ACI Worldwide Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ACI Worldwide Bundle

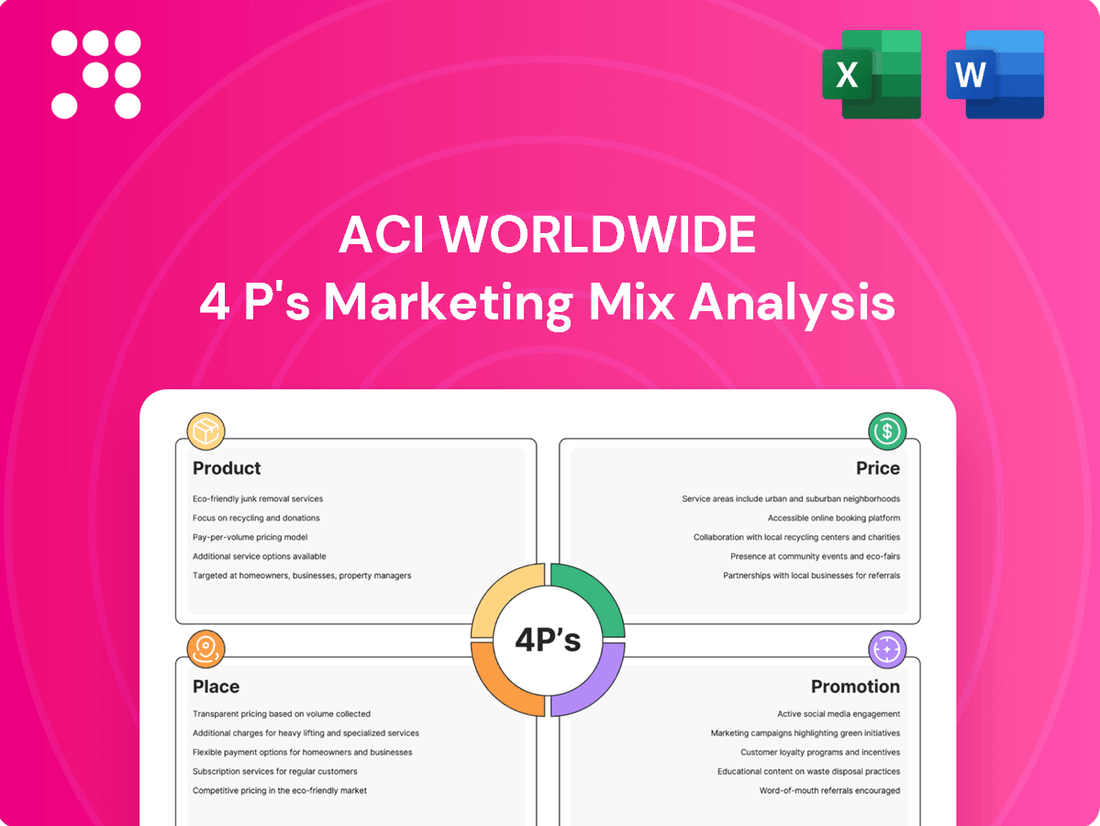

Unlock the secrets behind ACI Worldwide's market dominance with our comprehensive 4Ps Marketing Mix Analysis. Discover how their innovative product suite, strategic pricing, extensive distribution, and targeted promotions create a powerful competitive advantage.

Dive deeper into the specifics of ACI Worldwide's marketing strategy, from their cutting-edge solutions to their channel partnerships and communication campaigns. This in-depth analysis is your key to understanding their success.

Ready to gain actionable insights and save valuable research time? Get the complete, editable 4Ps Marketing Mix Analysis for ACI Worldwide, perfect for business professionals, students, and consultants seeking strategic clarity.

Product

ACI Worldwide's real-time payment solutions are central to their product strategy, offering financial institutions, intermediaries, and retailers a robust platform for immediate electronic transactions. This encompasses everything from foundational payment processing to sophisticated payment orchestration, ensuring a smooth flow of funds across various channels and transaction types.

The company's focus on enabling clients to adapt to the dynamic global digital payments landscape is evident in their product development. For instance, ACI's Universal Payments (UP) platform is designed to support a wide array of payment methods, including the rapidly growing real-time payments (RTP) infrastructure. By the end of 2024, it's projected that over 70 countries will have live RTP systems, highlighting the critical market need for ACI's offerings.

