ACI Worldwide Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ACI Worldwide Bundle

ACI Worldwide operates in a dynamic payments landscape, facing moderate threats from new entrants and intense rivalry among established players. Understanding the leverage of buyers and suppliers is crucial for ACI's strategic positioning.

The complete report reveals the real forces shaping ACI Worldwide’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers for ACI Worldwide is significantly shaped by the concentration of providers offering specialized technology. For instance, if ACI relies on a limited number of firms for its core real-time payment processing software or advanced fraud detection algorithms, these suppliers gain considerable leverage. This is particularly true in niche markets where developing comparable technology is complex and time-consuming, as demonstrated by the ongoing demand for specialized fintech infrastructure.

ACI Worldwide's reliance on specialized talent, such as payment system architects and cybersecurity experts, directly influences supplier bargaining power. In 2024, the tech sector continued to face a significant shortage of qualified cybersecurity professionals, with estimates suggesting a global deficit of over 3 million by the end of the year, according to industry reports.

This scarcity empowers skilled individuals and specialized recruitment firms. When the availability of such talent is limited, these suppliers can command higher wages and more favorable contract terms, directly impacting ACI Worldwide's operational costs and project execution timelines.

ACI Worldwide's reliance on specialized software and payment processing solutions means that switching vendors can be a complex and costly undertaking. High switching costs, stemming from integration challenges, data migration, and the need for retraining staff, significantly enhance the bargaining power of ACI's technology suppliers. For instance, if a core payment gateway provider were to increase prices, ACI might find it prohibitively expensive to move to a competitor, thus granting the incumbent supplier greater leverage.

Uniqueness of Supplier Offerings

Suppliers providing highly unique or custom solutions that are deeply embedded within ACI Worldwide's essential products wield considerable influence. When these specialized offerings prove challenging to reproduce or find replacements for, ACI's dependence on these particular vendors increases, potentially resulting in escalated expenses or less advantageous contract conditions.

For instance, in the fast-evolving payments technology sector, a supplier of a highly specialized fraud detection algorithm, critical to ACI's core platform, would possess significant bargaining power. If ACI Worldwide cannot easily integrate an alternative solution due to the complexity and proprietary nature of the existing one, this supplier can command higher prices or dictate terms. While specific financial data on ACI's supplier dependencies for proprietary components isn't publicly detailed, the industry trend in fintech highlights the strategic importance of such integrations. Many fintech companies, including those in ACI's space, reported increased R&D investment in 2024, partly to secure or develop unique technological capabilities, underscoring the value placed on specialized inputs.

- Proprietary Technology: Suppliers with patented or trade-secret technology that ACI relies on have strong leverage.

- Integration Depth: The more deeply a supplier's product is woven into ACI's offerings, the harder it is to switch.

- Limited Alternatives: A scarcity of comparable suppliers amplifies the power of existing ones.

- Supplier Concentration: If only a few suppliers offer a critical component, their bargaining power is enhanced.

Threat of Forward Integration by Suppliers

A supplier's potential to integrate forward and compete directly with ACI Worldwide significantly amplifies their bargaining power. This threat arises when a supplier, currently providing a crucial component or service to ACI, decides to develop and offer its own comprehensive payment orchestration platforms. Such a move would transform them from a partner into a direct competitor, potentially eroding ACI's market share and forcing ACI to concede to more favorable terms.

For example, a key provider of payment processing technology could leverage its existing infrastructure and expertise to build a competing end-to-end solution. This would directly challenge ACI's core business, forcing ACI to either compete with a more integrated offering or risk losing business to its former supplier. The financial implications for ACI could be substantial, impacting revenue streams and requiring strategic adjustments to maintain its competitive edge.

- Forward Integration Threat: Suppliers can become competitors by offering full payment solutions.

- Market Share Impact: Direct competition can reduce ACI Worldwide's existing market share.

- Leveraging Expertise: Suppliers can use their existing technical knowledge to build competing platforms.

The bargaining power of suppliers for ACI Worldwide is notably influenced by the concentration of providers offering specialized technology, particularly in niche fintech areas. When ACI relies on a limited number of firms for critical components like real-time payment processing software or advanced fraud detection, these suppliers gain significant leverage, especially given the complexity and time investment required to develop comparable alternatives.

