ACI Worldwide PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ACI Worldwide Bundle

Navigate the complex external forces shaping ACI Worldwide's future with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, and evolving social trends directly impact their operations and growth potential. Ready to gain a strategic advantage? Download the full PESTLE analysis now for actionable intelligence.

Political factors

Governments globally are tightening their grip on payment systems, prioritizing stability, security, and consumer safeguards. This means ACI Worldwide, operating on a global scale, must constantly update its offerings to meet a patchwork of national and international payment rules. For instance, the EU's Instant Payments Regulation and Verification of Payee requirements, which will be compulsory for European banks starting in October 2025, are prime examples of such evolving mandates.

The global political environment increasingly demands robust anti-money laundering (AML) and counter-terrorist financing (CTF) frameworks. ACI Worldwide's offerings are vital for financial institutions navigating these complex compliance landscapes, especially as new fraud methods emerge.

The sophistication of financial crime, including Authorized Push Payment (APP) scams that increasingly utilize AI, necessitates advanced solutions. ACI Worldwide's fraud prevention technologies directly address these evolving threats, helping banks and payment providers maintain regulatory adherence and protect their customers.

Governments and international bodies are actively pushing for improvements in cross-border payments. For instance, the G20 has outlined a roadmap to make these transactions quicker, more affordable, and more transparent, aiming for greater accessibility for everyone. This global push for standardization directly benefits companies like ACI Worldwide, whose software is designed to manage and optimize these complex payment flows in real-time.

Data Privacy and Localization Laws

Governments worldwide are intensifying scrutiny on data privacy and mandating data localization. For instance, the European Union's General Data Protection Regulation (GDPR) continues to set a high bar for data protection, with ongoing enforcement actions. Many countries are following suit, requiring companies like ACI Worldwide to store and process sensitive customer data within their borders. This trend impacts how ACI Worldwide manages its global operations and ensures compliance across diverse regulatory landscapes.

ACI Worldwide must navigate a complex web of data privacy and localization laws, which directly affect its software development and data management strategies. Adherence to these regulations, such as those mirroring GDPR's principles or specific localization mandates, influences decisions on data storage locations, processing protocols, and the intricate pathways of cross-border data transfers. Failure to comply can result in significant penalties, as seen with substantial fines levied under GDPR in recent years, underscoring the critical nature of these political factors for ACI Worldwide's operational integrity and market access.

- Global Data Privacy Landscape: Over 100 countries have enacted data protection laws as of early 2024, with many incorporating principles similar to GDPR.

- Localization Requirements: Several nations, particularly in Asia and South America, are increasingly implementing strict data localization mandates, requiring data to remain within national borders.

- Enforcement and Penalties: GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher, demonstrating the financial risk of non-compliance.

- Impact on Cloud Services: These regulations directly influence ACI Worldwide's reliance on and architecture of cloud-based services, necessitating careful vendor selection and contract negotiation.

Geopolitical Stability and Trade Policies

Geopolitical stability is crucial for ACI Worldwide, a global player. For instance, the ongoing geopolitical tensions in Eastern Europe, which began in early 2022, continue to create uncertainty. This can impact the willingness of businesses in affected regions to invest in new payment technologies, potentially slowing down adoption rates for ACI's solutions.

Changing trade policies also present a dynamic landscape. The United States and China, for example, have seen fluctuating trade relations, with tariffs imposed and renegotiated. While ACI Worldwide's core business isn't directly tied to specific goods, these broader trade dynamics can influence the economic health of its global client base, indirectly affecting their IT spending and investment capacity in payment infrastructure.

ACI's clients, often large financial institutions and merchants, are sensitive to global economic conditions influenced by these political factors. For example, if trade disputes lead to increased operational costs for a major retail client, that client might scale back discretionary spending, including upgrades to payment processing systems that ACI provides. The International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a figure that can be significantly impacted by unforeseen geopolitical events and trade policy shifts.

- Global trade tensions: Continued friction between major economic blocs can disrupt supply chains and impact overall business investment.

- Regional instability: Political unrest in key markets can deter foreign investment and slow down the adoption of new financial technologies.

- Tariff impacts: While not direct, tariffs can increase the cost of doing business for ACI's clients, potentially reducing their available capital for technology upgrades.

- Economic outlook: Projections for global economic growth, like the IMF's 3.2% for 2024, are subject to revision based on geopolitical developments.