ACI Worldwide's commitment to innovation in this space is crucial, as the demand for instant payments continues to surge. In 2023 alone, global real-time payment transaction volumes exceeded 100 billion, a figure expected to climb significantly by 2025, underscoring the market's reliance on providers like ACI to manage this growth effectively and securely.

ACI Worldwide's product offering heavily emphasizes robust fraud prevention and security, a critical element for financial institutions and merchants. Their solutions leverage AI and machine learning to detect and prevent fraudulent transactions in real-time, a necessity as digital payments surge. For instance, in 2024, the global cost of online payment fraud was projected to reach $48 billion, highlighting the immense value ACI provides by safeguarding client assets and reputations.

Omni-channel payment processing from ACI Worldwide is a core component of their product strategy, enabling businesses to accept payments seamlessly across physical stores, websites, and mobile apps. This comprehensive approach caters to the evolving consumer demand for flexible and convenient transaction methods.

ACI's Payments Orchestration Platform is key here, facilitating the integration and management of various payment types. This ensures a unified and secure customer journey, crucial as digital payment volumes continue to surge. For instance, in 2024, global digital payment transaction values were projected to exceed $10 trillion, highlighting the market's immense scale and the need for robust processing solutions.

Digital Banking and Bill Payment Solutions

ACI Worldwide's digital banking and bill payment solutions, exemplified by their ACI Speedpay platform, go beyond basic transaction processing. They enable financial institutions and businesses to offer robust online banking experiences and efficient bill payment services. This focus on modernizing payment infrastructure is crucial in today's digital economy, where consumers expect seamless and convenient financial interactions.

ACI Speedpay specifically addresses the need for streamlined disbursement and payment operations. It supports a variety of payout methods, catering to diverse customer preferences and business requirements. This flexibility allows companies to manage everything from customer refunds to vendor payments with greater ease and efficiency, enhancing operational effectiveness.

The company's commitment to innovation in this space is evident in its continuous development of features that support the evolving landscape of digital finance. For instance, in 2024, ACI Worldwide reported significant growth in its digital payments segment, driven by increased adoption of its cloud-based solutions by major financial institutions. This highlights the market's demand for advanced digital banking and bill payment capabilities.

- Enhanced Customer Experience: Facilitates intuitive online banking and bill payment, improving customer satisfaction.

- Operational Efficiency: Streamlines disbursement and payment processes for businesses, reducing manual effort.

- Flexible Payout Options: Supports multiple methods for sending and receiving funds, meeting diverse needs.

- Modernized Infrastructure: Positions banks, billers, and merchants for the future of digital payments.

Cloud-Native and API-Driven Platforms

ACI Worldwide's Product strategy is heavily influenced by its move towards cloud-native and API-driven payment platforms. This evolution offers clients unparalleled flexibility and scalability, crucial for navigating the dynamic payments landscape. By embracing this architecture, ACI empowers businesses to quickly integrate new payment methods and streamline operations.

The benefits of this product approach are tangible. For instance, ACI's cloud-native solutions enable faster time-to-market for new payment functionalities, a significant competitive advantage. Their API-driven design fosters seamless integration with diverse ecosystems, enhancing payment acceptance across various channels. This is critical as global digital payment transaction volumes are projected to reach over 1.5 trillion by 2027, according to Statista.

- Cloud-Native Architecture: Facilitates agile development and rapid deployment of payment solutions.

- API-Driven Approach: Enables seamless integration and extensibility for diverse payment needs.

- Scalability and Efficiency: Supports growing transaction volumes and operational optimization for clients.

- Enhanced Security: Multi-tenant cloud platforms offer robust data protection and compliance.