The scarcity of specialized talent, such as cybersecurity experts and payment system architects, further empowers suppliers. In 2024, the global tech sector, particularly cybersecurity, faced a substantial talent deficit, estimated at over 3 million professionals. This shortage allows specialized recruitment firms and highly skilled individuals to command higher rates and more favorable contract terms, directly impacting ACI's operational costs.

ACI's dependence on deeply integrated, proprietary solutions from vendors also strengthens supplier power. High switching costs, associated with integration, data migration, and retraining, make it difficult for ACI to change providers, granting incumbents greater leverage. For instance, if a key payment gateway supplier increases prices, ACI may find the cost of switching prohibitive, reinforcing the supplier's influence.

Suppliers capable of forward integration, meaning they could develop and offer their own competing payment orchestration platforms, pose a significant threat. This potential competition can erode ACI's market share and force concessions on pricing or contract terms, as suppliers leverage their existing infrastructure and expertise to challenge ACI directly.

| Factor | Impact on ACI Worldwide | Example/Data Point (2024) |

|---|---|---|

| Supplier Concentration | High leverage for few providers | Limited specialized fintech infrastructure providers |

| Talent Scarcity | Increased costs for specialized skills | Global cybersecurity talent deficit > 3 million |

| Switching Costs | Reduced ACI flexibility | Complex integration of core payment gateway software |

| Forward Integration Threat | Potential direct competition | Suppliers offering end-to-end payment solutions |

What is included in the product

This analysis delves into the competitive forces impacting ACI Worldwide, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the payments software industry.

Instantly identify and mitigate competitive threats with a comprehensive, actionable analysis of ACI Worldwide's market landscape.

Customers Bargaining Power

Customers of ACI Worldwide, such as banks and major retailers, encounter substantial costs and complexities when considering a switch from ACI's payment processing software. These switching costs stem from the deep integration of ACI's solutions into a customer's existing financial and operational systems, making a migration a significant undertaking.

The sheer magnitude of time, financial resources, and technical expertise needed to transition to a new payment infrastructure creates considerable inertia for these clients. This deep integration and the critical nature of payment systems mean that once a customer is onboarded with ACI, their ability to negotiate aggressively on price or terms is diminished due to the high barriers to exit.

ACI Worldwide's customer base is heavily concentrated among large financial institutions and major retailers. This means that a single client can account for a significant percentage of ACI's overall revenue. For instance, in 2023, ACI Worldwide reported that its top 10 customers represented approximately 30% of its total revenue, highlighting the substantial reliance on a few key accounts.

The sheer size and concentration of these clients grant them considerable bargaining power. They can leverage their importance to ACI to negotiate for customized software features, seek reduced pricing structures, or demand more advantageous contract terms. This dynamic directly impacts ACI's pricing flexibility and its ability to maintain high-profit margins on these crucial relationships.

ACI Worldwide's payment infrastructure is absolutely vital for its clients' day-to-day operations, handling everything from processing transactions to stopping fraud. Because these services are so essential, customers tend to focus more on how reliable and secure the solutions are, rather than just the price. This means they're often willing to pay a premium for ACI's proven track record, which naturally limits their ability to bargain down prices.

Availability of Alternative Solutions

The availability of alternative solutions significantly amplifies customer bargaining power for companies like ACI Worldwide. With numerous competitors offering comparable real-time electronic payment, fraud prevention, and online banking services, customers have a strong position to negotiate better pricing and service agreements. This competitive landscape allows clients to readily switch providers if ACI Worldwide's offerings do not meet their expectations or if rivals present more attractive terms.

For instance, the global digital payment market is highly competitive. In 2024, the market size was estimated to be over $2.5 trillion, with projections showing continued robust growth. This expansion is fueled by a multitude of players, from established financial institutions to agile fintech startups, all vying for market share. This broad ecosystem of providers means customers, especially large enterprises, can leverage multiple options to secure favorable contracts.

- High Market Competition: The presence of numerous providers in the payment solutions sector intensifies customer leverage.

- Customer Switching Costs: While ACI Worldwide's solutions can be integrated, the availability of alternatives with potentially lower switching costs empowers customers.

- Price Sensitivity: In a market with many similar offerings, customers are more likely to prioritize price, forcing providers to remain competitive.

- Innovation Pressure: The need to retain customers in a crowded market compels companies like ACI Worldwide to continuously innovate and improve their service offerings.