Governments worldwide are increasingly focused on payment system regulations, emphasizing stability and security. This means ACI Worldwide must continuously adapt its solutions to comply with diverse national and international rules, such as the EU's upcoming Instant Payments Regulation and Verification of Payee requirements, effective October 2025.

The global push for enhanced anti-money laundering (AML) and counter-terrorist financing (CTF) measures places ACI Worldwide's fraud prevention technologies at the forefront. As financial crime evolves, particularly with AI-driven APP scams, ACI's role in helping institutions maintain compliance and customer protection becomes even more critical.

Improvements in cross-border payments are a key political objective, with initiatives like the G20 roadmap aiming for faster, cheaper, and more transparent transactions. This global standardization effort directly benefits ACI Worldwide by creating a more unified market for its payment optimization software.

Data privacy and localization laws are becoming more stringent globally, with over 100 countries having data protection laws by early 2024, many mirroring GDPR. These regulations, including potential fines up to 4% of global annual revenue for GDPR non-compliance, significantly influence ACI Worldwide's data management and cloud service strategies.

What is included in the product

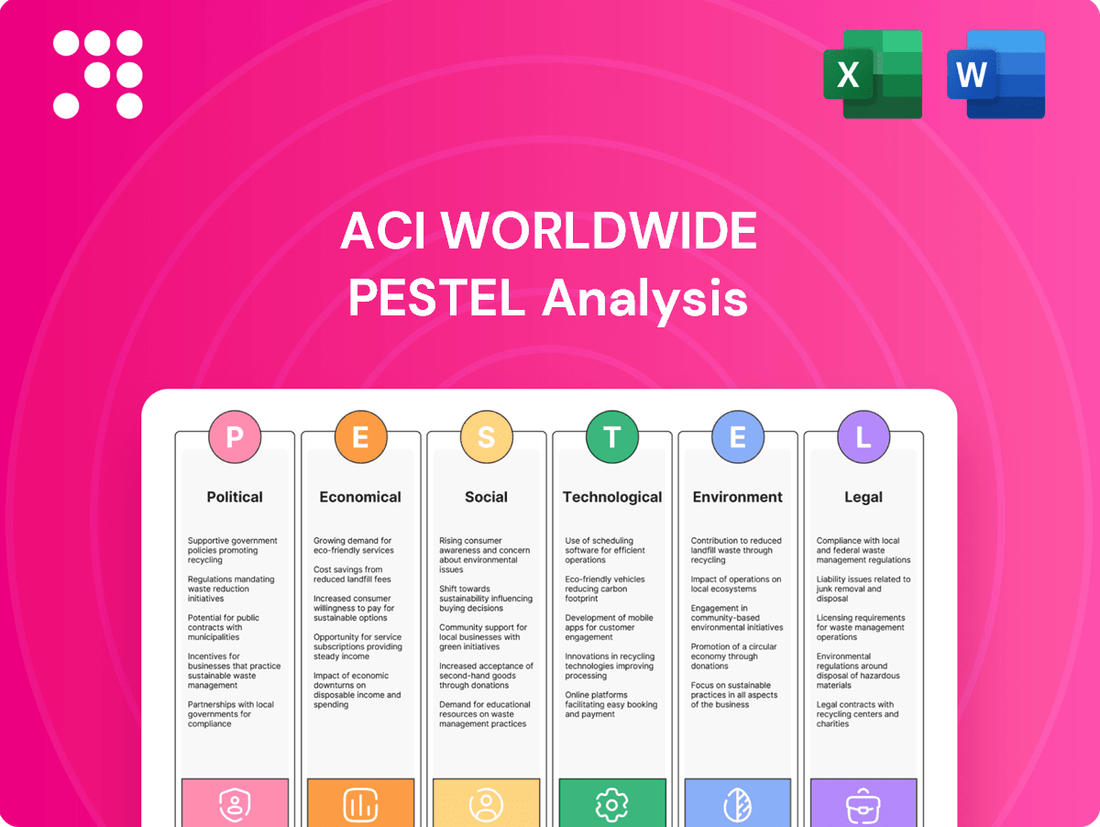

This PESTLE analysis of ACI Worldwide examines how political, economic, social, technological, environmental, and legal forces impact the company's operations and strategy.