ACI Worldwide's product suite is built around enabling real-time, seamless, and secure payments across diverse channels. Their Universal Payments (UP) platform and cloud-native, API-driven solutions are designed to meet the escalating demand for instant transactions and flexible payment orchestration. This focus ensures clients can adapt to evolving consumer expectations and a rapidly growing digital payments market, projected to see transaction values exceed $10 trillion globally in 2024.

| Product Area | Key Offerings | Market Relevance (2024-2025) | Customer Benefit |

|---|---|---|---|

| Real-Time Payments | UP Real-Time Payments | Over 70 countries expected to have live RTP systems by end of 2024. Global real-time payment transaction volumes exceeded 100 billion in 2023. | Enables instant fund transfers, improving cash flow and customer experience. |

| Payments Orchestration | Payments Orchestration Platform | Global digital payment transaction values projected to exceed $10 trillion in 2024. | Manages multiple payment methods and channels for a unified customer journey. |

| Digital Banking & Bill Pay | ACI Speedpay | Significant growth in ACI's digital payments segment in 2024 driven by cloud adoption. | Modernizes payment infrastructure for efficient online banking and bill payment services. |

| Fraud Prevention | AI/ML-driven fraud detection | Projected global cost of online payment fraud to reach $48 billion in 2024. | Safeguards assets and reputation by preventing fraudulent transactions in real-time. |

What is included in the product

This analysis provides a comprehensive examination of ACI Worldwide's marketing strategies, dissecting their Product, Price, Place, and Promotion tactics with real-world examples and strategic implications.

It's designed for professionals seeking a detailed understanding of ACI Worldwide's market positioning, offering a solid foundation for strategic planning and competitive benchmarking.

Provides a clear, actionable framework for ACI Worldwide's marketing strategies, directly addressing the pain point of disjointed or ineffective campaign execution.

Place

ACI Worldwide relies heavily on its direct sales force to connect with its core customer base, which consists of major financial institutions, central banks, and large retail corporations worldwide. This direct engagement is crucial for selling complex, enterprise-level solutions that often require customized implementations and ongoing relationship management with high-level decision-makers.

This direct sales model enables ACI Worldwide to gain a profound understanding of each client's unique requirements and to deliver sophisticated, tailored solutions. For instance, in 2024, ACI reported that its enterprise solutions segment, driven by direct sales, continued to be a significant contributor to its revenue, reflecting the value placed on personalized client interactions for complex software and service offerings.

ACI Worldwide boasts a substantial global presence, operating across the Americas, EMEA, and Asia Pacific regions. This extensive network includes numerous regional offices and specialized centers, ensuring localized support and expertise.

This widespread operational footprint allows ACI to deliver tailored payment solutions, effectively catering to diverse regional market demands and navigating complex regulatory landscapes. For instance, in 2023, ACI reported that over 80% of its revenue was generated from outside North America, highlighting its significant international engagement.

ACI Worldwide actively cultivates a broad network of strategic partnerships, encompassing technology providers and system integrators. This ecosystem is vital for expanding market penetration and enriching its product and service portfolio, ensuring ACI remains at the forefront of payment innovation.

Key collaborations with industry giants like Mastercard and Microsoft, alongside technology leaders such as Red Hat, are instrumental. Furthermore, partnerships with innovative fintechs, including Banfico and Ingo Payments, bolster ACI's ability to deliver integrated solutions and broaden its distribution channels, especially in the rapidly evolving digital payments landscape.

These alliances are fundamental to ACI’s strategy, enabling seamless integration and driving the modernization of the global payments infrastructure. For instance, ACI's ongoing collaboration with Mastercard on tokenization services aims to enhance security and streamline transaction processing, a critical element in today's financial environment.

Cloud-Based Delivery Models

ACI Worldwide is increasingly leveraging cloud-based delivery models, such as Software-as-a-Service (SaaS) and Platform-as-a-Service (PaaS), to distribute its payment processing and fraud prevention solutions. This shift offers clients enhanced scalability and flexibility while reducing their own IT infrastructure costs, a key driver in the financial technology sector's move to the cloud.

The adoption of cloud delivery is a strategic move to meet evolving client needs and industry trends. For instance, the global cloud computing market, which includes SaaS and PaaS, was projected to reach over $1.3 trillion in 2024, underscoring the significant demand for these services.

- Scalability: Cloud models allow clients to easily adjust resource usage based on transaction volume, a critical factor for businesses experiencing fluctuating demand.

- Flexibility: Clients can access ACI's advanced payment solutions from anywhere, facilitating remote operations and faster deployment.

- Cost Efficiency: By shifting to a cloud-based model, businesses can convert capital expenditures on hardware to operational expenditures, leading to more predictable IT spending.