Customer's Ability to Integrate In-House

The bargaining power of customers for ACI Worldwide is influenced by their ability to integrate payment solutions in-house. Large financial institutions and technologically advanced retailers often have the capital and technical know-how to develop their own payment processing and fraud detection systems. This capability, though resource-intensive, acts as a significant check on ACI's pricing power.

For instance, while developing proprietary systems can cost millions, the potential savings and customization offered by in-house solutions can be compelling for major players. This threat of disintermediation, even if not fully realized, forces ACI to remain competitive and responsive to customer demands for value and flexibility.

Consider the scale of operations for major banks; they manage billions in transactions annually. The cost-benefit analysis of building an in-house payment infrastructure versus outsourcing to a provider like ACI is a constant consideration. In 2024, the trend towards greater control over data and customer experience continues to drive interest in such internal capabilities.

- Customer Integration Capability: Large financial institutions and tech-savvy retailers can potentially develop payment processing and fraud prevention systems internally.

- Cost of In-House Development: While expensive, the long-term cost savings and customization of in-house solutions can be a powerful incentive for major clients.

- Pricing Ceiling: The latent threat of customers bringing functionality in-house limits ACI Worldwide's ability to command premium pricing.

- Market Dynamics: The ongoing drive for data control and enhanced customer experience in 2024 fuels the consideration of in-house payment solution development among large enterprises.

Customers of ACI Worldwide, particularly large banks and retailers, possess significant bargaining power due to the competitive landscape and their own capabilities. The availability of numerous alternative payment solution providers means clients can readily compare offerings and negotiate favorable terms, as seen in the over $2.5 trillion global digital payment market in 2024.

While switching costs are a factor, the threat of customers developing in-house payment systems, though costly, acts as a ceiling on ACI's pricing power. This potential for disintermediation, driven by a desire for data control and enhanced customer experience in 2024, forces ACI to remain competitive.

| Factor | Impact on ACI Worldwide | Customer Leverage |

|---|---|---|

| Market Competition | Forces competitive pricing and service | High due to numerous alternatives |

| Switching Costs | Creates customer inertia | Moderate, but mitigated by alternative offerings |

| In-House Development Threat | Limits pricing flexibility | High for large, capable clients |

| Customer Concentration | Increases reliance on key accounts | High for top customers (e.g., ~30% of revenue from top 10 in 2023) |