It provides actionable insights for stakeholders to navigate the external landscape and capitalize on emerging opportunities within the payments industry.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, distilling complex external factors into actionable insights for ACI Worldwide.

Economic factors

The global payments market is booming, projected to surpass $3 trillion by 2028, largely fueled by the rapid rise of digital and real-time payment methods. This significant expansion directly plays into ACI Worldwide's strengths, as their business is centered on software solutions that enable these very types of electronic and digital transactions.

The relentless growth of e-commerce is a primary economic engine for ACI Worldwide. In 2024, global e-commerce sales are projected to reach $7.0 trillion, a figure expected to climb to $8.1 trillion by 2026, according to Statista. This expansion directly fuels the need for robust payment processing infrastructure, a core offering of ACI Worldwide.

The widespread adoption of digital wallets further accelerates this trend. By the end of 2024, it's estimated that over 2.5 billion people worldwide will use a digital wallet, with this number anticipated to exceed 3 billion by 2027. This shift in consumer behavior creates a substantial market opportunity for ACI Worldwide's payment solutions, which are designed to handle the increasing volume and complexity of digital transactions.

Inflation and interest rate shifts significantly shape the economic landscape for companies like ACI Worldwide. For instance, in early 2024, inflation remained a persistent concern in many developed economies, though showing signs of moderation from 2023 peaks. This can impact consumer disposable income, potentially leading to reduced spending on discretionary services, which might indirectly affect transaction volumes processed by ACI's clients.

Rising interest rates, a common response to elevated inflation, increase the cost of borrowing for businesses. This could prompt financial institutions and retailers to scrutinize IT investments, potentially extending sales cycles or renegotiating contract terms for software and payment processing solutions offered by ACI. For example, in the US, the Federal Reserve maintained its benchmark interest rate in the 5.25%-5.50% range through mid-2024, a level not seen in over two decades, reflecting a tighter monetary policy environment.

Financial Inclusion Initiatives

Financial inclusion initiatives are significantly expanding access to formal financial services, with real-time payment systems playing a crucial role. These systems are onboarding millions into the banking ecosystem, creating new customer bases and transaction volumes. For instance, by the end of 2024, it's projected that over 70% of the global population will have access to digital payment systems, a substantial increase from previous years.

This growth directly translates into new revenue streams for financial institutions and technology providers like ACI Worldwide. As more individuals and small businesses participate in the digital economy, the demand for robust, secure, and efficient payment processing solutions intensifies. ACI Worldwide's platforms are essential for enabling these inclusive payment infrastructures.

Key impacts of these initiatives include:

- Increased Digital Transaction Volumes: As more people gain access, the sheer volume of digital payments processed is expected to surge, benefiting payment technology providers.

- Expanded Customer Base for Financial Services: Millions of previously unbanked individuals are entering the formal financial system, creating a larger addressable market.

- Growth in Demand for Real-Time Payment Infrastructure: The push for financial inclusion necessitates advanced payment technologies, directly supporting companies like ACI Worldwide.

- Enhanced Economic Participation: Greater financial access empowers individuals and small businesses, fostering broader economic activity and digital commerce.

Competition and Pricing Pressures

The payments sector is intensely competitive, with a constant influx of new entrants and rapidly advancing technologies. This dynamic environment forces companies like ACI Worldwide to prioritize innovation and maintain competitive pricing structures. Such pressures can directly influence revenue streams and profit margins, even within a growing market.

ACI Worldwide navigates a landscape where established financial institutions, fintech startups, and technology giants all vie for market share. This competition intensifies pricing pressures, as customers expect increasingly sophisticated payment solutions at affordable rates. For instance, the global digital payments market was valued at approximately $8.3 trillion in 2023 and is projected to reach $18.5 trillion by 2030, indicating robust growth but also highlighting the fierce competition for a piece of this expanding pie.

- Intensified Competition: The payments industry is characterized by a crowded market with both traditional players and agile fintech disruptors.

- Pricing Sensitivity: Customers demand advanced payment features at competitive price points, impacting ACI Worldwide's margin potential.

- Innovation Imperative: Continuous investment in new technologies and services is crucial to stay ahead, adding to operational costs.

- Market Share Dynamics: Aggressive pricing and feature differentiation are key strategies for capturing and retaining market share in this vibrant sector.

