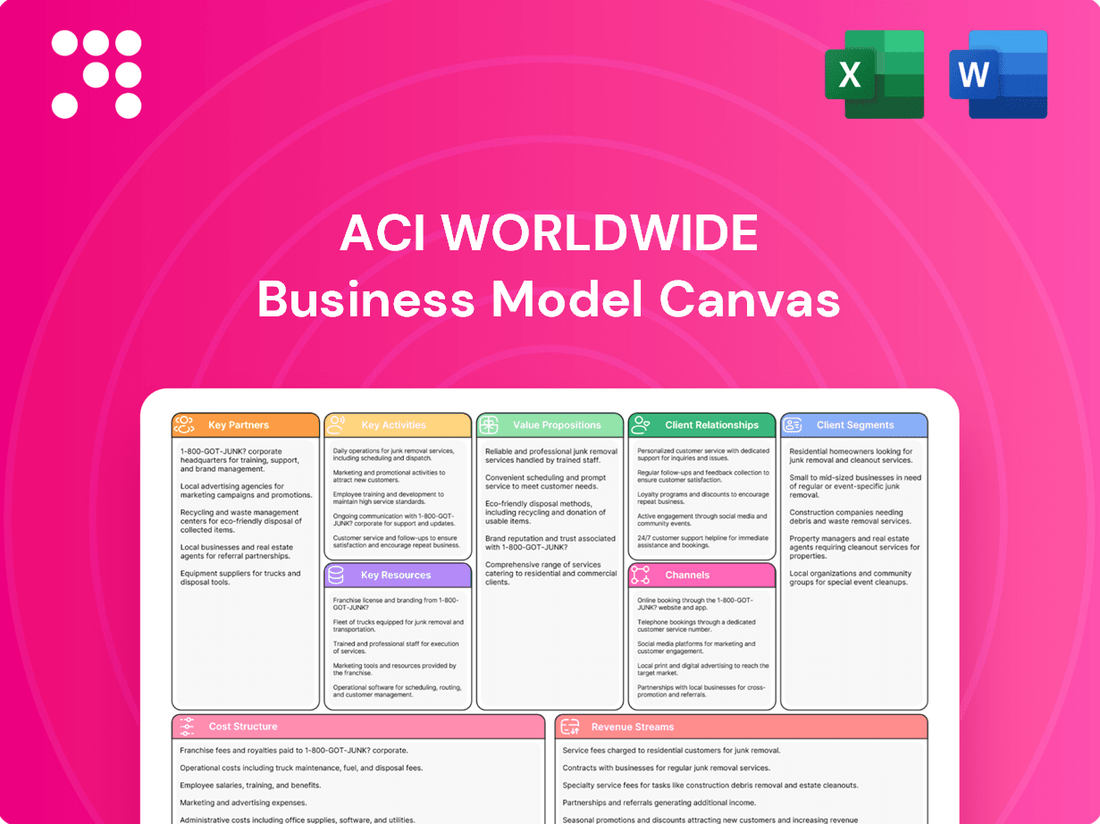

ACI Worldwide Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ACI Worldwide Bundle

Discover the intricate workings of ACI Worldwide's business model with our comprehensive Business Model Canvas. This detailed document breaks down their customer segments, value propositions, and revenue streams, offering a clear roadmap to their success.

Partnerships

ACI Worldwide partners with leading technology and cloud providers, including Microsoft, Red Hat, IBM, MongoDB, and Synadia Communications. These collaborations are fundamental to developing and refining ACI's cloud-native payments platform, ACI Connect. This strategic alignment ensures ACI's solutions offer enhanced operational resilience, scalability, and robust security, which are critical in today's evolving payments landscape.

ACI Worldwide forms strategic alliances with major financial institutions and payment processors worldwide, including notable collaborations with companies like Worldpay and Co-op. These partnerships are crucial for delivering the essential infrastructure and software that underpin secure and efficient payment processing, robust fraud prevention, and seamless digital payment acceptance.

Through these collaborations, ACI's technology empowers partners to enhance their operational stability and broaden their global footprint. This support extends to managing a wide array of payment types and optimizing operational expenditures, demonstrating the tangible benefits of these strategic relationships.

ACI Worldwide actively cultivates key partnerships with fintech innovators to broaden its service offerings and drive technological advancement. A prime example is their collaboration with Banfico, a specialist in payment verification services. This partnership enables ACI to seamlessly integrate advanced features, enhancing their payment solutions and providing clients with more robust capabilities.

These strategic alliances are crucial for ACI's ability to adapt to the rapidly changing digital payments environment. By working with specialized fintechs, ACI can quickly incorporate cutting-edge functionalities, addressing niche market demands and staying ahead of competitors. This ecosystem approach ensures ACI remains a leader in delivering comprehensive and innovative payment processing solutions.

Industry Associations and Regulatory Bodies

ACI Worldwide actively participates in key industry associations and collaborates with regulatory bodies. This engagement is vital for staying ahead of evolving compliance requirements and contributing to a more secure financial landscape.

For example, ACI's involvement in groups like the U.S. Federal Reserve's scam definition and classification working group directly influences how financial fraud is understood and addressed. This proactive stance helps set industry benchmarks.

ACI's commitment to compliance extends to adhering to significant regulations such as Europe's Digital Operational Resilience Act (DORA) and Australia's CPS 230 Operational Risk Management standard. These efforts ensure ACI's solutions meet rigorous operational and security demands.

These partnerships are instrumental in shaping a consistent and safer global payment ecosystem, fostering trust and efficiency for all participants.

- Industry Standards Development: ACI's participation in associations aids in defining and refining industry standards for payments and fraud prevention.

- Regulatory Compliance: Engagement with regulatory bodies ensures ACI's solutions align with and support critical compliance mandates like DORA and CPS 230.

- Fraud Mitigation: Collaboration on initiatives like scam definition working groups directly contributes to more effective fraud detection and prevention strategies.

- Operational Resilience: Involvement in schemes like the UK's operational resiliency framework helps ACI build and maintain robust, reliable payment systems.