- Innovation: Cloud platforms enable ACI to roll out updates and new features more rapidly, ensuring clients benefit from the latest advancements in payment technology.

Channel Partner Networks

ACI Worldwide leverages extensive channel partner networks, including local independent resellers and distributors, to broaden its market reach beyond direct sales. These partnerships are crucial for penetrating diverse geographic regions and specific market segments, such as smaller financial institutions. By providing localized expertise and support, these partners enhance ACI's ability to serve a wider customer base with its payment software solutions.

- Market Penetration: Channel partners enable ACI to access markets and customer segments that might be challenging to reach through direct sales alone.

- Localized Support: Resellers and distributors offer on-the-ground expertise and customer service tailored to regional needs and regulations.

- Scalability: These networks allow ACI to scale its sales and support operations efficiently across different geographies.

ACI Worldwide's place strategy is multifaceted, combining direct sales for enterprise clients with extensive channel partnerships to reach a broader market. This approach is supported by a significant global presence and a growing reliance on cloud-based delivery models, ensuring scalability and accessibility for its payment solutions.

The company's direct sales force is critical for engaging large financial institutions, where complex solutions require tailored implementations and ongoing relationship management. In 2024, this segment remained a key revenue driver, highlighting the value of personalized client interactions for sophisticated software and services.

ACI's global operational footprint spans the Americas, EMEA, and Asia Pacific, with numerous regional offices providing localized support and expertise. This extensive network allows ACI to cater to diverse regional demands and navigate complex regulatory environments, as evidenced by over 80% of its revenue coming from outside North America in 2023.

Strategic partnerships with technology providers and system integrators, including major players like Mastercard and Microsoft, are vital for expanding market reach and enhancing its product offerings. These alliances, such as the collaboration with Mastercard on tokenization services, are fundamental to modernizing global payment infrastructure.

Furthermore, ACI is increasingly adopting cloud-based delivery models like SaaS and PaaS for its payment processing and fraud prevention solutions. This strategic shift offers clients enhanced scalability and flexibility, aligning with the projected growth of the global cloud computing market, which was anticipated to exceed $1.3 trillion in 2024.

| Sales Channel | Target Market | Key Benefits |

|---|---|---|

| Direct Sales | Major Financial Institutions, Central Banks, Large Retail Corporations | Customized solutions, deep client understanding, ongoing relationship management |

| Channel Partners (Resellers, Distributors) | Smaller Financial Institutions, Diverse Geographic Regions, Specific Market Segments | Broader market penetration, localized expertise, scalable support |

| Cloud-Based Delivery (SaaS, PaaS) | All client segments seeking scalability, flexibility, and cost efficiency | Enhanced scalability, remote access, predictable IT spending, faster innovation rollout |

What You See Is What You Get

ACI Worldwide 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of ACI Worldwide's 4P's Marketing Mix is fully complete and ready for your immediate use.

Promotion

ACI Worldwide leverages industry conferences and events as a key promotional tool, actively participating in and hosting gatherings worldwide. These events are crucial for connecting with clients, both existing and potential, and for showcasing their latest advancements in payment modernization, fraud orchestration, and self-service banking. For instance, ACI's presence at the 2024 Nilson Report Payments Forum likely highlighted their ongoing efforts to drive innovation in the digital payments space.

ACI Worldwide leverages its extensive research and thought leadership to solidify its position as a leader in payments technology. Their publications, such as the 'Prime Time for Real-Time' report, offer deep dives into critical market trends and the significant economic impact of digital payment adoption.

These reports, including various whitepapers and industry insights, showcase ACI's specialized knowledge in real-time payments. For instance, reports highlight how real-time payments can boost GDP, with some estimates suggesting trillions of dollars in potential economic uplift globally by 2026.

ACI Worldwide leverages customer success stories and case studies to showcase its proven ability to deliver tangible value. These narratives highlight how their payment solutions empower clients to achieve significant growth and operational enhancements.

Long-standing relationships, such as the recent multi-year extension with Co-op, underscore ACI's reliability and the enduring effectiveness of its offerings. This demonstrates their capacity to support clients through evolving market demands and technological advancements.

By detailing how businesses scale, innovate, and secure their payment infrastructure, ACI builds essential trust and credibility. For example, their work with major financial institutions in 2024 has consistently shown improved transaction processing times and enhanced fraud detection rates, directly impacting client profitability.

