3M SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

3M Bundle

3M's diverse product portfolio and strong brand recognition are significant strengths, but the company faces challenges from increasing competition and potential supply chain disruptions. Understanding these dynamics is crucial for navigating the market.

Want the full story behind 3M's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

3M's brand equity is a significant asset, built on a legacy of innovation and trusted products like Post-it Notes and Scotch Tape, which have achieved household name status. This strong recognition fosters customer loyalty and provides a competitive edge across its various business segments.

3M's dedication to research and development is a cornerstone of its strategy, fueling a consistent stream of new products and technological advancements. This commitment is underscored by a significant planned investment of $3.5 billion in R&D between 2025 and 2027.

This substantial investment is targeted at developing approximately 1,000 new products, with a particular emphasis on rapidly expanding markets such as automotive electrification, industrial automation, and the burgeoning data center industry. Such a focused approach to innovation is crucial for 3M to not only maintain its competitive edge but also to secure its future growth trajectory.

3M's financial stability is a key strength, underscored by its strong balance sheet and consistently solid credit ratings. This financial health provides the company with significant flexibility to navigate market dynamics and pursue strategic objectives.

The company's capacity to generate substantial free cash flow is a critical advantage, enabling both reinvestment in innovation and attractive returns for its shareholders. This dual focus on growth and shareholder value creation is a hallmark of its financial strategy.

Demonstrating this commitment, 3M returned approximately $3 billion to shareholders via dividends and share repurchases in the first half of 2025. Furthermore, the company revised its full-year 2025 guidance upward, reflecting its robust operational performance and positive financial outlook.

Global Presence and Market Reach

3M's global presence is a significant strength, with almost half of its revenue generated outside the Americas, highlighting its extensive international market reach. The company actively operates in over 70 countries, demonstrating a robust worldwide operational capability. This broad geographical footprint, coupled with a diverse product portfolio and strong brand equity, positions 3M to effectively tap into the growth potential of emerging markets and meet escalating global demand across multiple industries.

This extensive global network allows 3M to:

- Diversify revenue streams: Reducing reliance on any single market.

- Access a wider customer base: Capitalizing on varying consumer needs and economic cycles.

- Leverage global supply chains: Optimizing production and distribution efficiency.

- Benefit from localized innovation: Adapting products to meet specific regional demands.

Focus on Operational Excellence and Sustainability

3M is sharpening its focus on operational excellence, aiming to boost its operating margin to 25% by 2027. This strategic push is designed to improve profitability and shareholder value.

Sustainability is a core tenet of 3M's strategy, evidenced by validated near-term carbon reduction targets. The company is actively working to decrease its environmental footprint.

- Carbon Reduction: 3M has set validated near-term targets for reducing greenhouse gas emissions.

- Resource Management: Initiatives are in place to lower water usage across operations.

- Plastic Reduction: The company is committed to reducing its reliance on virgin fossil-based plastics.

These sustainability efforts not only align with global environmental goals but also enhance 3M's competitive standing by meeting evolving customer and regulatory expectations.

3M's strong brand recognition, built on trusted products like Post-it Notes, fosters customer loyalty and provides a significant competitive advantage across its diverse business segments. This brand equity is a powerful asset in a crowded marketplace.

The company's unwavering commitment to research and development, backed by a planned $3.5 billion investment from 2025 to 2027, is a key strength. This investment aims to introduce approximately 1,000 new products, particularly in high-growth areas like automotive electrification and data centers, ensuring future relevance and market leadership.

3M's robust financial health, characterized by a strong balance sheet and solid credit ratings, grants it considerable flexibility. This financial stability allows for strategic investments and shareholder returns, as demonstrated by the approximately $3 billion returned to shareholders in the first half of 2025 and an upward revision of its full-year 2025 guidance.

Its extensive global presence, with operations in over 70 countries and nearly half of its revenue generated internationally, diversifies revenue streams and allows access to a wider customer base. This broad reach optimizes supply chains and facilitates localized innovation, positioning 3M to capitalize on global growth opportunities.

