Aena PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aena Bundle

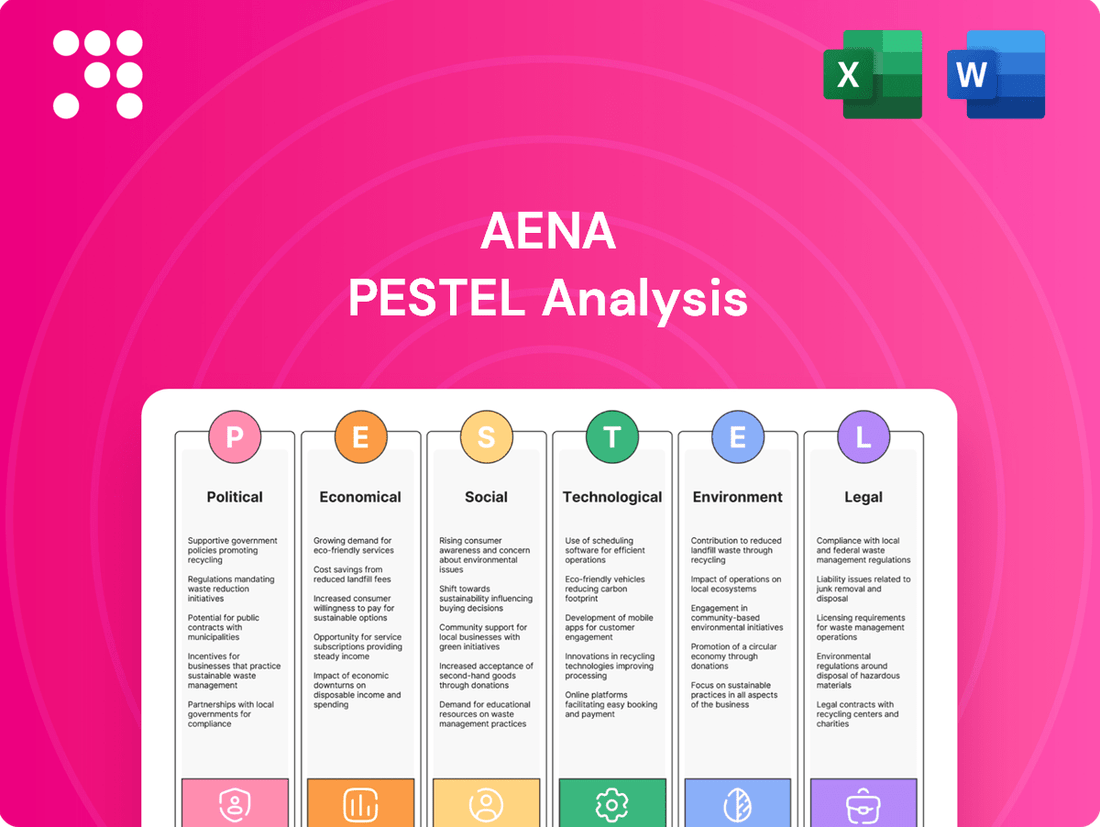

Unlock the critical external factors shaping Aena's destiny with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces that present both challenges and opportunities for the airport operator. Make informed strategic decisions and gain a competitive edge by leveraging these expert insights. Download the full PESTLE analysis now for actionable intelligence.

Political factors

Aena's operational landscape is significantly shaped by its majority ownership by the Spanish state, holding approximately 51% of its shares. This governmental stake means that national policies, economic strategies, and political stability directly influence Aena's investment plans and overall direction.

This close tie offers benefits like consistent government support for major projects, but it also presents potential challenges. For instance, political priorities might sometimes override purely commercial considerations, impacting pricing strategies or the pace of expansion, as seen in past debates over airport development fees.

The Spanish government's influence extends to strategic decision-making, potentially affecting Aena's ability to pursue certain international ventures or adopt innovative commercial models if they don't align with broader state objectives. This dynamic requires Aena to navigate a dual mandate of profitability and public service, a common theme in state-influenced enterprises.

The regulatory landscape for airports and air navigation services, dictated by entities like Spain's AESA and the European Union Aviation Safety Agency (EASA), profoundly influences Aena's operations. For instance, EASA's ongoing efforts to harmonize safety standards across Europe, including potential revisions to airport certification requirements expected in 2024-2025, directly impact Aena's compliance costs and operational procedures.

Shifts in aviation policies, such as the European Commission's proposed 'Fit for 55' package aiming for significant emissions reductions in aviation by 2030, present both challenges and opportunities. Aena must adapt to stricter environmental regulations, potentially investing in sustainable infrastructure, while also exploring new revenue streams related to green aviation initiatives.

