongoing reliance on these specialized contractors for critical infrastructure improvements.

Airports like those managed by Aena are substantial users of essential resources such as electricity, water, and fuel. Even with several utility providers available, the critical need for these services and the sheer volume Aena requires grants suppliers considerable leverage. Unexpected price hikes or interruptions in supply can directly affect Aena's operating expenses.

Aena's proactive approach includes its Strategic Electricity Plan, which aims to secure all its energy needs from renewable sources through fixed-price contracts extending to 2028. This strategy is designed to buffer against volatility in energy markets and strengthen Aena's position against potential supplier power.

IT and Software Vendors

IT and software vendors wield significant bargaining power over airport operators like Aena, primarily due to the critical and integrated nature of their services. Airport operations are deeply reliant on digital systems for everything from flight scheduling and passenger management to financial oversight. In 2024, the trend towards increased digitization, including for air cargo, further solidifies this reliance.

The bargaining power of these suppliers is amplified when they provide highly integrated or customized solutions. For Aena, switching from one IT vendor to another can involve substantial costs and operational disruptions, effectively raising switching costs and giving vendors leverage. This dependence is a key factor as Aena continues to invest in its digital transformation initiatives.

- High Integration: Many IT solutions are deeply embedded within airport infrastructure, making seamless replacement difficult.

- Customization: Bespoke software developed for specific airport needs increases vendor lock-in.

- Switching Costs: The financial and operational burden of changing IT providers is a significant barrier.

- Digital Transformation Focus: Aena's ongoing acceleration of digitization, including for air cargo, heightens its dependence on specialized IT and software.

Security and Ground Handling Service Providers

While Aena manages the overall airport operations, it frequently contracts out specific functions like security, cleaning, and sometimes even ground handling to external firms. This specialization, coupled with stringent regulatory demands, can narrow the field of eligible service providers, thereby enhancing their negotiating leverage when new contracts are being discussed. For instance, in 2023, the aviation security sector faced a global shortage of trained personnel, which could have influenced contract pricing for airports like those managed by Aena.

The specialized nature of security and ground handling services, often requiring specific certifications and trained personnel, can limit the number of qualified providers available to Aena. This scarcity can shift the balance of power towards these suppliers, allowing them to potentially command higher prices or more favorable contract terms. Aena's commitment to operational efficiency relies heavily on the performance of these outsourced services, making the selection and retention of capable providers a critical factor.

- Limited Qualified Providers: The need for specialized skills and regulatory compliance in aviation security and ground handling restricts the number of potential suppliers.

- Increased Negotiating Power: A smaller pool of qualified providers can lead to greater bargaining power for these companies during contract renewals or new agreements with airport operators like Aena.

- Impact on Operational Efficiency: The effectiveness of these outsourced services directly impacts Aena's overall operational performance and passenger experience, making supplier relationships crucial.

- Potential for Higher Costs: When suppliers have strong bargaining power, it can translate into higher service costs for Aena, affecting profitability.

Suppliers of specialized technology, like those for air traffic control and baggage handling, hold significant power over Aena due to their unique expertise and limited alternatives. This is highlighted by Aena's substantial investment plans, such as the €203.1 million allocated in Q1 2025 for such solutions.

Major construction firms for airport expansion projects also possess considerable leverage, given the limited number of qualified companies capable of handling these complex, high-value undertakings. The DORA II plan in 2024, with an additional €351 million approved by the Council of Ministers, underscores this reliance on specialized contractors.

IT and software vendors are particularly influential due to the critical, integrated nature of their services, which are essential for airport operations. Aena's ongoing digital transformation, including advancements in air cargo in 2024, increases its dependence on these providers, with switching costs being a significant deterrent.

| Supplier Type | Key Factors Influencing Power | Aena's Investment/Context | Impact on Aena |

| Specialized Technology Providers | Unique expertise, proprietary systems, few alternatives | €203.1M Q1 2025 allocation for solutions | Potential for higher costs, dependence on upgrades |

| Major Construction Firms | Limited pool of qualified companies for large projects | €351M DORA II plan in 2024 | Leverage in negotiating project costs and timelines |

| IT & Software Vendors | High integration, customization, high switching costs | Digital transformation focus, air cargo digitization (2024) | Vendor lock-in, operational disruption risks |

What is included in the product

This analysis unpacks the competitive forces impacting Aena, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the airport industry.