Economic factors significantly influence ACI Worldwide's operational environment, driven by robust growth in digital payments and e-commerce. The global digital payments market is expanding rapidly, projected to reach $18.5 trillion by 2030, up from $8.3 trillion in 2023, highlighting a substantial opportunity for payment technology providers like ACI. This expansion is further bolstered by the increasing adoption of digital wallets, with over 2.5 billion users expected globally by the end of 2024, creating a larger addressable market for ACI's solutions. However, economic headwinds such as inflation and rising interest rates, exemplified by the US Federal Reserve's sustained benchmark rate of 5.25%-5.50% through mid-2024, can impact client spending on IT investments and potentially affect transaction volumes. Financial inclusion initiatives are also a key economic driver, expanding access to digital payments and onboarding millions into the formal financial system, which directly benefits companies facilitating these transactions.

| Economic Factor | 2023 Value | 2024 Projection/Status | Impact on ACI Worldwide |

|---|---|---|---|

| Global Digital Payments Market | $8.3 Trillion | Projected to reach $18.5 Trillion by 2030 | Significant growth opportunity for payment solutions |

| Global E-commerce Sales | ~$7.0 Trillion | Projected to reach $8.1 Trillion by 2026 | Increased demand for payment processing infrastructure |

| Digital Wallet Users | ~2.5 Billion | Projected to exceed 3 Billion by 2027 | Expansion of customer base for digital transaction services |

| US Federal Reserve Benchmark Interest Rate | 5.25%-5.50% (through mid-2024) | Sustained higher rates | Potential impact on client IT spending and transaction volumes |

Preview the Actual Deliverable

ACI Worldwide PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of ACI Worldwide delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic direction.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You’ll gain a clear understanding of the external forces shaping ACI Worldwide’s business landscape, enabling more informed decision-making.

The content and structure shown in the preview is the same document you’ll download after payment. It provides a detailed breakdown of each PESTLE element, offering actionable insights into potential opportunities and threats for ACI Worldwide.

Sociological factors

Consumers are increasingly favoring digital and contactless payment methods, prioritizing speed and ease of use. This societal trend directly fuels ACI Worldwide's growth, as its platforms facilitate the seamless, mobile-centric, and intelligent payment experiences that are now the norm. For example, in 2024, global digital payment transaction volumes were projected to exceed $10 trillion, underscoring this significant consumer shift.

Consumers are increasingly relying on their smartphones for all digital interactions, including payments. This shift means mobile devices are no longer just an accessory but the primary gateway to financial services for a significant portion of the population. For instance, in 2024, global mobile payment transaction volume was projected to exceed $15 trillion, highlighting this trend's scale.

ACI Worldwide needs to prioritize a robust mobile-first strategy to remain competitive. This involves not only ensuring their payment processing solutions are fully optimized for mobile but also actively integrating with popular mobile wallets and staying ahead of emerging mobile payment technologies like QR code payments and in-app purchases. By 2025, it's estimated that over 85% of all new payment applications will be designed with a mobile-first approach.

As digital transactions surge, so does public vigilance against payment fraud, especially concerning complex scams like Authorized Push Payment (APP) fraud. This heightened societal awareness directly impacts the demand for advanced security measures.

ACI Worldwide's AI-powered fraud prevention capabilities are a critical response to this growing concern, serving as a core value proposition for their clientele in the evolving financial landscape.

Demand for Financial Inclusion and Accessibility

Societies worldwide are increasingly prioritizing financial inclusion, pushing for wider access to affordable and efficient financial services. This trend is particularly evident in emerging markets where a significant portion of the population remains unbanked or underbanked. ACI Worldwide plays a crucial role in this shift by enabling real-time payment infrastructures, which are instrumental in formalizing cash-heavy economies and extending the reach of formal banking services to underserved communities.

The expansion of real-time payment networks directly addresses the demand for greater financial accessibility. For instance, by mid-2024, over 70 countries had launched or were in the process of launching instant payment systems, facilitating billions of transactions monthly. This infrastructure allows individuals, even those without traditional bank accounts, to participate more fully in the digital economy, receive payments promptly, and access essential financial tools.

- Growing Demand: Surveys in 2024 indicated that over 60% of adults in developing economies expressed a desire for easier access to digital financial services.

- ACI's Contribution: ACI's solutions power many of these new real-time payment rails, enabling faster, cheaper, and more convenient transactions for millions.