Data and Analytics Firms

ACI Worldwide heavily relies on partnerships with data and analytics firms, like GlobalData, to fuel its market research. These collaborations are crucial for generating insightful reports that dissect payment trends and fraud. For instance, their joint 'Prime Time for Real-Time' and 'Scamscope' reports offer deep dives into real-time payment adoption and evolving fraud tactics.

These partnerships provide ACI and its clientele with critical data on payment behaviors and economic impacts. The insights gleaned from these reports, such as the growing adoption of real-time payments, enable ACI to refine its solutions and help customers navigate complex market dynamics. This data-driven approach is fundamental to developing effective strategies in the fast-paced payments industry.

- Data-Driven Insights: Partnerships with firms like GlobalData provide ACI Worldwide with essential market research and actionable data on payment trends.

- Key Reports: Collaborations produce influential reports such as 'Prime Time for Real-Time' and 'Scamscope,' detailing payment behaviors and fraud.

- Market Understanding: The data helps ACI and its clients grasp market dynamics, including the economic effects of real-time payments.

- Strategic Development: These insights are vital for formulating more effective strategies in the evolving payments landscape.

ACI Worldwide's key partnerships with technology giants like Microsoft and Red Hat are critical for its cloud-native payments platform, ACI Connect. These alliances ensure ACI’s solutions are scalable, secure, and resilient, essential for modern payment processing.

Strategic collaborations with major financial institutions and processors, such as Worldpay, underpin ACI's infrastructure for secure payment processing and fraud prevention. These relationships are vital for global reach and operational efficiency.

ACI also partners with fintech innovators like Banfico to integrate specialized services, enhancing its payment solutions with advanced features and adapting quickly to market demands.

Furthermore, ACI's engagement with industry associations and regulatory bodies, including its work with the U.S. Federal Reserve on scam classification, ensures compliance with standards like DORA and CPS 230, promoting a safer financial ecosystem.

Partnerships with data firms like GlobalData provide ACI with crucial market insights, as seen in reports like 'Prime Time for Real-Time,' which inform strategic development and client guidance in the dynamic payments sector.

| Partner Type | Key Partners | Impact |

|---|---|---|

| Technology Providers | Microsoft, Red Hat, IBM, MongoDB, Synadia Communications | Enhanced cloud-native platform (ACI Connect), scalability, security, resilience |

| Financial Institutions & Processors | Worldpay, Co-op | Underpinning payment infrastructure, fraud prevention, digital acceptance |

| Fintech Innovators | Banfico | Integration of advanced features, rapid adaptation to market needs |

| Data & Analytics Firms | GlobalData | Market research, insights on payment trends and fraud (e.g., 'Prime Time for Real-Time') |

| Industry Associations & Regulators | U.S. Federal Reserve, various industry groups | Standards development, regulatory compliance (DORA, CPS 230), fraud mitigation |

What is included in the product

ACI Worldwide's Business Model Canvas is a comprehensive framework detailing how it delivers payment solutions, focusing on its diverse customer segments like financial institutions and merchants, its robust technology infrastructure, and its revenue streams from software licensing and transaction fees.

ACI Worldwide's Business Model Canvas acts as a pain point reliever by providing a clear, visual roadmap of their complex payment processing operations, simplifying understanding and strategic alignment.

It addresses the pain of information overload by condensing ACI's multifaceted strategy into a digestible, one-page snapshot for efficient review and decision-making.

Activities

ACI Worldwide's primary focus is the ongoing development and refinement of its extensive software portfolio for electronic payments. This encompasses building new capabilities for real-time transactions, robust fraud detection, and advanced online banking functionalities.

Innovation is a cornerstone of their approach, exemplified by the cloud-native ACI Connetic platform. This commitment to innovation ensures they remain competitive and responsive to shifting market needs.

In 2024, ACI Worldwide continued to invest heavily in R&D, aiming to enhance its real-time payments capabilities, a critical area given the global push towards instant transactions.

ACI Worldwide's core activity is enabling financial institutions, intermediaries, and retailers to process and manage a wide array of payments across numerous channels. This foundational work involves supplying the essential infrastructure and software that ensures transactions are handled securely and efficiently.

They provide the critical payment infrastructure, which is vital for modern commerce. A significant aspect of this is their real-time, intelligent payment orchestration capabilities, allowing businesses to manage complex payment flows seamlessly.

In 2024, ACI Worldwide continued to be a major player in the payments industry, processing billions of transactions for clients globally. Their focus on real-time processing and fraud detection remains a key differentiator, especially as digital payment volumes surge.

ACI Worldwide's key activity revolves around developing and implementing robust fraud prevention and risk management solutions. This involves utilizing advanced, self-learning algorithms powered by artificial intelligence to proactively identify and stop fraudulent transactions, with a particular emphasis on combating Authorized Push Payment (APP) scams.

Ensuring compliance with critical industry regulations such as PCI DSS v4.0, Anti-Money Laundering (AML), and Know Your Customer (KYC) is also a core function. These measures are vital for maintaining trust and security in the rapidly evolving payments landscape, especially with the rise of instant payment systems.

In 2024, the stakes are higher than ever for financial institutions battling fraud. The Financial Crime Enforcement Network (FinCEN) reported that the estimated annual cost of financial crime in the U.S. alone is in the trillions of dollars, underscoring the critical nature of ACI's services.

Customer Support and Professional Services

ACI Worldwide's customer support and professional services are crucial for ensuring clients can effectively leverage its payment software. This includes comprehensive implementation, integration, and ongoing maintenance to guarantee smooth payment operations and adaptation to evolving payment technologies.

These services are delivered by regional teams focused on rapid response and efficient operational management, which is key to ACI's value proposition. For instance, in 2024, ACI continued to invest in its global support infrastructure to meet the demands of a rapidly changing payments landscape.

- Implementation and Integration: ACI's professional services teams guide clients through the complex process of deploying and integrating its payment solutions, ensuring seamless compatibility with existing systems.

- Ongoing Maintenance and Support: Providing continuous software updates, bug fixes, and technical assistance is vital for maintaining system stability and performance.

