ACI Worldwide SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ACI Worldwide Bundle

ACI Worldwide boasts significant strengths in its robust payment processing technology and established customer base, but faces challenges from evolving fintech landscapes and competitive pressures. Understanding these dynamics is crucial for anyone looking to invest or strategize within the payments sector.

Want the full story behind ACI Worldwide's market position, including detailed insights into their opportunities and threats? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

ACI Worldwide holds a commanding position in the digital payments sector, widely acknowledged for its dependable and forward-thinking solutions. The company's extensive experience in payments and its vast global reach are evident in its support of the financial infrastructure for more than 9,000 entities across the globe.

ACI Worldwide boasts a robust and expanding product portfolio designed to address diverse payment needs. Their offerings, such as ACI Universal Payments, ACI Realtime Payments, and ACI Fraud Management, are integral to critical payment infrastructure, online banking operations, and effective fraud prevention strategies.

The company's dedication to staying ahead is evident in its significant investment in research and development, allocating over $100 million in 2024 alone. This commitment ensures their solutions remain at the forefront of technological advancement.

Recent developments, including the cloud-native ACI Connetic platform, highlight ACI's focus on modernization. This platform uniquely combines card and account-to-account processing with advanced AI-driven fraud prevention, showcasing their forward-thinking approach.

ACI Worldwide demonstrated impressive financial strength in the first quarter of 2025. Revenue surged by 25% compared to the same period in 2024, reaching $395 million, while adjusted EBITDA saw a substantial 95% increase. This growth was largely driven by the Payment Software segment, which combined the former Bank and Merchant divisions and experienced a remarkable 42% revenue jump.

The company's confidence in its future is further underscored by its upward revision of full-year 2025 revenue guidance. This positive outlook reflects the success of its strategic initiatives and strong market positioning. A significant factor contributing to this stability is the substantial proportion of recurring revenue within its total revenue streams.

Global Presence and Diversified Client Base

ACI Worldwide boasts an impressive global reach, operating in over 95 countries. This extensive presence allows them to serve a wide array of clients, including major financial institutions, payment intermediaries, and retailers across diverse sectors like utilities, government, and healthcare. This broad operational scope and varied customer portfolio are key strengths, significantly reducing exposure to any single market's downturns.

The company’s solutions are integral to global real-time payment networks, facilitating seamless cross-border transactions and accommodating a multitude of payment types. This capability is crucial in today's interconnected financial landscape, positioning ACI Worldwide as a vital partner for businesses operating internationally. For instance, their role in supporting payment modernization initiatives worldwide underscores their global relevance.

- Global Operations: Presence in over 95 countries.

- Diverse Clientele: Serves financial institutions, intermediaries, and retailers.

- Industry Reach: Active in utilities, government, and healthcare sectors.

- Real-Time Payment Support: Enables cross-border payments across all global networks.

Advanced Fraud Prevention Capabilities

ACI Worldwide excels with advanced fraud prevention capabilities, leveraging AI-driven, self-learning algorithms for superior detection and financial crime prevention. This commitment to cutting-edge technology is a significant strength, particularly as financial crime evolves.

The company's ACI Fraud Management solution has earned industry recognition, notably being named 'Best Risk Management Solution Provider 2024' by MEA Finance. This award underscores the effectiveness and sophistication of their offerings in a critical sector.

ACI Worldwide's extensive experience in safeguarding payments, coupled with ongoing investments in AI and machine learning, positions them strongly to combat increasing financial crimes. This proactive approach is vital, especially with the rapid expansion of real-time payment systems.

Key aspects of their fraud prevention strength include:

- AI-Powered Detection: Utilizes self-learning algorithms for proactive and adaptive fraud identification.

- Industry Recognition: Awarded 'Best Risk Management Solution Provider 2024' by MEA Finance, validating their expertise.

- Real-Time Payment Focus: Addresses the growing challenges of fraud in fast-paced payment environments.

- Continuous Innovation: Ongoing investment in AI and machine learning ensures they stay ahead of emerging threats.

ACI Worldwide's robust product suite, including ACI Universal Payments and ACI Realtime Payments, underpins critical financial infrastructure globally. Their significant investment in R&D, exceeding $100 million in 2024, fuels continuous innovation, exemplified by the cloud-native ACI Connetic platform. This commitment ensures their solutions remain at the cutting edge of payment technology.