- Formalization of Economies: The shift from cash to digital transactions, facilitated by these systems, helps governments track economic activity and reduce the informal economy.

- Global Adoption: By the end of 2025, it's projected that over 100 countries will have operational real-time payment systems, further embedding financial inclusion globally.

Generational Shifts in Payment Habits

Generational differences significantly shape payment behaviors, with younger consumers, particularly Gen Z, increasingly favoring digital and innovative solutions. This demographic shows a marked preference for methods like Buy Now Pay Later (BNPL) services, which offer immediate gratification and flexible repayment options. For instance, a 2024 report indicated that BNPL usage among individuals under 30 had surged by 25% compared to the previous year.

ACI Worldwide must actively adapt to these evolving generational preferences to remain competitive. Catering to a spectrum of payment methods, from traditional card transactions to emerging digital wallets and BNPL, is crucial. The company's continued investment in technology to support seamless, user-friendly experiences across these diverse payment types will be key to capturing a broader market share.

- Gen Z and Millennial Adoption: Younger generations are leading the charge in adopting alternative payment methods.

- BNPL Growth: Buy Now Pay Later services are experiencing rapid expansion, driven by younger consumer demand.

- Digital First Approach: ACI Worldwide needs to prioritize digital payment solutions to meet generational expectations.

- User Experience is Key: Offering intuitive and convenient payment experiences across all channels is paramount.

Societal shifts towards digital and contactless payments are a major boon for ACI Worldwide, aligning with consumer demand for speed and convenience. The increasing reliance on smartphones for all financial activities, including payments, further solidifies the need for mobile-first solutions. For instance, global mobile payment transaction volume was projected to exceed $15 trillion in 2024, underscoring this trend's scale.

Growing public concern over payment fraud, particularly Authorized Push Payment (APP) fraud, drives demand for advanced security. ACI Worldwide's AI-powered fraud prevention capabilities directly address this societal vigilance, serving as a key value proposition. In 2024, fraud detection and prevention spending by financial institutions globally was expected to reach over $40 billion.

The global push for financial inclusion, especially in emerging markets, creates significant opportunities. ACI Worldwide's role in enabling real-time payment infrastructures is crucial for formalizing economies and extending financial services to underserved populations. By mid-2024, over 70 countries had launched instant payment systems, facilitating billions of transactions monthly.

Generational preferences, with younger consumers favoring digital and innovative payment methods like Buy Now Pay Later (BNPL), also influence the market. A 2024 report showed BNPL usage among those under 30 surged by 25%. ACI Worldwide's ability to support diverse payment types, from cards to digital wallets and BNPL, is vital for capturing this demographic.

Technological factors

The global push for real-time payments is accelerating, with the U.S. launching FedNow in July 2023 and Europe's Instant Payments Regulation driving adoption. These advancements directly impact ACI Worldwide, as their business thrives on enabling these instant transaction capabilities.

ACI Worldwide's solutions are designed to process these high-volume, rapid transactions efficiently. For instance, in 2023, ACI reported significant growth in its digital payments segment, partly fueled by the increasing demand for instant payment processing infrastructure.

Artificial intelligence (AI) and machine learning (ML) are fundamentally changing how fraud is detected, allowing for immediate identification and blocking of illicit transactions. ACI Worldwide is actively incorporating these advanced technologies, embedding self-learning AI algorithms into its fraud management systems to counter evolving cyber threats and authorized push payment (APP) scams.

For instance, in 2024, the global cost of financial fraud was projected to exceed $48 billion, highlighting the urgent need for sophisticated prevention tools. ACI's solutions leverage AI to analyze vast datasets in real-time, identifying anomalous patterns that signal fraudulent behavior far more effectively than traditional rule-based systems.

The financial industry's move to cloud-native payment platforms and Open Banking APIs represents a significant technological shift. ACI Worldwide's ACI Connetic platform exemplifies this, offering a scalable and cost-efficient approach to payments. This architecture is designed for agility, allowing for quicker adaptation to evolving market demands and regulatory changes.

Open Banking APIs are fundamentally changing how financial institutions interact, fostering innovation and competition. ACI Worldwide's strategic partnerships leverage these APIs to create integrated payment solutions, enhancing their ability to connect with a wider range of services and data sources. This integration is crucial for delivering seamless customer experiences in the digital age.