- Optimization and Consulting: ACI offers expertise to help clients optimize their payment workflows, enhance customer experience, and adapt to new payment methods and regulations.

- Regional Service Delivery: Dedicated regional teams ensure localized support, offering faster response times and tailored solutions to meet specific market needs.

Market Research and Thought Leadership

ACI Worldwide actively participates in extensive market research, frequently partnering with industry leaders to dissect global payment trends and anticipate future shifts. This deep dive into market dynamics is crucial for their strategic planning.

By consistently sharing their findings through reports and presentations, ACI establishes itself as a thought leader in the payments sector. For instance, in 2024, ACI highlighted the accelerating adoption of real-time payments globally, noting a significant increase in transaction volumes across key markets.

- Market Analysis: ACI's research in 2024 indicated that over 70% of countries were actively exploring or had implemented real-time payment systems, driving demand for their solutions.

- Thought Leadership: Their published insights in early 2024 projected a 25% year-over-year growth in cross-border real-time payments, influencing strategic investments by financial institutions.

- Product Roadmap: Insights from their 2024 market research directly informed ACI's development of new fraud detection capabilities tailored for the evolving digital payments landscape.

- Industry Collaboration: Partnerships for research in 2024 allowed ACI to gain early insights into emerging technologies like tokenization, shaping their product innovation pipeline.

ACI Worldwide's key activities center on developing and maintaining its comprehensive suite of payment software, focusing on real-time processing, fraud prevention, and digital banking solutions. They also provide essential customer support and professional services for implementation and ongoing maintenance, ensuring clients can effectively utilize their platforms.

Furthermore, ACI actively engages in market research and thought leadership, sharing insights on payment trends and collaborating with industry leaders. This research directly influences their product development, as seen in their 2024 focus on enhancing fraud detection for digital payments and their projections for real-time payment growth.

| Key Activity | Description | 2024 Impact/Focus |

| Software Development & Innovation | Building and enhancing payment processing, fraud detection, and digital banking software. | Continued investment in cloud-native solutions like ACI Connetic; focus on real-time payments. |

| Payment Infrastructure Provision | Supplying the core software and infrastructure for secure and efficient transaction management. | Enabling billions of transactions globally with a focus on real-time orchestration. |

| Fraud Prevention & Risk Management | Developing AI-powered solutions to combat financial crime, including APP scams. | Addressing the trillions of dollars in annual financial crime costs by enhancing proactive detection. |

| Customer Support & Professional Services | Providing implementation, integration, maintenance, and consulting services. | Investing in global support infrastructure to meet evolving market demands and ensure client success. |

| Market Research & Thought Leadership | Analyzing payment trends and sharing insights through reports and partnerships. | Informing product roadmaps based on 2024 research showing over 70% of countries exploring real-time payments. |

Full Document Unlocks After Purchase

Business Model Canvas

The ACI Worldwide Business Model Canvas preview you are viewing is the actual, complete document you will receive upon purchase. This is not a sample or mockup; it's a direct representation of the final deliverable, ensuring full transparency and no surprises. You'll gain immediate access to this professionally structured and ready-to-use Business Model Canvas, identical to what you see here.

Resources

ACI Worldwide's proprietary software, including its payments orchestration and fraud management systems, is a cornerstone of its business model. This intellectual property encompasses sophisticated algorithms, secure codebases, and patented technologies crucial for real-time electronic payments and robust fraud prevention. The ACI Connetic platform exemplifies this significant intellectual capital.

In 2024, ACI Worldwide continued to invest heavily in its software assets, recognizing their value in a rapidly evolving digital payments landscape. Their commitment to innovation ensures these solutions remain competitive, offering advanced capabilities that address critical industry needs for speed, security, and efficiency in financial transactions.

ACI Worldwide leverages a sophisticated technology infrastructure, heavily relying on cloud-native platforms such as Microsoft Azure. This robust foundation is critical for processing the immense volume of transactions they handle daily, ensuring consistent reliability and high performance for their payment solutions.

The company's strategic shift to multi-tenant cloud environments significantly boosts their scalability and strengthens data protection measures. This infrastructure underpins their ability to offer secure, efficient, and adaptable payment processing services to a global clientele.

ACI Worldwide’s global team of engineers, developers, and cybersecurity experts is a cornerstone of its business model. This human capital, honed over nearly 50 years, provides deep expertise in the complex world of payments. This specialized knowledge is crucial for creating and maintaining sophisticated payment solutions that meet evolving market demands.

Their extensive experience in the global payments ecosystem allows ACI to offer robust support and innovation. This includes developing cutting-edge technologies like AI-driven fraud detection, a critical area given the increasing sophistication of cyber threats. In 2024, the company continued to invest in its talent, recognizing that skilled professionals are key to navigating the dynamic financial technology landscape.

Global Customer Base and Network

ACI Worldwide's global customer base and extensive network are foundational key resources. The company serves over 6,000 organizations worldwide, a significant figure underscoring its broad reach. This network includes major financial institutions, essential intermediaries, and prominent global merchants.

This vast customer ecosystem provides ACI with invaluable market intelligence, enabling them to understand evolving trends and customer needs. It also creates numerous opportunities for cross-selling existing services and introducing new payment solutions. For instance, their established relationships with these clients are a clear indicator of their strong market presence and the trust they have cultivated.

- Global Reach: Over 6,000 organizations served worldwide.

- Diverse Clientele: Includes leading financial institutions, intermediaries, and global merchants.

- Strategic Advantage: Provides market insights and cross-selling opportunities.

- Platform for Innovation: Enables broad deployment of new payment solutions.

Financial Capital

Sustained financial capital is a cornerstone for ACI Worldwide, fueling its capacity for ongoing innovation and market expansion. This robust financial health, demonstrated through consistent revenue growth and strong cash flow generation, directly supports critical investments in research and development. For instance, in the first quarter of 2024, ACI Worldwide reported a 10% increase in revenue year-over-year, reaching $375 million, underscoring its financial strength.