The company's financial performance in Q1 2025 was strong, with revenue increasing 25% year-over-year to $395 million, alongside a 95% surge in adjusted EBITDA. This growth was significantly boosted by the Payment Software segment, which saw a 42% revenue jump, reflecting the success of their integrated strategies.

| Metric | Q1 2025 | YoY Change |

|---|---|---|

| Revenue | $395 million | +25% |

| Adjusted EBITDA | [Data not explicitly provided, but indicated as substantial increase] | +95% |

| Payment Software Revenue | [Data not explicitly provided, but indicated as strong growth] | +42% |

What is included in the product

Analyzes ACI Worldwide’s competitive position through key internal and external factors, highlighting its strengths in real-time payments and opportunities in digital transformation, while also addressing weaknesses in legacy systems and threats from emerging fintech competitors.

ACI Worldwide's SWOT analysis provides a clear roadmap for addressing operational inefficiencies and competitive threats, thereby alleviating strategic planning pain points.

Weaknesses

ACI Worldwide's reliance on a few major clients presents a notable weakness. A significant portion of their revenue, often stemming from large financial institutions and enterprise clients, creates a concentration risk. For instance, if one of these key contracts, which are typically subscription-based and crucial for recurring revenue, were to be lost or significantly delayed, it could have a substantial impact on ACI Worldwide's financial performance and profitability.

ACI Worldwide continues to grapple with the complexities of integrating its diverse legacy systems. While the company has invested in modernization, the sheer volume and age of some platforms make full consolidation a significant hurdle, impacting operational efficiency and potentially increasing maintenance costs.

The ongoing transition to the ACI Connetic platform, designed to unify operations onto a single cloud-native architecture, presents both opportunity and risk. This migration requires substantial capital outlay and carries the inherent possibility of service disruptions, a critical concern in the real-time payments sector.

The digital payments arena is incredibly crowded. ACI Worldwide contends with giants like Fiserv and FIS, alongside nimble fintech innovators such as Stripe and Adyen. The rise of alternative payment methods, including cryptocurrencies, further intensifies this competition, demanding constant innovation from ACI to stay ahead.

Companies like Pine Labs, which saw significant investment in 2024, and Razorpay, a major player in India, are aggressively expanding their reach. Even newer entrants like NOWPayments are carving out niches, particularly in the cryptocurrency space. This dynamic environment means ACI must continually refine its value proposition and service offerings to capture and retain market share.

Exposure to Macroeconomic Uncertainties

ACI Worldwide's reliance on global financial markets means its performance is susceptible to macroeconomic shifts. Economic slowdowns or instability can lengthen client decision-making processes and reduce overall transaction volumes, directly impacting ACI's revenue streams.

While ACI has demonstrated resilience, periods of economic uncertainty or downturns can hinder new business acquisition. This slowdown in customer strategy adoption can affect future revenue growth and the company's sales pipeline.

- Economic Sensitivity: Global economic health directly influences client spending and investment in new payment technologies.

- Transaction Volume Impact: Recessions or decreased consumer spending can lead to lower transaction volumes, affecting ACI's revenue from payment processing services.

- Pipeline Delays: Macroeconomic uncertainties can cause potential clients to postpone or cancel technology upgrade projects, impacting ACI's new business pipeline.

Potential for High Operational Costs

Developing and maintaining advanced payment technologies requires substantial investment in research and development, which can drive up operational costs for ACI Worldwide. This is particularly true as the company continues its significant R&D efforts and cloud migration initiatives.

While ACI's strategy focuses on unified platforms to eventually reduce operational expenses and boost performance, the initial capital outlay and continuous spending on technology upgrades and skilled personnel present a considerable challenge. For instance, in their 2023 fiscal year, ACI reported operating expenses of $1.35 billion, reflecting these ongoing investments.

- Significant R&D Investment: Continuous innovation in payment solutions necessitates ongoing expenditure.

- Cloud Migration Costs: Transitioning to and maintaining cloud infrastructure involves substantial upfront and recurring expenses.

- Talent Acquisition and Retention: Securing and keeping specialized tech talent adds to operational overhead.

- Technology Refresh Cycles: Keeping pace with rapid technological advancements requires regular investment in new systems and software.

ACI Worldwide's reliance on a concentrated client base poses a significant risk; losing even one major customer could severely impact its financial stability. The company's ongoing efforts to integrate disparate legacy systems, while necessary, continue to present operational inefficiencies and potential cost overruns.