Quickly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces.

Customers Bargaining Power

Airlines are Aena's main customers, driving aeronautical revenue through landing fees, passenger charges, and parking. Major carriers, particularly those with substantial operations at Aena's major airports like Madrid-Barajas and Barcelona-El Prat, hold significant bargaining power. This stems from their volume and the threat of reallocating flights or routes.

However, Aena's strong market position within Spain offers some counter-leverage. The Spanish competition authority's decision to freeze Aena's fees for 2025 highlights the impact of regulatory oversight on this customer bargaining power.

While passengers don't directly negotiate fees with Aena, their choices and spending habits wield considerable indirect influence. Their preferences shape Aena's commercial strategies, impacting non-aeronautical revenues from retail, food, and parking. A dip in passenger numbers or spending directly affects Aena's profitability.

Passenger satisfaction is a key driver for commercial success. For instance, Aena's commercial revenue saw a healthy 9.6% increase in Q1 2025, a rise largely attributed to increased passenger expenditure. This demonstrates how passenger behavior, even indirectly, can significantly boost Aena's financial performance.

Retail and concessionaire tenants, operating everything from shops to restaurants within Aena's airports, represent a significant customer base. Their leverage in negotiating lease terms and revenue-sharing hinges on the airport's prime location, high footfall, and the scarcity of comparable high-traffic commercial alternatives. Aena anticipates a substantial boost in its commercial revenue, projecting significant growth by 2026, driven by the success of recent tender processes.

Cargo Operators and Logistics Companies

The bargaining power of cargo operators and logistics companies dealing with Aena is shaped by several factors. These operators rely on Aena's airport infrastructure for their freight handling and storage operations. Their leverage in negotiations, particularly concerning handling fees and access to facilities, is directly tied to the volume of cargo they manage and the presence of viable alternative logistics hubs.

Aena's investments in its cargo infrastructure play a crucial role in mitigating this power. For instance, Aena's strategic plan for 2022-2026 outlines significant investments aimed at enhancing air cargo capacity and attracting a more diverse range of operators. This diversification can reduce reliance on any single large operator, thereby shifting the balance of power.

- Volume of Cargo: In 2023, Aena airports handled approximately 1.1 million tonnes of cargo, a figure that provides significant leverage for major cargo operators.

- Alternative Hubs: The availability and cost-effectiveness of competing airports and logistics centers directly influence the negotiation stance of these companies.

- Infrastructure Efficiency: The efficiency and modernity of Aena's cargo facilities, including warehousing and handling equipment, can either strengthen or weaken operator demands.

- Aena's Diversification Strategy: Aena's commitment to boosting air cargo and attracting new operators aims to create a more competitive landscape, potentially reducing the concentrated bargaining power of existing large players.

General Aviation and Private Aircraft Operators

While individual general aviation and private aircraft operators possess limited bargaining power, their collective demand is a significant factor for airport operators like Aena. Aena's ability to offer competitive pricing and specialized services for these smaller clients can sway their airport selection. Aena's overall traffic, which saw continued growth through 2024 and into Q1 2025, underscores the sustained demand across all operational segments, including private aviation.

- Limited Individual Power: Smaller general aviation and private jet operators typically have less individual leverage than major commercial airlines.

- Collective Influence: The combined demand from these operators represents a notable portion of Aena's revenue.

- Competitive Factors: Pricing and the availability of specialized services are key differentiators influencing operator choices for private flights.

- Market Trend: Aena's traffic growth in 2024 and Q1 2025 suggests a robust and expanding market for private aviation services.