Cybersecurity Threats and Data Protection

Cybersecurity threats are escalating, with ransomware and sophisticated phishing attacks becoming daily concerns for the digital payments sector. ACI Worldwide, as a key player, faces the constant challenge of protecting its infrastructure and client data from these evolving dangers. This necessitates ongoing, substantial investment in advanced security measures and stringent data protection protocols to maintain operational integrity and client confidence.

The financial services industry, including digital payment providers like ACI Worldwide, experienced a significant surge in cyberattacks. For instance, reports from 2023 indicated a substantial increase in ransomware incidents targeting financial institutions globally. ACI Worldwide's commitment to cybersecurity is therefore not just a technical requirement but a fundamental pillar of its business model, directly impacting its reputation and ability to operate.

- Increasing Threat Landscape: Cybercriminals are employing more advanced tactics, making detection and prevention more complex.

- Data Protection Imperative: Safeguarding sensitive financial information is paramount to maintaining customer trust and regulatory compliance.

- Investment in Security: Continuous upgrades to cybersecurity infrastructure and employee training are critical for ACI Worldwide.

Emergence of New Payment Technologies (e.g., CBDCs, Biometrics)

The payments ecosystem is rapidly evolving with the introduction of technologies like Central Bank Digital Currencies (CBDCs) and advanced biometric authentication methods. ACI Worldwide must actively track and potentially incorporate these advancements to maintain its competitive edge and adapt to emerging payment preferences. For instance, as of early 2024, several countries, including China with its digital yuan, are actively piloting CBDCs, signaling a significant shift in how digital transactions could be conducted.

Emerging payment methods, such as contactless wearables and sophisticated biometric scanners, are also reshaping consumer behavior. ACI Worldwide's ability to integrate these innovations will be crucial for offering seamless and secure transaction experiences. By 2025, it's projected that biometric payment authentication could see widespread adoption, with studies indicating a significant increase in consumer comfort with using fingerprints or facial recognition for purchases.

- CBDC Development: Over 130 countries were exploring or had launched CBDCs by late 2023, impacting traditional payment rails.

- Biometric Adoption: Juniper Research forecasts that the value of transactions secured by biometrics will exceed $3 trillion globally by 2026.

- Wearable Payments: The market for payment-enabled wearables is expected to grow substantially, offering new avenues for ACI Worldwide to support.

Technological advancements are reshaping the payments landscape, with real-time payment systems like FedNow and Europe's Instant Payments Regulation driving demand for ACI Worldwide's processing capabilities. The company's 2023 performance reflected this, showing growth in its digital payments segment due to this increased need for instant transaction infrastructure.

AI and machine learning are crucial for fraud detection, with ACI integrating these technologies to combat evolving threats like APP scams. Given that global financial fraud costs were projected to exceed $48 billion in 2024, ACI's AI-powered solutions are vital for real-time pattern analysis and fraud prevention.

The shift towards cloud-native platforms and Open Banking APIs, exemplified by ACI Worldwide's ACI Connetic platform, offers scalability and agility. This allows for quicker adaptation to market changes and regulatory shifts, enhancing ACI's ability to integrate with a broader financial ecosystem through API partnerships.

Emerging technologies like Central Bank Digital Currencies (CBDCs) and biometrics present new opportunities and challenges. With over 130 countries exploring CBDCs by late 2023 and biometric payment authentication projected for widespread adoption by 2025, ACI must adapt to these evolving payment preferences to maintain its competitive edge.

Legal factors

ACI Worldwide's payment solutions are significantly shaped by European regulations such as PSD2 and the anticipated PSD3. These directives mandate stricter fraud prevention measures and stronger customer authentication protocols, directly influencing ACI's product development for the European market.

The ongoing evolution of these payment service directives, including the potential for PSD3 to further refine licensing and operational requirements for payment service providers, necessitates continuous adaptation from ACI Worldwide. This regulatory landscape directly impacts the design and implementation of their payment processing technologies.

Global data privacy regulations, like the EU's General Data Protection Regulation (GDPR) and the EU-U.S. Data Privacy Framework (DPF), impose stringent rules on how companies handle personal information. ACI Worldwide must navigate these evolving legal landscapes to ensure its software and operations comply, safeguarding customer data and avoiding significant fines. For instance, GDPR violations can result in penalties of up to 4% of annual global revenue or €20 million, whichever is higher, emphasizing the critical need for robust compliance measures.