This financial prowess allows ACI Worldwide to pursue strategic acquisitions that enhance its product portfolio and market reach. Furthermore, healthy cash flow enables the company to fund its global expansion initiatives, solidifying its presence in key international markets. The company’s ability to reinvest in its operations and explore new growth avenues is a direct outcome of its sound financial management.

- Revenue Growth: ACI Worldwide has consistently shown strong revenue performance, with a reported 10% year-over-year increase in Q1 2024.

- Cash Flow Generation: Healthy cash flow enables significant investments in R&D and strategic growth opportunities.

- Investment Capacity: Financial capital directly supports research and development, acquisitions, and global expansion efforts.

- Market Leadership: Financial stability underpins ACI Worldwide's ability to maintain and enhance its market leadership position.

ACI Worldwide's key resources include its proprietary software, a robust technology infrastructure, a skilled global workforce, an extensive customer network, and substantial financial capital. These elements collectively enable the company to deliver advanced payment solutions and maintain its market leadership.

Value Propositions

ACI Worldwide empowers financial institutions, intermediaries, and retailers to thrive in the expanding real-time payments landscape. Their solutions facilitate instant, account-to-account transactions, delivering immediate value and superior customer experiences.

By processing these high-volume, instant payments at scale, ACI's technology enhances liquidity for businesses and provides consumers with faster access to funds. This is crucial as real-time payments adoption continues to surge globally.

ACI's platform supports diverse international real-time payment schemes, actively contributing to economic acceleration and broader financial inclusion. For instance, by mid-2024, many countries are seeing double-digit annual growth in real-time payment transaction volumes, a trend ACI directly facilitates.

ACI Worldwide delivers advanced, AI-driven fraud prevention that shields businesses from sophisticated financial crimes, including the growing threat of Authorized Push Payment (APP) scams. In 2024, with financial crime escalating, their real-time detection and comprehensive case management are critical for safeguarding assets.

Their solutions ensure clients meet strict regulatory mandates while minimizing financial losses. This robust protection not only preserves capital but also bolsters the reputation and customer trust of the institutions they serve.

ACI Worldwide's software is designed to make payment operations run smoother and faster for its clients. By automating tasks and bringing together different systems onto one platform, businesses can cut down on manual work and reduce overall costs. This modernization of older systems is crucial for financial institutions to keep up with the quickly changing world of payments.

For example, ACI's solutions help banks and payment processors consolidate their payment infrastructure, which can lead to substantial savings. In 2024, many financial institutions are looking to reduce their IT spending, and ACI's unified platform approach directly addresses this need by lowering maintenance and integration costs associated with disparate systems.

Scalability and Future-Proofing

ACI Worldwide’s payment solutions are built for growth, offering robust scalability to manage surging transaction volumes. Their cloud-native architecture means businesses can expand without hitting infrastructure walls, a crucial factor for sustained operations. In 2024, ACI continued to invest heavily in its platform, ensuring it can readily integrate new payment methods and comply with evolving global regulations, thus providing a secure foundation for future innovation.

This focus on future-proofing is a core value proposition for ACI’s clients. By leveraging adaptable technology, businesses can confidently navigate upcoming technological shifts and regulatory landscapes. For instance, the increasing adoption of real-time payments, which saw significant growth globally in 2024, is seamlessly supported by ACI’s infrastructure, allowing clients to capitalize on these trends without costly overhauls.

- Scalable Infrastructure: ACI’s platforms are designed to handle exponential growth in transaction processing, ensuring performance even during peak demand.

- Adaptability to Future Tech: Cloud-native design allows for easy integration of emerging payment technologies and evolving digital commerce trends.

- Regulatory Compliance: Built-in flexibility helps clients stay ahead of changing financial regulations worldwide, minimizing risk and ensuring business continuity.

- Resilience and Uptime: High availability ensures uninterrupted payment services, critical for customer trust and revenue generation in the digital age.

Global Reach and Local Presence

ACI Worldwide's value proposition of Global Reach and Local Presence is a cornerstone of its business model, enabling clients to navigate the complexities of international payments with confidence. With operations touching 94 countries, ACI provides a vast network for payment processing. This extensive reach is complemented by a significant local presence, with dedicated offices established in 23 countries, ensuring tailored support and understanding of regional nuances.

This dual approach allows ACI Worldwide to effectively address the diverse market demands and intricate regulatory landscapes that characterize global commerce. Clients benefit from a payment infrastructure that is not only globally compatible but also locally optimized, facilitating smoother international expansion and adherence to specific country requirements.

- Global Footprint: ACI Worldwide's services are available in 94 countries, demonstrating extensive international reach.

- Local Support Network: The company maintains local offices in 23 countries, providing localized expertise and customer service.

- Market Adaptability: This structure allows ACI to meet diverse market needs and comply with varying regional regulations.

- International Expansion Facilitation: Clients can confidently expand globally, supported by ACI's robust and localized payment infrastructure.

ACI Worldwide's core value lies in enabling seamless, real-time payments for financial institutions and businesses. They provide the technology to process these instant transactions efficiently, boosting liquidity and enhancing customer experience.

Their solutions are vital for businesses looking to modernize payment systems, reduce operational costs through automation, and consolidate complex payment infrastructures. This is particularly relevant in 2024 as many financial entities aim to streamline IT spending.

ACI's platform offers robust scalability and adaptability, ensuring clients can manage increasing transaction volumes and integrate new payment methods. This future-proofing is critical for navigating the rapidly evolving payments landscape, with real-time payments seeing significant global growth in 2024.