Major airlines, due to their significant flight volumes and the potential to shift operations, wield substantial bargaining power over Aena. This leverage allows them to negotiate favorable terms for landing fees and passenger charges. For instance, the Spanish competition authority's decision in 2024 to freeze Aena's fees for 2025 directly reflects this customer influence, albeit mediated by regulation.

| Customer Segment | Bargaining Power Factors | Aena's Counter-Leverage/Mitigation |

|---|---|---|

| Major Airlines | High volume, threat of route reallocation | Strong market position in Spain, regulatory oversight |

| Passengers (Indirect) | Spending habits, choice of services | Focus on passenger satisfaction, commercial revenue strategies |

| Retail/Concessionaires | Airport location, high footfall, limited alternatives | Prime airport locations, recent successful tender processes |

| Cargo Operators | Cargo volume, availability of alternative hubs | Infrastructure investment, diversification of operators |

| General Aviation/Private Operators | Collective demand | Competitive pricing, specialized services |

Preview Before You Purchase

Aena Porter's Five Forces Analysis

This preview showcases the complete Aena Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the airport industry. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, ready for immediate use.

Rivalry Among Competitors

Within Spain, Aena operates as a dominant force, managing 46 airports and two heliports, which essentially creates a near-monopoly over core airport services. This integration means there are no other domestic airport operators directly vying for the same passenger or cargo traffic, significantly reducing direct competition within the country.

Aena's key airports, Madrid and Barcelona, face significant competition from other major European hubs such as Frankfurt, Paris Charles de Gaulle, Amsterdam Schiphol, and London Heathrow. This rivalry centers on attracting international transit passengers and securing lucrative long-haul flight routes.

This intense competition compels Aena to constantly enhance its operational efficiency, expand its network connectivity, and elevate the overall passenger experience to maintain its appeal for both airlines and travelers. For instance, by the end of 2024, London Heathrow reported a substantial increase in passenger traffic, highlighting the dynamic nature of this competitive landscape.

Even within Aena's extensive network, competition for specific airline routes and passenger traffic exists. Regional airports often find themselves vying for the same low-cost carrier business, creating a dynamic where Aena must strategically manage its portfolio. This internal rivalry is a key consideration in Aena's network optimization efforts, aiming to prevent route cannibalization while simultaneously boosting overall passenger volumes.

Aena's proactive approach to network management is evident in its 2024 performance, where a remarkable 21 Spanish airports under its operation achieved record-breaking passenger numbers. This widespread success underscores the effectiveness of their strategy in capturing and growing traffic, even amidst internal competition for routes.

Competition in Non-Aeronautical Services

Aena faces significant competition in its non-aeronautical services, such as retail, food and beverage, and parking. These offerings are challenged by off-airport alternatives and the growing prevalence of online shopping and services. To thrive, Aena must continuously innovate its commercial strategies, ensuring competitive pricing and a superior passenger experience to encourage spending within the airport. This focus is evident in its performance, with commercial revenue experiencing a healthy 9.6% growth in Q1 2025.

The competitive landscape necessitates a dynamic approach from Aena. Key strategies include:

- Enhancing Passenger Experience: Creating an attractive and convenient shopping and dining environment within the airport is crucial to retain customer spending.

- Strategic Partnerships: Collaborating with popular brands and offering exclusive airport-only deals can differentiate Aena's offerings.

- Leveraging Technology: Implementing digital solutions for pre-ordering, loyalty programs, and personalized offers can boost engagement and sales.

- Competitive Pricing: Regularly reviewing and adjusting pricing to remain competitive with off-airport options is essential for capturing market share.

Regulatory and State Influence

Aena's position as a partially state-owned company operating under a concession model means that government regulations and policies significantly shape its competitive environment. These regulations often set parameters for pricing, capital expenditures, and operational standards, potentially limiting Aena's flexibility in competing with entirely private airports. This governmental oversight directly impacts its strategic options and market dynamics.

The Spanish competition authority's decision to maintain airport fees at their current levels for 2025 exemplifies the direct impact of regulatory power on Aena's operations. This freeze on fee increases can constrain revenue growth and influence investment decisions, thereby altering the competitive playing field. Such interventions underscore the substantial influence of state actors in Aena's market.

- Regulatory Framework: Aena operates within a concession model heavily influenced by Spanish government regulations, impacting pricing, investment, and service standards.