What You See Is What You Get

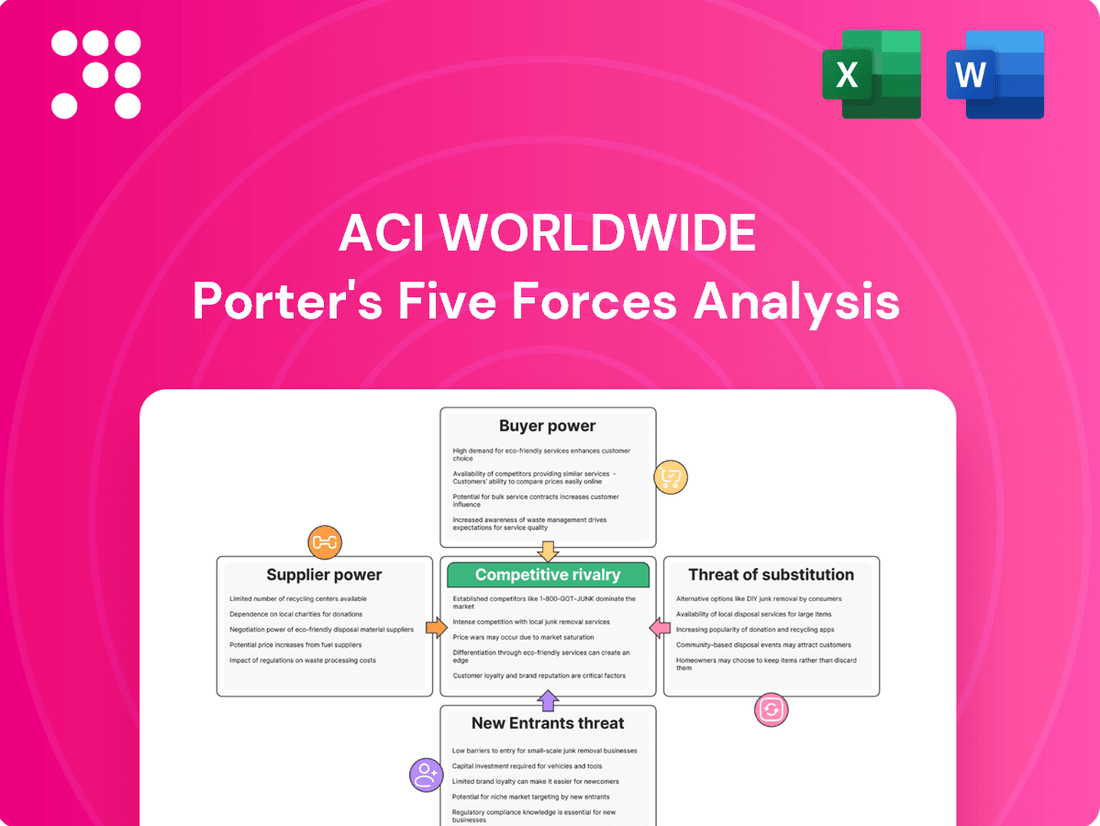

ACI Worldwide Porter's Five Forces Analysis

This preview showcases the comprehensive ACI Worldwide Porter's Five Forces Analysis, reflecting the exact document you'll receive immediately after purchase. You're looking at the actual, fully formatted analysis, providing an in-depth examination of competitive forces within the payments industry. Once you complete your purchase, you’ll get instant access to this exact file, ready for immediate use and strategic decision-making.

Rivalry Among Competitors

The digital payments sector is booming, with real-time payments and fraud prevention seeing significant expansion. This rapid growth, projected to reach $2.4 trillion by 2027 according to Statista, naturally fuels intense competition as companies battle for dominance.

ACI Worldwide thrives in this fast-paced landscape. Staying ahead requires constant innovation in technologies like AI and blockchain, as demonstrated by ACI's recent advancements in real-time fraud detection, which saw a 20% improvement in false positive rates for a major European bank in Q1 2024.

The electronic payments software market is quite crowded. Think of it like a busy marketplace with many different kinds of sellers. You have big, well-known companies that have been around for a while, plus newer, nimble fintech startups, and even giant tech firms jumping in. This fragmentation means ACI Worldwide is up against a wide array of rivals.

ACI Worldwide’s competitors aren't all the same. They include other companies that sell enterprise software, businesses that process payments directly, and those that specialize in financial technology. This diversity creates a highly competitive environment, not just for winning new business contracts, but also for attracting skilled employees. For instance, in 2023, the global digital payments market was valued at over $1.5 trillion and is projected to grow significantly, indicating a large but intensely contested space.

Developing and maintaining cutting-edge payment software demands massive upfront spending on research, infrastructure, and regulatory adherence. For instance, companies in this space often invest hundreds of millions of dollars annually in R&D alone.

These considerable fixed costs, coupled with the highly specialized nature of the technology and customer relationships, erect substantial barriers to exiting the market. This means established players, including ACI Worldwide, are driven to compete fiercely to maintain their market share and recoup these significant investments, even when the market experiences slower growth.

Product Differentiation and Switching Costs

ACI Worldwide’s competitive landscape is shaped by how effectively it differentiates its offerings. Competitors can gain an edge by providing unique features, a smoother user experience, or highly specialized solutions, thereby intensifying rivalry.

While ACI’s customers face significant switching costs, ongoing innovation from rivals means ACI must consistently improve its products. This is crucial to prevent customers from being enticed away by compelling new offerings from competitors.

- Differentiated Offerings: Competitors may focus on niche markets or specialized functionalities, creating unique value propositions.

- User Experience: A superior, intuitive user interface can be a powerful differentiator, even for less feature-rich solutions.

- Innovation Pressure: The need to match or surpass competitor advancements means ACI must invest heavily in R&D to maintain its market position.

- Customer Retention: High switching costs are a buffer, but continuous product enhancement is vital to proactively reduce churn.

Regulatory Landscape and Compliance Demands

The payments industry operates under a dense web of regulations, making compliance a significant competitive battleground. Companies like ACI Worldwide must continuously adapt their offerings to meet evolving global and local mandates such as PCI DSS for payment card security and GDPR for data privacy. This ongoing investment in compliance acts as a substantial barrier for new entrants, while simultaneously intensifying competition among existing players who must demonstrate robust adherence to these standards.