Digital Marketing and Public Relations

ACI Worldwide leverages digital marketing extensively, using press releases and online publications to disseminate crucial information such as product advancements, financial performance, and new strategic alliances. This approach ensures stakeholders are consistently informed about the company's trajectory.

Public relations efforts are a cornerstone of ACI's strategy, significantly boosting brand recognition and credibility. Notably, the company's inclusion in prestigious rankings like CNBC's World's Top Fintech Companies and TIME's America's Best Mid-Size Companies in 2025 underscores its strong market position and positive industry perception.

These PR achievements are not merely accolades; they translate into tangible benefits. For instance, enhanced brand visibility can attract top talent and foster stronger relationships with financial institutions and partners, contributing to ACI's overall growth and market leadership in the payments technology sector.

ACI's commitment to digital communication and public relations is vital for maintaining its competitive edge. By actively managing its online presence and securing positive media coverage, the company effectively communicates its value proposition and reinforces its standing as a leader in the fintech landscape.

Direct Sales and Relationship Building

Direct sales and robust relationship building are cornerstones of ACI Worldwide's promotional strategy, especially given its business-to-business (B2B) focus. Their globally distributed sales teams engage directly with financial institutions, retailers, and utility providers. This direct interaction allows ACI to deeply understand client-specific challenges and opportunities, enabling them to offer highly customized software solutions that address those precise needs.

This approach fosters enduring partnerships and is crucial for driving sustained revenue growth. For instance, ACI's emphasis on consultative selling means their representatives act as trusted advisors, building rapport and demonstrating value beyond just the software itself. This human-centric element is vital in the complex financial technology sector where trust and reliability are paramount.

- Direct Engagement: ACI's sales force directly interfaces with target clients, including major banks and large merchants.

- Needs Assessment: The sales process prioritizes understanding unique client requirements for tailored solutions.

- Partnership Focus: Building long-term relationships is key to client retention and future business development.

- Revenue Driver: This direct, relationship-driven promotion is a primary engine for ACI's revenue growth.

ACI Worldwide actively uses industry events, thought leadership, and customer success stories as key promotional tools. Their direct sales approach and strong public relations, including recognition in 2025 rankings, further bolster their market presence. This multi-faceted promotion strategy aims to build trust, showcase value, and drive growth in the competitive payments technology sector.

Price

ACI Worldwide likely employs value-based pricing for its enterprise solutions, aligning costs with the substantial benefits clients receive, such as enhanced operational efficiency and fraud mitigation. This approach acknowledges the significant return on investment for financial institutions and retailers leveraging ACI's payment technology.

The pricing structure for these complex software offerings would be highly customized, factoring in implementation scale, the mission-critical nature of payment processing, and the projected long-term value generated for each enterprise client.

ACI Worldwide's pricing strategy centers on flexible subscription and licensing models. For on-premise solutions, they offer multi-year, typically five-year, time-based software licenses. This approach provides clients with dedicated software access over an extended period.

The company is increasingly leveraging Software as a Service (SaaS) and Platform as a Service (PaaS) for its cloud-based offerings. These subscription-based models generate predictable, recurring revenue streams for ACI, aligning with industry trends towards cloud adoption and offering clients scalability.

ACI Worldwide's pricing strategy for specific solutions, especially those in payment processing and digital disbursement, often includes transaction-volume based fees. This approach directly links the cost of the service to how much it's used, which is a smart move for businesses with variable transaction volumes.

This model offers a flexible cost structure for clients, ensuring they only pay for what they utilize, and it allows ACI to grow its revenue in tandem with the expanding digital payments landscape. For instance, in 2023, global digital payment transaction volumes continued their upward trajectory, with estimates suggesting a significant increase, directly benefiting ACI's revenue through this pricing mechanism.

Tiered Pricing and Custom Enterprise Agreements

ACI Worldwide likely structures its pricing in tiers, offering different packages based on the breadth of features, included modules, service levels, and transaction volumes or user counts. This approach caters to a spectrum of clients, from smaller operations to larger enterprises. For instance, a basic tier might cover essential payment processing, while higher tiers unlock advanced fraud detection, analytics, and broader integration capabilities.