- State Ownership Influence: As a partially state-owned entity, Aena's strategic decisions are subject to governmental oversight, potentially affecting its ability to compete freely.

- Fee Freeze Impact: The Spanish competition watchdog's decision to freeze airport fees for 2025 directly limits Aena's revenue-generating capacity and strategic flexibility.

- Competitive Constraints: Regulatory dictates can create disparities in competitive advantages compared to fully privatized airport operators.

While Aena dominates Spain's domestic airport market, it faces intense international rivalry, particularly from major European hubs like Frankfurt and London Heathrow, vying for crucial transit passengers and long-haul routes. This competition forces Aena to continually improve its services and connectivity to remain attractive to airlines and travelers alike. For instance, London Heathrow's significant passenger traffic growth by the end of 2024 highlights this dynamic. Internally, Aena's regional airports also compete for low-cost carrier business, requiring strategic management to optimize its network and avoid cannibalizing traffic, as seen by the 21 Spanish airports achieving record passenger numbers in 2024.

Aena's non-aeronautical revenue streams, such as retail and parking, also face external competition from off-airport alternatives and online services, necessitating ongoing innovation in commercial strategies. The company saw a healthy 9.6% growth in commercial revenue in Q1 2025, demonstrating successful adaptation. Government regulations, including the 2025 airport fee freeze, also significantly shape Aena's competitive landscape, impacting its revenue and strategic flexibility compared to fully private operators.

| Competitive Factor | Aena's Position | Key Competitors/Challenges | Impact on Aena |

|---|---|---|---|

| Domestic Airport Operations | Near-monopoly in Spain | None directly within Spain | Dominant market share, limited direct rivalry |

| International Hub Competition | Strong presence in Madrid & Barcelona | Frankfurt, Paris CDG, Amsterdam Schiphol, London Heathrow | Need for service enhancement, route development, and passenger experience improvement |

| Non-Aeronautical Services | Significant revenue driver | Off-airport retail, online services, alternative parking | Pressure to innovate pricing, offerings, and customer experience |

| Regulatory Environment | Concession model, state influence | Spanish government regulations, competition authority decisions | Constraints on pricing, investment, and strategic flexibility (e.g., 2025 fee freeze) |

SSubstitutes Threaten

For short to medium-haul domestic and cross-border European journeys, high-speed rail presents a compelling alternative to air travel. Routes such as Madrid to Barcelona or Madrid to Seville are particularly susceptible, as rail offers comparable travel times, convenient city-center access, and a reduced environmental impact, potentially siphoning passengers away from Aena's airports.

This shift is not merely theoretical; ACI Europe observed a notable partial modal shift towards rail in 2024. This trend highlights the growing competitiveness of high-speed rail, directly impacting airlines and, by extension, airport operators like Aena.

For very short domestic trips, especially where roads are well-maintained, private cars and buses can indeed offer an alternative to flying. This is particularly true for travelers within Spain, where robust road networks exist.

While this substitution effect might slightly impact demand at smaller, regional airports, it's less of a concern for Aena's primary business, which focuses on longer-haul and inter-regional routes. Spain's thriving tourism industry, which saw over 85 million international visitors in 2023, continues to be a significant driver of air traffic growth, largely offsetting these shorter-distance alternatives.

For specific routes, particularly those connecting mainland Spain to island destinations like the Balearic and Canary Islands, ferry services present a potential substitute for air travel. These sea routes can appeal to leisure travelers or those needing to transport vehicles, offering a different, often more economical, travel experience. In 2023, Aena handled over 280 million passengers, underscoring the significant volume of air travel, which remains the primary mode for most of its key markets.

Virtual Communication and Remote Work

The increasing prevalence of virtual communication tools and the broader adoption of remote work present a significant long-term threat to traditional business travel, a vital revenue stream for airport operators like Aena. Companies are increasingly opting for virtual meetings over in-person engagements, which can directly reduce the demand for air travel, particularly for business-related journeys. This shift could impact premium airline services and, consequently, the overall passenger traffic that airports rely upon.