Global geopolitical events, such as the ongoing conflicts in Eastern Europe and the Middle East, continue to shape international travel patterns. These events can directly impact demand for air travel, influencing passenger volumes and cargo operations for companies like Aena. For instance, disruptions in major air corridors or heightened travel advisories in affected regions can lead to route adjustments and reduced passenger numbers.

Spain's foreign policy and its diplomatic relationships with key tourism source markets are crucial. Strong ties with countries like the UK, Germany, and France, which are major contributors to Spain's tourism industry, generally support higher passenger traffic at Aena's airports. Conversely, strained relations or economic instability in these source markets can negatively affect Aena's revenue streams.

In 2023, Aena reported a significant recovery in passenger traffic, reaching 284 million passengers, a 12.4% increase compared to 2022, nearing pre-pandemic levels. This recovery is closely tied to the stability of international relations and the ease of travel between Spain and its primary tourist origin countries.

Tourism Policies and Promotion

Government policies and promotional efforts significantly influence Spain's tourism sector, directly impacting Aena's passenger volumes. Initiatives like subsidies for new airline routes or targeted marketing campaigns can boost international arrivals, a key driver for airport operations. For instance, Spain's Ministry of Industry and Tourism has been actively involved in strategies to recover and grow tourism post-pandemic, with a focus on sustainability and digitalization.

The Spanish government's commitment to enhancing tourism infrastructure and accessibility is vital for Aena's growth. Changes in visa regulations or the simplification of entry procedures can lead to substantial increases in visitor numbers. In 2023, Spain welcomed over 85 million international tourists, a figure that underscores the impact of such policies on the travel industry and, by extension, Aena's performance.

- Government support for route development: Subsidies and incentives encourage airlines to launch new services to Spanish destinations, increasing connectivity and passenger flow.

- Marketing and promotional campaigns: National and regional tourism boards invest heavily in advertising Spain as a destination, directly driving demand for air travel.

- Visa and immigration policies: Streamlined entry procedures for key international markets can facilitate greater tourist numbers.

- Tourism infrastructure investment: Government funding for improving airports, transport links, and tourist facilities enhances the overall visitor experience and encourages repeat visits.

Privatization and Concession Trends

While Aena S.M.E., S.A. is majority state-owned by the Spanish government, global trends in airport privatization and the expansion of concession agreements for airport operations are significant political factors. These trends can shape Aena's strategic outlook, potentially opening doors for international expansion through public-private partnerships or influencing regulatory environments in markets where Aena operates or seeks to operate. For instance, the ongoing debate and implementation of airport privatization models in various European and emerging economies directly impact the competitive landscape and Aena's long-term growth prospects.

Government decisions regarding the sale of state assets or the adoption of public-private partnership (PPP) models are crucial. These decisions can create both opportunities and challenges for Aena. For example, if a government opts for a PPP to develop or manage an airport, Aena might find itself competing with private entities or, conversely, partnering with them. The increasing reliance on concessions for airport management globally, evidenced by the growth in the number of airports operated under such agreements, suggests a political willingness to involve private capital and expertise in infrastructure development, a trend Aena actively monitors and participates in.

Key considerations for Aena include:

- Shifting government policies on airport ownership and management.

- The increasing prevalence of airport concession models worldwide.

- Potential for international growth through PPPs and concessions.

- Impact of privatization on competition and regulatory frameworks.

Aena's operations are intrinsically linked to the Spanish government, which holds a majority stake, influencing strategic decisions and investment. This state ownership means national policies and political stability directly shape Aena's direction, balancing commercial goals with public service mandates.

Regulatory frameworks from bodies like EASA and Spain's AESA dictate operational standards, with ongoing updates to safety requirements in 2024-2025 impacting compliance costs. Furthermore, European initiatives like the 'Fit for 55' package are pushing for aviation emissions reductions, necessitating Aena's adaptation to stricter environmental regulations and investment in sustainable infrastructure.

Geopolitical events and Spain's foreign relations significantly affect international travel patterns and demand for air services. For instance, 2023 saw a strong recovery in passenger traffic, with 284 million passengers, a 12.4% increase from 2022, highlighting the sensitivity of Aena's performance to global stability and key market relationships.

Government support for tourism, including route development subsidies and promotional campaigns, directly boosts passenger numbers. Spain's success in attracting over 85 million international tourists in 2023 underscores the impact of favorable visa policies and infrastructure investment on Aena's revenue.

| Factor | Impact on Aena | 2023 Data/Trend |

|---|---|---|

| State Ownership (Spain) | Strategic direction, investment decisions, dual mandate | Spanish government holds ~51% |

| Aviation Regulation (EU/Spain) | Compliance costs, operational procedures, environmental investment | EASA safety standard harmonization, 'Fit for 55' emissions targets |

| Geopolitical Stability | International travel demand, passenger volumes | 284 million passengers in 2023 (+12.4% vs 2022) |

| Tourism Policy & Promotion | Passenger traffic, revenue generation | 85 million international tourists in Spain (2023) |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Aena, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights into how these global and regional forces can create both challenges and strategic advantages for Aena.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, making complex external factors digestible and actionable for Aena's strategic discussions.