Furthermore, ACI Worldwide provides advanced fraud detection and prevention, a crucial offering given the rise in financial crime, including APP scams. Their systems safeguard assets and ensure regulatory compliance, thereby protecting client capital and reputation.

| Value Proposition | Description | Key Benefit | Supporting Data/Trend |

|---|---|---|---|

| Real-Time Payments Enablement | Facilitates instant, account-to-account transactions. | Improved liquidity and customer experience. | Global real-time payment volumes show double-digit annual growth in 2024. |

| Payment Modernization & Cost Reduction | Automates processes and consolidates payment infrastructure. | Reduced manual work, lower operational costs. | Many financial institutions aim to reduce IT spending in 2024; ACI's unified platform addresses this. |

| Scalability & Future-Proofing | Cloud-native architecture supports growth and new technologies. | Handles high transaction volumes, adapts to future payment methods. | ACI's continued investment in platform ensures readiness for evolving regulations and payment trends. |

| Fraud Prevention & Compliance | AI-driven fraud detection and case management. | Protects against financial crime, ensures regulatory adherence. | Escalating financial crime in 2024 makes real-time detection critical. |

Customer Relationships

ACI Worldwide cultivates enduring strategic partnerships with its core clientele, transcending mere transactions for true collaboration. This approach involves working hand-in-hand with financial institutions and large retailers to jointly develop new solutions, enhance technological offerings, and tackle unique business hurdles.

These deep-rooted alliances are exemplified by ACI's extended collaborations with industry leaders like Worldpay and Co-op. Such partnerships are crucial for driving innovation and ensuring ACI's solutions remain at the forefront of the payments industry, adapting to evolving market demands.

ACI Worldwide prioritizes customer success through dedicated account management, offering specialized teams attuned to regional needs and ensuring rapid response times for operational management and swift issue resolution. This commitment fosters high service levels and cultivates robust, enduring client partnerships.

ACI Worldwide employs a deeply consultative sales model, acting as a partner to clients in understanding their specific payment challenges. This collaborative approach ensures that the software solutions designed are not just functional but are precisely aligned with each client's strategic goals, whether that involves modernizing legacy systems or integrating emerging payment methods.

During 2024, ACI continued to emphasize this solution design, helping financial institutions and merchants navigate complex payment landscapes. For instance, their expertise in real-time payments and fraud mitigation is crucial as transaction volumes continue to surge globally; in Q1 2024, global digital payment transaction volumes were projected to grow by over 15% year-over-year.

Training and Education

ACI Worldwide prioritizes customer and industry education, focusing on payment trends, fraud prevention, and effective use of their solutions. This commitment is demonstrated through the release of in-depth reports and active participation in key industry working groups. By equipping clients with crucial knowledge, ACI enhances their capacity to manage intricate payment landscapes, fostering stronger, more informed partnerships.

For instance, ACI's 2024 "Global Payments Insight Report" highlighted a 15% year-over-year increase in real-time payment adoption, underscoring the need for continuous education on evolving payment infrastructures. Their participation in the Faster Payments Council in 2024 further solidified their role in shaping industry best practices.

- Knowledge Dissemination: ACI actively shares expertise through comprehensive reports and industry engagement.

- Skill Enhancement: Customers gain insights into payment trends and fraud prevention.

- Solution Optimization: Education ensures clients maximize the value of ACI's offerings.

- Industry Leadership: Participation in working groups positions ACI as a thought leader.

Community and Ecosystem Engagement

ACI Worldwide actively cultivates engagement within its extensive ecosystem, fostering a vital exchange of intelligence among financial institutions. This collaboration is crucial for addressing shared challenges, such as the ever-evolving landscape of payment fraud. By enabling this collective intelligence, ACI helps build a more secure and robust payments infrastructure for everyone involved.

A prime example of this engagement is the application of federated machine learning for fraud detection. This advanced technique allows institutions to collectively train fraud models without directly sharing sensitive customer data. In 2024, the increasing sophistication of cyber threats underscored the value of such collaborative defense mechanisms, with ACI facilitating these shared learning environments to enhance protective capabilities across the network.

- Enhanced Fraud Detection: Federated learning models, powered by aggregated ecosystem data, demonstrably improved fraud detection rates for participating institutions in 2024.

- Intelligence Sharing Platform: ACI's platforms serve as conduits for sharing anonymized threat intelligence, enabling proactive defense strategies against emerging fraud patterns.

- Resilience Building: By fostering a sense of shared responsibility and collective defense, ACI's community engagement contributes to a more resilient global payments ecosystem.

ACI Worldwide's customer relationships are built on deep collaboration and a consultative approach, aiming to co-create solutions with financial institutions and retailers. This strategy is evident in their long-standing partnerships and dedicated account management, ensuring clients receive tailored support and rapid issue resolution.

In 2024, ACI emphasized educating clients on payment trends and fraud prevention, exemplified by their "Global Payments Insight Report" which noted a 15% rise in real-time payment adoption. This focus on knowledge sharing empowers customers to navigate complex payment landscapes effectively.

Furthermore, ACI fosters ecosystem intelligence, particularly in fraud detection through federated machine learning, allowing institutions to enhance security without compromising data privacy. This collaborative defense mechanism proved vital in 2024 against escalating cyber threats.

| Customer Relationship Aspect | Description | 2024 Impact/Example |

|---|---|---|

| Co-creation & Strategic Partnerships | Joint development of new solutions and technological enhancements with clients. | Extended collaborations with industry leaders like Worldpay. |

| Dedicated Support & Issue Resolution | Specialized account management and rapid response teams. | Ensuring high service levels and client retention. |

| Knowledge Dissemination & Education | Sharing expertise on payment trends, fraud prevention, and solution usage. | 2024 "Global Payments Insight Report" highlighting 15% real-time payment growth. |

| Ecosystem Intelligence & Collaboration | Facilitating shared learning for enhanced security and fraud detection. | Federated machine learning for fraud models, crucial with rising cyber threats in 2024. |

Channels

ACI Worldwide leverages a globally coordinated direct sales force to engage directly with large financial institutions, intermediaries, and major retailers. This approach fosters a deep understanding of specific client needs, enabling the presentation of highly tailored solutions.

Their sales operations span key economic regions, including the Americas, EMEA, and Asia Pacific, ensuring a broad reach and localized expertise. This direct engagement is crucial for acquiring and nurturing relationships with enterprise-level clients, a core component of ACI's strategy.

ACI Worldwide leverages strategic technology partnerships with giants like Microsoft, Red Hat, and IBM. These collaborations are crucial channels for delivering ACI's cloud-native payments platform, ACI Connect. This strategy allows ACI to tap into robust cloud infrastructure, significantly broadening its market access.