Despite this evolving landscape, Aena has demonstrated resilience. The company's passenger traffic saw a healthy increase of 4.9% in the first quarter of 2025, indicating that while the threat of substitutes exists, it has not yet fundamentally undermined overall growth. This suggests that other factors, such as leisure travel or the necessity of certain business trips, continue to drive passenger volumes.

- Virtual communication technologies like video conferencing platforms offer a viable alternative to business travel.

- Remote work policies adopted by many corporations can lead to a reduction in employee business trips.

- Potential impact on premium services; airlines may see less demand for first and business class seats.

- Aena's Q1 2025 passenger traffic growth of 4.9% shows continued demand despite substitute threats.

Alternative Cargo Transportation Methods

For air cargo, substitutes like sea, rail, and road freight exist, their viability depending on urgency, value, and volume. These alternatives can divert business from air transport, particularly for less time-sensitive or lower-value shipments.

Shifts in global logistics or supply chain strategies could influence Aena's cargo volumes. For instance, if companies prioritize cost savings over speed, they might opt for slower, cheaper transport methods.

Despite potential substitutes, air cargo remains essential for many sectors. Aena's freight traffic demonstrated this resilience, increasing by 18.6% in 2024, underscoring sustained demand for air freight services.

- Sea Freight: Lower cost for bulk, non-time-sensitive goods.

- Rail Freight: Efficient for large volumes over land, moderate speed.

- Road Freight: Flexible for last-mile delivery and regional transport.

- Aena's 2024 Freight Growth: 18.6% increase highlights continued reliance on air cargo.

High-speed rail and private vehicles pose a threat to short to medium-haul flights, especially on domestic routes. While Aena's passenger traffic grew 4.9% in Q1 2025, indicating resilience, these alternatives can siphon passengers, particularly for shorter journeys where convenience and cost are key factors.

Ferry services also offer a substitute for routes to islands, catering to leisure travelers and those needing to transport vehicles. Despite these options, Aena handled over 280 million passengers in 2023, showing the dominance of air travel for most of its core markets.

The rise of virtual communication and remote work presents a long-term challenge to business travel, a significant revenue source for airports. This trend could reduce demand for premium airline services, impacting overall passenger volumes, though leisure travel continues to drive growth.

For cargo, sea, rail, and road freight are viable substitutes, particularly for less urgent or lower-value shipments. However, Aena's freight traffic saw an 18.6% increase in 2024, demonstrating the continued importance of air cargo for time-sensitive logistics.

| Substitute Type | Impact on Aena | Supporting Data |

|---|---|---|

| High-Speed Rail | Threat to short/medium-haul European routes | ACI Europe noted partial modal shift towards rail in 2024. |

| Private Cars/Buses | Minor impact on regional airports for very short domestic trips | Spain's robust road network supports this. |

| Ferries | Potential substitute for island routes | Appeals to leisure travelers and those transporting vehicles. |

| Virtual Communication/Remote Work | Long-term threat to business travel | Companies increasingly opt for virtual meetings. |

| Sea, Rail, Road Freight | Substitute for air cargo, especially for non-urgent goods | Aena's freight traffic grew 18.6% in 2024, showing continued demand. |

Entrants Threaten

Establishing a new major airport demands immense capital, covering land acquisition, extensive infrastructure like runways and terminals, and specialized operational equipment. This financial hurdle is among the most significant barriers to entry across all industries, severely limiting the likelihood of new competitors emerging. For instance, Aena's DORA III plan anticipates annual investments surpassing €1 billion between 2027 and 2031, underscoring the prohibitive cost of entry.

Operating an airport is heavily encumbered by a labyrinth of national and international regulations. These cover critical areas like aviation safety, security protocols, environmental impact assessments, and essential air navigation service licenses. The journey to secure these approvals is notoriously protracted and demanding, presenting a substantial barrier for any aspiring new entrant.

For instance, Aena, a major airport operator, consistently adheres to these stringent requirements. In 2023, Aena reported significant investments in sustainability initiatives, including projects aimed at reducing carbon emissions and implementing noise zoning plans, demonstrating their ongoing commitment to regulatory compliance.