Custom enterprise agreements are a cornerstone for ACI's major clients. These agreements are meticulously crafted to address unique integration requirements, potential bespoke development work, and the establishment of long-term, strategic partnerships. Such tailored contracts often reflect the significant investment and complex operational needs of global financial institutions and large retailers, ensuring ACI's solutions align perfectly with their evolving business strategies.

ACI's tiered and custom pricing reflects the value delivered. For example, in 2024, financial institutions are increasingly demanding sophisticated, real-time fraud prevention, a feature typically found in higher-tier or custom-negotiated packages. The complexity and scale of these services justify the differentiated pricing models, ensuring ACI can support diverse client needs while maintaining profitability.

- Tiered Offerings: ACI's pricing likely segments its solutions into distinct tiers (e.g., Basic, Professional, Enterprise) to accommodate varying customer needs and budgets.

- Feature-Based Costs: Higher tiers or add-on modules typically include advanced functionalities such as sophisticated fraud management, detailed analytics, and enhanced compliance tools.

- Volume and User Scalability: Pricing often scales with transaction volume and the number of users or endpoints accessing the ACI platform.

- Custom Enterprise Solutions: Large clients benefit from bespoke agreements that incorporate specific integration needs, custom development, and dedicated support, reflecting strategic partnerships.

Competitive and Market-Driven Adjustments

ACI Worldwide's pricing strategy is keenly attuned to the competitive landscape of digital payments and fintech. They must balance offering attractive rates against the rising costs of operations, including inflation and evolving interchange fees, which significantly impact the profitability of payment processing. This dynamic requires regular evaluation and adjustment to maintain market relevance and financial health.

For instance, ACI Speedpay has seen pricing adjustments, a common practice to ensure its offerings remain competitive. These changes are not just about staying in the game; they are crucial for covering the substantial costs associated with maintaining and upgrading their sophisticated payment infrastructure, which is vital for continuous innovation in a rapidly evolving industry.

- Competitive Benchmarking: ACI actively monitors pricing from key competitors in the digital payments space to ensure their solutions are positioned attractively.

- Cost Pass-Through: Adjustments often reflect changes in underlying costs, such as network fees and regulatory compliance expenses, which are essential for sustainable operations.

- Value-Based Pricing: While competitive, ACI also aims to price based on the value and advanced features their solutions provide to financial institutions and merchants.

- Inflationary Impact: Like many businesses, ACI faces pressure from general economic inflation, necessitating price reviews to maintain profit margins and fund ongoing R&D.

ACI Worldwide's pricing reflects a strategic balance between value delivery and market competitiveness. Their tiered and custom enterprise solutions cater to diverse client needs, from basic payment processing to advanced fraud prevention. For instance, in 2024, the demand for real-time fraud detection, a premium feature, justifies higher pricing tiers.

Transaction-volume based fees are a key component, directly linking cost to usage, which is advantageous for businesses with fluctuating transaction volumes. This model saw significant benefit in 2023 as global digital payment volumes surged. Pricing adjustments, like those seen with ACI Speedpay, are crucial for maintaining competitiveness and covering operational costs, including inflation and network fees.

| Pricing Model | Key Features | Client Benefit | 2023/2024 Relevance |

|---|---|---|---|

| Value-Based | ROI, efficiency, fraud mitigation | Significant benefits for financial institutions | Underpins premium pricing for advanced solutions |

| Subscription (SaaS/PaaS) | Recurring revenue, scalability | Predictable costs, flexible access | Dominant model for cloud offerings |

| Time-Based Licenses | Multi-year access (e.g., 5-year) | Dedicated software access | For on-premise solutions |

| Transaction-Volume Based | Pay-per-use | Cost aligns with utilization | Benefited from 2023 digital payment growth |

| Tiered/Feature-Based | Basic to advanced features (e.g., fraud detection) | Catters to varying needs and budgets | Higher tiers for sophisticated demands in 2024 |

| Custom Enterprise Agreements | Bespoke integration, development | Tailored solutions for large clients | Strategic partnerships with global institutions |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for ACI Worldwide leverages a comprehensive set of data, including official company disclosures, investor relations materials, and industry-specific market research reports. We also incorporate insights from their public-facing product information and strategic partnership announcements.