Economic factors

Global economic health significantly impacts Aena, as a slowdown can curb both leisure and business travel, directly affecting passenger and cargo volumes. For instance, the International Monetary Fund (IMF) projected global growth to moderate to 3.1% in 2024, a slight dip from 3.2% in 2023, indicating a cautious economic environment.

Within Spain, economic performance is equally crucial. The Spanish economy demonstrated resilience, with GDP growth reaching 2.5% in 2023, exceeding initial expectations. Projections for 2024 suggest continued, albeit potentially slower, growth, with the Bank of Spain forecasting 1.5% expansion.

Key European markets, major sources of tourist and business traffic for Aena, also play a vital role. The Eurozone's economic outlook, with growth anticipated around 0.9% in 2024 according to the European Commission, suggests a mixed but generally supportive backdrop for air travel demand.

Rising inflation directly impacts Aena's operating expenses, from maintenance to staffing. For instance, Spain's inflation rate averaged 3.1% in 2023, a notable increase from 2022's 8.4% but still a significant factor for cost management.

Changes in interest rates, such as the European Central Bank's policy rates, affect Aena's cost of capital for its extensive infrastructure development and modernization programs. If rates remain elevated in 2024-2025, Aena's borrowing costs for new projects could increase, potentially impacting investment decisions.

While fuel prices are a direct airline cost, their volatility indirectly influences Aena's revenue. For example, sustained high fuel prices in 2023, averaging around $90-$100 per barrel for Brent crude, can pressure airlines to adjust routes or capacity, potentially leading to lower passenger traffic and thus reduced aeronautical revenue for Aena.

Aena's financial performance is intrinsically linked to passenger traffic, making current demand trends and future projections paramount. In 2023, Aena airports handled a robust 284.7 million passengers, a significant rebound from previous years.

Factors such as rising consumer confidence and increased disposable income are key drivers of travel demand. For instance, Spain's GDP grew by 2.5% in 2023, supporting consumer spending on leisure activities like air travel.

Looking ahead, forecasts suggest continued growth, with Aena anticipating passenger numbers to surpass 2019 levels in the coming years. The competitive landscape of airfares, influenced by low-cost carriers and airline capacity, will continue to shape travel volumes through Aena's network.

Commercial and Real Estate Revenue Potential

Aena's revenue streams extend significantly beyond landing fees, with commercial activities such as retail, dining, and car parking playing a crucial role. In 2023, non-aeronautical revenues accounted for 45.6% of Aena's total revenue, reaching €1,965.6 million. This diversification is vital, as economic health directly impacts passenger spending within airports and the overall success of real estate ventures.

The performance of these non-aeronautical segments is closely tied to consumer confidence and disposable income. For instance, during periods of economic growth, passengers are more likely to indulge in shopping and dining, boosting Aena's commercial revenue. Conversely, economic downturns can lead to reduced spending, affecting profitability from these sources.

- Retail and Food & Beverage: In 2023, retail and food & beverage revenues reached €1,263.7 million, a 16.6% increase compared to 2022, driven by higher passenger traffic and improved commercial offerings.

- Car Parking: Car parking revenue in 2023 was €379.7 million, up 17.4% from the previous year, reflecting increased travel and a recovery in demand for airport parking services.

- Real Estate: Aena's real estate segment, focused on developing logistics and business parks around its airports, is also sensitive to economic cycles, influencing investment and rental income potential.

- Economic Impact: Strong economic conditions in 2024 are expected to support continued growth in passenger spending, benefiting Aena's commercial revenue targets.

Exchange Rates and International Tourism

Fluctuations in exchange rates significantly impact international tourism to Spain, a key market for Aena. For instance, a stronger Euro against currencies like the British Pound or the US Dollar can make travel to Spain more costly for visitors from those countries. This increased expense might deter some potential tourists, leading to a decrease in international arrivals and subsequently affecting Aena's revenue from airport services and concessions.

In 2024, the Euro's performance against major currencies is a critical factor. If the Euro strengthens, for example, by 5% against the Pound, a trip that cost £1000 in the previous year might now cost £1050, directly impacting purchasing power for Spanish holidays. Aena, as the operator of major Spanish airports, directly feels the impact of these shifts in tourist spending and travel volume.

Consider these specific impacts:

- Impact on Tourist Numbers: A stronger Euro can lead to a slowdown in arrivals from non-Eurozone countries. For example, if the Euro appreciates by 3% against the US Dollar, American tourists may find Spain 3% more expensive, potentially reducing their travel plans.