3M's focus on operational excellence, targeting a 25% operating margin by 2027, and its commitment to sustainability, including validated carbon reduction targets, further solidify its strengths. These initiatives enhance profitability and align the company with evolving environmental expectations.

| Strength | Description | Supporting Data/Example |

|---|---|---|

| Brand Equity | Household name recognition and customer loyalty. | Products like Post-it Notes and Scotch Tape. |

| Innovation Pipeline | Consistent new product development driven by R&D. | $3.5 billion planned R&D investment (2025-2027) for ~1,000 new products. |

| Financial Stability | Strong balance sheet and credit ratings. | Returned ~$3 billion to shareholders (H1 2025); revised full-year 2025 guidance upward. |

| Global Reach | Operations in over 70 countries, significant international revenue. | Nearly half of revenue generated outside the Americas. |

| Operational Excellence & Sustainability | Focus on margin improvement and environmental responsibility. | Targeting 25% operating margin by 2027; validated near-term carbon reduction targets. |

What is included in the product

Delivers a strategic overview of 3M’s internal strengths and weaknesses alongside external market opportunities and threats.

Offers a structured framework to identify and address 3M's internal weaknesses and external threats, thereby mitigating potential business disruptions.

Weaknesses

3M has been significantly impacted by substantial legal settlements, most notably concerning PFAS 'forever chemicals' and faulty military earplugs. These legal entanglements have resulted in billions of dollars in settlements, directly affecting the company's profitability and investor sentiment.

The financial strain from these settlements, estimated to be in the tens of billions of dollars, has diverted crucial resources away from innovation and growth initiatives. This ongoing legal exposure continues to cast a shadow over 3M's financial stability and future outlook.

3M has grappled with operational dis-synergies and significant supply chain inefficiencies. These challenges have manifested in underutilized manufacturing equipment and a persistent need to refine demand forecasting accuracy, directly impacting their ability to meet delivery schedules and manage costs effectively. For instance, in Q1 2024, the company reported slower-than-expected sales growth in certain segments, partly attributed to these operational hurdles.

3M's workforce faces a significant challenge with a higher attrition rate compared to many of its peers. This turnover necessitates substantial ongoing investment in employee recruitment, onboarding, and training, impacting operational efficiency and potentially increasing costs. For example, in 2023, the company continued to navigate workforce adjustments, underscoring the persistent nature of this issue.

Despite considerable R&D expenditures, 3M has encountered difficulties in consistently delivering breakthrough products that outpace key competitors. This suggests a strategic emphasis on refining existing market-proven features rather than pursuing truly disruptive innovations, potentially limiting its ability to capture new market segments or redefine industry standards.

Impact of Healthcare Spinoff on Revenue

The spin-off of 3M's healthcare business into Solventum in April 2024 has significantly impacted its reported revenue. This strategic move, intended to sharpen focus on its industrial segments, resulted in a substantial reduction in 3M's top-line figures for its continuing operations. For instance, in the first quarter of 2024, 3M reported total revenue of $8.0 billion, a decrease from $8.3 billion in the prior year, largely attributable to the healthcare divestiture.

This divestment, while a strategic realignment, directly affects 3M's overall financial performance metrics. The absence of the healthcare division's sales means that the reported revenue figures for 3M now represent a narrower scope of its business activities. This makes direct year-over-year revenue comparisons challenging without accounting for the impact of the separation.

- Reduced Top-Line: The separation of the healthcare business directly lowered 3M's overall reported revenue.

- Strategic Refocusing: While impacting revenue, the spin-off allows 3M to concentrate on its core industrial businesses.

- Financial Metric Impact: Year-over-year revenue comparisons require adjustments to account for the divested segment.

Vulnerability to Economic Fluctuations in Core Segments

3M's reliance on traditional manufacturing and industrial markets, which are inherently cyclical, exposes a significant vulnerability. For instance, in the first quarter of 2024, the company reported a 4.8% decrease in sales for its Industrial segment, reflecting the impact of broader economic slowdowns in key customer industries.

This dependence on sectors sensitive to economic cycles means that periods of recession or reduced industrial activity can directly translate into lower demand for 3M's products. This was evident in 2023, where macroeconomic headwinds contributed to slower growth in several of its core business units.