Financial institutions and their technology partners, like ACI Worldwide, operate under strict anti-money laundering (AML) regulations and sanctions screening mandates. ACI's software is crucial for clients to conduct immediate sanctions checks, ensuring they adhere to rules aimed at preventing financial crime, a necessity amplified by the rise of instant payment systems.

Fraud Liability Shifts and Consumer Protection Laws

Governments and regulators are tightening their grip on fraud liability, especially concerning Authorized Push Payment (APP) scams. This means banks face increased accountability for fraud-related losses, a trend that intensified significantly in 2024 and is projected to continue. For instance, the UK's Payment Systems Regulator (PSR) has mandated that payment service providers reimburse victims of APP fraud within 24 hours, a policy that came into effect in October 2024, impacting millions of consumers and businesses.

ACI Worldwide's advanced fraud prevention technologies are therefore vital for its clients. These solutions help financial institutions not only to mitigate the financial impact of these growing liabilities but also to ensure they are compliant with these increasingly stringent consumer protection laws. The company's ability to offer robust fraud detection and prevention is a key selling point in this evolving regulatory landscape.

- Increased Regulatory Scrutiny: Regulators worldwide are imposing stricter penalties on financial institutions for failing to prevent fraud, particularly APP scams.

- Consumer Protection Mandates: New laws and regulations, like the UK's APP fraud reimbursement scheme, prioritize consumer protection, forcing banks to absorb more fraud losses.

- ACI's Role in Compliance: ACI Worldwide's fraud prevention tools are essential for banks to meet these enhanced consumer protection requirements and avoid significant financial penalties.

Cross-Border Regulatory Harmonization Efforts (e.g., ISO 20022)

The global financial landscape is increasingly focused on standardizing payment messaging, with a significant milestone being the full migration to ISO 20022 by November 2025. This widespread adoption necessitates substantial adjustments for payment technology providers like ACI Worldwide.

ACI Worldwide's preparedness for the ISO 20022 mandate is crucial for its continued success in facilitating smooth cross-border transactions. Failure to comply could impact its ability to serve clients engaging in international payments.

- ISO 20022 Adoption Timeline: The final deadline for full migration to ISO 20022 is November 2025, impacting all payment systems globally.

- Impact on Cross-Border Payments: Harmonized standards aim to improve the efficiency, transparency, and data richness of international financial transactions.

- ACI Worldwide's Role: Ensuring ACI Worldwide's platforms are fully compliant is essential for maintaining its competitive edge and supporting client needs in a standardized payment environment.

The increasing focus on combating Authorized Push Payment (APP) fraud, with the UK mandating reimbursement for victims from October 2024, places significant legal pressure on financial institutions. This regulatory shift requires payment providers like ACI Worldwide to offer robust fraud prevention solutions to help their clients meet these new consumer protection obligations and avoid substantial penalties. Consequently, ACI's ability to deliver advanced fraud detection and mitigation capabilities is paramount for maintaining client trust and compliance in the evolving payment ecosystem.

Environmental factors

There's a significant and increasing demand from investors, customers, and employees for businesses to actively engage in and transparently report on Environmental, Social, and Governance (ESG) practices. This trend is reshaping corporate priorities and influencing investment decisions across various sectors.

ACI Worldwide is responding to this pressure by regularly publishing sustainability reports. These reports detail the company's dedication to minimizing its environmental impact, such as through energy efficiency initiatives and waste reduction programs, and fostering responsible business conduct throughout its operations.

For instance, in its 2023 sustainability report, ACI Worldwide highlighted a 15% reduction in its Scope 1 and Scope 2 greenhouse gas emissions compared to its 2020 baseline, demonstrating tangible progress in its environmental stewardship efforts.

ACI Worldwide, as a software company deeply integrated with data centers and cloud services, faces significant environmental considerations tied to its energy consumption. The IT sector's growing emphasis on sustainability means ACI must actively manage its power usage.

Globally, data centers are major energy consumers, accounting for an estimated 1% to 1.5% of total global electricity consumption. By 2025, this figure is projected to rise, making energy efficiency a critical operational focus for companies like ACI.

ACI can mitigate its environmental footprint by optimizing its IT operations and embracing green cloud initiatives. For instance, adopting cloud providers committed to renewable energy sources, such as those powered by wind or solar, can significantly reduce ACI's carbon impact.