- Revenue Streams: Aena's revenue from retail, parking, and landing fees is directly tied to passenger traffic. A decline in international visitors due to unfavorable exchange rates translates to lower overall revenue for the company.

- Competitive Landscape: When the Euro is strong, neighboring countries with different currencies might become more attractive travel destinations, further challenging Aena's market position.

Global economic health significantly impacts Aena, as a slowdown can curb both leisure and business travel, directly affecting passenger and cargo volumes. For instance, the International Monetary Fund (IMF) projected global growth to moderate to 3.1% in 2024, a slight dip from 3.2% in 2023, indicating a cautious economic environment.

Within Spain, economic performance is equally crucial. The Spanish economy demonstrated resilience, with GDP growth reaching 2.5% in 2023, exceeding initial expectations. Projections for 2024 suggest continued, albeit potentially slower, growth, with the Bank of Spain forecasting 1.5% expansion.

Key European markets, major sources of tourist and business traffic for Aena, also play a vital role. The Eurozone's economic outlook, with growth anticipated around 0.9% in 2024 according to the European Commission, suggests a mixed but generally supportive backdrop for air travel demand.

Rising inflation directly impacts Aena's operating expenses, from maintenance to staffing. For instance, Spain's inflation rate averaged 3.1% in 2023, a notable increase from 2022's 8.4% but still a significant factor for cost management.

What You See Is What You Get

Aena PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Aena PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain valuable insights into Aena's strategic landscape with this complete and professionally structured report.

Sociological factors

Travelers increasingly favor budget airlines, with low-cost carriers accounting for a significant portion of air traffic. For instance, in 2023, Ryanair and EasyJet, major players in the European low-cost market, reported carrying hundreds of millions of passengers combined. This trend necessitates airports like those managed by Aena to efficiently handle high volumes of passengers with a focus on cost-effectiveness and streamlined services.

There's a growing demand for seamless digital experiences, from booking flights to navigating airports. Passengers expect mobile check-in, digital boarding passes, and real-time information readily available through apps. Aena's investment in digital transformation, including enhanced Wi-Fi and mobile-friendly services, directly addresses this evolving preference, aiming to improve passenger satisfaction and operational efficiency.

Sustainability is becoming a key consideration for many travelers, influencing their choice of airlines and airports. A growing segment of passengers actively seeks out environmentally responsible travel options. Aena's commitment to reducing its carbon footprint and promoting sustainable practices, such as investing in renewable energy sources for its facilities, aligns with these evolving preferences and can be a competitive advantage.

Demographic shifts are significantly reshaping travel demand for Aena. For instance, the aging population in Europe, with a growing segment of retirees, often leads to increased demand for leisure travel during off-peak seasons. Conversely, a rising youth population can drive demand for budget travel and short breaks. In 2023, Spain's population reached over 48 million, with a notable increase in the 65+ age group, indicating a growing market for mature travelers.

Following the pandemic, public perception of health and safety remains a critical factor in travel decisions. Aena's commitment to rigorous hygiene protocols, such as enhanced cleaning and air filtration systems, directly impacts passenger confidence. For instance, in 2024, Aena reported a significant increase in passenger traffic, demonstrating a growing trust in the safety measures implemented across its airports.

Cultural Influences and Tourism Trends

Cultural events and shifts in travel preferences directly influence passenger numbers at Aena's airports. For instance, the increasing popularity of Spain as a destination for cultural tourism, driven by festivals and historical sites, boosts traffic. In 2023, Spain welcomed 85.1 million international tourists, a record high, with a significant portion motivated by cultural experiences.

Major international conferences and sporting events also play a crucial role. The hosting of events like Formula 1 Grand Prix races or large-scale business summits can lead to substantial, albeit often temporary, increases in air travel. Aena's strategic planning must account for these fluctuating demands to optimize operations and revenue streams.

- Increased demand for cultural tourism: Spain's rich history and vibrant festivals attract millions, contributing to higher passenger volumes.

- Impact of major events: International conferences and sporting events can cause significant, short-term surges in air traffic.

- Adaptability is key: Aena's success hinges on its capacity to leverage positive cultural trends and mitigate potential disruptions.

Labor Relations and Workforce Dynamics

Aena's labor relations are a key sociological consideration. The company engages with various employee unions, and the nature of these relationships directly influences operational stability. For instance, in 2023, Aena navigated several labor negotiations, aiming to secure agreements that balance employee interests with business needs. These interactions are vital for maintaining smooth airport operations.

The availability of skilled labor is another significant factor. Airports require specialized personnel for roles ranging from air traffic control to ground handling. A shortage of qualified workers, particularly in technical fields, could lead to service disruptions and affect overall efficiency. As of early 2024, the aviation sector globally has been addressing a need for skilled workers, a trend Aena must monitor.