ACI Worldwide's commitment to regulatory adherence is a core aspect of its competitive strength. For instance, in 2024, the company likely continued to invest in solutions that support real-time payment regulations and open banking initiatives, which are becoming increasingly prevalent worldwide. These investments are not just about avoiding penalties; they are about building trust and ensuring the reliability of their payment processing platforms, a crucial differentiator in a market where security and integrity are paramount.

- Regulatory Complexity: Navigating diverse and changing regulations like PSD2 (Payment Services Directive 2) in Europe and similar frameworks in North America and Asia demands significant resources.

- Compliance as a Differentiator: Companies that excel in compliance, offering solutions that simplify regulatory burdens for their clients, gain a competitive edge.

- Investment in Security Standards: Maintaining certifications like PCI DSS Level 1 is non-negotiable and requires continuous auditing and technological upgrades, a costly but essential competitive factor.

The competitive rivalry within the electronic payments software sector is fierce, driven by a fragmented market featuring established enterprise software providers, direct payment processors, and agile fintech startups. This intense competition necessitates continuous innovation, with companies like ACI Worldwide investing heavily in areas such as AI and blockchain for advanced fraud detection and real-time payment capabilities. For example, ACI reported a 20% improvement in false positive rates for a major European bank in Q1 2024, showcasing their commitment to staying ahead.

High barriers to entry, stemming from substantial R&D and infrastructure costs, intensify rivalry among existing players. These significant fixed costs, estimated in the hundreds of millions annually for research alone, compel companies to compete aggressively for market share and to justify their investments. This dynamic means ACI Worldwide faces constant pressure to differentiate its offerings through superior user experience and specialized functionalities to retain customers, despite high switching costs.

Regulatory compliance further shapes competitive dynamics, acting as both a barrier to new entrants and a battleground for existing firms. Navigating complex mandates like PSD2 and PCI DSS requires ongoing investment, with companies excelling in compliance gaining a distinct advantage. ACI Worldwide's focus on supporting real-time payment regulations and open banking initiatives in 2024 underscores this critical aspect of competitive positioning.

| Competitor Type | Key Differentiators | Impact on ACI Worldwide |

| Established Enterprise Software Providers | Broad functionality, existing client relationships | Requires ACI to offer comprehensive solutions and strong support |

| Direct Payment Processors | Integrated payment processing, potentially lower costs | Pressures ACI on pricing and efficiency |

| Fintech Startups | Agility, niche specialization, innovative user interfaces | Drives ACI to innovate rapidly and improve user experience |

| Large Tech Firms | Extensive resources, broad ecosystem integration | Represents a significant competitive threat due to scale and reach |

SSubstitutes Threaten

Large financial institutions and major retailers, ACI Worldwide's core clientele, increasingly have the in-house capabilities to build and manage their own payment processing and fraud prevention solutions. This trend is driven by advancements in technology and a desire for greater control over critical financial infrastructure.

While developing such systems internally is a substantial undertaking, it presents a viable substitute, especially for organizations with unique or proprietary requirements that off-the-shelf solutions may not fully address. For instance, major banks might leverage their extensive IT departments and significant capital expenditures to create bespoke fraud detection algorithms.

This internal development capability acts as a significant check on ACI Worldwide's pricing power. When customers can credibly develop alternatives, they are less susceptible to price increases, forcing ACI to remain competitive and demonstrate clear value propositions for its services.

The proliferation of alternative payment methods poses a significant threat to ACI Worldwide. Digital wallets, peer-to-peer (P2P) payment apps, and Buy Now, Pay Later (BNPL) services are gaining substantial traction. For instance, global digital payment transaction volume was projected to exceed $10 trillion in 2024, a testament to their growing dominance.

While ACI's software often enables these new channels, the underlying technologies and platforms facilitating them can act as substitutes. If consumers and businesses increasingly adopt solutions that bypass traditional payment infrastructure, it could diminish the perceived necessity of ACI's core offerings. The ongoing exploration and potential rollout of central bank digital currencies (CBDCs) also represent a future substitute that could fundamentally alter the payment landscape.

For basic payment processing or data management, generic cloud computing services and open-source software can act as substitutes for some of ACI Worldwide's offerings. While these alternatives aren't a direct match for ACI's complex, real-time payment solutions, they can reduce demand for specific, modular parts of ACI's portfolio.