- Exposure to Cyclical Industries: A substantial part of 3M's revenue is tied to industries like automotive, construction, and general manufacturing, which are highly sensitive to economic cycles.

- Impact of Economic Downturns: During economic slowdowns, these core segments often experience reduced capital expenditure and consumer spending, directly affecting 3M's sales volumes and profitability.

- First Quarter 2024 Performance: The Industrial segment's sales decline of 4.8% in Q1 2024 underscores the immediate impact of economic fluctuations on 3M's traditional revenue streams.

The significant legal liabilities, particularly those related to PFAS chemicals and defective military earplugs, represent a major weakness for 3M. These settlements, amounting to billions of dollars, drain financial resources and create uncertainty.

Operational inefficiencies, including supply chain issues and underutilized manufacturing capacity, hinder 3M's ability to meet demand and control costs effectively. This was reflected in Q1 2024, where sales growth was slower than anticipated in certain areas due to these operational challenges.

High employee attrition rates require continuous investment in recruitment and training, impacting operational continuity and potentially increasing expenses. The company continued to manage workforce adjustments throughout 2023, highlighting the ongoing nature of this issue.

3M's struggle to consistently deliver breakthrough innovations, often focusing on refining existing products, may limit its competitive edge and ability to capture new market opportunities.

What You See Is What You Get

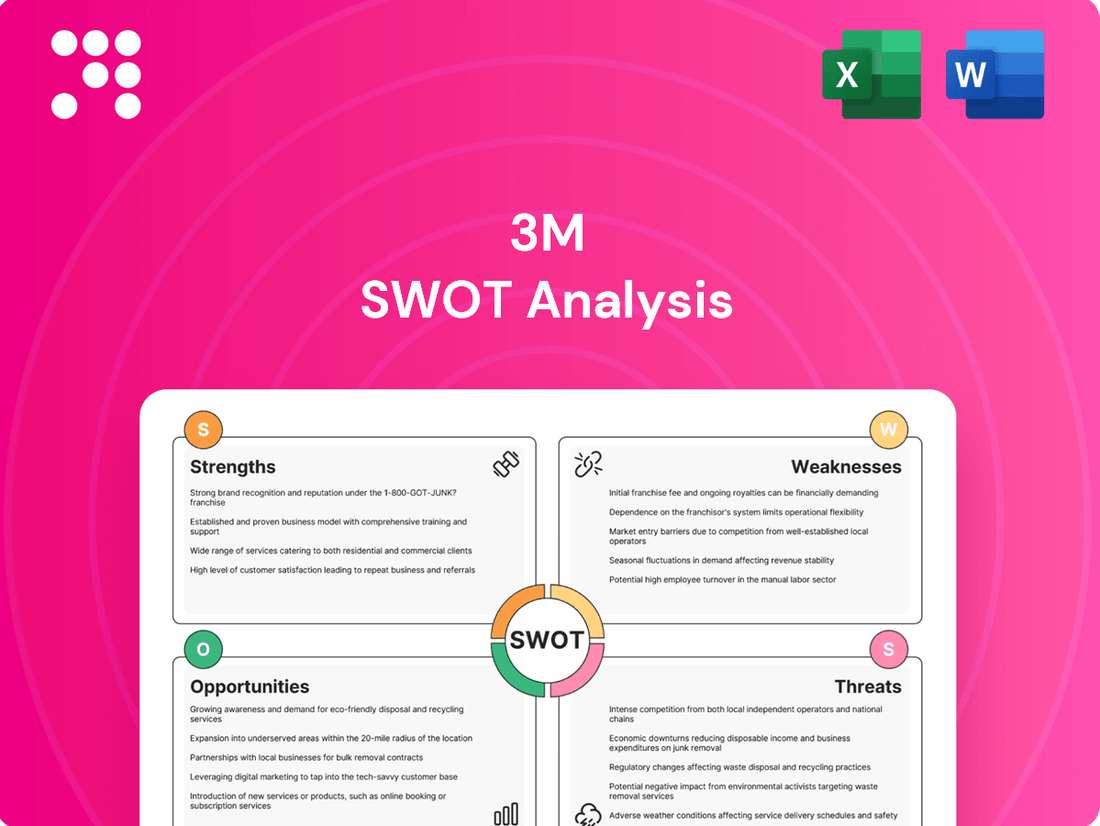

3M SWOT Analysis

You’re viewing a live preview of the actual SWOT analysis file for 3M. The complete version becomes available after checkout, offering a comprehensive breakdown of the company's Strengths, Weaknesses, Opportunities, and Threats. This ensures you receive the full, detailed report you expect.