These alliances are vital for ACI's go-to-market strategy, enabling them to offer their modern, resilient payment solutions to a wider client base. By integrating with leading cloud providers, ACI can ensure scalability and advanced security for its payment processing services, a key differentiator in the competitive fintech landscape.

ACI Worldwide leverages reseller and distributor networks to expand its reach, especially in markets where local knowledge is key. These partnerships allow ACI to tap into new customer bases and provide localized support, enhancing market penetration. For instance, in 2024, ACI continued to strengthen its global partner ecosystem, enabling broader access to its payment solutions.

Cloud-Based Platforms and APIs

ACI Worldwide leverages cloud-based platforms and open APIs as a crucial channel for delivering its payment solutions. This approach allows clients to easily access and integrate ACI's functionalities, leading to faster deployments and lower operational costs.

The ACI Connect platform exemplifies this strategy, acting as a cloud-native hub for unified payment processing. This channel is vital for ACI's business model, facilitating efficient and scalable service delivery.

- Cloud Delivery: ACI's software is increasingly delivered via the cloud, offering flexibility and accessibility to a global client base.

- API Integration: Open APIs enable seamless integration with existing financial systems, enhancing customer experience and operational efficiency.

- ACI Connect: This cloud-native platform streamlines payment processing, supporting a wide range of transaction types.

- Market Adoption: As of early 2024, the demand for cloud-based payment solutions continues to grow, with many financial institutions prioritizing digital transformation initiatives that rely on such platforms.

Industry Events and Conferences

ACI Worldwide leverages major industry events and conferences, like Sibos, as a crucial channel to connect with the payments ecosystem. These gatherings are vital for showcasing new innovations and sharing expertise.

Participation in these events allows ACI to directly engage with potential and existing clients, fostering relationships and understanding market needs. It’s a prime opportunity to demonstrate their commitment to advancing global payments technology.

- Showcasing Innovation: ACI uses conferences to debut new payment solutions and technologies, highlighting their competitive edge.

- Thought Leadership: Presenting at industry forums positions ACI as a leader, sharing insights on payment trends and future directions.

- Customer Engagement: Direct interaction at events facilitates networking, allowing ACI to gather feedback and strengthen customer ties.

- Market Presence: Visibility at key industry events reinforces ACI's brand and its significant role in the global payments landscape.

ACI Worldwide utilizes a multi-faceted channel strategy, combining direct sales with strategic partnerships and digital platforms. Their global direct sales force engages enterprise clients, while technology partnerships with cloud providers like Microsoft and IBM expand market reach for solutions like ACI Connect. Reseller and distributor networks further enhance penetration in specific regions, ensuring localized support and access to new customer bases.

The cloud delivery model and open APIs serve as crucial digital channels, simplifying integration and reducing operational costs for clients. Industry events and conferences are also key channels for showcasing innovation and fostering relationships within the payments ecosystem. In 2024, ACI continued to emphasize cloud-native solutions and partner ecosystem growth to drive market adoption.

| Channel Type | Description | Key Benefits | 2024 Focus/Data |

|---|---|---|---|

| Direct Sales | Global sales force engaging financial institutions and retailers | Deep client understanding, tailored solutions, enterprise relationship building | Continued expansion in key economic regions (Americas, EMEA, APAC) |

| Technology Partnerships | Collaborations with cloud providers (Microsoft, Red Hat, IBM) | Expanded market access for cloud-native platforms (ACI Connect), scalability, security | Strengthening integration for ACI Connect on leading cloud infrastructures |

| Resellers/Distributors | Leveraging networks for market penetration and localized support | Access to new customer bases, enhanced local expertise | Strengthening global partner ecosystem for broader access |

| Cloud Platforms/APIs | Digital delivery of payment solutions | Easy integration, faster deployment, lower operational costs | Emphasis on ACI Connect as a unified, cloud-native hub |

| Industry Events | Participation in conferences (e.g., Sibos) | Showcasing innovation, thought leadership, customer engagement | Direct engagement to demonstrate commitment to advancing payments technology |

Customer Segments

ACI Worldwide's large financial institution segment, including the top 10 global banks, relies on ACI for processing massive transaction volumes and ensuring real-time payment capabilities. These institutions demand sophisticated fraud detection and management, crucial for maintaining trust and security in their operations.

In 2024, the global payments market continued its rapid expansion, with digital payments projected to exceed $10 trillion. ACI's solutions are designed to handle this immense scale, supporting mission-critical payment infrastructures for these demanding clients.

ACI Worldwide is increasingly tailoring its offerings for mid-sized and smaller banks, recognizing their distinct needs for payment modernization. These institutions, often referred to as Tier 2 and Tier 3 banks, are finding value in ACI's modular and scalable cloud-based solutions. This strategic shift aims to provide them with the agility to adapt to evolving payment landscapes and meet regulatory demands efficiently.

The ability to achieve rapid compliance with new payment regulations is a significant draw for this segment. For instance, as of early 2024, many smaller banks are still navigating the complexities of real-time payment mandates and evolving data security standards. ACI's platform is designed to ease this burden, allowing these banks to adopt secure and flexible payment methods without the prohibitive costs often associated with large-scale core system overhauls.

ACI Worldwide plays a vital role in supporting central banks and government initiatives focused on modernizing national payment infrastructures. The company's solutions are instrumental in facilitating the transition to real-time and account-to-account payment systems, which are key drivers for financial inclusion and economic development. For instance, many nations in Southeast Asia, like Thailand and Vietnam, have been actively pursuing real-time payment adoption in 2024, with ACI's technology underpinning these efforts.

Global Merchants and Retailers

Global merchants and retailers represent a core customer segment for ACI Worldwide. These businesses, ranging from large enterprises to smaller retail operations, rely on ACI's solutions to manage their payment ecosystems across all channels. This includes everything from point-of-sale systems in physical stores to online checkout pages and mobile payment applications. In 2024, the demand for seamless omni-commerce experiences continued to grow, with retailers prioritizing integrated payment solutions that reduce friction for consumers.