Manual Processes or Legacy Systems

In certain smaller or less digitized businesses, manual processes or older legacy systems can act as a substitute for advanced payment solutions. While these methods are inherently inefficient, the cost and complexity of upgrading, or simply a lack of immediate need, can slow the adoption of newer technologies like those offered by ACI Worldwide.

For instance, a small retail business might continue using a manual cash register and basic accounting ledger instead of investing in a modern point-of-sale system integrated with digital payment processing. This inertia is often driven by budget constraints or a perception that existing methods are "good enough."

- Manual processes: Basic bookkeeping and transaction recording without specialized software.

- Legacy systems: Older, often outdated software or hardware that performs basic payment functions.

- Inertia and cost: Resistance to change due to existing investments and the perceived high cost of new technology.

- Limited digitization: Businesses with a lower overall reliance on digital infrastructure are more likely to retain manual or legacy systems.

Emergence of Blockchain and Distributed Ledger Technologies (DLT)

The emergence of blockchain and distributed ledger technologies (DLT) presents a potential long-term threat of substitutes for traditional payment processing. While ACI Worldwide may integrate these technologies, the independent development and widespread adoption of DLT-based payment networks could offer a fundamentally different infrastructure for transactions. If these technologies mature to directly handle the scale and security requirements of enterprise payments, they could pose a substitute threat.

The threat of substitutes for ACI Worldwide is multifaceted, stemming from both the potential for clients to develop in-house solutions and the rise of alternative payment technologies. Major financial institutions and retailers are increasingly building their own payment processing and fraud prevention systems, driven by a need for greater control and customization. This internal development capability, while costly, acts as a significant check on ACI's pricing power.

The rapid growth of alternative payment methods like digital wallets and Buy Now, Pay Later services also presents a substitute threat. While ACI's software often facilitates these channels, the underlying technologies can bypass traditional payment infrastructure, potentially reducing the perceived need for ACI's core offerings. For instance, global digital payment transaction volume was projected to exceed $10 trillion in 2024, highlighting the shift in consumer behavior.

Furthermore, for less complex needs, generic cloud services and open-source software can substitute for certain modular components of ACI's portfolio. Even manual processes and legacy systems persist in smaller businesses, driven by cost and inertia, representing a low-tech substitute for advanced payment solutions.

| Substitute Category | Examples | Impact on ACI | Market Trend (2024) |

|---|---|---|---|

| In-house Development | Custom-built payment platforms by large banks | Reduces reliance on third-party vendors, limits pricing power | Growing trend among large enterprises |

| Alternative Payment Methods | Digital wallets, BNPL services, P2P apps | Potential disintermediation of traditional payment flows | Global digital payment volume projected to exceed $10 trillion |

| Generic Technologies | Cloud computing services, open-source software | Substitution for specific, less complex functionalities | Increasing adoption for cost-efficiency |

| Legacy/Manual Systems | Manual bookkeeping, older POS systems | Persistence in smaller businesses due to cost and inertia | Significant portion of smaller businesses still utilize these |

Entrants Threaten

Entering the real-time electronic payments software market, where ACI Worldwide operates, demands significant upfront capital. Developing secure, scalable, and compliant platforms requires substantial investment, often in the hundreds of millions of dollars. For instance, companies need to invest heavily in infrastructure, cybersecurity measures, and ongoing research and development to stay competitive and address evolving fraud landscapes.

The payments industry is a minefield of global regulations, requiring strict adherence to standards like PCI DSS, Anti-Money Laundering (AML), and Know Your Customer (KYC) protocols. Obtaining the necessary licenses to operate is a significant hurdle.

Newcomers must navigate these intricate regulatory frameworks, secure certifications, and develop compliant infrastructure, all of which demand substantial investment and expertise, creating a formidable barrier to entry.

Financial institutions and large retailers place a premium on security, reliability, and trust when selecting payment infrastructure partners. This is a significant barrier for new entrants. ACI Worldwide, with its nearly five decades of proven performance, has cultivated a strong reputation that new players struggle to replicate quickly. Building this level of client confidence, especially for systems that handle mission-critical payment processing, takes considerable time and a flawless track record.