Opportunities

3M has significant avenues for global market expansion, especially within rapidly developing economies. The company's broad portfolio, encompassing everything from healthcare solutions to industrial adhesives, is well-suited to meet the growing needs across diverse industries in these burgeoning regions.

For instance, in 2024, emerging markets are projected to contribute a substantial portion to global GDP growth, presenting a fertile ground for 3M's established product lines and innovative new offerings. The company's ability to adapt its solutions to local market demands, coupled with its strong brand reputation, provides a distinct advantage in capturing market share.

3M's active portfolio management, including strategic acquisitions and divestitures, offers a significant opportunity to enhance shareholder value. The recent spin-off of its healthcare business, Solventum, in April 2024, is a prime example of this strategy, allowing 3M to concentrate on its industrial and consumer core businesses.

This strategic realignment is expected to streamline operations and sharpen focus on high-growth industrial segments. Future acquisitions could target complementary technologies or market access in areas like advanced materials or electronics, while divestitures of underperforming or non-core assets can further optimize the company's structure and financial performance, potentially boosting revenue growth in the 2024-2025 period.

3M's robust commitment to sustainability, underscored by Science Based Targets initiative (SBTi) validated climate and water goals, presents a significant opportunity. This focus allows 3M to differentiate itself in the market.

By embedding sustainability into its core strategy, 3M can capitalize on growing customer demand for environmentally conscious products. This can translate into increased market share and revenue streams.

Innovation in areas like climate technology and sustainable packaging, driven by these ESG initiatives, opens new avenues for business growth. For instance, in 2023, 3M reported a 10% increase in sales for its sustainable product portfolio, demonstrating tangible market traction.

Digital Transformation and Advanced Manufacturing Technologies

3M has significant opportunities to capitalize on digital transformation and advanced manufacturing. By investing in industrial automation, augmented reality, and robust data centers, the company can streamline operations and boost productivity. For instance, 3M's ongoing digital transformation initiatives aim to improve customer engagement and operational efficiency, with a focus on leveraging data analytics. The company has been investing in technologies that enhance its manufacturing processes, aiming for greater precision and speed.

The integration of Artificial Intelligence (AI) into product development presents a key avenue for 3M to accelerate innovation and gain a competitive edge. AI can optimize material science research, predict product performance, and shorten the cycle from concept to market. This strategic adoption of advanced technologies is crucial for maintaining leadership in its diverse product portfolios.

Key opportunities include:

- Enhancing Operational Efficiency: Implementing AI-driven predictive maintenance in manufacturing facilities to minimize downtime and optimize resource allocation.

- Accelerating Product Innovation: Utilizing AI and machine learning in R&D to speed up the discovery and testing of new materials and product designs.

- Improving Customer Experience: Deploying digital platforms and AR tools to provide enhanced customer support, product demonstrations, and personalized solutions.

- Supply Chain Optimization: Leveraging advanced analytics and automation to create a more resilient and efficient global supply chain, as seen in ongoing efforts to digitize logistics.

New Product Introductions and Innovation Pipeline

3M's commitment to innovation, with plans to introduce approximately 1,000 new products between 2025 and 2027, is a key growth driver. This robust pipeline targets high-demand sectors, signaling a strategic push to capture market share and address emerging customer requirements.

The company is channeling significant resources into its research and development efforts, aiming to leverage technological advancements in areas such as:

- Aerospace: Developing advanced materials and solutions for next-generation aircraft.

- Semiconductors: Creating innovative components and processes for the rapidly evolving chip industry.

- Industrial Automation: Providing cutting-edge technologies to enhance manufacturing efficiency and productivity.

This focus on innovation is expected to fuel organic sales growth, as 3M aims to solidify its position as a leader in critical and expanding markets by delivering differentiated and high-value solutions.