The threat of new entrants for airport operations is significantly dampened by the scarcity of suitable land, particularly in desirable locations close to major population hubs or existing transportation networks. This limited availability makes establishing a new airport a substantial hurdle.

Environmental regulations and community opposition pose further formidable barriers. Stringent environmental impact assessments, concerns over noise pollution, and potential local resistance can render greenfield airport projects politically unviable and economically prohibitive, as exemplified by Aena's own commitment to environmental stewardship outlined in its Climate Action Plan.

Established Network Effects and Infrastructure

Aena benefits from powerful network effects, making it difficult for new entrants to compete. Its extensive relationships with airlines, coupled with integrated ground transportation and a comprehensive national airport system, create a significant barrier.

Replicating this established infrastructure and convincing airlines and passengers to switch from Aena's well-trodden routes and facilities would be a monumental task for any newcomer.

To illustrate Aena's entrenched position, consider that its Spanish airports served a substantial 309.3 million travelers in 2024. This sheer volume underscores the difficulty new entrants would face in gaining traction.

- Established Airline Relationships: Aena's long-standing partnerships with numerous airlines provide a stable customer base.

- Integrated Ground Transport: Seamless connections to public transport and road networks enhance passenger convenience, a difficult asset for new players to match.

- National Airport System: Aena's ownership of a wide network of airports across Spain offers route flexibility and passenger choice that a new entrant would struggle to replicate.

Government Ownership and Strategic Importance

The Spanish government's substantial ownership in Aena, coupled with the strategic national importance of airports, acts as a significant deterrent to new entrants. This de facto barrier means the government is unlikely to approve or support any new competitor that could jeopardize its control over the existing airport infrastructure.

ENAIRE, a state-owned entity, holds a majority stake in Aena, reinforcing the government's influence and control over the sector. This ownership structure effectively limits the potential for new, independent players to enter the market and compete directly with Aena's established network.

- Government Stake: The Spanish state remains a key shareholder in Aena.

- Critical Infrastructure: Airports are designated as vital national assets.

- ENAIRE's Role: ENAIRE, a government-owned company, is Aena's majority shareholder.

The threat of new entrants in the airport sector is considerably low due to the immense capital required for infrastructure development and regulatory compliance. For example, Aena's DORA III plan projects investments exceeding €1 billion annually between 2027 and 2031, highlighting the prohibitive financial barriers. Furthermore, stringent safety, security, and environmental regulations necessitate extensive expertise and time to navigate, making market entry exceptionally challenging for newcomers.

The scarcity of suitable land, particularly in prime locations, coupled with strong community opposition and environmental concerns, creates significant hurdles. These factors can render new airport projects politically and economically unfeasible. Aena's commitment to environmental stewardship, as detailed in its Climate Action Plan, further emphasizes the complex regulatory landscape newcomers must contend with.

Aena's established network effects, including strong airline relationships and integrated transport links, present a formidable barrier. With 309.3 million travelers passing through its Spanish airports in 2024, replicating this scale and customer loyalty is a monumental task for any new entrant. The government's substantial stake in Aena, through ENAIRE, also acts as a deterrent, as new airport development could be seen as undermining national strategic interests.

| Barrier Type | Description | Example/Impact on New Entrants |

|---|---|---|

| Capital Requirements | High costs for land, infrastructure, and equipment. | Aena's DORA III plan: >€1 billion annual investment (2027-2031). |

| Regulatory Hurdles | Complex safety, security, and environmental regulations. | Protracted approval processes and ongoing compliance costs. |

| Land Scarcity & Opposition | Limited availability of prime locations and community resistance. | Difficulty in securing sites and potential for project delays or cancellations. |

| Network Effects | Established airline relationships and integrated transport. | Aena served 309.3 million passengers in 2024, creating a strong customer base. |

| Government Ownership | State's significant stake via ENAIRE. | Discourages competition that could impact national infrastructure control. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis leverages a comprehensive dataset, including industry-specific market research reports, company annual filings, and expert interviews. This blend of primary and secondary sources ensures a robust understanding of competitive dynamics.