Access to Distribution Channels and Customer Relationships

Gaining access to established distribution channels and cultivating strong customer relationships presents a significant hurdle for potential new entrants in the payments and electronic transaction processing sector. Companies like ACI Worldwide have invested heavily over many years to build and maintain these crucial connections with major financial institutions, intermediaries, and global retailers. For instance, ACI Worldwide’s solutions are deeply integrated into the operational fabric of many of the world's largest banks and merchants, making it difficult for newcomers to replicate this level of embeddedness and trust.

The process of establishing these vital relationships is not only lengthy but also inherently complex, requiring extensive due diligence, regulatory compliance, and proven reliability. New players would find it challenging to displace incumbent providers who already possess long-standing contracts and have demonstrated their ability to deliver consistent, secure, and efficient payment processing services. This deep integration acts as a powerful barrier, effectively limiting the ability of new entrants to effectively compete for market share and access the customer base that ACI Worldwide currently serves.

- High Switching Costs: Financial institutions and retailers often face substantial costs and operational disruptions when attempting to switch payment processing providers, reinforcing loyalty to established players like ACI Worldwide.

- Regulatory Hurdles: Navigating the complex and evolving regulatory landscape for financial services and payments requires significant expertise and resources, which new entrants may lack.

- Network Effects: The value of payment networks increases with the number of participants. Established networks, supported by incumbent providers, offer greater reach and utility, making it harder for new networks to gain traction.

Scalability and Network Effects

The electronic payments industry thrives on network effects; the more users a payment platform has, the more valuable it becomes. For instance, as of early 2024, global digital payment transaction volumes continued to surge, with projections indicating further growth. New entrants struggle to replicate this scale and the extensive interoperability that established players like ACI Worldwide possess, having already integrated with numerous payment networks and processing immense transaction volumes.

ACI Worldwide's established position, processing billions of transactions annually, creates a significant barrier. Competitors must invest heavily to achieve comparable reach and seamless integration across diverse payment ecosystems. This includes connecting with banks, card networks, and alternative payment providers worldwide, a feat that requires substantial time and capital.

- Network Effects: The value of payment platforms increases with user adoption, making it difficult for newcomers to gain traction.

- Interoperability Challenges: New entrants must build extensive integrations with existing financial infrastructure, a costly and complex undertaking.

- Economies of Scale: Established players like ACI benefit from lower per-transaction costs due to high processing volumes, a scale new entrants cannot easily match.

The threat of new entrants in the electronic payments software market, where ACI Worldwide operates, is generally low due to substantial barriers. Developing secure, scalable, and compliant payment platforms requires immense upfront capital, often in the hundreds of millions of dollars, for infrastructure, cybersecurity, and R&D. Navigating complex global regulations and obtaining necessary licenses also presents significant hurdles, demanding substantial investment and expertise. Furthermore, the industry's reliance on trust and proven performance means new players struggle to replicate the established reputation and client confidence that incumbents like ACI Worldwide have cultivated over decades.

| Barrier Type | Description | Impact on New Entrants | Example for ACI Worldwide |

|---|---|---|---|

| Capital Requirements | Developing robust payment systems demands massive investment in technology, security, and compliance. | High; requires significant funding to even begin operations. | Estimated development costs for a new, compliant payment platform can exceed $100 million. |

| Regulatory Compliance | Adhering to global financial regulations (PCI DSS, AML, KYC) and obtaining licenses is complex and costly. | High; requires specialized knowledge and resources to meet stringent requirements. | ACI Worldwide's long history ensures compliance with evolving financial regulations worldwide. |

| Brand Reputation & Trust | Financial institutions and merchants prioritize security and reliability, favoring established providers. | High; building trust and a proven track record takes considerable time and consistent performance. | ACI Worldwide has nearly 50 years of experience, processing billions of transactions annually. |

| Switching Costs | Existing clients face significant disruption and expense when changing payment processing providers. | High; encourages customer loyalty to incumbent providers. | Major banks and retailers are deeply integrated with ACI's systems, making transitions costly. |

Porter's Five Forces Analysis Data Sources

Our ACI Worldwide Porter's Five Forces analysis is built upon a foundation of verified data, including ACI Worldwide's annual reports, industry-specific market research from firms like Gartner and Forrester, and publicly available regulatory filings. We also incorporate insights from financial databases and economic indicators to ensure a comprehensive understanding of the competitive landscape.