Labor disputes, such as strikes or industrial action, pose a direct risk to Aena's operations. These events can cause significant delays, cancellations, and a negative impact on passenger experience. For example, past industrial actions have led to substantial operational disruptions, highlighting the sensitivity of Aena's business to workforce dynamics. Maintaining positive labor relations is therefore paramount for ensuring service continuity and customer satisfaction.

- Union Agreements: Aena's ongoing dialogue with employee unions is critical for industrial peace.

- Skilled Workforce: Ensuring a sufficient supply of trained personnel for airport functions is essential.

- Operational Impact: Labor disputes can directly affect service quality and Aena's reputation.

- Employee Satisfaction: High employee morale contributes to better service delivery and operational efficiency.

Sociological factors significantly influence Aena's operational landscape, encompassing everything from traveler preferences to workforce dynamics. The increasing demand for sustainable travel options means Aena must continue investing in eco-friendly initiatives to attract environmentally conscious passengers. Furthermore, demographic shifts, such as an aging population in Europe, create opportunities for leisure travel growth, particularly during off-peak periods.

Passenger confidence in health and safety protocols remains paramount, especially in the post-pandemic era. Aena's demonstrated commitment to rigorous hygiene measures directly impacts traveler trust, as evidenced by the significant increase in passenger traffic reported in 2024. Cultural trends, including Spain's burgeoning popularity for cultural tourism, also drive passenger volumes, underscoring the need for Aena to adapt to evolving travel motivations.

Labor relations and the availability of a skilled workforce are critical sociological considerations for Aena. Maintaining positive relationships with employee unions is essential for operational stability, as demonstrated by the company's navigation of labor negotiations in 2023. Addressing potential shortages of specialized personnel, a challenge faced by the aviation sector globally in early 2024, is crucial for preventing service disruptions and ensuring overall efficiency.

| Sociological Factor | Impact on Aena | Supporting Data/Trend (2023-2025) |

|---|---|---|

| Traveler Preferences | Increased demand for budget airlines and seamless digital experiences. | Low-cost carriers account for a significant portion of air traffic; passengers expect mobile check-in and digital services. |

| Sustainability | Growing passenger preference for environmentally responsible travel. | Aena invests in renewable energy sources to reduce its carbon footprint. |

| Demographics | Aging population drives leisure travel; youth population fuels budget travel. | Spain's population over 65 is growing, indicating a larger market for mature travelers. |

| Health & Safety Perception | Passenger confidence hinges on robust hygiene protocols. | Increased passenger traffic in 2024 suggests growing trust in safety measures. |

| Cultural Trends | Rising popularity of cultural tourism boosts passenger numbers. | Spain welcomed a record 85.1 million international tourists in 2023, many driven by cultural experiences. |

| Labor Relations | Crucial for operational stability and avoiding disruptions. | Aena engaged in labor negotiations in 2023 to balance employee interests and business needs. |

| Skilled Labor Availability | Shortages can lead to service disruptions and reduced efficiency. | The aviation sector globally faced a need for skilled workers in early 2024. |

Technological factors

Aena is actively integrating smart airport technologies to boost operational efficiency and passenger satisfaction. Innovations like biometric boarding and AI-driven security are designed to streamline processes and reduce passenger wait times. For instance, Aena's investment in automated baggage handling systems aims to minimize errors and speed up transit.

These technological advancements are crucial for Aena to maintain its competitive edge in the global aviation market. By embracing automation, Aena can offer a more modern and seamless travel experience, which is increasingly important for attracting and retaining passengers. The focus on smart solutions underscores Aena's commitment to future-proofing its operations.

Aena is heavily investing in digitalizing the passenger journey, recognizing that travelers expect seamless online and mobile interactions. This includes everything from flight information and booking to mobile check-in and even personalized services within the airport itself. By enhancing its digital platforms, Aena aims to meet these evolving customer demands.

A key technological factor for Aena is the ongoing development of its digital infrastructure and mobile applications. These tools are central to providing passengers with real-time updates, easy navigation, and convenient services. For instance, during 2023, Aena's airports saw a significant increase in app usage for services like parking reservations and lounge access, reflecting the growing reliance on digital solutions.

Aena, as a key player in air navigation services, directly benefits from advancements in Air Traffic Management (ATM). Innovations like NextGen in the US and SESAR in Europe are designed to enhance airspace capacity and reduce flight delays. These technologies are crucial for improving operational efficiency, a core aspect of Aena's service provision.

The implementation of these next-generation ATM systems is projected to significantly boost airspace capacity. For instance, SESAR aims to reduce air traffic control (ATC) related delays by up to 10% by 2035, which translates to substantial cost savings and improved passenger experience. Aena's investment in and adoption of these technologies directly supports its goal of safer and more efficient air travel.