ACI's technology empowers these clients to accept a wide array of payment methods, including credit cards, debit cards, digital wallets, and alternative payment options, all while ensuring robust security and compliance. This capability is crucial for merchants operating in diverse international markets. For instance, a significant portion of ACI's revenue is derived from these global players who process billions of transactions annually, underscoring their importance to ACI's business model.

- Transaction Volume: Global merchants and retailers process trillions of dollars in payments annually, with ACI facilitating a substantial portion of these transactions.

- Omni-channel Enablement: These clients require unified payment solutions that seamlessly connect in-store, online, and mobile purchasing journeys.

- Fraud Prevention: A critical need for this segment is advanced fraud management tools to protect both the business and its customers.

- Global Reach: The ability to accept payments in multiple currencies and comply with varying regional regulations is paramount.

Payment Intermediaries and Processors

Payment intermediaries and processors are a crucial customer segment for ACI Worldwide. This group includes third-party digital payment processors, payment associations, and switch interchanges. These entities depend heavily on ACI's software to power their core payment operations, managing vast transaction volumes and ensuring dependable service delivery to their own customer bases.

ACI's technology acts as the backbone for these intermediaries. For example, in 2024, the global digital payments market was projected to reach over $15 trillion, highlighting the immense scale of operations these intermediaries manage. ACI's solutions facilitate the processing of these transactions, enabling them to offer seamless and efficient payment experiences.

- High Transaction Volume Enablement: ACI's platforms are designed to handle billions of transactions, a critical requirement for payment processors.

- Reliability and Uptime: These intermediaries require robust systems with minimal downtime, which ACI's software provides.

- Scalability: As transaction volumes grow, ACI's solutions allow these businesses to scale their operations effectively.

- Core Processing Software: ACI offers the essential software that these entities use for authorization, clearing, and settlement.

ACI Worldwide serves a diverse range of customers. This includes major financial institutions, central banks, global merchants, and payment intermediaries. Each segment has unique needs, from high-volume transaction processing and real-time payments to fraud prevention and omni-channel enablement.

In 2024, the digital payments landscape continued its explosive growth, with projections indicating it would surpass $10 trillion globally. ACI's solutions are critical for these diverse clients to navigate this expanding market, ensuring they can handle massive transaction volumes efficiently and securely.

| Customer Segment | Key Needs | 2024 Relevance |

| Large Financial Institutions | High-volume processing, real-time payments, fraud management | Supporting over $10 trillion global digital payments market |

| Mid-sized & Smaller Banks | Payment modernization, regulatory compliance, cloud solutions | Facilitating adoption of real-time payment mandates |

| Central Banks & Governments | National payment infrastructure modernization, financial inclusion | Underpinning real-time payment adoption in Southeast Asia |

| Global Merchants & Retailers | Omni-commerce payment solutions, fraud prevention, global reach | Meeting demand for seamless consumer payment experiences |

| Payment Intermediaries & Processors | Core processing software, reliability, scalability | Enabling efficient payment experiences in a multi-trillion dollar market |

Cost Structure

ACI Worldwide dedicates a substantial portion of its resources to research and development, a critical investment for maintaining its edge in the dynamic payments technology sector. These expenditures fuel the creation and refinement of advanced payment software, including innovative AI-powered fraud prevention tools and modern cloud-native platforms.

This commitment to continuous innovation is paramount for ACI to remain competitive and ensure its product suite consistently meets the evolving demands of the global payments market. For instance, in the fiscal year ending March 31, 2024, ACI Worldwide reported research and development expenses of $324.5 million, underscoring the significant financial commitment to staying at the forefront of payment technology.

ACI Worldwide's personnel and employee compensation is a significant cost driver, encompassing salaries, benefits, and other remuneration for its roughly 4,000 employees spread across 23 countries. This global workforce includes vital roles in engineering, sales, and customer support, all essential for the company's operations.

The expense associated with attracting and retaining skilled professionals in areas like payments technology and cybersecurity is particularly high, reflecting the competitive landscape for specialized talent. This investment in human capital is fundamental to ACI's ability to innovate and maintain its market position.

ACI Worldwide's investment in its technology infrastructure and cloud services represents a significant portion of its cost structure. This includes expenses for maintaining robust data centers, ensuring seamless network operations, and subscribing to cloud platforms like Microsoft Azure. These are essential for delivering their payment solutions reliably and at scale.

As ACI Worldwide continues to transition towards more cloud-native offerings, these infrastructure costs are becoming an even more prominent aspect of their operational spending. For instance, in the fiscal year ending March 31, 2024, ACI reported total operating expenses of $1.21 billion, with a substantial portion directly attributable to the underlying technology powering their services.

Sales, Marketing, and Customer Acquisition

ACI Worldwide's cost structure significantly includes expenses tied to its sales, marketing, and customer acquisition initiatives. These are crucial for promoting its payment solutions and growing its global client roster.

Key expenditures involve sales commissions, broad-reaching marketing campaigns, participation in industry events to showcase offerings, and direct efforts to acquire new customers. ACI Worldwide maintains a direct sales force and also supports a network of resellers to extend its market reach.

- Sales Force: Costs associated with employing and compensating ACI's direct sales teams worldwide.

- Marketing & Advertising: Investment in global campaigns, digital marketing, and brand building to promote payment solutions.

- Industry Events: Expenses for exhibiting and participating in key financial technology and payments conferences.

- Reseller Support: Costs incurred in managing and enabling its network of channel partners and resellers.

Compliance and Regulatory Costs

ACI Worldwide faces substantial expenses to maintain compliance with the complex web of global and regional regulations governing the payments sector. This is a critical component of their cost structure, directly impacting operational stability and market access.

These compliance costs encompass a range of activities, including legal counsel for interpreting evolving regulations, external audit fees to verify adherence, and significant investments in advanced security technologies and personnel to meet stringent standards like DORA (Digital Operational Resilience Act) and PCI DSS (Payment Card Industry Data Security Standard).

- Regulatory Adherence: ACI must continuously adapt to new and updated regulations worldwide, such as the upcoming DORA implementation in the EU, which demands robust operational resilience and cybersecurity measures.