The substantial investment required for the ACI Connetic platform migration, coupled with the inherent risk of service disruptions during this critical transition, remains a key concern for the company.

| Weakness | Description | Financial Implication Example (FY2023) |

|---|---|---|

| Client Concentration | Revenue heavily dependent on a few large clients. | Loss of a major client could significantly reduce recurring revenue. |

| Legacy System Integration | Challenges in consolidating older, diverse platforms. | Increased maintenance costs and potential operational inefficiencies. |

| Cloud Migration Costs & Risk | High capital outlay for ACI Connetic with potential for service disruption. | Operating expenses were $1.35 billion in FY2023, reflecting ongoing tech investments. |

Same Document Delivered

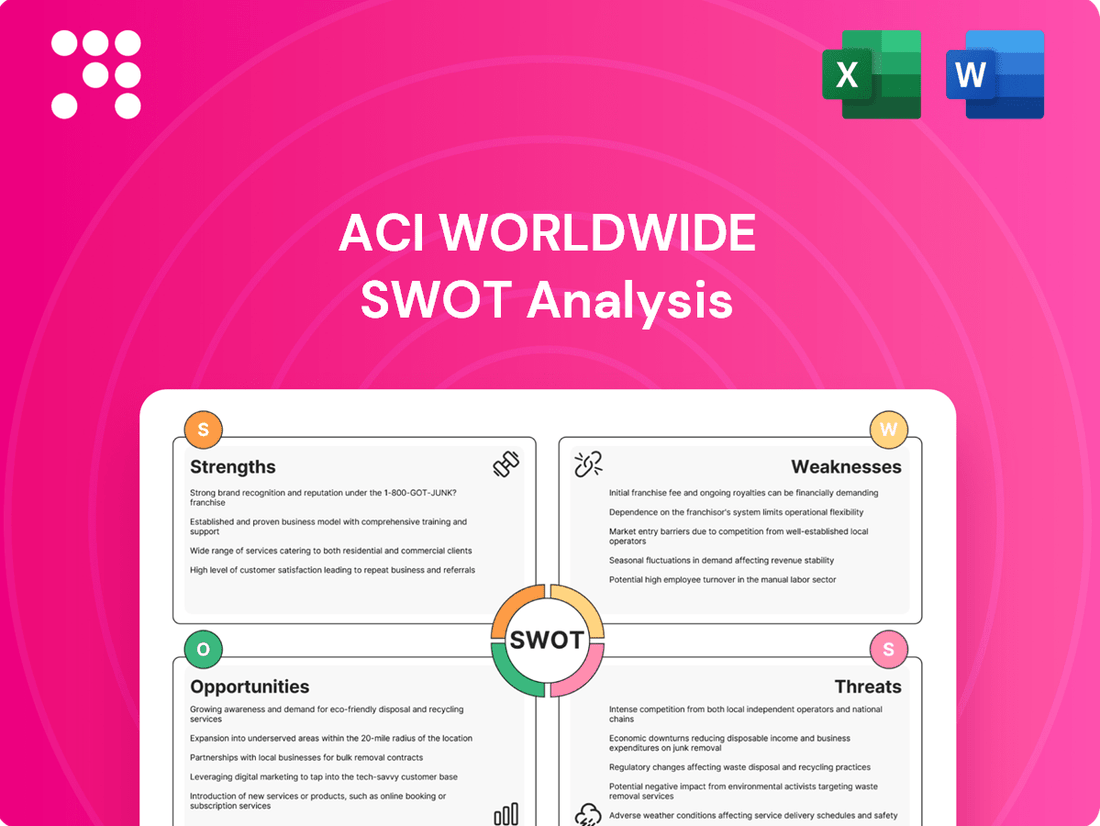

ACI Worldwide SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It details ACI Worldwide's Strengths, Weaknesses, Opportunities, and Threats, providing a comprehensive overview for strategic planning.

Opportunities

The worldwide move to real-time payments is a major chance for ACI Worldwide. By 2028, it's expected that over a quarter of all electronic payments globally will be in real-time, building on solid growth seen in 2023.

ACI is well-positioned to take advantage of this growing market, thanks to its knowledge and offerings like the Prime Time for Real-Time report and its ACI Realtime Payments platform.

The rapid expansion of digital and real-time payments, a trend accelerating into 2024 and projected to continue through 2025, has unfortunately also fueled a significant increase in the sophistication and volume of financial crime. This escalating threat landscape directly translates into a growing market demand for robust and advanced fraud prevention solutions.