Cybersecurity and Data Protection

Aena, as a major operator of critical infrastructure, manages extensive passenger and operational data, making robust cybersecurity a top priority. The company's commitment to protecting against evolving cyber threats and upholding data privacy is crucial for maintaining public trust and ensuring uninterrupted operations. In 2024, the global cybersecurity market is projected to reach over $200 billion, highlighting the significant investment required in this area.

Key technological considerations for Aena include:

- Enhanced threat detection and response systems: Implementing advanced solutions to identify and neutralize cyberattacks in real-time.

- Data encryption and access controls: Ensuring that sensitive passenger and operational information is protected through strong encryption and strict access protocols.

- Compliance with evolving data protection regulations: Adhering to regulations like GDPR, which mandate stringent data handling practices.

- Investment in employee training: Educating staff on cybersecurity best practices to mitigate human-error related vulnerabilities.

Sustainable Aviation Technologies

The drive towards sustainable aviation is significantly reshaping airport operations. Developments in sustainable aviation fuels (SAFs), electric aircraft, and more efficient engine designs are not just theoretical; they are actively influencing infrastructure needs. For instance, the increasing adoption of SAFs, which are projected to make up a significant portion of aviation fuel by 2030, will necessitate robust SAF distribution networks and storage facilities at airports.

Aena, as a major airport operator, must proactively adapt its facilities to accommodate these technological shifts. This includes preparing for the installation of electric aircraft charging stations, which will become increasingly common as electric and hybrid-electric planes enter commercial service. The International Air Transport Association (IATA) has set ambitious targets for SAF usage, aiming for 10% of global jet fuel to be SAF by 2030, underscoring the urgency of this infrastructure adaptation.

These technological advancements directly impact Aena’s capital expenditure plans and operational strategies. Airports will need to invest in new infrastructure to support these greener technologies, ensuring they can facilitate the charging of electric aircraft and the seamless handling of SAF. This strategic preparation is crucial for Aena to meet its own environmental goals and to remain competitive in an evolving aviation landscape.

- Infrastructure Investment: Airports like those managed by Aena will require significant investment in charging infrastructure for electric aircraft and advanced fueling systems for SAF.

- Operational Adjustments: Airlines and airport authorities must collaborate to streamline SAF supply chains and integrate electric aircraft operations efficiently.

- Environmental Compliance: Adapting to these technologies is key for Aena to meet increasingly stringent environmental regulations and carbon reduction targets set by aviation bodies.

- Future-Proofing: Proactive investment in sustainable aviation technologies ensures Aena’s long-term viability and attractiveness to airlines committed to decarbonization.

Aena is actively integrating smart airport technologies, such as biometric boarding and AI-driven security, to improve efficiency and passenger experience. By 2024, investments in automated baggage handling systems are expected to reduce errors and speed up transit, aligning with global trends in airport modernization.

The company's focus on digitalizing the passenger journey, through enhanced mobile applications and online services, reflects a growing demand for seamless travel interactions. Aena's airports saw a notable increase in app usage for parking and lounge bookings throughout 2023, demonstrating the growing reliance on digital solutions.

Advancements in Air Traffic Management (ATM), like SESAR in Europe, are critical for Aena to enhance airspace capacity and reduce flight delays. These systems aim to improve operational efficiency, with SESAR targeting up to a 10% reduction in air traffic control delays by 2035.

Cybersecurity is a paramount concern for Aena, given the vast amounts of data processed. The global cybersecurity market exceeded $200 billion in 2024, underscoring the need for robust threat detection and data protection measures to maintain trust and operational continuity.

The push for sustainable aviation is driving significant technological shifts, including the adoption of sustainable aviation fuels (SAFs) and electric aircraft. Aena is preparing its infrastructure for these changes, including the installation of electric aircraft charging stations, as SAF usage targets aim for 10% of global jet fuel by 2030.

| Technological Factor | Aena's Action/Focus | Impact/Projection |

| Smart Airport Technologies | Biometric boarding, AI security, automated baggage handling | Improved efficiency, reduced wait times, fewer errors |

| Digital Passenger Journey | Mobile apps, online booking, real-time information | Enhanced customer experience, increased digital service adoption (e.g., 2023 app usage growth) |

| Air Traffic Management (ATM) | Adoption of NextGen/SESAR technologies | Increased airspace capacity, reduced flight delays (SESAR targeting 10% ATC delay reduction by 2035) |

| Cybersecurity | Advanced threat detection, data encryption, compliance | Protection of sensitive data, operational continuity (market exceeding $200 billion in 2024) |

| Sustainable Aviation | SAF infrastructure, electric aircraft charging stations | Adaptation to greener aviation (10% SAF target by 2030), future-proofing operations |

Legal factors

Aena navigates a dense regulatory landscape, including Spanish national laws and international standards set by bodies like EASA and ICAO. These regulations cover critical areas such as flight safety, airport security, air traffic management, and overall airport operations. For instance, in 2023, Aena invested €1.2 billion in infrastructure improvements, much of which is directly tied to meeting evolving safety and operational compliance requirements.