ACI Worldwide's core business of facilitating electronic payments directly supports environmental sustainability by minimizing paper-based transactions and bills. This shift away from paper aligns with global efforts to conserve natural resources and combat climate change, as evidenced by the growing adoption of digital payment methods worldwide.

The ongoing digitalization trend is crucial for ACI Worldwide. In 2024, the global digital payments market was valued at over $2.5 trillion and is projected to grow significantly, indicating a strong demand for paperless solutions. This expansion underscores ACI's role in enabling more eco-friendly financial practices.

Climate Change Resiliency and Adaptation

While ACI Worldwide doesn't face direct physical climate risks to its own facilities, the increasing severity and frequency of extreme weather events worldwide pose a significant indirect threat. These events can disrupt the operational resilience of the data centers and network infrastructure that power its mission-critical payment systems. For instance, the widespread power outages and infrastructure damage caused by hurricanes in 2023 highlighted the vulnerabilities in global connectivity.

As a provider of essential financial infrastructure, ACI Worldwide's disaster recovery and business continuity strategies must proactively incorporate climate-related disruptions. This includes ensuring robust backup power solutions, geographically diverse data center locations, and comprehensive contingency plans that can withstand prolonged outages or widespread network failures stemming from climate events. The company's commitment to service availability, especially during periods of heightened economic activity like the holiday season, makes this crucial.

- Operational Resilience: Extreme weather events can impact third-party data centers and network providers, potentially affecting ACI Worldwide's service delivery.

- Business Continuity: Robust disaster recovery plans are essential to maintain uninterrupted payment processing, even when faced with climate-induced infrastructure failures.

- Client Impact: Disruptions to ACI Worldwide's services can have cascading effects on financial institutions and their customers, underscoring the importance of climate preparedness.

Supply Chain Sustainability

ACI Worldwide recognizes the importance of supply chain sustainability as a core component of its Environmental, Social, and Governance (ESG) strategy. The company actively seeks to partner with suppliers who demonstrate a commitment to responsible environmental practices. This focus helps build a more sustainable operational ecosystem, aligning with global efforts to reduce environmental impact.

ACI Worldwide's approach to supply chain sustainability involves rigorous supplier engagement. They encourage and, where possible, require suppliers to adopt environmentally sound practices. This collaborative effort aims to ensure that ACI's entire value chain contributes positively to environmental stewardship. For instance, in 2024, ACI continued its initiatives to assess and improve the environmental performance of its key suppliers, with a target to increase the number of suppliers meeting specific sustainability criteria by 15% by the end of 2025.

- Supplier Environmental Audits: ACI Worldwide conducts regular assessments of its suppliers' environmental performance, focusing on areas like waste management, energy consumption, and emissions.

- Sustainable Sourcing Policies: The company has implemented policies that prioritize sourcing from suppliers with strong environmental certifications and track records.

- Collaboration on Green Initiatives: ACI engages with its supply chain partners to identify and implement joint initiatives aimed at reducing carbon footprints and promoting circular economy principles.

- Transparency and Reporting: ACI Worldwide is committed to increasing transparency in its supply chain sustainability efforts, reporting on progress and challenges in its annual ESG reports.

ACI Worldwide's environmental strategy centers on reducing its operational carbon footprint, particularly through energy efficiency in data centers and promoting digital transactions. The company's commitment to sustainability is reflected in its 2023 report, which detailed a 15% reduction in Scope 1 and 2 greenhouse gas emissions against a 2020 baseline.

The increasing global reliance on digital payments, valued at over $2.5 trillion in 2024, directly supports ACI's role in reducing paper-based transactions and their associated environmental impact. Furthermore, ACI is actively engaged in enhancing supply chain sustainability, aiming to increase suppliers meeting specific environmental criteria by 15% by the end of 2025.

While ACI does not face direct physical climate risks, extreme weather events pose indirect threats to its operational resilience by impacting third-party data centers and network infrastructure. Robust disaster recovery and business continuity plans are therefore crucial for maintaining uninterrupted payment processing services.

PESTLE Analysis Data Sources

Our PESTLE analysis for ACI Worldwide is built upon a robust foundation of data sourced from reputable financial news outlets, official government publications detailing regulatory changes, and leading technology research firms. This comprehensive approach ensures that each aspect of the macro-environment is informed by current and credible information.