ACI Worldwide is well-positioned to capitalize on this opportunity. Their investment in AI-powered fraud management tools, coupled with a strategic emphasis on shared intelligence and collaborative defense mechanisms, directly addresses critical market needs. For instance, combating Authorized Push Payment (APP) fraud, a growing concern, showcases ACI's ability to meet this demand and potentially expand its service offerings in this vital area.

ACI Worldwide is strategically expanding its footprint by targeting smaller financial institutions, specifically Tier 2 and Tier 3 banks, which represent a significant untapped market. The company's new ACI Connect platform is a key enabler for this expansion, designed to simplify digital transformation for a wider array of banks globally.

International growth is a core focus, with recent efforts including a partnership with iNet in Saudi Arabia to enhance market penetration in the Middle East. This move underscores ACI Worldwide's commitment to leveraging strategic alliances to access and serve emerging economies effectively.

Leveraging Cloud-Native Solutions and Strategic Partnerships

ACI Worldwide's investment in cloud-native platforms, such as ACI Connect, presents a significant opportunity to boost scalability and security while potentially lowering operational costs for its clientele. This strategic shift is crucial in today's dynamic payment landscape.

Forming alliances with major cloud service providers like Microsoft Azure, Red Hat, and IBM bolsters ACI's capacity to offer highly reliable and secure payment processing solutions. These partnerships are vital for meeting stringent regulatory demands concerning operational resilience, a key concern for financial institutions.

- Enhanced Scalability: Cloud-native architecture allows for dynamic resource allocation, enabling ACI's platforms to handle fluctuating transaction volumes efficiently.

- Cost Reduction: By leveraging cloud infrastructure, clients can benefit from a pay-as-you-go model, reducing upfront capital expenditure and ongoing maintenance costs.

- Regulatory Compliance: Partnerships with leading cloud providers help ensure adherence to evolving operational resilience regulations, a critical factor for financial services.

- Innovation Acceleration: Access to advanced cloud technologies and services facilitates faster development and deployment of new payment features and solutions.

Emergence of New Payment Types and Use Cases

The payment landscape is rapidly changing, with new methods like instant payments and central bank digital currencies (CBDCs) emerging. Open banking initiatives are also paving the way for more integrated financial services. This evolution presents significant opportunities for ACI Worldwide to innovate and expand its offerings.

ACI Worldwide's expertise in supporting a wide array of payment types and its focus on intelligent payment orchestration position it well to capitalize on these trends. The company can develop and integrate solutions that cater to new use cases within the growing digital economy.

- Instant Payments Growth: The global instant payments market is projected to reach $3.8 trillion by 2027, according to Statista, highlighting a key area for ACI to leverage.

- Open Banking Adoption: By 2025, it's estimated that over 70% of banks globally will have adopted open banking strategies, creating demand for ACI's integration capabilities.

- Digital Wallet Expansion: The number of digital wallet users is expected to exceed 4.4 billion by 2025, signaling a need for ACI's versatile payment solutions.

The global shift towards real-time payments presents a substantial growth avenue for ACI Worldwide, with projections indicating that over a quarter of all electronic payments worldwide will be real-time by 2028, building on strong 2023 performance.

ACI's advanced fraud prevention solutions are in high demand due to the increasing sophistication and volume of financial crime, a trend that has accelerated into 2024 and is expected to continue through 2025.

Expanding its reach to smaller financial institutions through platforms like ACI Connect and forging international partnerships, such as with iNet in Saudi Arabia, are key strategies for market penetration and growth.

ACI's investment in cloud-native platforms and strategic alliances with major cloud providers like Microsoft Azure enhances scalability, security, and regulatory compliance, crucial for meeting evolving industry demands.

The company is poised to capitalize on emerging payment trends like instant payments, open banking, and digital wallets, leveraging its expertise in payment orchestration to develop innovative solutions for the digital economy.

Threats

The payments landscape is increasingly crowded. Agile fintechs and tech giants are launching innovative payment solutions, directly challenging established players like ACI Worldwide. This surge in competition can erode market share and put downward pressure on pricing.

For instance, the global fintech market was projected to reach $300 billion by 2025, highlighting the significant investment and growth in this sector. Companies like Stripe and Square have already captured substantial portions of the digital payments market, forcing ACI Worldwide to continually invest in research and development to stay ahead.