Failure to comply with these stringent aviation rules can result in significant repercussions for Aena. Penalties can range from substantial fines to the suspension of operating licenses, directly impacting its ability to function and generate revenue. The company's ongoing commitment to compliance is therefore essential for its sustained operational integrity and financial stability.

As Spain's primary airport operator, Aena navigates stringent competition laws designed to curb any monopolistic tendencies. These regulations are crucial for maintaining a level playing field, ensuring that airlines and other aviation-related businesses can operate fairly within the Spanish market.

The Spanish National Markets and Competition Commission (CNMC) actively monitors Aena's activities, particularly concerning pricing strategies for airport services and the allocation of valuable landing and takeoff slots. This oversight is vital for preventing Aena from leveraging its dominant position to the detriment of competitors.

In 2023, Aena reported a net profit of €1.45 billion, a significant increase from previous years, underscoring its substantial market presence. This growth highlights the importance of continued regulatory vigilance to ensure that such financial success does not stem from anti-competitive practices.

Aena must strictly adhere to Spanish labor laws, encompassing working conditions, minimum wage requirements, and collective bargaining agreements, which directly influence its operational expenses and HR strategies. For instance, the Spanish government's commitment to increasing the minimum wage, with a projected rise to €1,134 per month in 14 payments for 2024, directly impacts Aena's labor costs across its airport operations.

Fluctuations in employment regulations, such as those concerning temporary contracts or employee benefits, can significantly alter Aena's cost structure and its ability to manage its workforce efficiently. The ongoing discussions and potential reforms around labor flexibility and worker protections in Spain are key considerations for Aena's long-term human capital planning.

Data Privacy and GDPR Compliance

Aena's operations involve the extensive collection and processing of passenger data, necessitating rigorous compliance with data privacy laws like the General Data Protection Regulation (GDPR). Failure to uphold these standards can lead to substantial financial penalties and a damaged public image. For instance, in 2023, the Spanish Data Protection Agency (AEPD) continued to enforce GDPR, with fines issued to various entities for data breaches and non-compliance, underscoring the critical nature of these regulations for companies like Aena.

Ensuring robust data security and privacy practices is paramount for Aena. This includes implementing secure systems for data storage, anonymization techniques where appropriate, and clear consent mechanisms for data usage. The potential for significant fines, as seen across the EU in recent years, makes proactive compliance a strategic imperative, not just a legal obligation.

Key areas of focus for Aena regarding data privacy include:

- Secure handling of passenger information to prevent unauthorized access or breaches.

- Transparent data processing policies communicated clearly to all passengers.

- Adherence to GDPR principles such as data minimization, purpose limitation, and individual rights.

- Regular audits and updates to data protection protocols to align with evolving legal requirements and technological advancements.

Concession Agreements and Public Procurement

Aena's core operations are anchored by long-term concession agreements, primarily with the Spanish government, granting it the rights to manage and develop its airports. These agreements, often spanning decades, are crucial for Aena's business model, dictating operational frameworks and investment horizons.

Changes to the terms of these concessions or shifts in public procurement legislation can introduce significant uncertainty. For instance, any renegotiation of concession periods or the introduction of new bidding processes for airport management could alter Aena's long-term strategic planning and capital expenditure. In 2023, Aena continued to operate under its existing concessions, with no major governmental changes to these agreements reported, providing a stable operational environment.

Furthermore, the public procurement laws that govern infrastructure projects in Spain and other countries where Aena might seek expansion directly influence how contracts are awarded for airport development and upgrades. Adherence to these regulations is paramount, and any amendments could impact the cost and timeline of future projects. Aena's commitment to infrastructure development, as evidenced by its ongoing investments, makes it particularly sensitive to these legal and regulatory shifts.

Aena's legal framework is heavily influenced by Spanish and EU competition laws, ensuring fair market practices. The Spanish National Markets and Competition Commission (CNMC) monitors Aena's pricing and slot allocation to prevent anti-competitive behavior. In 2023, Aena's substantial net profit of €1.45 billion underscores the importance of this regulatory oversight to ensure fair competition.

Environmental factors

Aena faces increasing pressure from climate policies like the EU Green Deal, which aims for climate neutrality by 2050. This necessitates significant investment in reducing its carbon footprint, with a focus on energy efficiency and renewable sources. For instance, Aena's commitment to sustainability includes projects to increase the use of renewable energy at its airports.

International aviation standards, such as the International Civil Aviation Organization's (ICAO) Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA), also mandate emission reductions. Aena must adapt by investing in sustainable aviation fuels (SAFs) and operational improvements to meet these global targets, impacting operational costs and strategic planning.