3M's strategic focus on high-growth markets, particularly in emerging economies, offers substantial expansion opportunities. The company's diverse product portfolio is well-positioned to address the increasing demands in these regions. For example, 3M aims to leverage its expertise in advanced materials and electronics through strategic acquisitions and divestitures, such as the spin-off of its healthcare business in April 2024, to sharpen its focus on core industrial segments and drive revenue growth through 2025.

Furthermore, 3M's commitment to sustainability presents a significant competitive advantage, with a 10% increase in sales for its sustainable product portfolio reported in 2023. This focus on ESG initiatives is expected to drive new business growth in areas like climate technology and sustainable packaging. The company is also capitalizing on digital transformation and AI integration to enhance operational efficiency, accelerate product innovation, and improve customer experience, with plans to introduce around 1,000 new products between 2025 and 2027 across key sectors like aerospace and semiconductors.

| Opportunity Area | Key Initiatives/Focus | Projected Impact (2024-2025) | Supporting Data/Examples |

| Global Market Expansion | Targeting emerging economies, adapting products to local needs | Increased market share, revenue growth | Emerging markets projected to contribute significantly to global GDP growth in 2024. |

| Portfolio Optimization | Strategic acquisitions and divestitures (e.g., Solventum spin-off) | Streamlined operations, focus on high-growth industrial segments | Solventum spin-off completed April 2024. |

| Sustainability & ESG | Developing sustainable products, embedding ESG into strategy | Enhanced brand differentiation, new revenue streams | 10% increase in sustainable product portfolio sales (2023). SBTi validated climate and water goals. |

| Digital Transformation & AI | Industrial automation, AR, data analytics, AI in R&D | Improved efficiency, accelerated innovation, enhanced customer experience | Plans to introduce ~1,000 new products (2025-2027). Investing in AI for material science research. |

Threats

3M operates in markets characterized by intense global competition. For instance, in the automotive sector, a key area for 3M, the company faces rivals like Henkel and Avery Dennison, both strong global players with extensive product portfolios and R&D capabilities. This necessitates constant investment in new technologies and product development to stay ahead.

The industrial adhesives segment, a core part of 3M's business, is particularly competitive. Companies such as Arkema and Sika AG are significant global competitors, offering a wide range of adhesive solutions. In 2023, the global adhesives and sealants market was valued at approximately $65 billion, with growth driven by demand from construction and automotive industries, underscoring the high stakes for market share.

To counter these pressures, 3M must continually innovate and differentiate its offerings. Failure to do so can lead to erosion of market share and reduced pricing power. The company's strategy relies on leveraging its material science expertise to create unique products that command a premium and foster customer loyalty in a crowded marketplace.

Geopolitical tensions and trade conflicts represent significant external threats to 3M’s global business. For instance, ongoing trade disputes, particularly between major economies like the United States and China, can result in retaliatory tariffs, increasing the cost of raw materials and finished goods, directly impacting 3M's cost of goods sold and its pricing strategies in key markets.

These global uncertainties can disrupt 3M’s intricate supply chains, which rely on sourcing components and manufacturing across various countries. A disruption in one region due to political instability or trade restrictions could lead to production delays and shortages, affecting 3M's ability to meet customer demand and potentially causing revenue losses. The company’s diversified product portfolio, spanning healthcare, consumer goods, safety, and industrial sectors, means that trade disputes can impact multiple segments simultaneously.

Market volatility stemming from geopolitical events can also influence consumer and business spending, thereby affecting demand for 3M's products. For example, a slowdown in global manufacturing due to trade wars could reduce demand for 3M's industrial adhesives and abrasives. In 2023, 3M reported that approximately 50% of its sales originated outside the United States, highlighting its substantial exposure to international economic conditions influenced by geopolitical factors.

Macroeconomic headwinds, including persistent inflation and the specter of recession, present a significant threat to 3M's operations. For instance, global GDP growth projections for 2024 and 2025 have been revised downwards by organizations like the IMF, signaling a potential slowdown in overall economic activity.

This economic uncertainty directly impacts 3M by potentially dampening consumer spending and reducing industrial output. Such a contraction in demand across key sectors could translate into lower sales volumes and squeezed profit margins for the company's diverse product portfolio.