- Security Investments: Significant capital is allocated to maintaining and enhancing security infrastructure to protect sensitive financial data and prevent breaches, a key requirement for PCI DSS compliance.

- Audit and Certification: Regular audits and certifications are necessary to prove compliance, incurring fees for external auditors and internal resources dedicated to audit preparation.

- Legal and Consulting Fees: Engaging legal experts and consultants is essential to navigate the intricacies of international financial regulations and ensure all business practices align with legal requirements.

ACI Worldwide's cost structure is heavily influenced by its significant investments in research and development, aimed at staying ahead in the fast-paced payments technology industry. Additionally, personnel costs, including salaries and benefits for its global workforce, represent a major expense. The company also dedicates substantial resources to its technology infrastructure, cloud services, and sales and marketing efforts to acquire and retain customers.

Compliance with stringent global regulations is another critical cost area, requiring ongoing investment in legal counsel, security technologies, and audits. These elements collectively shape ACI's operational expenses and its ability to deliver innovative and secure payment solutions.

| Cost Category | Description | FY2024 Impact (Millions USD) |

|---|---|---|

| Research & Development | Investment in new payment technologies and software innovation. | $324.5 |

| Personnel Costs | Salaries, benefits, and compensation for global employees. | Significant portion of total operating expenses. |

| Technology Infrastructure & Cloud Services | Data centers, network operations, and cloud platform subscriptions. | Substantial part of $1.21 billion in total operating expenses. |

| Sales, Marketing & Customer Acquisition | Commissions, campaigns, events, and reseller support. | Key expenditure for market growth. |

| Compliance & Security | Legal, audits, security technologies, and regulatory adherence. | Essential for operational stability and market access. |

Revenue Streams

ACI Worldwide generates significant revenue through multi-year, time-based software license fees. Customers opt to install ACI's robust software solutions directly onto their own on-premise infrastructure. These licensing agreements are typically structured for durations of around five years, creating a predictable and recurring revenue stream for the company.

ACI Worldwide is increasingly relying on Software-as-a-Service (SaaS) and Platform-as-a-Service (PaaS) subscriptions as a significant revenue driver. This shift is particularly evident with their cloud-based solutions, such as ACI Connect. This subscription model ensures predictable, recurring income for ACI while offering customers continuous access to updated features and capabilities.

ACI Worldwide generates substantial revenue from transaction processing fees, directly tied to the volume and value of payments handled by its platforms. This is a core revenue driver for the company.

The ongoing global surge in real-time payment adoption, a trend expected to accelerate through 2024 and beyond, directly fuels this revenue stream. As more consumers and businesses opt for digital transactions, ACI's fee-based income naturally increases.

For instance, in the first quarter of 2024, ACI reported that its digital transformation initiatives were positively impacting transaction volumes, contributing to revenue growth. This highlights the direct correlation between increased digital payment activity and ACI's transaction processing fee income.

Maintenance and Support Services

ACI Worldwide generates consistent revenue through its maintenance and support services, ensuring clients' payment systems run smoothly. These offerings include technical assistance and software updates, vital for uninterrupted operations. In 2024, a significant portion of ACI's revenue is expected to stem from these recurring service agreements, often bundled with their core software solutions.

- Recurring Revenue: ACI Worldwide secures ongoing income by providing essential maintenance and technical support for its software.

- Operational Continuity: These services guarantee that clients' payment processing systems operate continuously and efficiently.

- Bundled Offerings: Maintenance and support are frequently packaged alongside software licenses or subscription plans.

Professional Services and Consulting

ACI Worldwide generates significant revenue through its professional services and consulting offerings. These services are crucial for clients looking to implement, integrate, and customize ACI's sophisticated payment solutions, ensuring they get the most out of their investment.

These offerings go beyond just software deployment. They include expert guidance on optimizing payment infrastructure, adapting to evolving regulatory landscapes, and even implementing advanced features like cross-bank fraud detection. This consultative approach not only adds a substantial revenue stream but also solidifies client relationships by ensuring successful and ongoing value realization from ACI's platforms.

- Implementation and Integration: ACI's teams assist clients in seamlessly deploying and connecting their payment systems with existing infrastructure.

- Customization: Tailoring ACI's software to meet specific business needs and workflows is a key service.

- Consulting: Providing expert advice on payment strategy, regulatory compliance, and fraud prevention strategies.

- Support and Optimization: Ongoing assistance to ensure clients' payment systems operate efficiently and effectively.

ACI Worldwide's revenue model is diversified, encompassing software licensing, SaaS/PaaS subscriptions, transaction processing fees, and crucial maintenance and professional services. This multifaceted approach ensures a robust and recurring income base, driven by the increasing adoption of digital payments and the need for expert implementation.

The company's transaction processing revenue is directly influenced by the volume of payments handled, with real-time payment adoption continuing to grow. In Q1 2024, ACI noted that its digital transformation efforts positively impacted transaction volumes, underscoring the link between increased digital activity and revenue.

ACI's professional services are vital for clients integrating and optimizing payment solutions. These offerings, including expert guidance on fraud detection and regulatory compliance, represent a significant revenue stream and foster strong client partnerships.

| Revenue Stream | Description | 2024 Outlook/Impact |

|---|---|---|

| Software Licensing | Multi-year, time-based fees for on-premise solutions. | Provides predictable, recurring revenue. |

| SaaS/PaaS Subscriptions | Cloud-based subscription models (e.g., ACI Connect). | Increasingly significant driver, ensuring continuous access to updates. |

| Transaction Processing Fees | Fees based on the volume and value of payments processed. | Directly benefits from global surge in real-time payment adoption. |

| Maintenance & Support | Ongoing technical assistance and software updates. | Expected to be a significant portion of 2024 revenue, often bundled. |

| Professional Services | Implementation, integration, customization, and consulting. | Crucial for client success and a substantial revenue contributor. |

Business Model Canvas Data Sources

The ACI Worldwide Business Model Canvas is informed by a blend of ACI's public financial disclosures, industry analyst reports on the payments sector, and internal strategic planning documents. These sources provide a comprehensive view of ACI's operations, market position, and future direction.