Noise pollution from airports is a major environmental concern, leading to increasingly stringent regulations. Aena, as a major airport operator, faces pressure to mitigate these impacts, which directly affects operational strategies and financial outlays. For instance, the European Union's Environmental Noise Directive sets limits for noise exposure, and non-compliance can result in significant penalties.

To address these challenges, Aena is investing in noise abatement procedures and quieter ground operations. This includes adopting best practices for flight path management and exploring technological advancements in ground equipment. The company also needs to consider potential compensation for communities affected by noise, adding another layer of cost and complexity to its business model.

Effective waste management, particularly recycling and landfill reduction, is a significant environmental focus for airport operations like Aena. In 2023, Aena reported a 67% recycling rate across its Spanish airports, an increase from 65% in 2022, demonstrating progress in tackling waste.

Adopting circular economy principles offers Aena a pathway to boost its sustainability credentials and lessen its environmental footprint. For instance, initiatives like reusing construction materials from airport infrastructure projects are being explored to divert significant volumes from landfills, aligning with a 2024 target to reduce non-recycled waste by 10%.

Biodiversity Protection and Land Use

Airport development, like Aena's ongoing projects and expansions, often intersects with local ecosystems. This means careful consideration must be given to protecting biodiversity and managing land use effectively. For instance, the expansion of Madrid-Barajas Airport in recent years has involved assessments of its impact on surrounding natural areas.

Aena is legally bound to conduct thorough environmental impact assessments (EIAs) before undertaking new construction or expansion. These assessments help identify potential risks to local flora and fauna and inform the development of mitigation strategies. Compliance with land-use planning regulations is crucial to ensure development aligns with broader environmental goals and conservation efforts.

Key considerations for Aena regarding biodiversity and land use include:

- Habitat Preservation: Implementing measures to protect sensitive habitats and species during airport construction and operation. Aena's commitment to sustainability includes targets for reducing its environmental footprint, which often involves biodiversity protection plans for its airport sites.

- Mitigation Measures: Developing and executing plans to offset any unavoidable environmental damage, such as creating new green spaces or restoring degraded areas.

- Regulatory Compliance: Adhering to national and international environmental laws and guidelines related to land use and biodiversity.

- Sustainable Land Management: Promoting responsible land use practices around airport facilities to minimize negative impacts on the surrounding environment.

Water Management and Resource Efficiency

Aena recognizes the critical importance of sustainable water usage and effective management of water discharge, especially given the scale of its airport operations. This focus is central to its environmental strategy. For instance, in 2023, Aena reported a reduction in water consumption across its Spanish airports, with specific initiatives targeting efficiency in terminal buildings and operational areas.

The company actively invests in advanced wastewater treatment facilities to ensure compliance with stringent environmental regulations. These systems are designed to process water used in aircraft de-icing, cleaning, and general airport services, minimizing the impact on local water bodies. Furthermore, Aena is implementing enhanced stormwater runoff management plans, incorporating green infrastructure solutions like permeable pavements and retention basins to filter pollutants before water re-enters the environment.

These efforts are not just about compliance; they directly contribute to Aena's overall environmental performance and its commitment to long-term sustainability. Key areas of focus include:

- Water Conservation Initiatives: Implementing water-saving fixtures and technologies in airport facilities.

- Wastewater Treatment: Operating and upgrading advanced treatment plants to meet discharge standards.

- Stormwater Management: Employing best practices to control and treat runoff, reducing pollution.

- Resource Efficiency: Continuously seeking ways to reduce overall water footprint across operations.

Aena's environmental strategy is heavily influenced by global climate policies and aviation industry standards aimed at reducing emissions. Initiatives like the EU Green Deal and the ICAO's CORSIA framework push for investments in sustainable aviation fuels and operational efficiencies. The company reported a 67% recycling rate in 2023, up from 65% in 2022, and aims to reduce non-recycled waste by 10% in 2024.

Noise pollution remains a significant challenge, with regulations like the EU's Environmental Noise Directive imposing strict limits. Aena is investing in noise abatement procedures and quieter ground operations to comply. Water management is also critical, with Aena implementing water-saving measures and advanced wastewater treatment facilities, leading to reduced water consumption across its Spanish airports in 2023.

Biodiversity and land use are key considerations for Aena's development projects, requiring thorough environmental impact assessments and adherence to land-use planning regulations to protect local ecosystems.

| Environmental Metric | 2022 Data | 2023 Data | Target | Notes |

|---|---|---|---|---|

| Recycling Rate (Spanish Airports) | 65% | 67% | N/A | Year-on-year improvement |

| Non-Recycled Waste Reduction | N/A | N/A | 10% reduction | Target for 2024 |

| Water Consumption | N/A | Reduced | N/A | Across Spanish airports |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Aena is built on a robust foundation of data from official airport authorities, national and international aviation bodies, and leading economic and market research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting Aena's operations.