Ongoing Litigation and Regulatory Scrutiny

Despite reaching significant settlements, 3M continues to face a landscape of ongoing litigation and heightened regulatory scrutiny. These persistent legal battles, particularly concerning environmental liabilities like PFAS (per- and polyfluoroalkyl substances), represent a substantial threat. For instance, in June 2023, 3M agreed to pay up to $12.5 billion to resolve claims related to "forever chemicals" in public water systems, a move that, while settling a major issue, still leaves the company exposed to future claims and potential new regulations. This ongoing legal exposure can lead to considerable financial penalties, impacting profitability and cash flow, and further erode public trust and brand reputation.

The company's exposure to product liability claims, coupled with the evolving regulatory environment, creates a dynamic and unpredictable threat. New regulations or stricter enforcement related to environmental standards or product safety could necessitate additional costly remediation efforts or product redesigns. For example, as of early 2024, discussions around stricter PFAS limits globally continue, potentially triggering further financial obligations for 3M. These factors collectively pose a significant risk to financial stability and operational continuity.

- Ongoing PFAS Litigation: 3M agreed to a settlement of up to $12.5 billion in June 2023 to resolve claims concerning PFAS in public water systems.

- Reputational Damage: Persistent legal challenges and environmental concerns can negatively impact consumer perception and brand equity.

- Regulatory Uncertainty: Evolving environmental regulations globally, particularly regarding PFAS, could lead to future financial liabilities and operational adjustments.

- Product Liability Exposure: Beyond PFAS, other product liability issues could emerge, leading to further legal costs and potential settlements.

Supply Chain Disruptions and Raw Material Costs

Persistent supply chain challenges continue to pose a significant threat to 3M. Raw material shortages and ongoing logistics cost inflation directly impact production efficiency and, consequently, profitability. For instance, in Q1 2024, 3M reported that supply chain issues contributed to higher input costs, although they did not provide specific figures for this line item alone.

The intricate nature of 3M's global supply chain renders it susceptible to various external disruptions. These can range from geopolitical events to natural disasters, each capable of escalating operating expenses. The company's reliance on a complex network of suppliers means that even localized issues can have ripple effects across its diverse product portfolio.

- Vulnerability to Geopolitical Instability: Global events can disrupt the flow of essential raw materials and components, increasing lead times and costs.

- Logistics Cost Volatility: Fluctuations in shipping rates and fuel prices directly impact the cost of moving goods through 3M's extensive supply chain.

- Raw Material Price Swings: Dependence on commodities means 3M is exposed to price volatility, affecting cost of goods sold.

- Single-Source Dependencies: Reliance on specific suppliers for critical materials creates a risk if those suppliers face production or financial difficulties.

Intense global competition across its diverse market segments, from automotive to industrial adhesives, necessitates continuous innovation and significant R&D investment to maintain market share and pricing power. Competitors like Henkel, Avery Dennison, Arkema, and Sika AG are formidable global players, intensifying the pressure on 3M to differentiate its offerings and leverage its material science expertise in a crowded marketplace.

Geopolitical instability and trade conflicts pose substantial threats, potentially leading to increased tariffs on raw materials and finished goods, disrupting intricate global supply chains, and impacting consumer and business spending. With approximately 50% of its sales originating outside the United States in 2023, 3M is particularly exposed to international economic conditions influenced by these global uncertainties.

Persistent macroeconomic headwinds, including inflation and the risk of recession, can dampen consumer spending and industrial output, directly affecting demand for 3M's products and potentially squeezing profit margins. Downward revisions to global GDP growth projections for 2024 and 2025 signal a challenging economic environment for the company.

Ongoing litigation, particularly concerning environmental liabilities like PFAS, represents a significant financial and reputational threat. The company's $12.5 billion settlement in June 2023 for PFAS claims highlights the substantial financial impact, while evolving regulations and potential future claims create ongoing uncertainty and risk.

SWOT Analysis Data Sources

This 3M SWOT analysis is built upon a robust foundation of data, drawing from the company's official financial statements, comprehensive market research reports, and expert industry analyses to ensure a thorough and insightful assessment.