This competitive pressure necessitates a strong focus on differentiation and continuous innovation. ACI Worldwide must adapt its strategies to counter the rapid advancements and customer acquisition tactics employed by these new market entrants to maintain its profitability and market position.

The payments industry faces a constantly shifting regulatory environment, with new rules like Europe's Digital Operational Resilience Act (DORA) and the UK's operational resiliency framework demanding continuous adaptation. ACI Worldwide must invest heavily in updating its platforms to meet these evolving compliance requirements, such as those targeting APP fraud prevention, which could strain resources if not managed proactively.

ACI Worldwide, as a custodian of sensitive financial transaction data and a provider of critical payment infrastructure, faces significant cybersecurity risks. A successful cyberattack or data breach could lead to severe reputational damage, loss of client confidence, and substantial financial penalties, particularly given the increasing regulatory scrutiny around data protection. For instance, the average cost of a data breach in 2024 reached $4.73 million globally, a figure that could disproportionately impact ACI given its role in financial ecosystems.

Technological Obsolescence and Rapid Innovation Cycles

The digital payments landscape moves at lightning speed. ACI Worldwide faces the constant threat of its current solutions becoming outdated due to rapid innovation. For instance, the increasing sophistication of AI in fraud detection and the emergence of new payment methods require continuous investment in research and development to remain competitive.

Failure to adapt quickly can lead to a loss of market share. Competitors who embrace emerging technologies, like real-time payment networks or advanced tokenization methods, could attract clients seeking cutting-edge solutions. This pressure to innovate is a significant challenge for ACI Worldwide.

- Rapid AI Advancements: The sector sees constant breakthroughs in AI for fraud prevention and customer analytics, demanding immediate integration.

- Emerging Payment Protocols: New standards for cross-border payments and digital currencies require swift adoption to maintain relevance.

- Client Expectations: Businesses expect payment providers to offer the latest, most secure, and efficient technologies, putting pressure on ACI Worldwide to deliver.

Economic Downturns Impacting Transaction Volumes

Economic downturns pose a significant threat to ACI Worldwide by directly reducing the volume of transactions processed. For instance, if consumer spending contracts due to inflation or recessionary fears, fewer payments will flow through ACI's platforms. This slowdown impacts revenue, especially for models reliant on per-transaction fees.

The global economic outlook for 2024 and 2025 suggests potential headwinds. Projections from organizations like the IMF indicate moderating global growth, which translates to fewer commercial and consumer transactions. This directly affects companies like ACI, whose revenue is closely linked to payment activity volumes.

- Reduced Consumer Spending: A slowdown in economic activity typically leads to less discretionary spending, impacting retail and e-commerce transaction volumes.

- Business Investment Slowdown: Companies may cut back on investments and operational spending during uncertain economic periods, reducing B2B transaction volumes.

- Impact on Transaction-Based Revenue: ACI's revenue, particularly from its real-time payments and digital banking solutions, is sensitive to the sheer number of transactions processed, making volume declines a direct threat.

The intensifying competition from agile fintechs and tech giants presents a significant threat, as these players often introduce innovative solutions that can capture market share and pressure pricing. Furthermore, the rapid evolution of payment technologies, including advancements in AI for fraud detection and new payment protocols, necessitates continuous and substantial investment in research and development for ACI Worldwide to remain competitive and relevant. Economic downturns also pose a risk, as reduced consumer and business spending directly impacts transaction volumes, thereby affecting ACI's revenue streams, particularly those tied to per-transaction fees.

| Threat Category | Specific Threat | Impact on ACI Worldwide | Supporting Data/Trend |

|---|---|---|---|

| Competition | Fintech and Tech Giant Disruption | Erosion of market share, pricing pressure | Global fintech market projected to reach $300 billion by 2025; companies like Stripe and Square have gained significant traction. |

| Technological Obsolescence | Rapid Innovation in Payments | Loss of competitive edge, need for constant R&D investment | Increasing sophistication of AI in fraud detection; emergence of new payment methods and protocols. |

| Economic Factors | Economic Downturns and Reduced Spending | Lower transaction volumes, decreased revenue | Projected moderating global growth for 2024-2025 impacting consumer and business spending. |

| Regulatory Environment | Evolving Compliance Requirements | Increased investment in platform updates, potential resource strain | New regulations like DORA in Europe and UK operational resiliency frameworks demand continuous adaptation. |

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of reliable data, including ACI Worldwide's official financial filings, comprehensive market research reports, and expert industry analysis to provide a robust strategic overview.